Best VPS for NinjaTrader 8 (2026): Ultra-Low Latency Hosting for Rithmic & Tradovate Connectivity

If you're a futures or forex trader using NinjaTrader 8, a low-latency VPS near the CME Group in Aurora, IL, is essential for fast, reliable trade execution, especially when running automated strategies. Here's why:

- Why Use a VPS? Home internet connections introduce delays due to distance, ISP routing, or outages. A Chicago-based VPS reduces latency to as low as 0.52ms, ensuring faster order fills and less slippage.

- Who Benefits? Traders using Rithmic or Tradovate data feeds, especially during high-volatility events like Non-Farm Payroll reports.

- What to Look For? High-performance processors (e.g., AMD Ryzen 9), NVMe SSDs, and direct connections to CME exchanges.

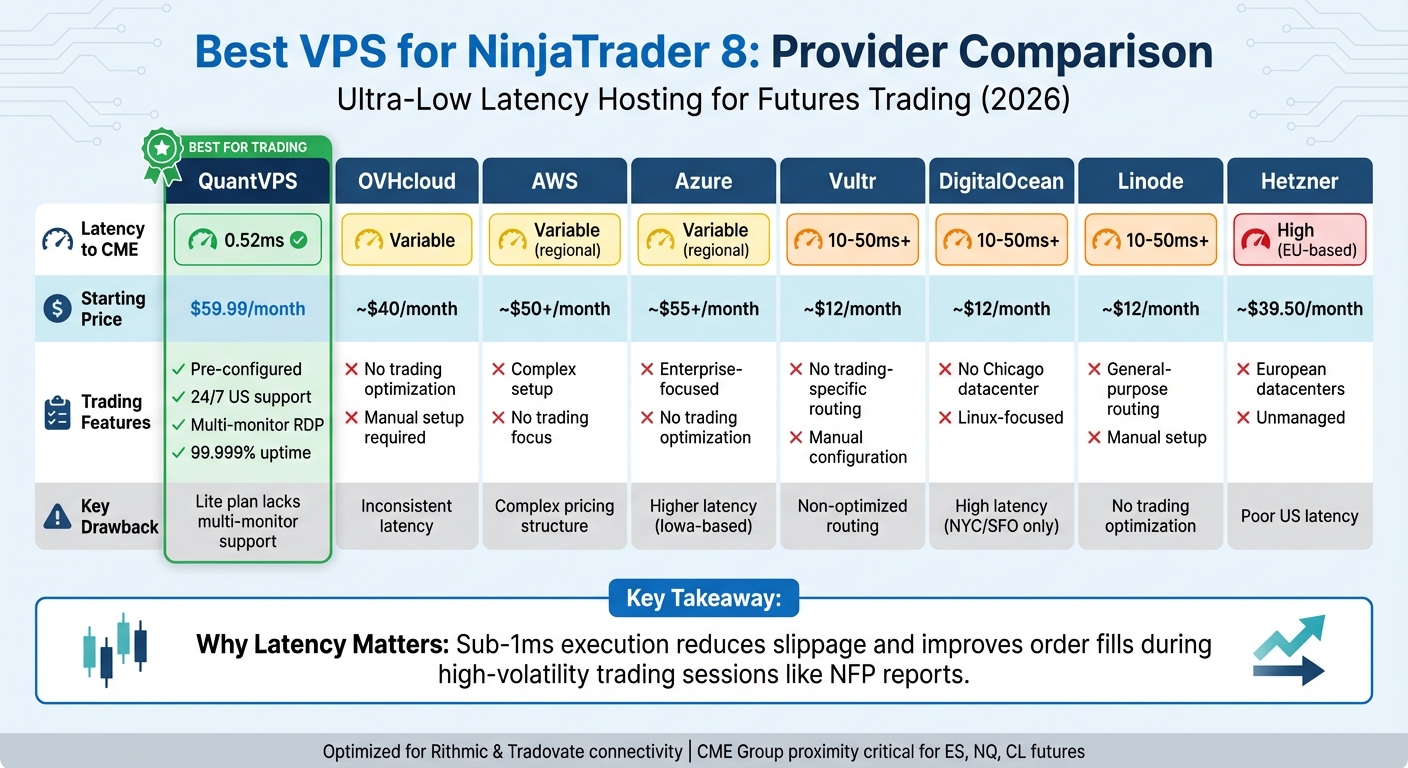

Options at a Glance:

- QuantVPS: Best for sub-0.52ms latency, pre-configured for trading, and 24/7 US-based support. Pricing starts at $59.99/month.

- OVHcloud: Budget-friendly but inconsistent latency and no trading-specific features.

- AWS & Azure: Enterprise-grade but complex setup and higher latency.

- Vultr, DigitalOcean, Linode, Hetzner: Affordable but lack optimized routing and trading features.

Quick Comparison

| Provider | Latency to CME | Pre-Configured for Trading | Starting Price | Key Drawback |

|---|---|---|---|---|

| QuantVPS | 0.52ms | Yes | $59.99/month | Lite plan lacks multi-monitor support |

| OVHcloud | Variable | No | ~$40/month | Inconsistent latency |

| AWS | Variable | No | ~$50+/month | Complex pricing |

| Azure | Variable | No | ~$55+/month | Higher latency |

| Vultr | 10–50ms+ | No | ~$12/month | Non-optimized routing |

| DigitalOcean | 10–50ms+ | No | ~$12/month | High latency |

| Linode | 10–50ms+ | No | ~$12/month | Manual setup required |

| Hetzner | High (EU-based) | No | ~$39.50/month | Poor US latency |

For the best performance, QuantVPS offers unmatched speed, reliability, and trading-specific features designed for serious traders.

VPS Provider Comparison for NinjaTrader 8: Latency, Features & Pricing

VPS Provider Comparison for NinjaTrader 8: Latency, Features & Pricing

1. QuantVPS

Latency to CME/Rithmic/Tradovate

QuantVPS delivers lightning-fast sub-0.52ms latency to the CME Group's matching engines in Chicago, USA. This ultra-low latency also extends to Rithmic and Tradovate data feeds, maintaining consistent microsecond-level performance. By using direct fiber-optic cross-connects to the CME exchange, QuantVPS eliminates unnecessary network hops, ensuring your data travels the shortest and fastest route possible.

For traders using NinjaTrader 8 - whether running automated strategies or scalping in fast-moving markets - this speed can make a tangible difference. Faster order execution means better fills and reduced slippage, especially during volatile trading sessions. The physical proximity to Chicago's financial infrastructure ensures trades are processed more quickly compared to standard internet routing. This performance is further supported by high-end hardware designed specifically for trading.

Server Specifications (CPU, RAM, Storage)

QuantVPS relies on cutting-edge AMD EPYC and Ryzen processors, tailored for high-frequency trading environments. The servers are equipped with high-speed DDR4 and DDR5 RAM and feature NVMe M.2 SSDs that deliver blazing-fast storage speeds of up to 3.5 GB/s. Network connectivity includes a 1Gbps+ connection with 10Gbps burst capability, ensuring smooth performance even during market surges.

All servers run on Windows Server 2022, pre-configured and fine-tuned for trading. QuantVPS simplifies server selection with a configurator that asks just five questions to determine the ideal CPU, RAM, and storage setup for your needs. Plans range from the VPS Lite option (4 cores, 8GB RAM, 70GB NVMe at $59.99/month or $41.99/month annually) to the Dedicated+ Server (16+ cores, 128GB RAM, 2TB+ NVMe at $399.99/month or $279.99/month annually). These setups ensure you optimize NinjaTrader 8 on your VPS for peak performance.

Pricing (Monthly/Annual)

QuantVPS offers a range of pricing plans to suit different trading needs, all backed by robust hardware. For example, the VPS Pro plan ($99.99/month or $69.99/month annually) supports 3–5 charts, featuring 6 cores, 16GB RAM, and compatibility with up to two monitors. The VPS Ultra plan ($189.99/month or $132.99/month annually) is designed for more demanding setups, handling 5–7 charts with 24 cores and 64GB RAM. Opting for annual billing provides a 30% discount on all plans, with payments securely processed through Stripe.

Trading-Focused Features

QuantVPS goes beyond hardware to enhance the overall trading experience. Key features include multi-monitor RDP support, allowing traders to maintain professional workspace layouts when accessing the VPS remotely. Automated backups protect your workspaces, indicators, and templates, ensuring your setup is always secure. With a 99.999% uptime guarantee, your strategies can run uninterrupted - even if your home PC is offline.

"Latency and slippage can turn a winning NinjaTrader strategy into a losing one. Our rapid execution NinjaTrader VPS, with <0.52ms latency to CME, minimizes slippage, ensuring your orders are filled closer to your intended price."

- QuantVPS

"Latency and slippage can turn a winning NinjaTrader strategy into a losing one. Our rapid execution NinjaTrader VPS, with <0.52ms latency to CME, minimizes slippage, ensuring your orders are filled closer to your intended price."

- QuantVPS

QuantVPS supports major futures data feeds like Rithmic, CQG, dxFeed, TT, and IQFeed. It’s also optimized for futures prop firms such as Apex, Bulenox, and TakeProfit Trader, meeting their stringent security and latency standards. To top it off, 24/7 US-based technical support via live chat and tickets ensures you get help with setup and troubleshooting whenever you need it. With an "Excellent" rating on Trustpilot, QuantVPS is a trusted choice for traders.

2. OVHcloud

Latency to CME/Rithmic/Tradovate

OVHcloud operates several data centers across the U.S., and opting for a server based in Chicago could help lower latency to CME's matching engines. However, due to standard routing practices, the latency to Rithmic and Tradovate feeds can be inconsistent. This variability might impact order fills and execution reliability, especially in fast-paced markets like ES or NQ. Let’s take a closer look at how OVHcloud’s hardware options meet the demands of trading environments.

Server Specifications (CPU, RAM, Storage)

OVHcloud provides a wide selection of VPS and dedicated server options with customizable CPU, RAM, and storage configurations. For traders using NinjaTrader 8, you will need to set up NinjaTrader on a VPS using a Windows Server environment, as OVHcloud does not offer pre-configured servers tailored for trading. NinjaTrader 8 relies heavily on strong single-core CPU performance to manage complex indicators and automated strategies without freezing or lagging. This means the server setup must be carefully optimized, which may require a solid understanding of technical configurations. While OVHcloud allows scaling of resources, getting the most out of its servers for trading workloads demands some expertise.

Pricing (Monthly/Annual)

OVHcloud's pricing varies depending on the server configuration, making it essential to balance cost and the performance needed for NinjaTrader 8, especially when connecting to Rithmic or Tradovate. While generally budget-friendly for standard uses, the pricing structure isn't specifically designed with futures trading in mind, which might require additional considerations.

Trading-Focused Features

Unlike platforms tailored for traders, OVHcloud does not offer features specifically designed for trading, such as pre-configured environments, automated backups, or support for multi-monitor setups over RDP. Its technical support is geared toward general IT issues, rather than the specific needs of optimizing NinjaTrader 8. While OVHcloud provides flexible cloud solutions, the manual setup required makes it less convenient compared to more trading-focused providers.

3. Amazon Web Services (AWS)

Latency to CME/Rithmic/Tradovate

For traders prioritizing ultra-low latency, even the smallest delay can make a difference. AWS operates data centers across several U.S. regions, but it doesn't offer infrastructure designed specifically for trading. While you can choose regions closer to Chicago, AWS relies on standard internet routing rather than specialized connections to exchanges. As a result, latency to CME, Rithmic, and Tradovate feeds tends to be higher and less consistent compared to trading-optimized setups that can achieve sub-1ms connectivity. For traders running automated strategies or scalping ES and NQ contracts, this added latency can affect order fills during fast-moving markets.

AWS does provide Cluster Placement Groups to minimize latency between instances within its network. However, this optimization only applies to communication between AWS instances, not external connections to trading feeds or exchanges. This limitation highlights the difference between AWS and trading-specific VPS solutions.

Server Specifications (CPU, RAM, Storage)

AWS offers high-performance computing options like C5 and C6 instances, which are built for general enterprise use. These instances, however, may not meet the single-core performance requirements of NinjaTrader 8. To handle complex indicators, multiple charts, or automated NinjaScript strategies effectively, processors with clock speeds ranging from 4.3GHz to 5.7GHz are recommended.

Setting up NinjaTrader 8 on AWS requires manual installation and optimization. This process demands technical expertise to configure the instance for trading workloads, including network setup, security adjustments, and performance tuning.

Pricing (Monthly/Annual)

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

AWS's pay-as-you-go pricing model can become expensive for high-frequency trading, especially if you're streaming real-time market data from Rithmic or Tradovate feeds. Unlike flat-rate VPS pricing, AWS charges separately for components like bandwidth, storage, and computing power. This makes cost tracking essential to avoid unexpected expenses.

Trading-Focused Features

AWS lacks pre-configured setups specifically tailored for trading and does not offer dedicated trading support. While its Amazon Time Sync Service provides sub-100 microsecond accuracy, this level of precision is more applicable to institutional high-frequency trading than to most retail futures traders. Overall, while AWS delivers robust enterprise solutions, it doesn't align with the specific demands of futures trading like platforms designed exclusively for that purpose.

4. Microsoft Azure

Latency to CME/Rithmic/Tradovate

Microsoft Azure, while a reliable enterprise cloud platform, isn’t specifically designed with trading in mind. Its latency to the CME Group is generally higher than that of trading-focused infrastructure. This is largely due to the location of its primary US Central region in Iowa, which is significantly farther from Aurora, Illinois - the hub for CME’s trading infrastructure. The increased distance introduces additional network hops, leading to higher round-trip times when connecting to Rithmic or Tradovate data feeds.

Although Azure offers features like Accelerated Networking and Proximity Placement Groups to improve internal communication, these tools don’t address the fundamental issue of physical distance. This limitation makes Azure less suitable for traders who prioritize ultra-low latency, especially compared to VPS solutions specifically built for trading.

Server Specifications (CPU, RAM, Storage)

Azure’s hardware options include D-Series (General Purpose) and E-Series (Memory Optimized) virtual machines, which provide balanced CPU-to-memory ratios. These configurations are adequate for running software like NinjaTrader 8. However, the standard processors used in Azure instances lack the high clock speeds - typically between 4.3 GHz and 5.7 GHz - that NinjaTrader 8 thrives on. High-clock-speed CPUs are critical for managing complex indicators, multiple charts, or automated trading strategies.

For storage, Azure offers Premium SSDs priced at around $0.12 per GB per month. These SSDs help reduce performance bottlenecks related to local databases and log files, ensuring smoother operation.

Pricing (Monthly/Annual)

Azure’s pricing is flexible, with options like Pay-As-You-Go, Reserved Instances, and Spot VMs [14, 17]. For example, a D2 v3 instance (2 vCPU, 8 GB RAM) costs approximately $154.03 per month on a Pay-As-You-Go plan. Opting for a 3-year reservation reduces the cost to about $100.08 per month. Traders should also factor in additional charges, such as $0.087 per GB for outbound data transfer, as well as costs for managed disk storage and public IP addresses.

Trading-Focused Features

Azure doesn’t offer preconfigured setups or dedicated support for trading platforms like NinjaTrader 8. While its enterprise-grade reliability and global infrastructure are impressive, the platform is primarily designed for general cloud computing rather than the specific demands of futures trading. For traders relying on sub-millisecond execution, Azure’s general-purpose design presents challenges. Achieving low-latency trading performance on Azure requires significant technical optimization, and the platform’s geographic distance from Chicago’s exchange infrastructure remains a critical limitation.

5. Vultr

Latency to CME/Rithmic/Tradovate

Vultr operates datacenters in key U.S. regions, including Chicago, but its servers don’t offer direct fiber-optic cross-connects to CME Group's matching engines. This lack of direct connectivity leads to additional network hops, which can increase both latency and variability when accessing Rithmic or Tradovate feeds.

While having a datacenter in Chicago might seem like an advantage, physical proximity alone doesn’t guarantee low-latency execution. Without routing specifically optimized for exchange connectivity, these datacenters are more suited for general-purpose hosting than for trading. For traders relying on automated strategies or needing fast, consistent execution, this variability can affect order fills and lead to increased slippage. These connectivity limitations highlight the gap between Vultr’s infrastructure and trading-optimized systems.

Server Specifications (CPU, RAM, Storage)

When it comes to hardware, Vultr’s High Frequency compute instances can handle NinjaTrader 8 reasonably well. These instances are equipped with CPUs running at around 3 GHz and NVMe storage, which are both useful for processing real-time market data. Since NinjaTrader 8 relies heavily on single-core performance for tasks like running indicators, order flow trading software, and automated strategies, the CPU clock speed becomes a key factor.

For basic setups, a High Frequency instance with 2 vCPUs and 4 GB of RAM is sufficient. However, for more complex configurations, upgrading to 4 vCPUs and 8 GB of RAM provides better performance. Despite these solid hardware options, the latency issues caused by non-optimized network paths remain a significant drawback.

Pricing (Monthly/Annual)

Vultr offers a flexible pay-as-you-go pricing model, with hourly and monthly billing options. This flexibility means no long-term commitments. High Frequency instances start at about $6.00 per month for 1 vCPU and 1 GB of RAM, though this entry-level option is too limited for serious trading. A more practical setup with 2 vCPUs and 4 GB of RAM costs roughly $12.00 per month, while 4 vCPUs and 8 GB of RAM are priced around $24.00 per month.

While the pricing is fair for general cloud infrastructure, it doesn’t include the exchange-adjacent connectivity or trading-specific optimizations that many traders require.

Trading-Focused Features

Vultr falls short when it comes to trading-specific features. It doesn’t offer preconfigured Windows environments, dedicated trading support, or broker-optimized routing. Users need to manually install and configure NinjaTrader 8, which can be both time-consuming and prone to errors.

Although Vultr’s developer-friendly interface is great for general VPS deployments, it lacks tools tailored for traders. Features like automated workspace backups, multi-monitor RDP optimization, or pre-tuned network configurations for broker feeds are missing. Additionally, without a support team familiar with NinjaTrader 8, Rithmic, or Tradovate, users are left to troubleshoot latency and execution issues on their own.

6. DigitalOcean

Latency to CME/Rithmic/Tradovate

DigitalOcean doesn’t have a datacenter in Chicago - the closest options are in New York City (NYC) and San Francisco (SFO). This geographic gap leads to higher latency when connecting to the CME Group's matching engines located in Aurora, Illinois. The increased physical distance adds more network hops between your trading platform and the exchange, which means slower connections.

For futures traders working with high-speed markets like ES, NQ, or CL, this can be a dealbreaker. Those extra milliseconds in network delays can lead to slower order executions and heightened slippage, particularly during volatile periods when every fraction of a second can impact your trades. On top of that, DigitalOcean's hardware setup and environment don’t help mitigate these latency issues.

Server Specifications (CPU, RAM, Storage)

DigitalOcean’s Droplets come with reliable hardware, but they’re designed primarily for Linux environments. If you need a Windows setup, you’ll have to install it yourself and purchase a Windows Server license. This adds complexity, time, and cost to the process.

Even though the hardware is capable, the absence of pre-configured Windows environments forces traders to handle setup, configuration, and optimization on their own. This makes it less appealing for traders who want a straightforward, ready-to-go hosting solution for platforms like NinjaTrader 8.

Pricing (Monthly/Annual)

While DigitalOcean’s Droplets start at around $6.00 per month, the added expense of a Windows license and the manual setup process diminishes the initial affordability. For traders, this means the cost advantage fades quickly, especially since the infrastructure isn’t designed with low-latency futures trading in mind.

Trading-Focused Features

DigitalOcean doesn’t offer any features tailored to trading. There’s no built-in support for NinjaTrader 8, no pre-configured environments for trading platforms, and no specialized network routing for broker connectivity. For tasks like research or applications where latency isn’t critical, DigitalOcean can work well. However, for active futures trading - especially with Rithmic or Tradovate feeds - it falls short compared to solutions specifically designed for trading. These shortcomings make it a less competitive option for traders who require performance and efficiency.

7. Linode (Akamai)

Latency to CME/Rithmic/Tradovate

Linode’s Chicago datacenter is strategically located near CME Group’s matching engines in Aurora, Illinois, which helps reduce physical distance. However, proximity alone doesn’t guarantee ultra-low latency. As a general-purpose cloud provider, Linode doesn’t offer specialized network routing tailored for trading. Without direct exchange cross-connects or optimized pathways to Rithmic and Tradovate data feeds, additional network hops and routing complexities can introduce delays. These latency issues can significantly affect trade execution during high-volatility markets, making server performance a critical consideration.

Server Specifications (CPU, RAM, Storage)

Linode provides reliable hardware across its VPS plans, offering a variety of CPU, RAM, and storage configurations. However, its Linux-focused environment presents a challenge for NinjaTrader 8 users, as it requires installing Windows Server and purchasing a separate license. This extra step adds both complexity and cost. While the hardware itself is capable, the absence of pre-configured Windows environments means traders must handle installation and fine-tuning themselves, which can be a hassle for those seeking a quick and seamless setup.

Pricing (Monthly/Annual)

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Linode’s base VPS pricing is competitive, but when you factor in the additional costs for Windows licensing and manual configuration, it becomes less attractive for NinjaTrader 8 users. These extra expenses can quickly add up, especially for traders looking for a cost-effective solution.

Trading-Focused Features

Linode doesn’t offer any trading-specific features. There’s no pre-installed NinjaTrader 8 support, no specialized routing to broker data feeds, and no trading-oriented customer service. While it’s technically possible to host NinjaTrader 8 on Linode after proper setup, the lack of trading-focused optimizations means it requires significant manual effort to achieve the performance needed for active futures trading. For traders who prioritize speed and reliability, Linode’s general-purpose infrastructure may introduce limitations that could impact critical execution during fast-moving markets.

8. Hetzner

Latency to CME/Rithmic/Tradovate

Hetzner operates its main data centers in Germany (Nuremberg and Falkenstein) and Finland (Helsinki). While this setup is convenient for European users, it poses challenges for U.S. futures traders. The significant physical distance to the CME Group's matching engines in Aurora, Illinois, leads to higher latency compared to U.S.-based hosting providers. This increased latency stems from additional network hops, slowing down order execution when connecting to Rithmic and Tradovate data feeds. For traders who rely on ultra-low latency during fast-moving markets, Hetzner's servers may not meet the mark. However, they can still be a viable choice for European traders or for tasks that aren't latency-sensitive, such as backtesting or strategy development.

Server Specifications (CPU, RAM, Storage)

Hetzner offers dedicated servers with modern hardware configurations. For example:

- AX41-NVMe: AMD Ryzen 5 3600, 64 GB RAM, and dual 512 GB NVMe SSDs.

- EX44: Intel Core i5-13500, 64 GB RAM, and dual 512 GB NVMe SSDs.

These setups provide ample processing power for NinjaTrader 8's multi-threaded operations and are well-suited for resource-intensive tasks like Strategy Analyzer optimizations and backtesting. While the hardware is strong, the overall value diminishes for live trading due to latency and other factors.

Pricing (Monthly/Annual)

Hetzner's pricing is competitive but comes with additional costs:

- AX41-NVMe: €37.30/month (around $39.50/month) with no setup fee.

- EX44: €39.00/month (around $41.30/month) plus a one-time setup fee of €79.00 (around $83.70).

- Optional add-ons include Windows Server 2022 Standard Edition for €49.00/month (around $51.90/month) and an IPv4 address for €1.70/month (around $1.80/month).

When factoring in these extras, the monthly cost can double, making it less appealing than other affordable VPS hosting solutions for futures trading.

Trading-Focused Features

Hetzner is not tailored for trading-specific needs. As an unmanaged "Root Server" provider, users are responsible for setting up and maintaining all software, including the Windows OS and NinjaTrader 8. There are no pre-configured trading environments, specialized routing to broker data feeds, or trading-focused customer support. While Hetzner guarantees 99.9% network availability (though some traders compare VPS providers to find 100% uptime guarantees) and operates ISO 27001:2022 certified data centers, its European infrastructure makes it better suited for backtesting and strategy development rather than live trading. For traders prioritizing low latency with Rithmic or Tradovate feeds, a VPS located closer to the U.S. is essential.

Master NinjaTrader 8 Setup on VPS: Full Walkthrough

Strengths and Weaknesses

Here’s an overview of the strengths and weaknesses of different VPS providers for hosting NinjaTrader 8, focusing on key performance and cost factors critical for futures trading.

Each VPS provider brings its own set of trade-offs when it comes to hosting NinjaTrader 8. QuantVPS stands out with ultra-low latency of 0.52ms to the CME matching engines in Chicago. Powered by AMD EPYC and Ryzen processors, along with NVMe M.2 SSDs and DDR4/5 RAM, it ensures top-tier performance. The service also includes 24/7 U.S.-based technical support, multi-monitor RDP compatibility, and a 99.999% uptime guarantee. Pricing starts at $59.99/month (or $41.99/month annually) for the VPS Lite plan, scaling up to $399.99/month (or $279.99/month annually) for the Dedicated+ Server. However, the VPS Lite plan lacks multi-monitor support, which could be a drawback for traders managing multiple chart windows. This low-latency performance is crucial for minimizing slippage and ensuring optimal order execution during volatile market conditions, making QuantVPS a top choice for active traders.

On the other hand, general-purpose cloud providers like OVHcloud, AWS, Azure, Vultr, DigitalOcean, Linode, and Hetzner can technically host NinjaTrader 8 but are not optimized for trading. While AWS and Azure offer enterprise-grade reliability, their complex pricing models include additional charges for data transfer, storage, and compute resources. Vultr and DigitalOcean provide simpler pricing, starting around $10–$40/month, but their U.S. datacenters are not CME-proximate, leading to higher and less predictable latency. Hetzner offers robust hardware at competitive prices (about €37.30–€39.00/month or roughly $39.50–$41.30/month), but its European datacenter locations result in significant latency issues for U.S.-based futures traders.

A major limitation across these general-purpose providers is the lack of direct fiber-optic cross-connects to the CME Group exchange and specialized routing to broker gateways. While they may suffice for backtesting, strategy development, or tasks that don’t rely on low latency, they fall short in fast-moving markets where every millisecond matters. Traders running automated NinjaScript strategies or engaging in high-frequency trading will notice the difference between sub-1ms execution and the 10–50ms+ latency typical of these platforms. For those prioritizing better fills, reduced slippage, and reliable execution with Rithmic or Tradovate, a Chicago-based trading VPS like QuantVPS remains the superior option.

| Provider | Latency to CME | CPU Type | Base Price | Trading Features |

|---|---|---|---|---|

| QuantVPS | 0.52ms | AMD EPYC/Ryzen | $59.99/month | Pre-configured Windows, 24/7 support, multi-monitor RDP, 99.999% uptime |

| OVHcloud | Variable (higher) | Intel Xeon | ~$40/month | Unmanaged, no trading optimization |

| AWS | Variable (regional) | Intel Xeon/AMD EPYC | ~$50+/month | Requires manual setup, complex pricing |

| Azure | Variable (regional) | Intel Xeon/AMD EPYC | ~$55+/month | Enterprise features, no trading focus |

| Vultr | 10–50ms+ | Intel/AMD | $10–$40/month | Basic VPS, no trading-specific routing |

| DigitalOcean | 10–50ms+ | Intel/AMD | $12–$48/month | Developer-focused, higher latency |

| Linode | 10–50ms+ | AMD EPYC | $12–$60/month | Reliable but requires tuning |

| Hetzner | High (EU-based) | AMD Ryzen/Intel | €37.30/month (~$39.50) | Strong hardware, poor U.S. latency |

This comparison highlights why a trading-optimized VPS like QuantVPS is the go-to solution for traders who need speed and reliability in futures trading.

QuantVPS latency data

Conclusion

For futures traders relying on Rithmic or Tradovate feeds, having a Chicago-based VPS with ultra-low latency - just 0.52ms - is a game changer. QuantVPS provides this lightning-fast connection to the CME Group matching engines, ensuring trades are executed with precision and speed.

Even if your trading needs aren't extreme, robust infrastructure can still make a noticeable difference. Choosing the best VPS or dedicated server for trading guarantees smooth data flow and uninterrupted automation, even during high-volatility sessions. The link between reliable infrastructure and trading performance is undeniable.

If you're serious about futures trading, investing in a VPS designed for high-speed execution is a no-brainer. QuantVPS combines direct fiber-optic cross-connects to the CME, cutting-edge AMD processors, NVMe storage, and 24/7 support. This powerful setup delivers the reliability and speed that can mean the difference between a winning strategy and one hindered by technical bottlenecks. For traders who demand precision and consistency, QuantVPS stands out as the go-to solution.

FAQs

Why is low latency essential for NinjaTrader 8 users?

Low latency is a game-changer for NinjaTrader 8 users, as it means faster order execution. This speed reduces the time it takes for your trades to reach the exchange and get confirmations - crucial in fast-moving futures markets where prices can shift in the blink of an eye.

With lower delays, you’re more likely to secure better fills, experience less slippage, and ensure your automated strategies execute as intended. For traders relying on high-speed data feeds like Rithmic or Tradovate, a low-latency setup is essential to staying competitive and seizing opportunities in volatile market conditions.

Why is QuantVPS the ideal VPS for futures traders using NinjaTrader 8?

QuantVPS is purpose-built for futures traders, offering ultra-low latency with servers located in Chicago. This setup provides lightning-fast connectivity to the CME, with speeds ranging from approximately 0.52 ms to 1 ms. Such rapid execution minimizes slippage, a critical advantage for both active and automated traders.

Powered by AMD EPYC CPUs, NVMe storage, and 1 Gbps+ networking, QuantVPS ensures the performance and reliability necessary for smooth trading operations. It also boasts a 100% uptime guarantee, 24/7 U.S.-based expert support, and seamless compatibility with platforms like NinjaTrader, Rithmic, Tradovate, and other major proprietary trading tools. These features make QuantVPS a trusted solution for traders who prioritize speed, precision, and reliability.

How does being near the CME Group improve trading performance?

Proximity to the CME Group plays a crucial role in boosting trading performance by cutting round-trip latency to incredibly low levels - typically around 0.5 to 0.7 milliseconds. This ultra-fast connection speeds up order execution, reduces the risk of slippage, and ensures trade confirmations are more reliable.

For active futures traders, especially those relying on automated systems or high-frequency strategies, this speed advantage can be the key to seizing the best trade opportunities in rapidly changing markets.

Low latency is a game-changer for NinjaTrader 8 users, as it means faster order execution. This speed reduces the time it takes for your trades to reach the exchange and get confirmations - crucial in fast-moving futures markets where prices can shift in the blink of an eye.

With lower delays, you’re more likely to secure better fills, experience less slippage, and ensure your automated strategies execute as intended. For traders relying on high-speed data feeds like Rithmic or Tradovate, a low-latency setup is essential to staying competitive and seizing opportunities in volatile market conditions.

QuantVPS is purpose-built for futures traders, offering ultra-low latency with servers located in Chicago. This setup provides lightning-fast connectivity to the CME, with speeds ranging from approximately 0.52 ms to 1 ms. Such rapid execution minimizes slippage, a critical advantage for both active and automated traders.

Powered by AMD EPYC CPUs, NVMe storage, and 1 Gbps+ networking, QuantVPS ensures the performance and reliability necessary for smooth trading operations. It also boasts a 100% uptime guarantee, 24/7 U.S.-based expert support, and seamless compatibility with platforms like NinjaTrader, Rithmic, Tradovate, and other major proprietary trading tools. These features make QuantVPS a trusted solution for traders who prioritize speed, precision, and reliability.

Proximity to the CME Group plays a crucial role in boosting trading performance by cutting round-trip latency to incredibly low levels - typically around 0.5 to 0.7 milliseconds. This ultra-fast connection speeds up order execution, reduces the risk of slippage, and ensures trade confirmations are more reliable.

For active futures traders, especially those relying on automated systems or high-frequency strategies, this speed advantage can be the key to seizing the best trade opportunities in rapidly changing markets.

"}}]}