OANDA Review: Still a Top Choice for Forex Traders?

OANDA, a forex broker established in 1996, remains a strong contender in the trading world. With oversight from seven Tier-1 regulators (e.g., CFTC, FCA, ASIC), OANDA processes $10.7 billion in daily transactions and offers a range of platforms, including its proprietary OANDA Trade, MetaTrader 4, and TradingView integration. Known for low-latency execution speeds (12 milliseconds) and tools like API libraries and VPS hosting, OANDA caters to beginners with a $0 minimum deposit and micro lot trading, while also appealing to high-volume and algorithmic traders through its Elite Trader program and low-cost Core Pricing model.

However, its higher-than-average spreads (e.g., 1.69 pips for EUR/USD) and limited asset options for U.S. clients (forex and crypto only) could be drawbacks. While OANDA excels in speed and regulatory compliance, costs and asset variety might influence its suitability depending on your trading style.

Key Takeaways:

- Platforms: OANDA Trade, MetaTrader 4, TradingView integration.

- Execution Speed: 12 milliseconds.

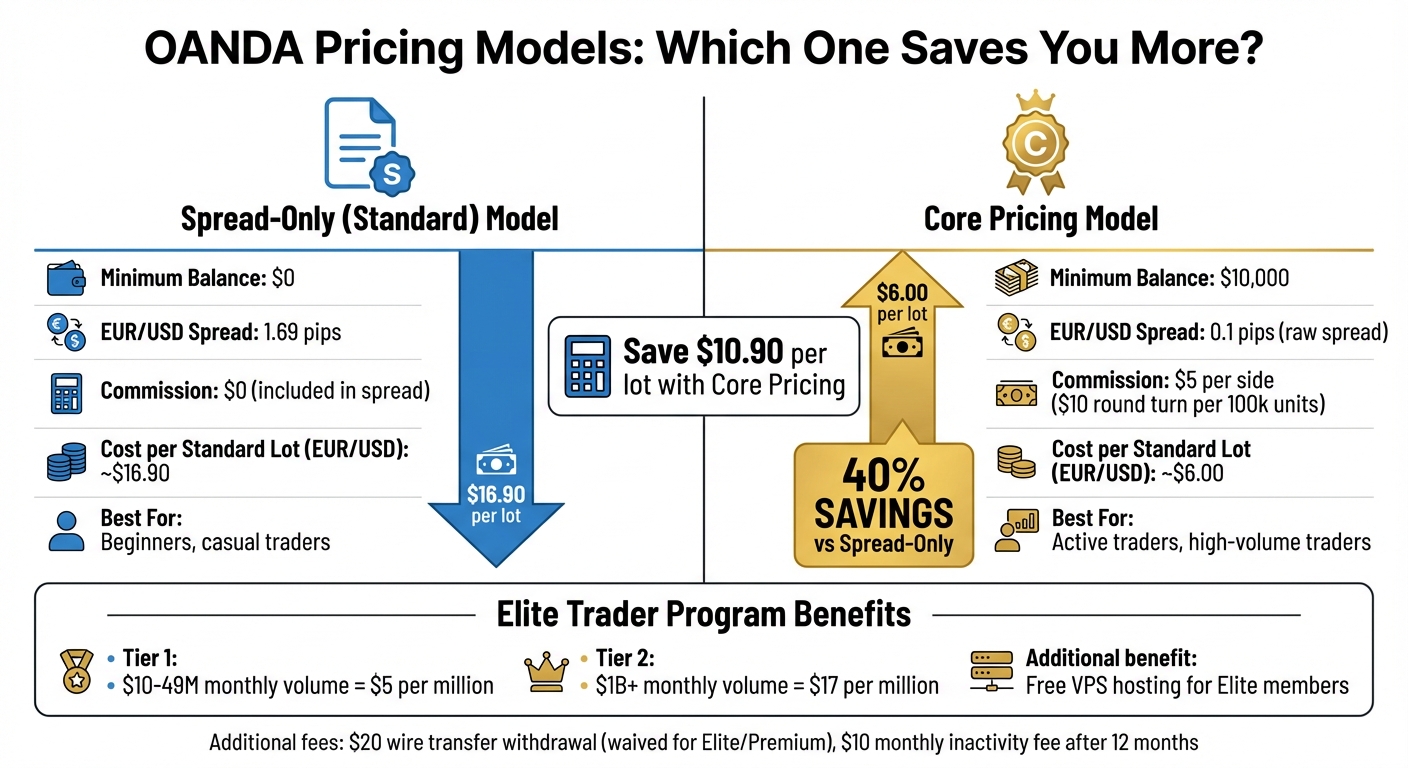

- Pricing Models: Spread-only (1.69 pips on EUR/USD) or Core Pricing (0.1 pips + $5 commission per side).

- Features for Advanced Traders: VPS hosting, API access, cash rebates for high-volume traders.

- Regulation: Tier-1 oversight, Trust Score of 93/99.

- Limitations: High spreads, inactivity fees, fewer tradable assets for U.S. clients.

OANDA balances speed, tools, and reliability, but traders should weigh its costs and limitations before choosing it.

OANDA Review: Unveiling the BEST Forex Broker in the US

Trading Platforms and Tools

OANDA provides traders with three main platform options: its proprietary OANDA Trade platform (accessible via web, desktop, and mobile), MetaTrader 4 (MT4), and direct integration with TradingView. These options are designed to address a variety of technical and strategic trading preferences.

The OANDA Trade platform comes equipped with over 100 technical indicators, more than 50 drawing tools, and the Autochartist feature for automated pattern recognition, all powered by TradingView's advanced charting capabilities. It also integrates the OANDA order book, offering real-time insights into market sentiment. Steven Hatzakis, Global Director of Online Broker Research at ForexBrokers.com, highlighted a standout feature:

A neat feature that stood out to me was the seamless transition to the trade ticket window from within the charts. Users can quickly enter their orders from the chart, then adjust their stop-loss and limit order levels with a simple drag and drop function.

A neat feature that stood out to me was the seamless transition to the trade ticket window from within the charts. Users can quickly enter their orders from the chart, then adjust their stop-loss and limit order levels with a simple drag and drop function.

However, he also noted:

OANDA's flagship OANDA Trade desktop and web trading platform is good – not great – and trails platform leaders such as IG and Saxo.

OANDA's flagship OANDA Trade desktop and web trading platform is good – not great – and trails platform leaders such as IG and Saxo.

For algorithmic traders, MetaTrader 4 (MT4) continues to be a dependable choice. OANDA enhances the standard MT4 experience with its Premium Upgrade package, which includes 28 additional tools and indicators, such as the Mini Terminal and Correlation Matrix. The platform also supports Expert Advisors (EAs) through a custom-built bridge that connects MT4's automation features with OANDA's pricing and execution system. Developers can further leverage OANDA's Algo Labs, which provides REST and FIX API libraries in Python, C#, and Java, along with access to 25 years of historical data covering over 200 currencies.

To support uninterrupted automated trading, OANDA offers VPS hosting through partnerships with providers like BeeksFX and Liquidity Connect. High-volume traders enrolled in the Elite Trader program can even enjoy free VPS access.

For those who need to trade on the go, the OANDA Trade mobile app ensures a seamless experience. It supports one-click trading directly from charts and includes over 30 technical indicators and 11 drawing tools. This mobile platform retains much of the functionality of its desktop counterpart, providing flexibility and convenience for traders wherever they are.

Fees and Spreads

OANDA Pricing Models Comparison: Spread-Only vs Core Pricing

OANDA Pricing Models Comparison: Spread-Only vs Core Pricing

OANDA's fee structure plays a significant role in its platform's appeal, offering traders two pricing models: Spread-only (Standard) and Core Pricing + Commission. The Spread-only model combines all trading costs into the bid-ask spread, eliminating separate commission charges. While this simplifies costs, it can be pricey - the average EUR/USD spread for a Standard account was 1.69 pips in August 2025. According to Steven Hatzakis, Global Director of Online Broker Research at ForexBrokers.com:

OANDA's forex trading costs are generally steep, with high effective spreads under both pricing models, compared to the best brokers.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

OANDA's forex trading costs are generally steep, with high effective spreads under both pricing models, compared to the best brokers.

The Core Pricing model is designed for active traders, requiring a minimum balance of $10,000. This option provides raw spreads as low as 0.1 pips on EUR/USD, paired with a fixed commission of $5 per side ($10 round turn) for every 100,000 units traded. For example, trading a standard lot of EUR/USD under Core Pricing typically results in an all-in cost of about $6.00, compared to approximately $16.90 with the Spread-only model - a savings of roughly 40%. High-volume traders can benefit even more from these reduced costs. This is particularly advantageous for those implementing Forex algorithmic trading strategies that rely on frequent execution.

For those trading high volumes, OANDA's Elite Trader program offers additional perks. Participants can earn cash rebates ranging from $5 to $17 per million traded, depending on monthly trading volume. For instance, traders handling $10–49 million monthly receive $5 per million, while those exceeding $1 billion qualify for $17 per million.

OANDA also provides VPS hosting through partners like BeeksFX and Liquidity Connect, with monthly costs ranging from $30 to $95. However, Elite Trader and Premium Plus members enjoy free access to these services. Additional fees include a $20 wire transfer withdrawal fee for U.S. and BVI accounts, though Elite and Premium members often receive waivers. An inactivity fee of 10 units of the account currency is charged monthly after 12 months of no trading activity.

Execution Quality

OANDA stands out with an average execution speed of 12 milliseconds, far surpassing the industry benchmark of 100 milliseconds, while managing a daily transaction volume of approximately $10.7 billion. This impressive speed is powered by OANDA's proprietary, fully automated execution engine.

The platform's execution engine is built entirely in-house, ensuring reliable order fulfillment even during volatile market conditions. Instead of depending on internal liquidity pools, OANDA sources its pricing directly from a global network of top-tier banks like Citibank, UBS, and JP Morgan. As OANDA puts it:

We own the quality of our forex trading system because we've built it... When you trade forex with OANDA, you know that when the markets are moving your orders are filled.

We own the quality of our forex trading system because we've built it... When you trade forex with OANDA, you know that when the markets are moving your orders are filled.

For traders utilizing algorithmic or high-volume strategies, OANDA offers VPS hosting from top providers to reduce latency and maintain 24/7 connectivity for automated systems. Elite Trader members trading $10 million monthly receive complimentary VPS access, while in Singapore, Premium account holders gain access to order book data updated every five minutes.

Steven Hatzakis, Global Director of Online Broker Research at ForexBrokers.com, highlights OANDA's strengths:

OANDA's main advantage is its automated execution across its account offering.

OANDA's main advantage is its automated execution across its account offering.

The broker also supports API access through Algo Labs, enabling traders to develop custom high-frequency strategies in Python and C#. Despite operating as a market maker, OANDA assures that there is no manual intervention to influence positions or manipulate stop orders. This combination of automation, robust VPS hosting, and transparent practices makes OANDA a dependable option for traders focused on precise execution.

Suitability for Different Trading Styles

OANDA stands out in its ability to cater to a variety of trading styles, making it a versatile choice for both beginners and experienced traders. Recognized as "Best in Class for Beginners" in 2025, OANDA offers a $0 minimum deposit and allows trading as little as 1 unit (0.001 micro lot). This low barrier to entry is especially helpful for new traders looking to experiment with strategies while keeping financial risk to a minimum - a critical feature considering that 71% to 76.6% of retail investor accounts lose money trading CFDs.

For day traders and scalpers, OANDA brings speed and flexibility to the table. With an average execution speed of just 12 milliseconds and no restrictions on scalping or hedging, it’s built for quick decision-making. DayTrading.com highlights OANDA's suitability for this group:

OANDA is a very good broker for day trading. Its spreads are tight, helping to reduce costs for active day traders... OANDA also supports multiple day trading strategies and systems, including scalping and algo trading.

OANDA is a very good broker for day trading. Its spreads are tight, helping to reduce costs for active day traders... OANDA also supports multiple day trading strategies and systems, including scalping and algo trading.

High-volume traders can benefit from OANDA's Elite Trader program, which offers rebates to help offset trading costs.

Algorithmic and high-frequency traders will appreciate OANDA's robust support for API-based custom strategies and MetaTrader 4 for automated trading using a low-latency VPS. The availability of Forex VPS hosting ensures low latency and consistent execution, with Elite Trader members receiving complimentary VPS access. For Singaporean Premium account holders (requiring a S$20,000 minimum deposit or US$30 million in quarterly volume), additional perks include orderbook data refreshed every five minutes - a 75% improvement in update frequency.

Swing traders, meanwhile, can leverage OANDA's integration with TradingView, providing access to advanced charting tools and over 100 technical indicators. Features like pattern recognition and fundamental analysis tools further enhance their ability to plan long-term trades. The unlimited demo account with $100,000 in virtual funds allows traders to test strategies without time constraints. However, some users have pointed out that the educational resources could be better organized, and the proprietary platform may take more time to master compared to more standardized options.

Steven Hatzakis, Global Director of Online Broker Research at ForexBrokers.com, underscores OANDA's accessibility:

OANDA does rank highly for its ease-of-use factor, making its Trade platform and client dashboard good for beginners, especially when compared to the complex trading software available from other brokers.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

OANDA does rank highly for its ease-of-use factor, making its Trade platform and client dashboard good for beginners, especially when compared to the complex trading software available from other brokers.

Whether you're trading micro lots, executing high-frequency strategies, or analyzing long-term market trends, OANDA's infrastructure is designed to adapt to your trading style. Note: U.S. clients are restricted to trading forex and cryptocurrencies, as CFDs on stocks and indices are not available domestically.

Pros and Cons

OANDA stands out for its fast execution and strict regulatory compliance, which are major advantages for traders. With an average order execution speed of just 12 milliseconds, it's particularly appealing to day traders and scalpers who rely on quick trade fills. For beginners, the platform's $0 minimum deposit and the option to trade micro lots as small as 0.001 provide a low barrier to entry, making it accessible to those just starting out.

However, there are limitations to consider. U.S. clients are restricted to trading only forex and cryptocurrencies, and the platform does not offer negative balance protection, which means traders could lose more than their initial deposits. Additionally, OANDA's average EUR/USD spread of 1.69 pips is higher than the industry average of 1.11 pips, potentially reducing profitability for those trading this popular pair.

Fees are another factor to weigh. A $10 monthly inactivity fee kicks in after 12 months of no trading activity, and withdrawal fees are relatively steep, which can further eat into profits.

For those using automated strategies, OANDA offers VPS hosting to support algorithmic trading. Elite Trader members even get complimentary VPS access, ensuring their Expert Advisors (EAs) can operate uninterrupted, even during local outages. These technical features enhance the platform's appeal for traders who rely on automation.

On the downside, OANDA lacks community-focused tools like copy trading and social investing features, which may deter traders who value these options. Additionally, customer support is unavailable on weekends, which could be inconvenient for some users. Despite these drawbacks, OANDA's strong regulatory framework, fast execution speeds, and robust VPS support make it a reliable choice for traders who prioritize efficiency and automation.

Conclusion

OANDA continues to stand out in 2026 as a reliable option for traders, thanks to its strong regulatory framework and impressive execution speeds. With a Trust Score of 93/99 and oversight from Tier-1 regulators, it provides the level of security that seasoned traders value. Its quick 12-millisecond execution times and $0 minimum deposit also make it appealing to both newcomers and experienced traders alike.

That said, there are some areas where OANDA falls short. The platform's spreads - such as 1.69 pips for EUR/USD - can eat into profits, particularly for high-frequency traders. Additionally, U.S. clients face certain limitations, including the absence of negative balance protection and a narrower range of tradable assets beyond forex and crypto.

For traders leveraging automated strategies or Expert Advisors on MetaTrader 4, combining OANDA with different VPS hosting options can significantly improve performance. Elite Trader members may even qualify for free VPS access through partners like BeeksFX and Liquidity Connect, ensuring uninterrupted trading and reduced latency. For Singapore Premium account holders, VPS hosting can cut downtime and boost orderbook refresh rates by as much as 75%.

As Steven Hatzakis points out:

OANDA's edge is its strong regulatory track record, with licenses in the strictest major financial centers. It also delivers robust market research content and an excellent mobile app.

OANDA's edge is its strong regulatory track record, with licenses in the strictest major financial centers. It also delivers robust market research content and an excellent mobile app.

FAQs

What makes OANDA a great choice for forex traders?

OANDA is well-regarded for its stringent regulatory compliance, competitive pricing, and robust trading tools. It operates under the supervision of top-tier regulators, including the U.S. CFTC/NFA and the U.K. FCA, which ensures a high level of transparency and investor security. Plus, with no minimum deposit requirement, it’s a practical choice for both new and seasoned traders.

The broker provides consistently low spreads on major currency pairs - like an average of 0.8 pips for EUR/USD - and maintains a clear, upfront fee structure with no hidden charges. OANDA’s trading platforms include the user-friendly OANDA Trade interface, MetaTrader 4 and 5, TradingView integration, and a mobile app. These platforms are equipped with features such as real-time charts, pattern recognition tools, and in-depth market research. Traders also have access to a diverse range of instruments, including forex, commodities, indices, and cryptocurrencies, along with advanced risk management options like guaranteed stop-loss orders. To top it off, their 24/5 U.S.-based customer support ensures reliable assistance whenever needed.

How does OANDA's pricing affect your trading costs?

OANDA provides two pricing models tailored to different trading preferences. The first is a spread-only model, where the trading cost is included in the spread. For major currency pairs, this typically ranges between 1.4 and 3.1 pips.

For high-volume traders, there's the Elite Trader program, which offers cash rebates ranging from $5 to $17 per million traded, effectively reducing overall trading expenses.

These options give traders the flexibility to pick a pricing structure that suits their trading habits, whether they trade occasionally or at a professional level.

What should U.S. clients know before trading with OANDA?

U.S. traders using OANDA should take note of some important regulatory and product-related considerations. OANDA U.S. operates under the oversight of the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). However, it's worth noting that its spot cryptocurrency products fall outside the NFA's regulatory scope. These transactions are facilitated through Paxos Trust Company, with assets held in Paxos accounts. Unlike traditional brokerage accounts, these are not protected by the Securities Investor Protection Corporation (SIPC), introducing additional custodial risks. As a result, crypto trading on OANDA may be better suited for those with a higher tolerance for risk.

For U.S. clients, leverage options are more restrictive compared to many international brokers. In compliance with CFTC regulations, leverage is capped at 50:1 for major currency pairs. On top of that, OANDA imposes several fees that traders should factor in, such as inactivity fees, charges for deposits and withdrawals (including bank wires or multiple debit card transactions), and currency conversion fees. Combined with the potential for losses exceeding the initial investment when trading with leverage, these terms highlight the importance of carefully assessing whether OANDA meets your trading preferences and risk appetite.