Tradeify Futures Prop Firm Review: Funding, Payouts & Customer Feedback

Tradeify is a U.S.-based futures prop trading firm offering traders access to institutional capital with straightforward funding options and fast payouts. With a 4.8-star Trustpilot rating, it emphasizes clear rules, disciplined risk management, and reliable customer support. Key highlights include:

- Funding Options: Accounts range from $25,000 to $750,000. Monthly fees start at $99, and traders can manage up to five funded accounts.

- Payouts: Traders keep 100% of the first $15,000 in profits and 90% thereafter. Payouts are processed daily, often within 24 hours.

- Account Types: Advanced Challenge, Growth Challenge, and Straight to Sim cater to different trading styles.

- Partnered Tools: QuantVPS ensures ultra-low latency and reliable infrastructure for smooth trading.

Tradeify is ideal for traders seeking clear funding paths and efficient payouts, while QuantVPS enhances trading performance with high-speed hosting.

Tradeify Prop Firm Review: EVERYTHING you need to know (Costs, Payouts, Plans) | SKIP the Evaluation

1. Tradeify Futures Prop Firm

Tradeify is a prop trading firm focused on futures, offering traders access to substantial capital alongside clear and straightforward policies. Their model emphasizes flexible account options, competitive profit-sharing, and a trading platform designed to help traders grow their accounts effectively.

Funding Programs

Tradeify provides three account types tailored to different trading styles and experience levels. Advanced Challenge accounts feature real-time intraday trailing drawdowns, while Growth Challenge accounts use end-of-day trailing drawdowns, which are more accommodating for swing traders. For seasoned traders, the Straight to Sim option skips evaluations, allowing them to start trading immediately.

Account funding ranges from $25,000 to $750,000, with specific profit targets and drawdown limits tied to each level. For example, a $50,000 Advanced account requires a $3,000 profit target with a $2,000 trailing drawdown, while a $150,000 account demands $9,000 in profits with drawdowns of $4,500 (Advanced) or $5,000 (Growth).

| Account Size | Evaluation Profit Target | Trailing Max Drawdown (Advanced/Growth) | Max Position Size |

|---|---|---|---|

| $50,000 | $3,000 | $2,000 | 5 contracts / 50 micros |

| $100,000 | $6,000 | $3,000 (Adv) / $3,500 (Growth) | 10 contracts / 100 micros |

| $150,000 | $9,000 | $4,500 (Adv) / $5,000 (Growth) | 15 contracts / 150 micros |

The monthly cost for these accounts varies: a $50,000 account is $99/month, while a $100,000 account costs $199/month. Alternatively, traders can opt for one-time fees ranging from $99 to $229. Traders are allowed to manage up to five funded accounts simultaneously, and funding is guaranteed for those who complete the evaluation without breaking any rules.

These funding options are designed to streamline the path to payouts, ensuring a transparent and efficient process.

Payout Structure

Tradeify offers a generous 90% profit share for withdrawals from simulated funded accounts. Payouts are processed daily, with funds typically arriving within 24 hours.

To qualify for payouts, traders must meet specific requirements. For Advanced and Growth Sim Funded accounts, withdrawals are allowed every seven trading days, provided at least five of those days show profits exceeding $150 for a $50,000 account, $200 for a $100,000 account, or $250 for a $150,000 account. Additionally, a 35% Consistency Rule ensures no single trading day accounts for more than 35% of total profits.

The Straight to Sim accounts have stricter rules, including a 20% Consistency Rule and set profit targets before withdrawals. Unlike Advanced Sim Funded accounts, these accounts do not require a $125 activation fee.

Payouts increase progressively. For instance, a $50,000 account starts with a minimum first payout of $1,500, scaling up to $2,500 by the fifth payout. After the sixth payout, traders can withdraw up to $25,000 per request per account. Once a withdrawal request is submitted, it cannot be edited or canceled. While trading can continue after submission, failing to meet minimum account requirements before processing will result in a denial of the payout.

Trading Infrastructure

Tradeify’s platform enforces strict risk management. Traders are automatically restricted from exceeding position limits, which range from 1 contract for a $25,000 account to 15 contracts for a $150,000 account. This ensures disciplined trading practices that align with the firm's evaluation guidelines.

Customer Feedback

Traders frequently praise Tradeify for its clear policies, quick payouts, and responsive support team.

"Easily one of the best prop firms I've worked with and I've tried all the top ones. Their rules are very straightforward and their payouts are very fast! Highly recommend the Tradeify team."

– Misael Flores

"Easily one of the best prop firms I've worked with and I've tried all the top ones. Their rules are very straightforward and their payouts are very fast! Highly recommend the Tradeify team."

– Misael Flores

"No stupid rules, yesterday I requested payout, today I have money in my account! Thank you guys! ✌️"

– Denis

"No stupid rules, yesterday I requested payout, today I have money in my account! Thank you guys! ✌️"

– Denis

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

"Tradeify has good competitive pricing, offers straight-to-funding, which I got a 2nd payout from. After I requested the payout, both times they were processed very quickly. The last payout was in my Rise account in 30 minutes after I requested it, even though it was 7 pm. This is a genuine review. Thank you!"

– RusCA

"Tradeify has good competitive pricing, offers straight-to-funding, which I got a 2nd payout from. After I requested the payout, both times they were processed very quickly. The last payout was in my Rise account in 30 minutes after I requested it, even though it was 7 pm. This is a genuine review. Thank you!"

– RusCA

"Just had a great experience with the online help chat. Youssef was super responsive and helpful."

"Just had a great experience with the online help chat. Youssef was super responsive and helpful."

"Amazing support from Amir. Thank you for all."

"Amazing support from Amir. Thank you for all."

Tradeify also actively addresses customer concerns, responding to roughly 35% of negative Trustpilot reviews - usually within two weeks - showing their commitment to resolving issues and maintaining satisfaction.

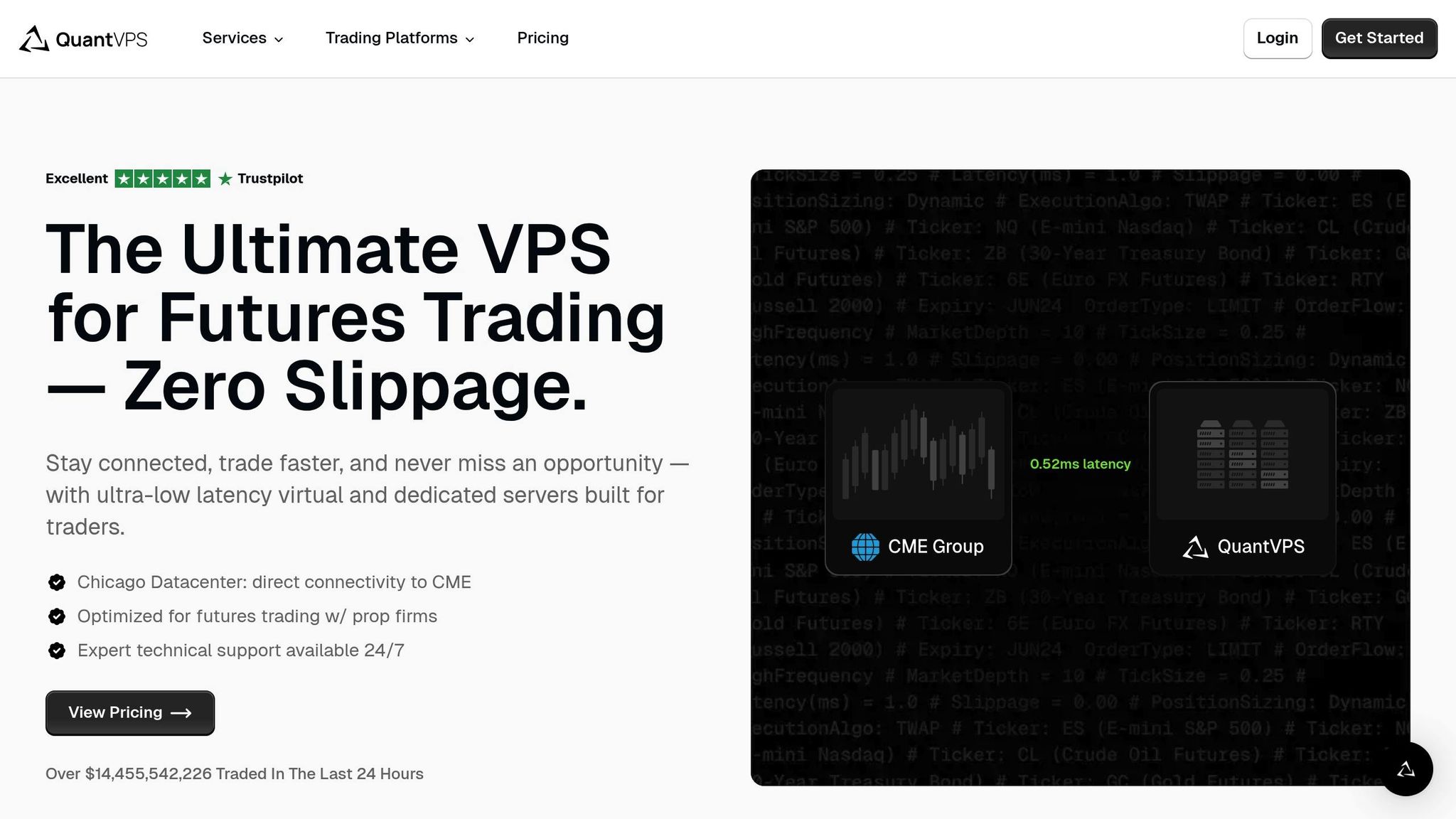

2. QuantVPS

QuantVPS plays a crucial role in keeping Tradeify's trading operations smooth and uninterrupted. Specializing in high-performance VPS hosting for futures and forex trading, QuantVPS provides the infrastructure traders need for fast, accurate trade execution. While it’s not a proprietary trading firm, QuantVPS acts as the technological backbone for efficient trading.

Trading Infrastructure

QuantVPS is built for speed and reliability. Its servers are strategically located in Chicago, close to the CME Group, to minimize network delays. With latency as low as 0.52 milliseconds to CME, QuantVPS gives traders the kind of split-second advantage that can make a big difference in algorithmic and high-frequency trading. The platform uses enterprise-grade processors, ultra-fast NVMe storage, and plenty of RAM to ensure orders are processed without delays or hiccups.

Security is another key focus. QuantVPS includes advanced cybersecurity measures, Anti-DDoS protection, automatic backups, full root access, and 24/7 monitoring, ensuring that trading operations remain secure and stable. This combination of speed, reliability, and security allows traders to stay in control of their positions and focus on market opportunities.

QuantVPS offers four distinct plans, each designed to cater to different trading needs:

| Plan | Price | Cores | RAM | Storage | Network | Monitor Support |

|---|---|---|---|---|---|---|

| VPS Lite | $59/month | 4x | 8GB | 70GB NVMe | 1Gbps+ | 1-2 charts |

| VPS Pro | $99/month | 6x | 16GB | 150GB NVMe | 1Gbps+ | 2-monitor support |

| VPS Ultra | $199/month | 24x | 64GB | 500GB NVMe | 1Gbps+ | 4-monitor support |

| Dedicated Server | $299/month | 16x+ | 128GB | 2TB+ NVMe | 10Gbps+ | 6-monitor support |

The platform is compatible with major trading applications like NinjaTrader, MetaTrader, and TradeStation, making it versatile for a variety of futures trading setups.

Customer Feedback

QuantVPS has earned high praise from its users, boasting a Trustpilot rating of 4.8 out of 5 from 255 reviews. Traders frequently highlight its consistent low latency, dependable uptime, and responsive technical support. The trust in QuantVPS is further reflected in the impressive $14.44 billion in futures volume traded on its low-latency servers in just the last 24 hours [7].

To ensure uninterrupted trading, QuantVPS provides expert technical support through various channels, including a ticket system, live chat, and a detailed knowledge base. This support system is designed to address any issues quickly and keep trading operations running smoothly [7].

Trading Infrastructure Comparison

This section highlights how Tradeify and QuantVPS contribute to the trading ecosystem in distinct but complementary ways. While Tradeify focuses on providing access to key trading platforms, QuantVPS delivers the high-performance hosting needed to run those platforms efficiently.

Let’s break down their differences in terms of technical performance, system requirements, and security. One notable distinction is platform compatibility. Tradeify users working with NinjaTrader must complete an extra step - signing a Non-Professional Data Agreement on Tradovate's website - to avoid delays in market data. On the other hand, QuantVPS offers broader compatibility, supporting NinjaTrader, MetaTrader 4/5, TradeStation, and many other trading tools [10].

QuantVPS stands out with latency under 0.52 milliseconds and near-perfect uptime. For example, in July 2025, QuantVPS reported that its Chicago-based core network maintained 100% operational status over 180 days, facilitating $14.47 billion in daily futures trading volume [7]. This level of performance directly benefits traders using platforms like those offered by Tradeify.

System requirements also set these services apart. Tradeify users need to meet basic hardware specifications, such as a Windows 10/11 system, a 1 GHz 64-bit processor, and at least 2GB of RAM for NinjaTrader 8. In contrast, QuantVPS eliminates these hardware concerns entirely by offering enterprise-grade servers with ultra-fast NVMe storage and up to 128GB of RAM, ensuring seamless performance for even the most demanding trading strategies.

Security measures further differentiate the two. Tradeify prioritizes monitoring trading activities, using advanced surveillance as part of its funded trader agreement. QuantVPS, however, focuses on infrastructure protection, offering features like anti-DDoS safeguards, automatic backups, and 24/7 system monitoring to keep trading operations running smoothly.

The services also differ in their core missions. Tradeify is built around providing access to simulated funding opportunities, while QuantVPS is designed to optimize trade execution. This makes QuantVPS especially valuable for traders running automated strategies or managing multiple platforms simultaneously. Together, they form a powerful combination, aligning funding opportunities with cutting-edge infrastructure.

Customer Reviews and Ratings

Both Tradeify and QuantVPS have earned impressive Trustpilot ratings, each holding a 4.8/5 score - Tradeify based on 646 reviews and QuantVPS on 259 reviews. These ratings highlight the strong reputations of both services, offering a glimpse into their respective strengths.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Tradeify's reviews frequently praise its clear rules, quick payouts, and transparent operations. For instance, on July 2, 2025, Mark Leonard, a trader from the U.S., shared:

"Tradeify is a great company to work with. Their rules are clear, and if you follow the rules and hit your targets, you get paid out. That's all anyone can ask for in this business. Payout took just a few hours. It's great to have a partner like them in this business."

"Tradeify is a great company to work with. Their rules are clear, and if you follow the rules and hit your targets, you get paid out. That's all anyone can ask for in this business. Payout took just a few hours. It's great to have a partner like them in this business."

This focus on fast payouts is echoed by Sebastián Vargas, who commented on April 5, 2025:

"Outstanding service, Payouts in less than 15 minutes. Trading tools properly set for winning in volatile environment, 24/7 support. Can't find anything better than this in the prop S2F industry."

"Outstanding service, Payouts in less than 15 minutes. Trading tools properly set for winning in volatile environment, 24/7 support. Can't find anything better than this in the prop S2F industry."

On the other hand, QuantVPS earns high marks for its technical performance and infrastructure reliability. Customers frequently highlight its fast setup, seamless integration, and dependable performance - qualities essential for uninterrupted trading.

The feedback paints a clear picture of how Tradeify and QuantVPS complement each other. Tradeify ensures funding clarity and dependable payouts, while QuantVPS delivers the technical backbone traders need for consistent execution.

| Service | Pros | Cons |

|---|---|---|

| Tradeify | Clear rules; Rapid payouts (minutes to hours); Responsive support; Transparent operations; Active trading community | Occasional platform update issues; Subscription renewal challenges |

| QuantVPS | Ultra-low latency; Reliable uptime; Fast setup; Seamless integration; 24/7 trading support | Pricing concerns; Limited data center transparency; Fewer client testimonials |

Both platforms consistently receive praise for their responsive support teams. Tradeify users often highlight how helpful the team is in navigating funding rules and ensuring smooth payout processes. Meanwhile, QuantVPS customers commend the technical expertise of its support staff in addressing infrastructure issues and optimizing trading setups.

Recent reviews further confirm the consistency of these services. Feedback from July 2025 continues to emphasize Tradeify's fast payouts and clear communication, while QuantVPS reviews underscore the platform's reliability and ability to support algorithmic trading strategies. These shared qualities demonstrate why traders often rely on Tradeify for funding and QuantVPS for technical performance.

Final Assessment

Tradeify stands out as a solid choice for U.S.-based futures traders looking for dependable funding options with clear and straightforward processes. With a 4.8/5 rating on Trustpilot across 646 reviews, the firm has gained recognition for its transparent rules, swift payouts, and reliable customer support. Offering a 90% profit share on Sim Funded accounts, Tradeify allows traders to manage accounts as large as $750,000, providing ample room for account growth. Pricing is competitive, starting at $99 per month for a $50,000 account and $199 per month for a $100,000 account.

Traders can move to Live Funded Accounts after achieving four successful payouts or accumulating $80,000 in total payouts. The maximum payout cap for these accounts is $100,000.

Adding to this strong funding framework, QuantVPS supports traders with high-performance infrastructure for seamless trade execution. Its compatibility with top futures trading platforms - like NinjaTrader, Sierra Chart, and TradeStation - ensures smooth operations. In just the past 24 hours, QuantVPS's servers have handled over $14.44 billion in futures trading volume, highlighting its capability to manage high-intensity trading activity [7].

FAQs

What are the main differences between Tradeify’s Advanced Challenge, Growth Challenge, and Straight to Sim accounts?

Tradeify provides three unique account options, each crafted to suit different trading preferences and objectives.

The Advanced Challenge accounts cater to traders seeking larger account balances, offering options like $50,000, $100,000, or $150,000. These accounts come with real-time trailing drawdowns, making them ideal for traders who are comfortable managing risk dynamically.

For those who value steady and consistent trading, the Growth Challenge accounts are a great fit. They feature an end-of-day trailing drawdown and include a 20% consistency rule, encouraging traders to maintain discipline in their approach.

Lastly, the Straight to Sim accounts are designed for traders looking for a straightforward simulation experience. Like the Growth Challenge, these accounts use an end-of-day trailing drawdown, with a focus on consistency and risk management.

The main differences between these accounts lie in their size options, the type of drawdowns they use, and the trading styles they are best suited to support.

What steps does Tradeify take to ensure fast and reliable payouts, and what are the qualifications for traders to request a payout?

Tradeify is dedicated to ensuring fast and dependable payouts, processing requests within 24 to 48 hours after approval. Traders have the flexibility to request payouts daily, with processing times calculated on a rolling 24-hour schedule to maintain efficiency.

To be eligible for a payout, traders need to meet specific requirements, such as achieving a minimum profit of $250 for accounts exceeding $50,000. Additionally, traders must adhere to Tradeify's guidelines on consistency and drawdowns. Once these conditions are met, the payout process is straightforward, with most approvals completed by the next payout cycle.

This efficient approach ensures traders can access their earnings quickly, providing a seamless and dependable experience for funded traders.

How does QuantVPS improve the trading experience for Tradeify users, and what advantages does it offer?

QuantVPS takes the trading experience for Tradeify users to the next level by offering ultra-low latency - just about 0.7 milliseconds to CME. This means trades are executed faster and more reliably, giving traders the edge they need to meet payout targets and fine-tune their strategies for maximum efficiency.

With servers based in Chicago, QuantVPS ensures 100% uptime and delivers robust processing power, making it a dependable choice for active futures traders. The close proximity to major exchanges significantly reduces delays, catering to professionals who prioritize speed and precision. Together, these features provide a smoother, more reliable trading experience, empowering users to pursue their goals with greater confidence.