Osprey FX Review: The Ultimate Broker Breakdown

Osprey FX, an offshore broker founded in 2019, shut down operations on June 6, 2025. Known for its ECN/STP model, it offered high leverage (up to 1:500), tight spreads, and unique prop funding challenges. However, the lack of regulatory oversight, withdrawal issues, and a controversial shift to its proprietary TradeLocker platform led to mixed reviews. Before closure, it catered to experienced traders but posed significant risks due to unregulated status and operational flaws.

Key Points:

- Founded: 2019, based in St. Vincent and the Grenadines.

- Leverage: Up to 1:500.

- Platforms: Dropped MetaTrader 4/5 in 2023 for TradeLocker.

- Prop Funding: Profit splits up to 90%, with fees starting at $59.

- Closure Date: June 6, 2025.

- Trust Issues: Unregulated, Trustpilot rating of 2.3/5, frequent payout delays.

Bottom Line: While Osprey FX offered advanced trading features, its unregulated status and operational challenges made it a risky choice for traders.

OspreyFX Review 2026: Should You Trust This Broker? (Tested)

Company Background and Regulation

Osprey FX, established in either 2018 or 2019 (sources vary), operates under Osprey Ltd, registered in St. Vincent and the Grenadines (Company Number 25288 BC 2019). Initially, the broker positioned itself as an ECN/STP provider for forex and CFD trading. Over time, it expanded into proprietary trading by introducing funded account challenges. While it originally supported MetaTrader 4 and MetaTrader 5, Osprey FX eventually transitioned exclusively to the TradeLocker platform, integrating TradingView and discontinuing MetaTrader support entirely. This shift marked the beginning of operational and regulatory hurdles.

Throughout its history, Osprey FX has operated without regulatory oversight. Its registration with the Financial Services Authority (FSA) of St. Vincent and the Grenadines is strictly administrative, serving only to confirm its location. This does not equate to regulatory supervision or trader protection. As noted by the DailyForex.com Team, "OspreyFX operates a brokerage and prop business without regulation. Its registration with the Financial Services Authority of St. Vincent and the Grenadines does not mean it has regulatory oversight from this agency – it's simply confirmation that the business is located there". Without the backing of government-enforced safeguards like insurance or compensation schemes, traders are exposed to greater risks. The broker is not required to meet strict capital standards, undergo regular audits, or adhere to client fund protection rules that regulated brokers must follow.

Independent reviews further underscore these risks. WikiFX rated Osprey FX at 1.57/10, categorizing it as "High potential risk", while Forex Peace Army gave it a score of 1.6/5. To mitigate trust issues, the broker implemented measures such as Two-Factor Authentication (2FA) and claimed to store client funds in segregated bank accounts, separate from its operational funds.

However, on June 6, 2025, Osprey FX announced its closure, ceasing all operations and cutting ties with its technology providers. Clients were instructed to withdraw any remaining funds immediately. This abrupt shutdown highlighted the dangers of trading with an unregulated offshore broker. At the time of closure, Osprey FX held a Trustpilot rating of 2.4/5 from 192 reviews, with frequent complaints about payout delays and the absence of regulatory protections.

These regulatory gaps and operational risks cast a shadow over Osprey FX’s history, setting the stage for a closer look at its execution and trading conditions.

Trading Platforms and Tools

In December 2023, Osprey FX made a sudden shift by dropping MetaTrader 4 (MT4) and MetaTrader 5 (MT5) - removing over 50 MT4 indicators and 21 MT5 timeframes - in favor of its proprietary platform, TradeLocker. This move effectively cut off traders from the globally recognized MetaTrader platforms, which have long been staples for millions of users.

"OspreyFX sparked controversy by making a bold move this week: opting to replace the well-established MetaTrader 4 and 5 (MT4/MT5) with its in-house platform, TradeLocker." - WikiFX

"OspreyFX sparked controversy by making a bold move this week: opting to replace the well-established MetaTrader 4 and 5 (MT4/MT5) with its in-house platform, TradeLocker." - WikiFX

Let’s take a closer look at how this decision impacts the trading experience through TradeLocker’s features and limitations.

TradeLocker introduced a sleek, mobile-friendly interface that integrates TradingView charts. This integration brought professional-grade tools for technical analysis directly into the platform, offering advanced drawing tools and customizable chart types. These additions aimed to enhance manual trading and enable detailed visual analysis.

But the transition wasn’t without its downsides. TradeLocker lacked the flexibility and automation that made MetaTrader platforms so popular. Features like Expert Advisors (EAs) - essential for 24/7 automated trading strategies on MT4 and MT5 - had limited functionality on TradeLocker. Traders who depended on custom indicators, scripts, or MQL4/MQL5 programming found themselves unable to use the tools they had built their strategies around.

On the performance side, the platform supported ECN/STP execution, routing orders to over 50 liquidity providers. This setup theoretically enabled quick order execution, making it suitable for high-frequency trading and scalping strategies. Osprey FX also continued to allow various trading methods, including EAs, news trading, and hedging.

Account Types and Prop Funding Challenges

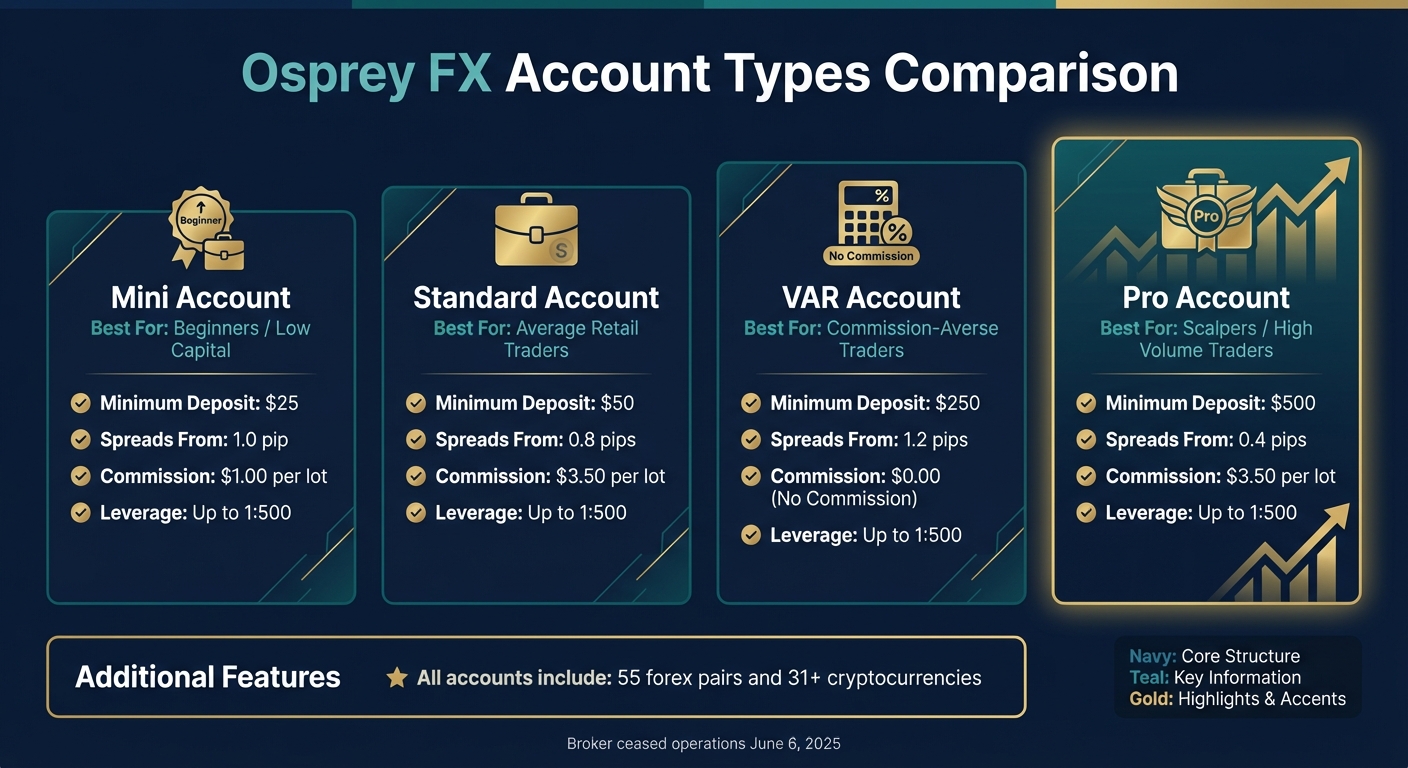

Osprey FX Account Types Comparison: Features, Spreads, and Commissions

Osprey FX Account Types Comparison: Features, Spreads, and Commissions

Osprey FX officially ceased operations on July 7, 2025, following the termination of its technology partnerships.

Before shutting down, Osprey FX catered to traders through two primary offerings: traditional brokerage accounts for those using their own capital and a prop evaluation program designed to provide access to larger simulated funding. The brokerage accounts came in four tiers, each tailored to different capital levels and trading strategies:

- The Mini Account required a minimum deposit of $25, offered spreads starting at 1.0 pip, and charged a $1.00 commission per lot.

- The Standard Account had a $50 minimum deposit, spreads from 0.8 pips, and a $3.50 commission per lot.

- The VAR Account operated on a no-commission model, required a $250 deposit, and provided spreads starting at 1.2 pips.

- The Pro Account required a $500 deposit, offered tighter spreads starting at 0.4 pips, and charged a $3.50 commission per lot.

All account types featured leverage of up to 1:500 and access to 55 forex pairs as well as 31+ cryptocurrencies.

Here’s a quick comparison of the account types:

Account Types Comparison

| Account Type | Min Deposit | Spreads (from) | Commission (per lot) | Best For |

|---|---|---|---|---|

| Mini | $25 | 1.0 pip | $1.00 | Beginners / Low Capital |

| Standard | $50 | 0.8 pips | $3.50 | Average Retail Traders |

| VAR | $250 | 1.2 pips | $0.00 | Commission-Averse Traders |

| Pro | $500 | 0.4 pips | $3.50 | Scalpers / High Volume Traders |

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Prop Funding with Osprey FX

Osprey FX also offered a prop evaluation program designed to help traders scale their strategies using simulated capital ranging from $5,000 to $200,000. The program followed a two-phase evaluation structure:

- Phase 1: Traders needed to hit a 10% profit target over at least 10 days, while adhering to a maximum daily loss limit of 5% and a total drawdown cap of 12%.

- Phase 2: The profit target was lowered to 8%, with an added rule that no single day's profit could exceed 30% of the total account balance.

Entry fees varied based on the account size, starting at $59 for a $5,000 account and going up to $899 for a $200,000 account. These fees were fully refundable after the first payout.

The program offered an initial profit split of 70%, which could increase to 90% as traders demonstrated consistent performance. There were no time limits for meeting profit targets, and traders could use a variety of strategies, including scalping, news trading, hedging, and Expert Advisors. However, traders had to complete KYC verification before receiving payouts, and accounts were automatically breached if inactive for 30 days.

Fees, Spreads, and Leverage

Osprey FX operates as a true ECN/STP broker, meaning it routes prices directly from liquidity providers without any dealing desk intervention. This setup allows the broker to offer variable spreads starting as low as 0.0 pips on certain accounts. On major pairs like EUR/USD, spreads typically begin at 0.1 pips, though they fluctuate based on market conditions and liquidity levels.

When it comes to commissions, Osprey FX tailors its structure to suit different types of traders. The exact fees depend on the account type, so it’s worth checking the Account Types Comparison table for specifics. Overall, the broker’s fee structure is competitive within the industry.

For traders seeking high leverage, Osprey FX offers up to 1:500 on all account types. This feature is particularly attractive to high-frequency traders and scalpers. The broker also supports trading strategies like scalping, news trading, and the use of Expert Advisors. However, it’s essential to keep in mind that higher leverage magnifies both potential profits and losses. Margin call and stop-out levels are set at 100% and 70%, respectively.

Swap charges apply to positions held overnight or through the weekend, varying based on the instrument and how long the position is held. These can be calculated using the broker’s swap calculator. Additional fees include $25 for wire transfers and $12 for ACH withdrawals, while withdrawals via cryptocurrency or credit/debit cards are free. These charges align with the broker's broader pricing approach.

The prop evaluation program also stands out for its pricing. Evaluation fees are fully refundable after the first payout, and traders can enjoy profit splits ranging from 70% to 90%.

Execution Speed, Drawdown Rules, and Trading Conditions

Osprey FX operates on an STP/ECN model, which means orders are routed directly to top-tier investment banks, hedge funds, and dark pools. This approach eliminates re-quotes and minimizes the chances of manipulation, ensuring a more transparent trading experience.

The platform places a strong emphasis on execution speed and trading conditions. While it's described as "ultra-fast", specific details about millisecond execution speeds aren't provided. However, the system is designed to minimize slippage, making it suitable for high-frequency trading, expert advisors (EAs), and scalping strategies. That said, traders may still encounter occasional slippage during periods of high market volatility, such as news-driven events.

For those participating in the funding program, strict rules are in place to manage risk. Traders must adhere to a 5% daily loss limit and a 12% static drawdown cap. During Phase 2, profits from a single day cannot exceed 30% of the total account profits. Additionally, accounts that remain inactive for 30 days are automatically terminated.

Standard trading accounts come with a margin call level set at 100% and a stop-out level at 70%. With leverage offered up to 1:500, traders need to employ careful risk management strategies to protect their capital. These rules and conditions highlight the importance of balancing execution speed with disciplined risk management to achieve consistent trading performance.

Deposits, Withdrawals, and Payouts

Important Update: On July 7, 2025, Osprey FX announced its closure, urging clients to withdraw their funds immediately. This sudden shutdown disrupted all deposit and withdrawal processes.

Prior to shutting down, Osprey FX supported deposits through several methods, including credit/debit cards, Bitcoin, bank wire transfers, VLoad, and UPay. The minimum deposit was generally $25, but bank wire transfers required at least $100 and came with a $25 fee. Additionally, new users were restricted to depositing a maximum of $2,000 until they completed identity verification within 30 days.

Withdrawal options were more restrictive. Profits could only be withdrawn via Bitcoin or bank wire transfer, and credit/debit card withdrawals were capped at the amount of the original deposit. Cryptocurrency withdrawals were processed relatively quickly, often within 24 hours, while bank wire transfers could take up to six days. Full KYC verification was required, and funds were only sent to accounts registered under the same name as the trading account.

The platform faced criticism for its operations. Trustpilot users rated it 2.4/5 based on 192 reviews, while Forex Peace Army gave it an even lower score of 1.6/5. Many complaints centered around delays in payouts and inconsistent customer support. These ongoing issues, combined with the abrupt closure, underscore the importance of withdrawing funds promptly.

Customer Support and User Reviews

Osprey FX officially closed its doors on June 6, 2025, bringing all customer support services to an abrupt halt. As previously mentioned, this sudden shutdown heightened existing concerns among traders and left many questions unanswered.

Before its closure, Osprey FX offered 24/7 customer support through live chat, email, and an online contact form. The live chat system started with an automated bot, which then transferred users to a human agent for further assistance. However, support was only provided in English, and there was no option for phone support or callback services.

User reviews painted a mixed picture of the broker. On Trustpilot, Osprey FX received a rating of 2.3 out of 5 from 190 reviews, while Forex Peace Army rated it even lower at 1.6 out of 5. Some traders appreciated the integration of TradeLocker with TradingView, which enhanced their trading experience. However, many others reported significant issues, including delays in withdrawals and lengthy processes for resolving payout disputes. The DailyForex team summarized the polarized feedback:

"It seems the firm either attracts five-star or 1-star review, suggesting customer experiences are at either end of the scale when it comes to satisfaction".

"It seems the firm either attracts five-star or 1-star review, suggesting customer experiences are at either end of the scale when it comes to satisfaction".

Adding to these challenges, Osprey FX operated as an unregulated broker in St. Vincent and the Grenadines, leaving traders without access to a financial ombudsman to mediate unresolved disputes. The feedback from users highlights the risks and operational flaws that were already a concern. Complaints about delayed payouts, combined with the eventual closure announcement, reinforce why caution was essential when dealing with this broker. These mixed experiences further illustrate the broader issues tied to Osprey FX's risk management and operational practices.

Pairing Osprey FX with QuantVPS for Better Performance

Important Note: Osprey FX ceased operations on June 6, 2025. This section is intended for informational purposes only, particularly for those researching past broker setups or who previously used the platform.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

When Osprey FX was active, traders using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) often encountered execution delays, especially on the TradeLocker platform. These delays were a significant hurdle for strategies like high-frequency trading, scalping, and running Expert Advisors (EAs). Tight spreads were a key feature of Osprey FX, but capturing them required ultra-low latency to minimize risks like slippage and missed trade entries. Unfortunately, TradeLocker’s performance challenges highlighted the necessity of using a dedicated VPS to maintain consistent execution speeds.

Traders addressed these issues by pairing their trading setup with QuantVPS. QuantVPS provided a stable, low-latency environment with dedicated resources, 24/7 uptime, and millisecond-level execution speeds - critical for high-frequency trading platform comparison and scalping strategies. Its infrastructure, powered by Windows Server 2022, NVMe storage, and unmetered bandwidth, allowed traders to run EAs without relying on a constantly running personal computer. This setup was especially crucial given Osprey FX’s leverage of up to 1:500 on Forex, which magnified both the potential rewards and risks associated with execution delays.

Pros and Cons of Osprey FX

Critical Update: Osprey FX ceased operations on June 6, 2025. This review reflects its features during its active years and serves as a historical reference for traders exploring similar offshore brokers.

Osprey FX gained attention for its ECN/STP execution model, which appealed to high-frequency traders and scalpers. The broker offered leverage as high as 1:500 and tight spreads starting at 0.1 pips on major currency pairs. With access to over 120 tradable assets - including 55+ Forex pairs and more than 30 cryptocurrencies - traders had the freedom to use strategies like scalping, news trading, and automated systems. The platform's low minimum deposit of $25 made it accessible for retail traders looking to experiment with different trading approaches.

However, the platform had its share of drawbacks. Trustpilot reviews averaged a low score of 2.3/5 from 190 users, many of whom complained about withdrawal delays and slippage during volatile market conditions. Forex Peace Army rated the broker even lower at 1.7/5 and marked it as "Out of Business" in July 2025. The transition from MetaTrader 4/5 to the proprietary TradeLocker platform frustrated many algorithmic traders who relied on MQL-based scripts and custom indicators. Additionally, the broker's crypto-centric withdrawal system, which included a $25 fee for bank wire transfers and high minimum withdrawal requirements, added complications for users who preferred traditional banking methods.

Comparison Table: Pros and Cons

| Pros | Cons |

|---|---|

| Leverage up to 1:500 for Forex and Metals | Ceased operations in June 2025 |

| ECN/STP execution with no dealing desk | Operated offshore without strict regulatory oversight |

| Tight spreads starting at 0.1 pips on major pairs | Shifted to TradeLocker, dropping MetaTrader 4/5 |

| Allowed high-frequency trading, scalping, and automated strategies | Trustpilot rating of 2.3/5 due to withdrawal delays |

| Low minimum deposits of $25 | $25 fee for bank wire withdrawals |

| Prop funding challenges starting at $59 | Steep commissions on stock/index trading ($7 per lot) |

| Access to 120+ tradable assets | Automated customer support system |

| Profit splits up to 90% on funded accounts | 74%–89% of retail accounts lost money |

Final Verdict on Osprey FX

Important Note: Osprey FX is no longer in operation, so this analysis serves as a historical assessment rather than a recommendation.

When it was active, Osprey FX gained attention from high-frequency and algorithmic traders due to its advanced trading options and access to institutional-grade liquidity from over 50 global banks. The platform supported scalping, hedging, news trading, and the use of Expert Advisors, making it appealing to those relying on automated strategies. However, the switch to TradeLocker disrupted these features, alienating traders who preferred MetaTrader platforms. Despite these offerings, the broker's operational risks were hard to overlook.

The biggest concern was its unregulated offshore status, which left traders without the protection of oversight from major financial authorities. User feedback reflected these risks, with Trustpilot ratings averaging 2.3/5 and Forex Peace Army ratings near 1.6/5. Complaints often cited withdrawal delays, steep wire transfer fees, and slippage during volatile market conditions.

Osprey FX did offer some appealing features, such as a $59 entry-level prop trading challenge, which allowed traders to test their skills with minimal upfront risk. However, the simulated capital model and a strict 30-day inactivity termination rule added layers of complexity. Additionally, its willingness to accept U.S. traders - uncommon among high-leverage CFD providers - raised questions about its long-term adherence to regulatory standards.

Key Takeaway: Osprey FX was designed for experienced traders willing to trade off regulatory safeguards for greater leverage and trading flexibility. However, the challenges faced by its users underscore the risks associated with unregulated offshore brokers. For professional traders, choosing a regulated broker with strong investor protections is a safer and more reliable option than platforms like Osprey FX.

FAQs

Why did Osprey FX replace MetaTrader with TradeLocker?

Osprey FX has shifted from the widely-used MetaTrader 4/5 platforms to its in-house TradeLocker platform, aiming to offer a more modern and customized trading experience. This change gives the broker greater control over platform features, enabling them to fine-tune functionality to suit different trading preferences.

With this proprietary platform, Osprey FX focuses on delivering better performance, quicker execution speeds, and tools designed to meet the needs of both novice and seasoned traders.

What are the risks of trading on an unregulated broker like Osprey FX?

Trading with an unregulated broker like Osprey FX carries a number of risks that you should carefully consider. Without regulatory oversight, there’s no assurance of investor protection, meaning your funds could be at risk in cases of fraud or platform malfunctions. One notable concern is the availability of extremely high leverage, sometimes as much as 500:1. While this can amplify potential profits, it also significantly increases the risk of substantial losses.

Another issue is the reliance on crypto-only deposits, which can restrict your payment options and make it harder to seek recourse if something goes wrong. Additionally, there’s always the chance that an unregulated platform could shut down without warning, leaving traders unable to recover their funds. These risks highlight the importance of thoroughly evaluating your options before choosing to trade with an unregulated broker.

What was the Osprey FX prop funding program, and how did it work before it closed?

Before shutting down, the Osprey FX prop funding program provided traders with an opportunity to trade using funded accounts - after completing a simulated trading challenge. Entry fees started at $59 for a challenge tied to a $5,000 account.

To pass the challenge, participants had to stick to strict rules, including a 5% daily loss limit and a 12% trailing drawdown. Successfully meeting these requirements unlocked funded accounts ranging from $5,000 to $200,000, with traders earning a profit share of 70% to 90%, based on their performance. This program was particularly appealing to traders aiming to grow their trading activity without putting their own money on the line.

Osprey FX has shifted from the widely-used MetaTrader 4/5 platforms to its in-house TradeLocker platform, aiming to offer a more modern and customized trading experience. This change gives the broker greater control over platform features, enabling them to fine-tune functionality to suit different trading preferences.

With this proprietary platform, Osprey FX focuses on delivering better performance, quicker execution speeds, and tools designed to meet the needs of both novice and seasoned traders.

Trading with an unregulated broker like Osprey FX carries a number of risks that you should carefully consider. Without regulatory oversight, there’s no assurance of investor protection, meaning your funds could be at risk in cases of fraud or platform malfunctions. One notable concern is the availability of extremely high leverage, sometimes as much as 500:1. While this can amplify potential profits, it also significantly increases the risk of substantial losses.

Another issue is the reliance on crypto-only deposits, which can restrict your payment options and make it harder to seek recourse if something goes wrong. Additionally, there’s always the chance that an unregulated platform could shut down without warning, leaving traders unable to recover their funds. These risks highlight the importance of thoroughly evaluating your options before choosing to trade with an unregulated broker.

Before shutting down, the Osprey FX prop funding program provided traders with an opportunity to trade using funded accounts - after completing a simulated trading challenge. Entry fees started at $59 for a challenge tied to a $5,000 account.

To pass the challenge, participants had to stick to strict rules, including a 5% daily loss limit and a 12% trailing drawdown. Successfully meeting these requirements unlocked funded accounts ranging from $5,000 to $200,000, with traders earning a profit share of 70% to 90%, based on their performance. This program was particularly appealing to traders aiming to grow their trading activity without putting their own money on the line.

"}}]}