How to Send Trades from TradingView to NinjaTrader Using Replikanto

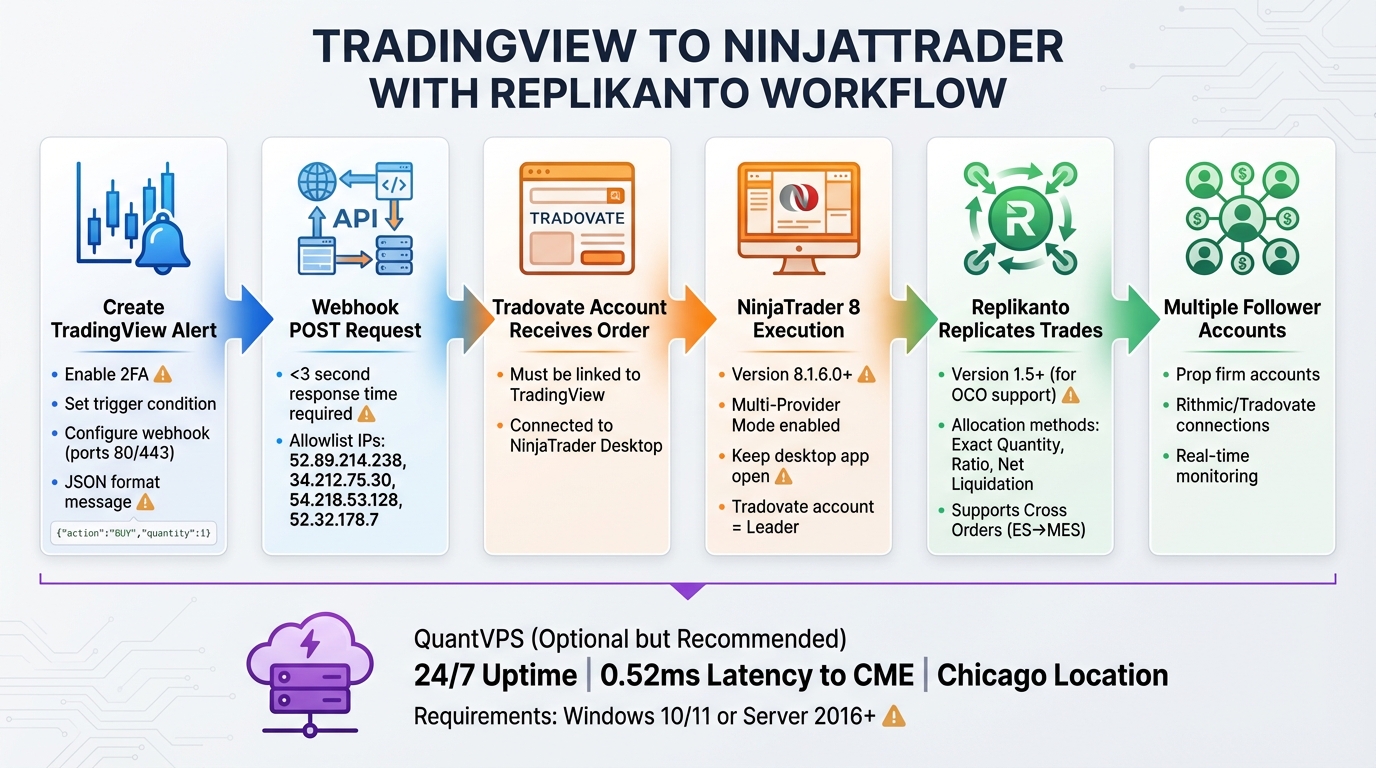

If you’re looking to connect TradingView’s alerts with NinjaTrader for trade execution, Replikanto is the tool you need. This guide explains how to set up TradingView alerts, configure NinjaTrader, and use Replikanto to replicate trades across multiple accounts. Here’s the process in a nutshell:

- Set up TradingView alerts with webhook support to trigger trades.

- Configure NinjaTrader 8 to receive and execute those alerts via broker connections like Tradovate or Rithmic.

- Install and set up Replikanto within NinjaTrader to copy trades to multiple accounts.

- Use a Windows VPS (like QuantVPS) to ensure uninterrupted execution and reduce latency in futures trading.

This setup allows you to leverage TradingView’s analysis tools while managing trades across multiple accounts in NinjaTrader. Follow the steps below for a reliable, automated trading workflow.

Complete Workflow: Sending Trades from TradingView to NinjaTrader via Replikanto

Complete Workflow: Sending Trades from TradingView to NinjaTrader via Replikanto

Best NinjaTrader VPS + Replikanto Trade Copier for TradingView!

Setting Up TradingView and NinjaTrader

This section walks you through the steps to configure TradingView and NinjaTrader for seamless trade execution. By setting up TradingView alerts and configuring NinjaTrader properly, you can enable Replikanto to mirror trades across all your accounts.

Creating TradingView Alerts

TradingView alerts can be triggered by price levels, indicator plots, strategy orders, or drawing objects. To connect these alerts to NinjaTrader, you’ll need to use webhooks. Before setting up webhook alerts, make sure you’ve enabled two-factor authentication (2FA) on your TradingView account.

To create an alert, open the chart for your strategy and click Create Alert. Define the trigger condition, such as a moving average crossover or a breakout above a resistance level. The Frequency setting lets you choose whether the alert triggers just once or every time the condition is met.

In the Message field, include only the command payload needed by NinjaTrader. Delete all default text from TradingView in this field. For strategy-based alerts, you can use dynamic variables like {{strategy.order.action}} and {{strategy.order.contracts}} to automatically fill in order details. For example, your alert message might look like this:

{"action":"BUY","quantity":1,"instrument":"NQ 03-26"}

TradingView processes alerts on its servers, so they’ll still work even if you’re logged out. However, webhook requests will fail if the receiving server takes longer than three seconds to respond. Also, TradingView only supports ports 80 and 443 for webhook URLs.

"If the alert message is valid JSON, the request will include an 'application/json' content-type header. Otherwise, the request will use 'text/plain' as a content-type header." - TradingView

"If the alert message is valid JSON, the request will include an 'application/json' content-type header. Otherwise, the request will use 'text/plain' as a content-type header." - TradingView

Once your alerts are set up, the next step is to configure NinjaTrader to process and execute those signals.

Configuring NinjaTrader for Order Execution

To prepare NinjaTrader 8, start by enabling Multi-Provider Mode. Go to Tools > Options > General, enable the setting, and restart the platform. Then, add your broker connection under Connections > Configure. This setup allows NinjaTrader to manage multiple broker accounts simultaneously, which is essential if you’re handling several funded accounts.

You’ll also need an add-on to bridge TradingView webhooks with NinjaTrader. Replikanto takes care of trade replication once orders reach NinjaTrader, but middleware is required to translate TradingView alerts into NinjaTrader-compatible orders. If you’re planning to use One-Cancels-the-Other (OCO) orders directly from TradingView, make sure you’re running Replikanto version 1.5 or later.

For users with strict network security, it’s important to allowlist TradingView’s IP addresses (52.89.214.238, 34.212.75.30, 54.218.53.128, and 52.32.178.7) to ensure webhook requests aren’t blocked.

Once NinjaTrader is set up, it’s time to test the entire workflow to confirm everything is functioning as expected.

Testing Your Signal-to-Order Workflow

Before going live, test your setup using NinjaTrader’s Sim101 account. Start with a simple market long order (quantity: 1). Once that works, you can move on to more advanced order types.

Ensure that the symbol formatting in TradingView matches the format used by your broker. Conduct tests during active market hours to see how latency and discrepancies in price feeds between TradingView and your broker might impact order execution. This is particularly important for maintaining low latency during high-volatility events.

To verify your webhook setup, use a Payload Test Page or a webhook generator to manually send HTTP POST requests to your webhook URL. This step ensures the connection is stable before relying on automated alerts. Also, double-check your JSON formatting - if it’s incorrect, TradingView will send the message as "text/plain" instead of "application/json", which could cause errors.

When using Replikanto, keep the NinjaTrader Desktop application open so you can monitor the Positions and Orders tabs in real time. This ensures trades from the leader account are captured and replicated to follower accounts with minimal delay.

Installing and Configuring Replikanto

Once TradingView and NinjaTrader are set up, the next step is getting Replikanto ready to replicate your trades. Replikanto operates as a NinjaScript add-on within NinjaTrader 8. To use it, you'll need version 8.1.6.0 or later running on Windows 10, 11, or Windows Server 2016 or newer. If you're on a Mac, you'll need to use a virtual machine or emulator to run NinjaTrader and Replikanto. After installation, configure your master and follower accounts to start trade replication.

Installing Replikanto in NinjaTrader

Begin by downloading the Replikanto add-on file. Open NinjaTrader 8, navigate to Tools > Import > NinjaScript Add-on, and select the file you downloaded. Once the import is complete, restart NinjaTrader to activate Replikanto. You can then access it via Tools > Replikanto in the Control Center.

Setting Up Master and Follower Accounts

Before configuring Replikanto, make sure all your accounts are connected in NinjaTrader. Replikanto automatically detects accounts that are already active on the platform. If you're using multiple broker connections (like Tradovate and Rithmic), you'll need to enable Multi-Provider Mode by going to Tools > Options > General, checking the box, and restarting NinjaTrader.

To configure Replikanto, open it from the Tools menu. Designate your master account - this is where trades will originate. Then, add your follower accounts, which will receive the replicated trades. You can choose from several allocation methods:

- Exact Quantity: Copies the same number of contracts.

- Ratio: Adjusts the trade size based on account size.

- Net Liquidation: Allocates trades based on account equity.

For accounts using different contract sizes, Replikanto supports Cross Orders. For example, a single ES contract in the master account can automatically replicate as a MES contract in a follower account.

"Replikanto has greatly improved my mindset when trading multiple accounts... I simply enter and let Replikanto do its thing. When copied across multiple accounts, those base hits add up quickly!" - Benjamin Steiner, Business Owner

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

"Replikanto has greatly improved my mindset when trading multiple accounts... I simply enter and let Replikanto do its thing. When copied across multiple accounts, those base hits add up quickly!" - Benjamin Steiner, Business Owner

If you’re handling multiple instruments, open a separate Replikanto window or tab for each symbol. For OCO (One Cancels the Other) orders from TradingView, ensure you're using Replikanto version 1.5 or later, as earlier versions don’t support this feature.

Testing Trade Copying

Before diving into live trading, test Replikanto with small trades - like a single micro contract - on the master account. Place a test order and check the Replikanto interface to confirm it replicates across all follower accounts. During testing, monitor the Positions and Orders tabs, especially if you’re triggering trades from TradingView.

Pay close attention to fill prices between the master and follower accounts. Some variation is normal due to market conditions and network latency, but testing helps you get a sense of expected slippage. If trades aren’t replicating, double-check that Replikanto is running and that all accounts are correctly connected in NinjaTrader.

Sending Trades from TradingView to NinjaTrader

Complete Workflow: TradingView to NinjaTrader to Replikanto

To send trades from TradingView to NinjaTrader, you'll need a linked Tradovate account. Here's how it works: TradingView places trades on a Tradovate account, which must then be connected to NinjaTrader Desktop. From there, Replikanto captures these trades in the NinjaTrader environment and replicates them to your follower accounts.

The process begins by creating an alert in TradingView with your desired entry conditions. Once the alert triggers, TradingView sends a webhook (an HTTP POST request) to an execution service, which places the order in your Tradovate account. Since this account is linked to NinjaTrader Desktop, the trade appears there, and Replikanto takes over to copy it across follower accounts.

Keep in mind that your webhook URL must use port 80 or 443; TradingView won't accept requests to other ports. For everything to function smoothly, the Tradovate account receiving the signals must be set as the Leader account in Replikanto. Additionally, ensure your TradingView alert messages use valid JSON syntax (e.g., {"action": "buy", "quantity": 1}) to maintain compatibility with most execution services.

Understanding this workflow is essential for troubleshooting and optimizing your setup, as discussed in the next section. A well-configured workflow ensures smooth trade execution and replication.

Fixing Common Problems

Several common issues can disrupt the TradingView-to-NinjaTrader workflow. For example, order mismatches often happen if the Tradovate account isn't correctly designated as the Leader in Replikanto or isn't properly connected to NinjaTrader Desktop. Always double-check these connections before diving deeper into troubleshooting.

Another challenge is network latency or market volatility, which can cause follower accounts to fill orders at slightly different prices. While minor variations are normal, using a high-performance VPS to run NinjaTrader and Replikanto can help minimize delays. If webhook alerts fail entirely, check that TradingView's IP addresses (52.89.214.238, 34.212.75.30, 54.218.53.128, 52.32.178.7) are allowlisted in your firewall.

Webhook timeouts are another potential issue. These occur when the execution service takes more than three seconds to respond, causing the alert to cancel. This is often a sign of server overload or connectivity problems.

For those using OCO (One Cancels the Other) orders in TradingView, ensure you're running Replikanto version 1.5 or later, as earlier versions don't support this feature. During live trading, it's a good idea to monitor follower accounts in NinjaTrader Desktop to catch any discrepancies early.

Expanding to Multiple Accounts

Before scaling up, start with a single follower account to ensure the entire workflow functions as expected. Once you're confident that trades replicate accurately and fill prices are within acceptable ranges, you can gradually add more follower accounts. This step-by-step approach makes it easier to pinpoint and resolve account-specific issues.

If you're managing multiple prop firm accounts, especially those using Rithmic or Tradovate, link each account as a follower in the Replikanto interface. You can customize allocation methods for each follower account - some might use exact quantity matching, while others rely on ratio-based or net liquidation allocation, depending on account size and risk preferences.

For traders handling five or more accounts, system performance becomes a critical factor. Both NinjaTrader and Replikanto require significant resources when managing multiple connections. Using a dedicated Windows VPS with ample CPU and RAM helps prevent lag during high-volume trading periods. To optimize performance, keep chart usage on the VPS to a minimum, reserving resources for order execution and replication.

Next, we'll explore how using QuantVPS can enhance system reliability and improve execution speed.

Running NinjaTrader and Replikanto on QuantVPS

Why Use a VPS for Futures Trading

Relying on a home computer for trading can be risky. Power outages, internet disruptions, or unexpected system updates could interfere with critical trade execution. Since NinjaTrader and Replikanto are Windows-based tools, traders using Mac or mobile devices with TradingView need a reliable Windows environment to complete their trading workflow seamlessly.

A Virtual Private Server (VPS) solves these issues by keeping your trading setup online and running 24/7, completely independent of your local machine. Another key benefit is reducing network latency. Delays between your computer and the broker can lead to price mismatches between leader and follower accounts, especially during volatile market conditions. QuantVPS tackles this problem by hosting servers in Chicago, just 0.52 milliseconds away from the CME Group's matching engines. For context, professional trading tools average about 34 milliseconds for order instructions. When trading fast-moving futures like ES or NQ, every millisecond matters.

"Latency and slippage can turn a winning NinjaTrader strategy into a losing one." - QuantVPS

"Latency and slippage can turn a winning NinjaTrader strategy into a losing one." - QuantVPS

In addition to speed, VPS setups offer enterprise-grade hardware, DDoS protection, and automated backups. These features safeguard your NinjaTrader configurations, including workspaces, indicators, and templates. For traders managing multiple prop firm accounts through Replikanto, this robust infrastructure minimizes the risk of platform freezes during high-volatility events such as Non-Farm Payroll releases.

Now, let’s explore how to set up NinjaTrader and Replikanto on QuantVPS.

Setting Up NinjaTrader and Replikanto on QuantVPS

Once you’ve chosen a QuantVPS plan that fits your trading needs, you’ll receive Remote Desktop Protocol (RDP) credentials to access your Windows Server 2022 environment. Use the built-in Remote Desktop Connection tool on Windows or download Microsoft Remote Desktop for Mac to log in. After accessing the VPS, install NinjaTrader 8 directly on the server, then add Replikanto through NinjaTrader’s Control Center.

To get started, link your Tradovate account to NinjaTrader, as Replikanto requires this connection and cannot directly integrate with Tradovate. If you’re using multiple broker connections (like Tradovate and Rithmic), enable "Multi-provider" mode by navigating to Tools > Options > General in NinjaTrader. This setting ensures Replikanto can detect all leader and follower accounts across various brokers.

"Your QuantVPS server runs 24/7 independently in our secure datacenter, keeping your futures platform and bots active even when your home computer is off." - QuantVPS

"Your QuantVPS server runs 24/7 independently in our secure datacenter, keeping your futures platform and bots active even when your home computer is off." - QuantVPS

After setting up your accounts, keep NinjaTrader running on the VPS so that Replikanto can replicate trades in real time. Test the system by placing a small trade in your leader account and verifying that it’s copied correctly to follower accounts with the proper allocation. This configuration ensures smooth integration between TradingView alerts, NinjaTrader executions, and Replikanto’s trade replication.

Improving VPS Performance

A strong VPS foundation is just the start - optimizing performance is essential for efficient trading. resource management is key, especially when copying trades across multiple accounts. Instead of overloading a single instance of Replikanto, open a new window or tab for each symbol being copied.

Choose a QuantVPS plan that aligns with your trading intensity. For example:

- VPS Lite (4 cores, 8GB RAM): Ideal for 1–2 charts.

- VPS Pro (6 cores, 16GB RAM): Suitable for 3–5 charts.

- VPS Ultra (24 cores, 64GB RAM) or Dedicated Server: Perfect for handling five or more follower accounts with multiple strategies [website].

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

To conserve VPS resources, monitor charts on your local device and reserve the VPS for execution tasks. Even with automation, it’s a good idea to periodically check follower accounts within NinjaTrader to ensure everything stays in sync. Additionally, when setting up TradingView webhooks, avoid including sensitive login details in the webhook body to maintain security.

Best Practices and Risk Management

Daily Operating Guidelines

To keep the TradingView–NinjaTrader connection running smoothly, stick to these daily practices. First, NinjaTrader must remain open on your Windows PC or VPS for Replikanto to work properly. Before diving into live trading, test your setup using NinjaTrader's "Sim101" simulation account to ensure everything is functioning as expected.

One common hurdle is symbol mapping. This process, explained in detail in the Testing section, ensures that TradingView symbols match NinjaTrader's contract expirations. Start with basic market orders to confirm the connection works before moving on to more advanced orders like limit or stop-limit.

Also, make sure you’ve enabled 2-factor authentication (2FA) on your TradingView account. This step is essential for webhook alerts to operate correctly.

Managing Risk Across Multiple Accounts

Effective risk management is just as important as smooth execution, especially when handling multiple accounts. Be prepared for minor differences in fill prices between leader and follower accounts due to market conditions and network latency. If you're working with accounts from different brokers, such as Tradovate and Rithmic, activate "Multi-provider" mode in NinjaTrader by navigating to Tools > Options > General and restarting the platform.

For traders using Replikanto version 1.5 or later, OCO (One Cancels Other) orders triggered through TradingView are fully supported. High-impact news events, like Non-Farm Payroll releases, can strain your system. Using a VPS for NinjaTrader during these times ensures your platform remains responsive, even when local PCs might struggle with heavy data loads.

Monitoring and Maintenance

Keeping a close eye on your system is key to catching any issues early. Use the NinjaTrader Desktop interface to monitor follower accounts while trades are active. This helps identify and resolve any synchronization problems quickly. If you adjust indicator settings in TradingView, remember to recreate the alert - otherwise, it will still trigger based on the previous configuration.

Maintenance is equally important. Regularly back up your NinjaTrader workspaces, indicators, and Replikanto settings. Services like QuantVPS offer automated backup solutions to safeguard your data from unexpected losses.

Conclusion

Bringing together TradingView's advanced charting tools with NinjaTrader's execution capabilities through Replikanto creates a streamlined trading process. This setup combines TradingView's analytical strength, NinjaTrader's professional-grade order execution, and Replikanto's ability to mirror trades across multiple accounts - including setups for prop firms like Apex, TopStep, and Earn2Trade.

To recap the workflow: TradingView generates the trading signals, but those orders must first route through NinjaTrader before Replikanto can replicate them to follower accounts. As FlowBots explains:

"By using this setup, you can leverage TradingView's charting and analysis tools while still having your trades managed by the Replikanto copier on NinjaTrader".

"By using this setup, you can leverage TradingView's charting and analysis tools while still having your trades managed by the Replikanto copier on NinjaTrader".

Proper configuration is critical. Activating Multi-Provider Mode, using Replikanto version 1.5 or later for OCO order support, and securing TradingView webhooks with two-factor authentication all play a role in ensuring smooth trade execution. Even minor errors in setup can cause missed orders, especially in fast-moving markets. The reliability of this system hinges on meticulous attention to these details.

Additionally, reducing latency and maintaining constant uptime are vital for staying competitive in volatile markets. Hosting your system on QuantVPS provides 24/7 uptime and ultra-low latency, ensuring uninterrupted connectivity during critical trading moments. Since TradingView cancels webhook requests that take longer than three seconds to process, using a dedicated VPS becomes essential for automated execution.

With everything properly configured, this system allows you to trade from anywhere while NinjaTrader and Replikanto handle the execution process effortlessly.

FAQs

How can I set up TradingView alerts to work with NinjaTrader using Replikanto?

To set up your TradingView alerts for seamless execution in NinjaTrader using Replikanto, follow these steps:

- Set Up Alerts in TradingView: On your TradingView chart, create alerts with clear and specific conditions, like crossovers or strategy signals. Format the alert message consistently, such as BUY 1 ES Mar2026, to ensure the execution logic can interpret it without errors.

- Enable Webhook Integration: In TradingView, activate the webhook option and provide the correct endpoint URL. Make sure the alert message contains all necessary details, including the action (e.g., BUY or SELL), contract size, ticker symbol, and expiration date.

- Match Symbols Between Platforms: Confirm that TradingView's symbols align with NinjaTrader's ticker format (e.g., ES in TradingView should correspond to ES MAR26 in NinjaTrader). Test the setup with a small trade to ensure the alert triggers properly and Replikanto accurately mirrors the order to follower accounts.

By sticking to a consistent alert format and testing your setup, you can ensure smooth and reliable communication between TradingView and NinjaTrader for automated trading.

What are the advantages of using a VPS like QuantVPS for running NinjaTrader and Replikanto?

Using a VPS like QuantVPS guarantees round-the-clock uptime and exceptionally low latency, making it perfect for running platforms like NinjaTrader and Replikanto without a hitch. With cutting-edge hardware, CME latency as fast as ≈1 ms, and strong DDoS protection, your trades can execute with greater speed and reliability.

A VPS also solves common problems like interruptions from local PC issues - think power outages, Wi-Fi drops, or unexpected updates. Plus, it allows you to manage multiple accounts simultaneously on a stable, high-speed server. This reliability is especially crucial for fast-paced markets such as ES, NQ, or CL.

How do I fix common issues when connecting TradingView to NinjaTrader using Replikanto?

To troubleshoot connectivity issues between TradingView and NinjaTrader via Replikanto, start by ensuring all components are functioning correctly. Make sure NinjaTrader 8 is open, Replikanto is launched (Tools → Replikanto), and the proper master account is selected. If trades aren’t being mirrored, a quick restart of Replikanto often resolves the problem. Additionally, double-check that your TradingView webhook is active and that alert messages use a straightforward, consistent format (e.g., BUY 1 ES March 2026) for seamless execution.

If follower accounts experience delays, high CPU or RAM usage on your computer might be the culprit. Running NinjaTrader and Replikanto on a low-latency VPS can stabilize performance and sidestep local network issues. For symbol-mapping problems, review Replikanto’s settings to confirm that master and follower symbols are paired correctly. Partial fills might occur due to market liquidity - consider adjusting allocation sizes or implementing risk-based scaling to address this.

When issues persist, try placing a small test trade in simulation mode and examine the Replikanto log for errors. Ensure your system has sufficient resources, and confirm that necessary ports (80/443) are open to support TradingView webhooks. By systematically addressing these areas, most connectivity and performance challenges can be resolved effectively.

To set up your TradingView alerts for seamless execution in NinjaTrader using Replikanto, follow these steps:

- Set Up Alerts in TradingView: On your TradingView chart, create alerts with clear and specific conditions, like crossovers or strategy signals. Format the alert message consistently, such as BUY 1 ES Mar2026, to ensure the execution logic can interpret it without errors.

- Enable Webhook Integration: In TradingView, activate the webhook option and provide the correct endpoint URL. Make sure the alert message contains all necessary details, including the action (e.g., BUY or SELL), contract size, ticker symbol, and expiration date.

- Match Symbols Between Platforms: Confirm that TradingView's symbols align with NinjaTrader's ticker format (e.g., ES in TradingView should correspond to ES MAR26 in NinjaTrader). Test the setup with a small trade to ensure the alert triggers properly and Replikanto accurately mirrors the order to follower accounts.

By sticking to a consistent alert format and testing your setup, you can ensure smooth and reliable communication between TradingView and NinjaTrader for automated trading.

Using a VPS like QuantVPS guarantees round-the-clock uptime and exceptionally low latency, making it perfect for running platforms like NinjaTrader and Replikanto without a hitch. With cutting-edge hardware, CME latency as fast as ≈1 ms, and strong DDoS protection, your trades can execute with greater speed and reliability.

A VPS also solves common problems like interruptions from local PC issues - think power outages, Wi-Fi drops, or unexpected updates. Plus, it allows you to manage multiple accounts simultaneously on a stable, high-speed server. This reliability is especially crucial for fast-paced markets such as ES, NQ, or CL.

To troubleshoot connectivity issues between TradingView and NinjaTrader via Replikanto, start by ensuring all components are functioning correctly. Make sure NinjaTrader 8 is open, Replikanto is launched (Tools → Replikanto), and the proper master account is selected. If trades aren’t being mirrored, a quick restart of Replikanto often resolves the problem. Additionally, double-check that your TradingView webhook is active and that alert messages use a straightforward, consistent format (e.g., BUY 1 ES March 2026) for seamless execution.

If follower accounts experience delays, high CPU or RAM usage on your computer might be the culprit. Running NinjaTrader and Replikanto on a low-latency VPS can stabilize performance and sidestep local network issues. For symbol-mapping problems, review Replikanto’s settings to confirm that master and follower symbols are paired correctly. Partial fills might occur due to market liquidity - consider adjusting allocation sizes or implementing risk-based scaling to address this.

When issues persist, try placing a small test trade in simulation mode and examine the Replikanto log for errors. Ensure your system has sufficient resources, and confirm that necessary ports (80/443) are open to support TradingView webhooks. By systematically addressing these areas, most connectivity and performance challenges can be resolved effectively.

"}}]}