Understanding Quad Witching: How to Trade These Volatile Days

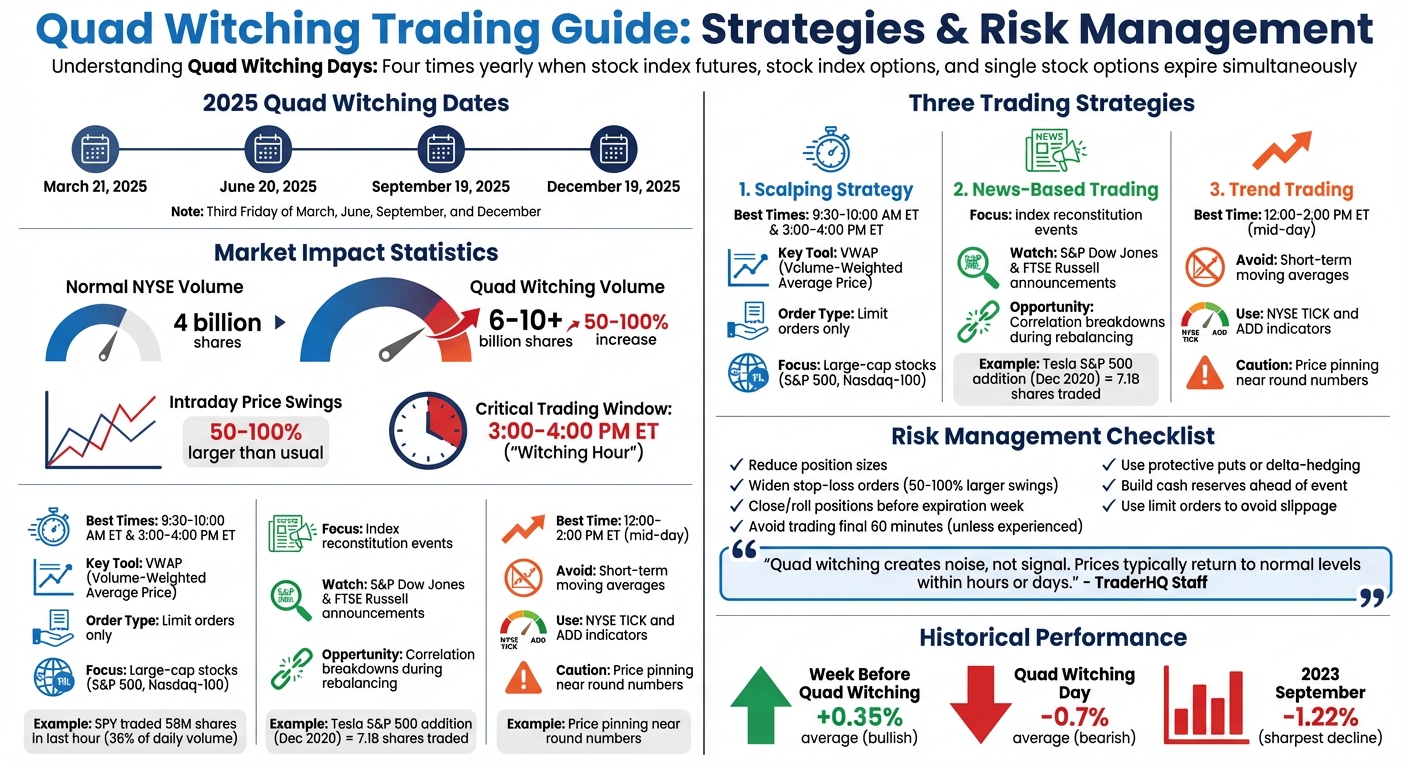

Quad Witching happens four times a year when stock index futures, stock index options, and single stock options expire simultaneously. This creates intense market volatility and trading activity, especially during the last hour of trading (3:00–4:00 PM ET) on the third Friday of March, June, September, and December. Traders see a surge in volume - often 50–100% higher than usual - and sharp price swings driven by institutional investors rebalancing portfolios, rolling over contracts, and hedging.

Key takeaways:

- Volatility drivers: Contract rollovers, rebalancing, hedging adjustments, and price pinning.

- Trading tips: Use VWAP for guidance, reduce position sizes, and avoid trading the final hour unless experienced.

- Risk management: Close or roll positions early, use protective strategies, and prepare for liquidity gaps.

For 2025, Quad Witching dates are March 21, June 20, September 19, and December 19. Proper strategy and preparation can help traders navigate these chaotic sessions effectively.

Quad Witching Trading Strategies and Risk Management Guide

Quad Witching Trading Strategies and Risk Management Guide

Market Volatility on Quad Witching Days

What Causes Quad Witching Volatility

Quad Witching days are known for their intense market activity, driven by contract rollovers, portfolio rebalancing, hedging adjustments, and price pinning. During contract rollovers, traders close expiring contracts and open new ones to maintain their market exposure. This process can push NYSE trading volume from a typical 4 billion shares to anywhere between 6 and 10 billion shares or more.

Quarterly rebalancing by index providers adds to the chaos, as fund managers execute large, high-volume trades to align with updated benchmarks. At the same time, options dealers and market makers adjust their hedging strategies - specifically delta and gamma hedges - when underlying prices approach strike levels. These adjustments significantly increase trading activity.

Another key factor is price pinning, where stock prices tend to gravitate toward heavily traded strike prices as traders reposition themselves. For example, on September 20, 2024, SPY saw a massive trading volume of 162 million shares - twice its usual level - while its price fluctuated by more than 1% within minutes. High-frequency traders also play a role, taking advantage of temporary price gaps between futures, options, and the underlying stocks, further amplifying the trading volume.

On Quad Witching days, intraday price swings can be 50% to 100% larger than usual. A striking example occurred on March 20, 2020, when the pandemic's market turbulence coincided with Quad Witching, resulting in a record-breaking 8.2 billion shares traded. Even the Thursday before Quad Witching sees a noticeable uptick in activity, with trading volumes often 30% to 50% higher as institutional traders begin unwinding their positions.

These factors not only stir up the equities market but also have a significant impact on futures and forex markets, as explored below.

Effects on Futures and Forex Markets

Futures markets see a significant surge in activity as traders roll over expiring contracts into the next quarter. Instruments like the E-mini S&P 500 and Nasdaq-100 experience massive volumes during these transitions. Stock index futures typically expire at the market's opening on Friday (Special Opening Quotation), while equity and index options expire at 4:00 PM ET. This staggered expiration schedule creates waves of volatility throughout the day.

Forex markets, while not directly tied to Quad Witching, feel the ripple effects. As global portfolios adjust, currency hedges linked to equity positions are unwound, causing unusual movements in currency pairs like EUR/USD. Liquidity in forex markets tends to alternate between surges and lulls during these periods. For instance, on September 18, 2020, the S&P 500 dropped 1.5% in its final trading hour due to institutional unwinding of large options positions in the technology sector. Technology and financial stocks, which dominate the derivatives market, often experience the sharpest volatility. On December 20, 2024, the Quad Witching session recorded the highest trading volume for the S&P 500 for the entire year.

How to Trade During Quad Witching

Scalping Strategies

Scalping during Quad Witching requires precision and careful timing. The best opportunities often occur in two key windows: the first 30 minutes after the market opens at 9:30 AM ET - when overnight positions are unwound - and the "witching hour" from 3:00 PM to 4:00 PM ET, when institutional traders finalize their adjustments. For instance, on September 20, 2024, SPY saw a staggering 58 million shares traded in the last hour alone, accounting for about 36% of its total daily volume.

One effective approach is the "Trade the Fade" strategy, which targets extreme price moves likely to reverse by the close or the next session. To execute this, rely on VWAP (Volume-Weighted Average Price) as your main reference point, as traditional indicators like RSI and Stochastics can often give misleading signals during these volatile periods. Always stick to limit orders to avoid significant slippage caused by widened bid-ask spreads.

Focus on large-cap stocks and indices like the S&P 500 and Nasdaq-100, as they offer better liquidity. Small-cap stocks, on the other hand, can experience erratic liquidity gaps. To manage this, consider temporarily widening your stop-loss orders to account for price swings that can be 50% to 100% larger than usual. These methods can prepare you for news-driven trading opportunities during rebalancing events.

News-Based Trading

Trading based on news during Quad Witching can be tricky, as companies typically avoid making major announcements on these days. Instead, the action often lies in institutional rebalancing and index reconstitution events. When major index providers like S&P Dow Jones or FTSE Russell adjust their benchmarks, fund managers execute large order flows, creating trading opportunities.

A notable example occurred in December 2020, when Tesla's addition to the S&P 500 coincided with Quad Witching. This event drove massive trading activity, with 7.1 billion shares exchanged as index funds rebalanced their portfolios. To capitalize on such events, monitor announcements about index changes well in advance, as they often lead to predictable spikes in volume.

"Quad witching creates noise, not signal. Prices typically return to normal levels within hours or days." – TraderHQ Staff

"Quad witching creates noise, not signal. Prices typically return to normal levels within hours or days." – TraderHQ Staff

During these high-volume periods, watch for correlation breakdowns. Assets that usually move independently may temporarily align due to mass institutional rebalancing. When news-driven opportunities fade, mid-day trends can provide alternative signals for trades.

Trend Trading Tactics

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

As volatility surges during Quad Witching, trend trading strategies can help capture sustained moves. The best time to spot reliable trends is mid-day, between 12:00 PM and 2:00 PM ET, when the initial unwinding has settled but the final-hour chaos hasn't yet begun. Look for stocks showing strong momentum compared to the broader market, as these are more likely to maintain their upward or downward trajectories despite the noise caused by derivative-driven moves.

Be cautious of price pinning near round numbers, such as $450, as market makers adjust their hedges near the close. This can result in false breakouts. To determine whether a breakout is genuine or mechanical, it’s often better to wait until the following Monday morning.

"Sometimes the optimal trade is staying out of the market entirely. The ability to preserve capital during chaotic periods often creates superior future opportunities." – TitanFX Research

"Sometimes the optimal trade is staying out of the market entirely. The ability to preserve capital during chaotic periods often creates superior future opportunities." – TitanFX Research

Avoid relying too heavily on short-term moving averages or traditional chart patterns like Fibonacci levels, as these signals can be overridden by the unique price action of Quad Witching. Instead, focus on market internals like the NYSE TICK or ADD, which tend to remain more dependable during high-volume sessions.

Risk Management During Quad Witching

Volatility during Quad Witching can be extreme, so reducing position sizes is critical. Intraday price swings can easily exceed normal risk parameters, turning even modest positions into significant liabilities. For example, on September 18, 2020, the S&P 500 dropped 1.5% in the final hour due to the unwinding of technology sector options positions by institutional traders.

To manage risk, consider closing or rolling derivative positions before expiration week. Avoid trading in the last 60 minutes to limit exposure to pin risk and time decay. Building cash reserves ahead of the event can also provide a buffer and ensure you have capital available for opportunities that arise post-expiration.

If you choose to hold positions during Quad Witching, protective measures like using puts or delta-hedging can help mitigate risk. Keep in mind that trading volume on the NYSE can surge from an average of 4 billion shares to as high as 6 to 10 billion shares or more. This spike can create temporary liquidity gaps, so adjust your stop-loss orders to account for rapid price fluctuations. Strong risk controls are essential for navigating the chaos and seizing the unique opportunities Quad Witching presents.

What Is Quad Witching? Quadruple Witching Days in 2025 Explained

Using QuantVPS for Quad Witching Trading

To make the most of the volatile trading opportunities during Quad Witching, having a reliable and fast connection is just as important as solid risk management.

Why Ultra-Low Latency VPS Matters

On Quad Witching days, trading volume on the NYSE can jump from an average of 4 billion shares to as much as 6–10+ billion. In such a fast-moving market, every millisecond can be the difference between a successful trade and a missed opportunity. QuantVPS offers ultra-low latency infrastructure with response times as fast as 0–1ms, ensuring your orders are executed before market conditions shift. This speed is especially critical during the "witching hour" (3:00 PM–4:00 PM ET), when institutional traders make their final adjustments, and bid-ask spreads widen dramatically. Whether you're scalping or employing more complex strategies, this kind of responsiveness is a game-changer for navigating volatile periods.

"High-frequency traders typically increase their activity during these periods, capitalizing on higher volatility and trading volumes." – Lime Trading Corp

"High-frequency traders typically increase their activity during these periods, capitalizing on higher volatility and trading volumes." – Lime Trading Corp

QuantVPS also guarantees 100% uptime, eliminating the risk of being disconnected due to local internet issues or hardware failures during highly volatile trading sessions. With intraday price swings often reaching 50–100% above normal levels, uninterrupted connectivity is essential to secure timely entries and exits. The platform also includes DDoS protection and automatic backups, adding an extra layer of reliability when over $4.5 trillion in derivative contracts are expiring simultaneously.

For traders using latency-sensitive strategies like arbitrage or high-frequency trading, QuantVPS's NVMe storage and high-performance CPUs ensure smooth, lag-free performance. This allows you to capitalize on fleeting price discrepancies between futures, options, and underlying stocks before the market corrects.

Choosing the Right QuantVPS Plan for Quad Witching

Your choice of VPS plan should align with the number of charts you monitor and the intensity of your trading activity during high-volume periods. For most traders, the Standard Plans provide excellent performance. However, if you're running more advanced strategies or need to track multiple positions, the Performance Plans (+) offer the extra power you’ll need.

Here’s a breakdown of the available plans:

| Plan | Monthly Cost | Annual Cost | Cores | RAM | Storage | Charts | Monitors | Best For |

|---|---|---|---|---|---|---|---|---|

| VPS Lite | $59.99 | $41.99/mo | 4 | 8GB | 70GB NVMe | 1–2 | None | Scalpers |

| VPS Pro | $99.99 | $69.99/mo | 6 | 16GB | 150GB NVMe | 3–5 | Up to 2 | Trend traders |

| VPS Ultra | $189.99 | $132.99/mo | 24 | 64GB | 500GB NVMe | 5–7 | Up to 4 | Portfolio managers |

| VPS Lite+ | $79.99 | $55.99/mo | 4 | 8GB | 70GB NVMe | 1–2 | None | Low-latency scalpers |

| VPS Pro+ | $129.99 | $90.99/mo | 6 | 16GB | 150GB NVMe | 3–5 | Up to 2 | News-based traders |

| VPS Ultra+ | $199.99 | $139.99/mo | 24 | 64GB | 500GB NVMe | 5–7 | Up to 4 | Professional arbitrage |

For traders with even greater demands - such as monitoring more than seven charts or running complex automated systems - the Dedicated Server ($299.99/month or $209.99/month billed annually) or Dedicated+ Server ($399.99/month or $279.99/month billed annually) offers unmatched performance. These servers come with 16+ dedicated cores, 128GB of RAM, and are designed to handle extreme volume spikes without any slowdown. All plans include 1Gbps+ network connectivity, unmetered bandwidth, and compatibility with platforms like NinjaTrader, MetaTrader, and TradeStation, running on Windows Server 2022.

Setting Up Your Trading System for Quad Witching

Optimizing Your Trading Environment

Quad Witching days bring a surge in market activity, and your trading system needs to be ready for the chaos. With NYSE volume potentially jumping from 4 billion to as much as 6–10 billion shares, it’s crucial to prepare for these extreme conditions. Use limit orders exclusively to maintain control over your trades, and adjust your stop-loss orders to account for intraday swings that can be 50–100% larger than usual. To further manage the heightened noise-to-signal ratio, consider reducing your position sizes.

When it comes to technical analysis, Volume-Weighted Average Price (VWAP) should be your go-to tool. Unlike best indicators for day trading like moving averages or RSI, which can lag or generate misleading signals during periods of heavy volume, VWAP tends to remain dependable. Additionally, keep an eye on market internals such as NYSE TICK and ADD to gain insights into institutional trading activity.

If you’re holding options or futures, it’s wise to close or roll them over before the final session to avoid risks like pin risk or automatic assignments. Many seasoned traders choose to handle this by Thursday afternoon, as trading volumes for these instruments peak around that time. For less experienced day traders, sitting out the final hour (3:00 PM–4:00 PM ET) might be a smart move, as price action during this "witching hour" is often dominated by mechanical rebalancing rather than meaningful market shifts.

Once your trading setup is optimized, the next step is to rigorously test and monitor your strategy to ensure it holds up under Quad Witching conditions.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Testing and Monitoring Your Strategy

Fine-tuning your trading setup is only part of the equation; you also need to validate its performance. Backtesting and live simulations are essential to ensure your strategy can handle the unique challenges of Quad Witching. Use historical data from prior events to test your system. For reference, the 2025 Quad Witching dates are March 21, June 20, September 19, and December 19. Historical patterns suggest that the week leading up to Quad Witching often sees bullish momentum, while the actual Friday - particularly the final hour - tends to be bearish. For instance, in 2023, the S&P 500 dropped an average of 0.7% on Quad Witching days, with September experiencing a sharper decline of 1.22%.

"The quadruple witching hour is bearish." – Oddmund Groette, Founder, Quantified Strategies

"The quadruple witching hour is bearish." – Oddmund Groette, Founder, Quantified Strategies

Simulate your strategy under conditions that mimic the opening 30 minutes (9:30–10:00 AM ET) and the final hour (3:00–4:00 PM ET), as these periods often feature wider spreads and increased slippage. Additionally, tracking metrics like open interest and "Max Pain" levels - the strike price where the largest number of options expire worthless - can provide valuable clues about price movements near the close. Testing and monitoring your strategy thoroughly will help you navigate the heightened volatility of Quad Witching with confidence.

Conclusion

Quad Witching days in 2025 - falling on March 21, June 20, September 19, and December 19 - are known for their intense and predictable volatility. During these quarterly events, trading volume typically jumps from 4 billion to anywhere between 6 and 10 billion shares, with intraday price swings increasing by 50–100% compared to normal days. It's crucial to recognize that this volatility is driven by mechanical rebalancing rather than any major fundamental market changes.

To manage the heightened risks of these days, focus on the strategies discussed earlier: using strict order controls, adjusting position sizes carefully, and leveraging tools like VWAP and Max Pain levels to guide your decisions. These tactics help you stay disciplined and make more informed moves during these turbulent trading sessions. Pay special attention to the final hour of trading, from 3:00 PM to 4:00 PM ET, when institutional rebalancing tends to cause the most dramatic price movements.

"The volatility is mechanical, not fundamental. Prices typically normalize quickly." – TraderHQ Staff

"The volatility is mechanical, not fundamental. Prices typically normalize quickly." – TraderHQ Staff

For traders aiming to seize opportunities during Quad Witching, having the right tools is critical. A low-latency VPS from QuantVPS can make all the difference, ensuring fast execution and reducing the risk of slippage during these high-stakes periods. Advanced trading infrastructure becomes a key asset for implementing these strategies effectively.

Historical data offers additional insights: backtests show a slight bullish trend leading up to Quad Witching days (average +0.35%) but a bearish performance on the day itself (average -0.7% in 2023). With well-tested trading strategies, reliable tools, and a disciplined approach, traders can confidently navigate the challenges of Quad Witching days and turn the volatility into an opportunity.

FAQs

What are the best ways to manage risk during Quad Witching days?

Managing risk during Quad Witching takes a steady hand and a clear plan to deal with the heightened market volatility. A good starting point is to establish firm risk limits: avoid putting more than 3% of your total capital into a single trade, and keep your overall exposure below 5%. These boundaries can shield your portfolio from sudden, unpredictable price swings.

Hedging is another smart move. Using protective options, like puts, can help cap potential losses while leaving room for gains. If you’re holding expiring futures contracts, consider closing or rolling them early to steer clear of last-minute price turbulence. Prioritize highly liquid contracts to minimize slippage and ensure smoother execution.

Tight stop-loss orders are essential, especially when intraday volatility spikes. On these high-activity days, it’s often wiser to focus on managing your current positions rather than chasing new opportunities. By sticking to these strategies, you can approach Quad Witching with more confidence and better control over potential risks.

What is Quad Witching, and how does it affect the futures and forex markets?

Quad Witching happens when four types of financial contracts expire at the same time: stock index futures, stock index options, single stock options, and single stock futures. It takes place four times a year, usually on the third Friday of March, June, September, and December.

On these days, the futures market sees a surge in trading volume and price swings. This is because traders are busy closing out or rolling over their positions, creating a flurry of activity. Stock index futures tend to feel the biggest impact during this period. However, the forex market remains largely unaffected by Quad Witching since the event is focused on equity-related derivatives.

Why is a low-latency VPS essential for trading during Quad Witching days?

A low-latency VPS is crucial during Quad Witching days, as these periods see a surge in market activity and rapid price shifts due to the simultaneous expiration of four major derivatives. In such a fast-moving environment, even the smallest delay in executing trades can result in slippage or missed chances.

With reduced execution delays, a low-latency VPS enables traders to respond swiftly, lock in better entry and exit points, and manage risks more effectively. This speed is key to staying competitive and capitalizing on the unique opportunities these high-volatility trading days bring.

Managing risk during Quad Witching takes a steady hand and a clear plan to deal with the heightened market volatility. A good starting point is to establish firm risk limits: avoid putting more than 3% of your total capital into a single trade, and keep your overall exposure below 5%. These boundaries can shield your portfolio from sudden, unpredictable price swings.

Hedging is another smart move. Using protective options, like puts, can help cap potential losses while leaving room for gains. If you’re holding expiring futures contracts, consider closing or rolling them early to steer clear of last-minute price turbulence. Prioritize highly liquid contracts to minimize slippage and ensure smoother execution.

Tight stop-loss orders are essential, especially when intraday volatility spikes. On these high-activity days, it’s often wiser to focus on managing your current positions rather than chasing new opportunities. By sticking to these strategies, you can approach Quad Witching with more confidence and better control over potential risks.

Quad Witching happens when four types of financial contracts expire at the same time: stock index futures, stock index options, single stock options, and single stock futures. It takes place four times a year, usually on the third Friday of March, June, September, and December.

On these days, the futures market sees a surge in trading volume and price swings. This is because traders are busy closing out or rolling over their positions, creating a flurry of activity. Stock index futures tend to feel the biggest impact during this period. However, the forex market remains largely unaffected by Quad Witching since the event is focused on equity-related derivatives.

A low-latency VPS is crucial during Quad Witching days, as these periods see a surge in market activity and rapid price shifts due to the simultaneous expiration of four major derivatives. In such a fast-moving environment, even the smallest delay in executing trades can result in slippage or missed chances.

With reduced execution delays, a low-latency VPS enables traders to respond swiftly, lock in better entry and exit points, and manage risks more effectively. This speed is key to staying competitive and capitalizing on the unique opportunities these high-volatility trading days bring.

"}}]}