Finding Your Trading Edge: The Science of Sustainable Market Advantage

A trading edge is what separates successful traders from the rest. It’s a repeatable, data-backed advantage that tilts the odds in your favor. Without one, trading becomes a losing game where fees, commissions, and randomness eat into profits. To create an edge, you need to:

- Identify inefficiencies in the market (e.g., price anomalies, behavioral patterns, or institutional constraints).

- Validate your edge with rigorous backtesting and statistical analysis to avoid relying on flawed assumptions.

- Ensure it’s durable by accounting for costs, risks, and the evolving nature of markets.

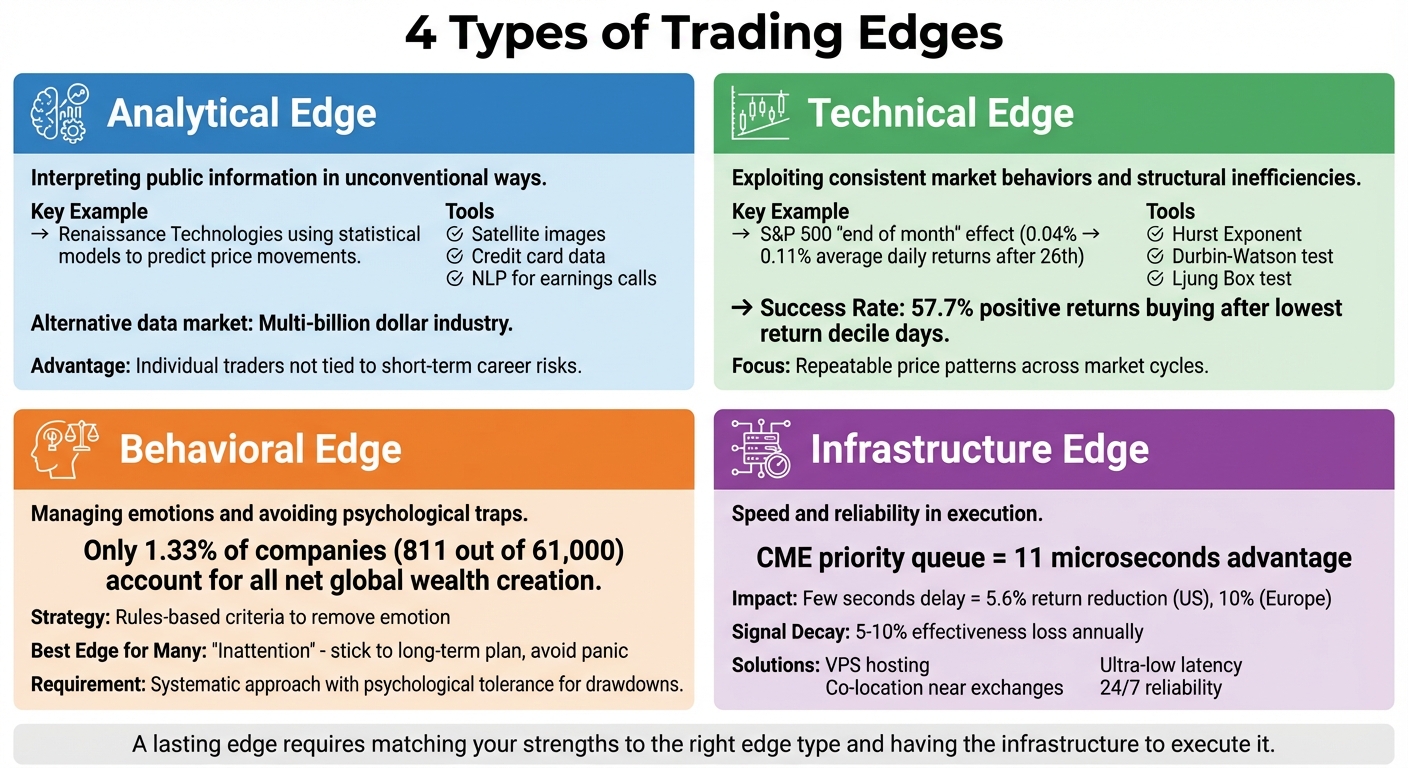

Edges fall into four main categories:

- Analytical: Interpreting public data in unique ways.

- Technical: Exploiting consistent price patterns.

- Behavioral: Managing emotions better than others.

- Infrastructure: Leveraging faster, more reliable systems.

Testing and execution are critical. Use tools like walk-forward testing, Monte Carlo simulations, and VPS-hosted systems to ensure reliability. Stay disciplined, monitor performance, and adjust only when supported by data. Trading success boils down to a systematic approach, careful validation, and precise execution.

What Makes a Trading Edge Last

Core Traits of a Lasting Edge

A lasting trading edge is built on a repeatable process that takes advantage of situations where market prices deviate from underlying fundamentals. To be effective, it must exploit persistent inefficiencies in the market while benefiting from barriers that prevent others from quickly copying it. These barriers could include high implementation costs or extended periods of underperformance that discourage competitors. Additionally, lasting edges rely on consistent market dynamics, such as information gaps, forced institutional flows (like pension fund rebalancing), or deeply rooted beliefs that resist change.

For an edge to endure, it must consistently produce a positive expected value after accounting for costs and risks. Even strategies with high win rates can fail if the occasional losses are disproportionately large. For instance, a strategy that wins 90% of the time but loses $10 for every $1 it gains would ultimately result in a negative outcome.

To ensure your edge is sustainable, rigorous statistical validation is crucial. Without this, even the most promising approach risks being based on flawed assumptions.

Using Data and Statistics to Validate Your Edge

Once you've identified a potential edge, validating its reliability through data is critical. Statistical analysis helps separate genuine edges from mere speculation or unproven theories. A real edge must stand up to scrutiny using probability and statistics, moving beyond reliance on intuition or unverified claims.

However, proving small edges can be challenging. The smaller the edge, the larger the sample size needed for statistical confidence. For example, a 0.5% edge requires 26,932 trials to achieve 95% confidence, while a 1% edge needs only 6,733 trials. Doubling the edge size from 0.5% to 1% reduces the required sample size by 75%. The table below illustrates this relationship:

| Win Rate | Edge Size | Trials Needed (95% Confidence) | Time to Proof (Daily Trading) |

|---|---|---|---|

| 50.5% | 0.5% | 26,932 | 74 years |

| 51.0% | 1.0% | 6,733 | 18 years |

| 52.0% | 2.0% | 1,683 | 5 years |

The formula $n \ge (Z_{\alpha} / (2 \times \text{edge}))^2$ demonstrates why proving small edges often requires extensive time and data. For example, a daily trader with a 51% win rate would need 18 years of trading to confirm their edge with 95% confidence.

When backtesting, it's vital to avoid biases that could distort results. Event-driven backtesting processes data one event at a time, closely mimicking real trading conditions and avoiding look-ahead bias. On the other hand, vectorized backtesting uses faster array operations but requires careful time alignment to prevent data leakage. Among these methods, walk-forward analysis is often considered the most reliable. It alternates between in-sample (training) and out-of-sample (testing) periods, ensuring the strategy isn't simply overfitted to historical data. If a strategy fails during out-of-sample testing, it likely won't hold up in real-world trading.

4 Types of Trading Edges

Four Types of Trading Edges: Analytical, Technical, Behavioral, and Infrastructure

Four Types of Trading Edges: Analytical, Technical, Behavioral, and Infrastructure

Trading edges can be grouped into four main categories, each offering a different way to gain an advantage in the markets. Knowing these categories helps you figure out where your strengths lie and how to match your approach to your resources and personality.

Analytical Edges

An analytical edge involves interpreting available information in a way that others don’t. It’s not about having exclusive data but about analyzing public information in unconventional ways. A great example is Renaissance Technologies, founded by Jim Simons. Simons explained their approach as follows:

"Renaissance essentially attempts to predict the future movement of financial instruments, within a specific time frame, using statistical models. The firm searches for something that might be producing anomalies in price movements that can be exploited".

"Renaissance essentially attempts to predict the future movement of financial instruments, within a specific time frame, using statistical models. The firm searches for something that might be producing anomalies in price movements that can be exploited".

Over the past decade, the alternative data market has grown into a multibillion-dollar industry. Traders now use tools like satellite images to estimate retail activity, credit card data to spot spending trends, and Natural Language Processing to analyze earnings calls for hints about management confidence. To make the most of an analytical edge, compare signals to historical baselines instead of viewing them in isolation. Focus on situations where the market is forced to act, like during index rebalancing, margin calls, or bond downgrades. Individual traders often have an advantage here because they’re not tied to short-term career risks or rigid rules, unlike institutions. By turning raw data into actionable insights, this edge allows traders to stand out through smarter analysis.

Next, technical edges rely on predictable market patterns to create opportunities.

Technical Edges

Technical edges take advantage of consistent market behaviors and structural inefficiencies. These edges aren’t about predicting fundamental value but rather about identifying and using repeatable price patterns.

For instance, the S&P 500 shows a recurring anomaly where average daily returns rise from 0.04% to 0.11% on days after the 26th of the month. This "end of month" effect has persisted for decades. Another example is buying after a day in the lowest return decile, which has historically resulted in positive one-day returns 57.7% of the time for the SPY ETF.

Tools like the Hurst Exponent can help determine if an asset is trending (value > 0.5) or mean-reverting (value < 0.5), which guides traders in picking the right strategies. Some traders strengthen their technical edge by requiring multiple technical signals - like support levels, moving averages, and Fibonacci retracements - to align before making a move.

To refine this edge further, statistical tests like Durbin-Watson or Ljung Box can check for autocorrelation in returns before deploying trend-following or mean-reversion strategies. Ensuring your average profit per trade (APPT) accounts for slippage and transaction costs is also critical. A technical edge focuses on finding and exploiting patterns that remain consistent across different market cycles.

Following these quantitative strategies, a behavioral edge centers on mastering emotional control.

Behavioral Edges

A behavioral edge comes from managing emotions and avoiding the psychological traps that cause many traders to fail. A study of global stocks revealed that only 811 companies (just 1.33% of the total) accounted for all net global wealth creation, underscoring how tough it is to outperform the market through active trading. For many individual investors, the most reliable edge might be "inattention" - sticking to a long-term plan and avoiding panic-driven decisions or chasing trends.

This edge requires a systematic approach, using rules-based criteria to remove emotion from trading decisions. For example, mean-reversion strategies often bring frequent small wins but occasional large losses, while trend-following strategies involve many small losses offset by a few big gains. Knowing your psychological tolerance for these outcomes can help you avoid abandoning strategies during inevitable drawdowns. A behavioral edge ensures you stick to proven strategies, no matter the market conditions.

Infrastructure Edges

Infrastructure is the backbone of trading success. Even the most innovative strategies can fail if execution is slow. In today’s markets, speed is everything. The "latency gap" often determines who captures an opportunity first. For example, firms with priority queue positions at the CME can receive private fill messages up to 11 microseconds before trades appear publicly.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

In competitive markets like FX and equities, a delay of just a few seconds can cut trading returns by 5.6% in the U.S. and nearly 10% in Europe. As Exegy puts it:

"The latency gap is the alpha gap: when edge disappears before you see it".

"The latency gap is the alpha gap: when edge disappears before you see it".

Predictive signals lose 5% to 10% of their effectiveness annually in U.S. and European markets due to increasing competition and signal saturation.

Services like QuantVPS offer high-performance hosting with ultra-low latency and 24/7 reliability. By co-locating servers near exchange data centers, traders can reduce latency to microseconds. Redundancy through multiple ISPs helps prevent network outages, while real-time alerts for issues like connection loss or order rejections ensure problems are addressed immediately. Using tools like Docker to containerize environments also ensures consistent performance across development and production servers. This edge provides the technical foundation needed for executing strategies efficiently and reliably.

How to Find Market Inefficiencies Using Data

Identifying a genuine market inefficiency isn’t something you stumble upon by chance - it requires a structured, scientific approach. Every strategy should begin with a specific, testable hypothesis grounded in sound economic reasoning. For instance, you might explore behavioral underreaction to earnings surprises or the effects of institutional constraints during index rebalancing. Without this foundation, you risk confusing random patterns with a sustainable edge. Let’s break down the process to uncover and confirm these inefficiencies.

The first step? Ensuring your data is reliable. Survivorship bias is a common pitfall - this occurs when failed or delisted stocks are excluded from historical datasets, leading to inflated backtest returns. For example, one simulation showed a 12.0% return when using survivor-only data, compared to just 0.8% when failed stocks were included. To avoid this, use point-in-time databases like CRSP, which preserve historical records, including bankrupt assets.

Once your data checks out, it’s time to transform it into actionable signals. Techniques like Z-scores, which standardize deviations using rolling means and standard deviations, help make patterns consistent across assets and timeframes. Backtesting then evaluates your hypothesis. Whether through vectorized screening or event-driven engines, this step mimics live trading conditions. A biased backtest using future data, for instance, might show a 1.5608% mean daily return, while a corrected point-in-time version reveals a much more modest 0.0373%.

The final hurdle is validation. Walk-Forward Analysis (WFA) rotates through training and testing periods to ensure your strategy performs across different market conditions, while Monte Carlo simulations shuffle trade sequences to estimate risks like maximum drawdowns. Keep in mind, testing thousands of random strategies will inevitably produce some that appear statistically significant purely by chance. For example, testing 1,000 random strategies at the 5% significance level will yield roughly 50 false positives. A true edge should remain robust even when parameters are adjusted by up to 30%.

Steps to Find and Test Inefficiencies

Here’s a breakdown of the process into actionable phases:

- Form a hypothesis based on economic rationale. For example, in November 2025, Mainak Singha documented a cross-sectional equity factor combining value and short-term reversal signals. By activating these signals only during "drift regimes" (periods when stocks had over 60% positive days in 63 days), the strategy achieved an annualized return of 158.6% with a maximum drawdown of -11.9% across S&P 500 data from 2004 to 2024. Even with a 30% parameter shift, the Sharpe ratio remained above 7.

- Test your hypothesis using rigorous statistical methods. In December 2025, Gagan Deep, Akash Deep, and William Lamptey validated five market microstructure patterns across 100 U.S. equities from 2015 to 2024. Using a walk-forward framework with 34 independent test periods, they found that signals driven by high information arrival and trading activity achieved a market-neutral beta of 0.058 with a maximum drawdown of just -2.76%. This ensures the strategy isn’t merely overfitted to past data.

- Stress test your strategy to confirm its sustainability. Run over 1,000 randomization trials to calculate a p-value. A valid edge should outperform random chance significantly (p-value < 0.001). As Peter Carr and Marcos Lopez de Prado warn:

"Calibrating a trading rule using a historical simulation (also called backtest) contributes to backtest overfitting, which in turn leads to underperformance".

"Calibrating a trading rule using a historical simulation (also called backtest) contributes to backtest overfitting, which in turn leads to underperformance".

- Estimate capacity - determine how much capital your strategy can handle before performance suffers due to market impact or slippage. A well-defined edge should specify its deployable capital range, such as $100 million to $500 million, to set realistic expectations.

Now that you understand the testing process, the next step is to examine how different inefficiency types vary in terms of duration, persistence, and ease of exploitation.

Comparing Different Market Inefficiency Types

To successfully implement a strategy, you need to align your resources with the inefficiency’s characteristics. Here’s a comparison of different inefficiency types:

| Inefficiency Type | Source of Edge | Duration/Persistence | Ease of Exploitation |

|---|---|---|---|

| Microstructure | Information arrival/Trading activity | Short-term; regime-dependent | High (requires low-latency infrastructure) |

| Behavioral (Drift) | Investor biases/Underreaction | Medium-term; persists in trends | Moderate (requires regime filters) |

| Institutional | Constraints/Arbitrage limits | Long-term; structural | Low (often requires high capital) |

Let’s break these down further:

- Microstructure inefficiencies, like order flow imbalances, are fleeting and require ultra-low latency systems to capitalize on. For example, these inefficiencies generated 0.60% quarterly returns during high-volatility periods (2020–2024) but lost 0.16% in calmer markets (2015–2019).

- Behavioral inefficiencies, driven by biases like underreaction to news, last longer. These can be exploited with regime filters that activate signals during favorable conditions.

- Institutional inefficiencies, such as forced selling during index rebalancing, are structural and persist over time. However, exploiting them often demands significant capital.

Your infrastructure should match the inefficiency type. For microstructure strategies, services like QuantVPS offer the low-latency hosting needed for time-sensitive trades. For behavioral or institutional strategies, focus on building strong data pipelines and monitoring systems to ensure your edge adapts as markets evolve.

Strategies and Tools for Improving Your Edge

After identifying and confirming an inefficiency, the next step is execution. Building a strong edge requires a solid strategy, the right tools, and effective risk controls.

Long-Term Market Timing Strategies

Once inefficiencies are validated, the focus shifts to refining your approach with specific strategies. Long-term methods often emphasize trend-based allocation and monthly rebalancing, which aim to capture broader market movements while keeping transaction costs low. These strategies usually operate on daily or weekly timeframes, making them practical for traders who can't monitor the market constantly. For example, a dual-momentum strategy might alternate between equities and bonds based on trailing 12-month returns, rebalancing monthly. This approach filters out short-term noise and focuses on sustained trends. The benefit? Lower turnover translates to fewer commissions and reduced slippage, preserving your edge over time.

Backtesting and Equity Curve Simulation

Backtesting platforms are crucial for testing whether your strategy can perform under real-world conditions. Take QuantConnect, for instance - it runs over 15,000 backtests daily and processes more than $45 billion in notional volume each month. It offers a free tier for beginners and paid options for access to institutional-grade data. Recently, it introduced "Mia", an AI assistant designed to help professional teams create, optimize, and deploy strategies using natural language.

Discipline is critical in backtesting. Research suggests that performing 0–30 backtests on a single idea is generally safe from overfitting, while 70+ backtests increase the risk significantly. Similarly, strategies with 0–10 parameters are often more robust, whereas 20+ parameters can lead to overfitting. As one expert from QuantStrategy.io advises:

"A slightly less profitable strategy that is highly robust is almost always preferable to a historically perfect strategy that immediately breaks down in live market conditions." - QuantStrategy.io

"A slightly less profitable strategy that is highly robust is almost always preferable to a historically perfect strategy that immediately breaks down in live market conditions." - QuantStrategy.io

Experienced quants typically aim to test a single hypothesis within 8–16 hours to avoid "data dredging" or over-optimizing a failing idea. These disciplined practices form the foundation for effective risk management and capital allocation.

Position Sizing and Risk Management

Risk controls are essential for turning a refined edge into consistent performance. Position sizing determines how much capital to allocate per trade, directly influencing growth and drawdowns. The Kelly Criterion provides a mathematical framework for optimal sizing, but full Kelly betting can result in significant drawdowns - up to 50% or more - even for profitable strategies. Many traders prefer fractional Kelly, betting 25% to 50% of the optimal amount. For example, half-Kelly retains 75% of potential growth while reducing variance by 25%.

In addition to individual trade sizing, implementing portfolio-level drawdown limits can protect your equity. Common controls include halting all trading if equity drops more than 5% in a day or 10% in a week. Many traders also cap risk at 1–2% of account equity per trade. To ensure realistic execution, limit order sizes to no more than 5% of the security's average daily volume (ADV).

Matching Infrastructure to Strategy Complexity

Your technology setup needs to align with your strategy's complexity to ensure smooth, real-time execution. For early development, a local PC might suffice, but it’s prone to power outages and connectivity issues. As you scale up, a VPS (Virtual Private Server) offers uninterrupted 24/7 operation. For more advanced, high-performance strategies, dedicated servers provide maximum reliability and should ideally be located near your broker's servers to minimize latency.

QuantVPS offers pricing plans tailored to different levels of trading activity:

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

- VPS Lite: $59.99/month (or $41.99/month billed annually). Supports 1–2 charts with 4 cores, 8GB RAM, and 70GB NVMe storage.

- VPS Pro: $99.99/month (or $69.99/month billed annually). Handles 3–5 charts with 6 cores, 16GB RAM, and support for up to 2 monitors.

- VPS Ultra: $189.99/month (or $132.99/month billed annually). Designed for 5–7 charts with 24 cores, 64GB RAM, and up to 4 monitors.

- Dedicated Server: $299.99/month (or $209.99/month billed annually). Built for 7+ charts and heavy workloads, offering 16+ dedicated cores, 128GB RAM, 2TB+ NVMe storage, and up to 6 monitors.

All plans include 1Gbps+ network speeds, unmetered bandwidth, and Windows Server 2022.

To ensure reliability, maintain redundancy with both primary and backup data feeds, and keep offsite backups of all code, configurations, and logs. Avoid jumping straight from backtesting to full-scale trading - use a gradual deployment process: start with paper trading, move to a small live account (25–50% size), and only then transition to full production.

Keeping Your Edge Working Over Time

A trading edge isn’t static; it evolves as markets change. Volatility shifts, and strategies that once thrived may lose their effectiveness. In fact, more than 90% of strategies that seem promising in backtests fail when applied with real capital. Even strategies published in academic journals often see their returns drop - by 26% out-of-sample and a staggering 58% after publication, as they get widely adopted. The key to staying ahead is having a systematic approach to monitor, review, and refine your edge without making unnecessary tweaks. This requires a data-driven process for ongoing analysis and adjustment.

Building a Data-Driven Trading Process

Your trading process should reflect your personality, schedule, and risk tolerance. Start by defining clear rules for entries, exits, and position sizing. Write these rules down to keep them front and center during live trading. Make it a habit to conduct a weekly review of your trades - not from the perspective of a gambler chasing profits, but with a scientific mindset. Focus on whether you followed your process, not just your profit and loss numbers. Studies show that deliberate reflection on performance data can improve results by almost 23%.

Keep a trading journal and classify trades by market conditions, such as "high volatility", "range-bound", or "news-driven." This categorization helps pinpoint where your edge works best and where it struggles. Without this level of detail, you might misinterpret temporary underperformance as a deeper issue with your strategy.

Monitoring and Checking Performance

Once you’ve established a systematic process, consistent monitoring becomes critical. Compare your live results to the metrics from your original backtests to identify any performance drift. Before going live, set clear stop criteria - for example, shutting down a system if its drawdown exceeds the 5th percentile of your Monte Carlo simulations or if the win rate drops more than 15% below historical averages. These predefined rules help you avoid emotional decisions during losing streaks.

QuantVPS can help with system monitoring by tracking uptime and execution reliability. Whether you’re running a single strategy on VPS Lite ($59.99/month or $41.99/month billed annually) or managing multiple systems on a Dedicated Server ($299.99/month or $209.99/month billed annually), reliable infrastructure monitoring ensures technical issues don’t erode your edge. Combine this with tools that automatically compare live performance to historical benchmarks to catch deviations early.

Adjusting to Market Changes

Markets constantly shift between trending, ranging, and high-volatility phases, so your edge must adapt. But don’t fall into the trap of overcomplicating your strategy. For instance, after a drawdown, resist the urge to pile on multiple indicators or filters at once. Instead, rely on robust backtesting and regular performance reviews, making adjustments only when supported by statistical evidence. Use the EDGE Framework as a guide:

- Evaluate performance over 20–50 trades.

- Distinguish the current market conditions.

- Make gradual, single adjustments (e.g., tweaking stop losses or entry criteria).

- Verify changes with data before scaling up.

For example, if your trend-following system starts underperforming, check if the market has shifted from trending to range-bound behavior. You might add a session filter to avoid low-liquidity hours or refine your entry signals. Test any changes on a small scale - over 20–30 trades - before applying them broadly.

As Kevin Davey, author of Building Winning Algorithmic Trading Systems, explains:

"Only 1 out of every 20 strategy ideas survives a complete validation process to reach live trading".

"Only 1 out of every 20 strategy ideas survives a complete validation process to reach live trading".

This level of discipline is just as crucial when making adjustments. Most tweaks won’t improve performance, so always demand statistical proof before committing more capital.

Conclusion

Building and maintaining a lasting trading edge demands thorough research, careful validation, and precise execution. The numbers back this up: survivorship bias alone can inflate backtested returns by a striking 11.2 percentage points. In one study of 1,000 random strategies with no real alpha, 84 still managed to show a Sharpe ratio above 1.0 - purely due to chance. Without grounding your strategies in robust, out-of-sample data, you risk mistaking random noise for meaningful signals.

Top traders approach strategy development like scientists. Instead of chasing patterns in historical data, they base their hypotheses on sound economic principles - concepts like volatility clustering, liquidity imbalances, or structural inefficiencies. They rely on rigorous validation techniques, such as Walk-Forward Analysis and Monte Carlo simulations, while accounting for real-world frictions like slippage and commissions from the outset. As quant.fish aptly put it:

"Models are multipliers - if your features are noise, all you multiply is noise".

"Models are multipliers - if your features are noise, all you multiply is noise".

Just as we’ve discussed earlier, ongoing validation strengthens your edge over time.

Execution is equally critical. Even small delays in execution can chip away at your returns. A Virtual Private Server (VPS) helps mitigate these risks by isolating your trading systems from local disruptions, ensuring automated strategies run smoothly without interruptions. Whether you’re deploying a single strategy or managing a portfolio of systems, tools like QuantVPS deliver the uptime, low latency, and monitoring capabilities you need to safeguard your edge.

It’s also important to recognize that even the most well-crafted strategies degrade over time. Predictive signals tend to lose 5–10% of their effectiveness annually. The key isn’t constant tweaking but disciplined monitoring and adjustment, guided by statistical evidence. Set predefined stop criteria, compare live performance to backtested benchmarks, and make gradual, data-supported changes when market dynamics shift.

Ultimately, your trading edge is built on a foundation of solid research, rigorous testing, dependable infrastructure, and continual adaptation. By staying committed to a disciplined, data-driven process, you can maintain your advantage in markets that are always changing. Stick to this approach, and you’ll be well-equipped to evolve alongside the markets.

FAQs

How do I know my trading edge is real?

To ensure your trading edge is legitimate, it's crucial to test whether your strategy consistently produces meaningful results over time. You can do this by applying methods like backtesting with historical data, out-of-sample testing, or even live trading to evaluate its performance.

It's also helpful to compare your strategy against random or simulated strategies. Pay close attention to key metrics like win rate and profit factor. If your strategy delivers steady positive results across these different approaches, it’s a strong indication that your edge is real and not just a streak of good luck.

How much data is needed to prove a small edge?

To confirm the reliability of a small trading edge, you typically need to analyze 200-500 trades under a variety of market conditions. This sample size helps ensure the results are statistically dependable and provides confidence in how the edge performs over time. It's crucial to test across different market environments to assess whether the edge can hold up consistently.

When should I change or stop a strategy?

Deciding whether to adjust or abandon a trading strategy requires careful attention to performance trends and specific indicators, such as significant drawdowns or shifts in market conditions. Tools like backtesting and robustness testing can help determine if a strategy is still delivering results. It's important to resist reacting impulsively to short-term market noise. Instead, rely on well-defined stop criteria to make decisions rooted in clear, data-backed analysis rather than being swayed by temporary market changes.

To ensure your trading edge is legitimate, it's crucial to test whether your strategy consistently produces meaningful results over time. You can do this by applying methods like backtesting with historical data, out-of-sample testing, or even live trading to evaluate its performance.

It's also helpful to compare your strategy against random or simulated strategies. Pay close attention to key metrics like win rate and profit factor. If your strategy delivers steady positive results across these different approaches, it’s a strong indication that your edge is real and not just a streak of good luck.

To confirm the reliability of a small trading edge, you typically need to analyze 200-500 trades under a variety of market conditions. This sample size helps ensure the results are statistically dependable and provides confidence in how the edge performs over time. It's crucial to test across different market environments to assess whether the edge can hold up consistently.

Deciding whether to adjust or abandon a trading strategy requires careful attention to performance trends and specific indicators, such as significant drawdowns or shifts in market conditions. Tools like backtesting and robustness testing can help determine if a strategy is still delivering results. It's important to resist reacting impulsively to short-term market noise. Instead, rely on well-defined stop criteria to make decisions rooted in clear, data-backed analysis rather than being swayed by temporary market changes.

"}}]}