The ETP Expert Trading Programmers Copier simplifies trading across multiple accounts by replicating trades in real time from a single "leader account" to multiple "follower accounts." Designed for Windows, it works with platforms like NinjaTrader, MetaTrader, and TradingView, and connects directly to engines such as Rithmic and Tradovate. At a one-time price of $197, it offers features like instrument-specific filtering, trade scaling, and support for prop firms that allow copy trading like Apex and TopStep.

For uninterrupted performance, pairing it with QuantVPS ensures ultra-low latency (0–1ms) and 24/7 availability. Starting at $59.99/month, QuantVPS provides robust infrastructure with multiple pricing tiers to support various trading setups.

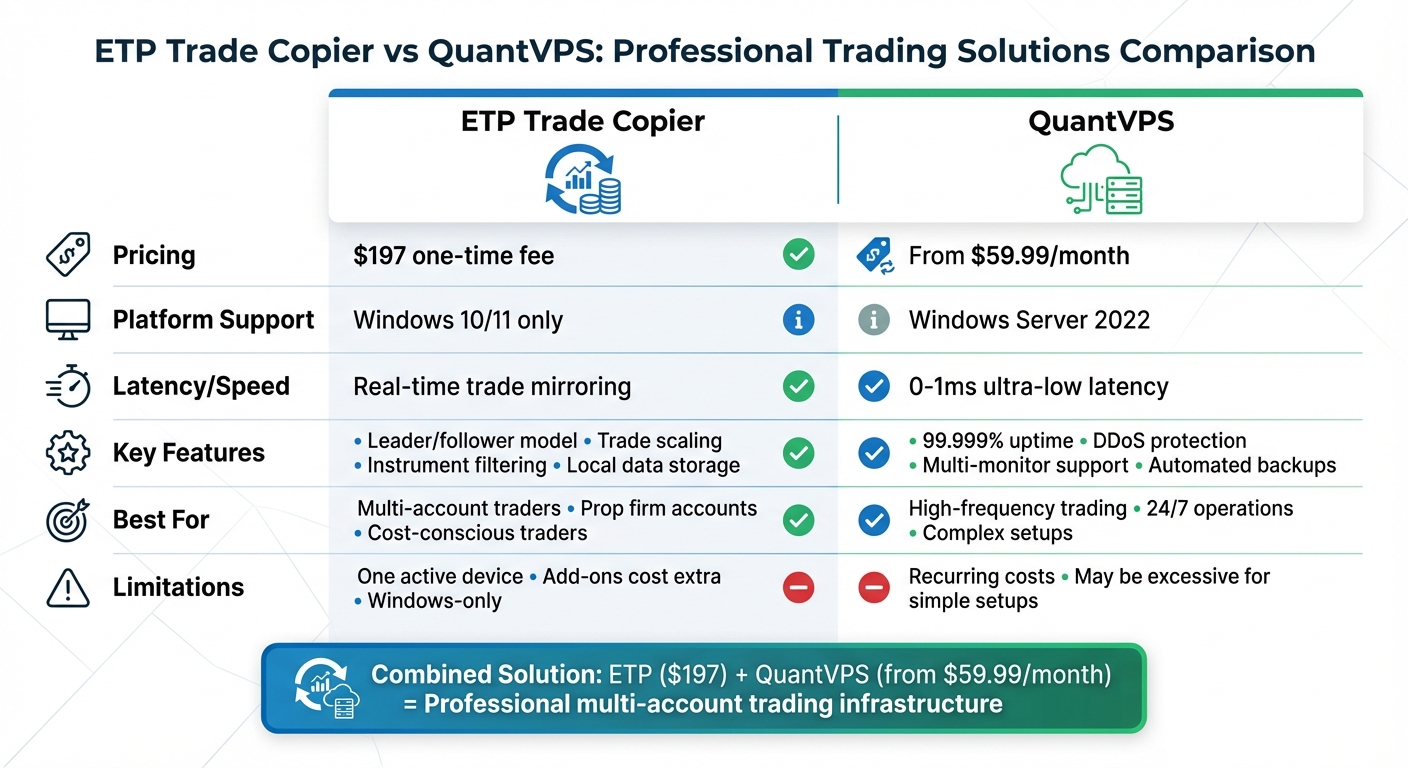

Key Points:

- ETP Copier: Real-time trade replication, customizable trade settings, $197 one-time fee.

- QuantVPS: Reliable hosting, low latency, pricing starts at $59.99/month.

Together, they offer a reliable solution for traders managing multiple accounts. Below is a quick comparison of their features.

Quick Comparison

| Feature | ETP Trade Copier | QuantVPS |

|---|---|---|

| Cost | $197 (one-time) | From $59.99/month |

| Platform Support | Windows 10/11 | Windows Server 2022 |

| Latency | Real-time trade mirroring | 0–1ms |

| Key Features | Leader/follower model, trade scaling | 24/7 uptime, DDoS protection |

| Limitations | Windows-only, one active device | Recurring cost |

The ETP copier is ideal for traders needing a cost-effective trade replication tool, while QuantVPS ensures reliable hosting for continuous operations.

ETP Trade Copier vs QuantVPS: Features, Pricing & Performance Comparison

ETP Trade Copier vs QuantVPS: Features, Pricing & Performance Comparison

1. ETP Expert Trading Programmers Copier

Multi-Account Functionality

The ETP copier operates on a leader-follower model, where a designated leader account initiates trades that are automatically mirrored by multiple follower accounts. What makes this software stand out is its platform-agnostic design. Instead of relying on specific trading platforms, it connects directly to trade processor engines like Rithmic, Tradovate, and DXtrade. This allows trades to replicate even if platforms such as NinjaTrader, MetaTrader, or TradingView are not running. As Expert Trading Programmers explains:

"The software’s platform-agnostic nature sets it apart… as long as it operates with a Rithmic connection, Trade Copier can effortlessly interface with it".

"The software’s platform-agnostic nature sets it apart… as long as it operates with a Rithmic connection, Trade Copier can effortlessly interface with it".

The copier offers flexibility by allowing users to choose specific instruments for replication and adjust position sizes across follower accounts. For instance, if the leader account trades 5 contracts, but the follower account supports only 2, the copier scales the trade accordingly. For users managing multiple strategies, the Multiple Account Groups add-on enables running several independent copiers simultaneously, which is especially useful for handling multiple prop firm accounts like Apex, TopStep, and PropShopTrader. This feature ensures smooth and efficient execution across various accounts.

Performance and Latency

The copier is designed for real-time synchronization, ensuring trades are mirrored instantly between leader and follower accounts. By integrating directly with brokers, it bypasses intermediary platform delays, minimizing latency. This is a critical factor in low latency futures trading where every millisecond counts. One user, Edwin Cape, shared his experience where the copier mistakenly placed extra orders. After submitting log files, the ETP support team identified the issue and released a fix within a week. This level of responsiveness has earned the software a 5.0-star rating, based on client feedback.

Additional Features and Flexibility

Beyond simple trade copying, the software includes instrument-specific filtering to prevent high-risk assets from being replicated to smaller accounts. Users can also scale trades by adjusting lot sizes or setting equity percentages. To ensure privacy, all personal data is stored locally with strong encryption and is never transmitted to ETP servers.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Philippe Cortellezzi shared his positive experience, stating:

"Their copier is young but already a great product and have a great roadmap. I use it without any issues and fullfil my expectations".

"Their copier is young but already a great product and have a great roadmap. I use it without any issues and fullfil my expectations".

The ETP team’s technical expertise is evident in their development of over 4,000 strategies, indicators, and add-ons. However, it’s worth noting that while the software can be installed on multiple devices, only one can actively copy trades at a time. These features combine to reduce errors and enhance trade efficiency across multiple accounts.

Pricing and Value

The base software is priced at a one-time fee of $197. Additional features, such as NinjaTrader integration, multiple account groups, and multiple broker connections, can be purchased directly within the software. With lifetime bug fixes included, this $197 investment offers a solid solution for traders seeking a reliable and flexible trade copier.

2. QuantVPS: High-Performance VPS for Futures Trading

QuantVPS works hand-in-hand with the ETP copier, providing the dependable infrastructure traders need to execute their strategies without interruptions.

Performance and Latency

Using a home PC to run the copier might seem convenient, but it comes with risks like power outages and internet disruptions. QuantVPS eliminates these worries by offering uninterrupted service. Located in a Chicago datacenter, it features direct fiber-optic connections to the CME, ensuring low and ultra-low latency. This setup is critical for the copier’s real-time trade replication, delivering consistent performance in live markets. Plus, since the ETP copier is Rithmic-based and platform-independent, it operates effortlessly on QuantVPS’s Windows Server 2022.

Equipped with NVMe SSDs and enterprise-grade processors, QuantVPS handles demanding tasks without slowing down. This is especially important for traders running multiple copier instances or managing several accounts simultaneously.

Features That Matter

QuantVPS goes beyond performance with features designed for convenience and security. Multi-monitor RDP access helps traders organize their workspace across multiple screens, making it easier to manage complex setups. Security is a top priority, with DDoS protection and automated backups safeguarding both copier configurations and trading data. Additionally, full root access gives users complete control to customize their server environment, tailoring it to the ETP copier’s requirements.

Pricing Options

QuantVPS offers flexible pricing plans to suit different trading needs:

- VPS Lite: At $59.99/month (or $41.99/month annually), this plan is ideal for traders managing 1–2 follower accounts. It includes 4 cores and 8GB RAM.

- VPS Pro: Designed for those handling 3–5 charts, this plan costs $99.99/month (or $69.99/month annually) and offers 6 cores, 16GB RAM, and support for up to 2 monitors.

- VPS Ultra: For traders managing 5–7+ charts, this plan provides 24 cores, 64GB RAM, and support for 4 monitors. It’s priced at $189.99/month (or $132.99/month annually).

For those needing even more power, Enhanced Performance Plans (marked with a "+") are available. These plans offer upgraded specifications for the same account capacities, with a slight increase in cost.

QuantVPS combines reliability, speed, and flexibility, making it a solid choice for futures traders looking to optimize their setup.

Pros and Cons

The ETP Trade Copier stands out for its flexibility and user-friendly design, while QuantVPS shines with its high-performance infrastructure. Understanding the strengths and limitations of each can help you decide what works best for your trading needs.

The ETP Trade Copier is known for its platform-agnostic design, meaning it works seamlessly with any Rithmic-connected trading system. This eliminates the need to commit to a single software platform. Its Leader/Follower structure is particularly useful for traders managing multiple accounts, such as those working with prop firms. Another key advantage is its focus on security – all personal data is stored locally on your device, keeping sensitive information under your control.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

That said, the ETP Trade Copier does have its drawbacks. It’s currently limited to Windows 10 and 11, with no support for Mac or Linux yet. While you can install it on multiple devices, only one device can be active at a time, which could be inconvenient for traders who need access from multiple locations. Additionally, features like NinjaTrader trade copying integration and support for multiple account groups require paid add-ons, which can increase the overall cost.

On the other hand, QuantVPS focuses on providing a robust infrastructure to support uninterrupted trading. It boasts a 99.999% uptime guarantee and 0-1ms latency, ensuring smooth and timely trade execution. Features like DDoS protection, automated backups, and multi-monitor support make it a reliable choice for complex trading setups. Full root control allows for extensive customization. Pricing starts at $59.99/month for the VPS Lite plan and goes up to $189.99/month for the VPS Ultra, with discounts available for annual billing.

However, QuantVPS’s subscription-based model means recurring costs, which can add up over time. For traders with simpler needs – like managing just a few follower accounts – the service might feel excessive or more than what’s necessary.

Here’s a quick comparison of the two solutions:

| Feature | ETP Trade Copier | QuantVPS |

|---|---|---|

| Advantages | Works with any Rithmic-based platform; one-time fee; local data storage; real-time mirroring | 99.999% uptime; ultra-low latency (0-1ms); DDoS protection; multi-monitor support; automated backups |

| Limitations | Windows-only; one active device at a time; advanced features require paid add-ons | Recurring monthly costs; may be too advanced for simple setups |

Conclusion

The ETP Trade Copier and QuantVPS work together to create a reliable and efficient trading solution. The copier replicates trades from a leader account to multiple follower accounts through trade replication, while QuantVPS ensures your trading systems stay operational around the clock. Together, they cater to traders who value seamless execution and dependable performance.

The ETP Trade Copier stands out with its straightforward, one-time pricing – perfect for managing multiple proprietary accounts. Its flexibility to integrate with any Rithmic-connected platform, such as NinjaTrader, MetaTrader, or TradingView, makes it a versatile tool. Plus, its ability to adjust trades to align with varying risk parameters across accounts makes it a practical choice for traders looking to scale.

QuantVPS, on the other hand, is all about speed and uninterrupted performance. Starting at $59.99 per month for the VPS Lite plan, it provides the infrastructure needed for high-frequency trading, where every millisecond matters.

For traders with simpler setups, running the ETP software on a home computer during market hours might suffice. However, if you’re juggling multiple strategies or need continuous operation – especially to take advantage of overnight market movements – the combination of ETP’s trade replication and QuantVPS’s robust infrastructure offers the dependability that professional traders demand. Ultimately, your choice should align with your trading volume, risk management approach, and operational needs.

FAQs

How does the ETP Trade Copier manage position sizes for multiple accounts?

The ETP Trade Copier simplifies managing position sizes across various accounts with its adjustable trade settings. You can fine-tune aspects like lot sizes, allocation percentages, and other key parameters to match your risk management approach and account needs.

This level of control ensures trades are copied precisely while adapting to differences in account sizes or trading styles, allowing you to decide exactly how positions are allocated.

What advantages does QuantVPS offer when paired with the ETP Trade Copier?

Using QuantVPS alongside the ETP Trade Copier offers clear advantages for traders juggling multiple accounts. Thanks to its ultra-low latency, QuantVPS ensures trades are copied almost instantly, minimizing slippage and keeping execution precise – even in fast-paced market conditions. This level of speed is especially important for high-frequency trading and smooth multi-account operations.

Beyond speed, QuantVPS provides reliable 24/7 uptime and robust cybersecurity, creating a stable and secure environment for uninterrupted trading. This reliability is crucial for the ETP Trade Copier to operate smoothly, ensuring trades are mirrored without any hitches or delays. These features together make QuantVPS a powerful tool for getting the best out of the ETP Trade Copier.

Can I use the ETP Trade Copier on multiple devices at the same time?

The ETP Trade Copier works smoothly across multiple devices at the same time. It’s a platform-independent tool, meaning you can connect it to several Rithmic accounts without any hassle. This feature is especially useful for those managing multiple trading accounts, as it efficiently handles various connections and account groups.

Whether you’re a professional trader or overseeing accounts for clients, the ETP Trade Copier offers the flexibility and ease you need – without locking you into one specific platform.