QuiverQuant Review: See Insider Trades & Alternative Data

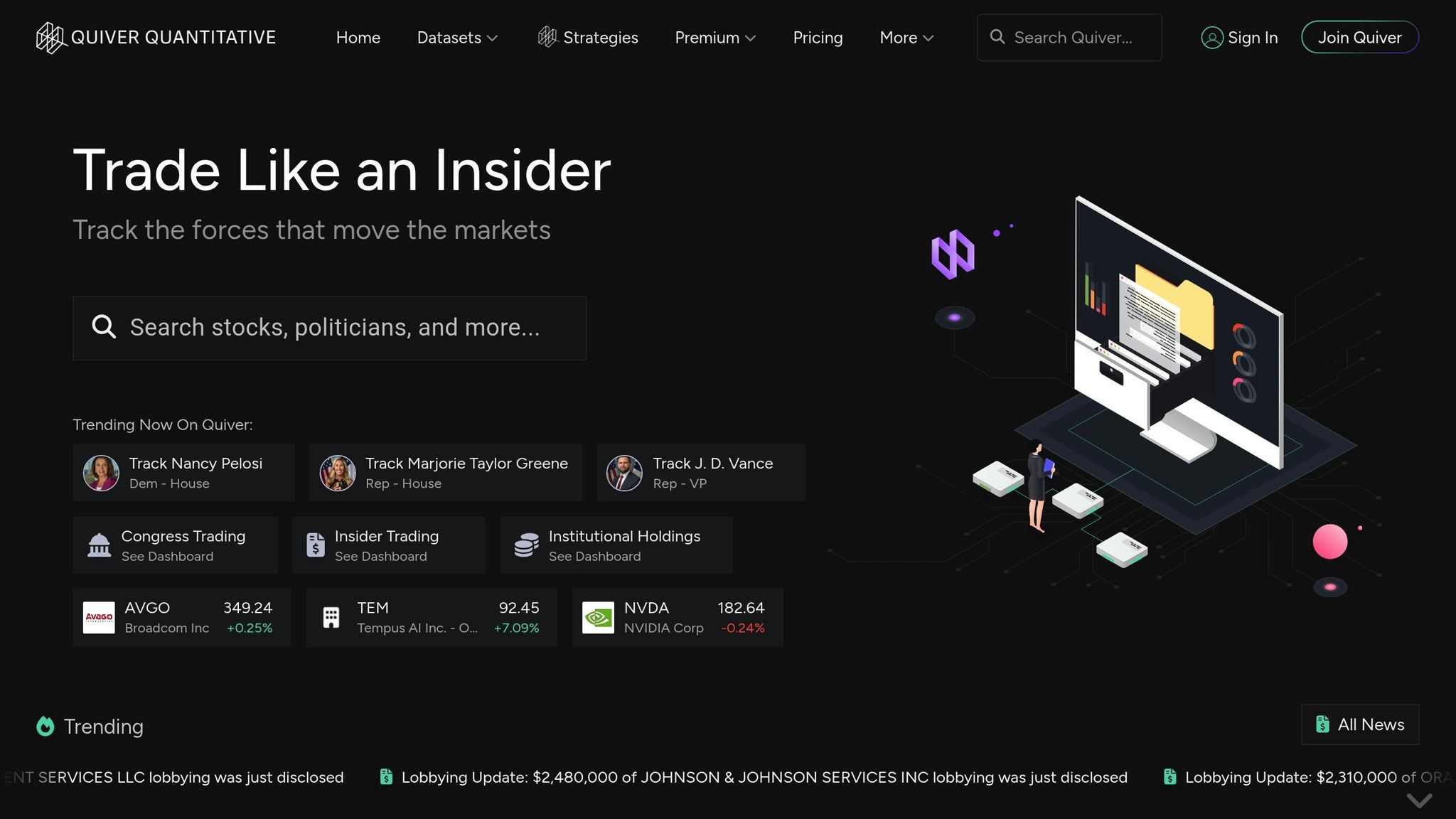

QuiverQuant is a platform that helps traders analyze insider trades, congressional trading patterns, and alternative data sources like government contracts and social sentiment. It offers tools like dashboards, filters, and alerts to simplify data interpretation. With a freemium model, its premium plan costs $25/month, unlocking advanced features like API access and extended historical data.

For executing trades based on these insights, QuantVPS provides high-performance VPS hosting optimized for trading platforms like NinjaTrader and MetaTrader. It offers ultra-low latency (as low as 0.52ms), robust hardware, and plans starting at $59.99/month.

Key Takeaways:

- QuiverQuant: Focuses on providing actionable data for medium-term trading strategies.

- QuantVPS: Ensures reliable, fast trade execution for high-frequency traders.

For traders combining both, QuiverQuant delivers early market insights, while QuantVPS ensures those insights are acted upon swiftly.

1. QuiverQuant

QuiverQuant is a data analytics platform that transforms unconventional data into actionable insights, helping traders gain an edge in the market. With its advanced analytics and tools, it bridges the gap between unique data sources and high-performance trade execution.

Insider Trading Insights

QuiverQuant keeps a close eye on insider transactions using SEC Form 4 data, presenting the information in a clear, user-friendly format. This makes it easier to spot significant buying or selling trends.

The platform also tracks stock transactions by members of Congress, offering a unique view into how elected officials are investing - particularly useful since these individuals may have early knowledge of industry-shaping developments.

The insider trading dashboard provides details like transaction amounts, timing, and the securities involved. Users can apply advanced filters to identify key trading signals and uncover patterns that might predict market shifts. Additionally, the platform calculates insider sentiment scores based on buy-to-sell ratios over specific timeframes, offering another layer of insight.

Beyond insider trading, QuiverQuant incorporates alternative data sources to enrich trading strategies.

Alternative Data Access

QuiverQuant goes beyond traditional data by tapping into unconventional sources that often reveal market movements before they show up in earnings reports or analyst coverage.

- Government Contracts: The platform tracks federal contract awards and spending patterns, offering early clues about companies poised for revenue growth from government deals.

- Social Sentiment: By monitoring social media platforms like Reddit and Twitter, QuiverQuant captures retail investor sentiment and discussion trends around specific stocks. This helps traders gauge momentum before it impacts prices.

These alternative data streams provide traders with a broader perspective, enabling them to anticipate market trends that might otherwise go unnoticed.

Data Visualization Tools

QuiverQuant makes complex data easier to understand through interactive charts and dashboards. Heat maps highlight insider trading activity across sectors and timeframes, while correlation analysis tools reveal links between alternative data and stock price movements. For instance, traders can analyze historical government contract data to predict how it might influence stock performance.

Custom alerts add another layer of convenience. Users can be notified about unusual insider activity or changes in government contracts via email or API integration. These alerts ensure traders stay informed in real time.

The platform also includes screening tools to help users filter stocks based on insider trading trends, government contract activity, or social sentiment metrics. This allows traders to uncover opportunities that might not appear on standard stock screeners.

Pricing and Accessibility

QuiverQuant operates on a freemium model. The free version offers access to basic insider trading data and limited historical insights, making it a great starting point for retail traders curious about alternative data.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

For $25 per month, the premium subscription unlocks the full suite of features, including comprehensive government contract tracking, extended historical data, advanced filtering options, and API access. This premium tier is ideal for traders who want to integrate QuiverQuant's data into their own systems for real-time updates or automated strategies.

The platform is entirely web-based, requiring no software installation. Its mobile-responsive design ensures traders can access data seamlessly across devices, whether at their desks or on the go.

2. QuantVPS: High-Performance VPS for Futures Trading

QuantVPS is designed to complement QuiverQuant's data insights by offering a high-performance platform tailored for traders. While QuiverQuant equips users with valuable data, executing strategies based on that data requires a reliable and precise infrastructure. That’s where QuantVPS steps in, delivering specialized hosting solutions optimized for high-frequency trading.

Here’s a closer look at how QuantVPS empowers traders to make the most of QuiverQuant’s insights.

Trading Platform Compatibility

QuantVPS supports popular trading platforms like NinjaTrader, MetaTrader, and TradeStation, all running on pre-optimized Windows Server 2022. This ensures seamless integration and smooth performance for traders.

For those who need multi-monitor setups, QuantVPS offers flexibility:

- VPS Pro: Supports up to 2 monitors.

- VPS Ultra: Handles up to 4 monitors.

- Dedicated Server: Accommodates up to 6 monitors simultaneously.

Additionally, full root access allows traders to customize their environment by installing proprietary software, automated trading systems, or custom indicators that process alternative data feeds. Whether you're running a simple strategy or a complex setup, QuantVPS has the tools to handle it.

Performance Specifications

QuantVPS is built to handle the rigorous demands of real-time trading. The VPS Ultra plan, for instance, offers 24 cores and 64GB of RAM, making it ideal for running complex algorithms that analyze both live market data and insider trading insights.

The hardware is powered by AMD EPYC processors and NVMe M.2 SSD storage, ensuring lightning-fast data access. This combination is critical for traders who need to process large datasets in real time. Network performance is equally impressive, with speeds of 1Gbps+ and burst capabilities up to 10Gbps, ensuring there are no delays when loading or processing data.

Infrastructure Reliability

QuantVPS operates from a Chicago-based datacenter with direct connectivity to the CME Group's matching engines. This strategic location ensures ultra-low latency - below 0.52 milliseconds to the CME Group exchange [1][3]. For traders relying on QuiverQuant’s insights, every millisecond counts, and this speed can mean the difference between executing a trade or missing an opportunity.

With an uptime guarantee of 99.999%, QuantVPS ensures automated strategies run without interruption [1][3]. To put this reliability into perspective, over $15.68 billion in futures volume was traded on QuantVPS's low-latency servers in just 24 hours as of October 21, 2025 [3].

The infrastructure also features direct fiber-optic cross-connects to the CME Group exchange, reducing network hops and ensuring trades execute in less than 1 millisecond [1]. Enterprise-grade security measures, including DDoS protection and advanced firewalls, safeguard sensitive trading data and operations.

Pricing Structure

QuantVPS offers a range of plans to suit different trading needs and budgets:

- VPS Lite: Starting at $59.99 monthly ($41.99 annually), this plan is ideal for basic strategies with limited data integration.

- VPS Pro: Priced at $99.99 monthly ($69.99 annually), it includes 6 cores and 16GB of RAM for moderate data processing needs.

- VPS Ultra: At $189.99 monthly ($132.99 annually), this plan offers 24 cores and 64GB of RAM for traders handling intensive data analysis.

- Dedicated Server: For $299.99 monthly ($209.99 annually), this option provides 16+ dedicated cores and 128GB of RAM, perfect for managing complex algorithmic systems.

For those seeking even more power, Performance Plans (+) are available. The VPS Pro+ plan costs $129.99 monthly, while the Dedicated+ Server is priced at $399.99 monthly, offering maximum computational power and enhanced network performance.

QuantVPS has earned a 4.7/5 rating on Trustpilot, based on 142 reviews. Users frequently highlight the platform’s quick setup, low latency, and dependable uptime as key advantages for trading operations.

Pros and Cons

This section compares QuiverQuant and QuantVPS, helping traders decide which platform best fits their trading style and technical needs. Each serves a distinct purpose - QuiverQuant focuses on data insights, while QuantVPS prioritizes execution performance.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

QuiverQuant Advantages and Limitations

QuiverQuant stands out for its access to alternative data insights that traditional platforms often lack. At $25/month, it provides traders with early market signals that can be valuable for medium-term strategies.

However, it does have its drawbacks. The mobile app experience is less polished compared to the desktop version, which could be an issue for traders who rely on mobile access. Another challenge is its performance during volatile or unpredictable markets. For instance, during the market fluctuations of 2022, its insider trading model underperformed, showcasing the limits of alternative data during high uncertainty.

Additionally, newer traders might find it difficult to fully utilize the platform without more structured guidance. Some users have also reported occasional delays in updates due to data collection limitations, and, as always, backtested strategies don’t guarantee future success. Lastly, QuiverQuant is not ideal for passive investors or those focused solely on day trading, as its data is better suited for medium-term strategies.

QuantVPS Strengths and Considerations

QuantVPS complements data-driven platforms like QuiverQuant by ensuring seamless trade execution. It offers ultra-low latency (0–1ms), a 100% uptime guarantee, and powerful hardware for demanding trading setups. Traders also benefit from multi-monitor support, which ranges from 2 monitors on VPS Pro plans to up to 6 monitors on dedicated servers.

Pricing is another factor to consider. The VPS Pro plan costs $99.99 per month but drops to $69.99 with annual billing. For traders with advanced needs, higher-tier plans like VPS Ultra ($189.99/month) or Dedicated+ Server ($399.99/month) provide additional performance capabilities.

| Platform | Key Strengths | Primary Limitations |

|---|---|---|

| QuiverQuant | Alternative data insights, early market signals, affordable pricing | Limited mobile app, struggles in volatile markets, requires advanced analysis |

| QuantVPS | Ultra-low latency, 100% uptime, robust hardware, multi-monitor support | Higher costs for advanced plans, with top-tier options nearing $400/month |

Integration Considerations

For traders looking to combine both platforms, it’s important to assess technical skills and budget. QuiverQuant offers free trials and a copy trading feature, making it easier to explore its capabilities. Pairing it with QuantVPS ensures that trades are executed without delays, leveraging the strengths of both platforms for a more efficient trading workflow.

Conclusion

QuiverQuant and QuantVPS play distinct but complementary roles in a trader's arsenal. QuiverQuant focuses on delivering alternative data insights, perfect for traders pursuing medium-term strategies and looking to uncover unique market perspectives. However, making the most of these insights requires strong analytical skills, which might not align with the needs of day traders or passive investors.

On the technical front, QuantVPS ensures fast and reliable execution for data-driven strategies. Its infrastructure is built to handle the demands of modern trading, ensuring trades are executed without delays once market signals are identified. With flexible plans, it caters to a variety of trading needs, from simpler setups to more advanced operations.

For traders with budget constraints or less complex strategies, evaluating QuiverQuant's data offerings can help determine if its insights align with their approach. At the same time, there are affordable VPS options available for those with straightforward execution requirements.

Professional traders managing larger portfolios can benefit from combining these tools. QuiverQuant provides early market signals that, when paired with QuantVPS's reliable infrastructure, create a powerful synergy. Higher-tier VPS plans can also handle the increased demands of larger trading volumes and more intricate strategies, ensuring seamless performance.

Ultimately, the choice depends on trading frequency and strategy complexity. Swing traders will find QuiverQuant's alternative data invaluable for market research, while high-frequency traders will appreciate QuantVPS's ability to deliver consistent, lag-free execution. Together, these platforms create a well-rounded solution that bridges market insights with operational precision, simplifying decision-making at every step.

FAQs

How does QuiverQuant leverage alternative data to enhance trading strategies?

QuiverQuant takes trading strategies to the next level by tapping into alternative data from unconventional sources like congressional trading activity, government contracts, social media sentiment, and patent filings. Using tools such as strategy backtesting, the Congressional Trading Tracker, and the Smart Score, this data is transformed into actionable insights, giving retail investors access to information that’s often exclusive to institutional traders.

By presenting this data in a clear, user-friendly way, QuiverQuant enables traders to make smarter decisions and stay ahead in the market.

What are the benefits of using QuantVPS to execute trades with insights from QuiverQuant's data?

QuantVPS provides a dependable platform tailored for executing trades using QuiverQuant’s data. By merging QuiverQuant’s unique insights - like insider trading trends and alternative data - with QuantVPS’s powerful infrastructure, traders gain the tools they need to make quicker and smarter decisions.

One of the standout features of QuantVPS is its low-latency performance, which ensures trades are executed with speed and precision. This capability is crucial when working with the time-sensitive data offered by QuiverQuant. On top of that, QuantVPS delivers a secure and scalable environment, making it an excellent fit for both individual traders and professionals looking to refine their strategies using data-driven approaches.

Is QuiverQuant better for day trading or medium-term strategies?

QuiverQuant offers a range of tools and data, including insights into insider trading and alternative data, designed to support both day trading and medium-term strategies. While the platform doesn’t explicitly favor one trading style over the other, its flexible data visualization tools and unique datasets can be tailored to fit different approaches.

For day traders, QuiverQuant’s real-time data and actionable insights can help spot quick opportunities in the market. Meanwhile, medium-term traders might find value in the platform’s alternative data sources, which provide deeper analysis and reveal broader trends. Ultimately, the way you leverage QuiverQuant depends on your specific trading goals and strategies.