AscendX Capital: Prop Firm Reviews & Payout Process

Quant Tekel, formerly known as AscendX Capital, is a proprietary trading firm offering retail traders access to institutional-level funding and advanced trading platforms. Rebranded in 2024, the firm provides funded accounts ranging from $200,000 to $2,000,000 with profit splits up to 90%. Despite its global reach and fast payouts (averaging 4 hours), concerns about strict trading rules, limited history (established in 2023), and low trust scores (2.83/10 on Traders Union, 1/100 on ScamAdviser) persist. Key features include:

- Account Types: QT Prime, QT Power, QT Instant (evaluation or instant funding models).

- Profit Targets: 6%-8% (evaluation accounts).

- Payouts: Bi-weekly or on-demand, processed within 3-5 business days.

- Platforms: MetaTrader 5, cTrader, DXTrade, TradeLocker.

- Restrictions: News trading bans, 2-minute minimum trade duration, and prohibited strategies like arbitrage.

While the firm offers high profit splits and scaling opportunities, strict rules and operational challenges may limit its appeal for some traders.

I Made $7700 In Prop Firms - Funding Pips - Ascendx Capital

Account Types and Evaluation Process

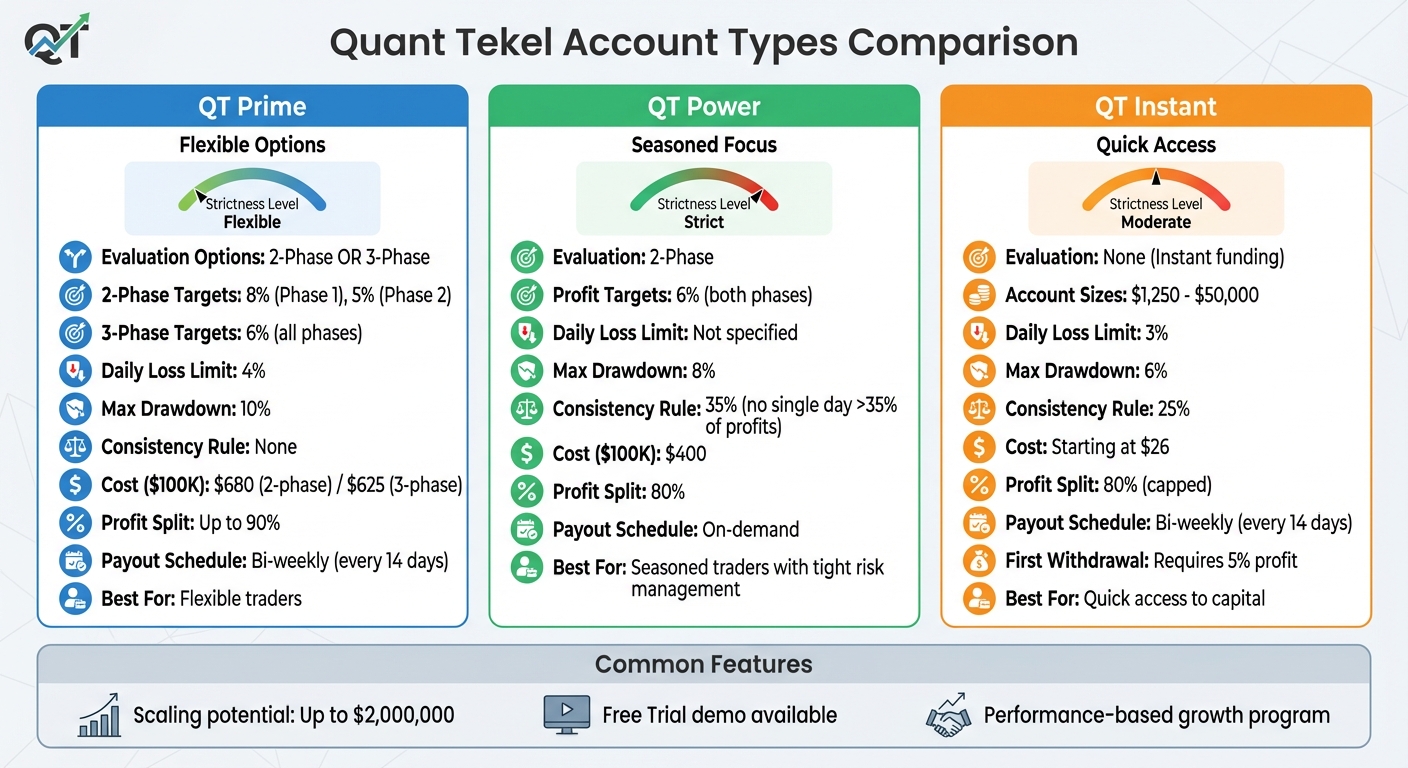

Quant Tekel Account Types Comparison: Features, Costs, and Requirements

Quant Tekel Account Types Comparison: Features, Costs, and Requirements

Quant Tekel offers three distinct account models tailored to different trading approaches: QT Prime, QT Power, and QT Instant. Pricing varies based on account size and evaluation type, ranging from $26 to $1,300.

QT Prime provides the most flexibility, offering both two-phase and three-phase evaluation paths. The two-phase model requires traders to hit an 8% profit target in Phase 1 and 5% in Phase 2, while the three-phase option sets a consistent 6% target for each stage. Both options feature a 4% daily loss limit and a 10% maximum drawdown, with no consistency rule. For a $100,000 account, the two-phase path costs $680, while the three-phase option is priced at $625.

QT Power is designed for seasoned traders who can manage tighter risk conditions. This two-phase model sets a 6% profit target for both phases but enforces stricter rules, including an 8% maximum drawdown and a 35% consistency rule (no single trading day can contribute more than 35% of total profits). A $100,000 QT Power account costs $400, but the tighter drawdown limits demand precise risk management.

QT Instant skips the evaluation process entirely, offering immediate access to trading capital. Account sizes range from $1,250 to $50,000, with fees starting at $26. This model imposes a 3% daily loss limit, a 6% maximum drawdown, and a 25% consistency rule. Additionally, traders must achieve a 5% profit before making their first withdrawal, and the profit split is capped at 80%, compared to the 90% available with evaluation accounts.

All evaluation accounts include access to a Free Trial demo, and traders can scale their capital up to $2,000,000 through a performance-based growth program. These account structures lay the groundwork for assessing trading conditions and profit-sharing options in the next section.

Trading Conditions and Platforms

Here’s a closer look at the trading conditions and platforms available for traders.

Quant Tekel provides access to MetaTrader 5, cTrader, TradeLocker, and DXTrade, offering a range of platforms to suit different trading styles and preferences. Traders can explore over 60 Forex pairs, global stock indices, commodities like metals and oil, and more than 60 cryptocurrency CFDs.

Leverage options differ based on the account type, as shown below:

| Asset Class | QT Prime | QT Power | QT Instant |

|---|---|---|---|

| Forex | 1:50 | 1:100 | 1:50 |

| Indices | 1:20 | 1:35 | 1:20 |

| Metals | 1:15 | 1:35 | 1:15 |

| Crypto | 1:1 | 1:2.5 | 1:1 |

Trading Rules and Restrictions

Specific rules apply to all funded accounts. For instance, news trading is not allowed on QT Instant and QT Prime accounts within five minutes before or after high-impact news events, as defined by the Forex Factory calendar. Additionally, Expert Advisors require prior approval, and certain strategies - like high-frequency trading, arbitrage, tick scalping, and group hedging - are strictly prohibited. Manual trades must stay open for at least two minutes, and traders are limited to a maximum of three concurrent positions per instrument.

Commissions and Risk Management

Commissions are set at $2.00 per lot (or $4.00 per round lot), except for indices and oil, which operate on variable spreads. Daily drawdown limits reset at 12:00 AM for MetaTrader 5 and 1:00 AM for DXTrade, helping traders manage their daily risk exposure.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

These trading conditions establish the framework for evaluating profit splits, passing a prop firm challenge, and understanding the payout process, ensuring a structured and consistent trading environment.

Profit Splits and Payout Process

Quant Tekel stands out with its transparent profit-sharing structure and forex prop firm payout systems, making it easier for traders to understand and access their earnings.

The profit split begins at 80% for all account types, with the opportunity to increase to 90% through their scaling program. High-tier funded accounts or traders who maintain profitability for 16 weeks can see their profit share rise by an additional 5%.

Payout frequency varies by account type. QT Prime and QT Instant accounts allow withdrawals every two weeks, while QT Power offers the flexibility of on-demand payouts. The firm commits to processing payout requests within 3–5 business days, with an average turnaround time of just 4 hours.

To qualify for a payout, traders must meet specific requirements:

- Earn a minimum profit of $100–$110.

- Complete at least 4 trading days (or 5 days for QT Instant).

- Close all trades and pending orders.

- Complete KYC verification.

- Maintain a consistency score of 25% for QT Instant or 35% for QT Power.

Here’s a quick summary of the profit split and payout details by account type:

| Account Type | Profit Split | Payout Timeline | Supported Methods |

|---|---|---|---|

| QT Prime | 80% - 90% | Bi-weekly (Every 14 days) | VISA, MasterCard, Crypto, Rise, Wire, PayPal, UPI |

| QT Power | 80% | On-demand | VISA, MasterCard, Crypto, Rise, Wire, PayPal, UPI |

| QT Instant | 80% | Bi-weekly (Every 14 days) | VISA, MasterCard, Crypto, Rise, Wire, PayPal, UPI |

The platform supports a wide range of withdrawal options, including VISA, MasterCard, cryptocurrency, wire transfers, PayPal, and UPI. Notably, the largest payout recorded by Quant Tekel was an impressive $84,533, demonstrating its capability for handling substantial earnings.

Pros and Cons

AscendX Capital (now operating as Quant Tekel) presents a mix of appealing features for traders, alongside some notable challenges.

On the positive side, the firm stands out with its 90% profit split and fast payouts, with funds processed within just four hours. The low profit targets - 7% for Phase 1 and 5% for Phase 2 - help reduce the pressure to take on excessive risks. Additionally, the absence of time limits during the evaluation phases is a significant advantage for swing traders, allowing them to trade at their own pace. There's also potential for scaling accounts up to $2,000,000, and the firm permits EAs (Expert Advisors) and is among the prop firms that allow copy trading, provided prior approval is obtained.

However, these advantages are offset by several operational and trading restrictions. One major concern is the firm's limited operating history, having been established as recently as October 2023. This raises questions about its long-term reliability. Traders Union has rated the firm 2.83/10, labeling it as high-risk, while ScamAdviser has given it a low 1/100 trust score. Compounding these concerns, the rebranding to Quant Tekel in 2024 has led to operational disruptions, with some traders reporting delays of 80 to 150+ days in receiving funded account credentials.

The firm's trading rules also introduce challenges. For example, the 2-minute minimum trade duration rule limits scalping opportunities, and funded accounts face a 5-minute blackout period around high-impact economic news releases. Violating this rule twice can result in termination of the account. Additionally, strategies like arbitrage and tick scalping are prohibited, and traders are restricted to a maximum of 3 open positions on the same instrument due to the firm's layering rule.

For a quick overview, here's a breakdown of the key pros and cons:

| Pros | Cons |

|---|---|

| 90% profit split | Limited operating history (founded October 2023) |

| Low profit targets (7% Phase 1, 5% Phase 2) | Strict 2-minute minimum trade duration |

| No time limits on evaluations | News trading restricted on funded accounts |

| 4-hour payouts | Prohibited strategies (arbitrage, tick scalping) |

| Scaling potential up to $2,000,000 | Geographic restrictions (residents of Iran, Iraq, North Korea, Russia, and Pakistan) |

| EAs and copy trading allowed (with approval) | Delays in account credentials during migration |

While the firm offers appealing features for traders, the operational uncertainties and strategy restrictions make it a mixed bag. These considerations will play a role in the final assessment.

Conclusion

AscendX Capital, now operating as Quant Tekel, presents a mix of opportunities and challenges for traders. With generous profit splits and relatively low profit targets, the firm can be appealing - particularly for swing traders who value evaluation processes without rigid time limits. Add to that the quick 4-hour payout processing and a scaling potential of up to $2,000,000, and it’s easy to see why some traders might be drawn to it.

That said, concerns about reliability can’t be ignored. The firm’s Traders Union rating of 2.83/10 and a ScamAdviser Trustscore of just 1/100 highlight potential risks. Rebranding has also led to delays in issuing funded account credentials, which could frustrate new users.

On top of these operational hiccups, strict trading rules may limit flexibility. Requirements like a 2-minute minimum trade duration and a 5-minute blackout period around high-impact news events can make it less ideal for day traders and scalpers.

Before committing any funds, take the time to thoroughly review the firm’s trading rules, seek pre-approval for any Expert Advisors you plan to use, and explore current user feedback. While the potential benefits are appealing, the operational challenges mean careful consideration is essential. Choosing the right prop trading partner requires diligence, and this firm is no exception.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

FAQs

What are the key differences between QT Prime, QT Power, and QT Instant accounts?

Currently, there’s limited information available about the specific features of the QT Prime, QT Power, and QT Instant account types. While these options are mentioned, key details - like funding limits, profit splits, evaluation criteria, or payout schedules - haven’t been shared in the available resources.

To get a clearer picture of these accounts, it’s best to contact Quant Tekel (formerly AscendX Capital) directly or consult their official materials. This will help you understand the offerings and choose the account that fits your trading objectives.

What is the payout process at AscendX Capital, and what are the requirements to receive earnings?

AscendX Capital has streamlined its payout process, keeping traders' needs front and center. Once you've reached the Funded stage and start earning profits, you can request a withdrawal at any time. Payouts are processed efficiently and are typically sent out every two weeks. Traders retain 90% of their profits, while the firm takes a 10% share as a profit fee. Approved funds are transferred directly to your preferred payment method.

Here’s what you need to qualify for a payout:

- Reach the Funded stage: You must complete the evaluation and trade using the firm’s capital.

- Earn profits: Payouts are tied to your profits, and you’ll need to meet the firm’s profit benchmarks (7% for the first phase and 5% for the second).

- Keep your account balance intact: After a withdrawal, your account balance must stay above the starting level.

There’s no waiting period or time limit for withdrawals - once you meet the profit requirements, you can request a payout whenever it suits you. This flexible approach ensures you can access your earnings quickly while keeping the bulk of what you earn.

What trading restrictions does AscendX Capital have, and how could they affect my strategy?

AscendX Capital has specific trading rules that you’ll need to keep in mind when planning your strategy. For starters, weekend trading is off-limits. This means all positions must be closed before the market wraps up on Friday, eliminating the option to hold trades over the weekend and manage any risks that might occur during that time.

There are also restrictions surrounding high-impact news events. You’re not allowed to place manual trades within 5 minutes before or after major economic announcements, like CPI or FOMC releases. However, you can use pre-set limit orders with stop-loss and take-profit levels, as long as they’re placed at least 5 minutes ahead of these events. Keep in mind, though, that these orders can’t be adjusted during the restricted period.

Leverage is limited to 1:30, which promotes more cautious position sizing and better risk management. Additionally, high-frequency trading and risky strategies - such as scalping or rapid-fire trades - are not allowed. This means traders are encouraged to focus on longer time frames and a more deliberate trading approach.

These rules might require some tweaks to your trading style. For instance, swing traders must ensure their positions are closed by Friday, and news traders will need to rely on carefully planned setups. Adapting to these guidelines not only keeps you compliant but also allows you to take advantage of the firm’s generous 90% profit split.

Currently, there’s limited information available about the specific features of the QT Prime, QT Power, and QT Instant account types. While these options are mentioned, key details - like funding limits, profit splits, evaluation criteria, or payout schedules - haven’t been shared in the available resources.

To get a clearer picture of these accounts, it’s best to contact Quant Tekel (formerly AscendX Capital) directly or consult their official materials. This will help you understand the offerings and choose the account that fits your trading objectives.

AscendX Capital has streamlined its payout process, keeping traders' needs front and center. Once you've reached the Funded stage and start earning profits, you can request a withdrawal at any time. Payouts are processed efficiently and are typically sent out every two weeks. Traders retain 90% of their profits, while the firm takes a 10% share as a profit fee. Approved funds are transferred directly to your preferred payment method.

Here’s what you need to qualify for a payout:

- Reach the Funded stage: You must complete the evaluation and trade using the firm’s capital.

- Earn profits: Payouts are tied to your profits, and you’ll need to meet the firm’s profit benchmarks (7% for the first phase and 5% for the second).

- Keep your account balance intact: After a withdrawal, your account balance must stay above the starting level.

There’s no waiting period or time limit for withdrawals - once you meet the profit requirements, you can request a payout whenever it suits you. This flexible approach ensures you can access your earnings quickly while keeping the bulk of what you earn.

AscendX Capital has specific trading rules that you’ll need to keep in mind when planning your strategy. For starters, weekend trading is off-limits. This means all positions must be closed before the market wraps up on Friday, eliminating the option to hold trades over the weekend and manage any risks that might occur during that time.

There are also restrictions surrounding high-impact news events. You’re not allowed to place manual trades within 5 minutes before or after major economic announcements, like CPI or FOMC releases. However, you can use pre-set limit orders with stop-loss and take-profit levels, as long as they’re placed at least 5 minutes ahead of these events. Keep in mind, though, that these orders can’t be adjusted during the restricted period.

Leverage is limited to 1:30, which promotes more cautious position sizing and better risk management. Additionally, high-frequency trading and risky strategies - such as scalping or rapid-fire trades - are not allowed. This means traders are encouraged to focus on longer time frames and a more deliberate trading approach.

These rules might require some tweaks to your trading style. For instance, swing traders must ensure their positions are closed by Friday, and news traders will need to rely on carefully planned setups. Adapting to these guidelines not only keeps you compliant but also allows you to take advantage of the firm’s generous 90% profit split.

"}}]}