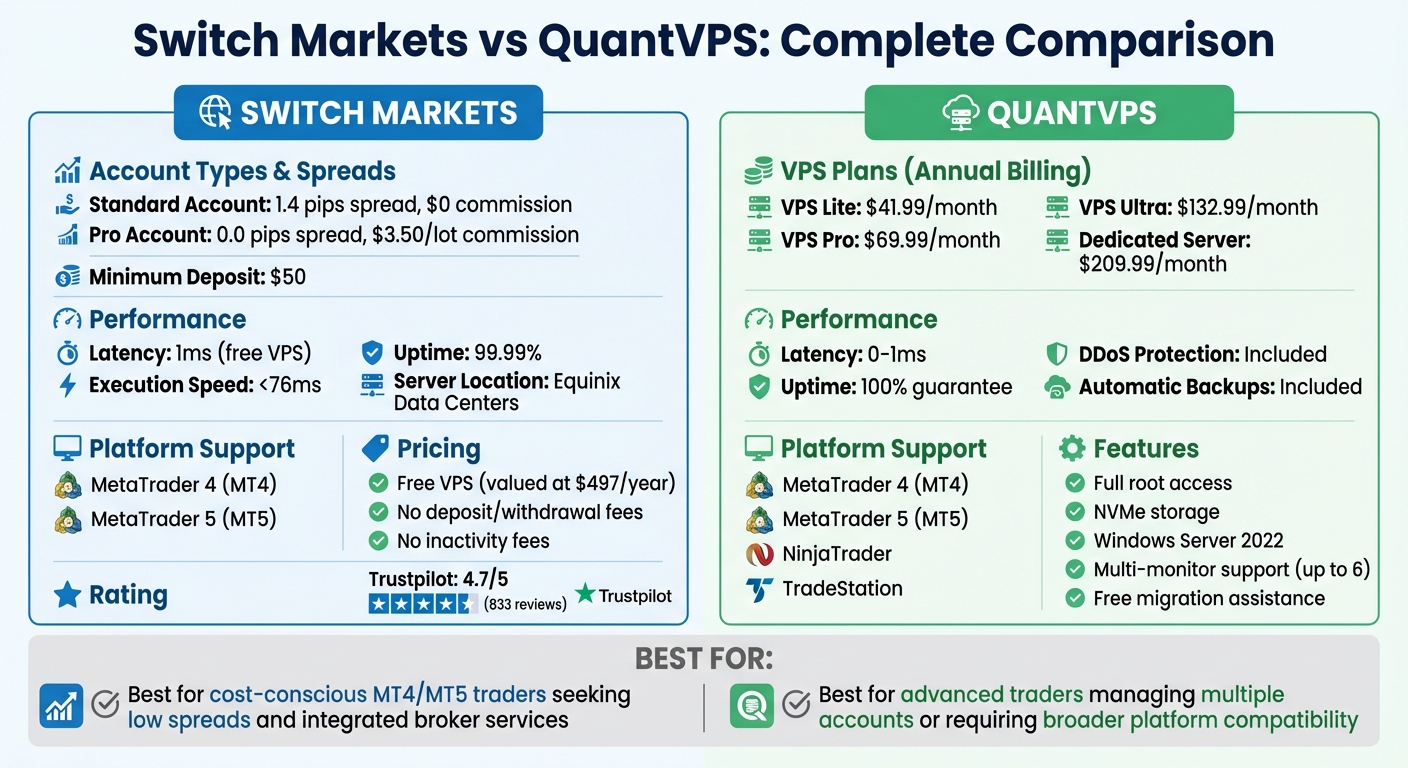

Switch Markets claims to deliver low trading costs with spreads starting at 0.0 pips for Pro accounts, paired with a $3.50 commission per lot. Standard accounts are commission-free but have slightly higher spreads starting at 1.4 pips. With a $50 minimum deposit, no fees for deposits/withdrawals, and a free VPS offering 1ms latency, it caters to both casual and high-frequency traders.

For those needing faster execution or broader platform compatibility, QuantVPS offers ultra-low latency (0-1ms), 100% uptime, and support for platforms like NinjaTrader and TradeStation, starting at $41.99/month (annual billing). While Switch Markets’ free VPS suits MT4/MT5 users, QuantVPS is ideal for traders managing multiple accounts or using advanced setups.

Key Takeaways:

- Switch Markets: Low spreads, free VPS, $50 deposit, MT4/MT5 support.

- QuantVPS: Faster execution, broader platform support, starts at $41.99/month.

Quick Comparison:

| Feature | Switch Markets | QuantVPS |

|---|---|---|

| Spreads | From 0.0 pips (Pro), 1.4 pips (Standard) | N/A (VPS service only) |

| Latency | 1ms (free VPS) | 0-1ms with 100% uptime |

| Platform Support | MT4, MT5 | MT4, MT5, NinjaTrader, TradeStation |

| Cost | Free VPS with $50 deposit | $41.99/month (VPS Lite, annual plan) |

Switch Markets is great for cost-conscious traders using MT4/MT5, while QuantVPS is better for advanced needs.

Switch Markets vs QuantVPS: Features, Pricing, and Performance Comparison

Switch Markets vs QuantVPS: Features, Pricing, and Performance Comparison

1. Switch Markets

Fee Structure

Switch Markets keeps things straightforward with two retail account options, both requiring a minimum deposit of $50. The Standard Account comes with zero commission and spreads starting at 1.4 pips on EUR/USD. On the other hand, the Pro Account offers raw spreads beginning at 0.0 pips, coupled with a $3.50 per lot per side commission (totaling $7 round turn). For institutional traders, the stakes are higher, with a $25,000 minimum deposit. The Institutional Standard Account provides spreads starting at 0.6 pips with no commission, while the Institutional Pro Account offers raw spreads and a $5.50 round-turn commission.

Switch Markets also stands out by eliminating hidden fees. There are no charges for deposits or withdrawals across more than 14 payment methods, and no inactivity fees. Their commitment to transparency has earned them a 4.7/5 rating on Trustpilot from 833 reviews, with many users applauding the zero-fee transaction policy.

Trading Platforms

Switch Markets doesn’t just focus on pricing – it also ensures traders have access to versatile tools. The broker supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which can be accessed on desktop (Windows/Mac), web browsers, and mobile devices (iOS/Android). MT4 is known for its one-click trading, Expert Advisors for automation, and customizable charts. Meanwhile, MT5 expands on these features, offering access to stocks and futures markets and an upgraded strategy tester for quicker and more accurate backtesting.

For traders who rely on advanced tools, Switch Markets integrates PineConnector, allowing TradingView alerts to link directly to MT5 accounts for seamless strategy execution. It also offers AlgoBuilder AI, which translates plain English commands into automated trading strategies. These features are complemented by a suite of performance tools, making trading more efficient and accessible.

Performance Optimization

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Performance is a priority for Switch Markets, especially for traders aiming to reduce costs and slippage. The broker hosts its servers in Equinix Data Centers, ensuring close proximity to liquidity providers and delivering average order execution speeds under 76 milliseconds. For those needing even faster execution, the broker provides a free VPS service (valued at $497 annually), which cuts latency down to just 1 millisecond.

Switch Markets also offers tools to help traders refine their strategies. The Risk Management EA calculates precise lot sizes based on individual risk-reward preferences. Trackatrader analyzes trading history to uncover patterns, while the AI Trading Agent – available for accounts with a $50+ balance – delivers real-time market updates to keep traders informed.

2. QuantVPS

Fee Structure

QuantVPS offers a variety of hosting plans to meet different trading needs. Here’s the breakdown:

- VPS Lite: $59.99/month, or $41.99/month if billed annually.

- VPS Pro: $99.99/month, or $69.99/month billed annually.

- VPS Ultra: $189.99/month, or $132.99/month billed annually.

- Dedicated Server: $299.99/month, or $209.99/month billed annually.

For traders seeking even better performance, QuantVPS provides Performance Plans (+) with upgraded specifications:

- VPS Pro+: $129.99/month, or $90.99/month billed annually.

- Dedicated+ Server: $399.99/month, or $279.99/month billed annually.

Every plan includes unmetered bandwidth, Windows Server 2022, and NVMe storage. These pricing options are designed to deliver performance while keeping costs competitive.

Trading Platforms

QuantVPS supports major trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), NinjaTrader, and TradeStation. This compatibility ensures smooth integration for traders using Expert Advisors (EAs) or automated strategies. With QuantVPS, you can rely on uninterrupted, 24/7 operation – perfect for automated trading systems.

What’s more, QuantVPS boasts 1-millisecond execution latency and a 100% uptime guarantee, minimizing delays that could affect trading outcomes, especially in markets with tight spreads.

Performance Optimization

QuantVPS is built for speed and reliability, offering ultra-low latency (0–1 millisecond) – a critical factor for scalpers and high-frequency traders. It also includes features like DDoS protection, automatic backups, and full root access, giving traders the flexibility to fine-tune their setup.

For those aiming for advanced setups, higher-tier plans include multi-monitor support, with the Dedicated+ Server accommodating up to six monitors. The service also offers global access and high-performance CPUs, ensuring seamless execution of strategies no matter where you are.

If you’re switching from another provider, QuantVPS makes the process easy and cost-effective with free migration assistance. These features combine to ensure tight spreads translate into real trading advantages.

Pros and Cons

Here’s a breakdown of how Switch Markets and QuantVPS compare when it comes to cost-effective trading:

| Feature | Switch Markets | QuantVPS |

|---|---|---|

| Low Spreads | Pro Account: from 0.0 pips ($3.50/lot commission); Standard Account: from 1.4 pips (no commission) | N/A – VPS service focused on execution speed |

| Latency | 1ms execution via free VPS (valued at $497/year for live accounts) | 0-1ms ultra-low latency with a 100% uptime guarantee |

| Platform Support | MT4 and MT5 only | MT4, MT5, NinjaTrader, TradeStation |

| Entry Barrier | $50 minimum deposit | $41.99/month (VPS Lite, annual billing) |

| Automation | Free VPS for 24/7 EA operation (requires support request) | Full root access, DDoS protection, automatic backups |

| Regulation | ASIC (Australia) and SVGFSA (offshore) – mixed levels of protection | N/A – infrastructure provider |

| Limitations | No cTrader or FIX API; VPS requires manual support request | No broker-specific features; additional service cost |

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

This table highlights the key differences and trade-offs between these two options for traders looking to maximize efficiency. Switch Markets stands out with its competitive Pro Account spreads starting at 0.0 pips and a Trustpilot rating of 4.7/5, alongside strong customer support. However, its Standard Account spreads of 1.4 pips and reliance on offshore SVGFSA regulation may provide less security for traders seeking robust oversight.

On the other hand, QuantVPS shines with its 0-1ms latency, broader platform compatibility (including NinjaTrader and TradeStation), and a 100% uptime guarantee, which outpaces Switch Markets’ 99.99% VPS uptime. Its infrastructure also allows for greater customization and control, thanks to features like full root access and DDoS protection.

For traders already using Switch Markets, the free VPS (available with a $50 deposit and a simple support request) offers excellent value for automated strategies. However, if you’re managing multiple broker accounts or require access to less common platforms, QuantVPS provides the flexibility and speed needed for more complex setups. Ultimately, the choice comes down to balancing Switch Markets’ integrated trading features with QuantVPS’s high-speed, multi-platform hosting to best suit your trading strategy.

Conclusion

Switch Markets delivers on its promise of low spreads through its Pro account, featuring raw spreads starting at 0.0 pips, a $3.50 per lot commission, and a strong 4.7/5 rating on Trustpilot based on 833 reviews. With a minimum deposit of just $50, it offers professional-grade trading conditions that are accessible even to those with a modest starting budget.

The broker’s free VPS provides 1ms execution latency and 99.99% uptime, making it an excellent choice for automated strategies. However, it has limitations for traders managing multiple accounts or using platforms beyond MT4 and MT5. This is where QuantVPS steps in as a valuable companion. With ultra-low latency ranging from 0-1ms, a 100% uptime guarantee, and support for platforms like NinjaTrader and TradeStation, QuantVPS fills the gaps that Switch Markets’ built-in VPS cannot address.

For traders utilizing the Pro account, combining it with QuantVPS – starting at $41.99/month for the VPS Lite plan – provides a competitive edge. The service offers full root access, DDoS protection, and automatic backups, giving traders enhanced customization and security compared to the broker’s free VPS. This pairing creates a seamless solution for those looking to optimize their trading performance.

This combination is particularly advantageous for scalpers and algorithmic traders. Switch Markets ensures cost-effective execution with its zero-pip spreads, while QuantVPS guarantees uninterrupted performance across multiple platforms and broker accounts. For those solely using MT4 or MT5, the broker’s free VPS is sufficient. However, traders with more diverse needs will find QuantVPS invaluable. Together, these tools create a reliable and efficient setup for traders seeking both affordability and high-performance execution.

FAQs

What’s the difference between Switch Markets’ Standard and Pro accounts?

The main distinction between Switch Markets’ Standard and Pro accounts lies in their pricing and spread structures. The Standard account is designed for traders who value simplicity, offering zero commission fees and spreads starting at approximately 1.4 pips. In contrast, the Pro account is tailored for those who prefer tighter spreads, beginning at 0.0 pips, but it comes with a commission per lot traded, typically ranging from $3.50 to $5.50.

Both accounts are compatible with MetaTrader 4 and 5 platforms, provide leverage of up to 1:500, and require a minimum deposit of $50, making them accessible to various trading styles and experience levels. The decision ultimately depends on whether you prefer a straightforward pricing model or tighter spreads with associated commission fees to align with your trading approach.

How does Switch Markets’ free VPS help improve trading performance?

Switch Markets’ free VPS (Virtual Private Server) offers traders a dependable, uninterrupted setup for executing trades efficiently. With this service, platforms like MetaTrader 4 and MetaTrader 5 can operate continuously, even if your personal device is offline or facing connectivity issues. This ensures smoother trading with lower latency and quicker order execution – key advantages for strategies like scalping or high-frequency trading.

Another major benefit is its compatibility with automated trading systems, such as Expert Advisors. The VPS keeps these systems running 24/7 without requiring manual oversight, reducing the chances of interruptions from internet outages or hardware problems. For traders looking to boost efficiency and minimize execution risks, this free VPS is a game-changer for maintaining consistent and reliable trading performance.

Why should traders consider QuantVPS instead of Switch Markets’ free VPS service?

Traders often lean toward QuantVPS instead of Switch Markets’ free VPS service due to its better performance, dependability, and tailored features. While Switch Markets does provide a free VPS, it might fall short in areas like speed, uptime, and flexibility compared to what a dedicated option like QuantVPS offers.

QuantVPS is crafted with high-frequency and algorithmic traders in mind, offering low-latency connections and reliable server performance. It also comes with stronger support, advanced security measures, and customizable settings, making it ideal for those who need a seamless and stable trading setup. For traders focused on efficiency and reliability, QuantVPS stands out as a solid option.