Best VPS for Interactive Brokers (IBKR) in 2026: Chicago vs New York Explained

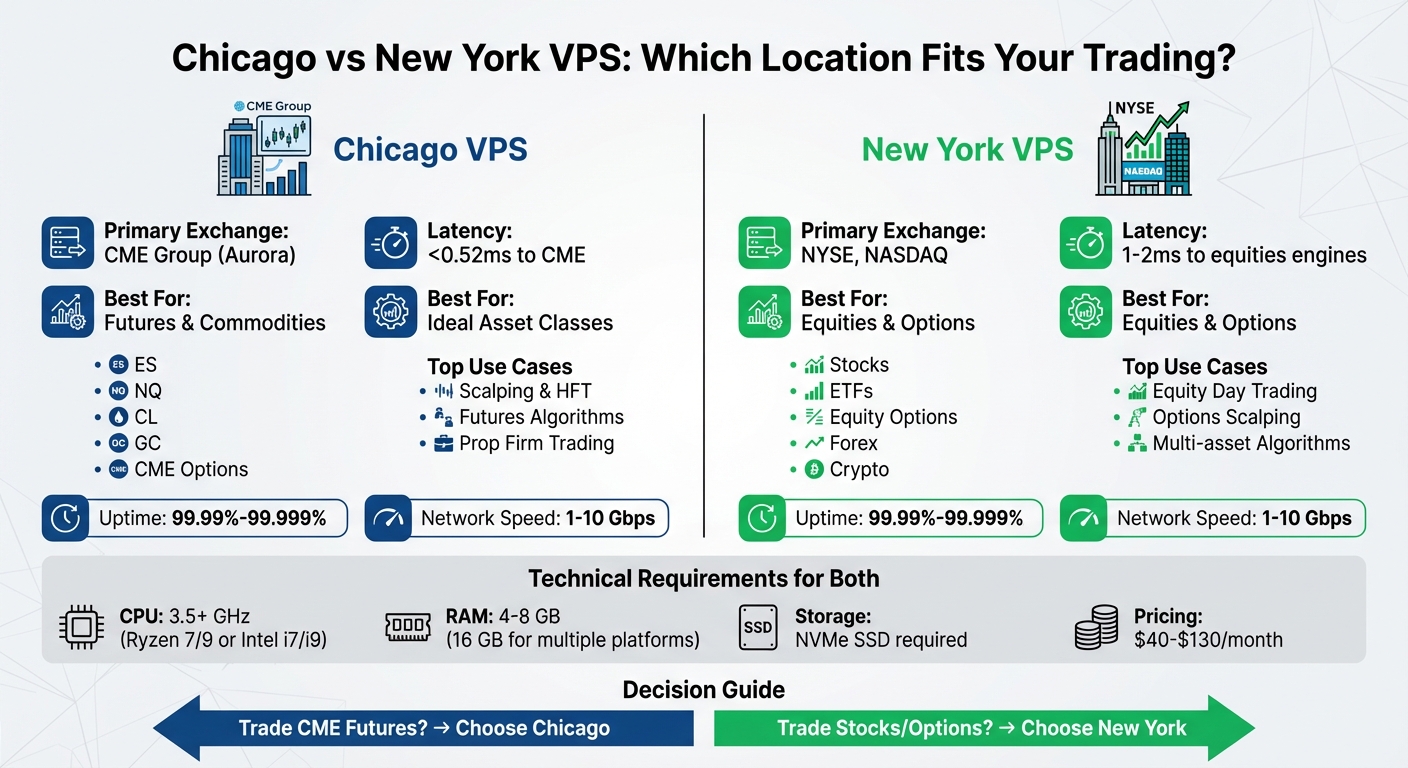

When trading on Interactive Brokers (IBKR), choosing the right VPS location can significantly impact your trading performance. The proximity of your VPS to financial exchanges directly influences latency, which is crucial for fast and accurate trade execution. Here’s the key takeaway:

- Chicago VPS: Best for futures traders using CME products (like ES, NQ, CL, GC). Offers sub-1ms latency to CME’s Aurora matching engines, ideal for scalping, high-frequency trading, and automated IBKR API strategies.

- New York VPS: Best for equity and options traders focusing on NYSE and NASDAQ. Provides 1–2ms latency, suitable for stock trading, options scalping, and multi-asset strategies.

Both locations offer enterprise-grade reliability with uptime guarantees of 99.99% or higher, ensuring uninterrupted trading.

Quick Comparison

| Feature | Chicago VPS | New York VPS |

|---|---|---|

| Primary Exchange | CME (Futures) | NYSE, NASDAQ |

| Latency | < 0.52ms to CME | 1–2ms to equities |

| Best For | Futures, Commodities | Equities, Options |

| Use Cases | Scalping, Algos | Day Trading, APIs |

If you trade CME futures, go with Chicago. For equity and options trading, New York is the better pick. Each VPS location ensures faster execution and reduced slippage for its respective market.

Chicago vs New York VPS for IBKR Trading: Latency and Performance Comparison

Chicago vs New York VPS for IBKR Trading: Latency and Performance Comparison

Chicago VPS for Futures and CME Trading

Proximity to CME Infrastructure

Chicago is home to the CME Group's matching engines, located in Aurora, Illinois. This is where futures contracts like ES (E-mini S&P 500), NQ (E-mini NASDAQ-100), CL (Crude Oil), GC (Gold), and 6E (Euro FX) are executed. Hosting your VPS in a Chicago-based datacenter allows your trade orders to travel over direct fiber connections to these engines, resulting in latencies as low as 0.52ms. Compare that to the 20ms to 100ms+ latencies most retail traders face when using home internet connections.

But it’s not just about speed. Proximity also reduces jitter - those unpredictable delays that can disrupt order execution. With minimized routing and jitter, your orders arrive more consistently, which is critical for traders using IBKR API strategies. These advantages are particularly valuable for high-speed strategies, as discussed below.

Best Use Cases for Chicago VPS

- Scalping and high-frequency strategies: These rely heavily on ultra-low latency. When trading small tick movements on contracts like ES or NQ, every millisecond matters. Sub-1ms latency can mean faster execution, better prioritization, and reduced slippage.

- Automated and algorithmic trading: If you’re using the IBKR API, you need uninterrupted, 24/7 operation. A Chicago VPS ensures your trading bots stay online even during local connectivity issues. This is especially critical for traders working with prop firm accounts, where uptime is non-negotiable.

Additionally, a Chicago VPS plays a key role in risk management. During volatile market conditions, it ensures that bracket orders and trailing stops remain active, safeguarding your trades.

Chicago Datacenter Infrastructure

Chicago’s datacenters don’t just provide low latency - they’re built to deliver reliable, high-performance trading environments. These facilities typically offer uptime guarantees between 99.99% and 99.999%. Network speeds start at 1Gbps, with burst capabilities reaching 10Gbps, ensuring stable connections even during high-volume trading periods.

When it comes to hardware, performance matters. Many trading platforms, like IBKR Trader Workstation (TWS), are single-threaded and benefit more from high CPU clock speeds than from multiple cores. For optimal performance, look for VPS configurations with CPUs running at 3.5 GHz or higher, such as AMD Ryzen or Intel i7/i9 processors. Pair this with NVMe SSDs to handle rapid tick data during volatile sessions.

"The best VPS for futures trading in 2026 is not simply the server with the lowest advertised ping - it's a Chicago- or Aurora-proximate machine that keeps your platforms, algorithms, and charting stable through volatile market conditions." – Optimus Futures

"The best VPS for futures trading in 2026 is not simply the server with the lowest advertised ping - it's a Chicago- or Aurora-proximate machine that keeps your platforms, algorithms, and charting stable through volatile market conditions." – Optimus Futures

New York VPS for Equities and Options Trading

Proximity to NYSE and NASDAQ

New York datacenters are strategically positioned just 1–2 milliseconds away from the order matching engines of the NYSE and NASDAQ. This close proximity allows trade orders to travel through direct fiber connections, cutting down on delays. For traders dealing with popular stocks or executing intricate multi-leg options strategies, this speed advantage can lead to improved order fills and reduced slippage.

High-performance servers, equipped with processors running at 3.5 GHz or faster and paired with NVMe SSDs, ensure seamless handling of tick data for platforms like IBKR TWS. This setup is particularly beneficial for traders focused on equities and options.

"Ultra-low latency is critical for rapid trade execution and minimizing slippage." – QuantVPS

"Ultra-low latency is critical for rapid trade execution and minimizing slippage." – QuantVPS

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Best Use Cases for New York VPS

Trading strategies such as options scalping and equity day trading thrive with the help of a New York VPS. For options scalpers, minimal latency ensures optimal fills in fast-moving markets. Equity day traders benefit from near-instant order execution, enabling precise entries and exits closer to target prices. Additionally, using a VPS for API-driven automated strategies ensures uninterrupted 24/7 connectivity, keeping trading bots operational even during local network disruptions.

For those engaged in market making or tracking order flow, the ability to process large volumes of tick data with high priority is another advantage of a New York-based setup. Beyond execution speed, the robust infrastructure further amplifies these benefits, making it a reliable choice for serious traders.

New York Datacenter Infrastructure

New York datacenters go beyond just speed, offering a robust technical foundation to maximize trading performance. Standard network speeds start at 1 Gbps, with burst capabilities reaching up to 10 Gbps. Uptime guarantees ranging from 99.99% to 99.999% ensure trading platforms remain active, even during local connectivity issues.

Most trading platforms, including IBKR TWS, are designed to perform best with high single-thread processing power. To keep up with volatile market conditions, it’s crucial to use a VPS with processors running between 3.5 GHz and 4.8 GHz, such as Intel i7/i9 or AMD Ryzen models. Pairing this with NVMe SSD storage ensures fast chart loading and efficient processing of Level 2 data, whereas traditional SATA SSDs may struggle with the high-frequency tick data typical in equities and options trading.

When you combine low-latency connections, enterprise-grade hardware, and dependable infrastructure, New York datacenters provide an ideal environment for executing IBKR trading strategies with precision and speed.

Chicago vs. New York: Direct Comparison

Comparison Table

Deciding between Chicago and New York for your VPS location depends on your trading focus and strategy.

| Feature | Chicago VPS | New York VPS |

|---|---|---|

| Primary Exchange Proximity | CME Group (Aurora/Chicago) | NYSE, NASDAQ |

| Best Asset Classes | Futures, Commodities, CME Options | Stocks, ETFs, Equity Options, Forex, Crypto |

| Typical Latency | < 0.52ms to CME | 1–2ms to equities engines |

| Trader Use Case | Scalpers, Futures Algos, Prop Firm Traders | Equity Day Traders, Multi-asset Algos |

| Uptime Guarantee | 99.99% to 99.999% | 99.99% to 99.999% |

This table highlights the key differences between the two VPS locations. Chicago stands out with its sub-millisecond latency to CME futures markets, reaching speeds as low as 0.52ms. This ultra-fast response time is particularly valuable for strategies like ES or NQ scalping, where maintaining a competitive position in the order queue can significantly impact performance. Meanwhile, New York VPS solutions deliver 1–2 milliseconds of latency to NYSE and NASDAQ engines, making them an excellent choice for traders focused on equities and options.

"For algorithmic traders, location is the priority. Aurora-proximate VPS hosts provide consistent, near-zero latency that helps preserve queue priority and execution efficiency." – Optimus Futures

"For algorithmic traders, location is the priority. Aurora-proximate VPS hosts provide consistent, near-zero latency that helps preserve queue priority and execution efficiency." – Optimus Futures

The key difference boils down to the exchange infrastructure that aligns with your trading needs.

Which Location Fits Your Trading Style

If you're trading CME futures like ES, NQ, CL, or GC, Chicago is the ideal choice. Its proximity to Aurora and Chicago matching engines ensures orders are transmitted via direct fiber connections, reducing slippage and improving fill quality, especially during high-volatility periods. This makes Chicago a favorite for prop traders and those running automated strategies requiring sub-millisecond execution.

On the other hand, New York is better suited for traders dealing in U.S. equities, equity options, or diverse portfolios that include automated forex trading and crypto. For automated stock trading algorithms, options scalping, or managing a broad IBKR portfolio, being close to NYSE and NASDAQ matching engines ensures the rapid execution necessary for these asset classes.

Ultimately, your decision should hinge on where most of your trading activity takes place. Once you've pinpointed your primary trading focus, you can align your strategy with the right VPS location for optimal performance.

How to Choose the Right VPS Location for IBKR

Match Your Strategy to the Right Location

Your trading strategy should guide your VPS location choice. If you're focused on trading CME futures like ES, NQ, CL, or GC, a Chicago-based VPS is ideal. Its close proximity to CME Group's matching engines ensures sub-millisecond execution speeds, which can be crucial during high-volatility periods.

For equity and options traders, a New York VPS is the better choice. Being near the NYSE and NASDAQ matching engines reduces latency, which is especially important for automated trading algorithms or options scalping. Even multi-asset traders handling forex, crypto, and stocks can benefit from New York's broad connectivity options.

"For algorithmic traders, location is the priority. Aurora-proximate VPS hosts provide consistent, near-zero latency that helps preserve queue priority and execution efficiency." – Optimus Futures

"For algorithmic traders, location is the priority. Aurora-proximate VPS hosts provide consistent, near-zero latency that helps preserve queue priority and execution efficiency." – Optimus Futures

A quick way to assess latency is by pinging your broker’s gateway using the command prompt. This simple test can help you determine if a VPS will significantly outperform your current home connection.

Technical Requirements and Budget

Since IBKR Trader Workstation operates as a single-threaded application, prioritize CPUs with speeds of 3.5 GHz or higher, such as Ryzen 7/9 or Intel i7/i9 models. Allocate 4–8 GB of RAM for a single instance, and consider scaling up to 16 GB if you're managing multiple platforms.

NVMe storage is a must for handling large bursts of tick data during periods of market volatility. Standard SATA SSDs might struggle under such conditions. Pricing for VPS setups typically ranges from $40 to $75 per month for basic or standard configurations, while professional setups can cost up to $130 per month. Look for uptime guarantees of 99.99% or higher to ensure your automated strategies and server-side orders stay active, even if your home internet goes down.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

These technical details are the foundation for enhancing your trading server performance that aligns with your trading goals.

Using Multiple VPS Locations

If you're trading across different asset classes, consider using two separate VPS instances - one in Chicago for CME products and another in New York for equities. This setup ensures optimal execution for each asset type without sacrificing latency. For example, you could run ES scalping algorithms on a Chicago VPS while managing equity options strategies on a New York server. You can even automate IBKR trades by routing alerts through specialized bridge software.

Both VPS instances can be accessed remotely via RDP, enabling you to monitor futures and stock trades simultaneously. Additionally, this dual-location strategy builds in redundancy: if one datacenter experiences issues, the other remains operational. Just make sure to allocate sufficient resources to avoid performance bottlenecks or interference from noisy neighbors.

Conclusion

Choose your VPS location based on the asset class you trade most frequently. If you're trading CME futures like ES, NQ, or CL, a Chicago-based VPS offers the low and ultra-low latency needed for faster execution and reduced slippage in volatile markets. On the other hand, traders focusing on NYSE and NASDAQ equities or options will benefit from a New York VPS, ensuring quicker order execution and improved fill quality.

The ideal VPS setup pairs CPUs running above 3.5 GHz with NVMe storage to handle rapid tick data processing efficiently. This ensures your trading platform remains operational 24/7, even during local outages. Whether you specialize in a single market or diversify across multiple asset classes, this technical reliability is key.

For those trading across multiple markets, using dual VPS locations provides the best of both worlds - speed and redundancy.

"For most retail futures traders, a Virtual Private Server functions primarily as a stability and risk-management tool, with latency optimization as a secondary benefit." – Optimus Futures

"For most retail futures traders, a Virtual Private Server functions primarily as a stability and risk-management tool, with latency optimization as a secondary benefit." – Optimus Futures

FAQs

Why is low latency crucial when using a VPS for trading on Interactive Brokers (IBKR)?

Low latency plays a crucial role when trading on IBKR, as it shortens the time it takes for your orders to reach IBKR's servers and be executed in the market. This speed can make a big difference, resulting in better fills, reduced slippage, and more accurate pricing - key factors for high-frequency, scalping, or automated trading strategies.

A low-latency VPS helps minimize delays, ensuring your trades are executed quickly and reliably. This can give you a significant advantage, especially in fast-moving markets or during periods of high volatility when precise timing is critical to your trading approach.

How does choosing between a Chicago or New York VPS impact my IBKR trading strategy?

The location of your VPS can significantly impact your IBKR trading strategy by minimizing latency and enhancing execution speed. For traders dealing with CME-linked products like futures and options on futures, a Chicago-based VPS is a top choice. With near-instant access (around 1 ms) to CME's matching engines, it ensures rapid order execution, which is crucial for strategies like high-frequency trading, scalping, or algorithmic approaches that rely on speed and precision.

If your focus is on equities, options, or forex, a New York-area VPS is the better option. Positioned within 1–2 ms of major exchange gateways like NYSE and NASDAQ, it provides faster connectivity and reliable performance tailored to these asset classes.

To optimize your trading strategy, align your VPS location with your trading focus: Chicago for futures and CME products, and New York for equities, options, and forex.

What are the key technical requirements for running Interactive Brokers (IBKR) on a VPS?

To get the most out of your Interactive Brokers (IBKR) experience on a VPS, it's important to focus on hardware and network features that deliver fast, stable, and reliable performance.

Start with a high-performance CPU - options like AMD EPYC or Ryzen processors work well. For basic setups, aim for at least 4 vCPU cores, but for tasks like multi-chart monitoring or back-testing, you'll need 6 to 24 cores. When it comes to memory, 8 GB is a good starting point for simpler needs, but 16 GB or more is better suited for heavier workloads. For storage, go with NVMe SSDs for quick data access. Around 70 GB should suffice for single strategies, while 150 GB or more is recommended if you're running multiple platforms or working with large historical datasets.

The location of your VPS also plays a big role in reducing network latency. For equities and options trading, a VPS in New York is ideal, while Chicago is better suited for futures or CME-related strategies. Additionally, make sure your VPS offers 99.9%+ uptime, dedicated resources, and dependable 24/7 support to keep your trading platforms running without interruptions. With the right setup, you can enjoy faster execution and minimize slippage, giving your trading strategies an edge.

Low latency plays a crucial role when trading on IBKR, as it shortens the time it takes for your orders to reach IBKR's servers and be executed in the market. This speed can make a big difference, resulting in better fills, reduced slippage, and more accurate pricing - key factors for high-frequency, scalping, or automated trading strategies.

A low-latency VPS helps minimize delays, ensuring your trades are executed quickly and reliably. This can give you a significant advantage, especially in fast-moving markets or during periods of high volatility when precise timing is critical to your trading approach.

The location of your VPS can significantly impact your IBKR trading strategy by minimizing latency and enhancing execution speed. For traders dealing with CME-linked products like futures and options on futures, a Chicago-based VPS is a top choice. With near-instant access (around 1 ms) to CME's matching engines, it ensures rapid order execution, which is crucial for strategies like high-frequency trading, scalping, or algorithmic approaches that rely on speed and precision.

If your focus is on equities, options, or forex, a New York-area VPS is the better option. Positioned within 1–2 ms of major exchange gateways like NYSE and NASDAQ, it provides faster connectivity and reliable performance tailored to these asset classes.

To optimize your trading strategy, align your VPS location with your trading focus: Chicago for futures and CME products, and New York for equities, options, and forex.

To get the most out of your Interactive Brokers (IBKR) experience on a VPS, it's important to focus on hardware and network features that deliver fast, stable, and reliable performance.

Start with a high-performance CPU - options like AMD EPYC or Ryzen processors work well. For basic setups, aim for at least 4 vCPU cores, but for tasks like multi-chart monitoring or back-testing, you'll need 6 to 24 cores. When it comes to memory, 8 GB is a good starting point for simpler needs, but 16 GB or more is better suited for heavier workloads. For storage, go with NVMe SSDs for quick data access. Around 70 GB should suffice for single strategies, while 150 GB or more is recommended if you're running multiple platforms or working with large historical datasets.

The location of your VPS also plays a big role in reducing network latency. For equities and options trading, a VPS in New York is ideal, while Chicago is better suited for futures or CME-related strategies. Additionally, make sure your VPS offers 99.9%+ uptime, dedicated resources, and dependable 24/7 support to keep your trading platforms running without interruptions. With the right setup, you can enjoy faster execution and minimize slippage, giving your trading strategies an edge.

"}}]}