Top AI-Based Forex Trading Bots and Platforms Revealed

AI-powered forex trading bots are transforming how traders approach the market. These bots analyze trends, execute trades, and adjust strategies in real-time using machine learning. Here’s a quick breakdown of the seven platforms covered:

- Tickeron: Provides advanced trading signals but requires integration with brokerage accounts for execution.

- GPS Forex Robot: Tailored for MetaTrader 4, using a spread-insensitive approach. Low-cost entry at $149.

- Odin Forex Robot: Limited details available; research recommended before use.

- FXStabilizer Pro: Focuses on low drawdown and steady performance; latency-sensitive.

- Ganon Forex Robot: Grid-based, trend-following strategy designed for MetaTrader 4.

- Forex Fury: Scalping-focused with a 93% win rate, verified by Myfxbook. Pricing starts at $249.99.

- Happy Frequency EA: Multi-strategy bot with verified results, but requires a higher deposit.

Key Takeaways:

- Match the bot to your trading style and experience.

- Scalping bots need low-latency VPS setups.

- Verify performance data before committing.

- Consider capital requirements and pricing.

For beginners, GPS Forex Robot offers simplicity. Advanced traders may prefer Forex Fury or Happy Frequency EA for flexibility and performance transparency. Always prioritize verified results and technical compatibility when selecting a bot.

Which Forex Robot Is the Most Profitable in 2025? (Full Review)

1. Tickeron

Tickeron is an AI-driven platform that provides advanced trading signals but doesn’t handle trade execution directly through its own interface.

Platform Compatibility

Tickeron’s AI Robots work seamlessly with well-known brokerages like Binance, Alpaca, Kraken, TD Ameritrade, and Interactive Brokers. The platform supports both backtesting and live trading, giving users the tools to refine and test their strategies before deploying them. To enable automated trading, users need to link their brokerage accounts to the platform.

This integration sets the stage for evaluating how Tickeron’s features stack up against other top trading platforms.

2. GPS Forex Robot

GPS Forex Robot represents the shift toward AI-powered forex trading, offering an automated solution tailored for MetaTrader 4 users.

Strategy Type

This robot uses a spread-insensitive trading approach, ensuring consistent results even when spreads fluctuate. This strategy allows for smooth operation within trading platforms.

Platform Compatibility

GPS Forex Robot is specifically designed for the MetaTrader 4 (MT4) platform and works best with MT4 Build 1420. To use it, you'll need a forex account compatible with MT4.

Pricing (USD)

The robot is available for a one-time payment of $149.

Infrastructure Sensitivity

With a required minimum deposit of just $100, GPS Forex Robot offers a low-cost entry point. This makes it a practical choice for beginners or those wanting to experiment with automated trading without a large financial commitment.

3. Odin Forex Robot

After looking at GPS Forex Robot, let’s turn to another automated trading tool: Odin Forex Robot. Unfortunately, specifics about its trading methodology, platform compatibility, verified performance, pricing, and system requirements aren't readily available at this time. To get the most accurate and up-to-date details, it’s crucial to review the official documentation before diving in. This highlights why careful research is essential when considering AI-powered forex trading tools.

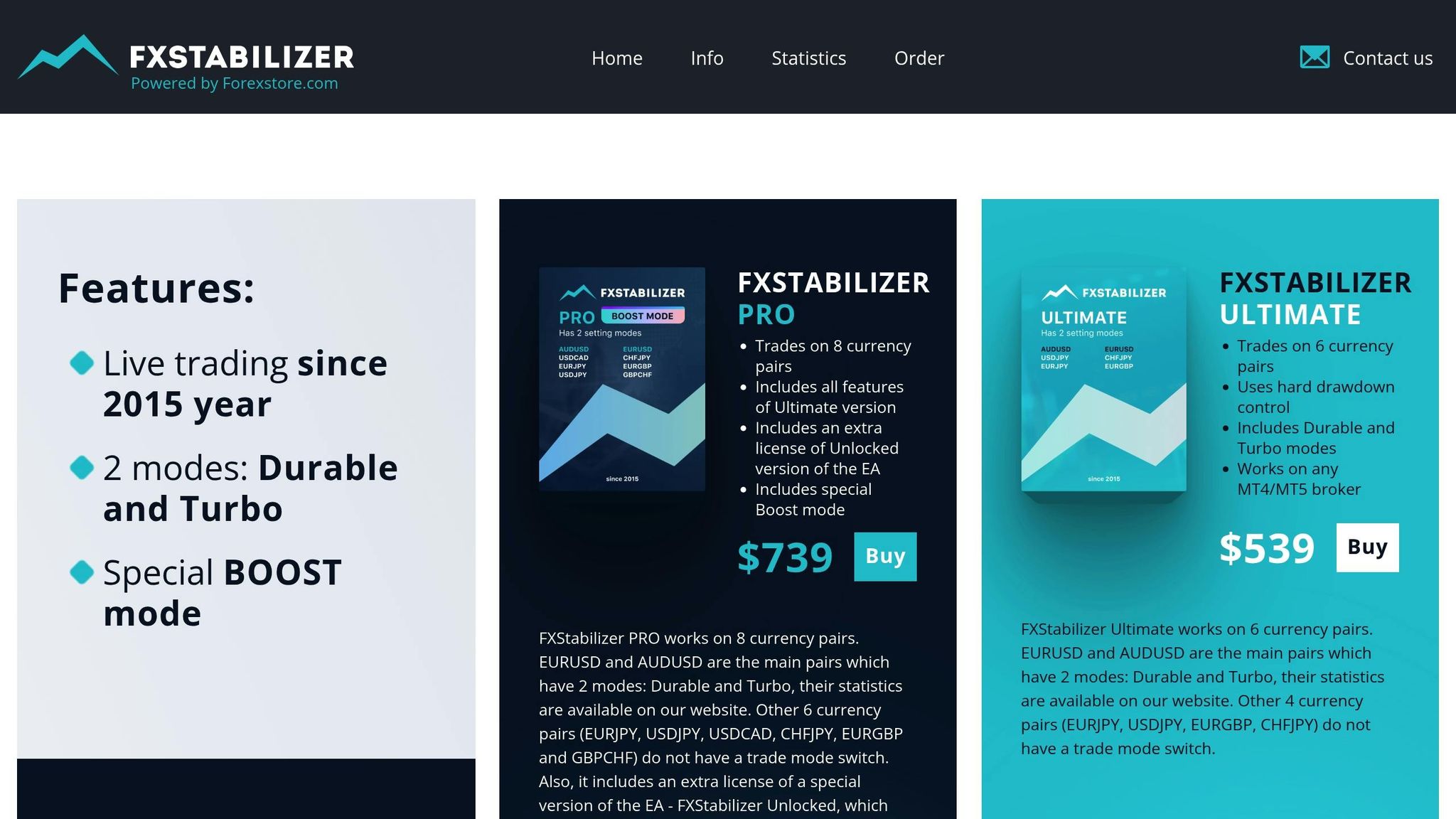

4. FXStabilizer Pro

The effectiveness of FXStabilizer Pro largely hinges on the quality of your trading setup. Factors like latency, connection reliability, and hardware performance play a significant role in its overall performance.

Infrastructure Sensitivity

Latency is a key factor in forex trading. Professional traders typically aim for latencies under 20 milliseconds, while high-frequency trading strategies often require latencies below 100 milliseconds to function effectively.

To achieve the best results, it's wise to position your VPS close to major forex trading hubs such as London, New York, Tokyo, or Frankfurt. Doing so can significantly lower latency and reduce slippage during trades. Some forex VPS providers even report ultra-low latencies of around 0.30 milliseconds, which can greatly improve execution accuracy.

Beyond latency, the hardware used also impacts performance. High-speed CPUs, NVMe SSDs, and adequate amounts of RAM help prevent delays in processing trades. A stable, fiber-optic internet connection is also preferable to slower options like satellite links.

Additionally, using a dedicated VPS ensures your trading system remains unaffected by power outages or internet disruptions, providing a more stable environment for FXStabilizer Pro.

While having top-tier hardware and connectivity is important, verifying the system's actual performance is equally critical.

Verification Status

Since publicly available documentation on FXStabilizer Pro is limited, traders are encouraged to dig deeper. Conduct thorough research and directly request detailed performance metrics from the developers before deploying the system in live trading conditions.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

5. Ganon Forex Robot

The Ganon Forex Robot is an automated trading tool designed for use with the MetaTrader platform. However, there’s a noticeable lack of detailed documentation about its AI capabilities and trading methods.

Strategy Type

From the available information, it appears that Ganon uses a grid-based, trend-following strategy. This involves placing orders both above and below the current market price to take advantage of price fluctuations. The robot focuses on major currency pairs like EUR/USD and GBP/USD, but specifics - such as how it determines entry and exit points, manages risk, or incorporates AI - remain unclear. Its design ensures smooth operation within the MetaTrader 4 environment.

Platform Compatibility

This robot is built specifically for MetaTrader 4 (MT4) and operates as an Expert Advisor (EA). Installation follows the standard MT4 process: simply copy the EA file into the appropriate "experts" folder and enable automated trading through the platform’s settings.

Verification Status

Performance transparency is limited. While the vendor provides screenshots and user testimonials, there’s no robust backtesting data or independent verification. Before committing, it’s wise to request more comprehensive performance metrics.

Infrastructure Sensitivity

Grid-based trading systems are often sensitive to execution delays. Although detailed technical requirements aren’t provided, using a dedicated VPS with a stable, low-latency connection is recommended to minimize potential connectivity issues.

6. Forex Fury

Forex Fury is a well-regarded automated trading system in the forex market, known for delivering consistent results. This expert advisor (EA) has gained trust through verified trading outcomes, which highlight its reliability and strategic design.

Strategy Type

Forex Fury employs a scalping strategy with three adjustable risk levels - low, medium, and high - so traders can tailor the system to match their risk tolerance. It also offers features like retrace and Martingale strategies for more advanced users, while beginners can stick to the conservative preset. Impressively, Forex Fury has a 93% winning track record, as verified by Myfxbook accounts, showcasing its ability to achieve steady monthly returns across various market conditions.

Platform Compatibility

Forex Fury is designed exclusively for MetaTrader 4, ensuring smooth integration with this popular trading platform. It comes with detailed installation guides and offers unlimited demo licenses, allowing traders to test and refine their strategies before committing real funds.

Verification Status

One of Forex Fury's standout features is its verified live trading accounts through Myfxbook, which provide transparency and credibility. Unlike systems that rely on backtesting or unverified claims, these accounts demonstrate real-world performance. Forex Fury has earned high ratings across several platforms:

- Benzinga: 4.5 out of 5 stars, ranked #1 robot.

- Forex Robot Nation: 4.8 out of 5 stars.

- Trustpilot: 4.3 out of 5 stars from 187 reviews.

- SiteJabber: 4.59 out of 5 stars from 91 reviews.

These ratings reflect the system's reliability and user satisfaction.

Pricing (USD)

Forex Fury offers two lifetime plans with free updates, responsive support, and competitive features:

| Plan | Current Price | Original Price | Live Accounts | Key Features |

|---|---|---|---|---|

| Gold Lifetime | $249.99 | $349.99 | 1 | Unlimited demos, lifetime updates, installation videos |

| Diamond Lifetime | $459.99 | $529.99 | 2 | All Gold features plus an extra live account license |

Compared to other top-rated robots on MQL5, which range from $349 to $1,745, Forex Fury is considered reasonably priced. However, some reviewers have pointed out that it costs more than some basic alternatives. As Benzinga notes:

"The main reason for this less-than-perfect rating for the bot is the EA's high pricing, which is more than double what some other forex trading robots currently cost."

"The main reason for this less-than-perfect rating for the bot is the EA's high pricing, which is more than double what some other forex trading robots currently cost."

Infrastructure Sensitivity

Because Forex Fury relies on a scalping strategy, stable connectivity and low latency are crucial for success. Quick trade execution is key to maintaining profitability, particularly during high-frequency trading periods. To minimize slippage and ensure consistent performance, traders are advised to use a dedicated VPS with reliable internet connectivity. This setup can significantly enhance the EA's effectiveness for serious users.

7. Happy Frequency EA

Next on our list is Happy Frequency EA, a trading tool that combines multiple strategies to navigate various market conditions. This EA employs a mix of four approaches - Trend, Grid, Hedge, and Semi-martingale - backed by verified performance in live trading environments.

Strategy Type

Happy Frequency EA is designed to adapt to different market scenarios. During trending markets, it follows directional price movements, while in ranging markets, it uses grid strategies. Operating on the M5 timeframe, it focuses on nine major currency pairs: USD/CAD, EUR/USD, EUR/GBP, EUR/JPY, EUR/CHF, GBP/USD, AUD/USD, USD/CHF, and USD/JPY. Traders can choose from four risk modes: low, medium, high, or combined.

A built-in news filter protects trades during major economic announcements, and regular updates (current version 1.2) ensure that the software stays relevant in changing market conditions. Its multi-strategy framework sets it apart from earlier trading solutions, offering flexibility for traders who value adaptability.

Platform Compatibility

The EA is compatible with both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. It supports a variety of account types, including Micro, Mini, Standard, and ECN, making it accessible to a broad spectrum of traders.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Verification Status

Happy Frequency EA prioritizes transparency by showcasing its performance through verified live trading accounts on Myfxbook.com. As of now, its live account - launched on July 17, 2023 - has achieved a total gain of +173.31%, with an average monthly gain of 6.30%. However, it’s worth noting that the drawdown stands at 43.64%. Additionally, the EA has earned a 7.0/10 rating on eatested.com, reflecting its effectiveness in real-world trading scenarios.

Pricing (USD)

Happy Frequency EA comes as part of the Happy Forex Full Pack, which includes nine other systems. The package offers a 30-day money-back guarantee and a lifetime license with no recurring fees after the first month. Pricing details are:

| License Type | Price | Original Price | Discount |

|---|---|---|---|

| 2 Licenses | $758 (€699) | $1,083 (€999) | 30% |

| 5 Licenses | $975 (€899) | $1,393 (€1,285) | 30% |

As a bonus, buyers also receive the Happy INDIcators PRO at no additional cost.

Infrastructure Sensitivity

Given its multi-strategy design and short-term (M5) trading focus, low latency is critical for optimal performance. A VPS is highly recommended for 24/7 operation, ensuring minimal slippage and fast trade execution. For standard accounts, a minimum deposit of $4,000 is recommended, while micro or cent accounts can start with as little as $40.

Advantages and Disadvantages

AI-powered Forex bots come with their own set of strengths and weaknesses. Knowing these trade-offs is crucial for traders to find a tool that aligns with their experience, risk tolerance, and trading style.

| Product Name | Main Advantages | Main Disadvantages | Optimal Use Case |

|---|---|---|---|

| Tickeron | AI-driven pattern recognition, in-depth market analysis, and educational resources | Subscription-based pricing; requires time to fully understand and utilize | Multi-strategy trading; learning-focused trading |

| GPS Forex Robot | Strong backtesting results, easy-to-use interface, and automated trade management | Limited to certain currency pairs; performance varies with market shifts | Trend trading; beginner-friendly automation |

| Odin Forex Robot | Advanced risk management, multi-timeframe analysis, and consistent performance tracking | High upfront cost; requires knowledge of MT4/MT5 platforms | Advanced trend trading; risk-conscious strategies |

| FXStabilizer Pro | Focuses on low drawdown, steady returns, and conservative trading | Slower profit generation; less suitable for aggressive strategies | Conservative trading; prioritizing capital safety |

| Ganon Forex Robot | Great for scalping with high-frequency trading and fast execution | Needs ultra-low latency; sensitive to spread changes | Scalping; short-term trading |

| Forex Fury | Proven track record, active community support, and frequent updates | Subscription costs; performance tied to market volatility | Multi-strategy trading; community-driven approaches |

| Happy Frequency EA | Combines trend, grid, and hedge strategies with verified live results and news filters | Higher drawdown; requires a larger minimum deposit | Flexible trading; adaptable to changing conditions |

Key Considerations for Traders

When choosing a Forex bot, technical requirements, costs, and usability are critical factors to weigh. For instance:

- Technical Demands: Scalping bots, like Ganon Forex Robot, require ultra-low latency and VPS hosting to function effectively. On the other hand, trend-following systems, such as FXStabilizer Pro, are more forgiving but still benefit from stable connections.

- Capital Requirements: Some bots work with smaller account balances, while others, like Happy Frequency EA, require a higher initial deposit. This reflects their differing approaches to risk management and position sizing.

- Ease of Use: Platforms vary in complexity. Some, like Tickeron, offer extensive educational resources, making them suitable for traders willing to learn. Others, like GPS Forex Robot, are designed for immediate use with minimal setup.

- Performance Transparency: Verification methods differ across systems. Some bots showcase live performance and detailed drawdown reports, while others rely heavily on backtesting, which may not always reflect real-world results.

- Market Adaptability: Multi-strategy bots can adjust to changing conditions, offering flexibility. However, this often comes with added complexity. Single-strategy bots may perform well in specific conditions but struggle during challenging market phases.

- Cost Structures: Pricing models also vary. Subscription-based platforms require ongoing payments, while lifetime licenses involve a one-time purchase. Traders should evaluate their long-term needs to decide which pricing model makes sense for them.

Understanding these factors helps traders match the right bot to their trading goals and preferences.

Final Recommendations

When choosing an AI Forex bot, it's essential to align your choice with your trading experience, risk tolerance, and technical setup. The detailed features of the bots mentioned earlier can help guide your decision.

If you're a beginner, look for bots with user-friendly interfaces and automated trade management. GPS Forex Robot is a solid option for those just starting out. On the other hand, advanced traders often need tools that allow for deep customization, strong risk management, and multi-timeframe analysis. For such needs, Odin Forex Robot is a great choice, though it does require familiarity with platforms like MT4 or MT5.

For scalpers and high-frequency traders, speed is critical. Ganon Forex Robot is designed for rapid trade execution, but this strategy demands an ultra-low latency setup. Make sure your VPS can handle these requirements. For example, our VPS hosting offers ultra-low latency and guarantees 100% uptime, making it an excellent option for traders with high-speed demands.

Conservative traders, who focus on preserving capital, should consider bots that emphasize steady performance over quick profits. FXStabilizer Pro is built to prioritize low drawdowns and consistent returns. If you prefer a multi-strategy approach, bots like Tickeron and Forex Fury are worth exploring, though it’s important to factor in subscription costs and other operational expenses.

Your capital size also plays a role in determining the right bot. Some bots work well with smaller account balances, while others, such as Happy Frequency EA, are better suited for larger deposits. Be sure to match your available capital with the bot's operational requirements.

FAQs

How can I choose the right AI-powered Forex trading bot for my trading style and experience?

To choose the right AI-powered Forex trading bot, start by considering your trading style and skill level. If you're a beginner, look for bots with simple interfaces, built-in risk management tools, and pre-designed strategies that make trading less intimidating. On the other hand, experienced traders might prefer bots offering advanced customization, powerful backtesting tools, and in-depth performance tracking.

Another key factor is the bot's ability to process real-time market data and adjust to changing conditions effectively. Check if the platform offers dependable customer support and clear, step-by-step documentation to help you navigate its features. By aligning your trading goals with the bot's capabilities, you'll be better equipped to make a smart choice.

What do I need to successfully set up and use a scalping-focused Forex trading bot?

To make the most of a scalping-focused Forex trading bot, start with a reliable, high-speed internet connection. This ensures trades are executed quickly, which is essential for scalping strategies. You'll also need a trading platform that supports automated trading and offers low latency, as even small delays can impact your results.

When configuring the bot, focus on a strategy that incorporates 1–3 key technical indicators like moving averages, RSI, or Bollinger Bands. These tools help the bot identify trading opportunities. Additionally, set tight stop-loss and take-profit levels to keep risks under control. It's crucial to regularly monitor the bot and adjust its settings to align with shifting market conditions, ensuring it continues to perform effectively.

By addressing these setup and technical details, you can boost the bot's efficiency and enhance your trading results.

Why is it important to check the performance of Forex trading bots before using them, and how can I do this effectively?

When using Forex trading bots, keeping an eye on their performance is crucial to ensure they meet your trading objectives and operate consistently. While past results can offer some insight, they’re not a crystal ball for future outcomes, so a thorough evaluation is a must.

To gauge performance, pay attention to key metrics like profitability, drawdown, and win rate. Start by running backtests with historical data to see how the bot would have performed in the past. Then, take it a step further by testing the bot in a demo account to observe its behavior in live market conditions. Make it a habit to check its performance regularly - weekly reviews are a good rule of thumb. This way, you can catch potential issues early and tweak settings to adapt to market changes, helping you steer clear of losses caused by overfitting or shifting trends.

To choose the right AI-powered Forex trading bot, start by considering your trading style and skill level. If you're a beginner, look for bots with simple interfaces, built-in risk management tools, and pre-designed strategies that make trading less intimidating. On the other hand, experienced traders might prefer bots offering advanced customization, powerful backtesting tools, and in-depth performance tracking.

Another key factor is the bot's ability to process real-time market data and adjust to changing conditions effectively. Check if the platform offers dependable customer support and clear, step-by-step documentation to help you navigate its features. By aligning your trading goals with the bot's capabilities, you'll be better equipped to make a smart choice.

To make the most of a scalping-focused Forex trading bot, start with a reliable, high-speed internet connection. This ensures trades are executed quickly, which is essential for scalping strategies. You'll also need a trading platform that supports automated trading and offers low latency, as even small delays can impact your results.

When configuring the bot, focus on a strategy that incorporates 1–3 key technical indicators like moving averages, RSI, or Bollinger Bands. These tools help the bot identify trading opportunities. Additionally, set tight stop-loss and take-profit levels to keep risks under control. It's crucial to regularly monitor the bot and adjust its settings to align with shifting market conditions, ensuring it continues to perform effectively.

By addressing these setup and technical details, you can boost the bot's efficiency and enhance your trading results.

When using Forex trading bots, keeping an eye on their performance is crucial to ensure they meet your trading objectives and operate consistently. While past results can offer some insight, they’re not a crystal ball for future outcomes, so a thorough evaluation is a must.

To gauge performance, pay attention to key metrics like profitability, drawdown, and win rate. Start by running backtests with historical data to see how the bot would have performed in the past. Then, take it a step further by testing the bot in a demo account to observe its behavior in live market conditions. Make it a habit to check its performance regularly - weekly reviews are a good rule of thumb. This way, you can catch potential issues early and tweak settings to adapt to market changes, helping you steer clear of losses caused by overfitting or shifting trends.

"}}]}