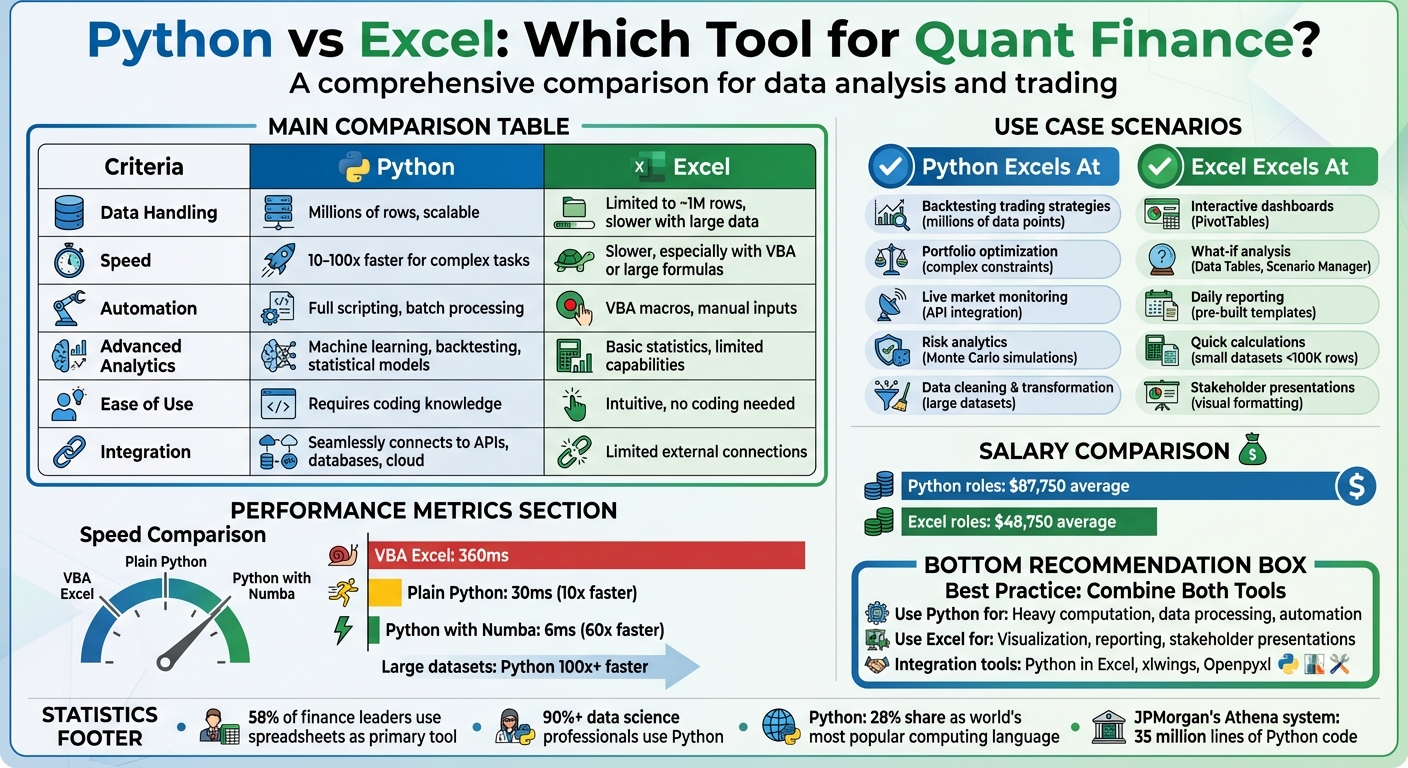

Python and Excel are two key tools in quantitative finance, each excelling in specific areas. Here’s a quick breakdown:

- Python is better for handling large datasets, automating workflows, and performing advanced analytics like machine learning or backtesting. It’s faster, scalable, and integrates well with APIs and databases.

- Excel is ideal for smaller datasets, quick calculations, and creating interactive dashboards or reports. Its user-friendly interface makes it accessible for non-programmers.

Key takeaway: Use Python for heavy computation and automation, and Excel for visualization and stakeholder presentations. Combining both tools can streamline workflows and maximize efficiency.

Quick Comparison

| Criteria | Python | Excel |

|---|---|---|

| Data Handling | Millions of rows, scalable | Limited to ~1M rows, slower with large data |

| Speed | 10–100x faster for complex tasks | Slower, especially with VBA or large formulas |

| Automation | Full scripting, batch processing | VBA macros, manual inputs |

| Advanced Analytics | Machine learning, backtesting, statistical models | Basic statistics, limited capabilities |

| Ease of Use | Requires coding knowledge | Intuitive, no coding needed |

| Integration | Seamlessly connects to APIs, databases, and cloud | Limited external connections |

Pro Tip: Use Python for heavy lifting (e.g., data cleaning, analysis) and export results to Excel for visualization and reporting. Tools like Python in Excel or libraries like xlwings make this integration seamless.

Python vs Excel for Quantitative Finance: Complete Comparison Guide

Python vs Excel for Quantitative Finance: Complete Comparison Guide

Tools and Skills – Financial Modeling with Python and Excel

Python for Quantitative Finance Data Analysis

Python has firmly established itself as a favorite among quantitative finance professionals for handling complex data analysis tasks. Its rich ecosystem of libraries offers tools that go far beyond what Excel can achieve, especially in advanced statistical modeling and machine learning.

Key Strengths of Python

One of Python’s standout features is its speed and scalability. It can process massive datasets – think tens of thousands of data points – in a fraction of the time it would take Excel. For instance, recalculating financials for 200 issuers, which might take hours in Excel, can be done in minutes with Python. This efficiency is largely due to libraries like NumPy and Pandas, which are designed to handle large-scale data operations far more efficiently than Excel’s cell-by-cell approach.

Python’s library ecosystem is another big draw. Tools like NumPy and Pandas enable high-speed numerical operations and data manipulation. Meanwhile, specialized libraries such as SciPy, scikit-learn, QuantLib, TA-Lib, Zipline, and PyAlgoTrade cater to tasks like statistical analysis, pricing, technical analysis, and backtesting. Together, they make Python a powerhouse for financial data analysis.

"With 100 lines of Python code, I can plot datasets repeatedly without crashing my system."

– Kelly Kochanski, MIT B.Sc. in Physics and Earth Science

"With 100 lines of Python code, I can plot datasets repeatedly without crashing my system."

– Kelly Kochanski, MIT B.Sc. in Physics and Earth Science

Python also shines in automation and reproducibility. Unlike Excel, where manual tasks can lead to errors, Python’s code-based workflows minimize mistakes and ensure consistency. Tools like Git provide version control, making it easy to track changes and document assumptions – critical for live trading algorithms and other high-stakes applications.

Practical Use Cases for Python

Python’s capabilities make it a go-to tool for backtesting trading strategies. Libraries like Zipline allow traders to test algorithms against years of historical data, even processing tick-by-tick data that would overwhelm Excel. This speed enables thousands of simulations to fine-tune strategies and evaluate risks before risking actual capital.

Another key application is factor model construction. Python can handle cross-sectional datasets with hundreds of stocks, calculating multiple factors – such as momentum, value, and volatility – and testing their predictive accuracy. This type of multi-factor analysis is nearly impossible in Excel due to its memory and speed limitations.

Python also plays a major role in live trading algorithms. Scripts can be deployed on QuantVPS servers to connect directly with broker APIs, execute trades in real-time, and manage positions automatically. This level of integration and automation is far beyond what Excel macros can achieve.

Challenges of Using Python

While Python offers immense power, it does come with challenges. First, it requires a solid understanding of coding. Unlike Excel’s intuitive, point-and-click interface, Python demands knowledge of programming syntax, data structures, and logical thinking. For finance professionals without a technical background, the learning curve can be intimidating.

Managing Python environments and dependencies can also be tricky. Many projects require specific library versions, and setting up these environments – especially for tasks like deploying scripts on QuantVPS servers – requires careful configuration. Tasks like handling file paths and troubleshooting remote execution are additional hurdles that Excel users don’t face.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Collaboration is another area where Python can be less user-friendly. In Excel, formulas are visible in cells, making it easy for others to follow the logic. Python’s logic, however, resides in code files, which can be harder to interpret for non-programmers. This often requires extra effort to document code and explain methodologies, especially when working with teams that include both Python and Excel users.

These challenges highlight the trade-offs of using Python for quantitative analysis, but for those who master it, the benefits often outweigh the obstacles.

Excel for Quantitative Finance Data Analysis

While Python often takes the spotlight for advanced tasks, Excel remains a foundational tool in quantitative finance. Its widespread use and user-friendly interface make it a go-to option for many traders and analysts.

Key Strengths of Excel

Excel’s broad adoption gives it an edge as a highly accessible and familiar tool. Its intuitive design reduces the learning curve, making it easier for beginners to start analyzing data and creating models. Unlike Python, which requires coding skills, Excel’s point-and-click interface allows users to dive into analysis right away. This accessibility also makes it a universal platform for sharing insights across teams, ensuring smoother collaboration.

One of Excel’s standout features is its flexibility. Users can design custom financial models with complete control over formulas and layouts, tailoring them to specific needs.

Power Query, a more recent addition, has significantly boosted Excel’s capabilities. This tool connects to various data sources – databases, web pages, cloud services, and CSV files – and enables users to clean and transform data through a no-code interface. With Power Query, data can be refreshed at set intervals, keeping financial models and reports up-to-date without manual intervention.

Practical Use Cases for Excel

Excel is particularly effective for building interactive dashboards used in portfolio monitoring and risk management. For instance, traders can leverage PivotTables to create real-time visual summaries. These dashboards can track daily profit and loss, highlight risk-limit breaches, and monitor exposure across asset classes – all without requiring any coding.

Another area where Excel shines is what-if analysis. Tools like Data Tables and Scenario Manager make it easy to test how changes to variables – such as interest rates or volatility assumptions – impact portfolio valuations. This real-time interactivity helps traders explore various scenarios and respond to stakeholder queries on the spot.

Excel also streamlines daily reporting tasks. Many trading desks rely on prebuilt templates that automatically pull overnight data, calculate performance metrics, and format results into professional reports. Conditional formatting further simplifies the process by quickly flagging anomalies before reports are finalized and sent to management.

These practical applications highlight Excel’s strengths, but they also set the stage for examining its limitations.

Limitations of Excel

Excel’s limitations become evident when working with large datasets. The software has hard caps: 1,048,576 rows and 16,384 columns. Modern financial datasets often exceed these thresholds, and performance issues can arise well before hitting these limits. For example, datasets with more than 10,000 rows and complex formulas can cause noticeable lag. To maintain optimal performance, datasets are typically kept below a few hundred thousand rows.

Another significant drawback is the increased risk of manual errors in complex models. A simple typo can misinterpret entire data columns, and intricate formulas can become difficult to audit or maintain. In high-stakes fields like investment management, where precision is critical, these risks are magnified. Additionally, Excel lacks robust features for data governance, version control, and audit trails, making collaboration more challenging and raising compliance concerns.

Excel also struggles with advanced quantitative tasks. Its built-in statistical tools are limited compared to programming languages like Python or R. Tasks such as machine learning, detailed backtesting, or processing high-frequency tick data can quickly push Excel beyond its capabilities. File size limitations – 2GB for 32-bit desktop versions and 100MB for Excel Online – further restrict its usability for large-scale or complex projects.

Python vs Excel: Head-to-Head Comparison

When comparing Python and Excel for quantitative finance workflows, the differences become striking. Building on earlier discussions of their strengths and challenges, this section dives into how these tools stack up against each other in practical scenarios.

Comparison Across Key Metrics

The performance gap between Python and Excel is especially noticeable in speed and scalability. For instance, a VBA function in Excel took around 360 milliseconds to execute, while the same logic in plain Python completed in just 30 milliseconds – making Python 10 times faster. With Numba‘s JIT compilation and vectorized operations, Python’s execution time dropped even further to 6 milliseconds, making it 60 times faster than VBA. When working with large datasets, Python’s ability to process data in chunks can make it over 100 times faster than Excel.

| Metric | Python | Excel |

|---|---|---|

| Data Size Handling | Processes millions of rows in seconds; handles megabytes to terabytes | Limited to 1,048,576 rows; performance degrades significantly beyond 100,000 rows |

| Processing Speed | Leverages vectorized operations and compiled code; 10–100x faster than Excel VBA | Calculates row by row with limited multi-threading due to dependency chains |

| Automation Capabilities | Supports full scripting with repeatable pipelines, batch processing, and scheduling | Relies on VBA macros, which are less efficient and heavily depend on manual inputs |

| Statistical Depth | Offers advanced libraries like SciPy, Statsmodels, and Scikit-learn for complex modeling | Provides basic statistical functions; lacks depth for advanced analytics |

| Setup Requirements | Requires Python installation, IDE setup, and learning programming syntax | Pre-installed on most systems; offers immediate point-and-click access |

| Integration | Seamlessly connects to databases (SQL, NoSQL), APIs, cloud storage, and trading platforms | Struggles with external connections; lacks robust API integration |

These metrics highlight why Python often outshines Excel in handling large datasets and complex workflows.

Quantitative Finance Scenarios

The choice between Python and Excel often depends on the specific demands of the task. For smaller datasets (under 100,000 rows), Excel is sufficient. However, for larger datasets or tasks involving advanced analytics, machine learning, or automation, Python is the better option.

| Scenario | Python Performance | Excel Performance |

|---|---|---|

| Backtesting Trading Strategies | Excellent – libraries like Zipline and PyAlgoTrade efficiently handle millions of data points with event-driven architecture for high-frequency trading | Limited – struggles with large historical datasets; calculations slow down with complex formulas |

| Portfolio Optimization | Superior – SciPy and other specialized libraries solve complex optimization problems with multiple constraints | Adequate for small portfolios – Solver add-in works for basic optimization but hits limits quickly |

| Live Market Monitoring | Strong – connects directly to live exchanges and broker APIs for real-time data processing and automated execution | Good for dashboards – PivotTables and conditional formatting allow visual monitoring but lack automation capabilities |

| Risk Analytics | Excellent – handles Monte Carlo simulations with thousands of iterations and complex statistical models | Basic – works for simple VaR calculations but struggles with advanced risk modeling |

| Data Cleaning & Transformation | Highly efficient – Pandas processes large datasets and applies complex transformations in seconds | Moderate – Power Query handles basic transformations but slows down with large files |

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

In quantitative finance, the choice of tool can have a significant impact on efficiency and accuracy. Python shines in scenarios requiring speed, scalability, and advanced analytics, while Excel remains a go-to for simpler, smaller-scale tasks.

Combining Python and Excel for Quantitative Finance

In the world of quantitative finance, professionals don’t have to pick sides between Python and Excel. Instead, they often use both tools together to leverage their unique strengths. By late 2024, 58% of finance leaders still relied on spreadsheets as their primary tool, while over 90% of data science professionals turned to Python for more intricate tasks. This combination highlights how well these tools complement each other.

Python takes care of the heavy lifting – pulling data from APIs and databases, performing complex transformations, and analyzing large datasets. Excel, on the other hand, comes into play for final reporting, visualization, and presenting results to stakeholders who prefer the familiarity of spreadsheets. This blend of capabilities is increasingly common in finance, with major institutions adopting such workflows. For example, JPMorgan’s "Athena" trading and risk system operates on a staggering 35 million lines of Python code.

When to Use Python and Excel Together

Each tool has its sweet spot. Python is unbeatable for data preprocessing – it connects to market data APIs, cleans and transforms massive datasets, and handles statistical calculations that would overwhelm Excel. Once Python completes its tasks, the processed data can be exported to Excel for reporting and visualization.

Microsoft’s "Python in Excel" feature, available to Excel 365 users, has made this integration even smoother. By typing =PY() directly into Excel cells, analysts can tap into Python libraries like pandas, NumPy, and scikit-learn without ever leaving their spreadsheet. This feature bridges the gap between Python’s coding power and Excel’s user-friendly interface. For more advanced automation, libraries like xlwings and Openpyxl allow Python scripts to control Excel workbooks, offering a modern alternative to outdated VBA macros.

Here’s how a typical workflow might unfold: Python extracts, processes, and analyzes market data, then exports summary statistics to Excel. Analysts can then use Excel’s PivotTables, conditional formatting, and other features to create interactive dashboards, apply additional business logic, and share results with portfolio managers – no Python knowledge required.

Optimizing Workflows with QuantVPS

To run Python and Excel efficiently, you need reliable infrastructure. QuantVPS offers the processing power and stability required to handle these hybrid workflows without hiccups. With plans ranging from the VPS Pro (6 cores, 16GB RAM, $99.99/month) to Dedicated Servers (16+ cores, 128GB RAM, $299.99/month), QuantVPS ensures that traders can seamlessly process data with Python while maintaining Excel dashboards – all on the same remote server with low latency and guaranteed uptime.

QuantVPS is built to support Windows Server 2022, making Python and Excel integration effortless. For quantitative analysts managing automated trading strategies, this means Python can handle real-time calculations and execute trades, while Excel tracks positions and risk metrics across multiple displays. Plus, with unmetered bandwidth and NVMe storage included in every plan, transferring large datasets between Python and Excel happens instantly, eliminating the delays often faced when processing financial data locally.

Conclusion

Deciding between Python and Excel for quantitative finance doesn’t have to be an either-or choice. Python excels at managing large datasets, performing complex calculations, and automating workflows – areas where Excel can struggle. With Python holding a 28% share as the world’s most popular computing language and average salaries for Python-related roles around $87,750 compared to $48,750 for Excel-focused positions, it’s easy to see why Python has become a must-have skill. Still, Excel’s user-friendly interface and clear visuals make it invaluable for quick data exploration, polished reporting, and sharing insights with non-technical audiences.

The best strategy? Combine the strengths of both tools. Use Python for tasks like data processing, heavy computations, and building automated systems, then transfer the results to Excel for formatting, visualization, and presentations. This hybrid approach maximizes efficiency and scalability, blending Python’s computational power with Excel’s accessibility to create a seamless financial analysis workflow.

To make this integration work smoothly, you need reliable infrastructure. QuantVPS makes it easy to bridge the gap, offering high-performance capabilities to run Python scripts and Excel dashboards side by side. With features like Windows Server 2022 support, NVMe storage, and unmetered bandwidth, QuantVPS ensures fast data transfers between the two tools, eliminating delays and providing consistent uptime with low latency.

FAQs

Why is Python often preferred over Excel for data analysis in quantitative finance?

Python has become a go-to tool in quantitative finance because it’s fast, flexible, and highly capable. When it comes to handling large datasets or performing complex calculations, Python outpaces Excel by a significant margin. This makes it perfect for tasks like statistical modeling, automating workflows, and even algorithmic trading.

What sets Python apart is its rich collection of libraries like Pandas and NumPy, which make data manipulation and analysis much more straightforward. On top of that, Python seamlessly integrates with other tools and systems, making it an excellent choice for professionals dealing with dynamic, large-scale financial data.

How can Python and Excel work together effectively for financial data analysis?

Python and Excel work hand-in-hand to supercharge financial data analysis. With Python’s robust libraries like pandas, NumPy, and matplotlib, you can tackle advanced data manipulation, perform statistical modeling, and create insightful visualizations. By integrating Python directly into Excel using =PY() formulas or automating processes with scripts, you get the best of both worlds.

This combination lets you use Excel’s familiar interface for tasks like data entry and formatting, while Python handles heavy lifting – processing large datasets, automating repetitive workflows, and executing complex calculations. Together, they offer a powerful and efficient solution for quantitative finance professionals.

What challenges do finance professionals face when switching from Excel to Python?

For finance professionals who are well-versed in Excel, making the leap to Python can feel like stepping into unfamiliar territory. Unlike Excel’s user-friendly, visual interface, Python operates in a coding environment that demands a different approach. This shift can be particularly tricky for those with little to no background in programming, as it requires learning how to write and debug code – a skill that’s not always intuitive.

On top of that, Python’s learning curve can seem steep, especially when tackling tasks like managing large datasets, automating repetitive workflows, or diving into advanced statistical analysis. These tasks might feel overwhelming at first. But here’s the good news: with consistent practice and the help of libraries like Pandas and NumPy, these initial hurdles can be overcome. These tools open the door to powerful capabilities that can revolutionize workflows in quantitative finance.