How My Funded FX Works: Trading Terms, Conditions & Challenges

My Funded FX (MFFX) offers traders a chance to access simulated trading capital by completing a two-phase evaluation process. With profit splits ranging from 80% to 92.75%, traders can earn payouts while adhering to strict risk management rules. Here's what you need to know:

-

Evaluation Phases:

- Phase 1: Achieve an 8% profit target with 3-5 profitable days.

- Phase 2: Hit a 5% profit target with 3-7 profitable days.

- Both phases allow unlimited trading days and require trades to meet specific duration rules.

-

Key Rules:

- Daily Loss Limit: 5%.

- Overall Loss Limit: 8%-10%.

- Trades must remain open for at least 2 minutes, with 50% of profits coming from trades held over 5 minutes.

-

Trading Features:

- Markets include Forex, Indices, Crypto, and Commodities.

- Weekend trading is prohibited; all positions must close by Friday's market close.

- News trading is allowed but restricted around high-impact events.

-

Payouts & Scaling:

- Minimum payout: $100 after 7 trading days.

- Payouts are processed within 1-5 business days.

- Accounts can scale up to $1 million with consistent performance.

- Phase 1: Achieve an 8% profit target with 3-5 profitable days.

- Phase 2: Hit a 5% profit target with 3-7 profitable days.

- Both phases allow unlimited trading days and require trades to meet specific duration rules.

- Daily Loss Limit: 5%.

- Overall Loss Limit: 8%-10%.

- Trades must remain open for at least 2 minutes, with 50% of profits coming from trades held over 5 minutes.

- Markets include Forex, Indices, Crypto, and Commodities.

- Weekend trading is prohibited; all positions must close by Friday's market close.

- News trading is allowed but restricted around high-impact events.

- Minimum payout: $100 after 7 trading days.

- Payouts are processed within 1-5 business days.

- Accounts can scale up to $1 million with consistent performance.

To succeed, traders must follow the rules, maintain discipline, and focus on steady performance rather than risky trades.

My Funded FX Prop Firm Review: Pros, Cons, Hidden Risks With My Funded FX Challenge.

My Funded FX Evaluation Models Explained

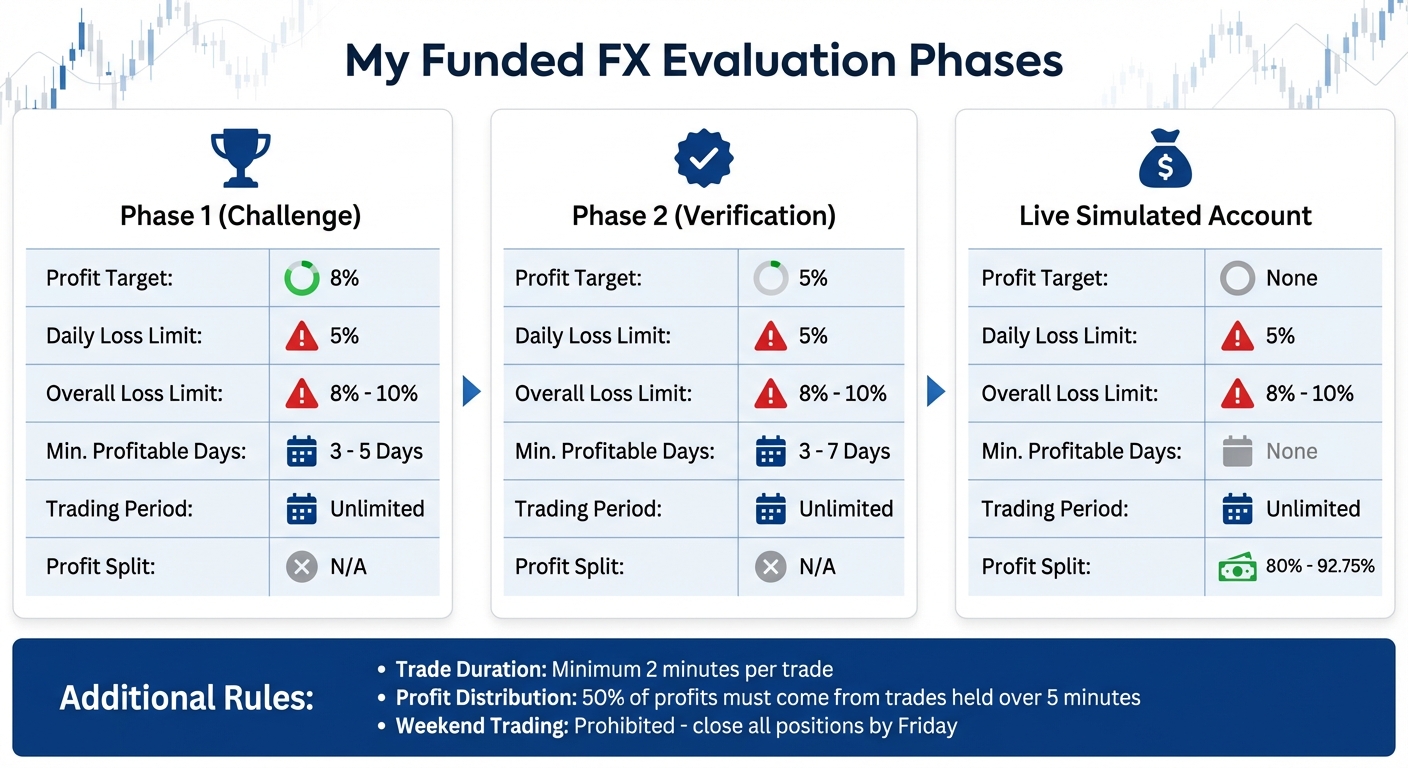

My Funded FX Evaluation Phases: Requirements and Rules Comparison

My Funded FX Evaluation Phases: Requirements and Rules Comparison

How Evaluation Challenges Work

My Funded FX offers two evaluation options for traders: the Standard Two-Step Challenge and the Fast-Track One-Step Challenge. The Standard model requires traders to complete two separate phases before accessing a funded simulated account. On the other hand, the Fast-Track Challenge simplifies the process, requiring traders to hit an 8% profit target in a single step, though with stricter conditions.

Once you successfully complete these phases, you’ll gain access to a Live Simulated Account, where you can keep between 80% and 92.75% of your net profits, depending on your selected plan and any additional features you’ve purchased. All evaluations are conducted through the Match Trader platform.

Let’s break down the requirements for each phase.

Phase 1 and Phase 2 Requirements

Phase 1, or the Challenge phase, sets an 8% profit target and requires 3 to 5 profitable trading days, depending on the account type you choose. Once you meet these criteria, you move directly to Phase 2 without waiting for manual approval.

Phase 2, called the Verification phase, lowers the profit target to 5% but increases the requirement to 3 to 7 profitable trading days. Both phases allow unlimited trading days, giving you the flexibility to meet your goals at your own pace. However, there are specific trade duration rules: each trade must stay open for at least 2 minutes, and at least 50% of your total profits must come from trades held for longer than 5 minutes.

Here’s a quick overview of the metrics for each phase:

| Feature | Phase 1 (Challenge) | Phase 2 (Verification) | Live Simulated Account |

|---|---|---|---|

| Profit Target | 8% | 5% | None |

| Daily Loss Limit | 5% | 5% | 5% |

| Overall Loss Limit | 8% - 10% | 8% - 10% | 8% - 10% |

| Min. Profitable Days | 3 - 5 Days | 3 - 7 Days | None |

| Trading Period | Unlimited | Unlimited | Unlimited |

| Profit Split | N/A | N/A | 80% - 92.75% |

Risk Management Rules and Drawdown Limits

To ensure disciplined trading, My Funded FX enforces two key loss limits: a daily loss limit (typically 5%) and an overall loss limit (usually 8% to 10%). Exceeding either of these limits results in the termination of your account.

For added flexibility, traders can purchase optional add-ons like FlexiShield, which increases the daily loss limit by 2% for an additional 25% fee, or BufferZone, which adds 3% to the daily loss limit for a 30% fee. Another important rule to keep in mind: all open positions must be closed before the market closes on Friday to avoid penalties for holding trades over the weekend.

Trading Terms and Conditions

Account Rules and Allowed Trading Strategies

My Funded FX provides traders with the opportunity to use both swing trading and algorithmic strategies. All trades are executed with 3:1 leverage, and you can access a variety of markets, including major forex pairs, indices, commodities, and cryptocurrencies. To gain an edge in these markets, many traders use advanced visualization tools to monitor order flow and liquidity.

To promote responsible trading, there are specific rules in place. Trades must remain open for at least 2 minutes, and over half of your total profits should come from trades held longer than 5 minutes. These guidelines are designed to prioritize sound risk management and avoid reliance on high-frequency trading methods.

For every trade, commissions are charged at $2.00 per side, which amounts to $4.00 per round trip. Be sure to include these costs when planning your trading strategies.

Next, let’s explore how timing and news-related rules impact trading activities.

Time and News Trading Restrictions

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Trading around major news events is permitted, but there are strict timing rules. You cannot open new positions within 2 minutes before or after high-impact news releases like NFP, CPI, or FOMC. If you do execute a trade during this window, it must stay open for at least 2 minutes to remain valid.

Weekend trading is not allowed, so all positions must be closed before the market closes on Friday. However, overnight trading during the week is allowed, though you’ll need to account for any swap charges and the potential risks of trading in low-liquidity conditions.

Additionally, accounts will be permanently deactivated after 30 days of inactivity, so consistent engagement is necessary to maintain your account.

These rules set the stage for understanding the payout process and account scaling options.

Payout Policies and Account Scaling

When you achieve Live Simulated Trader status, you’ll receive an 80/20 profit split - meaning you keep 80% of your simulated profits. To qualify for a payout, you must trade for at least 7 calendar days and adhere to all risk management rules. Once you submit a payout request, it’s typically reviewed within 1 to 2 business days, and approved payments are sent within 5 days via Crypto or Riseworks.

There’s also a 50% consistency rule in place: no single trading day’s profit can exceed 50% of your total gains at the time of your payout request. If one trade contributes disproportionately to your earnings, your withdrawal might be denied. This encourages traders to distribute profits across multiple days.

Scaling opportunities are available for traders who consistently demonstrate strong performance. Regular evaluations consider your trading strategy, profit consistency, and adherence to risk management. Traders who meet these criteria may qualify for increased trading capital, bonuses, or even higher profit shares - rewards earned through disciplined and rule-compliant trading.

How to Pass My Funded FX Challenges

Creating a Rules-Based Trading Plan

To pass a prop firm challenge like My Funded FX, your trading plan must align with specific targets: an 8% profit in Phase 1 and a 5% profit in Phase 2, all while staying within strict loss limits - 5% daily and 8% overall. Breaking these rules ends your evaluation immediately, so precision is non-negotiable.

Start by determining your risk per trade. With a 5% daily loss cap, choose position sizes that allow for multiple losing trades without breaching the limit. For example, risking 1% per trade means you could endure five consecutive losses and still stay within the rules.

Consistency is key. To move forward, you need at least three profitable trading days per phase. This emphasizes steady performance over occasional big wins. Keeping a detailed trading journal can help you track daily profits, losses, trade durations, and rule compliance to meet this requirement.

Don’t overlook trade duration rules. Trades must stay open for at least 2 minutes, and half of your total profits must come from trades held longer than 5 minutes. Use a news calendar to avoid high-impact events that could interfere with the ±2-minute window around major announcements.

Once your rules are set, focus on ensuring a stable trading environment. This is where QuantVPS becomes essential.

Daily Execution and Platform Setup with QuantVPS

A solid platform setup is critical for executing your trading plan without hiccups. My Funded FX primarily uses Match Trader. Running Match Trader on a QuantVPS instance ensures reliable 24/7 access, a static IP to avoid security issues, and low-latency connections for accurate order execution .

If you rely on Expert Advisors (EAs) or automated strategies, configure them to comply with trade duration rules. Additionally, set up reminders or automated scripts to close all positions before the market shuts on Friday, as My Funded FX prohibits holding trades over the weekend .

Keep a close eye on your account equity through the VPS dashboard. Hitting a 10% profit milestone resets the drawdown to your starting balance. Maintaining a profit cushion can help you stay within drawdown limits during market fluctuations and avoid accidental breaches when withdrawing funds.

Managing Psychology and Avoiding Common Mistakes

Once your technical setup is ready, focus on maintaining discipline and avoiding psychological pitfalls. One common mistake is the "all-or-nothing" mindset - risking 3.5% to 5% on a single trade to hit profit targets quickly . Success comes from steady performance, not gambling on one lucky trade.

"This rule [30% best day rule] is in place to prevent payouts being requested after just one lucky day or a single high‐risk trade." – FundedFX

"This rule [30% best day rule] is in place to prevent payouts being requested after just one lucky day or a single high‐risk trade." – FundedFX

Avoid increasing your position size dramatically during high-volatility events. Overleveraging during news releases is a common reason traders fail evaluations . Stick to the strategies you’ve tested and refined, and don’t experiment with unproven methods during this critical period.

Revenge trading - trying to recover losses after hitting your daily loss limit - is another major account killer . Use automated risk tools or hard stops to cap your losses . If you reach your daily limit, log off for the day. No single trade is worth jeopardizing your entire evaluation.

The habits you develop during the evaluation phase will carry over to your funded account. Rule compliance should become second nature.

"Success means proving your trading acumen through achievable profit targets and strict rule adherence. This stage builds the foundation for professional trading." – MyFundedFutures

"Success means proving your trading acumen through achievable profit targets and strict rule adherence. This stage builds the foundation for professional trading." – MyFundedFutures

Consider joining the My Funded FX community through Discord or webinars. Engaging with experienced traders can provide valuable feedback and insights. Many users also highlight the platform’s fast support and reliable payouts - resources that can help you overcome challenges before they escalate into major setbacks.

Managing Your Funded Account

Once you’ve transitioned from evaluation to a funded account, the real work begins. It’s not just about following trading rules anymore - it’s about staying on top of daily operations, handling withdrawals, and focusing on growing your account.

Daily Operations for Funded Accounts

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Now that you’re funded, staying compliant is key. Make sure to log in or place a trade at least once every 30 days. Also, close all positions before the market shuts down on Fridays. The same trade duration and profit distribution rules from your evaluation phase still apply. News trading is allowed, but there’s a catch: if you open or close a trade within 2 minutes of major events like NFP or FOMC announcements, that trade needs to stay open for at least 2 minutes to count as valid.

Once you’ve got your daily routine locked in, the next step is managing your payouts efficiently.

How to Request and Receive Payouts

Ready to withdraw your profits? Here’s how it works: head to the "Live Simulated Account" section and hit "Request Payout" once your gross profit reaches $100 and you’ve completed at least 7 active trading days. You’ll need to choose your payout method - Crypto, RISE, or card - and make sure your KYC is completed and your payment account is set up ahead of time. The internal review usually takes 1–2 business days, and after approval, you’ll see your funds within 1–5 days.

Keep in mind, no single day can contribute more than 30% of your total profits for payout eligibility. Once your account hits a 10% profit milestone, the drawdown resets to your starting balance. Also, make sure to leave at least 2% of your profits in the account after a withdrawal to keep your funded status intact. If you’re a U.S. trader, don’t forget to report and pay taxes on your payouts and commissions.

After you’ve streamlined your payout process, it’s time to think bigger - scaling your account and growing your capital.

Scaling Your Account and Growing Capital

My Funded FX offers opportunities to scale your account, increasing its size, daily loss limits, and contract allowances. For instance, a $2,000 funded account can grow to $20,000 or more through custom scaling plans. If you achieve five consecutive payouts, you may qualify for account upgrades, higher capital, and better profit splits. To maintain consistency, avoid making drastic changes in your position sizes. Instead, focus on frequent trades with smaller sizes to ensure no single trading day contributes too heavily to your overall profits.

As your account grows, you might need to upgrade your QuantVPS instance. While a $2,000 account works fine on QuantVPS Lite, scaling up to $20,000 or more will likely require a high-performance trading VPS like a Pro or Ultra plan. These upgrades provide the additional resources needed for more charts, faster trade execution, and reduced latency. To stay on track, use a consistency calculator or dashboard to monitor how consistency rules work and your best trading day’s impact on your overall profits, ensuring you remain eligible for future payouts and scaling opportunities.

Some plans even include a "Flex Add-On", allowing you to withdraw 50% of your profits while letting the rest compound in your account. This feature can help you grow your capital further.

Conclusion

Achieving a funded account with My Funded FX requires more than just skill - it demands unwavering adherence to the rules and consistent performance. With over $56 million paid out to more than 500,000 traders, the platform has shown that those who respect its guidelines can succeed.

Key rules include the 5% daily and 8% overall loss limits, as well as ensuring no single trading day accounts for more than 50% of total profits. Violating these rules leads to immediate disqualification. The system is clear but unforgiving; even small technical errors can result in blocked payouts or account resets.

To make the most of your funded account, stay active by placing at least one trade every 30 days and avoid holding positions over the weekend by closing them before Friday's market close. Regularly check your dashboard, use prudent position sizing, and steer clear of high-risk "all-or-nothing" strategies that could jeopardize 3.5% to 5% of your account on a single trade. Those who scale to $1 million accounts do so through disciplined, rule-abiding trading rather than chasing fast profits.

FAQs

What happens if I go over the daily or overall loss limits in My Funded FX?

If you hit the 2% daily loss limit, it’s considered a "soft breach", which might disqualify you from moving forward. Exceeding the 8% overall loss limit, however, leads to an automatic failure of the challenge and forfeiture of your funded account.

To prevent these outcomes, keep a close eye on your trades, follow the program’s risk management guidelines, and carefully plan your strategies to stay within the established boundaries.

How do I qualify for account scaling and access more trading capital?

To qualify for account scaling and access to increased trading capital, you’ll need to complete the Evaluation-to-Live (ETL) plan and consistently hit the program’s profit milestones. Once you pass the ETL evaluation, you’ll begin trading with a live-funded account starting at $2,000. If you pass multiple accounts at the same time, your starting balance could be higher. As you meet the required profit targets, your account size, daily loss limit, and the number of contracts you can trade will grow according to a predefined scaling structure - eventually reaching $20,000 or more.

To move through the scaling levels, you’ll need to meet these three conditions:

- Hit profit targets without exceeding the trailing drawdown.

- Adhere to risk management rules, staying within the daily loss limit.

- Stay active, trading at least once every seven days to maintain consistency.

By meeting these criteria, you’ll keep the 80% profit split and gain access to larger trading allowances. Successfully balancing profit-making with effective risk management will help you scale your account and unlock greater trading opportunities.

What happens if I don’t follow the trade duration or profit distribution rules?

If you don’t follow the rules for trade duration or profit distribution, your challenge will be disqualified, and your demo account will be terminated. To stay on track, make sure you fully understand the program's guidelines and stick to them. This is key to keeping your eligibility and moving forward in the evaluation process.

If you hit the 2% daily loss limit, it’s considered a "soft breach", which might disqualify you from moving forward. Exceeding the 8% overall loss limit, however, leads to an automatic failure of the challenge and forfeiture of your funded account.

To prevent these outcomes, keep a close eye on your trades, follow the program’s risk management guidelines, and carefully plan your strategies to stay within the established boundaries.

To qualify for account scaling and access to increased trading capital, you’ll need to complete the Evaluation-to-Live (ETL) plan and consistently hit the program’s profit milestones. Once you pass the ETL evaluation, you’ll begin trading with a live-funded account starting at $2,000. If you pass multiple accounts at the same time, your starting balance could be higher. As you meet the required profit targets, your account size, daily loss limit, and the number of contracts you can trade will grow according to a predefined scaling structure - eventually reaching $20,000 or more.

To move through the scaling levels, you’ll need to meet these three conditions:

- Hit profit targets without exceeding the trailing drawdown.

- Adhere to risk management rules, staying within the daily loss limit.

- Stay active, trading at least once every seven days to maintain consistency.

By meeting these criteria, you’ll keep the 80% profit split and gain access to larger trading allowances. Successfully balancing profit-making with effective risk management will help you scale your account and unlock greater trading opportunities.

If you don’t follow the rules for trade duration or profit distribution, your challenge will be disqualified, and your demo account will be terminated. To stay on track, make sure you fully understand the program's guidelines and stick to them. This is key to keeping your eligibility and moving forward in the evaluation process.

"}}]}