How to Forward Test a Trading Algo Before Going Live

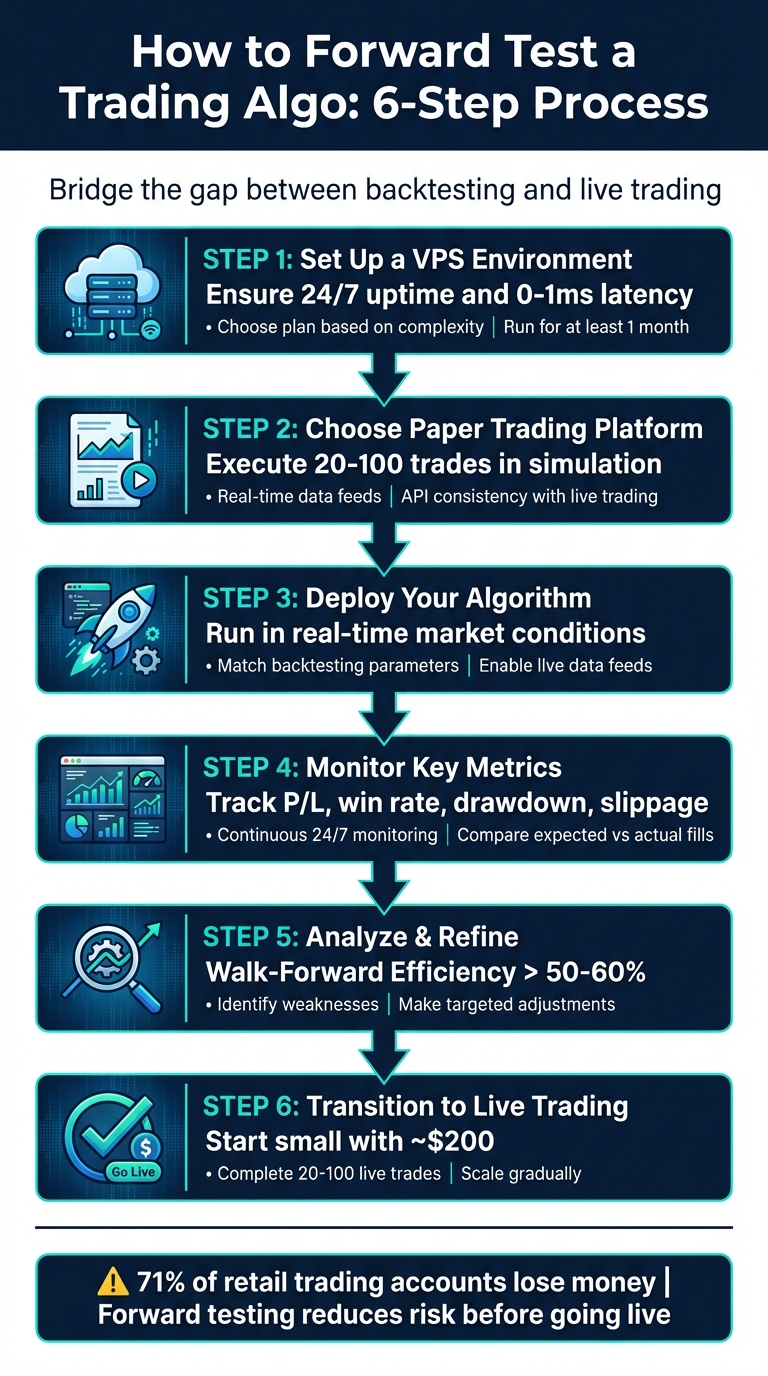

Forward testing is the step where you test your trading algorithm in live market conditions without risking real money. Unlike backtesting, which uses historical data, forward testing exposes your strategy to real-time price feeds, spreads, slippage, and volatility. Here's a quick breakdown of the process:

- Set up a VPS: Use a Virtual Private Server (like QuantVPS) for stable, uninterrupted testing.

- Choose one of the top algo trading platforms: Select platforms like NinjaTrader or Alpaca that simulate live trading conditions.

- Deploy your algorithm using algorithmic trading tools: Run your strategy in real-time, ensuring it matches your backtesting setup.

- Monitor performance metrics: Track profit-loss ratio, win rate, drawdown, slippage, and fees to evaluate results.

- Refine your strategy: Use insights to make targeted adjustments and validate improvements.

- Transition to live trading: Start small with real money to confirm the strategy works under actual market conditions.

Forward testing bridges the gap between theoretical results and live trading challenges, helping you refine and prepare your strategy before risking real capital.

6-Step Forward Testing Process for Trading Algorithms

6-Step Forward Testing Process for Trading Algorithms

Step 1: Set Up a VPS Environment with QuantVPS

Why VPS Is Necessary for Forward Testing

Using a personal computer for forward testing comes with risks like power outages, internet interruptions, and inconsistent performance. A Virtual Private Server (VPS) eliminates these issues, offering a stable and reliable environment that mirrors real-market conditions. With a VPS, you get consistent connectivity and performance 24/7.

QuantVPS, in particular, delivers ultra-low latency (0–1ms), ensuring accurate fill prices and execution speeds. In contrast, home internet connections often experience delays, which can lead to overly optimistic testing results.

Key Features of QuantVPS for Trading Algorithms

QuantVPS is specifically designed for algorithmic trading, providing an infrastructure capable of handling real-time market data and executing orders swiftly. It uses NVMe storage for lightning-fast data access, which is crucial for algorithms that need to process complex calculations quickly. On top of that, QuantVPS offers a 100% uptime guarantee and built-in DDoS protection, ensuring your forward testing runs smoothly and securely.

Another advantage is its compatibility with major trading platforms like NinjaTrader, MetaTrader, and TradeStation. This allows you to test your strategies in the same environment you'll use for live trading. Why does this matter? Because backtested strategies often deliver only 60–75% of their projected returns when moved to forward testing. Testing on the same infrastructure helps narrow this gap, providing a more accurate assessment of your strategy's performance.

Select the Right QuantVPS Plan

Choosing the right VPS plan depends on the complexity of your trading algorithm. For simpler strategies, the VPS Lite plan (4 cores, 8GB RAM, 70GB NVMe) is a good fit at $59.99 per month - or $41.99 per month if billed annually. If you're running complex, multi-chart setups, the VPS Ultra plan (24 cores, 64GB RAM, 500GB NVMe) offers the power you need at $189.99 per month - or $132.99 per month with an annual subscription.

To ensure reliable results, let your algorithm run on the VPS for at least one month. This timeframe allows you to capture market cycles and verify uninterrupted performance.

Once your VPS is set up and running smoothly, the next step is selecting a paper trading platform for realistic simulation.

Forward Testing Your Trading Strategy

Step 2: Choose Paper Trading Platforms and Demo Accounts

Once your VPS environment is ready, the next step is to simulate live trading conditions using a solid paper trading platform.

The Role of Paper Trading in Forward Testing

Paper trading acts as a bridge between theoretical backtesting and strategy optimization and actual live trading. It allows your algorithm to operate under real-time, evolving market conditions, uncovering potential issues like unfilled orders, sudden price changes, network interruptions, or the need for retry logic. Beyond these technical challenges, paper trading also factors in real-world frictions like slippage, bid-ask spreads, commissions, and overnight swap fees - elements that can significantly impact returns if overlooked during testing.

As Alpaca Markets explains:

"Paper trading provides a good approximation for what one might expect in real trading, but it is not a substitute for real trading and performance may differ".

"Paper trading provides a good approximation for what one might expect in real trading, but it is not a substitute for real trading and performance may differ".

To ensure your algorithm is ready for live trading, aim to execute between 20 and 100 trades in the paper trading environment. This range helps evaluate its performance under various market conditions.

Key Factors for Platform Selection

When selecting a paper trading platform, look for one that integrates seamlessly with QuantVPS and closely mimics live trading conditions. QuantVPS supports platforms like NinjaTrader, TradeStation, MetaTrader 4/5, Quantower, MultiCharts, Tradovate, and TradingView. Ensure the platform offers a Windows desktop application or compatible API client to work with these systems.

Real-time data integration is critical. The platform must provide live data feeds to simulate current market conditions accurately. For instance, Alpaca offers free real-time market data from IEX for its paper trading accounts, while QuantConnect’s Paper Brokerage Model includes $100,000 in fictional capital for testing.

Another crucial feature is API consistency. Your paper trading API should match the live API, allowing for an easy transition to live trading by simply swapping the API key and endpoint. For example, Alpaca uses a dedicated paper endpoint, "https://paper-api.alpaca.markets", separate from its live trading endpoint.

Look for platforms that offer high-quality execution simulations. These should simulate realistic order fills based on actual market quotes rather than theoretical prices. Platforms with customizable brokerage models can enhance testing by allowing you to set fees, margins, and asset classes for brokers like Interactive Brokers or OANDA. Some platforms even let you reset account balances or create multiple paper accounts for more flexibility.

Lastly, ensure the platform aligns with your algorithm's programming language. For example, TradeStation is ideal for EasyLanguage scripts, while platforms like QuantConnect and Alpaca are better suited for Python, C#, or C++ algorithms.

Step 3: Deploy Your Algorithm for Real-Time Simulation

Prepare Your Algorithm for Deployment

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

To get your algorithm ready for real-time simulation, integrate it using the platform's scripting language, such as Pine Script, EasyLanguage, or MQL4/MQL5.

Make sure the algorithm's parameters - like entry and exit criteria, stop-loss, take-profit, and position sizing - match those of your paper account. For example, if you're simulating with $10,000 in capital and 2:1 leverage, these settings should align exactly. Any mismatch can lead to inaccurate results.

Switch your API from backtesting mode to paper mode. For instance, if you're using Alpaca, update the base URL to "https://paper-api.alpaca.markets". Then, set your algorithm to live mode to enable automatic order placements.

Add a warm-up function to preload historical data into your indicators. Use minute- or tick-level resolution for precise order timing, ensuring the simulation reflects real-world conditions.

Simulate Live Market Conditions

Connect your algorithm to a real-time data feed from your broker or platform. This step is what distinguishes forward testing from backtesting. Unlike backtesting, forward testing processes live market dynamics, including price fluctuations, news events, and volatility as they unfold. For example, QuantConnect and Alpaca provide real-time IEX market data for paper accounts, while TradeStation offers free real-time data for non-professional traders.

Consider deploying your algorithm on a service like QuantVPS to ensure 24/7 uninterrupted connectivity. Set up logging functions to track the internal states and variables of your algorithm. This helps you analyze why certain trades were executed - or why they weren't. Additionally, configure automated alerts via email or SMS for order events. This way, you can monitor performance without staying glued to your screen.

As William Eckhardt wisely stated in New Market Wizards:

"In general, the delicate tests that statisticians use to squeeze significance out of marginal data have no place in trading, we need blunt statistical instruments, robust techniques".

"In general, the delicate tests that statisticians use to squeeze significance out of marginal data have no place in trading, we need blunt statistical instruments, robust techniques".

Your simulation must also account for real-world trading frictions. These include slippage, bid-ask spreads, commissions, swap fees for overnight positions, and the potential for unfilled orders. Many platforms even simulate partial fills about 10% of the time to mimic real market liquidity constraints.

Run your algorithm long enough to collect meaningful data. Aim for a sample size of 20 to 100 trades during forward testing. This range allows you to account for market variability and evaluate how your strategy performs under different conditions. Resist the urge to adjust your algorithm's rules mid-test after a few losses - doing so compromises the integrity of your data.

Once you've logged detailed order events and completed 20 to 100 trades, you'll have a solid foundation to analyze performance metrics in the next step.

Step 4: Monitor Key Performance Metrics During Testing

Key Metrics for Forward Testing

Once you've completed a sufficient number of trades, it's time to focus on tracking key metrics. Start with your profit–loss ratio to determine if you're consistently profitable after accounting for fees. Then, look at your win rate to understand whether your success comes from frequent small wins or a few larger gains.

Another critical metric is drawdown, which measures the largest decline in your equity curve from a peak to a trough. This helps gauge how much capital you could potentially lose before recovering. As IG International emphasizes:

"Past results are never a fool-proof indicator of future performance. Rather, it's part of doing your due diligence before opening a position".

"Past results are never a fool-proof indicator of future performance. Rather, it's part of doing your due diligence before opening a position".

You’ll also want to keep a close eye on slippage and fill rates, which measure the gap between your expected execution price and the actual price. Additionally, monitor trading and swap fees for overnight positions, as these recurring costs can erode your profitability, even if your strategy appears sound on paper. It's worth noting that about 71% of retail client accounts lose money when trading CFDs, highlighting the importance of rigorous metric tracking.

Regularly assessing these metrics in a stable environment is essential to ensure reliable testing results.

Use QuantVPS for Continuous Monitoring

To effectively monitor these metrics, having a dependable VPS framework is key. QuantVPS offers 24/7 connectivity, enabling uninterrupted performance tracking. Given that automated trading now accounts for around 70% of all financial market activity - and up to 80% in equities - a reliable VPS is indispensable for maintaining accurate data collection.

QuantVPS allows for a testing period of at least one month, which is crucial for observing how your strategy performs across various market conditions. This extended timeframe helps you identify whether deviations are caused by the algorithm itself or external factors like latency-related slippage. By maintaining a parallel trading journal on your VPS, you can compare the expected fills from your algorithm with the actual fills, pinpointing any execution gaps that could affect your bottom line.

This continuous monitoring provides a solid foundation for analyzing your results and fine-tuning your strategy in the next phase.

Step 5: Analyze Results and Refine Your Strategy

Identify Strengths and Weaknesses

Once you've collected enough data, it's time to compare your forward test results with backtesting outcomes. This comparison can reveal whether your algorithm is genuinely identifying market patterns or if it was simply overfitted to historical noise. Focus on key metrics like profit factor, maximum drawdown, and win rate to gauge performance.

One critical aspect to consider is execution. Backtesting often overlooks real-world factors, so your forward test should validate these execution details. For instance, if your profit factor during live simulation is significantly lower than in backtesting, it could point to hidden costs like slippage or latency.

A helpful tool for spotting weaknesses is Walk-Forward Efficiency (WFE). This metric evaluates how well your optimized strategy performs on new data. A WFE score above 50–60% generally indicates a solid, reliable algorithm, while a lower score might signal overfitting to historical data.

| Metric | Purpose in Analysis | Robustness Indicator |

|---|---|---|

| Walk-Forward Efficiency (WFE) | Assesses how optimization translates to live data | > 50–60% indicates a robust strategy |

| Maximum Drawdown | Measures the largest peak-to-trough decline | Consistency across timeframes suggests stability |

| Profit Factor | Ratio of gross profit to gross loss | Stability across market conditions |

Refine the Algorithm Through Iteration

After identifying areas for improvement, focus on making targeted adjustments rather than completely overhauling your strategy. For example, you might refine stop-loss levels, entry conditions, or position sizing based on observed discrepancies in execution.

If forward testing highlights excessive slippage with market orders, you could switch to limit orders with adjusted entry triggers. Keep the number of parameters in your strategy to a minimum - ideally three or four - to reduce the risk of overfitting. This is especially important if your algorithm struggles in sideways markets but excels in trending ones.

Following significant changes, re-run backtests before conducting another forward test. This iterative process ensures that your refinements improve the strategy's performance without merely adapting to recent market quirks. Additionally, monitor the gap between expected and actual execution prices to set realistic profit expectations. Using Monte Carlo simulations can also help you stress-test your updated parameters across a variety of market conditions.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

These refinements will help you prepare your strategy for live trading, ensuring it’s as effective and reliable as possible.

Step 6: Transition to Live Trading on QuantVPS

Reduce Risks During Transition

After achieving consistent results in forward testing, it's time to move to live trading. Start small - around $200 - to test your strategy in real-world conditions. This lets you evaluate how well your algorithm handles actual execution costs like slippage and swap fees without risking significant capital. Aim to complete 20 to 100 live trades before deciding to scale up. This trial phase helps confirm that your algorithm can deliver consistent results when real money is on the line, giving you the confidence to increase your position sizes gradually.

Use QuantVPS for Live Trading

Once you're ready for live trading, QuantVPS makes the deployment process smooth and efficient. Begin by connecting your brokerage account - enter your credentials, configure data providers, and select your QuantVPS instance for continuous operation. To ensure uninterrupted trading, enable the "Automatic Restart" feature, which helps your algorithm recover from temporary API disconnections. The setup process typically takes about 5 minutes.

After deployment, double-check that your brokerage positions, cashbook holdings, and equity values are correctly reflected in the live results interface. Avoid placing manual trades in the same account during live trading to prevent conflicts or race conditions. If you need to tweak your strategy, use the "Schedule Event" function to make adjustments remotely without disrupting operations. And for emergencies, the "Liquidate" button allows you to instantly close all positions and halt trading.

Conclusion

Forward testing serves as the bridge between backtesting results and the unpredictable reality of live markets. Unlike historical simulations, this phase exposes you to real-time hurdles like slippage, bid-ask spreads, unfilled orders, and trading fees - elements that can significantly impact your strategy's performance. It also helps you develop the psychological resilience required for live trading.

Once forward testing is complete, the next step is carefully transitioning to live trading. Testing your strategy with a sample of 20–100 trades in real-time conditions ensures its viability. Starting small - say, with $200 - allows you to evaluate execution performance in live markets while keeping financial risk manageable.

QuantVPS plays a pivotal role in this process. With its round-the-clock operational stability and low-latency execution, it ensures your algorithm performs consistently. Using the same VPS setup for both forward testing and live trading reduces discrepancies in execution speed and other technical factors, creating a smoother transition into live trading.

It’s important to note that about 71% of retail trading accounts lose money when dealing with complex instruments. By incorporating a dependable infrastructure like QuantVPS during forward testing, you can better prepare for the challenges of live markets and reduce the risks tied to real-world trading frictions.

FAQs

Why do you need a VPS for forward testing a trading algorithm?

Using a VPS for forward testing is essential because it offers a reliable, always-on environment for your trading algorithm. Unlike personal devices, which are prone to power outages, hardware issues, or internet interruptions, a VPS ensures your algorithm operates smoothly and experiences uninterrupted real-market conditions.

Another key advantage is the low-latency connection a VPS provides. This reduces delays in trade execution, giving you a more accurate picture of how your strategy performs. With this dependable setup, you can fine-tune your approach before deploying it in live trading.

What’s the difference between paper trading, backtesting, and live trading?

Paper trading, backtesting, and live trading each play a distinct role in refining and testing a trading algorithm.

Backtesting involves analyzing historical market data to see how a strategy would have performed in the past. It’s a great way to uncover potential strengths and weaknesses in your approach. However, it doesn’t reflect real-time factors like latency or the complexities of order execution, which are critical in live markets.

Paper trading, on the other hand, takes things a step further by simulating trades in a live market environment using real-time price data - but without risking actual money. This method lets you see how your algorithm handles real-world conditions, such as price changes, delays, or partial order fills, all while keeping your wallet safe.

Finally, live trading is where the strategy faces its ultimate challenge. Here, trades are executed with real money, exposing the algorithm to practical hurdles like slippage, execution costs, and potential order rejections.

These steps create a natural progression: start with historical testing through backtesting, move to real-time simulations with paper trading, and culminate with live trading to see how your strategy performs in the real world.

What performance metrics should I track while forward testing a trading algorithm?

When testing a trading algorithm in live market conditions, keeping an eye on critical performance metrics is essential to evaluate how well it’s working. Here are some key metrics to focus on:

- Profit and Loss (P&L): This shows how much profit (or loss) the algorithm generates over time. It’s a straightforward way to see if the results match your expectations.

- Win Rate: This metric tracks the percentage of successful trades. A higher win rate often indicates a more consistent strategy.

- Drawdown: This measures the largest drop in your account balance, giving you insight into the risks involved and whether they’re within your comfort zone.

- Sharpe Ratio: By looking at the risk-adjusted return, this metric helps you determine if the returns justify the level of risk the algorithm is taking.

- Execution Metrics: Factors like slippage, latency, and order fill rates are crucial to ensure the algorithm performs smoothly in real-time trading.

By routinely analyzing these metrics, you can fine-tune your strategy, address any weaknesses, and build confidence before fully committing to live trading.

Using a VPS for forward testing is essential because it offers a reliable, always-on environment for your trading algorithm. Unlike personal devices, which are prone to power outages, hardware issues, or internet interruptions, a VPS ensures your algorithm operates smoothly and experiences uninterrupted real-market conditions.

Another key advantage is the low-latency connection a VPS provides. This reduces delays in trade execution, giving you a more accurate picture of how your strategy performs. With this dependable setup, you can fine-tune your approach before deploying it in live trading.

Paper trading, backtesting, and live trading each play a distinct role in refining and testing a trading algorithm.

Backtesting involves analyzing historical market data to see how a strategy would have performed in the past. It’s a great way to uncover potential strengths and weaknesses in your approach. However, it doesn’t reflect real-time factors like latency or the complexities of order execution, which are critical in live markets.

Paper trading, on the other hand, takes things a step further by simulating trades in a live market environment using real-time price data - but without risking actual money. This method lets you see how your algorithm handles real-world conditions, such as price changes, delays, or partial order fills, all while keeping your wallet safe.

Finally, live trading is where the strategy faces its ultimate challenge. Here, trades are executed with real money, exposing the algorithm to practical hurdles like slippage, execution costs, and potential order rejections.

These steps create a natural progression: start with historical testing through backtesting, move to real-time simulations with paper trading, and culminate with live trading to see how your strategy performs in the real world.

When testing a trading algorithm in live market conditions, keeping an eye on critical performance metrics is essential to evaluate how well it’s working. Here are some key metrics to focus on:

- Profit and Loss (P&L): This shows how much profit (or loss) the algorithm generates over time. It’s a straightforward way to see if the results match your expectations.

- Win Rate: This metric tracks the percentage of successful trades. A higher win rate often indicates a more consistent strategy.

- Drawdown: This measures the largest drop in your account balance, giving you insight into the risks involved and whether they’re within your comfort zone.

- Sharpe Ratio: By looking at the risk-adjusted return, this metric helps you determine if the returns justify the level of risk the algorithm is taking.

- Execution Metrics: Factors like slippage, latency, and order fill rates are crucial to ensure the algorithm performs smoothly in real-time trading.

By routinely analyzing these metrics, you can fine-tune your strategy, address any weaknesses, and build confidence before fully committing to live trading.

"}}]}