AI is transforming forex trading by automating analysis, improving trade execution, and managing risk in real-time. The three platforms discussed – QuantVPS, Trade Ideas, and MetaTrader – offer distinct tools and features to meet different trader needs.

- QuantVPS provides low-latency VPS hosting for AI systems, ensuring reliable and fast trade execution. Plans range from $59/month to $299/month, depending on trading complexity and resource needs.

- Trade Ideas uses its proprietary Holly AI engine for market scanning and predictive analysis. It offers automated trading and backtesting tools, with pricing starting at $89/month (billed annually).

- MetaTrader integrates customizable AI tools like Expert Advisors for rule-based trading. It supports dynamic risk management, real-time strategy adjustments, and works with over 1,200 brokers.

Quick Comparison:

| Platform | Key Features | Pricing (Starting) | Best For |

|---|---|---|---|

| QuantVPS | Low-latency VPS, unmetered bandwidth | $59/month | Traders needing reliable infrastructure |

| Trade Ideas | AI market scanner, predictive analysis | $89/month | Active traders seeking market insights |

| MetaTrader | Expert Advisors, broker flexibility | Free (basic tools) | Technically skilled traders |

Each platform has its strengths, so your choice should align with your trading style, technical skills, and budget.

How To Trade Using AI – Actual Strategy

1. QuantVPS

QuantVPS specializes in high-performance VPS hosting tailored for algorithmic forex trading. Founded by Ethan Brooks, the platform is built to meet the demands of AI-driven trading systems, offering the low-latency infrastructure needed to execute trades efficiently in the fast-paced forex market.

Infrastructure Requirements

The backbone of any successful AI forex trading system is its technical infrastructure, and QuantVPS delivers on this front. With servers boasting latency as low as 0–1 millisecond, traders can achieve near-instant execution, a crucial factor in seizing market opportunities. The platform also ensures 100% uptime, eliminating the risk of downtime that could lead to missed trades.

QuantVPS employs NVMe storage across all plans, providing lightning-fast data access. This is essential for AI systems that rely on processing massive datasets, whether it’s historical forex data or live market feeds. Additionally, all plans come with unmetered bandwidth, so AI algorithms can consume data freely without worrying about hitting limits.

Each server includes full root access, giving traders the freedom to customize their trading environment. Whether it’s installing specific machine learning libraries, tweaking trading algorithms, or running specialized forex analysis software, users have full control.

Automation Features

QuantVPS is compatible with popular trading platforms like MetaTrader, NinjaTrader, and TradeStation, ensuring seamless integration for AI trading systems. These systems can run continuously, with automatic backups safeguarding both algorithms and trading data.

For traders managing complex AI systems, the platform offers multi-monitor support. The VPS Pro plan supports up to 2 monitors, the VPS Ultra can handle 4, and the Dedicated Server option accommodates up to 6 monitors, making it easier to oversee multiple trading strategies simultaneously.

To protect against potential disruptions, QuantVPS includes DDoS protection in all plans, shielding AI systems from cyber threats. It also provides system monitoring tools, enabling real-time performance tracking of AI algorithms.

Pricing

QuantVPS offers four pricing tiers, each designed to cater to different levels of trading complexity:

| Plan | Monthly Price | CPU Cores | RAM | Storage | Monitor Support | Best For |

|---|---|---|---|---|---|---|

| VPS Lite | $59 | 4 cores | 8GB | 70GB NVMe | No multi-monitor | Simple AI strategies (1–2 currency pairs) |

| VPS Pro | $99 | 6 cores | 16GB | 150GB NVMe | Up to 2 monitors | Moderate AI complexity (3–5 currency pairs) |

| VPS Ultra | $199 | 24 cores | 64GB | 500GB NVMe | Up to 4 monitors | Advanced AI systems (5–7 currency pairs) |

| Dedicated Server | $299 | 16+ cores | 128GB | 2TB+ NVMe | Up to 6 monitors | Enterprise-level trading (7+ currency pairs) |

The VPS Lite plan, priced at $59/month, is ideal for traders running basic AI strategies on 1–2 currency pairs. However, it does not include multi-monitor support, which may limit its utility for more complex setups.

For traders managing more sophisticated AI systems, the VPS Pro plan at $99/month offers enhanced processing power with 6 CPU cores and 16GB of RAM. This plan is well-suited for algorithms that analyze sentiment or use advanced technical indicators across multiple forex pairs.

The VPS Ultra plan, priced at $199/month, is geared toward serious traders. With 24 CPU cores and 64GB of RAM, it can handle AI systems that require intensive backtesting or run multiple strategies simultaneously.

At the top tier, the Dedicated Server plan at $299/month provides enterprise-grade resources, including 128GB of RAM and over 2TB of NVMe storage. This option is perfect for institutional traders or individuals managing large-scale AI trading operations that demand substantial computational power for real-time analysis across numerous currency pairs.

Next, we’ll explore how Trade Ideas uses similar infrastructure to support AI-driven trading.

2. Trade Ideas

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.9% uptime • Chicago & NY data centers • From $59.99/mo

FUTURES — 60% off first month

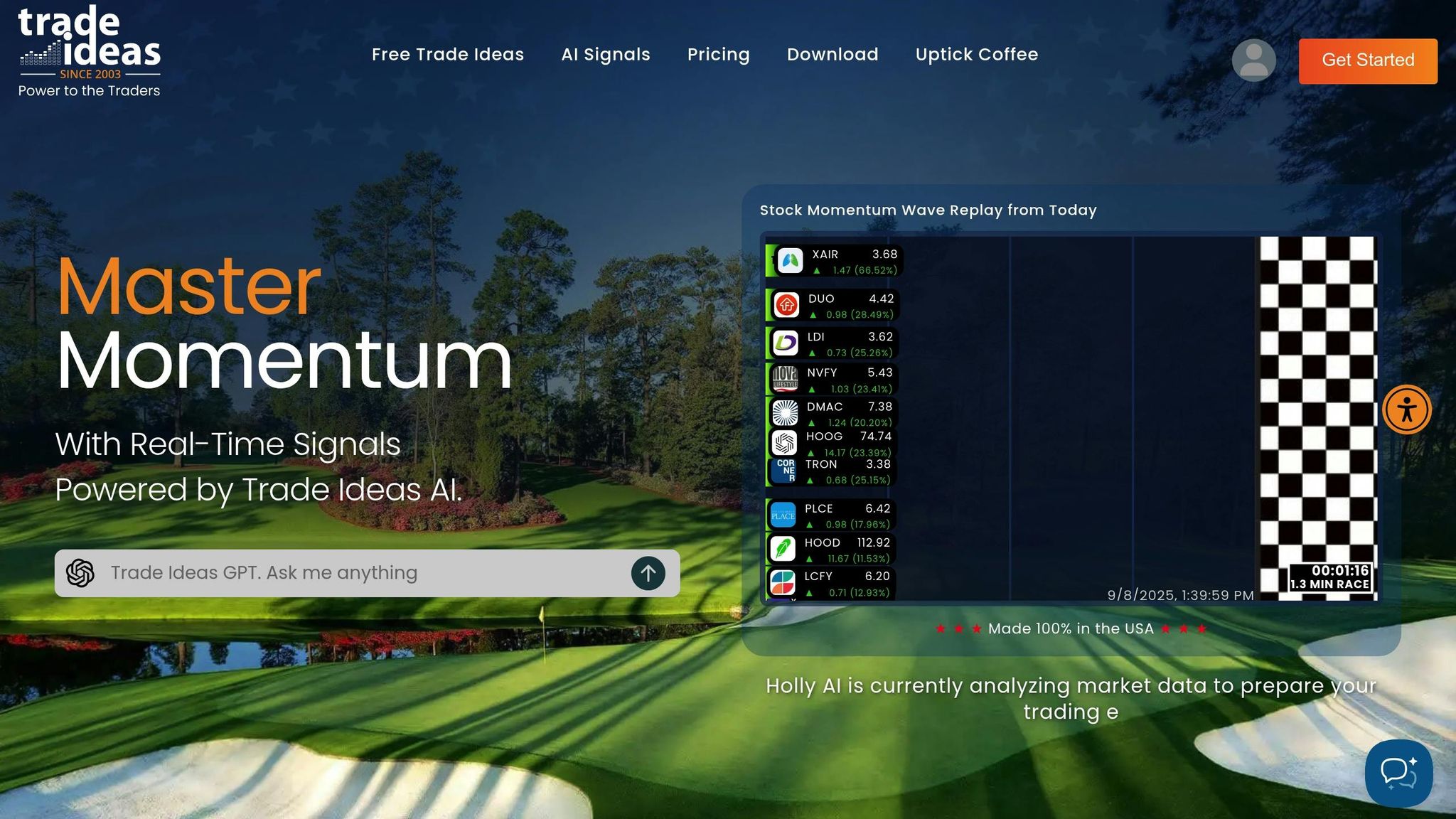

Trade Ideas is an AI-driven platform designed to scan stocks and forex markets. Powered by its proprietary Holly AI engine, it analyzes market data to identify potential trading opportunities. The platform aims to help traders make well-informed decisions by providing actionable insights and signals.

Predictive Capabilities

The Holly AI engine uses advanced machine learning to study market trends and detect patterns that could signal price movements. By combining technical indicators with sentiment analysis, it provides real-time updates on potential market shifts. The platform also includes backtesting tools, enabling traders to test AI-generated strategies against historical data before applying them in live markets.

Automation Features

Trade Ideas connects directly with various brokers through API integrations, allowing traders to execute trades automatically based on AI-generated signals. It features a customizable alert system that sends notifications via email, SMS, or desktop alerts, ensuring traders stay updated on opportunities as they arise. Additionally, the platform supports rule-based automated trading, including features like automated position sizing, stop-loss management, and profit-taking setups.

Accessibility and Infrastructure

As a cloud-based platform, Trade Ideas eliminates the need for local hardware or software installations. It can be accessed through web browsers, desktop applications, and mobile apps, giving traders the flexibility to monitor signals and manage trades from almost any device. The platform relies on real-time market data feeds to ensure accurate pricing information during trading hours.

Pricing

Trade Ideas offers various subscription plans tailored to different trader needs. For the latest pricing details and features, it’s best to check the platform’s official website. Up next, we’ll look at MetaTrader AI Integrations to explore another approach to AI-powered forex trading.

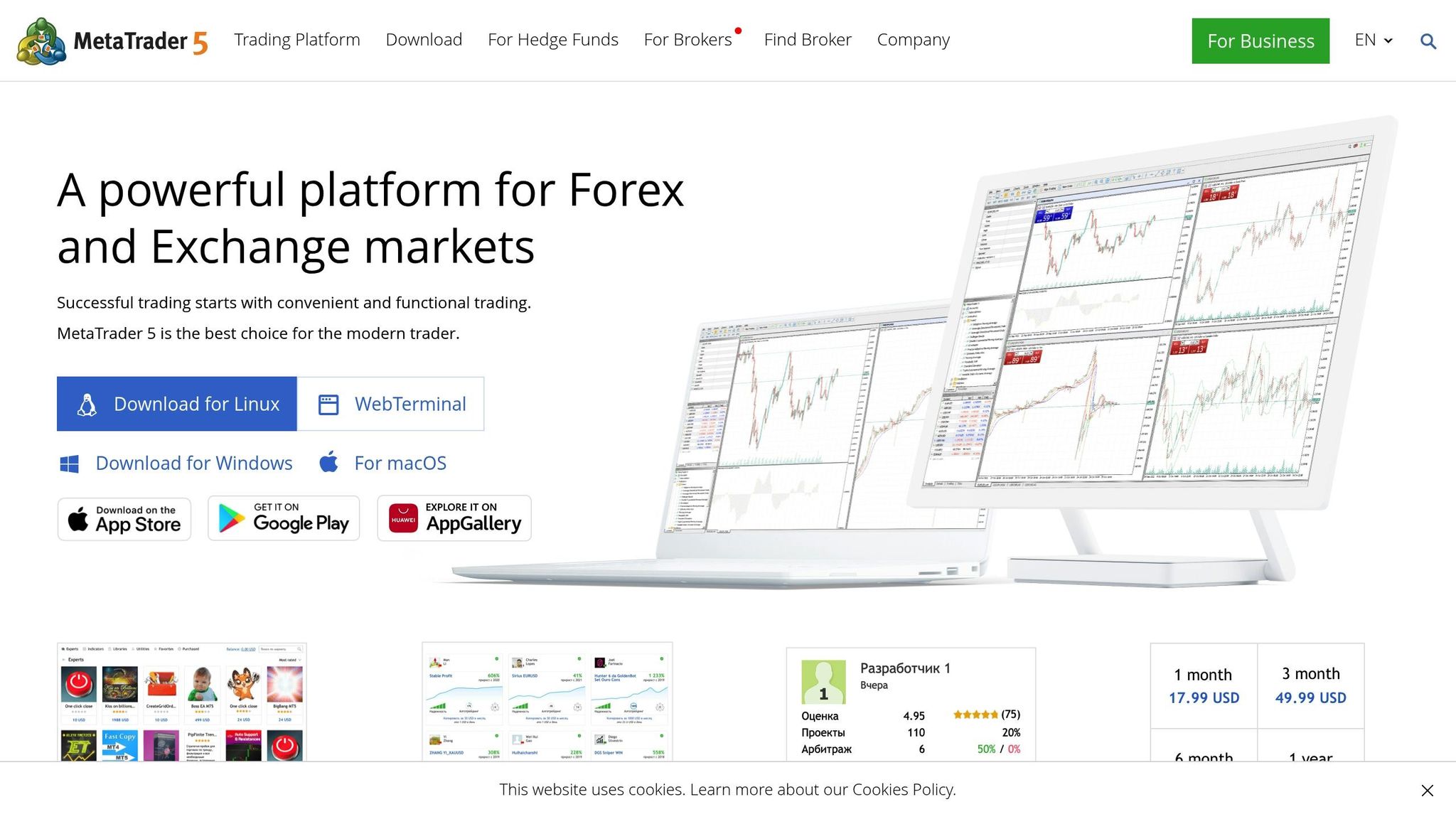

3. MetaTrader AI Integrations

MetaTrader offers a robust suite of AI tools designed to support precise, rules-based forex trading. Known for its automation capabilities, MetaTrader enables traders to execute forex trades using advanced AI-driven modules that provide customizable and scalable solutions for fast decision-making.

Similar to QuantVPS and Trade Ideas, MetaTrader’s AI integrations aim to enhance market responsiveness by automating essential trading tasks. With these tools, traders can deploy Expert Advisors to analyze market data, execute trades, adjust stop-loss orders, and manage risk – streamlining operations and reducing the need for manual intervention.

Expert Advisors and Algorithmic Trading

At the heart of MetaTrader’s AI capabilities are its Expert Advisors (EAs). These automated trading systems can handle multiple currency pairs at once, executing trades using algorithms that factor in technical indicators, price action, and market sentiment. Advanced EAs can even adapt their strategies on the fly, adjusting parameters like lot sizes, entry points, and risk thresholds based on real-time market conditions.

Dynamic Risk Management

MetaTrader’s AI-powered risk management tools are designed to ensure consistent control over trading risks. These tools automatically calculate position sizes based on account equity and pre-set risk parameters. They also adjust stop-loss and take-profit levels dynamically as market conditions shift. Some of the more advanced features include correlation analysis, which helps traders avoid overexposure to closely related currency pairs.

Custom Indicators and Real-Time Strategy Adjustments

The platform supports custom AI indicators that go beyond traditional technical analysis. These indicators can assess factors such as news sentiment, economic events, and inter-market relationships to generate more refined trading signals. Additionally, MetaTrader’s AI modules can switch between strategies automatically, adapting to market conditions – whether trending, ranging, or highly volatile.

Market Scanner Integration

MetaTrader’s AI-powered market scanners work continuously to monitor hundreds of currency pairs, searching for trading opportunities based on specific criteria. These scanners can identify breakout patterns, key support and resistance levels, and momentum shifts across multiple timeframes, providing traders with alerts for high-probability setups.

With its deep customization options and a wealth of community-developed tools, MetaTrader has solidified its reputation as a leader in AI-powered forex trading. Its advanced features not only streamline trading processes but also offer the flexibility to adapt to diverse market scenarios, making it a go-to platform for traders seeking AI-driven solutions.

Advantages and Disadvantages

When it comes to forex trading platforms, each offers its own set of strengths and challenges. Knowing these trade-offs can help traders pick the one that suits their specific needs and trading style.

QuantVPS delivers the infrastructure AI trading systems need to thrive. With ultra-low latency (0–1 ms) and a 100% uptime guarantee, it ensures trades are executed without delays or disruptions. Its compatibility with popular software like MetaTrader and NinjaTrader adds flexibility for implementing various AI strategies. However, QuantVPS lacks built-in AI tools, meaning traders need to integrate external solutions, which can add complexity.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

FUTURES — 60% off first month

Trade Ideas stands out with its AI-driven market scanning capabilities, highlighted by its Holly AI, which averages about 25% annually on stock picks. It’s particularly strong in real-time pattern recognition across multiple forex pairs. The platform offers tiered pricing: the Birdie Bundle costs $127/month ($89/month if billed annually), while the Eagle Elite plan is $254/month ($178/month annually). That said, the platform’s interface can feel overwhelming to beginners due to the sheer volume of data and signals it generates.

MetaTrader AI integrations offer extensive customization options. With availability at over 1,200 brokers, it’s widely accessible. Its Expert Advisors (EAs) can handle multiple currency pairs and adjust strategies in real time. However, the performance of its AI tools can be inconsistent, and their success often hinges on the user’s ability to adapt to changing market conditions. Additionally, traders should watch out for scams involving so-called "Forex robots" that promise unrealistic returns. Using MetaTrader effectively often requires a solid technical background.

| Platform | Key Strengths | Main Weaknesses | Best For |

|---|---|---|---|

| QuantVPS | Ultra-low latency, 100% uptime, broad compatibility | No built-in AI tools; requires external setup | Traders with existing AI systems needing reliable infrastructure |

| Trade Ideas | Proven AI results (25% annual average), real-time scanning | Complex interface; higher-tier plans are pricey | Active traders seeking data-driven market analysis |

| MetaTrader | Customization, access to 1,200+ brokers, large community | Inconsistent AI performance; technical expertise required | Technical traders aiming for full control over AI strategies |

Each platform aligns differently with trader priorities, emphasizing the balance between simplicity and customization. While some platforms focus on ease of use, others cater to those who prefer to fine-tune their strategies.

Pricing is another factor to consider. QuantVPS starts at $59/month, but additional AI software costs may apply. Trade Ideas includes AI features in its premium pricing tiers. MetaTrader, on the other hand, offers basic AI tools for free, though advanced capabilities often require extra investment.

In terms of predictive accuracy, the platforms take varied approaches. Trade Ideas provides measurable performance metrics, MetaTrader’s results depend heavily on the quality of programming, and QuantVPS ensures flawless signal execution without technical delays. Weighing these factors is key to finding the platform that complements your trading strategy.

Final Recommendations

Choosing the right AI forex trading solution depends on your trading experience, technical know-how, and budget. Here’s how to align your decision with your specific needs:

For traders seeking a solid foundation for their existing AI systems, QuantVPS is a dependable choice. With its low latency and guaranteed uptime, it ensures your trading strategies run smoothly without interruptions. QuantVPS offers flexible pricing, starting at $59/month for basic plans and scaling up to $299/month for advanced setups, making it suitable for both simple strategies and complex multi-algorithm systems.

If you’re an active trader looking for advanced market analysis, Trade Ideas provides powerful AI-driven scanning tools to help identify opportunities. While its features are robust, new users might need time to get comfortable with the platform’s interface.

For technically inclined traders, MetaTrader’s AI integrations provide extensive customization through Expert Advisors, enabling real-time strategy adjustments. This platform is widely supported by brokers, and many offer basic AI tools at no extra cost – perfect for budget-conscious beginners.

When making your decision, think about your risk tolerance and the time commitment each solution requires. QuantVPS takes care of the technical backend, freeing you to focus on trading decisions, while Trade Ideas and MetaTrader may require more hands-on management and regular optimization.

Ultimately, your choice should reflect your trading style and volume. High-frequency traders will appreciate QuantVPS’s ultra-low latency for rapid executions. Swing traders might lean toward Trade Ideas for its detailed analytical tools, while position traders could start with MetaTrader’s basic AI features and upgrade as their needs evolve.

FAQs

How does QuantVPS compare to Trade Ideas and MetaTrader for AI-powered Forex trading?

QuantVPS focuses on delivering ultra-low latency VPS hosting specifically designed for Forex traders who depend on powerful AI and algorithmic trading bots. Its primary goal is to enhance the performance and dependability of automated trading systems. However, it’s important to note that QuantVPS does not come with pre-installed AI tools or trading signals.

Trade Ideas takes a different approach, serving as an AI-powered platform tailored for active traders. It provides tools like real-time market scanning, AI-driven trade suggestions, and automated alerts, all aimed at spotting potential trading opportunities.

MetaTrader, especially MetaTrader 5, operates as a trading platform that supports AI integrations and automated trading through its Expert Advisors feature. It’s built for tasks like technical analysis, backtesting, and implementing trading strategies. Unlike QuantVPS, which offers hosting solutions, MetaTrader is geared toward executing AI-based trading strategies directly.

What is the cost of AI platforms for Forex trading, and which ones offer the best value for different trading needs?

The price of AI platforms for Forex trading varies widely, starting at around $40 per month for basic tools and going beyond $200 per month for advanced systems packed with premium features. The ideal choice largely depends on your trading experience and specific goals.

If you’re a beginner or trade casually, budget-friendly platforms with essential features like pattern detection and market analysis can often meet your needs. On the other hand, professional traders or those looking for advanced automation and predictive analytics might find the higher-priced options worthwhile. These platforms often come with more sophisticated tools that can improve trading efficiency and decision-making.

The key is to select a platform that strikes a balance between cost and the features necessary to support your trading strategy.

What skills do you need to use AI tools in MetaTrader, and how can beginners start?

To make the most of AI tools in MetaTrader, having a basic grasp of programming – especially MQL5, the scripting language used for creating Expert Advisors (EAs) and custom indicators – can be incredibly helpful. But don’t worry if coding isn’t your thing. There are plenty of no-code AI tools available that let beginners explore how AI can enhance trading strategies without writing a single line of code.

For those just starting out, online tutorials and step-by-step guides are a great way to dive in. These resources simplify the process of integrating AI into MetaTrader, enabling users with limited technical skills to tap into features like automated trading, predictive analysis, and trend identification. With the right tools and guidance, leveraging AI for smarter trading becomes much more accessible.