How to Understand Liquidity in Trading & Measure Market Flow

Liquidity in trading refers to how easily you can buy or sell an asset without causing significant price changes. High liquidity means smoother transactions with stable prices, while low liquidity can lead to higher costs and unpredictable price swings. Here's what you need to know:

- Why Liquidity Matters: It impacts trading costs, execution speed, and market stability. High liquidity ensures tighter bid-ask spreads and less slippage, while low liquidity can amplify volatility.

- How to Measure Liquidity: Key metrics include bid-ask spreads (narrow spreads indicate high liquidity), trading volume, order flow imbalances, and price impact.

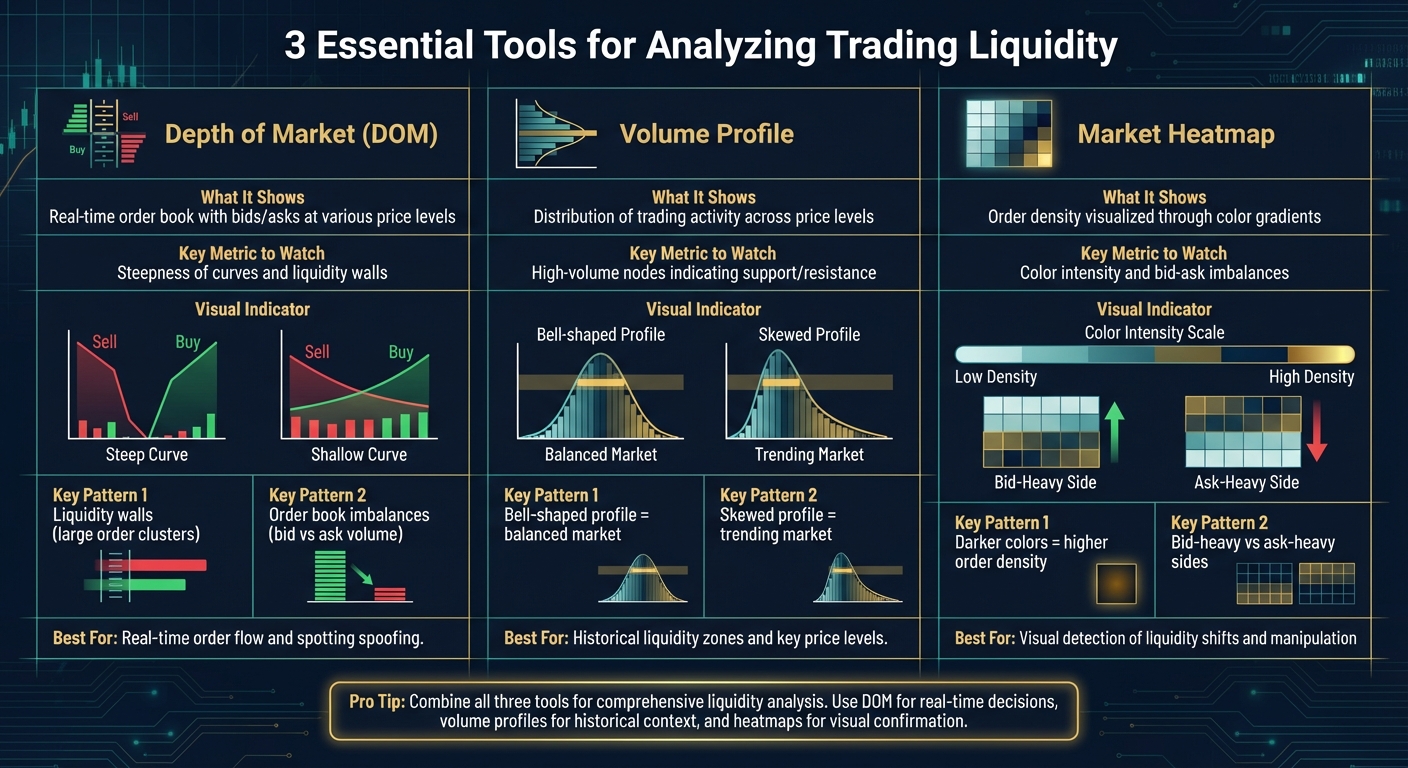

- Tools for Analysis: Use Depth of Market (DOM), volume profiles, and heatmaps to visualize order book data, identify liquidity zones, and spot trading opportunities.

- Trading Liquidity Zones: Liquidity pools often form around psychological price levels or key support/resistance zones. Watch for liquidity sweeps - sharp price moves into these zones followed by reversals.

Understanding liquidity helps you anticipate market behavior, improve trade execution, and identify high-probability setups. Use tools like DOM and heatmaps to locate liquidity zones, and always confirm signals before entering trades.

What is LIQUIDITY in Trading? 💧💰 (Trading Liquidity Grabs & Sweeps)

How Liquidity Affects Market Flow and Trading Performance

Let’s take a closer look at how liquidity directly influences trade execution and overall market behavior.

How Liquidity Impacts Trade Execution

When you place a trade, liquidity determines how closely the execution price matches your expectations. In highly liquid markets, slippage - the gap between your expected price and the actual execution price - is minimal. With numerous buyers and sellers actively participating, trades are executed quickly and at stable prices, making costs more predictable.

Speed is also a key factor. Efficient execution becomes even more vital when using low-latency tools like QuantVPS. These solutions reduce the time (measured in milliseconds) between when you place an order and when it’s executed. On the flip side, in less liquid markets, trades often consume multiple price levels, leading to unpredictable costs and execution delays.

A striking example of this occurred during the volatile week of March 16, 2020. E-mini S&P 500 futures experienced extreme market turbulence. Order book depth plummeted by 90% compared to January 2020, and price dispersion widened significantly at the height of trading activity. This illustrates how reduced liquidity amplifies volatility and makes execution less reliable.

Liquidity and Market Behavior

Liquidity doesn’t just impact individual trades - it also shapes how the market behaves as a whole. In liquid markets, prices adjust quickly to new information and tend to move in smaller, more predictable steps. This is because arbitrage activity speeds up the alignment of prices with their intrinsic values, facilitating efficient price discovery.

For instance, research on NYSE stocks from 1993 to 2002 found that in more liquid, decimal-based pricing systems, prices more closely resembled random walk patterns - a key indicator of market efficiency - compared to periods with larger tick sizes.

"Liquidity stimulates arbitrage activity, which, in turn, enhances market efficiency." - Tarun Chordia, Richard Roll, and Avanidhar Subrahmanyam, Journal of Financial Economics

"Liquidity stimulates arbitrage activity, which, in turn, enhances market efficiency." - Tarun Chordia, Richard Roll, and Avanidhar Subrahmanyam, Journal of Financial Economics

Market makers are essential to maintaining this flow. By constantly providing bid and ask prices, they act as stabilizers, ensuring trades can always find a counterparty. During periods of high trading activity, market makers ramp up quote refresh rates to handle aggressive single-sided orders, which helps tighten spreads and stabilize the market. Without their efforts, even moderately sized trades could cause sharp price swings and leave gaps in the order book.

These dynamics highlight the critical role liquidity plays in shaping market performance and set the foundation for exploring practical methods to measure liquidity and pinpoint liquidity zones.

How to Measure Liquidity and Market Flow

Liquidity isn't just about price movements; it’s about understanding how efficiently you can enter or exit a trade. To get a clear picture of liquidity and market flow, focus on three key metrics that can help you anticipate execution quality.

Bid-Ask Spread

The bid-ask spread is one of the quickest ways to assess liquidity costs. It’s the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). When this gap is narrow - sometimes just a few cents or ticks - it reflects a liquid market with low transaction costs.

"When the spread between the bid and ask prices tightens, the market is more liquid; when it grows, the market instead becomes more illiquid." - Investopedia

"When the spread between the bid and ask prices tightens, the market is more liquid; when it grows, the market instead becomes more illiquid." - Investopedia

Tight spreads often align with high trading volumes, which help reduce transaction costs. However, spreads can fluctuate throughout the day, typically widening at market open and close when liquidity is thinner, and tightening during peak trading hours in the middle of the day.

Beyond spreads, analyzing volume and order flow can provide deeper insights into market dynamics.

Volume and Order Flow Imbalances

Volume represents the level of trading activity, while order flow reveals the balance between aggressive buying and selling. For example, when high volume occurs without much price movement, it might indicate absorption - where large passive orders are counteracting aggressive trades. This can signal key support or resistance levels.

Pay attention to divergences between price and cumulative volume delta (CVD). If CVD hits a new high, but prices don’t follow, it could mean passive sellers are absorbing aggressive buyers, often hinting at a potential reversal. Tools like footprint charts can highlight these imbalances, showing clusters of heavy volume that frequently align with significant support or resistance zones.

Price Impact

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Price impact measures how much a trade shifts the market from its initial price and offers a broader view of liquidity. In highly liquid markets, large trades can be executed with minimal slippage, making price impact a better indicator of genuine liquidity than the order book alone.

For example, during tariff-related volatility in April 2025, a $58.75M trade moved prices by 5.4 basis points. Later, a similar trade caused only 4.5 ticks of dispersion. Compare this to March 2020, when a smaller $33M trade caused a 10 basis point impact, showing how illiquid conditions can amplify slippage.

"A low level of resting volume at the top of the order book does not necessarily indicate a lack of liquidity. A high quote refresh rate can allow incoming buy and sell orders to be filled without a significant price change." - CME Group

"A low level of resting volume at the top of the order book does not necessarily indicate a lack of liquidity. A high quote refresh rate can allow incoming buy and sell orders to be filled without a significant price change." - CME Group

When price impact is minimal and trading volumes are high, it’s a sign of deep liquidity - markets capable of absorbing large trades without significant disruptions.

Tools and Methods for Analyzing Liquidity

Trading Liquidity Analysis Tools Comparison: DOM vs Volume Profile vs Market Heatmap

Trading Liquidity Analysis Tools Comparison: DOM vs Volume Profile vs Market Heatmap

When it comes to understanding liquidity, tools like bid-ask spreads and volume imbalances lay the groundwork. But to dig deeper, advanced methods such as order book analysis, volume profiles, and heatmaps can turn raw data into actionable trading insights.

Reading Order Book Data and DOM

Depth of Market (DOM) tools give you a real-time snapshot of pending buy and sell orders at various price levels. If the bid and ask curves are steep, it signals a dense liquidity zone near the current price. On the other hand, shallow curves may indicate a thin market, where prices can move sharply with minimal trading activity.

"The depth chart serves as a window into market liquidity, showing how much buying and selling pressure exists at different price levels." - Highsoft

"The depth chart serves as a window into market liquidity, showing how much buying and selling pressure exists at different price levels." - Highsoft

Key patterns to watch for include liquidity walls, which are clusters of large orders at certain price points. These often act as temporary support or resistance levels. Another important signal is order book imbalances, where the bid volume significantly outweighs the ask volume - or vice versa. Such imbalances can hint at potential price movements. Platforms like NinjaTrader excel at processing these rapid order flow changes with low latency, making it easier to spot opportunities or detect spoofing - when traders place large orders only to cancel them to mislead others.

Pairing these insights with trading volumes across price levels can provide a fuller picture of market dynamics.

Using Volume Profiles

Volume profiles highlight where trading activity has been concentrated over a specific timeframe. These high-volume areas often correspond to price levels that serve as key support or resistance zones. Unlike basic volume bars that show overall trading activity, volume profiles break it down by price level, offering a clearer view of where liquidity truly exists.

A bell-shaped profile suggests balanced buying and selling, while a skewed profile points to a trending market. By combining volume profiles with DOM data, you can confirm whether high-volume zones align with the current order book depth, strengthening your trade decisions.

While volume profiles focus on historical trading activity, heatmaps provide a more dynamic, visual representation.

Using Market Heatmaps

Market heatmaps use color intensity to show order density, with darker or more vibrant colors representing higher volumes of pending orders. They also offer historical context, showing how liquidity shifts as prices approach specific levels.

To make the most of heatmaps, rely on high-speed data feeds to avoid lag. Pay attention to key metrics like order density (indicated by color intensity), bid-ask spread width, and order flow imbalances to gauge potential price directions. For example, a heavier bid side may indicate upward pressure, while a heavier ask side could signal downward movement. Heatmaps are also effective for spotting market manipulation, such as spoofing, by revealing large orders that appear and vanish before execution.

| Tool | What It Shows | Key Metric to Watch |

|---|---|---|

| DOM | Real-time order book with bids/asks at various price levels | Steepness of curves and liquidity walls |

| Volume Profile | Distribution of trading activity across price levels | High-volume nodes indicating support/resistance |

| Market Heatmap | Order density visualized through color gradients | Color intensity and bid-ask imbalances |

How to Find and Trade Liquidity Zones

Finding Liquidity Pools

Liquidity tends to gather around key price levels, such as psychological numbers, previous highs and lows, and swing points. These zones are magnets for stop-loss orders and breakout trades, often targeted by institutional traders and algorithms.

To locate liquidity pools, start by examining order book data and volume profiles. Look for large clusters of orders, often called "liquidity walls", which indicate concentrated buying or selling interest. Steep curves on market depth charts usually point to strong liquidity, while shallow curves suggest thinner markets that are more vulnerable to sharp price moves. Using heatmap data can also be helpful - it highlights real-time order clusters through variations in color intensity, showing where buyers and sellers are most active. Identifying these zones is the first step in building an effective trading strategy.

Pay particular attention to areas where dense buy orders are met with sparse sell orders. These imbalances often signal the potential for upward price movement.

Trading Liquidity Sweeps

Once you've pinpointed liquidity zones, the next step is to watch how price behaves within these areas to identify trading opportunities.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

A liquidity sweep occurs when the price makes a sharp move into a liquidity-rich zone, triggering clusters of stop-loss orders before reversing direction. These movements often leave behind candlestick patterns like hammers or shooting stars, indicating that a liquidity grab has taken place.

For example, in August 2024, a trader using Bookmap identified a cluster of buy orders at $100 and thin sell orders near $101. The trader entered a position at $100.05 with a stop at $99.90 and exited at $100.95 as sell orders began to intensify, securing a profit.

When trading liquidity sweeps, it’s essential to avoid jumping in immediately as the price hits a liquidity zone. Instead, wait for confirmation, such as a clear rejection pattern or a Change of Character (CHoCH), where the current trend fails to continue - like a bearish trend that doesn’t produce a new lower low.

Consider entry strategies like these:

- Targeting a swing point that was breached during the sweep, once the price returns to that level.

- Using a 50% retracement between the swing point and the extreme of the sweep.

- Entering when the price fills a gap created during the sharp move.

Timing is everything. Using a reliable trading infrastructure, such as QuantVPS, can help ensure quick execution, allowing you to enter trades before the price reverses. Place your stop-loss orders just beyond the extreme high or low of the sweep. If the price revisits this level, it may be time to reassess your reversal strategy.

Conclusion

This guide has provided you with the knowledge to analyze and trade liquidity effectively. At its core, understanding liquidity is about recognizing where real orders are positioned and how prices respond when those zones are tested. By interpreting liquidity accurately, you gain valuable insights into market behavior, giving you an edge in making informed trading decisions. You've explored tools like bid-ask spreads, volume profiles, and order book data to measure market flow, and learned techniques for identifying liquidity pools at key psychological levels, as well as trading liquidity sweeps with proper confirmation signals.

To put these strategies into practice, make it a habit to chart high-volume nodes and order blocks regularly. Keep a close eye on DOM data, heatmaps, and CVD to differentiate genuine liquidity from spoofing activity.

"Liquidity shows where real buy and sell orders are waiting, not just how fast a trade can be executed." - FTMO

"Liquidity shows where real buy and sell orders are waiting, not just how fast a trade can be executed." - FTMO

For tools like heatmaps and volume profiles to perform at their best, stable, high-speed data and low latency are essential. Running these resource-intensive applications on a local machine can introduce delays, which can lead to missed opportunities - especially during liquidity sweeps, where precise timing is critical. A reliable execution infrastructure, such as QuantVPS, can help by offering ultra-low latency (0–1ms) and dependable connectivity. This is particularly important for traders using platforms like NinjaTrader with advanced volume profiles or DOM tools to track order book changes. A VPS positions your trading terminal closer to exchange servers, reducing slippage and improving order execution quality.

With the right tools and infrastructure in place, always prioritize risk management to protect your capital. Stick to a disciplined approach: risk only 1–2% of your account per trade, aim for a 2:1 reward-to-risk ratio, and set daily loss limits between 3–5%. Focus on high-quality setups where multiple liquidity indicators align, wait for confirmation before entering trades, and let your infrastructure handle the execution speed while you stay focused on analyzing market flow.

FAQs

How does market liquidity affect trading costs and order execution?

Liquidity is a major factor in shaping your trading costs and the speed at which your orders are executed. In markets with high liquidity, there’s a larger pool of buyers and sellers at every price level. This leads to tighter bid-ask spreads, which can significantly lower your transaction costs and reduce the risk of price slippage. By minimizing these costs, you get to keep more of your potential profits. On the flip side, markets with low liquidity often have wider spreads, meaning even small trades can push prices, resulting in higher costs and less favorable trade outcomes.

Another advantage of high liquidity is faster order execution. A wealth of matching orders ensures your trades are filled almost instantly at the quoted price. In contrast, low-liquidity markets can cause delays or partial fills, increasing the likelihood of slippage and leaving you vulnerable to less favorable price shifts.

To make the most of your trading, use tools like the order book, volume profiles, or market heatmaps. These can help you spot deep market depth and tight spreads - key indicators of sufficient liquidity for cost-effective and speedy execution.

What are the best tools to identify and analyze liquidity zones in trading?

To get a clear picture of liquidity zones in trading, you can rely on tools designed to reveal market flow and order activity. Some of the most commonly used options include market depth charts, volume profiles, and liquidity indicators. These tools help pinpoint areas where significant buy or sell orders are clustered, giving you valuable insights for smarter trading decisions.

Take Depth of Market (DOM) tools, for example. They provide a real-time view of the order book, displaying current bid and ask levels. Volume profile tools, on the other hand, highlight price levels with the highest trading activity, making it easier to identify where the market is most active. Heatmaps add another layer by visually tracking large orders and showing where liquidity is concentrated. By using these tools together, you can gain a deeper understanding of market behavior and refine your trading approach.

What is a liquidity sweep in trading, and how can I trade it effectively?

A liquidity sweep happens when a large market order eliminates a cluster of pending orders, causing a brief imbalance in the market. This often leads to a rapid price reversal, creating opportunities for traders. To effectively trade a liquidity sweep, you’ll need to spot it using tools like an order book or Depth of Market (DOM). Watch for a sudden drop or spike in market depth on one side and a noticeable increase in executed volume. These movements often occur in thin liquidity zones, where stop-loss orders get triggered, resulting in short-term price swings.

Once you've pinpointed a liquidity sweep, consider positioning yourself on the opposite side of the order flow. For instance, if a sell-side sweep clears out buy-side liquidity, you might enter a long position just above the cleared area. On the flip side, a buy-side sweep could present a shorting opportunity. To refine your strategy, pair this approach with technical analysis, like candlestick patterns or breakout signals, to build confidence in your trade. Always use a tight stop-loss just beyond the swept level to limit potential losses, and adjust your position size based on the remaining market depth. This methodical approach allows you to take advantage of short-term price corrections while safeguarding your capital.

Liquidity is a major factor in shaping your trading costs and the speed at which your orders are executed. In markets with high liquidity, there’s a larger pool of buyers and sellers at every price level. This leads to tighter bid-ask spreads, which can significantly lower your transaction costs and reduce the risk of price slippage. By minimizing these costs, you get to keep more of your potential profits. On the flip side, markets with low liquidity often have wider spreads, meaning even small trades can push prices, resulting in higher costs and less favorable trade outcomes.

Another advantage of high liquidity is faster order execution. A wealth of matching orders ensures your trades are filled almost instantly at the quoted price. In contrast, low-liquidity markets can cause delays or partial fills, increasing the likelihood of slippage and leaving you vulnerable to less favorable price shifts.

To make the most of your trading, use tools like the order book, volume profiles, or market heatmaps. These can help you spot deep market depth and tight spreads - key indicators of sufficient liquidity for cost-effective and speedy execution.

To get a clear picture of liquidity zones in trading, you can rely on tools designed to reveal market flow and order activity. Some of the most commonly used options include market depth charts, volume profiles, and liquidity indicators. These tools help pinpoint areas where significant buy or sell orders are clustered, giving you valuable insights for smarter trading decisions.

Take Depth of Market (DOM) tools, for example. They provide a real-time view of the order book, displaying current bid and ask levels. Volume profile tools, on the other hand, highlight price levels with the highest trading activity, making it easier to identify where the market is most active. Heatmaps add another layer by visually tracking large orders and showing where liquidity is concentrated. By using these tools together, you can gain a deeper understanding of market behavior and refine your trading approach.

A liquidity sweep happens when a large market order eliminates a cluster of pending orders, causing a brief imbalance in the market. This often leads to a rapid price reversal, creating opportunities for traders. To effectively trade a liquidity sweep, you’ll need to spot it using tools like an order book or Depth of Market (DOM). Watch for a sudden drop or spike in market depth on one side and a noticeable increase in executed volume. These movements often occur in thin liquidity zones, where stop-loss orders get triggered, resulting in short-term price swings.

Once you've pinpointed a liquidity sweep, consider positioning yourself on the opposite side of the order flow. For instance, if a sell-side sweep clears out buy-side liquidity, you might enter a long position just above the cleared area. On the flip side, a buy-side sweep could present a shorting opportunity. To refine your strategy, pair this approach with technical analysis, like candlestick patterns or breakout signals, to build confidence in your trade. Always use a tight stop-loss just beyond the swept level to limit potential losses, and adjust your position size based on the remaining market depth. This methodical approach allows you to take advantage of short-term price corrections while safeguarding your capital.

"}}]}