What Is Latency Arbitrage? High-Frequency Trading Explained

Latency arbitrage is a high-frequency trading (HFT) strategy that exploits tiny delays - measured in microseconds - between price updates on different exchanges. Traders with faster systems use these delays to profit from outdated prices before others can react. This practice, often called "time-based information asymmetry", is a cornerstone of modern financial markets, where speed determines success.

Key points:

- How it works: Traders exploit "stale quotes" by buying or selling at outdated prices on slower exchanges before prices align.

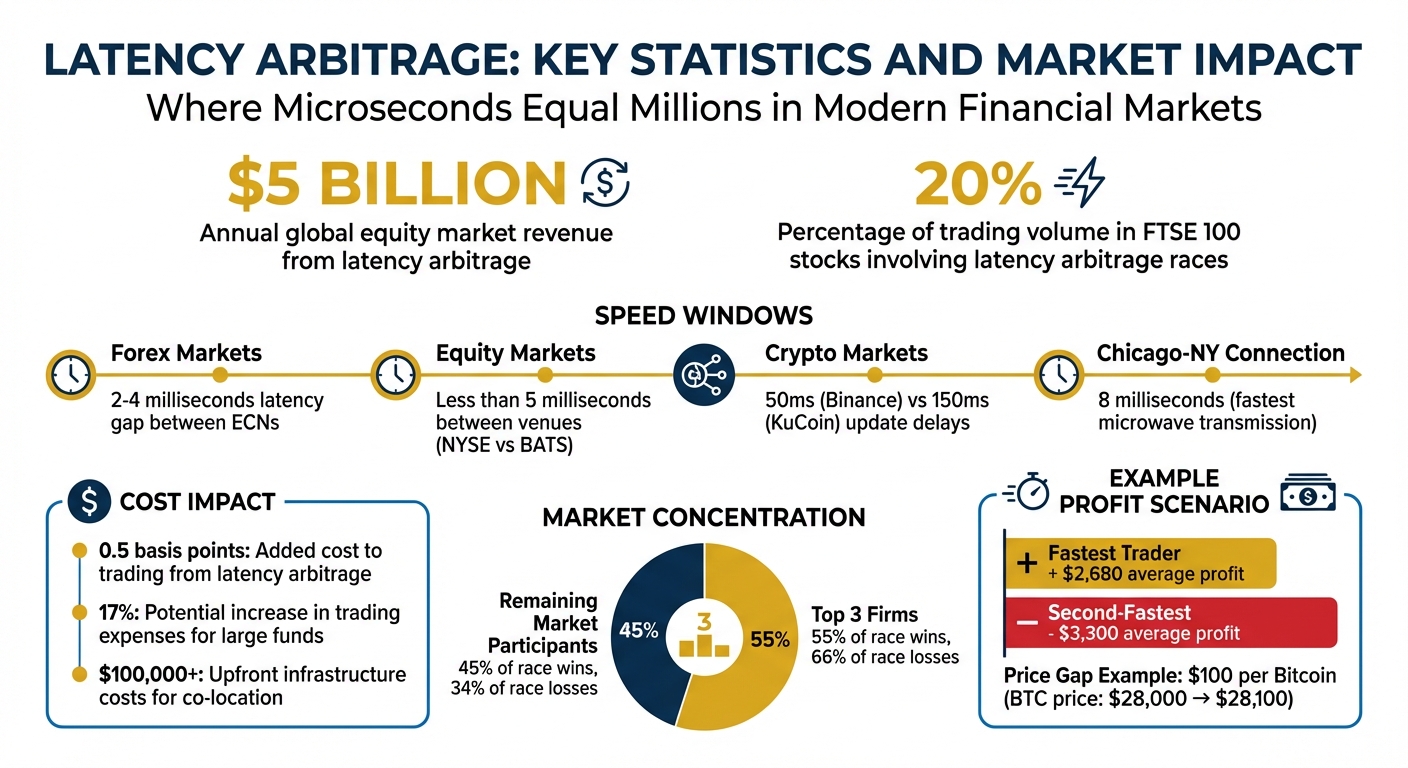

- Impact: Latency arbitrage accounts for 20% of trading activity on major exchanges and generates $5 billion annually in global equity markets.

- Technology: Firms invest in co-location, microwave transmission, and custom hardware like FPGAs to minimize latency.

- Criticism: Critics argue it acts as a hidden "tax" on slower traders, inflating costs and potentially destabilizing markets.

For anyone in trading, understanding latency arbitrage is essential to navigating today’s ultra-low latency trading systems.

Latency Arbitrage: Key Statistics and Market Impact in High-Frequency Trading

Latency Arbitrage: Key Statistics and Market Impact in High-Frequency Trading

HFT Strategies Explained: Unveiling Latency Arbitrage #shorts

What Is Latency Arbitrage in High-Frequency Trading?

Latency arbitrage is a high-frequency trading (HFT) strategy that takes advantage of tiny delays - measured in milliseconds or even microseconds - in how market data flows between exchanges or trading participants. When prices change on one exchange, there’s a brief moment before this updated information reaches other venues. Traders with faster systems can exploit this gap, buying or selling at outdated prices before the rest of the market catches up.

This opportunity comes from what’s known as "stale quotes" - prices that have already been updated on one exchange (the "leader") but remain unchanged on another (the "lagger"). Algorithms compete in a race to capitalize on this gap by buying at the lower price on one venue and selling at the higher price on another. The first trader to reach the exchange’s matching engine wins the profit.

"The root cause of latency arbitrage is the design of modern financial exchanges, specifically the combination of (i) treating time as continuous (infinitely divisible) and (ii) processing requests to trade serially (one-at-a-time)." - Matteo Aquilina, Eric Budish, and Peter O'Neill, Researchers, Financial Conduct Authority

"The root cause of latency arbitrage is the design of modern financial exchanges, specifically the combination of (i) treating time as continuous (infinitely divisible) and (ii) processing requests to trade serially (one-at-a-time)." - Matteo Aquilina, Eric Budish, and Peter O'Neill, Researchers, Financial Conduct Authority

For example, in the FTSE 100, latency races happen roughly once per minute for each stock. The winning algorithm often beats its closest competitor by just 5 to 10 microseconds. This competition is highly concentrated, with the top three firms accounting for over 55% of race wins and 66% of race losses. This razor-thin margin sets the stage for the mechanics of how latency arbitrage works.

How Latency Arbitrage Works

Latency arbitrage relies on monitoring multiple exchanges in real time using high-frequency trading platforms to identify price differences as soon as they appear. Algorithms aggregate bid-ask data from different venues to create synthetic order books that reveal profitable gaps instantly. When a price discrepancy is detected, the system executes trades simultaneously - buying at the lower price on one exchange and selling at the higher price on another - before the prices align.

A clear example of this occurred in September 2025 with BTC/USDT trading. Binance updated its price feeds every 50ms, while KuCoin had a 150ms delay. When a buy wall pushed Bitcoin’s price from $28,000 to $28,100 on Binance, a bot located near KuCoin’s servers bought BTC at the stale $28,000 price before KuCoin’s prices adjusted, earning $100 per Bitcoin.

A similar equity arbitrage example between NYSE and BATS in September 2025 highlighted the same principle. A firm co-located at BATS detected a price increase in Apple (AAPL) and quickly bought shares on NYSE before the price adjusted upward. This trade capitalized on a latency window of less than 5ms, capturing profits before the price normalized across venues.

In addition to cross-exchange arbitrage, traders also use "synthetic arbitrage", which involves tracking correlated assets. For instance, they might monitor a "leader" asset, like a futures contract, and trade a "lagger" asset, such as an ETF, based on predictable timing patterns between the two.

| Feature | Cross-Exchange Arbitrage | Synthetic Arbitrage |

|---|---|---|

| Focus | Identical assets on different exchanges (e.g., BTC on Binance vs. KuCoin) | Correlated assets (e.g., an ETF vs. its underlying stocks) |

| Mechanism | Exploits data propagation delays between venues | Exploits price lag between a derivative and its underlying instrument |

These strategies highlight why speed is absolutely critical in latency arbitrage.

Why Speed Matters in Arbitrage Trading

Speed is everything in latency arbitrage because the profit window lasts for only microseconds or milliseconds. If a trader’s system is even slightly slower than a competitor’s, the opportunity disappears, and the trade could result in a loss due to slippage - when prices move unfavorably before an order is completed.

In foreign exchange (FX) markets, latency gaps between Electronic Communication Networks (ECNs) are typically just 2–4 milliseconds. In equities, the window can be even shorter - less than 5 milliseconds between venues like NYSE and BATS. During these brief intervals, only the fastest trader profits, while others are left with outdated data or unfilled orders.

"In the modern market, speed is currency. Latency arbitrage shows how milliseconds can make millionaires." - Siddharth Vadera, Founder, Big Brain Money

"In the modern market, speed is currency. Latency arbitrage shows how milliseconds can make millionaires." - Siddharth Vadera, Founder, Big Brain Money

To achieve these speeds, firms invest heavily in specialized infrastructure. Hardware such as Field-Programmable Gate Arrays (FPGAs) processes market data and executes trades at the hardware level, operating in nanoseconds compared to the milliseconds required by standard CPUs. Even time synchronization plays a role - HFT systems use Precision Time Protocol (PTP) or GPS-based clocks to ensure all servers are aligned to the same microsecond, avoiding costly timestamp mismatches.

The financial stakes are enormous. Around 22% of daily trading volume in the FTSE 100 involves latency-arbitrage races. By executing millions of trades each day, HFT firms turn tiny fractions of a cent into substantial profits. In this world, being a microsecond faster than the competition is the difference between thriving and falling behind.

Technology Requirements for Latency Arbitrage

Latency arbitrage thrives on speed - where even microseconds can mean the difference between a profitable trade and a missed opportunity. To stay competitive, firms rely on highly optimized infrastructure, from server placement to network technology, designed to minimize delays. Let’s dive into how co-location, low-latency networks, and other technologies help reduce these crucial delays.

Co-Location and Low-Latency Networks

Co-location is the gold standard for cutting down latency. By placing trading servers directly within exchange data centers - like the NYSE in Mahwah, New Jersey, or CME Group in Chicago - firms eliminate the need for data to travel long distances. This proximity reduces execution times to mere microseconds.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

For traders unable to invest in full co-location, proximity hosting offers a more affordable alternative. Servers are placed in data centers near exchange hubs, making it a popular choice for retail and mid-tier traders. While it doesn’t match the speed of co-location, it still delivers low-latency performance without the hefty infrastructure costs, which can exceed $100,000 upfront.

When it comes to long-distance trading - like between Chicago and New York or London and Frankfurt - many firms use microwave transmission lines instead of traditional fiber optics. Microwaves travel through the air faster than light moves through fiber, shaving off valuable microseconds. Although weather can interfere with microwave signals, the speed advantage makes it a favorite for cross-market arbitrage.

Traders also use Direct Market Access (DMA) to bypass intermediaries and send orders directly to an exchange’s matching engine, avoiding routing delays that could add milliseconds to execution times. Additionally, technologies like Precision Time Protocol (PTP) or GPS-based clocks ensure servers are synchronized down to the nanosecond, preventing costly errors caused by timestamp mismatches.

High-Performance VPS Hosting for HFT

For traders who can’t physically co-locate, high-performance VPS hosting offers a strong alternative. A Virtual Private Server (VPS) provides dedicated computing resources - like CPU, RAM, and storage - without the hassle of managing physical hardware. The key is choosing a VPS provider optimized for trading, with ultra-low latency connections, robust uptime, and compatibility with popular platforms like NinjaTrader, MetaTrader, and TradeStation.

QuantVPS is a standout in this space, offering servers located near major financial hubs to minimize signal travel time. The platform boasts 100% uptime, a critical feature for algorithmic trading strategies that must operate around the clock to seize fleeting arbitrage opportunities. With NVMe storage and high-performance CPUs, QuantVPS ensures fast market data processing and order execution.

Additional features like DDoS protection and automatic backups safeguard traders from network attacks and data loss, which could otherwise disrupt operations and lead to financial losses. Full root access allows traders to customize configurations, such as integrating WebSocket or FIX protocol connections for faster real-time data feeds compared to traditional REST APIs. Multi-monitor support is another bonus, enabling traders to track multiple markets and order books simultaneously without compromising performance.

QuantVPS Plans Comparison for Latency Optimization

QuantVPS offers two main tiers of hosting plans - Standard and Performance (+) - each tailored to different trading needs. The Standard Plans are ideal for most algorithmic strategies, while the Performance Plans provide enhanced resources and lower latency for high-frequency or multi-market arbitrage. Below is a comparison of the available plans:

| Plan | Cores | RAM | Storage | Network Speed | Monitors | Monthly Price | Annual Price |

|---|---|---|---|---|---|---|---|

| VPS Lite | 4 | 8GB | 70GB NVMe | 1Gbps+ | None | $59.99 | $41.99/month |

| VPS Lite+ | 4 | 8GB | 70GB NVMe | 1Gbps+ | None | $79.99 | $55.99/month |

| VPS Pro | 6 | 16GB | 150GB NVMe | 1Gbps+ | Up to 2 | $99.99 | $69.99/month |

| VPS Pro+ | 6 | 16GB | 150GB NVMe | 1Gbps+ | Up to 2 | $129.99 | $90.99/month |

| VPS Ultra | 24 | 64GB | 500GB NVMe | 1Gbps+ | Up to 4 | $189.99 | $132.99/month |

| VPS Ultra+ | 24 | 64GB | 500GB NVMe | 1Gbps+ | Up to 4 | $199.99 | $139.99/month |

| Dedicated Server | 16+ | 128GB | 2TB+ NVMe | 10Gbps+ | Up to 6 | $299.99 | $209.99/month |

| Dedicated+ Server | 16+ | 128GB | 2TB+ NVMe | 10Gbps+ | Up to 6 | $399.99 | $279.99/month |

For traders running basic arbitrage algorithms or monitoring a few charts, VPS Lite or VPS Lite+ offers sufficient resources. For those handling more complex strategies or monitoring multiple exchanges, VPS Pro or VPS Pro+ provides additional power. Professional traders executing high-frequency strategies should consider VPS Ultra or Dedicated Server plans, which offer maximum processing power and multi-monitor support for real-time market tracking.

All plans include unmetered bandwidth and Windows Server 2022, ensuring compatibility with leading trading platforms. The Performance Plans (+) are especially suited for traders who need every possible edge in speed, making them perfect for latency-sensitive strategies like cross-exchange arbitrage.

Real-World Examples of Latency Arbitrage

Latency arbitrage, a strategy that thrives on speed, plays out daily in forex, futures, and cryptocurrency markets. The concept is simple: traders exploit tiny time gaps - often measured in milliseconds - before prices synchronize across different trading platforms. Let’s dive into how this unfolds in various markets.

In the forex market, traders keep a sharp eye on Electronic Communication Networks (ECNs) like EBS and Currenex. These platforms often display asynchronous quotes. For instance, if the EUR/USD pair spikes on one ECN but lags on another, high-frequency trading bots act instantly, executing trades on the slower platform before liquidity providers can adjust their quotes. These fleeting opportunities typically last just 2–4 milliseconds.

"Milliseconds matter in latency arbitrage. Even a small delay in the transmission of information can mean the difference between a profitable trade and a loss." - LiquidityFinder

"Milliseconds matter in latency arbitrage. Even a small delay in the transmission of information can mean the difference between a profitable trade and a loss." - LiquidityFinder

In futures-to-spot arbitrage, traders take advantage of the "leader-lagger" relationship between futures and spot markets. low latency futures trading venues like CME often update prices faster than spot exchanges such as Binance. For example, if a futures price surges, a bot can quickly buy on the slower spot exchange before the prices catch up. This strategy is particularly effective in cryptocurrency markets, where the absence of a consolidated price tape leads to frequent sub-second price mismatches.

A striking example of price discrepancies occurred in the cryptocurrency market during 2017–2018. Bitcoin prices diverged by as much as 40% between South Korean and U.S. exchanges, creating an estimated $2 billion in potential arbitrage profits. While not a pure latency arbitrage case, it highlights how price gaps across venues can create lucrative opportunities.

The stakes in latency arbitrage are massive, especially for professional trading firms. For instance, Mosaic Finance filed a legal claim reported by Global Trading, alleging that a 3.2-nanosecond speed advantage on Eurex cost them €75 million in annual revenue. This underscores why high-frequency trading firms pour resources into co-location, microwave transmission lines, and advanced hardware. In this game, even nanoseconds can translate into millions of dollars. This highlights the critical distinction between low latency and ultra-low latency trading infrastructures.

Tools and Strategies for Latency Arbitrage

Algorithmic Trading Methods

Latency arbitrage relies on advanced algorithms like cross-asset arbitrage and statistical arbitrage to capitalize on tiny price differences in mere microseconds. Cross-asset arbitrage identifies mismatches in pricing between correlated assets, such as a stock and its futures contract, when they update at different speeds. On the other hand, statistical arbitrage uses mathematical models to spot and profit from temporary mispricings.

Another key method, data feed arbitrage, takes advantage of delays between faster direct exchange feeds and slower consolidated sources like the Securities Information Processor (SIP) in the U.S. These slight delays create a prime opportunity for arbitrage. Some firms also use front-running strategies, where they detect large institutional orders moving through fragmented exchanges and race to trade ahead of them.

"The increasing use of high-speed trading and other advanced technologies has created new challenges for regulators and market participants alike." - SEC

"The increasing use of high-speed trading and other advanced technologies has created new challenges for regulators and market participants alike." - SEC

To maintain their edge, firms invest in hardware acceleration tools like Field-Programmable Gate Arrays (FPGAs) and specialized network adapters. These devices process data directly at the hardware level, bypassing slower software processes. However, these algorithmic strategies are only effective when paired with ultra-low latency environments, made possible by advanced VPS hosting and co-location services. To ensure no opportunity is missed, firms also deploy sophisticated monitoring tools to capture every microsecond advantage.

Monitoring and Performance Tools

Effective monitoring systems are essential for fine-tuning algorithmic strategies and minimizing latency risks. Tools like order flow visualization, including Sierra Charts with heatmaps and Level II/III Depth of Market (DOM) displays, help traders monitor large orders and spot liquidity imbalances in real time. Additionally, firms use DES kernels for nanosecond-precise simulation testing to evaluate strategies before live trading. Research shows that the fastest trader can earn about $2,680, while the second-fastest could lose around $3,300 in average profit.

"Latency rank, rather than absolute magnitude, is the key factor in allocating returns among agents pursuing a similar strategy." - David Byrd, Georgia Institute of Technology

"Latency rank, rather than absolute magnitude, is the key factor in allocating returns among agents pursuing a similar strategy." - David Byrd, Georgia Institute of Technology

Smart Order Routing (SOR) systems are another critical tool, scanning multiple exchanges simultaneously to secure the best execution price while minimizing the impact of outdated data. Some exchanges, like the Investors Exchange (IEX), have introduced a "speed bump" that delays all incoming orders by 350 microseconds, leveling the playing field by neutralizing the speed advantage of latency arbitrageurs. To further optimize performance, firms use ultra-low latency switches and routers to reduce internal network delays. Additionally, Order Book Imbalance (OBI) indicators help predict short-term price movements by analyzing shifts in supply and demand dynamics.

Risks and Challenges in Latency Arbitrage

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Legal and Ethical Issues

Latency arbitrage walks a tightrope between being a clever market strategy and an exploitative practice. While it remains legal in the United States, regulatory bodies like the SEC, CFTC, and ESMA are increasingly scrutinizing algorithmic trading behaviors such as quote stuffing, layering, and spoofing. To promote fairness and transparency, regulators now demand equal access to data and the use of "explainable AI" models to clarify how market abuse is detected.

The ethical concerns revolve around whether latency arbitrage imposes a "hidden tax" on slower traders. Studies indicate this practice adds a 0.5 basis point cost to trading, potentially increasing expenses for large funds by about 17%. Critics argue that it fosters an expensive and unproductive race for speed.

"The race for speed drives enormous investment in non-productive infrastructure – cables, towers, and data centers that don't improve capital formation or innovation" - Siddharth Vadera, Founder, Big Brain Money

"The race for speed drives enormous investment in non-productive infrastructure – cables, towers, and data centers that don't improve capital formation or innovation" - Siddharth Vadera, Founder, Big Brain Money

Another issue is the creation of "phantom liquidity", which can disappear during market volatility, posing systemic risks. The 2010 Flash Crash, when the Dow Jones Industrial Average plummeted nearly 1,000 points (9%) within minutes, highlighted how such practices can exacerbate instability.

In response, some exchanges have implemented measures to level the playing field. For instance, the Investors Exchange (IEX) introduced a 350-microsecond "speed bump" to curb unfair advantages, and European MiFID II regulations mandate equal data access for all traders. Non-compliance with these regulations can lead to hefty fines or even trading suspensions. All of this adds to the ethical and regulatory challenges faced by firms engaging in latency arbitrage, which also comes with steep infrastructure demands.

Infrastructure Costs

Beyond legal and ethical hurdles, the financial and technical requirements of latency arbitrage are daunting. Entering this space requires significant investment. Exchanges like the NYSE and CME charge high fees for co-location services, while specialized hardware such as FPGAs, advanced network adapters, and low-latency switches further drive up costs. Firms also pour millions into infrastructure like microwave transmission towers to shave milliseconds off data transmission times - currently, the fastest connection between New York and Chicago exchanges clocks in at just 8 milliseconds.

A 2021 study analyzing 2015 data from the London Stock Exchange revealed that latency arbitrage races accounted for 20% of trading volume in FTSE 100 stocks, with global equity market latency arbitrage rents estimated at $5 billion annually. However, this field is highly concentrated, with the top three firms dominating over 55% of race wins and losses. These steep costs create significant barriers to entry, favoring only the most well-funded firms.

Operational risks are another major concern. Rapid price reversals, or "legging risk", along with network congestion, can wipe out profits. Additionally, the high-speed nature of these trades leaves systems vulnerable to software glitches or execution errors, which can lead to substantial losses in seconds. Even with massive investments, the challenges of latency arbitrage make success anything but certain.

Conclusion

Latency arbitrage showcases the intricate blend of speed, technology, and strategy that defines modern financial markets. In this high-stakes arena, races are decided in mere microseconds - often within 5–10 microseconds - determining who comes out on top. To stay ahead, leading firms pour resources into co-location services, microwave transmission lines, and cutting-edge hardware like FPGAs. With around $5 billion on the line annually in global equity markets, the competition is intense and dominated by a select few top-tier players.

The technology required for latency arbitrage is far from standard. It demands infrastructure that minimizes delays at every level. High-performance VPS hosting plays a critical role by reducing the physical and digital distance between trading systems and exchanges. QuantVPS meets this challenge with ultra-low latency connections (as fast as 0–1ms), 100% uptime reliability, and dedicated resources tailored for algorithmic trading platforms like NinjaTrader and MetaTrader.

For traders aiming to thrive in high-frequency environments, having the right hosting solution isn't just helpful - it's essential. Whether you're managing a few charts or running complex, resource-heavy strategies, QuantVPS plans are designed to scale with your needs, ensuring you have the speed and performance required to compete. In the world of high-frequency trading, success relies on a combination of robust technology, strategic positioning, and dependable hosting. Latency arbitrage demands a seamless integration of these elements to stay competitive in today’s fast-paced markets.

FAQs

How does latency arbitrage affect fairness in financial markets?

Latency arbitrage is a tactic used by ultra-fast traders to capitalize on tiny price differences before anyone else has the chance to act. By leveraging their speed, these traders gain an edge, leaving slower participants at a disadvantage. The result? Slower traders often end up paying higher prices or selling for less, even though these price discrepancies disappear almost instantly.

While this practice is within the bounds of the law, it raises serious questions about fairness. Research indicates that latency arbitrage makes up a significant chunk of trading activity and creates hidden costs for other market participants. The profits are concentrated in the hands of a small group of firms, while the broader market shoulders the burden. This imbalance can disrupt market efficiency and drain liquidity, making it harder for capital to flow fairly among all participants.

What technology is needed for successful latency arbitrage in trading?

To thrive in latency arbitrage, traders rely on advanced technology that reduces delays in processing market data and executing trades. Low-latency networks are a cornerstone of this approach, often using dedicated fiber-optic connections, microwave links, or millimeter-wave systems to bypass the slower routes of public internet traffic. These specialized networks ensure data moves at lightning speed.

Another critical factor is server co-location. By positioning servers directly inside or near exchange data centers, traders can cut down the physical distance that data needs to travel, saving precious microseconds.

On the hardware side, high-performance components like ultra-fast CPUs, FPGAs, or GPUs are indispensable. These tools handle the rapid processing of data and execution of orders in sub-millisecond intervals. Pair this with optimized software - featuring lightweight operating systems and custom-designed algorithms - and traders gain the ability to analyze market data and seize opportunities with minimal delay. When combined, these technologies deliver the speed and accuracy necessary to excel in latency arbitrage.

Why is speed so important in high-frequency trading, especially for latency arbitrage?

Speed plays a key role in high-frequency trading, where latency arbitrage hinges on taking advantage of minuscule delays in price updates across markets. Traders with the quickest systems can seize these fleeting price differences - often disappearing in milliseconds - before anyone else.

To stay ahead, firms pour resources into low-latency networks, cutting-edge algorithms, and co-located servers positioned near exchange data centers. These technologies enable them to execute trades faster than their rivals, capitalizing on momentary price gaps that might otherwise go unnoticed.

Latency arbitrage is a tactic used by ultra-fast traders to capitalize on tiny price differences before anyone else has the chance to act. By leveraging their speed, these traders gain an edge, leaving slower participants at a disadvantage. The result? Slower traders often end up paying higher prices or selling for less, even though these price discrepancies disappear almost instantly.

While this practice is within the bounds of the law, it raises serious questions about fairness. Research indicates that latency arbitrage makes up a significant chunk of trading activity and creates hidden costs for other market participants. The profits are concentrated in the hands of a small group of firms, while the broader market shoulders the burden. This imbalance can disrupt market efficiency and drain liquidity, making it harder for capital to flow fairly among all participants.

To thrive in latency arbitrage, traders rely on advanced technology that reduces delays in processing market data and executing trades. Low-latency networks are a cornerstone of this approach, often using dedicated fiber-optic connections, microwave links, or millimeter-wave systems to bypass the slower routes of public internet traffic. These specialized networks ensure data moves at lightning speed.

Another critical factor is server co-location. By positioning servers directly inside or near exchange data centers, traders can cut down the physical distance that data needs to travel, saving precious microseconds.

On the hardware side, high-performance components like ultra-fast CPUs, FPGAs, or GPUs are indispensable. These tools handle the rapid processing of data and execution of orders in sub-millisecond intervals. Pair this with optimized software - featuring lightweight operating systems and custom-designed algorithms - and traders gain the ability to analyze market data and seize opportunities with minimal delay. When combined, these technologies deliver the speed and accuracy necessary to excel in latency arbitrage.

Speed plays a key role in high-frequency trading, where latency arbitrage hinges on taking advantage of minuscule delays in price updates across markets. Traders with the quickest systems can seize these fleeting price differences - often disappearing in milliseconds - before anyone else.

To stay ahead, firms pour resources into low-latency networks, cutting-edge algorithms, and co-located servers positioned near exchange data centers. These technologies enable them to execute trades faster than their rivals, capitalizing on momentary price gaps that might otherwise go unnoticed.

"}}]}