Blueberry Markets vs. IC Markets: A Head-to-Head Broker Comparison

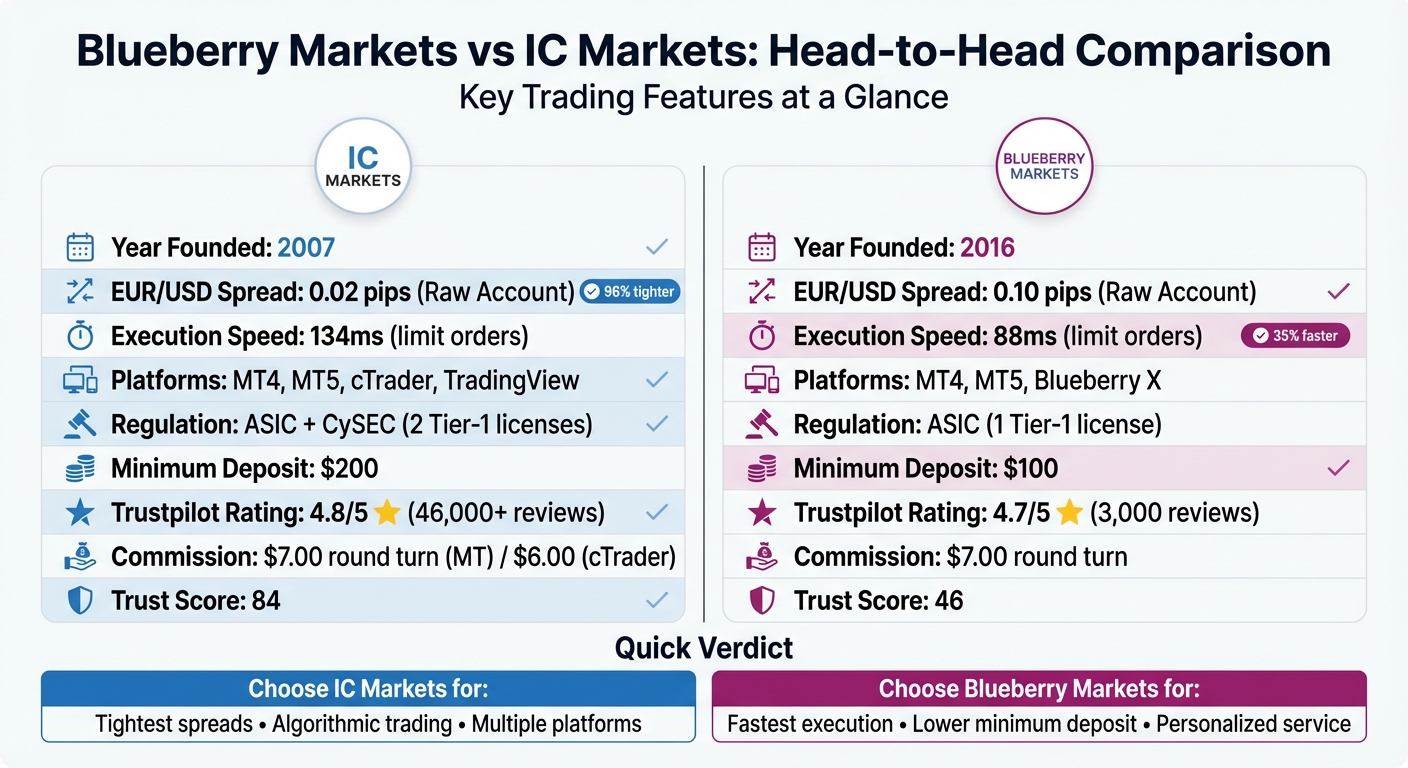

When choosing between Blueberry Markets and IC Markets, your decision depends on your trading priorities. IC Markets, established in 2007, is a global leader offering ultra-tight spreads (EUR/USD as low as 0.02 pips) and extensive platform options, including cTrader. Meanwhile, Blueberry Markets, founded in 2016, excels in execution speed (88ms for limit orders) and personalized customer service, making it ideal for traders seeking a tailored experience.

Key Takeaways:

- Spreads: IC Markets offers tighter spreads (EUR/USD: 0.02 pips vs. Blueberry's 0.10 pips).

- Execution Speed: Blueberry Markets is faster (88ms vs. IC Markets' 134ms for limit orders).

- Platforms: IC Markets supports MT4, MT5, cTrader, and TradingView; Blueberry adds Blueberry X.

- Regulation: IC Markets has two Tier-1 licenses (ASIC, CySEC) vs. Blueberry's single ASIC license.

- Minimum Deposit: Blueberry requires $100; IC Markets, $200.

- Customer Ratings: IC Markets scores 4.8/5 on Trustpilot (46,000+ reviews); Blueberry Markets scores 4.7/5 (3,000 reviews).

Quick Comparison

| Feature | IC Markets | Blueberry Markets |

|---|---|---|

| Year Founded | 2007 | 2016 |

| Spreads (EUR/USD) | 0.02 pips (Raw Account) | 0.10 pips (Raw Account) |

| Execution Speed | 134ms (limit orders) | 88ms (limit orders) |

| Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, Blueberry X |

| Regulation | ASIC, CySEC (Tier-1) | ASIC (Tier-1) |

| Minimum Deposit | $200 | $100 |

| Trustpilot Rating | 4.8/5 (46,000+ reviews) | 4.7/5 (3,000+ reviews) |

Choose IC Markets for lower spreads and advanced tools for algorithmic trading.

Choose Blueberry Markets for faster execution and personalized service.

Blueberry Markets vs IC Markets: Key Features Comparison

Blueberry Markets vs IC Markets: Key Features Comparison

Regulation and Security

Regulatory Oversight

IC Markets operates under two Tier-1 licenses from ASIC and CySEC, earning a trust score of 84 and being rated as Trusted. In comparison, Blueberry Markets, which is solely licensed by ASIC, holds a trust score of 46.

Both brokers offer negative balance protection under ASIC regulations, ensuring that losses are limited to the amount deposited. As Jody McDonald from Arielle Executive explains:

As a retail investor, you're protected under Australian regulation from losing more than the amount deposited in your accounts if you fail to meet margin calls.

As a retail investor, you're protected under Australian regulation from losing more than the amount deposited in your accounts if you fail to meet margin calls.

For clients in Europe, IC Markets provides an additional safeguard through the Investor Compensation Fund (ICF), which offers coverage of up to €20,000 in the event of broker insolvency.

IC Markets also holds Tier-4 offshore registrations with entities such as the FSA, SCB, and FSC, enabling leverage of up to 1:1000. Meanwhile, Blueberry Markets manages an offshore entity registered with SVG-FSA. These regulatory structures enhance client fund protection and ensure compliance.

Client Fund Security

Both brokers ensure client funds are stored in segregated trust accounts at National Australia Bank (NAB). IC Markets takes an extra step by also using Westpac as a second custodial bank - both institutions are AA-rated. Noam Korbl from CompareForexBrokers highlights:

In Australia, to comply with ASIC regulations, the broker holds all client funds in segregated client trust accounts at AA-rated Australian banks. Your money isn't mixed with the company's cash or used to fund any of its operating expenses.

In Australia, to comply with ASIC regulations, the broker holds all client funds in segregated client trust accounts at AA-rated Australian banks. Your money isn't mixed with the company's cash or used to fund any of its operating expenses.

IC Markets further strengthens security with SSL encryption for payment processing and Two-Factor Authentication (2FA) for its share trading platform. These measures have earned IC Markets accolades such as "#1 MetaTrader Broker" and "#1 Algo Trading Broker" for 2025, as recognized by ForexBrokers.com. Additionally, both brokers adhere to AML and CTF regulations, ensuring a strong stance against fraudulent activities.

Trading Platforms and Tools

Platform Options

Both brokers provide a range of trading platforms, but their approaches differ. IC Markets supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView, all operating on their Raw Pricing infrastructure. Meanwhile, Blueberry Markets includes its proprietary Blueberry X terminal alongside MetaTrader options.

The MetaTrader experience varies significantly between the two brokers. IC Markets enhances MT4 with its "Advanced Trading Tools" suite, offering over 20 plugins like sentiment analysis, correlation tracking, and mini terminals for precise trade sizing. This effort earned IC Markets the "Best MT4/MT5 Broker" award in 2025, with Christian Harris noting, "What sets IC Markets apart from other brokers is their attention to the core function of executing trades and providing excellent service to traders". On the other hand, Blueberry Markets focuses on faster execution speeds.

Both brokers support algorithmic trading through Expert Advisors (EAs) on MetaTrader platforms. IC Markets goes a step further by offering cTrader Automate and API access for high-frequency trading. Their infrastructure connects to over 25 liquidity providers and features a "freeze level" of 0, allowing stop-loss orders to be placed close to market prices - an advantage for automated strategies. Blueberry Markets also supports EAs and adds Pine Scripting via TradingView, catering to traders who prefer custom script-based strategies.

These platform distinctions highlight the brokers' differing approaches to trade execution, explored further below.

Execution Types and Features

IC Markets operates on an ECN model, sourcing liquidity from over 25 providers. The broker handles over $1 trillion in monthly trading volume, with trade servers hosted in Equinix's NY4 (New York) and LD5 (London) data centers. Execution speeds average 134ms for limit orders and 153ms for market orders.

Blueberry Markets, on the other hand, employs a "no dealing desk" model with ECN-style spreads on its Raw account. In 2026, testing revealed significantly faster execution speeds - 88ms for limit orders and 94ms for market orders - earning it a spot among the top 10 globally. Noam Korbl from CompareForexBrokers remarked:

Blueberry Markets impresses with execution speeds that rival the fastest in the industry. With 88ms for limit orders and 94ms for market orders, the broker earned a top-10 spot in my tests.

Blueberry Markets impresses with execution speeds that rival the fastest in the industry. With 88ms for limit orders and 94ms for market orders, the broker earned a top-10 spot in my tests.

Additionally, Blueberry Markets passes positive slippage to clients, improving fill quality.

For copy trading, IC Markets offers a more extensive ecosystem, including Myfxbook AutoTrade, ZuluTrade, MetaTrader Signals, and cTrader Copy. Blueberry Markets supports MetaTrader Signals and DupliTrade, though the latter requires a $2,000 minimum deposit.

Fees, Spreads, and Pricing

Spreads and Commissions

When it comes to spreads, IC Markets offers a clear edge. On Raw accounts, the average EUR/USD spread is just 0.02 pips, compared to Blueberry Markets' 0.10 pips. For Standard accounts, the difference is also notable - IC Markets averages 0.82 pips, while Blueberry Markets averages 1.20 pips. Noam Korbl from CompareForexBrokers highlights this advantage:

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Trading with IC Markets saves you $0.80 per lot on EUR/USD alone and much more on the other pairs.

Trading with IC Markets saves you $0.80 per lot on EUR/USD alone and much more on the other pairs.

Both brokers charge $3.50 per side (or $7.00 round turn) on MetaTrader Raw accounts. However, IC Markets provides an additional option for cTrader users, charging $3.00 per $100k traded (or $6.00 round turn), while Blueberry Markets does not support cTrader. High-volume traders might find IC Markets even more appealing through their Raw Trader Plus program, which cuts commissions to as low as $1.00 per lot for those trading over 2,000 lots per month.

In terms of overall fees, both brokers maintain competitive pricing structures beyond spreads and commissions.

Additional Fees

Neither broker imposes inactivity fees. Both also offer free internal deposits and withdrawals, though international bank wires may come with intermediary fees ranging from $20 to $25. Blueberry Markets automatically archives accounts after 90 days of inactivity if the balance falls below $100, but no fee is charged for this.

For overnight positions, both brokers use standard swap rates, with triple swaps typically applied on Wednesdays to cover weekends. Blueberry Markets also caters to Islamic traders by offering swap-free accounts, where interest is replaced with a fixed administration fee. Additionally, currency conversion fees might apply if your deposit currency differs from your account's base currency.

Execution Speeds and Latency

Execution Speeds

When it comes to execution speed, Blueberry Markets stands out. Independent tests from early 2026 revealed that limit orders were processed in 88 milliseconds, while market orders took 94 milliseconds, placing it 7th among brokers. In comparison, IC Markets showed slower speeds, with limit orders at 134 milliseconds and market orders at 153 milliseconds, ranking 17th out of 36 brokers tested.

Despite these differences, IC Markets offsets its slightly slower retail execution by connecting with over 50 liquidity providers. This extensive network helps reduce slippage during periods of market volatility. The broker handles an impressive 500,000 trades daily, with algorithmic strategies accounting for 60% of the activity.

The performance gap becomes even more pronounced when using the best VPS for forex trading. Blueberry Markets secured the 1st overall ranking, achieving 82ms for limit orders and 90ms for market orders. Meanwhile, IC Markets dropped to 8th place, with execution times of 233ms for limit orders and 168ms for market orders. The choice of platform also plays a role - MetaTrader 5, with its 64-bit processing, provides faster execution compared to MetaTrader 4's 32-bit architecture.

These metrics highlight how execution speeds vary, setting the stage to explore how server placement impacts latency.

Server Locations and Latency

Server placement is a critical factor in reducing latency, especially for traders relying on high-frequency strategies. IC Markets operates state-of-the-art hardware in Equinix NY4 (New York) and LD5 (London) data centers. These locations offer verified latency as low as 2 milliseconds in New York. On the other hand, Blueberry Markets recently relocated its servers from Tokyo (Equinix TY3) to London, while maintaining some infrastructure in New York, achieving latency as low as 7 milliseconds.

For traders utilizing co-located VPS hosting within these data centers, latency can drop to an impressive 0.33 to 0.37 milliseconds. This ultra-low latency is crucial for high-frequency trading, where even a fraction of a millisecond can make a difference. IC Markets caters to this need by offering free VPS hosting to traders who trade more than 15 standard lots per month. Meanwhile, Blueberry Markets provides VPS hosting through Beeksfx for around $20.00 per month, with free access available for eligible live account holders.

Steven Hatzakis, Global Director of Online Broker Research at ForexBrokers.com, underscores IC Markets' infrastructure advantage:

IC Markets' scalable execution makes it a perfect fit for traders who want to run algorithmic strategies.

IC Markets' scalable execution makes it a perfect fit for traders who want to run algorithmic strategies.

VPS Hosting Features

Broker VPS Offerings

Both brokers provide VPS hosting to facilitate automated forex trading, but their terms and performance vary. At Blueberry Markets, traders need to complete 10 lots per round turn each month to qualify for free VPS access. Their VPS offers impressive features like 1 ms latency, a 100% uptime guarantee, and 24/5 technical support through live chat and email.

IC Markets also includes free VPS hosting as a perk, typically requiring a monthly trading volume of 15 lots. It supports automated trading on MT4, MT5, and cTrader platforms. However, recent tests show that Blueberry Markets' VPS delivers faster execution speeds compared to IC Markets' offering. Traders who don’t meet the brokers’ volume requirements might need to spend between $20 and $30 per month on third-party VPS services. For those who want to bypass broker-specific conditions, premium VPS solutions provide greater flexibility and enhanced performance.

QuantVPS Advantages

QuantVPS stands out by offering a specialized VPS infrastructure tailored for futures and forex trading. With latency as low as 0–1 ms and a 100% uptime guarantee, it eliminates the trading volume requirements often tied to broker-provided VPS services.

Plans at QuantVPS start with the VPS Lite package, priced at $59.99 per month (or $41.99 per month when billed annually). This entry-level option includes 4 cores, 8 GB RAM, and 70 GB NVMe storage, all running on Windows Server 2022. For more demanding setups, the VPS Pro plan costs $99.99 per month (or $69.99 per month annually) and supports 3–5 charts with 6 cores, 16 GB RAM, and multi-monitor functionality. For professional traders, the Dedicated Server plan offers unmatched performance with 16+ dedicated cores, 128 GB RAM, and over 2 TB of NVMe storage, priced at $299.99 per month (or $209.99 per month annually). All plans include DDoS protection, automatic backups, and compatibility with popular platforms like NinjaTrader, MetaTrader, and TradeStation.

Customer Support and Education

Support Channels

Both IC Markets and Blueberry Markets provide 24/7 support through live chat, phone, and email. Blueberry Markets takes a more personal approach by assigning dedicated account managers to all funded clients - a feature that earned them recognition as a finalist for Best Online Customer Service by Finder.

IC Markets, on the other hand, offers broader multilingual support in 11 languages, compared to Blueberry Markets' support in English, Thai, and Vietnamese. For instance, IC Markets provides Chinese-language assistance from 9:00 AM to 11:00 PM Beijing time. Both brokers maintain excellent Trustpilot ratings, with IC Markets scoring 4.8/5 and Blueberry Markets close behind at 4.7/5. Blueberry Markets also offers Premium and Premium+ tiers for clients with account balances of $10,000 and $50,000, respectively. These tiers include perks like customized spreads and access to a personal sales trader.

In late 2023, Blueberry Markets introduced a "VIP Trading Room" powered by the Rockqet platform, attracting nearly 1,000 clients within the first month. This platform automatically assigns roles based on deposit levels, granting eligible traders direct access to Chief Traders like Jon Kibbler. Richard Lee, Head of Owned & Earned at Blueberry Markets, praised Rockqet’s hands-on approach:

Personally, what separated Rockqet with other partners was that when problems arose, they didn't send us articles to read or draw a line of ownership, they immediately went ahead and actually RESOLVED the issue.

Personally, what separated Rockqet with other partners was that when problems arose, they didn't send us articles to read or draw a line of ownership, they immediately went ahead and actually RESOLVED the issue.

Both brokers complement their strong support systems with educational resources designed to empower their traders.

Educational Resources

IC Markets caters to experienced traders with an extensive range of educational and algorithmic trading tools. These include over 1,304 webinars, daily Web TV updates from the New York Stock Exchange, and a podcast series called "IC Your Trade." They also integrate research tools like Trading Central and Autochartist directly into their MetaTrader platforms.

Blueberry Markets organizes its educational content in a "Knowledge Hub", tailored to traders at Beginner, Intermediate, and Advanced levels. While its library is more curated - featuring 11 news items and 4 main articles compared to IC Markets' 96 news items and 39 articles - this focused approach is particularly helpful for beginners. However, professional traders looking for a more extensive, self-guided learning experience may find IC Markets' larger library more appealing.

Suitability for Trading Styles

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Scalping and Day Trading

IC Markets stands out for scalpers who focus on tight spreads rather than raw execution speed. For instance, IC Markets offers an average EUR/USD raw spread of just 0.02 pips, compared to Blueberry Markets' 0.10 pips. That 0.08-pip difference could mean an additional cost of about $0.80 per standard lot.

Noam Korbl from CompareForexBrokers highlights this advantage:

The platform runs on IC's Raw Pricing infrastructure, delivering institutional-grade liquidity and sub-200ms execution that actually makes high-frequency scalping and news trading practical.

The platform runs on IC's Raw Pricing infrastructure, delivering institutional-grade liquidity and sub-200ms execution that actually makes high-frequency scalping and news trading practical.

IC Markets also offers a cost advantage for volume traders through its cTrader Raw account, which features a lower commission rate of $6.00 round-turn compared to the typical $7.00.

Blueberry Markets, on the other hand, emphasizes speed. Its limit orders execute in just 88ms, significantly faster than IC Markets' 134ms - about 35% quicker. For day traders dealing with volatile market conditions, this speed can result in more precise order fills and less slippage.

Another feature that sets IC Markets apart is its "freeze level" of 0, which allows traders to place stop-loss orders as close to the market price as needed. This is especially valuable for scalping strategies that require tight setups. Both brokers permit scalping without restrictions, so the choice ultimately depends on whether you prioritize tighter spreads (IC Markets) or faster order execution (Blueberry Markets).

These distinctions in spread and execution speed also play a role in the performance of automated trading systems.

Automated Trading Systems

While fast execution is crucial for scalping and day trading, automated trading systems demand even more robust infrastructure. IC Markets offers infrastructure designed for latency-sensitive algorithmic trading. With enterprise-grade hardware located in NY4 (New York) and LD5 (London) data centers, the broker achieves internal execution speeds of less than 1ms. For clients trading 15+ lots monthly, IC Markets also provides free VPS hosting, enabling automated systems to operate directly from the same data centers as the broker's servers, which minimizes network delays.

IC Markets enhances its automation tools with "Advanced Trading Tools" for MetaTrader 4, which include over 20 plugins for features like sentiment analysis and correlation tracking. Additionally, its cTrader platform offers depth-of-market views and a high-speed execution engine, giving algo traders detailed control over their orders.

Blueberry Markets, however, excels in real-world execution speeds, with 88ms for limit orders and 94ms for market orders, ranking it among the fastest globally. While IC Markets benefits from deeper liquidity sourced from over 25 providers, Blueberry's sub-100ms execution times can be a game-changer for automated strategies that depend on quick order fills during volatile moments. Both brokers support MetaTrader 4, MetaTrader 5, cTrader, and TradingView, though IC Markets is often praised for smoother integration across these platforms.

For traders looking beyond broker-provided VPS solutions, QuantVPS vs ForexVPS comparisons show that QuantVPS is a strong alternative. It specializes in infrastructure for forex and futures trading, offering ultra-low latency connections (0–1ms) to major data centers and a 100% uptime guarantee. Plans start at $59.99/month for the VPS Lite tier, which supports 1–2 charts with 4 cores and 8GB RAM. For those running multiple automated strategies, the VPS Pro tier at $99.99/month accommodates 3–5 charts with 6 cores and 16GB RAM, making it a reliable choice for more complex setups.

Final Verdict

If you're a trader focused on keeping costs low or running algorithmic systems, IC Markets comes out on top. With EUR/USD spreads averaging just 0.02 pips, it offers spreads that are practically institutional-grade, making it a great option for high-volume traders looking to save. As Noam Korbl from CompareForexBrokers points out:

Trading with IC Markets saves you $0.80 per lot on EUR/USD alone and much more on other pairs.

Trading with IC Markets saves you $0.80 per lot on EUR/USD alone and much more on other pairs.

Additionally, its broader platform offerings, such as cTrader, are ideal for scalping strategies that rely on ultra-tight spreads.

On the other hand, Blueberry Markets stands out for its faster execution speeds and personalized customer service. Its execution speed is about 35% faster than IC Markets, which can be a game-changer for manual traders or automated systems during volatile markets. Reviews consistently highlight its excellent customer support and dedicated account managers, making it an attractive choice for those who value a more tailored experience. Plus, the $100 minimum deposit makes it accessible for newer traders.

For those looking to take their trading infrastructure to the next level, top low-latency VPS providers can make a noticeable difference. QuantVPS offers ultra-low latency (0–1ms to major data centers), a 100% uptime guarantee, and plans starting at $59.99/month for the VPS Lite tier (4 cores, 8GB RAM). For more demanding setups, the VPS Pro tier at $99.99/month provides 6 cores and 16GB RAM, ensuring reliable performance for complex trading strategies.

- Choose IC Markets if you prioritize the lowest spreads and high-frequency algorithmic trading.

- Choose Blueberry Markets if faster execution and personalized service are more important to you.

Whichever broker you go with, a specialized VPS like QuantVPS can enhance your trading performance, ensuring your strategies run seamlessly with minimal latency around the clock.

FAQs

How do the trading platforms of Blueberry Markets and IC Markets compare?

Blueberry Markets sticks to the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are favorites among traders for their solid features and ease of use. On the other hand, IC Markets expands its offering by including cTrader alongside MT4 and MT5. What sets cTrader apart is its highly customizable interface and unique order-execution engine, which makes it a strong choice for traders who rely on high-frequency or algorithmic strategies.

By focusing exclusively on the MetaTrader suite, Blueberry Markets keeps things straightforward. However, IC Markets stands out by giving traders a wider range of platform options, allowing them to pick one that best suits their trading style and goals.

How do Blueberry Markets and IC Markets compare in terms of regulation and client fund security?

Both Blueberry Markets and IC Markets operate under the regulation of the Australian Securities and Investments Commission (ASIC), adhering to stringent standards for licensing and safeguarding client funds. Beyond ASIC, Blueberry Markets is also regulated by the Securities Commission of the Bahamas (SCB). Meanwhile, IC Markets extends its regulatory reach with licenses not only from ASIC and SCB but also from authorities in Cyprus and Seychelles.

This expanded regulatory framework gives IC Markets oversight across multiple jurisdictions, including supervision aligned with EU standards through its Cyprus license. Both brokers ensure the security of traders' funds by maintaining segregated client accounts, as mandated by their respective regulators. However, IC Markets gains an edge with its broader regulatory coverage, offering additional layers of oversight through its diverse licensing portfolio.

Which broker is better for high-frequency or algorithmic trading?

For traders focused on high-frequency or algorithmic strategies, IC Markets is a more fitting choice. It delivers ultra-tight spreads sourced from over 25 liquidity providers, raw-spread accounts with minimal commissions, and a spread-only account with no extra fees. These features make it well-suited for low-cost, high-volume trading approaches.

IC Markets also supports advanced platforms like cTrader in addition to MT4 and MT5, both known for their fast execution speeds and compatibility with automated trading systems. By comparison, Blueberry Markets only offers MT4 and MT5, without emphasizing the ultra-low spreads or low latency that are crucial for scalping or algorithmic trading.

Blueberry Markets sticks to the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are favorites among traders for their solid features and ease of use. On the other hand, IC Markets expands its offering by including cTrader alongside MT4 and MT5. What sets cTrader apart is its highly customizable interface and unique order-execution engine, which makes it a strong choice for traders who rely on high-frequency or algorithmic strategies.

By focusing exclusively on the MetaTrader suite, Blueberry Markets keeps things straightforward. However, IC Markets stands out by giving traders a wider range of platform options, allowing them to pick one that best suits their trading style and goals.

Both Blueberry Markets and IC Markets operate under the regulation of the Australian Securities and Investments Commission (ASIC), adhering to stringent standards for licensing and safeguarding client funds. Beyond ASIC, Blueberry Markets is also regulated by the Securities Commission of the Bahamas (SCB). Meanwhile, IC Markets extends its regulatory reach with licenses not only from ASIC and SCB but also from authorities in Cyprus and Seychelles.

This expanded regulatory framework gives IC Markets oversight across multiple jurisdictions, including supervision aligned with EU standards through its Cyprus license. Both brokers ensure the security of traders' funds by maintaining segregated client accounts, as mandated by their respective regulators. However, IC Markets gains an edge with its broader regulatory coverage, offering additional layers of oversight through its diverse licensing portfolio.

For traders focused on high-frequency or algorithmic strategies, IC Markets is a more fitting choice. It delivers ultra-tight spreads sourced from over 25 liquidity providers, raw-spread accounts with minimal commissions, and a spread-only account with no extra fees. These features make it well-suited for low-cost, high-volume trading approaches.

IC Markets also supports advanced platforms like cTrader in addition to MT4 and MT5, both known for their fast execution speeds and compatibility with automated trading systems. By comparison, Blueberry Markets only offers MT4 and MT5, without emphasizing the ultra-low spreads or low latency that are crucial for scalping or algorithmic trading.

"}}]}