High-Frequency Trading with FPGAs Explained Simply

In high-frequency trading (HFT), speed is everything. Profits depend on how quickly trades are executed - sometimes within nanoseconds. CPUs and GPUs often fall short in this ultra-fast environment, which is why trading firms turn to FPGAs (Field-Programmable Gate Arrays). These specialized hardware devices are faster, more consistent, and better suited for the demands of HFT. Here's what you need to know:

- What is HFT? Algorithms execute trades in milliseconds or nanoseconds, exploiting brief market opportunities.

- Why FPGAs? Unlike CPUs and GPUs, FPGAs process data in parallel at the hardware level, bypassing software delays and achieving ultra-low latency.

- Key Benefits: FPGAs are faster (as low as 480 nanoseconds), more predictable, and fully customizable for specific trading tasks like market data processing and order execution.

- Real-World Use: FPGAs handle tasks such as decoding market data, performing pre-trade risk checks, and enabling latency-sensitive strategies like arbitrage.

FPGAs have become essential in the trading world, especially when paired with low-latency hosting solutions like QuantVPS. Together, they ensure maximum speed and reliability in a field where every nanosecond matters.

FPGA in HFT Systems Explained | Why Reconfigurable Hardware Beats CPUs

Why FPGAs Work Better for HFT

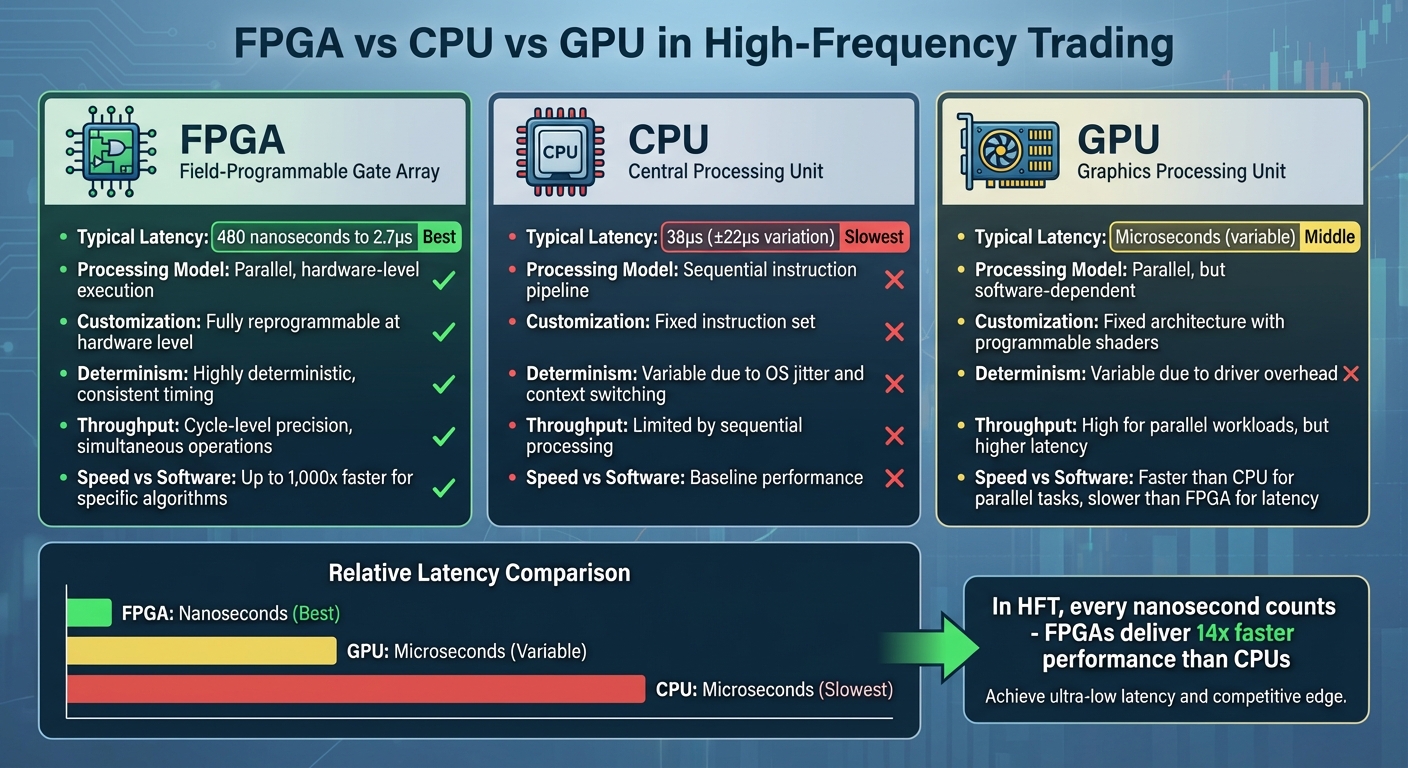

FPGA vs CPU vs GPU Performance Comparison for High-Frequency Trading

FPGA vs CPU vs GPU Performance Comparison for High-Frequency Trading

FPGAs (Field Programmable Gate Arrays) operate at the hardware level, bypassing the delays typically associated with conventional processors. Unlike CPUs and GPUs, which rely on operating systems, software layers, and sequential instruction pipelines, FPGAs process data using custom hardware circuits built specifically for tasks like high-frequency trading (HFT). This unique architecture delivers performance gains that can make or break profitability in the ultra-competitive, nanosecond-driven world of trading.

Speed and Latency Benefits

CPUs often face challenges like OS jitter, context switching, and cache latency, all of which introduce delays and unpredictability to processing times. FPGAs avoid these issues entirely by using custom architectures designed for specific tasks such as market data filtering, order book reconstruction, and trade execution. This results in deterministic behavior and consistent ultra-low-latency performance. Jean-François Gagnon from Orthogone highlights this advantage:

"FPGAs overcome these bottlenecks by executing logic at the hardware level. With custom architectures tailored for specific tasks - like market data filtering, order book reconstruction, and trade execution - FPGAs deliver deterministic behavior and consistent ultra‐low‐latency performance."

"FPGAs overcome these bottlenecks by executing logic at the hardware level. With custom architectures tailored for specific tasks - like market data filtering, order book reconstruction, and trade execution - FPGAs deliver deterministic behavior and consistent ultra‐low‐latency performance."

A practical example of this can be seen in a 2011 FPGA-based ITCH feed handler built on the Stone Ridge RDX-11 platform. It processed NASDAQ's market data feed with a turnaround latency of just 2.7µs, with minimal variation. In contrast, a CPU handling the same task recorded a latency of 38±22µs, over 14 times slower and far less consistent. More recently, FPGA-based systems have achieved average latencies as low as 480 nanoseconds, significantly outperforming both CPUs and GPUs.

Hardware Customization for Trading

FPGAs are built with reprogrammable logic blocks and interconnects, allowing them to implement virtually any algorithm directly in hardware. This adaptability enables trading firms to create custom architectures tailored to specific HFT tasks - whether it's parsing market data packets or performing pre-trade risk assessments - while eliminating the overhead of traditional software.

One of the standout features of FPGAs is their ability to perform parallel processing. They can handle multiple operations simultaneously, such as market data filtering, order book reconstruction, and trade signal generation, all with cycle-level precision. Research has shown that FPGA IP libraries can cut latency in electronic trading by a factor of 2.

By 2025, companies like Velvetech are offering specialized FPGA programming solutions tailored for traders. These include implementations for Order Gateway, News Alert Systems, and TCP Injection Trade for Ultra-Low Latency, showcasing how hardware customization directly addresses the speed demands of modern HFT. John W. Lockwood from Algo-Logic Systems further emphasizes the value of FPGAs:

"The hardened network transceivers in modern FPGAs along with the ability to customize the network stack implementation also make FPGAs suitable for ultra‐low latency networking interfaces. This can also be useful in other domains, including financial applications such as high‐frequency trading where FPGA reprogrammability allows integration of the rapidly changing trading algorithms on the same chip as this low‐latency networking interface."

"The hardened network transceivers in modern FPGAs along with the ability to customize the network stack implementation also make FPGAs suitable for ultra‐low latency networking interfaces. This can also be useful in other domains, including financial applications such as high‐frequency trading where FPGA reprogrammability allows integration of the rapidly changing trading algorithms on the same chip as this low‐latency networking interface."

Comparison Table: FPGA vs. CPU/GPU in HFT

| Feature | FPGA | CPU | GPU |

|---|---|---|---|

| Typical Latency | 480 nanoseconds to 2.7µs | 38µs (±22µs variation) | Microseconds (variable) |

| Processing Model | Parallel, hardware-level execution | Sequential instruction pipeline | Parallel, but software-dependent |

| Customization | Fully reprogrammable at hardware level | Fixed instruction set | Fixed architecture with programmable shaders |

| Determinism | Highly deterministic, consistent timing | Variable due to OS jitter and context switching | Variable due to driver overhead |

| Throughput | Cycle-level precision, simultaneous operations | Limited by sequential processing | High for parallel workloads, but higher latency |

| Speed vs. Software | Up to 1,000x faster for specific algorithms | Baseline performance | Faster than CPU for parallel tasks, slower than FPGA for latency |

How FPGAs are Used in HFT Systems

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

High-Frequency Trading (HFT) thrives on nanosecond-level precision, and FPGAs (Field Programmable Gate Arrays) rise to the challenge with their specialized hardware routines. They play a pivotal role in three key areas: processing market data, executing orders with risk checks, and enabling latency-sensitive trading strategies.

Market Data Processing

In HFT, speed is everything, and FPGAs excel at processing market data with unparalleled efficiency. They decode, filter, and normalize data in real time, operating at cycle-level precision. By handling these tasks inline at network speeds, FPGAs filter out irrelevant data almost instantly, giving trading algorithms the edge they need to act faster.

For example, in 2012, Algo-Logic Systems introduced an FPGA IP library capable of sustaining a 10Gb/s Ethernet line rate with an end-to-end latency of just 1 microsecond (1,000 nanoseconds) - a significant improvement over software-based systems. More recently, FPGA-based hardware decoding of market data protocols like Ethernet, IP, UDP, and FAST demonstrated a fourfold reduction in latency compared to traditional software approaches.

What makes FPGAs so effective? Their ability to process incoming data packets in parallel. This means they can decode packet headers, rebuild order books, and generate trading signals simultaneously - all within a single clock cycle. This rapid data handling lays the foundation for immediate order execution and risk management.

Order Execution and Risk Management

FPGAs don’t just process data - they also execute trades with incredible speed. By optimizing network stacks, FPGAs handle the most latency-critical parts of the tick-to-trade pipeline. They can make trade decisions - whether to buy, sell, or hold - and determine trade amounts within a single clock cycle, which is roughly 20 nanoseconds at 50MHz.

Jean-François Gagnon from Orthogone highlights an important feature of FPGA technology:

"Pre-trade risk assessments can be embedded directly in hardware logic."

"Pre-trade risk assessments can be embedded directly in hardware logic."

This capability is exemplified by the AMD Alveo™ UL3422 FinTech accelerator, which boasts up to a 7X latency reduction compared to its predecessor. These systems conduct pre-trade checks for volume, price, and collateral directly in hardware, ensuring compliance without sacrificing speed. As Micheal McGuirk from AMD puts it:

"In situations where every nanosecond counts, you can do inline trades and FPGAs at the nanosecond level which not quite possible for CPUs."

"In situations where every nanosecond counts, you can do inline trades and FPGAs at the nanosecond level which not quite possible for CPUs."

Latency-Sensitive Strategies

Strategies like arbitrage and market-making rely on predictable, ultra-low-latency performance, making FPGAs indispensable. At the 3rd International Conference on Automation, Computing and Renewable Systems (ICACRS) in 2024, researchers showcased an FPGA-based system capable of achieving an average latency of 480 nanoseconds while processing up to 150,000 orders per second.

These strategies exploit brief price discrepancies in the market. FPGAs are ideal for this because they deliver consistent processing latency, ensuring the same output for identical inputs, regardless of external conditions. Some systems combine CPUs with FPGAs, where the CPU handles less time-critical tasks, leaving the FPGA to focus exclusively on latency-sensitive algorithms.

Using FPGAs with High-Performance VPS Solutions

FPGAs are known for their lightning-fast processing speeds, operating at nanosecond levels. But to truly harness their potential, they need a hosting environment that matches their speed and minimizes latency. This is where high-performance VPS solutions come in, providing the optimized infrastructure that allows FPGA-driven trading systems to work at their best.

Why High-Performance VPS Matters for FPGA Integration

FPGAs thrive on ultra-low latency, but without the right VPS setup, their performance can hit roadblocks. These devices connect via PCIe interfaces and depend on ultra-low latency controllers to handle rapid data transfers efficiently. A high-performance VPS ensures the necessary computing power and network speed to keep data flowing smoothly, preventing slowdowns that could impact trading performance.

Network connectivity is just as critical as raw processing power. For FPGA systems, the VPS must be housed in a low-latency colocation datacenter close to exchange servers. Proximity is key - without it, even the fastest FPGA processing can't overcome delays caused by network lag. This is why platforms like QuantVPS, which combine low-latency hosting with FPGA-optimized infrastructure, are game-changers for traders.

QuantVPS: Optimized for High-Speed Trading

QuantVPS operates from a datacenter in Chicago, USA, strategically positioned near the CME Group's matching engines. This location is no coincidence - it's designed to minimize latency, offering traders a connection speed of under 0.52ms to CME, a crucial advantage for futures trading. As of December 16, 2025, QuantVPS servers handle an impressive $16.44 billion in daily futures trading volume.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

The platform's infrastructure is built for speed and reliability. It features AMD EPYC and Ryzen processors, high-speed DDR4/5 RAM, and NVMe M.2 SSD storage, all working together to ensure rapid data processing. For traders who can't afford any performance compromises, QuantVPS offers dedicated servers with 100% AMD Ryzen power, eliminating the overhead associated with virtualization. The network setup includes a Gigabit network with 10Gbps burst capability and redundant pathways, ensuring consistent and reliable data throughput.

For FPGA-based trading systems that require uninterrupted operation, QuantVPS guarantees 99.999% uptime and 100% network availability. Servers come preloaded with Windows Server 2022, configured specifically for trading environments. Additional features like DDoS protection, automated backups, and multi-monitor RDP support make it a comprehensive solution for professional traders. QuantVPS also supports leading trading software and offers the flexibility to design custom dedicated server setups, making it an ideal choice for integrating FPGA acceleration into high-frequency trading systems.

Conclusion

FPGAs have transformed high-frequency trading by achieving nanosecond-level latency and delivering consistent performance that CPUs simply can't match. By handling multiple functions simultaneously at the hardware level, FPGAs eliminate delays caused by operating system overhead, context switching, and the limitations of sequential processing. This makes them indispensable in trading environments where every microsecond counts.

However, this hardware speed must be matched by a robust network infrastructure. Even the fastest FPGA systems can't overcome the challenges of high network latency. That’s why combining FPGAs with high-performance VPS solutions, like QuantVPS, creates a powerful ecosystem for trading. With strategically placed data centers offering ultra-low latency and advanced hardware, QuantVPS ensures seamless integration and optimal performance for FPGA-based systems.

As markets evolve, the integration of tailored hosting solutions provides a critical edge. For traders and firms operating in these fast-paced environments, FPGAs are no longer optional - they’ve become essential building blocks for modern trading infrastructure. Beyond equities and options, FPGAs are now making an impact in foreign exchange and cryptocurrency markets, with retail investors driving demand for this cutting-edge technology. As the race for lower latency intensifies, pairing FPGAs with optimized hosting solutions isn’t just about keeping pace - it’s about staying ahead of the competition.

FAQs

Why are FPGAs so effective at reducing latency in high-frequency trading?

FPGAs excel at cutting down latency in high-frequency trading by leveraging customizable hardware that processes tasks in parallel. This means multiple operations can run at the same time, unlike traditional processors that handle tasks sequentially. The result? Faster and more efficient task execution.

What sets FPGAs apart is their deterministic performance, delivering consistent and predictable response times no matter the external conditions, such as network variability. In high-frequency trading, where even a microsecond can make a difference, this reliability provides a crucial advantage.

Which high-frequency trading tasks gain the most from FPGA customization?

FPGA customization plays a crucial role in high-frequency trading, where ultra-low latency and precision are non-negotiable. Here’s how FPGAs are used in this fast-paced environment:

- Market data processing: They enable rapid analysis of incoming data streams, helping traders spot opportunities in real time.

- Order execution: FPGAs ensure trades are placed and confirmed almost instantly, minimizing any delay.

- Pre-trade risk checks: Compliance and risk checks are performed seamlessly without slowing down trade execution.

- Algorithmic calculations: Complex trading strategies are executed at lightning speeds, often in nanoseconds.

By customizing hardware for these specific tasks, FPGAs empower traders and firms to operate with unmatched speed and efficiency, giving them a clear advantage in the high-stakes world of high-frequency trading.

Why are FPGAs and high-performance VPS solutions essential for success in high-frequency trading?

FPGAs and high-performance VPS solutions play a crucial role in high-frequency trading by providing ultra-low latency and reliable performance. FPGAs are built to handle data processing at lightning-fast speeds, enabling trades to be executed within nanoseconds. Meanwhile, high-performance VPS solutions ensure stable and fast connections to trading platforms.

Together, these technologies empower traders to respond to market shifts almost instantly, seizing opportunities and staying ahead in the highly competitive trading environment. By integrating these tools, firms can enhance execution speed and streamline their trading strategies for better efficiency.

FPGAs excel at cutting down latency in high-frequency trading by leveraging customizable hardware that processes tasks in parallel. This means multiple operations can run at the same time, unlike traditional processors that handle tasks sequentially. The result? Faster and more efficient task execution.

What sets FPGAs apart is their deterministic performance, delivering consistent and predictable response times no matter the external conditions, such as network variability. In high-frequency trading, where even a microsecond can make a difference, this reliability provides a crucial advantage.

FPGA customization plays a crucial role in high-frequency trading, where ultra-low latency and precision are non-negotiable. Here’s how FPGAs are used in this fast-paced environment:

- Market data processing: They enable rapid analysis of incoming data streams, helping traders spot opportunities in real time.

- Order execution: FPGAs ensure trades are placed and confirmed almost instantly, minimizing any delay.

- Pre-trade risk checks: Compliance and risk checks are performed seamlessly without slowing down trade execution.

- Algorithmic calculations: Complex trading strategies are executed at lightning speeds, often in nanoseconds.

By customizing hardware for these specific tasks, FPGAs empower traders and firms to operate with unmatched speed and efficiency, giving them a clear advantage in the high-stakes world of high-frequency trading.

FPGAs and high-performance VPS solutions play a crucial role in high-frequency trading by providing ultra-low latency and reliable performance. FPGAs are built to handle data processing at lightning-fast speeds, enabling trades to be executed within nanoseconds. Meanwhile, high-performance VPS solutions ensure stable and fast connections to trading platforms.

Together, these technologies empower traders to respond to market shifts almost instantly, seizing opportunities and staying ahead in the highly competitive trading environment. By integrating these tools, firms can enhance execution speed and streamline their trading strategies for better efficiency.

"}}]}