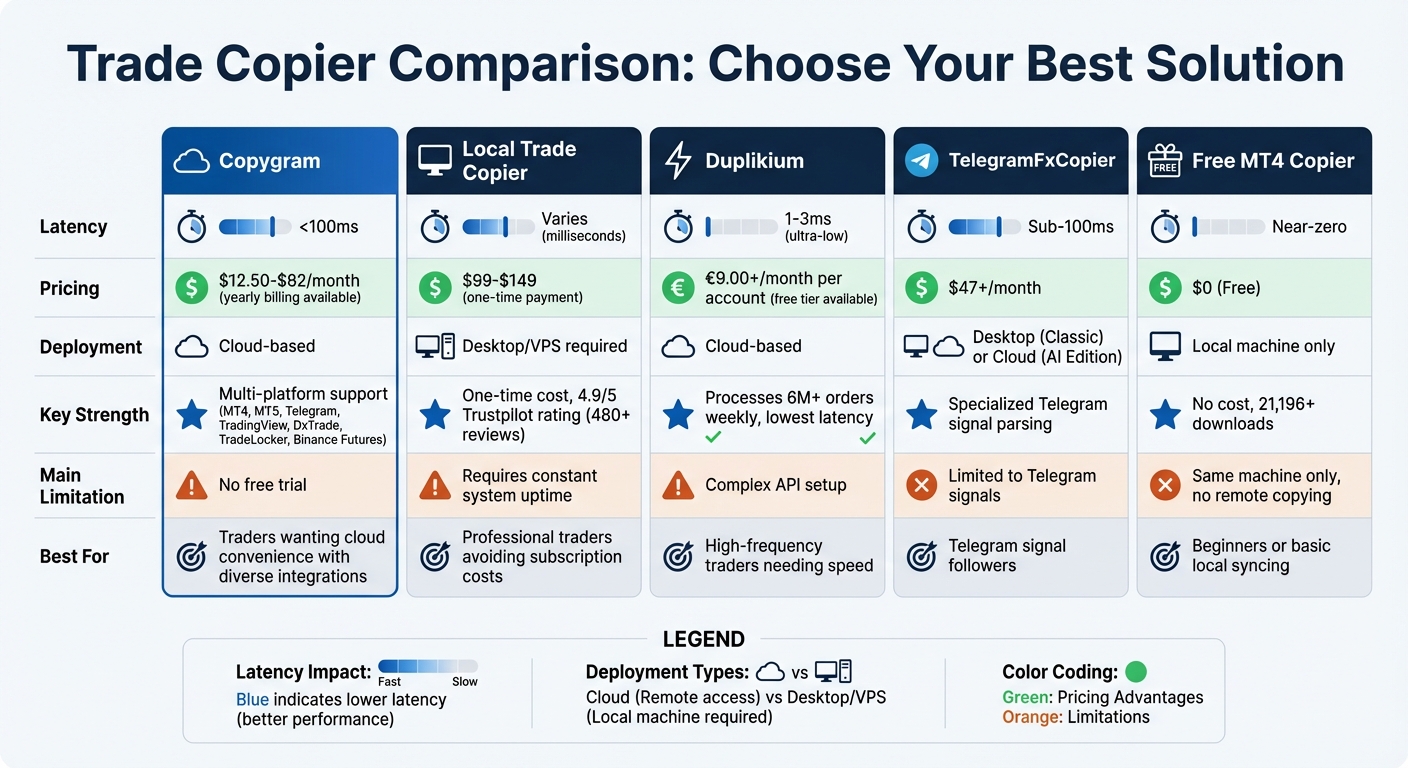

Copygram Review and Top Alternatives for MT4 / MT5

Managing multiple trading accounts on MT4/MT5 can be tricky and error-prone. Trade copier tools solve this by automating trade replication across accounts. Copygram stands out as a cloud-based solution, offering fast execution (<100ms), 24/7 operation, and support for platforms like MT4, MT5, and Telegram. It’s priced between $12.50/month (billed yearly) and $82/month, with features like risk management, symbol mapping, and cross-platform integrations.

Other options include:

- Local Trade Copier: A desktop-based tool with a one-time cost starting at $99. Requires constant system uptime.

- Duplikium: A cloud-based copier with ultra-low latency (1–3ms). Pricing starts at €9.00/month per account.

- TelegramFxCopier: Ideal for Telegram signals, offering both desktop and cloud-based versions starting at $47/month.

- Free MT4 Copier: A no-cost local solution with near-zero latency but limited to the same machine.

Each tool caters to different needs, from cloud convenience to budget-friendly local setups. For a quick comparison of features and pricing, refer to the table below.

| Trade Copier | Latency | Pricing | Key Feature | Limitation |

|---|---|---|---|---|

| Copygram | <100ms | $12.50–$82/month | Cloud-based, multi-platform | No free trial |

| Local Trade Copier | Varies (ms) | $99+ (one-time) | One-time cost | Requires constant system uptime |

| Duplikium | 1–3ms | €9.00+/month | Ultra-low latency | Complex API setup |

| TelegramFxCopier | Sub-100ms | $47+/month | Telegram signal parsing | Limited to Telegram |

| Free MT4 Copier | Near-zero | Free | No cost | Local machine only |

Choosing the right tool depends on your trading style, budget, and technical preferences.

MT4/MT5 Trade Copier Comparison: Features, Pricing and Latency

MT4/MT5 Trade Copier Comparison: Features, Pricing and Latency

Best Trade Copier for MT4, MT5, cTrader, TradingView, DXTrade & more! | Duplikium Trade Copier

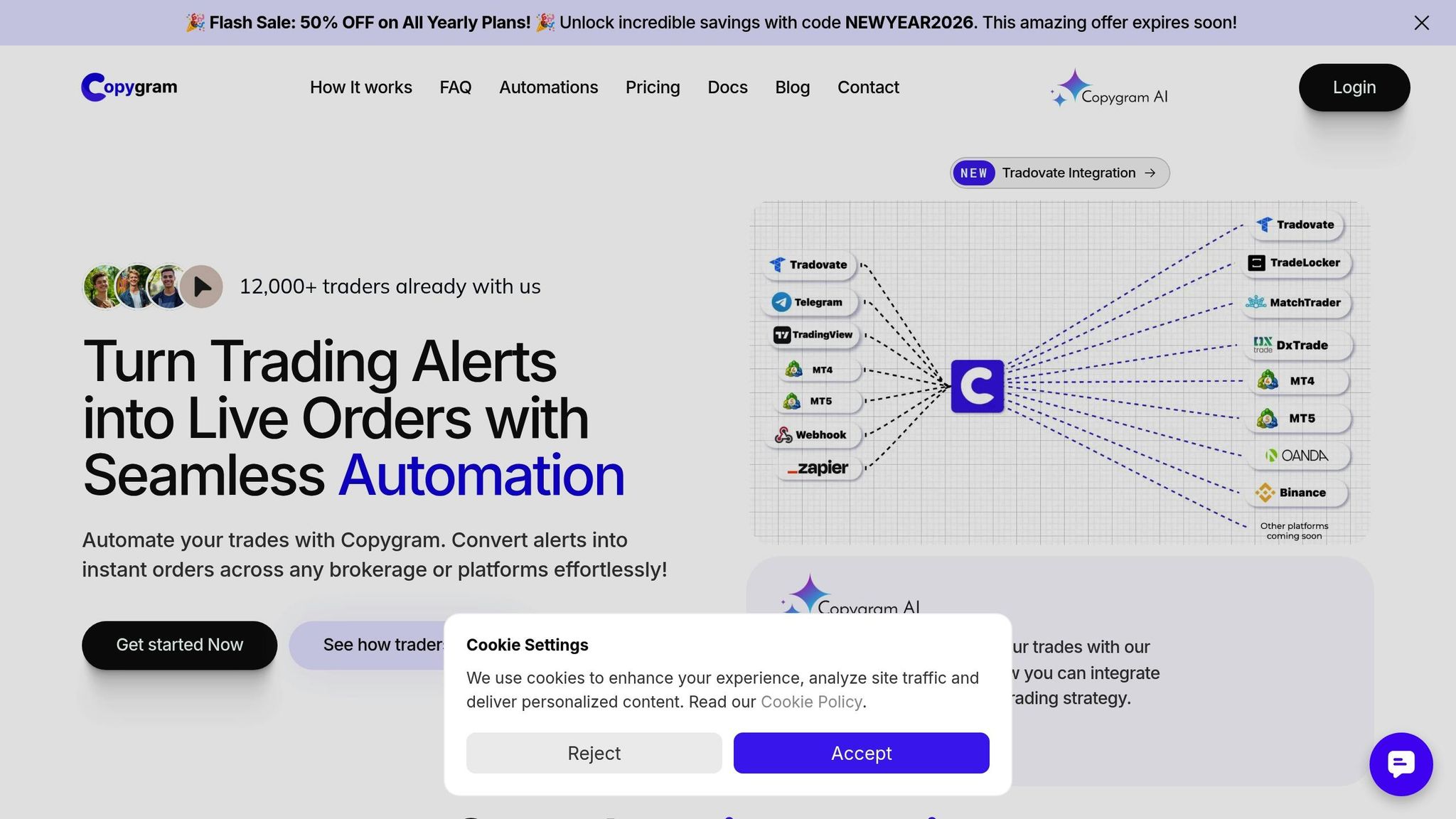

1. Copygram

Copygram operates entirely in the cloud, eliminating the hassle of keeping a computer or VPS running around the clock. The platform uses a custom-built Expert Advisor (EA) to link your MT4 or MT5 terminal directly to Copygram's servers. The setup is straightforward and typically takes less than 10 minutes. All you need to do is provide your broker details (server, login, and password) and install the EA on your MetaTrader terminal.

Latency

Copygram offers lightning-fast trade copying with an average latency of under 100ms. This is significantly faster than most local solutions, which usually range between 500ms and 3 seconds. The platform achieves this speed through its globally distributed servers and automatic failover systems, ensuring 99.99% uptime. If you're managing multiple accounts, this speed reduces slippage and missed entries, making a noticeable difference in performance.

Risk Management Features

Copygram comes equipped with a variety of risk management tools to suit different trading styles. You can:

- Set fixed lot sizes for consistent exposure.

- Use risk-per-trade percentages that adjust automatically based on account equity.

- Apply lot multipliers to scale positions.

For prop firm traders, there's a maximum drawdown cap that automatically closes trades if losses reach a specified threshold, helping you stay compliant with challenge rules. Additionally, you can modify or override Stop Loss and Take Profit levels on follower accounts - or choose not to copy them at all. The auto symbol-mapping feature ensures smooth execution by automatically handling broker-specific symbol variations, like converting "EURUSD" to "EURUSD.m" when needed.

Integration Options

Copygram supports more than just MT4 and MT5. It integrates with platforms like Telegram, TradingView, DxTrade, TradeLocker, MatchTrader, Oanda, Binance Futures, and Tradovate as either senders or receivers. This makes it a versatile choice for traders copying signals from Telegram channels or managing accounts across different platforms. The "Rooms" feature allows you to organize trading environments efficiently. For instance, you can set up one room to copy Telegram signals to multiple MT4 accounts and another to mirror trades between MT5 accounts at different brokers. To enhance performance when connecting MetaTrader accounts, using a VPS like AWS Lightsail is recommended.

Pricing

Copygram offers three pricing tiers:

- Basic Plan: $25/month (or $12.50/month if billed yearly). Includes 2 trading accounts (1 sender, 1 receiver) with unlimited orders.

- Pro Plan: $40/month (or $20/month yearly). Adds AI Trade Validation and support for Telegram and TradingView as senders.

- Premium Plan: $82/month (or $41/month yearly). Covers 5 trading accounts (1 sender and up to 4 receivers per room) and offers unlimited rooms.

As of January 2026, you can save 50% on all yearly plans with the promo code NEWYEAR2026.

Next, we'll dive into other trade copier options to see how they stack up in terms of features and pricing.

2. Local Trade Copier

Local Trade Copier takes a hands-on approach compared to cloud-based alternatives. Instead of relying on remote servers, it operates directly on your Windows PC or VPS, which means your system needs to stay up and running continuously. This software is compatible with any broker offering MT4 or MT5 platforms and is a favorite among US-based traders because it adheres to the first-in-first-out (FIFO) rules required by American brokers.

Latency

Local Trade Copier is designed to replicate trades in under 1 second during normal market conditions. By comparison, other trade copiers typically have latencies ranging from 500 milliseconds to 3 seconds. The speed of trade copying depends on factors like your internet connection and hardware setup. To optimize performance, you can adjust the synchronization rate, particularly when using pending orders, to reduce CPU usage. For the best results, running the software on one of the best forex VPS providers is highly recommended.

Risk Management Features

This platform offers eight distinct modes for managing risk. One standout feature is the "Risk Per Trade (%)" mode, which calculates lot sizes so that a stop loss would only cost a set percentage of your account balance. For traders working with top forex prop firms, the "Max Daily Loss (MDL)" feature is a game-changer - it halts all trading and copying once your daily drawdown hits a pre-set limit. Other tools include the "Equity Stop" feature, which closes all positions if your account equity falls below a specified level, and the "Moving Average on Account Balance (MAAB)" filter, which pauses trade copying when the master account's equity drops below its moving average. These features are designed to help you weather losing streaks and protect your account.

Integration Options

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Local Trade Copier works exclusively with MT4 and MT5 platforms and supports all types of accounts, including demo, real, ECN, STP, and FIFO accounts. It allows for flexible trade copying setups, such as one-to-many, many-to-one, or reverse trading, all on the same computer. The software supports a wide range of asset classes, including Forex, CFDs, commodities, cryptocurrencies, indexes, and stocks. If your master and client accounts have differing symbol names (e.g., GOLD versus XAUUSD), the custom symbol mapping feature ensures trades are executed correctly. These features make it a versatile solution for traders with complex setups.

Pricing

Local Trade Copier provides a 7-day free trial, giving you the chance to explore all its features before committing. The MT4 version is currently available for $50 (discounted from $100), and the MT5 version is priced the same at $50 (also discounted from $100). If you need to copy trades between MT4 and MT5 platforms, you’ll need to purchase both versions separately. A free demo version is also available, but it’s limited to 4-hour sessions on demo accounts.

3. Duplikium

Duplikium is a cloud-based trade copier that eliminates the need for local VPS setups or software installations. Operating entirely on Duplikium's servers - strategically located in financial hubs like Frankfurt, London, New York, and Singapore - it ensures that traders can avoid the hassle of keeping their computers running non-stop. This makes it an attractive option for those looking for a more hands-off copy trading solution. Let’s take a closer look at its speed, risk management tools, integration capabilities, and pricing.

Latency

Duplikium boasts internal latency between 1-3 milliseconds, staying below 10 milliseconds even in highly volatile markets. Such low latency can provide a competitive edge, letting you act on trades faster than traders using slower systems. This often results in better fill prices and minimizes slippage. To give you an idea of its scale, Duplikium processes over 6 million orders weekly across more than 25,000 connected accounts. For best results, it’s recommended to select the server nearest to your broker - whether that’s in Frankfurt, London, New York, or Singapore.

"The performance improvement was immediate - executions that previously took a second or more now happen almost instantly." - Sarah K., Institutional Trader

"The performance improvement was immediate - executions that previously took a second or more now happen almost instantly." - Sarah K., Institutional Trader

Risk Management Features

Duplikium includes advanced risk management tools, such as dynamic position sizing. This feature automatically adjusts lot sizes based on account balance, ensuring your risk percentage remains consistent even as your equity changes. Another standout feature is reverse trading, which allows you to take the opposite side of a signal provider’s trades - ideal for hedging or leveraging a losing strategy. Additionally, you can fine-tune signals by customizing risk parameters for individual trades. To ensure reliability, the platform is built with redundant systems, minimizing the chances of missed trades during periods of high market volatility.

Integration Options

Duplikium seamlessly integrates with a wide range of platforms, including MT4, MT5, cTrader, DXTrade, TradingView, FXCM, LMAX, and NinjaTrader. This versatility allows you to mirror trades across platforms - for instance, from MT4 to cTrader or MT5 to LMAX - without technical headaches. With connections to over 5,000 broker servers globally, Duplikium also offers a Trade Copier API, making it an excellent choice for businesses building white-label copy trading solutions. This flexibility caters to both individual traders and institutions managing multiple accounts.

Pricing

Duplikium provides a free trial, including €30 in credit, so users can explore its full features before making a commitment. Subscription plans start at €9.00 per account per month, with discounts for volume users, dropping to €6.00 per month for those managing 1,000 or more accounts. For those who prefer flexibility, the prepay plan operates on a pay-as-you-go structure, starting at €0.50 per account per day and decreasing to €0.20 for high-volume users. Optional add-ons include static shared IPs for €2/month and dedicated IPs for €5/month.

4. TelegramFxCopier

TelegramFxCopier is a tool designed to transfer Telegram trading signals directly to your MT4/MT5 platforms. It comes in two versions: the Classic Edition, a desktop-based software that executes trades in milliseconds, and the AI Edition, a cloud-based solution powered by MetaAPI for even faster performance. Unlike the Classic Edition, the AI Edition doesn’t require a VPS, allowing you to manage trades conveniently from your phone, tablet, or computer. Both versions are compatible with all Telegram formats.

Latency

Speed is a defining feature of TelegramFxCopier. The Classic Edition ensures signals are processed in milliseconds, reducing the risk of slippage by executing trades immediately upon signal arrival - whether at market price or pre-set entry points for pending orders. The AI Edition leverages cloud computing and advanced algorithms to achieve even lower latency. To put this into perspective, while most trade copiers experience latencies between 500 milliseconds and 3 seconds, TelegramFxCopier operates within mere milliseconds.

Risk Management Features

TelegramFxCopier provides a comprehensive suite of risk management tools. These include trailing stops, custom breakeven settings, and flexible lot-sizing options across multiple take-profit levels. For instance, the system can automatically adjust your stop loss to breakeven once the first take-profit level is hit, then continue trailing it as additional targets are reached. Traders can select fixed lot sizes or use percentage-based risk settings, with the ability to customize lot sizes for specific symbols or exclude certain currency pairs altogether. The AI Edition goes a step further by analyzing signal quality to recommend optimal take-profit and stop-loss levels, while cloud-based monitoring offers real-time risk alerts.

Integration Options

Both the Classic and AI Editions integrate seamlessly with MT4 and MT5 platforms. The Classic Edition uses an Expert Advisor that operates on your desktop or VPS, while the AI Edition connects via MetaAPI for cloud-based execution. Detailed video guides and live chat support (available five days a week) make setup straightforward. The software supports trading in Forex, indexes, and commodities. Additionally, the AI Edition’s mobile compatibility allows for flexible trade management without the need to keep a computer running 24/7. These integration options enhance usability and ensure efficient trade execution.

Pricing

TelegramFxCopier offers both subscription plans and lifetime licenses. All plans include unlimited access to Telegram channels, trading signals, and advanced risk management features. For traders using proprietary firm accounts, a Platinum support tier is available to optimize your settings, with live chat assistance provided five days a week. Whether you’re a casual trader or someone who heavily relies on Telegram signals, TelegramFxCopier provides a versatile solution tailored to your needs.

Next, we review Free MT4 Copier.

5. Free MT4 Copier

If you're looking to duplicate trades across multiple accounts without spending a dime, free solutions like Copiix are worth considering. Copiix, for instance, has been downloaded over 21,196 times and processes more than 6 million orders every week. However, there’s a key limitation: all trading terminals must operate on the same computer or VPS. These local copiers don’t support remote copying across different physical locations. Let’s dive into its performance, risk tools, integration, and cost.

Latency

One of the standout benefits of local operation is speed. Latency is kept under 1 millisecond, which means no delays caused by routing signals through external cloud servers. For traders where every pip matters, this speed can minimize slippage and ensure follower accounts execute trades at the same price as the master account.

Risk Management Features

Free MT4 copiers come with basic risk management tools. These typically include lot size multipliers, fixed lot sizing, and the ability to replicate stop-loss and take-profit levels from the master account. While these features cover the essentials, advanced tools like daily drawdown limits, news protection filters, and equity-based auto-scaling are generally found in paid options. For simple trade duplication, the free tools are usually enough.

Integration Options

Most free MT4 copiers are versatile, supporting cross-platform copying between MT4 and MT5. Some, like Copiix, even work with cTrader. They’re compatible with various brokers and can handle unlimited trading accounts simultaneously. Many also include symbol mapping features, which automatically adjust for broker-specific naming differences, preventing missed trades. To get started, enable "Allow algorithmic trading" in MetaTrader by navigating to Tools > Options > Expert Advisors. Keep in mind, a Forex VPS solutions is crucial for uninterrupted operation, as home computers are susceptible to power outages and internet disruptions.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Pricing

The best part? It’s completely free - $0. For traders who are new to trade copying or need basic local syncing, these options provide reliable functionality without any financial commitment.

"At ClickAlgo, we tested the Free version of Copiix and found it one of the easiest trade copiers available. It's perfect if you're managing multiple accounts or want to share trades".

"At ClickAlgo, we tested the Free version of Copiix and found it one of the easiest trade copiers available. It's perfect if you're managing multiple accounts or want to share trades".

Pros and Cons

Here's a breakdown of the strengths and limitations of each trade copier, making it easier to compare their features and decide which one suits your needs:

Copygram operates entirely in the cloud, so no VPS is needed. It boasts latency under 100ms and supports integrations with MT4/MT5, Telegram, TradingView, DxTrade, TradeLocker, and Binance Futures. However, it doesn’t offer a free trial, and its monthly subscription costs range from $25 to $82.

Local Trade Copier is available as a one-time purchase starting at $99, which can save money in the long term. It’s highly rated, with a 4.9/5 score on Trustpilot based on over 480 reviews. On the downside, it requires your system to remain operational at all times.

Duplikium delivers top-tier performance with 1–3ms latency and processes more than 6 million orders weekly. It also provides a free tier for basic users. However, its API setup can be intimidating for less experienced traders.

TelegramFxCopier is tailored for parsing Telegram signals with latency under 100ms. Its pricing starts at $47 per month. The limitation? It’s primarily useful only if you rely on Telegram for trading signals.

Free MT4 Copier options, like Copiix, offer local copying with near-zero latency at no cost. The catch is that they only function on the same machine, lacking any remote copying capabilities.

To summarize, here’s a quick comparison of key features and limitations:

| Trade Copier | Latency | Pricing | Key Strength | Main Limitation |

|---|---|---|---|---|

| Copygram | <100ms | $25–$82/month | Cloud-based; diverse integrations | No free trial |

| Local Trade Copier | Varies (ms) | $99–$149 one-time | One-time cost; 4.9/5 Trustpilot | Requires constant system uptime |

| Duplikium | 1–3ms | Free – $21.85+/month | Ultra-low latency; free tier | API setup complexity |

| TelegramFxCopier | Sub-100ms | $47+/month | Telegram signal parsing | Limited to Telegram |

| Free MT4 Copier | Near-zero | $0 | Completely free | Local machine only |

Each tool has its own strengths and weaknesses, so the best choice depends on your specific trading needs and technical preferences.

Conclusion

Finding the right trade copier comes down to balancing your experience, budget, and trading style. If you're just starting out, Free MT4 Copier is a solid choice - it’s free and doesn’t impose account or trade limits. Prefer to skip the hassle of technical setups and VPS management? Cloud-based options like Copygram or Duplikium are worth considering. Copygram, trusted by over 12,000 users, offers an easy-to-use dashboard, while Duplikium includes a free tier capable of handling up to 20 orders daily. For those with more demanding needs, advanced tools provide extra functionality.

Experienced traders and those managing multiple accounts often require more powerful solutions. Local Trade Copier is a standout option, boasting a 4.9/5 Trustpilot rating from more than 480 reviews. Its one-time pricing starts at $99, making it an appealing choice for professionals looking to avoid ongoing subscription costs. Additionally, traders working with prop firms or needing cross-platform compatibility can benefit from Copygram’s support for platforms like DxTrade and TradeLocker, along with features designed specifically for passing a prop firm challenge.

For traders focused on replicating signals, some tools excel in this area. For example, TelegramFxCopier is ideal for those using Telegram channels, offering lightning-fast execution under 100ms and the ability to handle both text and image-based signals.

If keeping costs low is a priority, free local copying tools like Free MT4 Copier (e.g., Copiix) are great options. On the other hand, if you’re ready to invest, Duplikium processes over 6 million orders weekly with latency as low as 1–3ms , a critical factor in low latency forex trading. Meanwhile, Copygram’s plans, ranging from $25 to $82 per month, cater to different account needs. The key is to align each tool’s features with your specific trading goals.

FAQs

What’s the difference between cloud-based and local trade copiers?

Cloud-based trade copiers function on remote servers managed by the provider. They offer round-the-clock availability, automatic updates, and impressively low latency - often under 100 milliseconds. Since these systems don’t rely on a personal computer or VPS to stay operational, they’re dependable and can be easily scaled across multiple trading accounts.

In contrast, local trade copiers run on your own hardware, such as a home computer or a rented VPS. Their performance hinges on factors like your internet connection, power stability, and the overall health of your system. Any downtime or maintenance issues can disrupt trade copying, and you’ll need to handle updates, monitoring, and hardware expenses yourself.

For traders seeking reliability, minimal effort in maintenance, and easy scalability, cloud-based options are a solid choice. However, for those who prefer hands-on control and are comfortable managing the technical aspects, local copiers might be a better fit.

How does Copygram manage risk across multiple MT4/MT5 trading accounts?

Copygram offers versatile tools to help protect your trading capital across multiple accounts. For each linked MT4/MT5 account, you can adjust settings like fixed lot sizes, lot multipliers, or percentage-of-balance sizing to match your trading preferences. On top of that, you can establish equity protection limits and set dynamic stop-loss and take-profit levels for improved risk control. These options make it easy to align risk management with the specific strategies and objectives of each account.

What is the best trade copier for traders on a budget?

For traders keeping an eye on their budget, the Duplikium cloud-based copier stands out as a cost-effective choice. It offers a free tier with basic features, and its paid plan starts at just $22 per month - a fraction of the cost of many other cloud-based copiers, which typically range between $50 and $100 per month.

For those seeking a completely free option, the FX Blue local copier is worth considering. It allows for trade copying at no charge but does require all trading terminals to operate on the same machine. While both tools have their merits, Duplikium’s mix of a free tier and an affordable paid plan makes it an excellent pick for traders aiming to get the most value without breaking the bank.

Cloud-based trade copiers function on remote servers managed by the provider. They offer round-the-clock availability, automatic updates, and impressively low latency - often under 100 milliseconds. Since these systems don’t rely on a personal computer or VPS to stay operational, they’re dependable and can be easily scaled across multiple trading accounts.

In contrast, local trade copiers run on your own hardware, such as a home computer or a rented VPS. Their performance hinges on factors like your internet connection, power stability, and the overall health of your system. Any downtime or maintenance issues can disrupt trade copying, and you’ll need to handle updates, monitoring, and hardware expenses yourself.

For traders seeking reliability, minimal effort in maintenance, and easy scalability, cloud-based options are a solid choice. However, for those who prefer hands-on control and are comfortable managing the technical aspects, local copiers might be a better fit.

Copygram offers versatile tools to help protect your trading capital across multiple accounts. For each linked MT4/MT5 account, you can adjust settings like fixed lot sizes, lot multipliers, or percentage-of-balance sizing to match your trading preferences. On top of that, you can establish equity protection limits and set dynamic stop-loss and take-profit levels for improved risk control. These options make it easy to align risk management with the specific strategies and objectives of each account.

For traders keeping an eye on their budget, the Duplikium cloud-based copier stands out as a cost-effective choice. It offers a free tier with basic features, and its paid plan starts at just $22 per month - a fraction of the cost of many other cloud-based copiers, which typically range between $50 and $100 per month.

For those seeking a completely free option, the FX Blue local copier is worth considering. It allows for trade copying at no charge but does require all trading terminals to operate on the same machine. While both tools have their merits, Duplikium’s mix of a free tier and an affordable paid plan makes it an excellent pick for traders aiming to get the most value without breaking the bank.

"}}]}