AI-Powered Real-Time Trading News Feed for Investors

AI-powered real-time trading news feeds are reshaping how traders access and act on market information. These tools use advanced natural language processing (NLP) and sentiment analysis to filter critical updates - like earnings reports, economic indicators, and market sentiment shifts - delivering instant, actionable alerts. Speed and reliability are key, as every millisecond can impact trading outcomes.

Key highlights:

- Real-time alerts: Push notifications for market-moving events.

- AI summaries: Simplified insights from complex news.

- Sentiment analysis: Tracks market mood with numerical scores.

- Low-latency infrastructure: Ensures swift data delivery and execution.

- Customizable filters: Tailored updates based on user preferences.

- Integration with trading platforms: Enables immediate action on insights.

- Risk management tools: Helps monitor volatility and reduce slippage in Forex trading.

Platforms like QuantVPS enhance these systems with high-speed servers, ultra-low latency, and continuous uptime, ensuring traders can capitalize on opportunities without delays.

Technologies Behind AI News Feeds

Natural Language Processing and Sentiment Analysis

AI-driven news feeds heavily rely on Natural Language Processing (NLP) to transform unstructured text - like chat messages, earnings reports, and breaking news - into actionable insights for trading. By identifying key financial details within text, such as ticker symbols, trade sizes, or market directions (buy or sell), NLP automates workflows, cutting down on manual tasks and reducing errors. It even uses smart synonyms to recognize different terms that share the same intent, like equating "TAM" with "market size", ensuring no critical data slips through the cracks.

Building on NLP, sentiment analysis interprets the tone and subjective meaning of text, assigning numerical scores to capture sentiment shifts. These scores, often paired with visual cues like color coding (positive, negative, or neutral), help traders monitor market mood over time. For instance, AlphaSense has spent over a decade refining its sentiment analysis tools to deliver precise tonal scores. In a notable example, Bloomberg upgraded its Instant Bloomberg service in July 2024 by integrating NLP to automatically identify and process quote requests within chat rooms. This feature extracts security details and sends them directly to pricing engines via API, streamlining processes for banks and brokers.

As Bloomberg Professional Services highlights:

"NLP has made it possible to identify content, such as the security size, side of the market, and intent related to an inquiry, within chat room text that can be digitized for use within users' internal systems".

"NLP has made it possible to identify content, such as the security size, side of the market, and intent related to an inquiry, within chat room text that can be digitized for use within users' internal systems".

These advancements depend on a fast, reliable infrastructure to convert insights into real-time trading decisions.

Low-Latency Infrastructure Requirements

For these analytical technologies to work seamlessly, trading systems need infrastructure capable of operating at microsecond-level speeds. AI-powered trading platforms can assess market conditions and execute trades in under 100 microseconds. To achieve this, high-frequency trading setups often position servers in central network hubs, like Chicago, to reduce data travel time between the news source, AI processor, and trading exchange.

The most efficient systems use push-based data delivery instead of polling or "firehose" methods. This approach ensures traders receive only the most critical event alerts, avoiding information overload while enabling immediate action. A great example is Bloomberg's real-time corporate earnings feed, which delivers market-moving KPIs for over 10,000 companies. As Colette Garcia, Global Head of Enterprise Data Real-Time Content at Bloomberg, explains:

"Events data has traditionally posed challenges for front-office professionals due to fragmented disclosures and required manual searches across sources, time-sensitivity of the data, and the need to monitor up to thousands of tickers at once".

"Events data has traditionally posed challenges for front-office professionals due to fragmented disclosures and required manual searches across sources, time-sensitivity of the data, and the need to monitor up to thousands of tickers at once".

To handle these demands, QuantVPS offers high-performance servers with direct data connections, eliminating bottlenecks during critical trading moments. This infrastructure is key to supporting the low-latency futures trading operations essential for processing AI-powered news feeds.

Features of AI News Feeds for Traders

Real-Time Alerts and Customization

AI news feeds provide instantaneous alerts as events unfold, saving traders from the hassle of manually refreshing screens or filtering through irrelevant updates. These alerts can be delivered in various formats - audio cues, text messages, or visual banners - directly on trading screens, ensuring traders stay informed without distraction. The alerts are tailored to match predefined criteria like earnings announcements or critical economic indicators.

A standout feature is the use of "Smart Synonyms", which ensures that searching for terms like "TAM" also captures related phrases such as "total addressable market" or "market size". Traders can create custom filter templates by selecting specific tickers, sectors, news sources, or topics, receiving only the information that aligns with their trading strategies. For instance, Bloomberg’s Economic Releases data feed tracks up to 3,000 indicators across more than 100 countries, while its Corporate Events Calendar monitors over 50,000 public companies worldwide. These personalized alerts become even more effective when integrated with trading systems, enabling seamless decision-making.

Integration with Trading Platforms

AI news feeds can connect directly to trading platforms, enabling traders to act immediately on market alerts. Tools like "Brokerage Plus" allow automatic order placement when an AI scanner identifies a market-moving headline. Similarly, "External Linking" syncs stock symbols from news feeds with third-party charting tools for streamlined analysis.

Advanced solutions like Bloomberg’s B-PIPE offer unified data pipelines, combining news insights, market data, pricing, and analytics into a single stream. This ensures consistent real-time information across both manual desktop terminals and automated workflows, reducing discrepancies in decision-making. Colette Garcia, Global Head of Enterprise Data Real-Time Content at Bloomberg, highlights this approach:

"As the front office embraces automation to navigate evolving market conditions... Bloomberg is committed to delivering real-time events data... to empower customers to make informed, data-centric decisions for immediate alpha capture".

"As the front office embraces automation to navigate evolving market conditions... Bloomberg is committed to delivering real-time events data... to empower customers to make informed, data-centric decisions for immediate alpha capture".

QuantVPS enhances these integrations with its high-performance hosting infrastructure, providing the low-latency connections needed for smooth data flow between AI news feeds and trading platforms. This setup enables traders to execute orders as quickly as insights arrive, with built-in risk controls offering added protection during volatile market conditions.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Risk Management and Volatility Tools

AI news feeds also include tools for managing risk, such as volatility tracking and slippage controls, which are particularly useful during high-impact events. Sentiment analysis features assign numerical scores and use color-coding to quickly highlight whether market sentiment is positive, negative, or neutral, acting as an early warning system for shifts in market mood.

Generative AI further simplifies complex information by creating bullet-point summaries of earnings calls and reports, offering traders concise insights at a glance. George Karas, Senior Executive Trader at Trillium Trading, shares his perspective:

"The new AI-Powered News Summaries... provide clear, concise insights that allow me to quickly grasp the essence of complex stories. As an event-driven proprietary trader, I find this to be an incredibly valuable tool for staying informed in a constantly evolving market".

"The new AI-Powered News Summaries... provide clear, concise insights that allow me to quickly grasp the essence of complex stories. As an event-driven proprietary trader, I find this to be an incredibly valuable tool for staying informed in a constantly evolving market".

Some platforms also include Python backtesting libraries to assess how specific news-based entry signals have performed historically, helping traders refine their strategies before committing funds. Real-time event calendars combined with volatility monitoring help traders navigate high-impact periods effectively. QuantVPS’s robust infrastructure ensures these tools maintain peak performance even during intense market activity, giving traders the confidence to manage risks efficiently.

I Built an AI Bot That Reads Market News and Predicts Sentiment Instantly [Free Python Script]

Benefits of AI News Feeds on QuantVPS Infrastructure

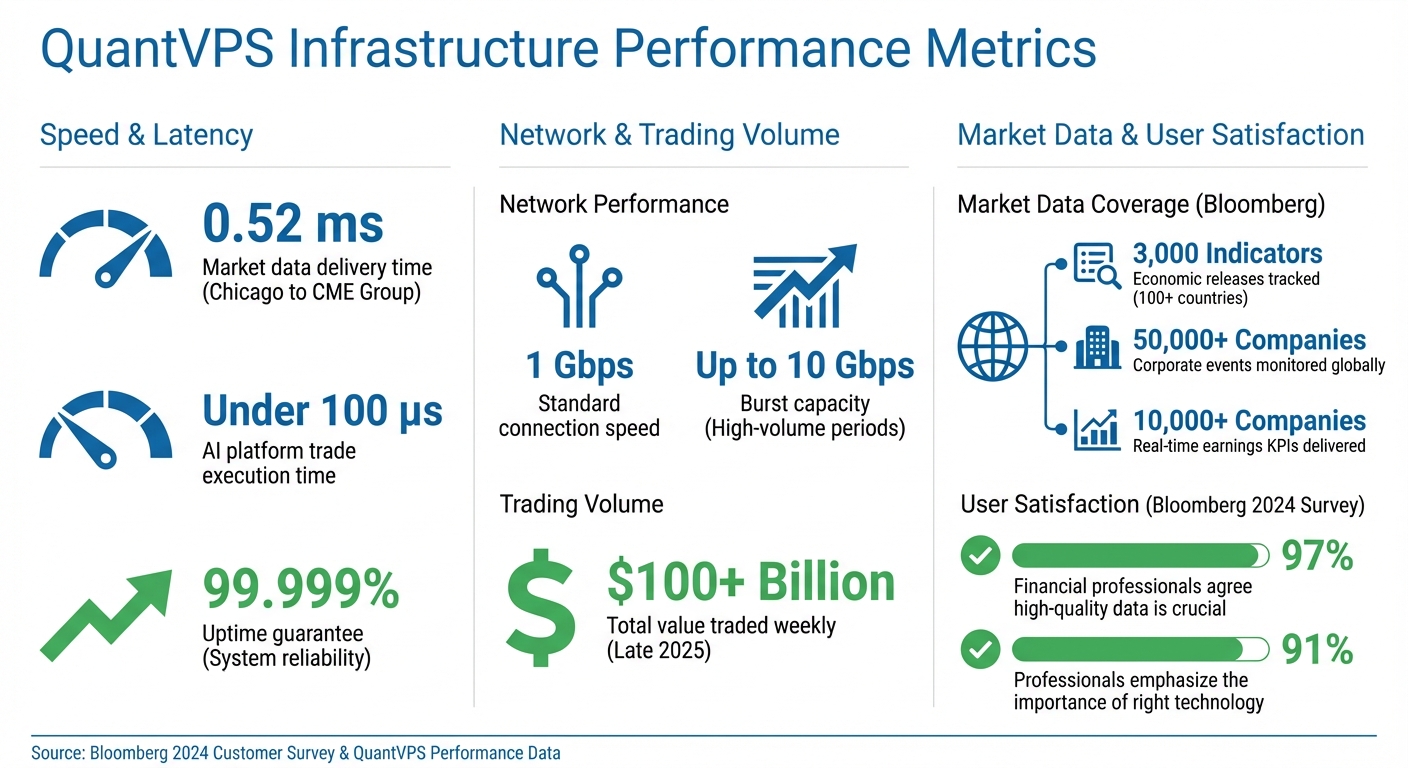

AI Trading News Feed Benefits: Key Statistics and Infrastructure Performance

AI Trading News Feed Benefits: Key Statistics and Infrastructure Performance

QuantVPS's advanced infrastructure enhances the performance of AI news feeds, delivering tangible advantages in high-stakes trading scenarios.

Faster Decision-Making in Volatile Markets

In fast-moving markets, timing is everything. QuantVPS's Chicago-based datacenter connects directly to the CME Group exchange using fiber-optic cross-connects, achieving market data delivery in under 0.52 milliseconds. This ultra-low latency allows AI-powered news feeds to analyze sentiment and trigger trade signals almost instantly. During unpredictable events - like surprise Federal Reserve announcements or unexpected earnings results - QuantVPS ensures traders can act on AI-generated alerts without delays.

To handle the demands of AI processing, QuantVPS deploys enterprise-grade AMD EPYC and Ryzen processors, paired with DDR4/5 RAM and NVMe M.2 SSDs. These components efficiently manage the heavy computational load of sentiment analysis and news filtering. The infrastructure's reliability is evident, with over $100 billion traded on QuantVPS servers in just one week in late 2025. This speed and efficiency empower traders to capitalize on fleeting opportunities in volatile markets.

Reducing Slippage and Downtime

Slippage - when trades execute at a price different from the intended one - can significantly impact profits, especially during news-driven volatility. QuantVPS combats this with a 99.999% uptime guarantee, ensuring that AI news feeds and automated trading systems stay online, even during market turbulence. Robust DDoS protection further shields trading operations from disruptions caused by cyberattacks.

"Our Chicago datacenter provides ultra-low latency directly to the CME exchange, enabling faster futures trade execution and minimizing slippage."

- QuantVPS

"Our Chicago datacenter provides ultra-low latency directly to the CME exchange, enabling faster futures trade execution and minimizing slippage."

- QuantVPS

With 1Gbps standard connections and a burst capacity of up to 10Gbps, QuantVPS handles data surges during major news events seamlessly. This prevents lag that could lead to subpar order execution, giving traders a competitive edge when it matters most.

Supporting AI and Backtesting Strategies

QuantVPS isn't just about speed - it also supports the strategic side of trading.

AI-driven strategies require significant computational power, which many local machines can't provide. QuantVPS's Performance+ plans are designed for these demands, offering high-speed DDR5 memory and NVMe storage to handle complex algorithm backtesting and manage portfolio-specific alerts. The infrastructure enables AI bots and news filters to operate continuously, capturing opportunities in global forex and futures markets around the clock.

For intensive backtesting, the ChartVPS Alpha Series starts at $70/month, providing 2 cores (Ryzen 9950X) and 8GB DDR5 RAM. For even greater power, GPU-accelerated Gamma Series plans begin at $200/month. Monitoring tools like ServerIQ help users track CPU and RAM usage, ensuring efficient AI processing even during periods of high market activity. This combination of continuous monitoring and computational power allows traders to refine strategies and adapt to market volatility with precision.

Setting Up AI News Feeds with QuantVPS

Choosing the Right QuantVPS Plan

QuantVPS offers several low-latency trading servers designed to meet a range of AI news monitoring needs:

- VPS Pro: Priced at $99.99/month (or $69.99/year), this plan includes 6 cores, 16GB of RAM, and 150GB of NVMe storage. It’s a solid choice for moderate chart setups and basic AI filtering on platforms like NinjaTrader or TradeStation.

- VPS Ultra: At $189.99/month ($132.99/year), this plan provides 24 cores, 64GB of RAM, and 500GB of NVMe storage. It’s ideal for handling 5–7 charts and running intensive AI sentiment analysis without performance slowdowns.

- VPS Pro+: For $129.99/month ($90.99/year), this plan adds Multi-Monitor RDP support, making it easier to manage multiple news feeds and charts across up to two monitors.

- Dedicated+ Server: Designed for professional workloads, this plan costs $399.99/month ($279.99/year) and delivers 16+ dedicated cores, 128GB of RAM, and over 2TB of NVMe storage. It supports up to six monitors and is perfect for setups requiring 7+ charts.

Configuring AI Feeds and Filters

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Once you’ve selected the right plan, you can set up your AI tools to take full advantage of QuantVPS’s high-speed connectivity. Begin by installing your trading and AI news tools directly onto your VPS.

For comprehensive market intelligence, consider tools like AlphaSense or Trade Ideas. AlphaSense, for instance, indexes over 500 million premium business documents - including equity research, SEC filings, and expert transcripts - providing in-depth coverage for news analysis.

To stay ahead of the curve, create "Saved Searches" within your AI tool and set up keyword filters for specific risk factors like "SEC inquiry", "lower guidance", or "production issue." Opt for real-time notifications to receive instant updates via email or push alerts when relevant news breaks. Many tools also include built-in sentiment analysis, assigning numerical scores to news events, which can help automate risk management by identifying shifts in market tone.

For those using AI scanners like Trade Ideas, enabling "External Linking" connects the AI directly to your charting platform. This allows the tool to send symbols automatically to your trading interface, streamlining execution. If your strategies demand more computational power, QuantVPS’s Performance+ plans can handle the extra workload.

Using Performance+ Plans for Complex Strategies

Performance+ plans are built for demanding tasks, featuring high-core AMD EPYC and Ryzen processors, high-speed DDR4/5 RAM, and NVMe M.2 SSDs. These specs eliminate bottlenecks during data-heavy processes like rapid news analysis and trading.

One of the key benefits of these plans is their ability to keep your AI bots and news filters running 24/7, even when your local computer is off. This ensures you never miss opportunities in global forex and futures markets, regardless of the time.

With a 1Gbps+ network connection and the ability to burst up to 10Gbps, Performance+ plans handle data spikes during major news events without lag. Whether you’re preparing automated earnings reports or conducting competitive benchmarking, these plans ensure your AI-powered workflows run smoothly, even during periods of extreme market volatility.

Conclusion

AI-powered real-time trading news feeds have reshaped how traders respond to market events. By pulling data from sources like press releases, regulatory filings, and earnings calls the moment they’re disclosed, these tools allow traders to act on opportunities before the broader market catches up. According to Bloomberg's 2024 customer survey, 97% of financial professionals agree that high-quality data is crucial for making decisions, while 91% highlight the importance of having the right technology to perform their roles effectively. This edge in speed and data quality is driving industry leaders to champion these advancements.

Experts underline that success with AI-driven insights hinges on two things: speed and accuracy. Without the right infrastructure, even the best insights can fall short.

That’s where QuantVPS comes in. Their cutting-edge infrastructure ensures ultra-low latency, which is critical for event-driven and high-frequency trading strategies. With Performance+ plans, traders benefit from reliable 1Gbps+ network connections, high-performance CPUs, and NVMe storage. These features eliminate data bottlenecks, delivering actionable insights to your platform in milliseconds - making the difference between a missed opportunity and a profitable trade.

FAQs

How does AI sentiment analysis improve trading decisions?

AI sentiment analysis empowers traders to make quicker, more informed decisions by converting news and social media chatter into real-time sentiment scores. These scores reveal changes in market sentiment early, often before they influence prices, giving investors a key advantage in spotting both opportunities and potential risks.

By filtering out the clutter of excessive information, AI helps traders zero in on actionable insights. This allows them to stay ahead in dynamic markets and fine-tune their strategies for improved outcomes.

What technology is required to power low-latency AI-driven trading news feeds?

Low-latency, AI-driven trading news feeds rely on a finely tuned infrastructure to deliver crucial market insights in mere milliseconds. At the heart of this setup are high-performance data centers or colocation facilities strategically located near major exchange hubs. These facilities feature ultra-fast fiber connections and redundant network paths designed to operate with sub-millisecond latency, ensuring lightning-fast data delivery from source to user.

The process kicks off with dedicated pipelines that pull in raw news feeds - ranging from financial wires to social media streams - into real-time processing systems. Once ingested, the data is immediately partitioned, timestamped, and stored in in-memory storage systems to keep delays to an absolute minimum. Advanced AI models, powered by GPUs or other specialized accelerators, then analyze the data. These models classify sentiment, extract vital details, and generate concise summaries on the fly. What’s more, they can scale up seamlessly during high-traffic periods, maintaining smooth and reliable performance.

The final step involves edge-caching nodes and lightweight APIs, which deliver these processed insights directly to traders’ screens in under 10 milliseconds. This rapid delivery empowers traders to make quick, informed decisions in fast-moving, volatile markets.

How can traders customize AI-powered news alerts to match their strategies?

Traders have the ability to tailor AI-powered news alerts to fit their unique trading strategies. By selecting specific keywords, companies, sectors, or investment themes, they can ensure the updates they receive are highly relevant. For instance, they might set alerts for a particular stock ticker, a product name, or phrases like "supply chain disruption." These alerts can be tied to individual stocks, groups of related companies, or broader market trends, keeping traders focused on the information that matters most.

For even more precision, advanced settings let traders refine their alerts using filters such as sentiment analysis, preferred news sources (like SEC filings or press releases), or even triggers based on price movements. Notifications can be customized to align with their workflow - whether they prefer instant push alerts, hourly updates, or daily summaries - delivered via email or mobile devices. This level of personalization ensures traders stay informed in real time without being overwhelmed by irrelevant information, enabling them to respond swiftly and effectively in fast-moving markets.

AI sentiment analysis empowers traders to make quicker, more informed decisions by converting news and social media chatter into real-time sentiment scores. These scores reveal changes in market sentiment early, often before they influence prices, giving investors a key advantage in spotting both opportunities and potential risks.

By filtering out the clutter of excessive information, AI helps traders zero in on actionable insights. This allows them to stay ahead in dynamic markets and fine-tune their strategies for improved outcomes.

Low-latency, AI-driven trading news feeds rely on a finely tuned infrastructure to deliver crucial market insights in mere milliseconds. At the heart of this setup are high-performance data centers or colocation facilities strategically located near major exchange hubs. These facilities feature ultra-fast fiber connections and redundant network paths designed to operate with sub-millisecond latency, ensuring lightning-fast data delivery from source to user.

The process kicks off with dedicated pipelines that pull in raw news feeds - ranging from financial wires to social media streams - into real-time processing systems. Once ingested, the data is immediately partitioned, timestamped, and stored in in-memory storage systems to keep delays to an absolute minimum. Advanced AI models, powered by GPUs or other specialized accelerators, then analyze the data. These models classify sentiment, extract vital details, and generate concise summaries on the fly. What’s more, they can scale up seamlessly during high-traffic periods, maintaining smooth and reliable performance.

The final step involves edge-caching nodes and lightweight APIs, which deliver these processed insights directly to traders’ screens in under 10 milliseconds. This rapid delivery empowers traders to make quick, informed decisions in fast-moving, volatile markets.

Traders have the ability to tailor AI-powered news alerts to fit their unique trading strategies. By selecting specific keywords, companies, sectors, or investment themes, they can ensure the updates they receive are highly relevant. For instance, they might set alerts for a particular stock ticker, a product name, or phrases like "supply chain disruption." These alerts can be tied to individual stocks, groups of related companies, or broader market trends, keeping traders focused on the information that matters most.

For even more precision, advanced settings let traders refine their alerts using filters such as sentiment analysis, preferred news sources (like SEC filings or press releases), or even triggers based on price movements. Notifications can be customized to align with their workflow - whether they prefer instant push alerts, hourly updates, or daily summaries - delivered via email or mobile devices. This level of personalization ensures traders stay informed in real time without being overwhelmed by irrelevant information, enabling them to respond swiftly and effectively in fast-moving markets.

"}}]}