How to Copy Trades in NinjaTrader: Best Tools for Multi-Account Trading

Managing multiple trading accounts in NinjaTrader can be overwhelming without the right tools. Trade copiers simplify this process by automatically replicating trades across all accounts, saving time and reducing errors. Whether you're a prop trader, money manager, or retail trader, choosing the right trade copier is critical for accurate execution, especially in fast-moving markets like futures.

Key Takeaways:

- Why Use Trade Copiers? They eliminate manual errors, ensure consistent execution, and save time when managing multiple accounts.

- Top Features to Look For: Speed (under 100ms for fast markets), ATM strategy support, scaling for different account sizes, and risk management tools.

-

Best Tools for 2025:

- CrossTrade: Best for professionals and high-frequency traders; ultra-low latency and advanced risk filters.

- Replikanto: Reliable for multi-account setups; ideal for swing traders.

- Affordable Indicators: Budget-friendly for beginners; simple setup with lifetime pricing.

- VPS Hosting: A must for low latency and stable performance, especially for time-sensitive strategies.

- CrossTrade: Best for professionals and high-frequency traders; ultra-low latency and advanced risk filters.

- Replikanto: Reliable for multi-account setups; ideal for swing traders.

- Affordable Indicators: Budget-friendly for beginners; simple setup with lifetime pricing.

Quick Comparison:

| Tool | Best For | Latency | Price Tier | Key Features |

|---|---|---|---|---|

| CrossTrade | Prop traders, professionals | <100ms | Premium | Advanced risk filters, scaling |

| Replikanto | Multi-account managers | ~200ms | Mid-tier | Stability, connection recovery |

| Affordable Indicators | Retail traders, beginners | ~250ms | Budget | ATM strategy support, ease of use |

For smooth operations, pair the trade copier with a high-performance VPS to minimize delays and ensure reliable synchronization. Proper setup and testing in simulation mode are essential before live trading.

NinjaTrader Trade Copier | Overview & New Features

How Copy Trading Works in NinjaTrader

NinjaTrader's copy trading operates on a straightforward master–follower structure. In this system, trades executed in the master account are instantly mirrored in the connected follower accounts. This replication process forms the core of how copy trading functions within NinjaTrader.

Master and Follower Account Setup

The master account takes the lead in all trading activities, ensuring that every action is duplicated across the linked follower accounts. Within NinjaTrader, one account is designated as the master, and it can be connected to multiple follower accounts. Once linked, trades from the master account are automatically replicated in the follower accounts without additional input. The platform supports both Master Position and Follower Position configurations for seamless synchronization.

What to Look for in NinjaTrader Trade Copiers

Choosing the right trade copier for NinjaTrader is crucial since it directly affects your trading efficiency and accuracy. A poor choice can lead to missed trades, delays in execution, or synchronization errors that could cost you money. Here's what you should focus on:

Speed and Execution Time

Top-tier NinjaTrader trade copiers operate with execution speeds of under 100 milliseconds, ensuring trades are mirrored almost instantly across follower accounts. This is especially critical in fast-moving markets like the ES or NQ, where even a delay of 500 milliseconds can turn a profitable trade into a missed opportunity.

When assessing execution speed, check how the copier handles network interruptions. High-quality copiers maintain connectivity and queue orders during brief disconnections, ensuring smooth operation. Using a high-performance VPS can further reduce latency, improving execution times across all accounts.

Additionally, ensure the copier integrates seamlessly with NinjaTrader's ATM (Automated Trade Management) strategies, as this can significantly impact efficiency.

ATM Strategy Support and Sync

ATM strategies are a cornerstone of professional NinjaTrader setups. They handle key tasks like stop losses, profit targets, auto breakeven, and trailing stops, making them essential for smooth trade management. For trade copiers, supporting ATM strategies is non-negotiable to ensure consistent execution across all accounts.

Advanced copiers simplify this process by sending only entry orders, allowing follower accounts to manage exits locally. This approach minimizes synchronization problems that could leave positions unprotected.

Another critical feature is partial fill handling. If your master account gets a partial fill on an entry order, the copier must adjust the follower accounts' exit orders accordingly. Without this, you risk creating exit orders that exceed the actual position size, exposing your accounts to unnecessary risk.

To avoid synchronization conflicts, it's best to use ATM strategies with identical names and configurations across all accounts. While different strategies can technically work, aligning setups simplifies troubleshooting and ensures smoother operations.

Multi-Account Scaling and Filters

Once execution and strategy support are covered, scaling features become important for managing multiple accounts effectively. Position scaling allows trades to be adjusted based on account size. For example, a $50,000 master account can scale trades proportionally for $25,000 or $100,000 follower accounts. This is particularly useful when managing prop firm accounts with varying capital allocations.

Risk management tools like filters are equally essential. These let you set limits for position sizes, daily losses, and drawdowns for each account. Such safeguards are invaluable when managing accounts with different risk profiles or when certain accounts approach their maximum allowable losses.

Account grouping is another feature to look for. This lets you organize accounts by strategy type, size, or risk profile, streamlining the management process for traders handling dozens of accounts. You can also selectively enable or disable copying for specific accounts, providing flexibility during volatile market conditions or when individual accounts need special attention.

Lastly, pre-allocation methods ensure contracts are distributed evenly before trades are executed. This prevents follower accounts from competing for fills, which can lead to uneven position sizes across your network.

Best NinjaTrader Trade Copier Tools for 2025

Here are some of the top trade copier tools available for NinjaTrader in 2025. These tools accommodate a variety of trading styles, budgets, and performance needs, whether you're a professional prop trader or a retail beginner experimenting with multi-account setups.

CrossTrade Trade Copier

CrossTrade is a next-generation trade copier designed for professional traders who require ultra-low latency and advanced risk management. With execution speeds consistently under 100 milliseconds (when hosted on high-performance infrastructure), it ensures real-time synchronization.

What makes CrossTrade stand out is its advanced risk filters and position scaling, which automatically adjust trade sizes based on account equity. This feature is particularly useful for prop traders managing accounts of different sizes. It also supports ATM strategies and offers detailed functionality, as outlined earlier in this guide.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

During partial fills, CrossTrade intelligently adjusts exit orders across all accounts, preventing over-leveraging. This tool is ideal for traders using high-frequency strategies on QuantVPS hosting, ensuring precise replication across multiple accounts.

Best for: Prop firm traders, professional money managers, and high-frequency strategy users.

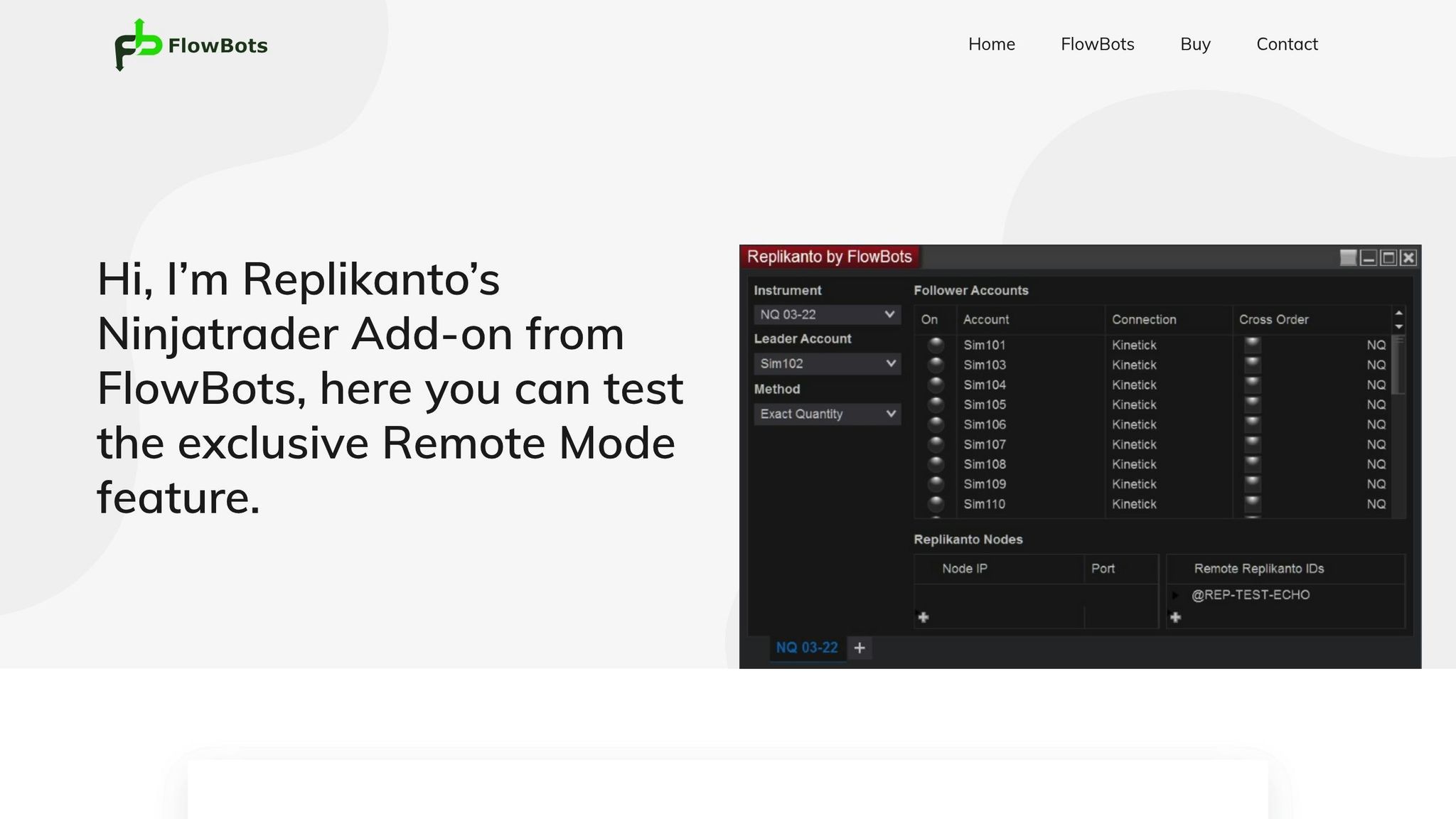

Replikanto

Replikanto has earned a reputation for its stability and accuracy in order replication. While its execution speed of around 200 milliseconds isn’t as fast as newer tools, its reliability makes it a favorite among swing and position traders.

The platform focuses on essential functionality without unnecessary features, excelling at replicating market, limit, and stop orders. It also handles bracket orders and OCO (One-Cancels-Other) setups with ease. Even during volatile market conditions, Replikanto maintains excellent synchronization, where other tools might falter.

One standout feature is its connection recovery system. If a follower account loses connectivity, Replikanto queues pending orders and executes them as soon as the connection is restored, ensuring no trades are missed. It also includes logging tools for troubleshooting.

Best for: Traders who value reliability over speed, swing traders, and those managing moderate-sized account networks (5-15 accounts).

Affordable Indicators (Duplicate Account Actions)

Affordable Indicators is a beginner-friendly trade copier offering full ATM strategy support and straightforward exit management. Its entry-level pricing makes it appealing for those new to multi-account trading.

With execution speeds of around 250 milliseconds, it’s suitable for swing trading and longer-term strategies. The setup process is simple, thanks to step-by-step guides designed for new users.

However, this tool lacks advanced scaling features, and its risk management options are limited to basic position limits. For traders managing 2-5 accounts with straightforward strategies, these limitations are unlikely to pose significant issues. Its reliable sync speed and responsive customer support have made it a popular choice for retail traders.

Best for: Retail traders, beginners exploring multi-account setups, and those on a budget.

Other Available Options

Several other trade copier tools cater to specific needs within the NinjaTrader ecosystem:

- Trade Copier Pro: Works well for small account networks with basic copying needs, offering reliable performance for budget-conscious traders.

- Simple Trade Copier: A lightweight solution for basic order replication, suitable for testing setups or light usage.

- TradeSyncer: A cloud-based tool that connects NinjaTrader with platforms like TradingView or Tradovate. With a 300-400ms latency, it’s not ideal for scalping but works for cross-platform strategies.

- Apex NT8 Internal Copier: Designed for Apex Trader Funding users, this tool facilitates copying between funded and evaluation accounts within their ecosystem. While effective for its purpose, it lacks the flexibility of standalone solutions.

On the other hand, Traders Post has faced criticism for poor synchronization reliability, leading to dissatisfaction among users. It’s a tool best avoided.

Tool Comparison Table

| Tool | Platform Support | ATM Sync | Scaling | Delay | Price Tier | Best For |

|---|---|---|---|---|---|---|

| CrossTrade | NT8 | ✅ | ✅ | <100ms | Premium | Prop Traders |

| Replikanto | NT8 | ✅ | ✅ | ~200ms | Mid-tier | Multi-account setups |

| Affordable Indicators | NT8 | ✅ | ❌ | ~250ms | Budget | Retail / beginners |

| Trade Copier Pro | NT8 | ✅ | ❌ | ~300ms | Budget | Small networks |

| TradeSyncer | Cloud | ✅ | ✅ | 300-400ms | Mid-tier | Cross-platform traders |

| Traders Post | Cloud | ❌ | ❌ | 1-5s | Mid-tier | None (avoid) |

The right trade copier depends on your specific needs. High-frequency traders and prop firm users will likely prefer CrossTrade for its speed and advanced features. Meanwhile, retail traders may find Affordable Indicators or Replikanto sufficient for reliable multi-account replication on a dedicated VPS.

VPS Setup and Performance Requirements

Running multiple NinjaTrader instances demands a reliable, high-performance setup. A professional VPS ensures lightning-fast execution, in stark contrast to the delays often experienced on a home computer. Below, we’ll explore the performance requirements and key practices to optimize your VPS for NinjaTrader copy trading.

Why Use VPS Hosting for Copy Trading

In copy trading, precision matters. A dedicated VPS provides the low-latency and stable connection needed to replicate trades accurately. While home internet might feel fast enough for browsing or casual trading, it can introduce delays that lead to follower accounts executing trades several seconds after the master account. This delay can result in poor trade fills and higher slippage, especially during volatile market conditions.

A VPS solves these problems by maintaining a consistently low-latency connection to broker servers. For example, QuantVPS servers in Chicago and New York deliver latency under 1 millisecond to major futures exchanges, ensuring trades are replicated almost instantly across all accounts. Additionally, the 100% uptime guarantee is essential for multi-account setups. If your master account disconnects, follower accounts stop receiving signals, leaving positions unmanaged. A professional VPS mitigates these risks with robust infrastructure and dependable power systems.

VPS Performance Requirements

To ensure smooth and reliable trade copying, your VPS needs to meet specific performance benchmarks:

- CPU: NinjaTrader is resource-heavy on the CPU. At least 4 cores are recommended, but if you’re managing multiple accounts, additional cores can improve performance.

- Memory: Adequate RAM is critical for handling charting, strategy calculations, and order management. While 4GB may work for a single account, multi-account setups should start with 8GB or more.

- Storage: Fast storage is a must for accessing historical data and writing trade logs efficiently. NVMe SSDs provide exceptional read and write speeds, preventing slowdowns during peak trading times.

- Network: A robust network connection is key to execution speed. Reducing ping from 200ms to under 5ms can drastically improve trade responsiveness and reduce slippage. QuantVPS Alpha-Series plans, designed for CPU-intensive platforms like NinjaTrader, rank in the top 1% globally for VPS performance.

Setup Best Practices

Once you’ve secured a VPS with the right specifications, follow these best practices to maximize performance:

- Host all accounts on the same VPS: This minimizes delays between the master and follower accounts.

- Synchronize data feeds: Use the same data provider and connection settings across all NinjaTrader instances to avoid price discrepancies.

- Standardize time zones: Set all VPS instances to the same time zone, ideally matching your primary exchange’s location (usually Central or Eastern Time).

- Plan for peak usage: Configure your VPS to handle high activity periods, such as market opens, when data feeds and strategy executions are at their busiest.

Best Practices for Multi-Account Copy Trading

Building on our earlier discussion about VPS performance and trade copier tools, these tips can help fine-tune your multi-account trading strategies. Setting up an effective trade copier system involves more than just installation and linking accounts.

Test in Simulation Mode First

Before you dive into live trading with a new trade copier, give it a thorough test run. NinjaTrader’s simulation engine is a great tool for this, as it closely mimics live trading conditions. You can use the Simulation connection for live-data emulation or the Simulated Data Feed to test automated strategies and ATM setups in a controlled environment.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Most trade copier tools, like Duplicate Account Actions, integrate seamlessly with NinjaTrader’s simulation platforms. Even if you’re trading with prop firm accounts, such as those from Apex Trader Funding, they often operate in simulation mode, making this testing process directly relevant to your live trading workflow.

To get started, connect all your simulation accounts through the NinjaTrader Control Center. Run your usual trading strategies for a realistic period, keeping a close eye on order synchronization, partial fills, and any error messages. Document any issues and address them before transitioning to live accounts. Once testing is complete, apply these settings consistently across all accounts.

Use the Same Data Feeds

Consistency in data feeds is crucial for accurate trade replication. Even slight variations between the master and follower accounts can lead to synchronization problems, resulting in missed trades or incorrect order executions.

To avoid these issues, ensure all accounts are using the same data provider and have identical settings, including matching time zones for consistent timestamps. This is especially important when using low-latency VPS hosting, as cloud-based copiers can introduce delays that disrupt synchronization.

Avoid Cloud Copiers for Fast Trading

If your trading strategy relies on precise timing - like scalping or trading breakouts - cloud-based copiers might not be your best choice. These tools can introduce additional latency, which is especially problematic for strategies sensitive to even the smallest delays.

For these scenarios, hosting all your trading accounts on the same VPS is a smarter move. This setup ensures minimal replication delays, as everything operates on the same server. In volatile markets, where every millisecond counts, this can mean the difference between hitting a profitable trade or missing the mark entirely. High-frequency strategies are particularly vulnerable to these delays.

For example, using a VPS solution like QuantVPS, which offers sub-millisecond latency to major futures exchanges in Chicago and New York, can significantly enhance performance for time-sensitive copy trading setups. By keeping your master NinjaTrader instance and follower accounts on the same VPS, you can maintain the speed and precision needed for successful trading.

Choosing the Right Tool for Your Trading Setup

Picking the right trade copier boils down to understanding your trading style, account type, and budget. Let’s break down the options based on these factors.

For prop firm traders and professionals, CrossTrade stands out as the top-tier choice. With lightning-fast sub-100ms latency, real-time syncing, and advanced risk management features, it’s tailored for traders who need to stay compliant with prop firm rules. These features are essential for maintaining your funded status and executing trades without delays.

Retail traders and beginners might find Affordable Indicators' Duplicate Account Actions a perfect starting point. Backed by over 200 Trustpilot reviews and an impressive 4.8/5 star rating, this tool offers dependable performance for everyday trading. The $175 lifetime license eliminates the need for recurring fees, and its full ATM strategy support covers most standard trading scenarios with ease.

Multi-account managers, who prioritize stability above all else, should consider Replikanto. Its intuitive interface simplifies configuration, making it an excellent choice for managing several accounts at once. With a $199 lifetime license (including one year of updates), it offers solid value for traders juggling multiple portfolios.

Scalpers and high-frequency traders require ultra-low latency, which makes CrossTrade the go-to option despite its premium price tag. On the other hand, swing traders can comfortably use any of the top three tools, as minor latency differences won’t affect longer-term trades. Pairing your trade copier with a powerful VPS setup ensures even better reliability and precision.

Hosting your NinjaTrader master instance on a dedicated VPS guarantees sub-millisecond connectivity, preventing sync issues during critical moments. However, steer clear of cloud-based solutions like Traders Post, which often suffer from delays ranging from 1 to 5 seconds and unreliable syncing.

It’s also worth noting that the most expensive tool isn’t always the best fit. For example, retail traders managing a simple two-account setup often achieve excellent results with Affordable Indicators, making premium features unnecessary. Focus on selecting a tool that aligns with your specific trading needs.

| Tool | Best For | Key Advantage | Price Point |

|---|---|---|---|

| CrossTrade | Prop traders, professionals | Advanced risk management | Premium |

| Replikanto | Multi-account managers | Stability and simplicity | Mid-tier |

| Affordable Indicators | Retail traders, beginners | Proven reliability, lifetime license | Budget |

FAQs

What are the benefits of using a VPS for NinjaTrader copy trading, and how does it improve performance?

Using a VPS for NinjaTrader copy trading can greatly enhance your trading experience and performance. A low-latency VPS, particularly one based in major trading hubs like Chicago or New York, ensures trade signals are transmitted almost instantly. This helps reduce slippage and execution delays - critical factors in fast-paced futures markets.

On top of that, a VPS offers a stable and dependable environment with dedicated resources like CPU and RAM. This eliminates interruptions caused by local network issues or computer performance hiccups. For multi-account traders or prop traders, this reliability is vital, as it ensures precise, real-time trade replication across all accounts.

Hosting your NinjaTrader setup on a VPS not only delivers smoother and more consistent trading performance but also lowers the risks tied to manual errors or hardware problems at home.

How can I make sure my trade copier works seamlessly with ATM strategies in NinjaTrader?

To get the most out of your ATM strategies in NinjaTrader, it's essential to use a trade copier that fully supports ATM parameters. This includes critical elements like stop loss, profit targets, and any order adjustments. The copier should be capable of accurately mirroring these settings across all connected accounts.

For smooth and consistent trading, make sure your copier is set up to keep all ATM strategy settings synchronized between your master and follower accounts. This ensures that orders stay aligned and avoids any execution delays or mismatches when handling multiple accounts.

What should I look for in a trade copier to efficiently manage multiple accounts in fast-paced markets?

When choosing a trade copier to manage multiple accounts in fast-paced markets, prioritize tools that offer ultra-low latency. This ensures your orders are replicated quickly and accurately, reducing the risk of slippage during volatile market shifts. It's also essential to select a copier that supports ATM strategies and can handle partial fills without compromising execution precision.

If you're managing several accounts or strategies, scalability becomes crucial. Opt for a copier equipped with reliable filtering options and a proven track record of stable performance on VPS hosting. Additionally, make sure the copier provides detailed documentation and has a responsive support team to help you tackle any issues efficiently.

Using a VPS for NinjaTrader copy trading can greatly enhance your trading experience and performance. A low-latency VPS, particularly one based in major trading hubs like Chicago or New York, ensures trade signals are transmitted almost instantly. This helps reduce slippage and execution delays - critical factors in fast-paced futures markets.

On top of that, a VPS offers a stable and dependable environment with dedicated resources like CPU and RAM. This eliminates interruptions caused by local network issues or computer performance hiccups. For multi-account traders or prop traders, this reliability is vital, as it ensures precise, real-time trade replication across all accounts.

Hosting your NinjaTrader setup on a VPS not only delivers smoother and more consistent trading performance but also lowers the risks tied to manual errors or hardware problems at home.

To get the most out of your ATM strategies in NinjaTrader, it's essential to use a trade copier that fully supports ATM parameters. This includes critical elements like stop loss, profit targets, and any order adjustments. The copier should be capable of accurately mirroring these settings across all connected accounts.

For smooth and consistent trading, make sure your copier is set up to keep all ATM strategy settings synchronized between your master and follower accounts. This ensures that orders stay aligned and avoids any execution delays or mismatches when handling multiple accounts.

When choosing a trade copier to manage multiple accounts in fast-paced markets, prioritize tools that offer ultra-low latency. This ensures your orders are replicated quickly and accurately, reducing the risk of slippage during volatile market shifts. It's also essential to select a copier that supports ATM strategies and can handle partial fills without compromising execution precision.

If you're managing several accounts or strategies, scalability becomes crucial. Opt for a copier equipped with reliable filtering options and a proven track record of stable performance on VPS hosting. Additionally, make sure the copier provides detailed documentation and has a responsive support team to help you tackle any issues efficiently.

"}}]}