CME Historical Data: Complete Guide to Futures Prices & API Access

CME historical data is a vital resource for traders, offering detailed records of past trading activity on the Chicago Mercantile Exchange. It includes price movements, trading volumes, and settlement prices across various asset classes like commodities, currencies, and equity indices. Traders use this data to analyze market trends, backtest strategies, and refine algorithmic trading systems.

Key points covered:

- Types of Data: End-of-Day, Intraday, Settlement Prices, Time and Sales, and Market Depth.

- Access Options: CME DataMine (official source) and third-party platforms with flexible tools.

- Data Formats: CSV, JSON, or binary, adhering to U.S. standards (MM/DD/YYYY dates, Central Time).

- API Integration: Automates data retrieval for real-time and historical analysis, with secure authentication and robust error handling.

- QuantVPS for Trading: Offers low-latency servers for efficient data processing, backtesting, and live trading.

This guide helps traders leverage CME data for building and testing strategies while ensuring smooth integration into trading systems.

Get Historical Futures Price Data In Python With Yahoo_fin

How to Access CME Historical Futures Prices

Getting your hands on historical futures data from the Chicago Mercantile Exchange (CME) involves choosing the right method that fits your trading goals. CME offers multiple options, each with its own features and pricing structure.

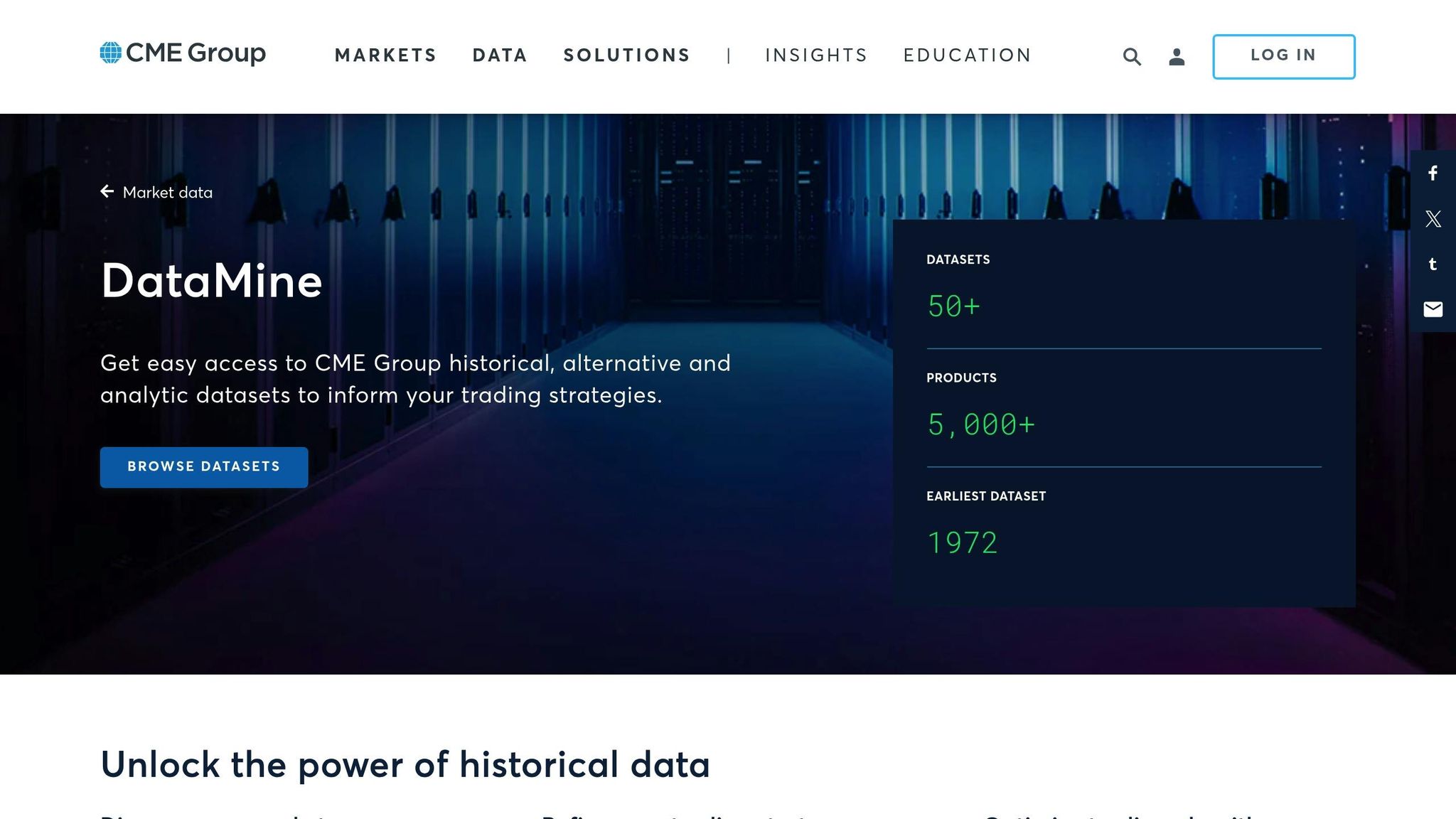

Direct Access via CME DataMine

CME DataMine is the official platform for accessing historical futures prices across major asset classes. As the exchange’s primary data source, it provides highly accurate and comprehensive datasets tailored for trading and analysis. The platform operates on a subscription model, with costs varying based on the specific data sets and depth of information you need.

When using CME DataMine, you’ll notice the data is formatted to align with U.S. standards. For instance, dates are displayed in the MM/DD/YYYY format, prices include appropriate decimal points (e.g., $1,234.56), and volume figures are separated by commas for clarity.

Third-Party Platforms for Data Access

If you’re looking for flexibility, third-party platforms and licensed distributors are great alternatives. These services often provide additional features and competitive pricing. They offer subscription-based access to real-time, delayed, and end-of-day data, along with tools that enhance usability. When choosing a third-party provider, consider factors like geographical coverage, supported asset classes, and user-friendly interfaces to ensure the service meets your specific needs.

For example, cloud-based platforms like Google Cloud Platform deliver cost-effective solutions with 10-minute delayed data and simplified access to market depth. This type of delayed data can be particularly useful for backtesting and developing trading strategies.

Data Formatting and Structure

Regardless of the access method you choose, understanding the data’s format is essential for smooth integration into your trading systems. CME historical data is typically available in formats like CSV, JSON, or binary.

The data adheres to U.S. conventions: dates are in MM/DD/YYYY format, timestamps are in Central Time (CT), prices are displayed with precise decimals, and volumes are comma-separated. Contract symbols follow CME’s standardized naming system, which includes expiration months and years for easy identification.

Data files generally include key metrics like open, high, low, close, settlement prices, volume, open interest, and timestamps. Some files may also include bid/ask spreads and detailed trade records. Familiarity with these formats ensures a seamless experience when integrating data into your trading platforms or analysis tools, making backtesting and strategy development more efficient.

API Access for CME Historical Data

APIs streamline the process of retrieving CME historical data by automating access to real-time futures pricing. This integration eliminates the hassle of manual downloads and enables seamless connections with trading platforms, backtesting systems, and custom analytics tools.

Available APIs for CME Data

The CME Group offers official APIs that grant access to both historical and real-time market data. These APIs require secure authentication, typically through API keys, and deliver data in widely-used formats like JSON and XML. This ensures compatibility with various programming languages and trading platforms. These tools work alongside other data access methods previously discussed.

In addition to CME's own APIs, licensed market data vendors provide access to CME historical data as part of their broader offerings. These services often aggregate data from multiple exchanges, presenting it in consistent formats and sometimes including built-in analytics to enhance usability.

API Integration Basics

Getting started with API integration involves setting up secure authentication. This typically includes registering an API key and using token-based authentication, with automated token refresh to ensure uninterrupted data access.

APIs generally follow standard HTTP request protocols, allowing users to specify parameters like contract symbols, date ranges, and data granularity. The returned data includes essential market details such as open, high, low, and close prices, along with volume, open interest, and settlement figures - all formatted according to U.S. conventions.

To ensure smooth operation, it's critical to implement robust error handling. Techniques like exponential backoff and detailed logging can help manage issues such as rate limits, invalid requests, or data gaps.

When working with U.S.-based trading systems, it's also important to configure settings that align with local trading practices.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

U.S.-Specific API Setup

For trading systems operating in the U.S., time zone alignment is a key consideration. CME data is provided in Central Time (CT), reflecting the Chicago-based exchange's location. Many APIs include options to convert timestamps to other time zones, such as Eastern Time (ET), to match regional market hours.

Traders should also account for CME-specific market session schedules, including unique holiday observances that may affect data availability. Planning API requests around these schedules can help avoid disruptions.

Regulatory compliance is another important factor. Data usage must adhere to strict guidelines, including restrictions on redistribution and requirements for proper attribution. Keeping detailed audit trails and ensuring compliance with reporting standards is essential.

Finally, optimizing API connections can improve performance. For example, choosing endpoints closer to U.S.-based data centers can reduce latency, especially during periods of high data traffic. This is particularly critical for traders working with time-sensitive data.

Using QuantVPS for CME Data Access and Trading

When it comes to seamless CME data access and time-sensitive trading, having a reliable hosting solution is non-negotiable. QuantVPS offers tailored virtual private server (VPS) solutions designed specifically for futures and forex traders. Let’s take a closer look at how QuantVPS can enhance your CME data trading experience.

QuantVPS Features for Traders

QuantVPS is built for speed and reliability, delivering ultra-low latency connectivity with response times as fast as 0-1ms. This makes it ideal for handling large volumes of CME historical data or executing real-time API calls. With a 100% uptime guarantee, your trading algorithms and data collection processes stay uninterrupted.

The platform integrates easily with popular trading platforms like NinjaTrader, MetaTrader, and TradeStation, allowing you to incorporate CME data feeds directly into your existing setup. Each VPS runs on Windows Server 2022, providing a familiar and stable environment for most trading applications.

Additional features include DDoS protection and automatic backups to safeguard your data and configurations. Full root access is also provided, giving you complete control to customize your trading environment for specific CME data processing needs.

With global accessibility and real-time system monitoring, you can manage your CME data collection and trading systems from anywhere, all while keeping tabs on server performance during high-intensity operations.

QuantVPS Plans Comparison

QuantVPS offers four distinct plans, each designed to meet different trading and data processing requirements:

| Plan | Monthly Price | CPU Cores | RAM | Storage | Network | Monitors | Best For |

|---|---|---|---|---|---|---|---|

| VPS Lite | $59.00 | 4 cores | 8GB | 70GB NVMe | 1Gbps+ | None | Basic CME access |

| VPS Pro | $99.00 | 6 cores | 16GB | 150GB NVMe | 1Gbps+ | Up to 2 | Moderate API usage |

| VPS Ultra | $199.00 | 24 cores | 64GB | 500GB NVMe | 1Gbps+ | Up to 4 | Intensive data processing |

| Dedicated Server | $299.00 | 16+ cores | 128GB | 2TB+ NVMe | 10Gbps+ | Up to 6 | Enterprise-level operations |

All plans come with unmetered bandwidth, a critical feature for downloading large CME historical datasets or maintaining continuous real-time API connections.

Why Choose QuantVPS for CME Data?

QuantVPS stands out with its high-performance NVMe storage, ensuring quick access to CME datasets - perfect for backtesting and executing algorithmic strategies that rely on historical data patterns.

Its robust network and dedicated resources ensure smooth API connections and efficient data processing. With speeds of 1Gbps+ (or 10Gbps+ for dedicated servers), you can manage multiple CME contracts simultaneously without any slowdowns. Higher-tier plans also support multiple monitors, making it easier to analyze CME data across several screens while running backtests or monitoring live trades.

QuantVPS provides the tools and infrastructure you need to stay ahead in CME trading, whether you're handling basic data access or running enterprise-level operations.

Using CME Historical Data for Trading Strategies

CME historical data forms the backbone of strategy creation and risk-free testing, especially when paired with QuantVPS's high-performance infrastructure.

Backtesting with CME Data

Backtesting lets you turn historical CME data into actionable insights by simulating how a trading strategy would have performed in the past. To do this right, you need clean, accurate data and enough computational power to handle multiple scenarios at once.

When selecting CME contract data, make sure it includes roll dates and contract specifications to reflect the market accurately. The dataset should cover open, high, low, and close prices, along with trading volume, in your preferred timeframe - whether that's tick-by-tick, minute-by-minute, hourly, or daily intervals.

Adjustments for contract rollovers are often necessary, especially in futures markets where contracts expire frequently. Using methods like back-adjustment ensures price continuity across contract transitions, making your backtesting results more reliable.

QuantVPS enhances backtesting by speeding up processing and increasing algorithm efficiency. This is particularly valuable when testing strategies across various timeframes or running Monte Carlo simulations.

Platforms like NinjaTrader and TradeStation integrate easily with QuantVPS, allowing you to import CME historical data and conduct in-depth strategy tests. These platforms factor in real-world variables like transaction costs, slippage, and market conditions, giving you a more realistic view of your strategy's potential.

To evaluate performance, go beyond basic profit and loss metrics. Look at risk-adjusted returns, such as the Sharpe ratio, maximum drawdowns, and win-rate consistency in different market conditions. The depth of CME data enables you to test strategies under diverse scenarios, including high volatility, trending markets, or sideways movements.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

These backtesting insights are the building blocks for creating finely-tuned, algorithm-driven strategies.

Algorithmic Strategy Development

Developing algorithmic trading strategies combines market analysis, statistical methods, and precise coding. QuantVPS provides the computational power needed to develop and test intricate algorithms that work with real-time market data.

The process often starts with forming a hypothesis based on market patterns. For example, you might notice seasonal trends in natural gas prices or sharp moves in response to economic news. CME historical data allows you to quantify these observations and test their reliability.

Next, you'll define entry and exit rules using tools like technical indicators, fundamental data, or statistical models. Common approaches include mean reversion for range-bound markets, momentum strategies for trending conditions, or arbitrage opportunities between related CME contracts.

Risk management is critical when moving from backtesting to live trading. Your algorithm should include rules for position sizing, stop-loss levels, and correlation checks to avoid overexposure to similar market movements. Historical data can help fine-tune these parameters by showing how different risk management strategies performed in past market cycles.

QuantVPS's multi-monitor setup is especially useful during strategy development. It allows you to track code execution, monitor live market data feeds, and analyze performance metrics all at once. Root access also lets you install specialized trading libraries for advanced functionality.

Before going live, paper trading acts as a crucial intermediary step. Most trading platforms supported by QuantVPS offer simulated environments where your algorithm can process real-time CME data without financial risk. This phase can reveal issues like data feed interruptions or execution delays that backtesting might overlook.

Compliance and U.S. Trading Rules

When transitioning from development to execution, it's essential to understand U.S. trading rules and compliance requirements.

The Commodity Futures Trading Commission (CFTC) regulates futures markets and requires detailed record-keeping of trading activities. With QuantVPS, you can maintain comprehensive logs of trading decisions, data sources, and algorithm updates. The platform’s automatic backup feature ensures these records are secure and ready for regulatory review.

While Pattern Day Trading (PDT) rules don’t apply to futures, position limits exist for certain CME contracts. Large traders must report positions exceeding specific thresholds, so your algorithm should monitor positions to stay compliant. Historical data can help determine optimal position sizes that maximize returns while adhering to these limits.

Futures trading also offers tax advantages under Section 1256, but this requires meticulous transaction records. These tax benefits make CME futures appealing for algorithmic strategies, but keeping accurate logs is non-negotiable.

Additionally, CME contracts are quoted differently depending on the product. For instance, crude oil prices are in dollars per barrel, natural gas in dollars per million BTU, and agricultural products in cents per bushel or pound. Your algorithm needs to account for these unit differences when processing data and calculating positions.

CME products often trade nearly 24 hours a day through the Globex platform. Algorithms hosted on QuantVPS can capitalize on these extended hours, but they must also factor in varying liquidity and volatility during overnight sessions compared to regular trading hours.

Conclusion

Let’s revisit some key insights: CME historical data forms the backbone of successful futures trading strategies, offering the essential information needed to design, test, and refine trading approaches. Whether you're working on backtesting algorithms, spotting market trends, or building predictive models, having access to detailed historical price data transforms raw numbers into actionable strategies.

Profitable trading relies on a solid infrastructure that supports backtesting, algorithm development, and seamless live execution. However, the effectiveness of this process depends heavily on the strength of the systems that power it.

Key Takeaways

- CME historical data provides critical advantages for futures traders. Accurate historical prices allow traders to backtest strategies under various market conditions, while recognizing patterns can uncover seasonal trends and recurring behaviors. Historical volatility analysis sharpens risk assessments, and predictive models improve with access to comprehensive datasets.

- Optimized infrastructure, like QuantVPS, ensures effective strategy execution by bridging the gap between historical data analysis and live trading. With ultra-low latency connectivity, traders can ensure that the performance observed during backtesting translates smoothly to live markets.

- Round-the-clock operation keeps trading algorithms and data processes running seamlessly throughout CME’s extended trading hours.

- Advanced hardware is vital for handling large datasets. QuantVPS servers, powered by AMD EPYC processors and high-speed DDR4/5 RAM, excel at managing complex backtesting and simulations, making them ideal for testing strategies across multiple timeframes or running advanced algorithmic models.

- Integration with top trading platforms simplifies workflows, enabling traders to move effortlessly from data analysis to live execution within a unified environment.

FAQs

What are the benefits of using CME DataMine for accessing historical futures prices?

CME DataMine is a cloud-based, self-service platform that gives users direct access to CME Group's historical futures data. By bypassing third-party platforms, it ensures a reliable and accurate source of information, offering a level of consistency that traders and analysts can trust.

The platform features an intuitive interface, making it simple to query, share, and manage data. It’s also designed to help users save both time and money, making it a practical choice for those focused on backtesting, strategy development, or automated trading systems.

How can I keep my API integration with CME historical data compliant with U.S. trading regulations?

To comply with U.S. trading regulations when using CME historical data through an API, it's crucial to adhere to CME's guidelines on how the data is used and shared. These rules are in place to ensure the correct and lawful management of market data.

Equally important is safeguarding data security. This means incorporating measures such as encryption, robust authentication protocols, and regularly updating API keys. You should also set up clear access controls, follow proper data handling practices, and conduct regular audits. These steps not only protect sensitive trading information but also help ensure you meet regulatory standards.

What should I look for when selecting a QuantVPS plan for my trading strategy?

When choosing a QuantVPS plan, it's essential to think about a few key factors. First, look at the server location - you'll want it as close as possible to your broker's data center to keep latency to a minimum. Next, check the hardware specifications, like CPU and RAM, to ensure they can handle the demands of your trading software and strategies. Also, pay attention to plan features, including network speed, uptime reliability, and customer support, to make sure your trading runs smoothly without interruptions.

QuantVPS offers several plans tailored for traders, including options specifically designed for low-latency, automated futures trading. Pricing starts at $69.99 per month, giving you access to the performance and dependability needed to execute your strategies efficiently.