Best Quantower Alternatives Compared: NinjaTrader, Tradovate, Bookmap, Sierra Chart

Quantower is a popular trading platform, but it may not meet every trader's unique needs. Whether you're looking for advanced order flow tools, automation features, or platforms optimized for futures trading, there are several alternatives to consider. Here's a quick breakdown:

- NinjaTrader: Known for its advanced charting, DOM tools, and automation capabilities. Works well for prop firm traders and costs $60–$200/month.

- Tradovate: A cloud-based platform offering simplicity and cross-device compatibility. Great for traders who value flexibility, priced at $180/month.

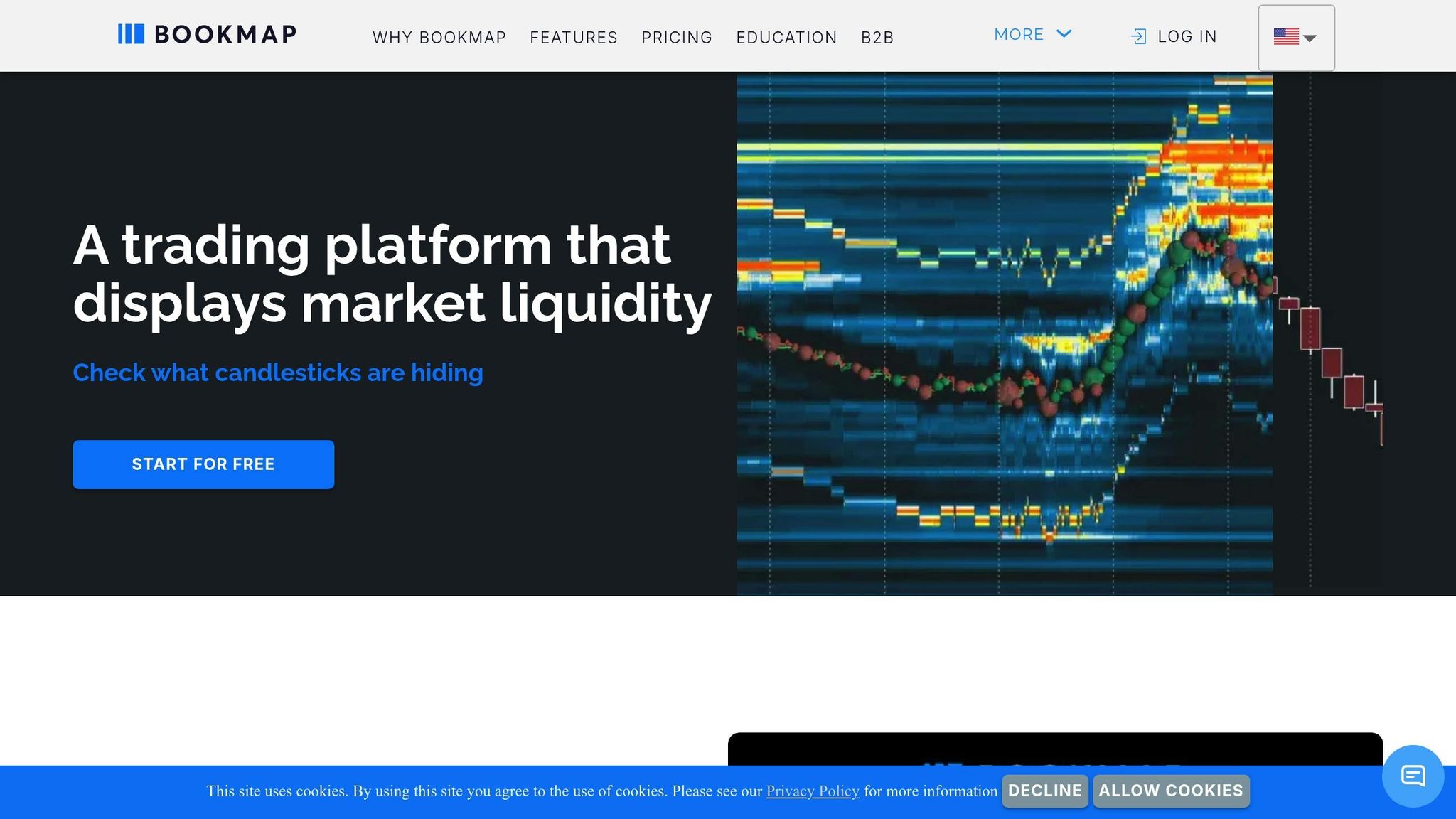

- Bookmap: Focuses on market depth visualization using heatmaps. Ideal for scalpers and starts at $250/month.

- Sierra Chart: Offers low-latency performance, advanced charting, and order flow tools for $36/month. A favorite for professional scalpers.

- ATAS: Specializes in order flow analysis and footprint charts, priced at $98/month.

- Jigsaw Daytradr: Tailored for DOM-focused trading, widely used by scalpers, starting at $180/month.

- MotiveWave: Great for technical analysis with tools like Elliott Wave and Fibonacci patterns. Costs $24–$159/month.

- TradeStation: Features automation via EasyLanguage and robust execution tools, with commission-based pricing.

- MultiCharts: Focused on strategy automation and development, priced at $99–$199/month.

Quick Comparison

| Platform | Best For | Order Flow Tools | Automation | Monthly Cost |

|---|---|---|---|---|

| NinjaTrader | Futures & Automation | Advanced | Yes | $60–$200 |

| Tradovate | Cloud-Based Trading | Basic | Limited | $180 |

| Bookmap | Market Depth Analysis | Advanced | Limited | $250+ |

| Sierra Chart | Low-Latency Scalping | Advanced | Yes | $36 |

| ATAS | Order Flow Analysis | Advanced | Limited | $98 |

| Jigsaw Daytradr | DOM Trading | Advanced | No | $180 |

| MotiveWave | Technical Analysis | Basic | Yes | $24–$159 |

| TradeStation | Automation & Execution | Basic | Yes | Commission |

| MultiCharts | Strategy Development | Basic | Yes | $99–$199 |

Each platform has its strengths, so the best choice depends on your trading style, needs, and budget. For scalpers, Sierra Chart or Jigsaw Daytradr are strong picks. If you prioritize automation, NinjaTrader or MultiCharts may be better suited. For traders who need mobility, Tradovate's cloud-based design stands out.

Ninjatrader vs Tradovate vs Quantower: Which Trading Platform is Better?

1. NinjaTrader

NinjaTrader stands out as a strong alternative to Quantower, especially for professional futures traders. It combines advanced charting tools with precise trade execution, making it a go-to platform in high-level trading circles. Let’s take a closer look at how NinjaTrader’s features stack up against other alternatives.

Charting Capabilities

NinjaTrader delivers powerful charting tools equipped with a wide selection of technical indicators, drawing tools, and multi-timeframe analysis. This setup allows traders to simultaneously monitor multiple instruments and timeframes, offering a comprehensive view of market trends.

Order Flow & DOM Tools

The platform shines with its Order Flow+ suite and SuperDOM, which provide real-time insights into market depth and order activity. These tools include customizable price ladders, ATM strategies, footprint charts, cumulative delta, and market depth maps, all designed to enhance trade management.

"Order flow is more than a charting style - it's a way of understanding how futures markets move, tick by tick. For active traders, order flow can offer real-time insights into who's in control of the market and how price levels are being challenged or defended." - NinjaTrader Team

"Order flow is more than a charting style - it's a way of understanding how futures markets move, tick by tick. For active traders, order flow can offer real-time insights into who's in control of the market and how price levels are being challenged or defended." - NinjaTrader Team

For traders who prioritize low latency and precision, especially in VPS setups, these features are indispensable.

Automation Support

NinjaTrader supports automation through custom C# coding and an easy-to-use Strategy Builder. Additionally, its integrated trade copier simplifies account management for those juggling multiple accounts, making it a versatile tool for both discretionary and automated trading approaches.

Prop Firm Compatibility

The platform integrates seamlessly with leading market data providers like Rithmic, CQG, and Interactive Brokers, ensuring reliable routing for prop firm traders. It also includes essential risk management tools and profit-and-loss tracking, meeting the high standards of transparency and control required in professional trading environments.

Performance & Cost

NinjaTrader offers a free charting package with live data, making it accessible to traders at any level. For those seeking more advanced features, the Lifetime License is available for $1,395 or as a monthly lease for $59. The Order Flow+ suite is included with the Lifetime License or can be added separately for $59/month. To maximize performance, the platform thrives on high-speed internet and powerful CPUs, ensuring smooth operation even when running detailed order flow tools.

2. Tradovate

Tradovate offers a modern, cloud-based solution for futures trading, standing out from traditional desktop platforms like Quantower. By operating directly in your browser, it removes the hassle of installations while delivering professional-grade tools that work seamlessly across operating systems.

The platform's charting system is fully browser-based, providing responsive, cross-platform charts equipped with essential indicators and drawing tools. It supports multiple timeframes and chart types, including candlestick, bar, and line charts. While it doesn't boast an extensive library of indicators like some desktop platforms, it covers the core tools most traders rely on daily. Whether you're using a Windows PC, Mac, or even a Chromebook, Tradovate ensures your charts look and function the same. This consistency is a huge plus for traders who frequently switch devices during the day. Let’s take a closer look at some of Tradovate’s standout features.

Order Flow & DOM Tools

Tradovate includes a reliable depth of market (DOM) interface with customizable price ladders and one-click order entry, making it easy to view market depth at a glance. The order entry system supports bracket orders, stop losses, and profit targets, making it particularly appealing for active scalpers.

While its order flow tools are straightforward, they prioritize speed and simplicity over in-depth market microstructure analysis, which may appeal to traders who value efficiency over complexity.

Automation Support

Tradovate also offers strong automation capabilities. It supports automated trading through APIs and trade copier functionality, allowing seamless integration with popular algorithmic trading solutions. Since the platform operates in the cloud, you can run automated strategies without the need to keep your home computer running 24/7 - an advantage for traders focused on efficiency and convenience.

Prop Firm Compatibility

Tradovate has gained traction among proprietary trading firms due to its reliability and transparent execution. Firms like FundingTicks, Take Profit Trader, and The Trading Pit recognize Tradovate as a primary trading platform. Its built-in risk management tools and detailed trade reporting meet the strict transparency and monitoring requirements of prop firms.

With direct connections to major futures exchanges, Tradovate ensures low-latency execution, a critical factor for prop firms focused on trader performance.

Performance & Cost

When it comes to pricing, Tradovate operates on a commission-based model, avoiding monthly software fees. Futures commissions typically range from $0.49 to $1.29 per contract, depending on trading volume and account type. This structure can be more budget-friendly for active traders who might otherwise face both platform fees and commissions.

The platform runs smoothly on any modern browser with a stable internet connection. For high-frequency trading strategies, using a robust VPS can further optimize performance.

3. Bookmap

Bookmap offers a unique way to visualize market depth by using heatmap technology. Instead of relying on traditional numeric displays, it presents a thermal image-style view of liquidity pools and tracks how orders flow through various price levels in real time.

One of its standout features is liquidity visualization, which provides traders with an intuitive way to analyze order flow. Each price level is shown as a colored band, with the intensity of the color indicating the order volume. This makes it easier to spot key levels of support, resistance, and potential breakout points. Let’s dive into how Bookmap’s order flow tools elevate market analysis.

Order Flow & DOM Tools

Bookmap excels at visualizing market activity. Its heatmaps dynamically display bid/ask liquidity and market depth, helping traders quickly identify patterns in order flow. For instance, traders can monitor how large orders enter the market and whether they’re being absorbed or driving price movements. This insight is invaluable for spotting potential breakouts or reversals.

The market depth heatmaps showcase how orders accumulate or vanish over time, making the platform particularly appealing to scalpers and day traders who need to make split-second decisions.

In addition to its visual tools, Bookmap includes traditional DOM (Depth of Market) functionality. This allows traders to place orders directly through the interface while maintaining complete visibility of market depth and liquidity flow.

Automation Support

Bookmap complements its visualization tools with API integration, focusing less on built-in strategy development and more on enabling custom solutions. Its robust APIs allow developers to design tailored trading algorithms that leverage the platform’s detailed liquidity data.

By integrating Bookmap’s visual data with external execution systems, traders can combine its advanced visualization capabilities with their existing automated trading setups. This flexibility appeals to professional traders who require precise tools to enhance their strategies.

Performance & Cost

Running Bookmap efficiently requires a high-performance setup. The platform demands powerful CPUs and substantial RAM to handle its real-time processing needs, especially when tracking multiple instruments simultaneously. Additionally, its continuous rendering of heatmaps relies heavily on strong graphics processing, which can strain standard computer systems.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Subscription plans start at around $49 per month for basic features, while professional packages, which include full functionality and multiple data feeds, cost up to $165 per month. These prices reflect the platform’s specialized capabilities and the computational power required for its advanced tools.

For many users, operating Bookmap on a dedicated VPS with high-performance specs ensures optimal performance. This setup minimizes latency and ensures the platform runs smoothly, making it ideal for professional traders who depend on reliable and fast order flow analysis. The resource-intensive nature of Bookmap underscores its focus on delivering precision and performance for serious trading environments.

4. Sierra Chart

Sierra Chart stands out as a powerful option for professional futures scalpers, offering advanced charting tools and low-latency performance. Designed for traders who demand precision and customization, it provides a range of features tailored for in-depth analysis and high-speed trading. Let’s break down what makes Sierra Chart a go-to platform for advanced trading strategies.

Charting Capabilities

The charting engine in Sierra Chart is built to handle multiple timeframes and studies without compromising performance. Its footprint charts give detailed insights into bid/ask volume, while the Market and Volume Profile tools can be adjusted to fit any trading session. For traders who need specialized visualizations, the platform supports custom studies built in C++, enabling the creation of unique indicators that process data with precision.

Order Flow & DOM Tools

Sierra Chart’s Depth of Market (DOM) tools provide real-time updates on market depth, a crucial feature for scalpers. Its order flow tools include footprint charts that reveal patterns in aggressive buying and selling. Traders can also monitor delta divergences and cumulative volume delta, while the ladder-style interface enables quick, one-click order entries - perfect for fast-paced trading environments.

Automation Support

For those looking to automate their strategies, Sierra Chart offers the ACSIL framework, which supports custom indicators and automated systems programmed in C++. It also allows integration with external DLLs for third-party tools. For less complex setups, traders can use Excel-based trading or set up customizable alerts via email, SMS, or audio notifications. These automation features help traders stay on top of fast-moving market conditions.

Prop Firm Compatibility

Sierra Chart integrates seamlessly with major data feeds like Rithmic and CQG, making it a strong choice for professional trading setups. It also includes risk management tools such as position sizing calculators and maximum loss controls, meeting the operational standards required by many proprietary trading firms.

Performance & Cost

Known for its efficient resource usage and reliable performance, Sierra Chart delivers the speed and stability professional traders need. While the platform has a steep learning curve, its analytical capabilities and overall performance make it a worthwhile investment. Pricing is straightforward, but for the latest details, it’s best to consult the official website.

5. ATAS

ATAS is a specialized platform designed for traders who focus on order flow analysis and footprint charting, making it a go-to choice for futures trading enthusiasts.

Charting Capabilities

With its user-friendly interface, ATAS delivers detailed footprint charting that helps traders analyze market microstructure and track order flow in real time. This level of precision allows for quick and informed decision-making.

Prop Firm Compatibility

The platform's clean and efficient visuals are not just helpful for personal trading but also meet the high standards required by proprietary trading firms. ATAS integrates seamlessly with several major data feeds, including Rithmic, CQG, and DxFeed. Its compatibility with Rithmic stands out, as this data feed is widely used by prop firms for both data and order routing services.

6. Jigsaw Daytradr

Jigsaw Daytradr has earned a strong reputation among scalpers, thanks to its specialized DOM (Depth of Market) interface that delivers real-time market depth - perfect for traders who thrive on quick decision-making in fast-moving markets.

Order Flow & DOM Tools

The platform's DOM interface is specifically designed to provide a clear and detailed view of market depth while enabling one-click order execution. This combination makes it a go-to tool for scalping strategies, particularly on high-volume futures contracts like ES (E-mini S&P 500) and NQ (E-mini Nasdaq-100). Its clean and efficient layout ensures traders can pinpoint liquidity levels and execute trades with lightning-fast precision, minimizing delays.

Prop Firm Compatibility

Jigsaw Daytradr also integrates seamlessly with the Rithmic data feed, a feature that boosts its appeal for prop trading setups. This integration guarantees the low-latency execution and high-quality data that professional trading firms demand. Additionally, its DOM tools are fine-tuned to support the rapid, high-frequency trading strategies often employed in these environments.

These targeted features give Jigsaw Daytradr a distinct edge in the competitive world of futures trading platforms, complementing the wider range of tools available to traders.

7. MotiveWave

MotiveWave is a powerful trading platform that combines flexible charting tools with detailed market analysis. It supports advanced techniques like Elliott Wave, Fibonacci retracements, and pattern recognition, making it a solid choice for traders focused on futures markets. Whether you're into manual trading or prefer semi-automated strategies, this platform has something to offer.

Charting Capabilities

MotiveWave’s charting tools are highly customizable, offering a variety of bar types, custom time frames, and automated pattern recognition for setups like Elliott Wave, Gartley, and Gann. Its Volume Profile and multi-timeframe analysis let traders overlay different timeframes onto a single chart, giving a clear view of both short-term momentum and long-term market structure. Plus, traders can create custom instruments, such as synthetic contracts or spread charts, that go beyond the limits of standard data feeds. On top of all that, the platform enhances efficiency with automation features that simplify trade execution.

Automation Support

For traders who like to blend automation with analysis, MotiveWave offers a framework for custom indicators and automated pattern alerts. While it doesn’t provide the full C# automation ecosystem available in some competing platforms, its pattern recognition tools are well-suited for swing and position traders who rely on detailed market insights.

Prop Firm Compatibility

MotiveWave isn’t just about analysis - it’s built to integrate seamlessly with professional trading setups. It connects with over 30 brokers and data providers, making it a reliable choice for prop traders. While it doesn’t focus on ultra-fast execution, its compatibility with professional-grade data sources ensures it meets the needs of traders who emphasize in-depth analysis alongside dedicated execution platforms.

Performance & Cost

MotiveWave offers several pricing tiers to accommodate different needs. There’s a free Community Edition for beginners, while the Standard plan costs $24 per month, and the Ultimate plan is priced at $159 per month. A 14-day free trial is available for those who want to test the waters. For traders who prefer a one-time payment, higher-priced purchase options are also available. The platform is less demanding on system resources, making it a great fit for those who prioritize detailed market analysis over real-time order flow visualization.

8. TradeStation

TradeStation stands out as a platform built for traders who need accuracy and speed in both order execution and market analysis. Its proprietary Matrix order entry system is a key feature, offering advanced order types and reliable position management. This ensures traders have precise control over their trades at all times.

The platform also comes equipped with built-in charting tools and supports EasyLanguage, a scripting language designed for creating automated trading strategies. When paired with a high-performance Virtual Private Server (VPS), TradeStation's Matrix system and automation tools deliver smooth, low-latency execution - an essential for futures traders.

9. MultiCharts

MultiCharts is an advanced platform designed for futures traders looking to transition from discretionary trading to semi-automated systems. It combines powerful charting tools with automation capabilities, making it a versatile choice for serious traders.

Charting Capabilities

MultiCharts provides a comprehensive charting experience, offering over 200 technical indicators and drawing tools. With its multi-timeframe analysis and Portfolio Trader feature, users can efficiently manage positions across multiple futures contracts from a single interface.

The platform's real-time scanning tools are particularly useful for identifying trading opportunities across various markets. Traders can create custom market scanners tailored to technical criteria, price patterns, or volume activity. This functionality is ideal for managing extensive watchlists, such as those with 50 or more futures contracts. These tools serve as a strong foundation for developing and automating trading strategies.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Order Flow & DOM Tools

Beyond charting, MultiCharts includes features to support order execution. Its Depth of Market (DOM) interface provides basic bid/ask data and market depth, though it lacks advanced tools like footprint charts or liquidity heatmaps, which are often preferred by professional scalpers.

The platform also supports Chart Trading, allowing traders to place orders directly on price charts. This feature simplifies execution by enabling users to set stop losses, profit targets, and bracket orders right on the chart, making it especially helpful for swing and position traders.

Automation Support

MultiCharts excels in strategy automation, supporting programming languages like EasyLanguage, PowerLanguage, C#, and .NET. This compatibility allows traders to import and modify existing strategies, including those from TradeStation, with minimal effort.

The platform's Strategy Optimization engine enables users to backtest strategies across multiple parameters simultaneously, helping them refine their automated systems. Additionally, the Portfolio Backtester allows traders to test strategies across entire futures sectors, delivering detailed performance analytics.

Prop Firm Compatibility

MultiCharts is compatible with major futures brokers like Rithmic, CQG, and Interactive Brokers, and adheres to many prop firm risk management standards. While it’s not as widely used as platforms like NinjaTrader or Tradovate in the prop trading community, some firms, including Apex Trader Funding and FTMO, do support it. However, traders should confirm compatibility with their specific prop firm before fully committing.

The platform includes essential risk management tools such as position sizing controls and maximum drawdown limits, aligning with the requirements of most prop trading firms.

Performance & Cost

MultiCharts starts at $99 per month, with a Professional edition available for $199 per month. The platform requires Windows, 8GB of RAM, and a dedicated graphics card for optimal performance. For traders running multiple strategies or charts, a high-speed VPS can further enhance functionality.

However, users with lower-end hardware may encounter performance issues during high-volume sessions, particularly around major economic events. For the best experience, a robust system setup is recommended.

Platform Comparison: Strengths and Weaknesses

Each trading platform brings its own set of strengths and weaknesses, making it essential to align your choice with your trading style. Here's a breakdown of some of the most popular platforms, highlighting their key features and potential drawbacks.

NinjaTrader is a robust alternative to Quantower, offering free charting and cost-effective futures execution. It boasts an extensive ecosystem of add-ons and strong support for prop firms, making it a favorite among professional traders. However, the platform's complexity can be daunting for beginners.

Tradovate stands out for its simplicity and cloud-based design. Priced at $180 per month, it’s particularly appealing to Mac users who want to avoid virtualization software. While its interface is streamlined, it may lack the customization and advanced order flow tools found on more traditional desktop platforms.

Bookmap is well-known for its heatmap feature, which provides exceptional liquidity visualization for analyzing market depth and flow. With a starting price of $250 per month, it’s ideal for traders seeking detailed market insights, especially when used with high-performance hardware or VPS setups.

Sierra Chart is a go-to for professional scalpers, offering high performance and low latency at just $36 per month. Its efficiency makes it a solid choice for high-frequency trading, although its advanced customization options may require a learning curve.

ATAS specializes in order flow and footprint analysis, providing intuitive tools for $98 per month. While it excels in its niche, it lacks some of the broader charting and automation features that other platforms provide.

Jigsaw Daytradr is tailored for traders focusing on depth-of-market (DOM) tools. Starting at $180 per month, it delivers specialized DOM features but offers limited charting capabilities.

MotiveWave caters to technical analysts with advanced tools for Elliott Wave, Fibonacci, and structured analysis. At $167 per month, it’s ideal for traders who prioritize these features but may be overkill for those focused solely on futures trading.

TradeStation offers an all-in-one solution with EasyLanguage programming for automated strategies. While it supports multi-asset trading, its commission-based pricing can add up quickly for active traders.

MultiCharts shines in automation and supports multiple programming languages, making it a strong choice for discretionary futures trading. With a subscription cost ranging from $99 to $199 per month, it requires a higher level of technical knowledge compared to some of its competitors.

When choosing a platform, it’s less about finding the "best" option and more about identifying the one that fits your specific trading needs. For example, scalpers may gravitate toward Sierra Chart or Jigsaw Daytradr for their speed and precision, while those requiring advanced automation might lean toward NinjaTrader or MultiCharts. Traders focused on order flow visualization often favor Bookmap or ATAS.

Performance is another critical factor. Platforms like Bookmap and NinjaTrader benefit greatly from high-performance hardware or VPS hosting, while Sierra Chart’s efficiency makes it a good option for lower-end systems. For traders looking to bypass hardware limitations, Tradovate’s cloud-based design can be a practical solution.

Cost is another key consideration. Sierra Chart offers affordability at $36 per month, while Bookmap’s pricing reflects its advanced, specialized tools.

Most platforms are compatible with major futures data feeds like Rithmic and CQG, ensuring they meet the requirements of many prop firms. However, traders should confirm specific compatibility with their chosen platform before committing.

To summarize the key differences, here’s a comparison table:

| Platform | Best For | DOM Quality | Order Flow | Automation | Prop Firm Friendly | Difficulty | Monthly Cost |

|---|---|---|---|---|---|---|---|

| Quantower | Multi-asset trading | High | High | Good | Yes | Medium | $150–300 |

| NinjaTrader | All-around futures | High | High | High | Yes | Medium-High | $60–200 |

| Tradovate | Cloud-based trading | Good | Good | Limited | Yes | Low | $180 |

| Bookmap | Liquidity visualization | Good | High | Limited | Moderate | High | $250–500 |

| Sierra Chart | High-performance scalping | High | High | Good | Yes | High | $36 |

| ATAS | Order flow analysis | Good | High | Limited | Moderate | Medium | $98 |

| Jigsaw Daytradr | DOM trading | High | High | None | Yes | Medium | $180 |

| MotiveWave | Technical analysis | Good | Limited | Good | Limited | Medium | $167 |

| TradeStation | Multi-asset automation | Good | Limited | High | Limited | High | Commission-based |

| MultiCharts | Strategy development | Good | Limited | High | Moderate | High | $99–199 |

Conclusion

Selecting the right trading platform boils down to your trading style and specific needs. If you're a scalper who values speed and precision, Sierra Chart delivers outstanding performance, while NinjaTrader offers a robust suite of depth-of-market (DOM) tools and extensive add-ons. Jigsaw Daytradr is another strong contender for professional-grade DOM features. For traders who rely on automation, NinjaTrader shines with its powerful C# programming capabilities, MultiCharts supports multiple programming languages, and TradeStation stands out with its user-friendly EasyLanguage platform.

If mobility and simplicity are your priorities, Tradovate is a great choice. Its cloud-based design eliminates installation hassles and works seamlessly across devices, making it especially appealing for Mac users who prefer to avoid virtualization software. For order flow analysis, platforms like Bookmap and ATAS provide exceptional visualization tools to help you better understand market depth and liquidity patterns.

Beyond platform features, the importance of execution speed and stability cannot be overstated. Platforms such as Bookmap, Sierra Chart, NinjaTrader, and Quantower perform best when paired with high-speed CPUs and low-latency network connections. Hosting these platforms on a QuantVPS Chicago server - offering latency of less than 1 millisecond to the CME - can significantly enhance execution, chart speed, and order flow stability. This combination of advanced hardware and ultra-low latency connectivity could be the difference between a successful trade and a missed opportunity. New users can take advantage of a 60% discount on their first month with the code: FUTURES.

Ultimately, your success depends on choosing a platform that aligns with your trading style and supporting it with high-performance infrastructure. Each platform brings its own strengths to the table - find the one that complements your approach and trading goals.

FAQs

What should I consider when choosing a trading platform to replace Quantower?

When choosing a platform to replace Quantower, it's important to focus on the features that align with your trading needs and style. Here are some key elements to keep in mind:

- Charting tools: Prioritize platforms with robust technical analysis capabilities, such as custom indicators, footprint charts, and volume profile features. These tools can offer deeper insights into market trends.

- Order flow and DOM tools: Look for real-time market depth, order book data, and tools that visualize liquidity. These features are essential for understanding market dynamics.

- Automation support: If you rely on automated strategies, ensure the platform supports programming languages like C# or EasyLanguage for seamless strategy creation.

- Futures routing: Verify that the platform connects to trusted futures data providers such as Rithmic, CQG, or Tradovate to ensure accurate and reliable data.

- Prop firm compatibility: Check if the platform supports well-known proprietary trading firms like Apex, MFFU, or FundingTicks.

You’ll also want to weigh factors like user-friendliness, subscription costs, and system performance requirements, particularly if you plan to use a VPS. Striking the right balance between these considerations will help you choose a platform that complements your trading objectives.

How does a cloud-based platform like Tradovate compare to traditional desktop trading platforms in terms of performance and flexibility?

Cloud-based platforms such as Tradovate bring a range of benefits that set them apart from traditional desktop-based trading tools. Thanks to its cloud infrastructure, Tradovate delivers reliable, low-latency performance across multiple devices - whether you're on a desktop, mobile, or using a web browser. This means traders can enjoy consistent, smooth performance no matter where they are.

Another major perk is the simplicity of its setup. Tradovate skips the hassle of complex installations or the need for high-powered hardware. It’s also fully compatible with Mac systems without requiring extra software like Parallels. Add in its responsive design and user-friendly interface, and it’s clear why Tradovate appeals to traders who value convenience and efficiency. If accessibility and ease of use are what you’re after, Tradovate is worth considering.

Which trading platform is ideal for traders focused on automation and developing custom strategies?

If you're focusing on automation and crafting strategies, NinjaTrader and TradeStation are excellent platforms to consider. NinjaTrader provides powerful tools for automated trading, including a C#-based scripting environment, trade copiers, and a variety of add-ons to enhance functionality. Meanwhile, TradeStation offers its proprietary scripting language, EasyLanguage, which makes it simpler to design custom strategies and indicators.

Both platforms cater to traders who value flexibility and precision in automated trading. They also support multiple asset classes and work seamlessly with leading futures brokers.

When choosing a platform to replace Quantower, it's important to focus on the features that align with your trading needs and style. Here are some key elements to keep in mind:

- Charting tools: Prioritize platforms with robust technical analysis capabilities, such as custom indicators, footprint charts, and volume profile features. These tools can offer deeper insights into market trends.

- Order flow and DOM tools: Look for real-time market depth, order book data, and tools that visualize liquidity. These features are essential for understanding market dynamics.

- Automation support: If you rely on automated strategies, ensure the platform supports programming languages like C# or EasyLanguage for seamless strategy creation.

- Futures routing: Verify that the platform connects to trusted futures data providers such as Rithmic, CQG, or Tradovate to ensure accurate and reliable data.

- Prop firm compatibility: Check if the platform supports well-known proprietary trading firms like Apex, MFFU, or FundingTicks.

You’ll also want to weigh factors like user-friendliness, subscription costs, and system performance requirements, particularly if you plan to use a VPS. Striking the right balance between these considerations will help you choose a platform that complements your trading objectives.

Cloud-based platforms such as Tradovate bring a range of benefits that set them apart from traditional desktop-based trading tools. Thanks to its cloud infrastructure, Tradovate delivers reliable, low-latency performance across multiple devices - whether you're on a desktop, mobile, or using a web browser. This means traders can enjoy consistent, smooth performance no matter where they are.

Another major perk is the simplicity of its setup. Tradovate skips the hassle of complex installations or the need for high-powered hardware. It’s also fully compatible with Mac systems without requiring extra software like Parallels. Add in its responsive design and user-friendly interface, and it’s clear why Tradovate appeals to traders who value convenience and efficiency. If accessibility and ease of use are what you’re after, Tradovate is worth considering.

If you're focusing on automation and crafting strategies, NinjaTrader and TradeStation are excellent platforms to consider. NinjaTrader provides powerful tools for automated trading, including a C#-based scripting environment, trade copiers, and a variety of add-ons to enhance functionality. Meanwhile, TradeStation offers its proprietary scripting language, EasyLanguage, which makes it simpler to design custom strategies and indicators.

Both platforms cater to traders who value flexibility and precision in automated trading. They also support multiple asset classes and work seamlessly with leading futures brokers.

"}}]}