How AI Is Redefining Wall Street and Global Markets

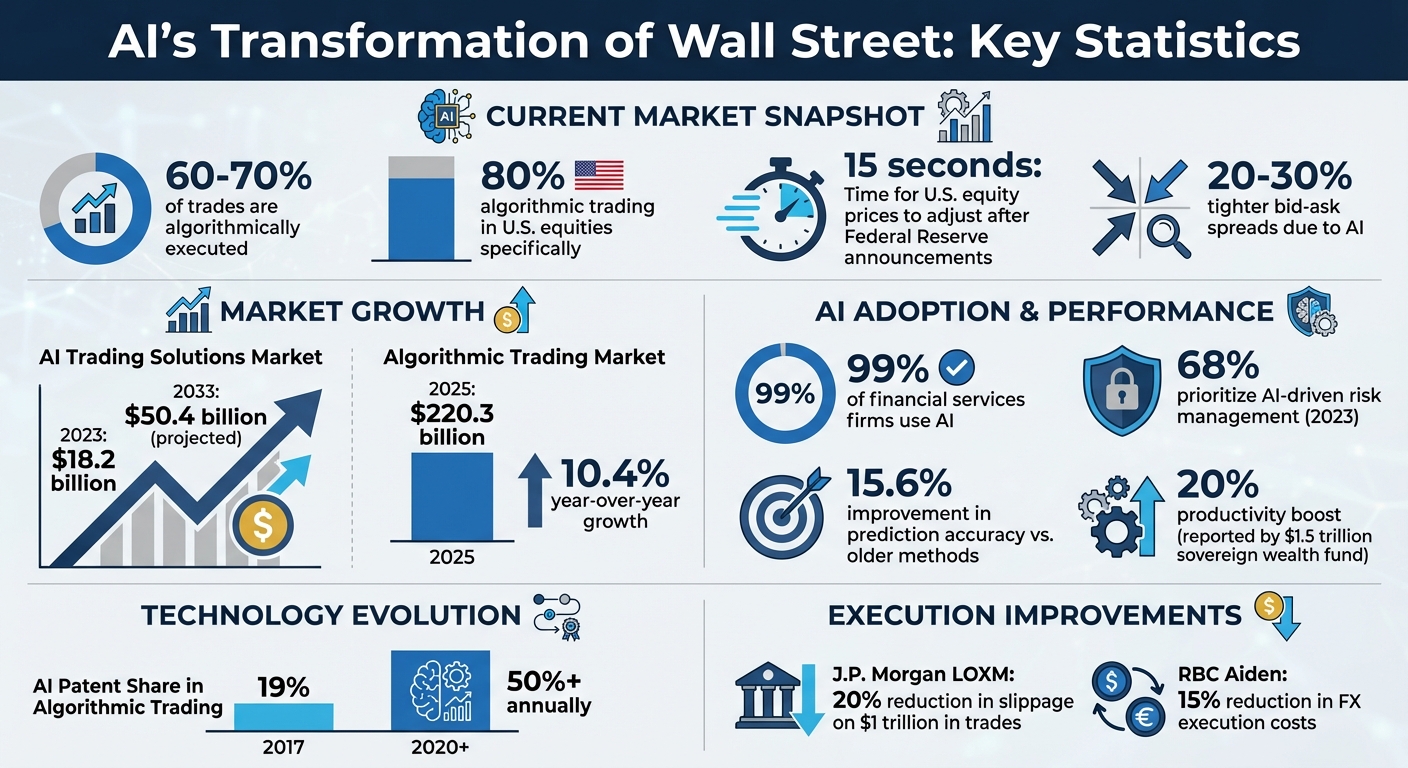

AI is transforming Wall Street and global financial markets by automating trades, analyzing massive datasets, and improving decision-making speed. Currently, 60%-70% of trades are algorithmically executed, with AI systems processing data in milliseconds. The market for AI-powered trading solutions, valued at $18.2 billion in 2023, is projected to reach $50.4 billion by 2033. Key advancements include:

- Machine Learning: Develops trading strategies using historical data, uncovering patterns and anomalies.

- Deep Learning: Analyzes unstructured data like social media and satellite imagery for insights.

- Generative AI: Creates synthetic market scenarios and assists in research with real-time insights.

AI is also reshaping market behavior by enhancing liquidity, narrowing bid-ask spreads, and enabling faster price discovery. For instance, U.S. equity prices now adjust within 15 seconds of Federal Reserve announcements. Infrastructure like GPUs, low-latency networks, and VPS hosting supports these systems, ensuring reliability and speed. However, challenges like overfitting, systemic risks, and regulatory compliance remain critical areas of focus.

The integration of AI into trading demands substantial investments but offers high returns, such as a 20% productivity boost reported by a $1.5 trillion sovereign wealth fund. As AI adoption grows, firms must balance cutting-edge technology with strong governance and human oversight to stay competitive.

AI Trading Market Statistics and Impact on Wall Street 2023-2033

AI Trading Market Statistics and Impact on Wall Street 2023-2033

Generating Trading Strategies with AI: Practical Walkthrough

AI Technologies Powering Financial Markets

Artificial intelligence is reshaping trading through tools like machine learning, deep learning, and generative AI. Each of these technologies brings unique strengths to tackle the challenges of today's fast-paced markets. Together, they drive smarter and quicker trade execution, as explored below.

Machine Learning for Trading Strategies

Machine learning leverages historical data to craft trading strategies, build portfolios, and automate decision-making. By identifying patterns in vast datasets, it generates predictions based on countless past scenarios. Supervised learning techniques, such as regression models, predict returns, while classification models generate buy or sell signals. Meanwhile, unsupervised learning uncovers hidden market clusters and flags anomalies that may reveal trading opportunities. Reinforcement learning takes it a step further, using methods like Q-learning and Deep Q-Networks (DQN) to refine strategies dynamically based on real-time market feedback.

Deep Learning and Alternative Data Analysis

Deep learning dives into unstructured data, uncovering insights that traditional algorithms might miss. For instance, in 2024, Kuntara Pukthuanthong, the Robert J. Trulaske, Jr. Professor of Finance at the University of Missouri, introduced Variational Recurrent Neural Networks (VRNNs). These models use graph-based visualizations to forecast stock prices, achieving impressive results like a Sharpe ratio of 2.94 for equally weighted portfolios and 2.47 for value-weighted ones, alongside an alpha of 55 weekly basis points after adjusting for risk factors.

Pukthuanthong also developed Image Firm Similarities (IFS), analyzing four million images to assess company operations. This innovation enhances strategies like pair trading, diversification, and momentum detection.

"Financial markets are not static entities; they pulsate with life, evolving and reacting to many stimuli. This dynamism is reminiscent of frames in a cinematic reel, where each frame, though a standalone snapshot, is intrinsically linked to its predecessor, painting a broader narrative." - Kuntara Pukthuanthong, Robert J. Trulaske, Jr. Professor of Finance at the University of Missouri

"Financial markets are not static entities; they pulsate with life, evolving and reacting to many stimuli. This dynamism is reminiscent of frames in a cinematic reel, where each frame, though a standalone snapshot, is intrinsically linked to its predecessor, painting a broader narrative." - Kuntara Pukthuanthong, Robert J. Trulaske, Jr. Professor of Finance at the University of Missouri

Investment managers now rely on deep learning systems to analyze alternative data sources, such as social media posts and satellite imagery, uncovering new connections between economic variables.

Generative AI for Trading Operations

Generative AI, powered by large language models (LLMs), goes beyond predictions. It processes unstructured data, produces alpha-generating strategies, and facilitates iterative workflows. These tools can simulate synthetic market scenarios, allowing traders to test strategies without risking actual capital. Additionally, they streamline research by acting as conversational assistants, offering real-time insights from news feeds and clarifying market trends.

"What is new is that the large language models that form the backbone of the most impressive generative AI systems are now enabling investors to process very large amounts of unstructured, often text-based, data to enhance their already powerful analytical tools." - Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department, IMF

"What is new is that the large language models that form the backbone of the most impressive generative AI systems are now enabling investors to process very large amounts of unstructured, often text-based, data to enhance their already powerful analytical tools." - Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department, IMF

How AI Changes Market Behavior and Trading Dynamics

AI isn't just refining individual trades - it’s reshaping the entire market landscape. From narrowing bid–ask spreads to enabling split-second responses to economic signals, AI is redefining market making and liquidity in profound ways.

AI-Powered Market Making and Liquidity

Today, between 60% and 70% of trades are executed algorithmically. In U.S. equities, this figure climbs to 80%, with narrower spreads - 20–30% tighter - and increased liquidity.

Price discovery has also become much faster. For instance, U.S. equity prices now adjust within just 15 seconds of the Federal Reserve releasing its minutes, aligning short-term reactions with broader market trends.

"The adoption of the latest iterations of artificial intelligence by financial markets can improve risk management and deepen liquidity."

- Nassira Abbas, Charles Cohen, Dirk Jan Grolleman, Benjamin Mosk, IMF Staff

"The adoption of the latest iterations of artificial intelligence by financial markets can improve risk management and deepen liquidity."

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

- Nassira Abbas, Charles Cohen, Dirk Jan Grolleman, Benjamin Mosk, IMF Staff

The algorithmic trading market is booming, valued at $220.3 billion in 2025, reflecting a 10.4% year-over-year growth. AI plays a pivotal role in driving this expansion. AI-driven Exchange-Traded Funds (ETFs) are a niche but rapidly evolving space, with turnover rates of about once a month - far higher than the less-than-once-a-year turnover typical of actively managed equity ETFs. Patent data further underscores AI’s growing influence: the share of AI-related content in algorithmic trading applications jumped from 19% in 2017 to over 50% annually since 2020.

Cross-Asset and Macro Trading with AI

AI’s ability to uncover hidden connections across asset classes is a game changer. These systems analyze diverse data sources - corporate earnings calls, regulatory filings, satellite imagery, credit card spending patterns, and even online search trends. This broad analysis reveals relationships among supply chain dynamics, sector momentum, and asset pricing across various classes.

Deep learning models process thousands of variables at once, making them particularly effective in volatile markets. They identify subtle, nonlinear patterns that human traders might miss. Time series forecasting models, on the other hand, focus on sequential data like interest rates and macroeconomic indicators, offering insights for both short-term trading and long-term portfolio strategies. This blend of quantitative analysis and qualitative insights, often referred to as a quantamental approach, enhances decision-making and potential returns.

Smart Order Routing and Execution Optimization

AI-driven smart order routing has revolutionized trade execution across U.S. lit exchanges, dark pools, and alternative trading systems. For example, J.P. Morgan’s LOXM agent handled $1 trillion in trades, achieving a 20% reduction in slippage. Similarly, RBC’s Aiden platform, powered by deep reinforcement learning, cut foreign exchange execution costs by 15%.

These systems leverage real-time data to generate buy and sell signals, executing trades in milliseconds. High-frequency trading strategies now process thousands of orders in fractions of a second, operating at speeds far beyond human capability. To support this, robust infrastructure is essential. Low-latency connectivity, cloud computing, and specialized VPS hosting enable the high-speed data processing and near-instantaneous communication required for such operations.

"When markets trade on accurate data, they attempt to function optimally."

- Maximilian Goehmann, PhD candidate in the Department of Management at LSE

"When markets trade on accurate data, they attempt to function optimally."

- Maximilian Goehmann, PhD candidate in the Department of Management at LSE

Infrastructure Requirements for AI Trading Systems

AI-powered trading strategies demand a high-performance infrastructure capable of managing enormous data streams, performing complex calculations in real time, and delivering consistent reliability - especially when every millisecond counts.

Data Engineering and Computing Power

AI trading systems rely on two key types of computing power. First, GPUs are essential for model training and backtesting, offering up to 100× faster processing compared to CPUs. On the other hand, live trading requires high-performance CPUs to handle market data with minimal latency.

Storage is just as critical. For instance, a 100-billion parameter language model needs over 400GB just to store its weights, not to mention the terabytes required for tick data, order book snapshots, and alternative datasets. SSDs enable real-time data access, while high-bandwidth memory ensures fast data transfers to processing units. Inefficient data pipelines can reduce traditional AI deployments to just 70% efficiency, but solutions like DDN Infinia can accelerate data retrieval speeds by 2× to 50×.

Network infrastructure forms the backbone of AI trading systems by connecting them to exchanges swiftly and reliably. Technologies such as InfiniBand, RoCE, and WebSocket protocols ensure ultra-low latency data movement. For example, Talos provides institutional-grade trade execution with WebSocket-based connectivity. In high-frequency trading, even an extra 18 inches of Ethernet cable can add a nanosecond of latency. This underscores the importance of every detail in these competitive environments. Dedicated VPS hosting is often a must-have for establishing this high-performance computing foundation.

VPS Hosting for AI-Driven Trading

In the U.S., VPS hosting offers a cost-efficient alternative to co-location for traders using AI strategies. QuantVPS, for instance, delivers infrastructure tailored specifically for algorithmic trading, featuring 0-1ms latency and a 100% uptime guarantee. The platform supports popular tools like NinjaTrader, MetaTrader, and TradeStation, allowing traders to focus on their strategies without worrying about infrastructure.

The VPS Pro plan ($99.99/month, or $69.99/month if billed annually) includes 6 cores, 16GB of RAM, and 150GB of NVMe storage - sufficient for most AI-driven strategies running 3-5 charts simultaneously. For more demanding workloads, the VPS Ultra plan offers 24 cores and 64GB of RAM, while dedicated servers with up to 128GB of RAM cater to the most resource-intensive applications. Each plan also includes DDoS protection, automatic backups, and unmetered bandwidth on a 1Gbps+ network, ensuring uninterrupted operations even during market volatility. These VPS solutions complement advanced hardware by providing a stable and reliable trading environment.

System Monitoring and Uptime Management

Once high-speed data processing and VPS hosting are in place, continuous monitoring becomes critical to maintaining performance. The 2012 Knight Capital Group incident - where a software glitch led to $440 million in losses in under an hour - is a stark reminder of the risks of inadequate monitoring. Modern systems must track real-time performance, identify anomalies, and automatically shut down strategies if they exceed predefined thresholds.

"Invest in robust hardware and software, implement regular maintenance schedules, and have backup systems in place. Ensuring network security and uptime is crucial for uninterrupted trading operations."

"Invest in robust hardware and software, implement regular maintenance schedules, and have backup systems in place. Ensuring network security and uptime is crucial for uninterrupted trading operations."

Fault tolerance and data recovery mechanisms are equally important. Replicated storage area networks and order management systems ensure that trading operations continue seamlessly, even if a component fails. Regular maintenance - including software updates, hardware upgrades, and performance optimizations - keeps systems running efficiently and securely, adapting to changing market conditions. For platforms like Citadel Securities, which processes over $461 billion in daily trade volume, these safeguards are not optional - they are essential to maintaining market stability.

Future Trends and Challenges in AI Trading

Risk Management and Regulatory Compliance

AI trading comes with its share of hurdles, particularly in managing risks like overfitting and systemic feedback loops that can disrupt markets. Overfitting occurs when models perform well during backtesting but fail to adapt to real-world market changes. Systemic feedback loops, on the other hand, arise when similar AI algorithms interact, potentially amplifying market volatility. A stark example of this was the May 6, 2010 Flash Crash, where cascading algorithmic triggers wiped out nearly $1 trillion in market value within minutes.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

"The issue was that there were a lot of algorithms with similar settings that were each triggering each other … and that created a cascading failure that led to this sudden and huge drop in the market"

- Maximilian Goehmann, PhD candidate at LSE

"The issue was that there were a lot of algorithms with similar settings that were each triggering each other … and that created a cascading failure that led to this sudden and huge drop in the market"

- Maximilian Goehmann, PhD candidate at LSE

In response, U.S. regulators are stepping up their efforts. By 2023, 68% of financial services firms had identified AI-driven risk management and compliance as a top priority. Regulatory bodies now demand firms to demonstrate the quality of their data, conduct independent stress testing, and adopt Explainable AI techniques like SHAP and LIME to make algorithmic decisions more transparent. Meanwhile, the UK Treasury Committee is actively investigating the systemic risks and potential for market abuse posed by AI systems. Experts are also pushing for voluntary data certification initiatives to promote transparency and build trust among market participants.

These regulatory challenges are not merely obstacles - they’re sparking innovation in AI trading, driving advancements that aim to meet these new standards.

Emerging AI Market Innovations

The initial frenzy around AI trading is giving way to a more measured focus on results. Investors now expect clear proof of earnings impact and a solid return on investment. Open-source AI platforms are gaining traction, challenging proprietary systems by offering lower costs and greater transparency. Many firms are likely to adopt hybrid approaches, blending open-source frameworks with proprietary technology to achieve both cost efficiency and competitive edge.

As AI reshapes the trading landscape, infrastructure demands are evolving too. Advanced AI models have demonstrated a 15.6% improvement in prediction accuracy compared to older statistical methods. These advancements are leveling the playing field by making high-level risk analytics accessible to smaller players who previously couldn’t afford institutional-grade tools. With 99% of financial services firms now using AI in some capacity, the competitive advantage increasingly belongs to those who can seamlessly integrate these technologies.

The workforce is also adapting. Routine tasks are being automated, freeing up human teams to focus on strategic decision-making. New roles are emerging, such as AI Ethics Specialist and AI Prompt Specialist, reflecting the growing need for expertise in managing and guiding AI systems effectively.

Conclusion

AI has reshaped Wall Street and global financial markets, bringing an unprecedented level of precision and efficiency to tasks that were once unimaginable. With tools powered by machine learning, deep learning, and natural language processing, these systems can now process massive datasets, adapt to shifting market conditions, and deliver predictive insights that traditional methods simply can't match.

This evolution isn't just about improving market mechanics - it's also driving a transformation in investment strategies. For instance, implementing AI trading models often demands upfront investments ranging from $500,000 to over $1 million, not to mention ongoing costs. Despite these high entry points, the payoff can be substantial. One example: a $1.5 trillion sovereign wealth fund reported a 20% boost in productivity after incorporating AI systems. The challenge lies in striking the right balance between bold innovation and the infrastructure needed to support it.

Modern AI models require robust infrastructure capable of handling real-time data processing, ultra-low latency, and the significant computational demands of today’s trading systems. Legacy systems, on the other hand, can act as barriers, introducing inefficiencies that slow down adoption and performance. To address this, solutions like QuantVPS provide specialized services tailored for algorithmic trading, offering ultra-low latency (0–1ms), guaranteed 100% uptime, and dedicated resources. Starting at $41.99 per month (with annual billing), these services give traders access to institutional-grade tools.

The firms that will thrive in the future are those that seamlessly integrate advanced AI capabilities with reliable, high-performance infrastructure while keeping human oversight at the core. As financial markets become even more automated, the ability to blend cutting-edge technology with sound governance and strategic human input will define the leaders in this rapidly evolving landscape.

FAQs

How is AI transforming trading on Wall Street?

AI is transforming the way trading operates on Wall Street. It can sift through enormous amounts of data in real-time, spot patterns that even the sharpest human analysts might miss, and execute trades with lightning speed and precision. This combination of speed and insight allows traders to make quicker, more informed decisions, boosting both market efficiency and profitability.

With tools like predictive analytics and algorithmic trading models, AI helps fine-tune strategies by forecasting market movements and managing risks more effectively. By automating intricate processes, AI not only saves valuable time but also reduces the likelihood of human error, giving traders a powerful advantage in the high-stakes world of finance.

What challenges arise when using AI in financial markets?

Integrating AI into financial markets comes with its own set of challenges. Even minor errors in data can have outsized effects on the market, potentially leading to major disruptions. On top of that, AI systems can unintentionally create feedback loops that intensify market volatility, complicating efforts to keep things stable.

Another major concern lies in achieving transparency and explainability. Many advanced AI models function like "black boxes", making it tough for traders and regulators to grasp how decisions are being made. This lack of insight can undermine trust and complicate compliance in an industry where regulation is critical.

How does AI analyze social media data for trading decisions?

AI leverages cutting-edge technologies like deep learning, natural language processing (NLP), and large language models (LLMs) to make sense of unstructured data from social media. These tools allow AI to grasp the context of posts, assess sentiment, and uncover insights that can inform market predictions and trading strategies.

By monitoring trends, breaking news, and public sentiment in real time, AI can spot opportunities or risks that might be overlooked when relying solely on traditional data sources. This real-time analysis sharpens decision-making and gives traders an edge in the ever-changing market landscape.

AI is transforming the way trading operates on Wall Street. It can sift through enormous amounts of data in real-time, spot patterns that even the sharpest human analysts might miss, and execute trades with lightning speed and precision. This combination of speed and insight allows traders to make quicker, more informed decisions, boosting both market efficiency and profitability.

With tools like predictive analytics and algorithmic trading models, AI helps fine-tune strategies by forecasting market movements and managing risks more effectively. By automating intricate processes, AI not only saves valuable time but also reduces the likelihood of human error, giving traders a powerful advantage in the high-stakes world of finance.

Integrating AI into financial markets comes with its own set of challenges. Even minor errors in data can have outsized effects on the market, potentially leading to major disruptions. On top of that, AI systems can unintentionally create feedback loops that intensify market volatility, complicating efforts to keep things stable.

Another major concern lies in achieving transparency and explainability. Many advanced AI models function like "black boxes", making it tough for traders and regulators to grasp how decisions are being made. This lack of insight can undermine trust and complicate compliance in an industry where regulation is critical.

AI leverages cutting-edge technologies like deep learning, natural language processing (NLP), and large language models (LLMs) to make sense of unstructured data from social media. These tools allow AI to grasp the context of posts, assess sentiment, and uncover insights that can inform market predictions and trading strategies.

By monitoring trends, breaking news, and public sentiment in real time, AI can spot opportunities or risks that might be overlooked when relying solely on traditional data sources. This real-time analysis sharpens decision-making and gives traders an edge in the ever-changing market landscape.

"}}]}