Top Multi-Asset Prop Trading Firms: Futures, Forex, Crypto & More

Looking for a prop trading firm that matches your trading style? Here's the key: Multi-asset proprietary trading firms provide capital for traders to manage, offering profit splits (up to 90%) and access to assets like futures, forex, and crypto. You start with an evaluation phase, prove your skills, and potentially trade accounts ranging from $25,000 to $1 million+.

Key Highlights:

- Profit Splits: 80%–90% of profits shared with traders.

- Evaluation Fees: $149–$219, typically refundable after the first payout.

- Tradable Assets: Futures, forex, cryptocurrencies, indices, commodities, and more.

- Risk Management: Daily loss caps and trailing drawdown limits are standard.

- Platforms: MetaTrader, NinjaTrader, cTrader, DXtrade, and others.

Top Firms Covered:

- FTMO: High payouts, strict rules, and scaling up to $2M.

- The Trading Pit: Multi-asset access and scaling up to $5M.

- BrightFunded: Wide asset variety and loyalty rewards.

- Funded Trading Plus: Flexible evaluations and 100% profit potential.

- FundedNext: Fast payouts and both CFD and futures accounts.

- Blue Guardian: Dual divisions for CFDs and futures, with up to $850K in funding.

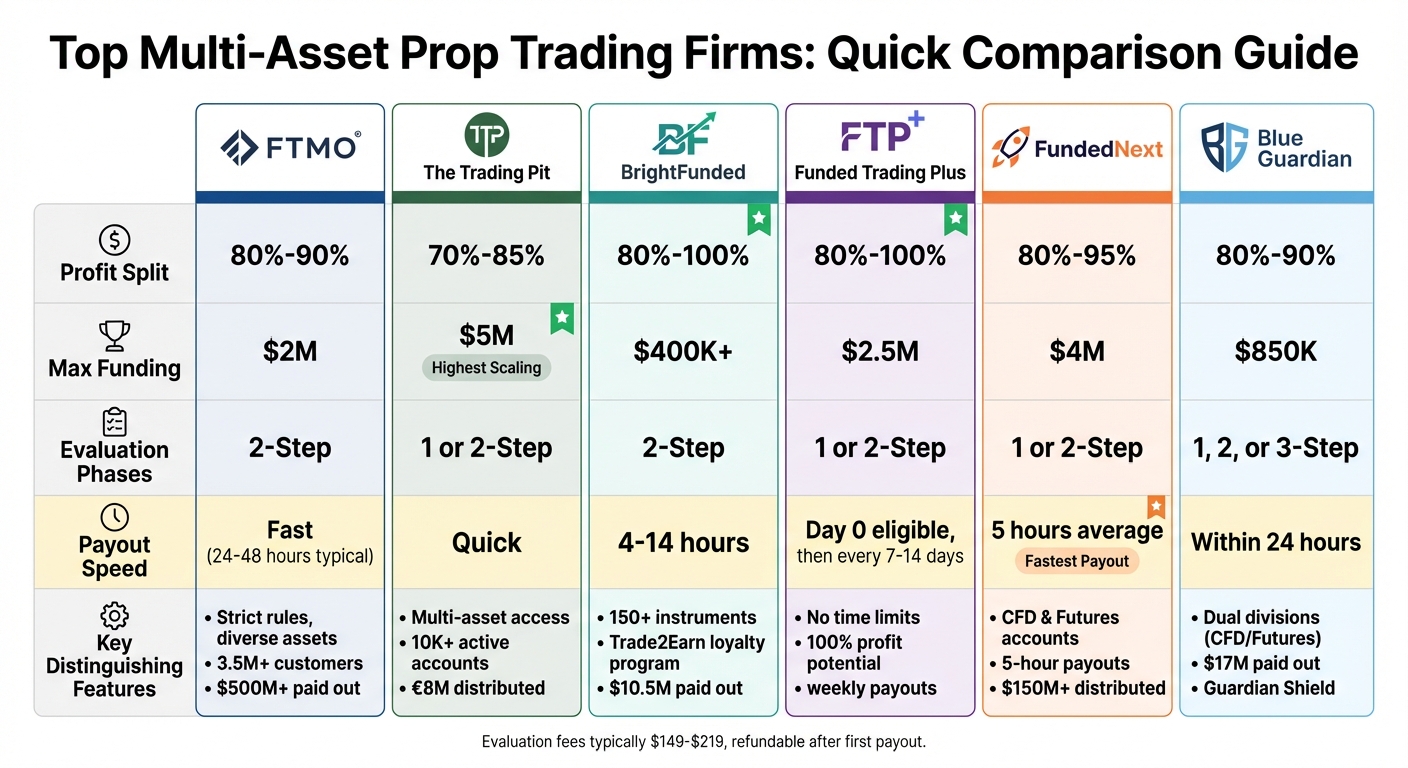

Quick Comparison Table

| Firm | Profit Split | Max Funding | Evaluation Phases | Key Features |

|---|---|---|---|---|

| FTMO | 80%-90% | $2M | 2-Step | Strict rules, diverse assets |

| The Trading Pit | 70%-85% | $5M | 1 or 2-Step | Multi-asset, flexible funding |

| BrightFunded | 80%-100% | $400K+ | 2-Step | Loyalty program, quick payouts |

| Funded Trading Plus | 80%-100% | $2.5M | 1 or 2-Step | No time limits, static drawdowns |

| FundedNext | 80%-95% | $4M | 1 or 2-Step | Futures/CFDs, fast payouts |

| Blue Guardian | 80%-90% | $850K | 1, 2, or 3-Step | Dual funding divisions |

What Matters Most:

- Profit Splits: Higher splits mean more earnings for you.

- Risk Rules: Look for firms with limits that suit your strategy.

- Payout Speed: Fast withdrawals (some within hours) ensure cash flow.

- Assets: Choose firms offering the instruments you trade.

Whether you're into forex, crypto, or futures, pick a firm that aligns with your goals and trading style.

Top 6 Multi-Asset Prop Trading Firms Comparison: Profit Splits, Funding & Features

Top 6 Multi-Asset Prop Trading Firms Comparison: Profit Splits, Funding & Features

How To Become A Profitable Multi-Asset Trader With Divitrades

1. FTMO

Since its inception in 2015, FTMO has made waves in the trading world, distributing over $500 million in rewards to traders across more than 140 countries and serving an impressive 3.5 million customers. The firm earned the title of "Best Prop-Trading Firm" at the Finance Magnates London Summit in both 2023 and 2024. By 2025, FTMO partnered with OANDA, broadening its reach and making its evaluation program accessible to U.S. traders. This strong track record reflects its ability to cater to a wide range of trading needs.

Asset Coverage

FTMO provides access to a diverse set of assets, including forex, indices, commodities, stocks, and cryptocurrencies. Forex traders can explore major, minor, and exotic currency pairs with raw spreads starting from 0 pips. In July 2025, FTMO expanded its crypto offerings by adding 22 new cryptocurrency pairs, such as SOL, BNB, XLM, AAVE, and LINK, giving traders more options beyond Bitcoin and Ethereum.

Funding Structure

FTMO’s evaluation process is designed to test traders’ skills through a two-step challenge. The first phase, the FTMO Challenge, requires achieving a 10% profit target, followed by a 5% target in the Verification phase. Both phases are conducted on simulated accounts without time limits. Successful traders gain access to simulated capital ranging from $10,000 to $200,000, with the potential to scale up to $1 million through the Premium Programme. Notably, one trader achieved a simulated profit of $1,206,225, setting a record.

Profit Split & Fees

FTMO offers traders a generous profit split, ranging from 80% to 90%. The evaluation process involves a one-time fee that is fully refundable after the first profit withdrawal. Account sizes start at $10,000, requiring a fee of €89, and go up to $200,000, with a fee of €1,080. There are no recurring monthly charges. In a single month, FTMO distributed over $9.6 million in rewards, with some top traders earning over $50,000 during the same period[18,21].

Risk Rules

FTMO enforces strict risk management rules to ensure disciplined trading. Daily loss limits are capped at 5%, while the total drawdown limit is set at 10%. Traders are required to trade on at least four days during each evaluation phase. Violating these rules results in immediate disqualification. To help traders stay on track, FTMO provides the Account MetriX tool, which allows real-time monitoring of performance and adherence to the rules[18,19].

Trading Platforms & Tools

FTMO supports a range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and DXtrade. The firm also emphasizes trader development through FTMO Academy and offers tools like a Trading Journal, Economic Calendar, and Equity Simulator. With a Trustpilot rating of 4.8/5 from 34,970 reviews, FTMO is frequently praised for its fast payouts and round-the-clock customer support, available in 20 languages[17,18].

2. The Trading Pit

The Trading Pit (TTP) has established itself as a prominent name in multi-asset proprietary trading. Recognized as the "Best Multi-Asset Prop Trading Firm 2025" at the FundedTrading Awards and earning the title of "Most Flexible Funding Offering for 2025" from Forex Prop Reviews, TTP operates in over 180 countries. With more than 10,000 active monthly accounts, over 450,000 trades processed each month, and €8 million in trader rewards distributed, TTP stands out as a significant player in the industry.

Asset Coverage

TTP provides traders with access to a broad range of asset classes, all managed through a single account. These include forex, stocks, ETFs, futures, options, and cryptocurrencies. Traders can work with major global indices like the S&P 500, Nasdaq, and Dow Jones, alongside currency pairs spanning major, minor, and exotic categories. Popular cryptocurrencies such as Bitcoin, Ethereum, and Ripple are also part of their offerings. Additionally, traders can choose from specialized CFD or Futures accounts or mix multiple asset types during trading challenges. This integrated setup allows for seamless management of diverse assets within one account [22,24].

Funding Structure

TTP employs a challenge-based funding model, offering both 1-step and 2-step prop firm challenge evaluations. Upon successfully completing the evaluation, traders enter into a Signal Provider agreement and gain access to an "Earning Account", where they share in trading profits. Consistent performance can lead to account scaling, with balances reaching as high as $5,000,000. Challenge fees begin at $95 for a $20,000 account, and traders can qualify for funding in as little as seven days [13,24,25].

Profit Split & Fees

TTP offers profit splits ranging from 70% to 85%, with no recurring monthly fees. A one-time challenge fee applies, and traders benefit from a 100% refund of this fee upon passing Level 1. Trading costs vary by asset type: forex, metals, energy futures, and CFD indices incur a flat $5.00 per round lot fee, while U.S. equities are commission-free. EU/UK equities and cryptocurrency trades are subject to a 20% fee. Additionally, current promotions include waiving the €129 activation fee for Futures Challenges [22,23,25].

Risk Rules

Risk management is a cornerstone of TTP’s approach. Traders are required to follow strict guidelines, including daily loss limits and maximum trailing drawdown limits. The firm enforces a "Gambling Policy" to prevent overleveraging and reckless trading, emphasizing the importance of stop-loss orders. Futures traders must close positions between 3:10 PM and 5:00 PM CT, and no more than 50% of total profits can be generated in a single day to encourage steady performance. Violating these rules can result in profit forfeiture or account termination [22,23].

Trading Platforms & Tools

TTP supports traders with advanced platforms like MetaTrader 4, MetaTrader 5, TradingView, Quantower, and Rithmic [22,13]. To enhance the trading experience, they provide tools such as Squawk Box for real-time market audio and daily webinars. Their educational resources include ebooks, podcasts, videos, and infographics, all aimed at helping traders refine their skills. With a Trustpilot rating of 4.2/5, TTP is frequently praised for its quick payouts, responsive support, and clear rules [23,24].

3. BrightFunded

BrightFunded is a multi-asset proprietary trading firm based in the U.S., designed to work around Pattern Day Trader (PDT) regulations. With over $10.5 million paid out to traders and more than 27,500 active participants, it has gained recognition, including being named "Best for Multi-Asset Traders" by Benzinga. The firm boasts a solid 4.4/5 rating on Trustpilot, with traders frequently highlighting its quick payout process - often completed in less than 14 hours. This strong foundation supports its wide range of tradable instruments.

Asset Coverage

BrightFunded offers access to over 150 tradable instruments across various asset classes. Forex traders can enjoy leverage up to 1:100, a significant advantage over the standard 50:1 cap in the regulated U.S. retail market. The firm also supports over 40 cryptocurrency pairs, including Bitcoin and Ethereum, with direct USDC payouts to digital wallets. Additionally, traders can access global indices, commodities, and metals. As CEO Jelle Dijkstra puts it:

"The firm is on a relentless mission to build the ultimate trading ecosystem".

"The firm is on a relentless mission to build the ultimate trading ecosystem".

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Funding Structure

BrightFunded uses a two-phase evaluation process. Traders must hit an 8% profit target in Phase 1 and a 5% target in Phase 2 to qualify for an Apex funded trading account [28,30]. Account sizes range from $5,000 to $200,000, with evaluation fees starting at €55 for the smallest account and going up to €975 for the largest. These fees are fully refundable after passing the evaluation and receiving the first payout. Successful traders can scale their accounts beyond the initial funding, with some accounts reaching $400,000 or more. The firm also runs a Trade2Earn loyalty program, where traders earn tokens for each lot traded, which can be redeemed for free evaluations or profit split upgrades [28,34].

Profit Split & Fees

Once funded, traders start with an 80% profit split, which can increase to 90% or even 100% through the scaling plan. BrightFunded also offers a 15% profit share on earnings made during the evaluation phase, paid out with the first funded withdrawal. Payouts are processed quickly - within 24 hours, and sometimes as fast as 4 hours. After the first 30 days of funded trading, payouts can be requested every 7 days [28,34].

Risk Rules

BrightFunded enforces strict risk guidelines, including a 5% maximum daily loss and a 10% overall maximum loss, both calculated as fixed drawdowns rather than trailing limits. Traders must complete at least 5 trading days in each evaluation phase. While news trading is permitted during evaluations, funded accounts have a 10-minute restriction around major economic announcements unless positions are held for more than 48 hours. Additionally, the firm prohibits certain strategies such as grid trading, tick scalping, high-frequency trading, and hedging between accounts [28,30,34].

Trading Platforms & Tools

BrightFunded supports multiple trading platforms, including MetaTrader 5, cTrader, and DXtrade. Many U.S.-based traders prefer DXtrade for its compliance and smooth execution. These platforms accommodate a wide array of asset classes, including forex, cryptocurrencies, indices, and commodities. The firm's credibility is further reinforced by its leadership team, which includes advisors from the European Central Bank and key brokerage firms [27,29].

4. Funded Trading Plus

Funded Trading Plus has carved out a niche among top proprietary trading firms with its flexible funding options and quick payouts. Based in the UK, the firm has earned accolades like "Most Trusted Trading Firm UK 2025" from International Business Magazine and "Best Proprietary Trading Firm of the Year UK 2025" from World Business Outlook. With a solid 4.4/5 rating on Trustpilot based on over 2,500 reviews, it’s clear that traders appreciate its fast payout system - sometimes completed in mere minutes - and its transparent operating principles. CEO Simon Massey emphasizes this commitment, stating:

"Our 5-Star Promise isn't just meaningless words on a page, it's a reflection of our dedication to providing an exceptional experience."

"Our 5-Star Promise isn't just meaningless words on a page, it's a reflection of our dedication to providing an exceptional experience."

What sets Funded Trading Plus apart is the absence of time limits on challenges and monthly fees, offering traders the freedom to progress at their own pace.

Asset Coverage

Funded Trading Plus provides access to 53 instruments across four asset categories. These include:

- 37 forex pairs: Covering majors, minors, and exotics like USD/ZAR.

- 9 indices: Such as NAS100, SPX500, GER40, UK100, and JPN225.

- 4 commodities: Including Gold, Silver, Brent, and WTI.

- 4 cryptocurrencies: BTC, ETH, LTC, and BCH.

Although direct exchange-traded futures aren’t available, the firm offers comprehensive options through CFDs. Leverage depends on the asset class, with forex going up to 30:1, indices and commodities up to 20:1, and cryptocurrencies capped at 2:1. Trading costs include a $7.00 round-lot commission for forex and commodities, while indices and cryptocurrencies are commission-free.

Funding Structure

Traders can select from three funding paths:

- 1-Step Program: Requires a 10% profit target, with a maximum drawdown of 6% and a daily limit of 4%.

- 2-Step Program: Includes Premium (8% and then 5% targets) and Prestige Pro (which uses a static drawdown).

- Instant Funding: For those who want immediate access to trading capital.

Entry fees range from $119 for a $5,000 account to $4,500 for a $100,000 account. There’s no restriction on the number of trading days, meaning traders can qualify in a single day if they meet the requirements. Accounts can scale up to $2.5 million, with traders eligible for an increase each time they achieve a 10% profit on their funded account.

Profit Split & Fees

Funded Trading Plus offers a standout profit-sharing model. Traders begin with an 80% profit split, which rises to 90% after reaching a 20% profit milestone and further increases to 100% upon hitting a 30% profit target. This structure surpasses the typical industry range of 70–85%. Payouts can be requested from Day 0 of the funded phase, with subsequent withdrawals allowed every 7 to 14 days. The minimum withdrawal amount is $50. Verified trader Alan (thepunisher.ie) shares his experience:

"FT+ should be a straight 5 stars... they are the only ones to pay out WEEKLY and having the fastest payouts."

"FT+ should be a straight 5 stars... they are the only ones to pay out WEEKLY and having the fastest payouts."

The firm charges only a one-time evaluation fee, with no recurring monthly costs.

Risk Rules

Risk management at Funded Trading Plus is tailored to each program. Most challenges use relative (trailing) drawdown, while the Prestige Lite and Prestige Pro programs employ static drawdown. Maximum drawdown limits range from 6% to 10%, with daily limits typically set between 3% and 6%. Traders are allowed to use news trading, hedging, and Expert Advisors (EAs) on MT4, MT5, and cTrader. However, strategies like arbitrage and grid trading are not permitted. Weekend holding is an option for the Experienced, Premium, and Prestige programs, but positions must be closed before Friday’s market close in the Advanced and Master programs. Additionally, accounts must execute at least one trade every 30 calendar days to remain active.

Trading Platforms & Tools

Funded Trading Plus supports a variety of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, DXTrade, and Match-Trader, which integrates with TradingView. While MT4, MT5, and cTrader allow the use of EAs (with a $25 fee for cTrader or platform changes), DXTrade and Match-Trader do not support them. The firm also fosters a strong community, with over 50,000 active members in its Discord group, offering traders access to peer support and valuable resources.

5. FundedNext

FundedNext stands out by offering both CFD and regulated Futures accounts under one brand umbrella. Since its launch in 2022, the company has funded over 137,800 accounts and distributed more than $150 million to over 47,300 traders globally. With a 4.6/5 Trustpilot rating based on 35,000+ reviews, it’s clear that traders appreciate the platform. FundedNext has also received accolades like "Best Trading Experience" and "Quickest Payout." Impressively, payouts are typically processed within 5 hours, and if they take longer than 24 hours, traders receive an additional $1,000 credited to their withdrawal.

Asset Coverage

FundedNext gives traders access to a wide range of assets, including over 70 CFD symbols and 30 regulated CME Futures contracts. The CFD options include major and minor forex pairs like EURUSD and GBPUSD, commodities such as Gold, Silver, and Crude Oil, global indices like US30, NDX100, and GER30, and cryptocurrencies like BTCUSD and ETHUSD. On the Futures side, offerings span stock indices (E-mini ES, NQ), metals and energy contracts (GC, SI, and CL), agricultural products (Corn, Soybeans, Live Cattle), and currency futures.

CFD accounts operate on popular retail platforms such as MT4, MT5, cTrader, and Match-Trader. Futures accounts, on the other hand, are available on institutional-grade platforms like Tradovate, NinjaTrader, and TradingView. This diverse platform support ensures traders have the tools they need for their preferred trading style.

Funding Structure

FundedNext provides tailored funding options for both CFD and Futures traders. CFD traders can choose from models like Stellar 1-Step, 2-Step, Lite, or Instant. Futures traders, meanwhile, can opt for the Rapid Challenge, which focuses on speed without daily loss limits, or the Legacy Challenge, which includes a 15% profit share during the challenge phase.

Futures challenge fees range from $129 for a $25K account to $449 for a $100K account. Evaluation targets require traders to achieve 8%–10% profit in Phase 1 and 5% in Phase 2, all while adhering to strict drawdown limits. Traders who accumulate $100,000 in total active profits become eligible for the Live Trading Program, where they can trade with real capital. This flexible structure accommodates a variety of trading goals and styles.

Profit Split & Fees

Profit-sharing is competitive at FundedNext. CFD traders receive 80%–95% of their profits, while Futures traders start with a 50% split, which increases to 100% after completing 30 benchmark days. Additionally, certain models, like Stellar and Legacy Futures, offer a 15% performance bonus based on Challenge Phase profits.

The firm charges a one-time challenge fee with no monthly costs. This fee is refunded with the first payout for most accounts or the third payout for Stellar Lite accounts. Minimum withdrawals are $100 for CFD accounts, while Futures accounts require $250 to $500. Futures trading also incurs a $3 commission per side per contract ($6 round-turn), along with a $1 exchange and regulatory fee upon closing.

Risk Rules

Risk management varies between CFD and Futures accounts. For CFDs, there’s typically a 5% daily loss limit and an overall drawdown limit of 6%–10%. Futures Rapid accounts, however, have no daily loss limits, while Legacy accounts do. The Futures Consistency Rule limits single-day profits to 40% of the target, and traders must complete five Benchmark Days (earning $100–$200 each) to qualify for withdrawals.

Both account types permit news trading, hedging, and the use of Expert Advisors in forex, though arbitrage is restricted. Accounts can scale up to $4 million through a structured scaling plan. Futures accounts also feature automatic contract scaling based on the end-of-day balance.

Trading Platforms & Tools

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

FundedNext supports a variety of platforms tailored to different trading needs. CFD traders can use MT4, MT5, cTrader, or Match-Trader, while Futures traders have access to Tradovate, NinjaTrader, and TradingView.

The company also offers "Fundee", a multilingual AI assistant that supports 32 languages, alongside 24/7 multilingual human support. Both tools have received praise from traders for their reliability and accessibility.

6. Blue Guardian

Blue Guardian operates with two distinct funding divisions: one dedicated to CFDs and another for Futures. Since its inception, the firm has distributed over $17 million to more than 60,000 traders, with individual earnings reaching as high as $140,000. By offering this dual-division structure, Blue Guardian aligns with the practices of top proprietary trading firms, catering to both CFD and Futures traders and broadening opportunities across multiple asset classes. Here's a closer look at what sets Blue Guardian apart, including its asset offerings, funding models, profit-sharing plans, and risk management strategies.

Asset Coverage

The primary division focuses on CFDs, covering Forex, Indices, Commodities, and Crypto. Forex trading offers leverage of up to 1:100 during the evaluation phase and 1:50 for funded accounts. Indices and commodities are capped at 1:10 leverage, while crypto CFDs have a leverage of 1:2. Blue Guardian's Futures division, launched in 2025, specializes in CME-regulated contracts. These include stock indices like the E-mini ES and NQ, metals and energy products such as GC, SI, and CL, and even agricultural commodities. Traders can access up to $400,000 in funding through the main division, with an additional $450,000 available in the Futures division, providing a combined total of over $850,000 in professional funding.

Funding Structure

Blue Guardian offers four evaluation models tailored to different trading styles:

- 1-Step Evaluation: Requires a 10% profit target with a 4% daily loss limit and a 6% maximum drawdown.

- 2-Step Evaluation: Includes targets of 10% and 5% across two phases, with a 3% daily loss limit.

- 3-Step Evaluation: A more gradual progression for traders.

- Instant Funding: Designed for those seeking immediate access to capital.

Account fees vary, starting at $58 for a $10,000 account and going up to $997 for a $200,000 account. These fees are refundable after the fourth payout. For beginners, a $5,000 Instant Funding Starter account is available for just $19. Blue Guardian also employs its proprietary "Guardian Shield", which triggers a soft breach by closing all trades if the account incurs a 1% loss.

Profit Split & Fees

In the main division, traders can earn profit splits ranging from 80% to 90%, with an optional upgrade to maximize earnings. The Futures division offers an enticing structure: traders keep 100% of their first $15,000 in profits, followed by a 90% split thereafter. CEO Sean Bainton highlighted the firm's mission:

"At Blue Guardian, we set out to challenge the industry's status quo - where high costs and restrictive rules limit traders' potential. We built a firm that offers fair opportunities, cutting-edge technology, and a sustainable model."

"At Blue Guardian, we set out to challenge the industry's status quo - where high costs and restrictive rules limit traders' potential. We built a firm that offers fair opportunities, cutting-edge technology, and a sustainable model."

Payouts are processed within 24 hours, and if there’s a delay, the firm compensates the trader with an additional $200. The minimum withdrawal is $100, with default payouts available every 14 days or weekly with an optional add-on. This transparent profit-sharing model encourages disciplined trading while keeping fees straightforward.

Risk Rules

Blue Guardian has identified that exceeding the Maximum Daily Drawdown accounts for more than 73% of all account breaches. The main division uses a trailing drawdown of 6% for most accounts, while the Futures division adopts an "End of Day" drawdown, allowing for more flexibility during intraday trading. To ensure fair trading practices, traders must avoid opening or closing positions within 5 minutes of high-impact news events and must hold trades for at least 2 minutes to avoid tick scalping violations. Additionally, accounts require at least one trade every 30 days to remain active. Notably, the Futures division eliminates activation and monthly platform fees; traders only pay for the initial evaluation.

Trading Platforms & Tools

Blue Guardian supports popular platforms like MetaTrader 4, MetaTrader 5, and cTrader for CFD trading. For the Futures division, traders gain access to institutional-grade platforms such as Tradovate, NinjaTrader, and Rithmic. The firm boasts a 4.5/5 rating on Trustpilot from over 1,400 reviews, with traders frequently praising its quick payouts and responsive customer support team.

Advantages and Disadvantages

Each trading firm has its own strengths and challenges, catering to different trading styles and preferences. Here's a closer look at what some of the top firms bring to the table, along with their potential drawbacks.

FTMO stands out with a generous 90% profit split and scaling opportunities up to $2,000,000. On the flip side, their strict risk management rules can be tough for traders who favor aggressive strategies. The Trading Pit offers access to a wide range of assets, including Forex, Stocks, ETFs, Futures, Options, and Crypto, with profit splits ranging from 80% to 85% and scaling potential up to $5 million. However, their strict "Gambling Policy" might limit traders who use high-frequency methods.

BrightFunded shines with diversity, offering over 150 instruments and 40+ crypto pairs, along with features like the "Trade2Earn" loyalty program and unlimited scaling with profit splits reaching up to 100%. Funded Trading Plus provides flexibility with various funding models, allowing EA usage and weekend positions, though they charge an additional $25 for cTrader access. FundedNext offers three funding models, a 24-hour reward guarantee, and has paid out over $237.2 million to more than 84,100 traders. However, they restrict weekend positions on certain models and enforce a 40% consistency rule for challenge accounts.

When choosing a firm, it’s crucial to consider industry success rates. Statistics reveal that only 5–10% of traders pass evaluations, and about 20% of funded traders receive payouts. This highlights the importance of aligning a firm’s rules with your trading style. Profit splits of 80% or more are highly competitive, making firms like FTMO, BrightFunded, and The Trading Pit appealing to experienced traders aiming for maximum earnings.

Another factor to weigh is withdrawal speed. FundedNext processes payouts in around 5 hours, while Funded Trading Plus offers withdrawal schedules of 3, 5, or 7 days. Risk management rules also vary widely. For instance, FundedNext’s Rapid Challenge accounts have no daily loss limits, which can benefit swing traders. Meanwhile, static drawdowns - favored by some firms - are often seen as more trader-friendly than trailing drawdowns, which adjust with account equity and can lock in losses. These differences emphasize the importance of selecting a firm that aligns with your trading approach and goals.

Conclusion

When selecting a trading firm, it's important to find one that aligns with your skills and trading style. For beginners, firms with straightforward rules - like Funded Trading Plus - might be a better fit. Experienced traders, on the other hand, may lean toward options like FTMO, which offers a generous 90% profit split and scaling up to $2 million. Multi-asset traders could explore BrightFunded or FundedNext, both of which have a solid track record of payouts.

The type of evaluation model a firm uses is another key factor. One-step challenges provide quicker access to funded accounts, while two-step models often offer more manageable profit targets. Beginners might also prefer static drawdowns, as they are less restrictive compared to trailing ones. For those focused on futures trading, firms with Chicago-based infrastructure can deliver optimal execution speeds, making them a practical choice.

Payout efficiency cannot be overlooked. Fast payouts are essential, especially for professional traders. For example, FundedNext ensures payouts within 24 hours and even compensates delays with an additional $1,000. This kind of reliability supports consistent cash flow, which is crucial for maintaining momentum in trading.

If you manage multiple accounts or use automated strategies, platform reliability becomes even more critical. QuantVPS stands out in this area, offering ultra-low latency of under 0.52ms to the CME and an impressive 99.999% uptime. This ensures uninterrupted operations, which is essential for seamless execution during all trading sessions.

Lastly, aligning the firm's rules with your trading strategy can significantly impact your success. For instance, swing traders should prioritize firms that allow holding positions over the weekend, while news traders should look for prop firms that allow news trading during major economic announcements. Choosing a firm that complements your approach can make all the difference in achieving long-term profitability.

FAQs

What should I look for when selecting a proprietary trading firm?

When selecting a proprietary trading firm, there are several factors to weigh carefully. Start by examining the profit-sharing structure, evaluation fees, and how long it typically takes to qualify for funding. Also, consider the firm’s scaling opportunities, capital limits, and the range of asset classes they support - whether that’s futures, forex, cryptocurrencies, or others.

Don’t overlook the firm’s policies on drawdowns, their withdrawal procedures, and their overall industry reputation. Additional perks, such as access to advanced trading platforms, mentorship opportunities, or educational resources, can also play a crucial role in your development as a trader. Taking these elements into account will help you choose a firm that fits your trading objectives and approach.

How do profit splits work at multi-asset proprietary trading firms?

Profit splits are the way traders at multi-asset proprietary firms earn a portion of the profits they generate using the firm's capital. After successfully completing the evaluation phase and receiving a funded account, any net profits are divided between the trader and the firm. In most cases, the split heavily favors the trader, typically ranging from 70% to 90%, with the firm taking the remaining 10% to 30%. Some firms even go further, offering top-performing traders the chance to keep up to 100% of their profits in certain scenarios.

The structure of these splits often depends on factors like account type, performance, or the amount of capital allocated. For instance, a trader might start with an 80/20 split - where they keep 80% of the profits and the firm takes 20% - and see their share increase as they demonstrate consistent performance or handle larger accounts. This setup allows traders to directly benefit from their success while the firm covers its costs for capital and risk management. This mutually beneficial model makes prop trading an attractive choice for U.S. traders looking to trade futures, forex, stocks, or crypto without putting their own money on the line.

What are the typical evaluation steps in proprietary trading firms?

Proprietary trading firms use a step-by-step evaluation process to assess potential traders. It typically kicks off with an initial challenge, often referred to as Phase 1. During this stage, traders are required to hit specific profit targets while following strict risk management guidelines.

Those who succeed advance to the verification phase, designed to test their consistency and reinforce their ability to manage risk effectively. The final stage is the funded account phase, where traders gain access to the firm's capital. Here, they trade with real funds and share in the profits they generate. This structured approach allows firms to identify talented traders while ensuring that risk management remains a top priority.

When selecting a proprietary trading firm, there are several factors to weigh carefully. Start by examining the profit-sharing structure, evaluation fees, and how long it typically takes to qualify for funding. Also, consider the firm’s scaling opportunities, capital limits, and the range of asset classes they support - whether that’s futures, forex, cryptocurrencies, or others.

Don’t overlook the firm’s policies on drawdowns, their withdrawal procedures, and their overall industry reputation. Additional perks, such as access to advanced trading platforms, mentorship opportunities, or educational resources, can also play a crucial role in your development as a trader. Taking these elements into account will help you choose a firm that fits your trading objectives and approach.

Profit splits are the way traders at multi-asset proprietary firms earn a portion of the profits they generate using the firm's capital. After successfully completing the evaluation phase and receiving a funded account, any net profits are divided between the trader and the firm. In most cases, the split heavily favors the trader, typically ranging from 70% to 90%, with the firm taking the remaining 10% to 30%. Some firms even go further, offering top-performing traders the chance to keep up to 100% of their profits in certain scenarios.

The structure of these splits often depends on factors like account type, performance, or the amount of capital allocated. For instance, a trader might start with an 80/20 split - where they keep 80% of the profits and the firm takes 20% - and see their share increase as they demonstrate consistent performance or handle larger accounts. This setup allows traders to directly benefit from their success while the firm covers its costs for capital and risk management. This mutually beneficial model makes prop trading an attractive choice for U.S. traders looking to trade futures, forex, stocks, or crypto without putting their own money on the line.

Proprietary trading firms use a step-by-step evaluation process to assess potential traders. It typically kicks off with an initial challenge, often referred to as Phase 1. During this stage, traders are required to hit specific profit targets while following strict risk management guidelines.

Those who succeed advance to the verification phase, designed to test their consistency and reinforce their ability to manage risk effectively. The final stage is the funded account phase, where traders gain access to the firm's capital. Here, they trade with real funds and share in the profits they generate. This structured approach allows firms to identify talented traders while ensuring that risk management remains a top priority.

"}}]}