Day trading is a fast-paced strategy where traders buy and sell financial instruments within the same day to capitalize on short-term market movements. Success in this field requires proper education, technical skills, and a reliable trading setup. This guide highlights seven expert-recommended online courses for day trading in 2026, focusing on their curriculum, mentorship, tools, and pricing.

Key Takeaways:

- Bear Bull Traders: Great for beginners and advanced traders, with a focus on trading psychology. Pricing starts at $99/month.

- Warrior Trading: Offers live trading experiences and tiered courses. Pricing ranges from $797 to $3,997.

- Bullish Bears: Affordable option with trade rooms and swing trading focus. Membership starts at $47/month.

- Humbled Trader: Known for mentorship and realistic strategies. Lifetime access costs $1,999.

- Investors Underground: Offers extensive video lessons and active trading communities. Pricing starts at $297/month.

- Machine Learning for Trading by Google Cloud: Teaches algorithmic trading using AI tools like TensorFlow. Available via Coursera subscription.

- Trading Algorithms by Indian School of Business: Combines financial theory with practical algorithmic trading. Offered on Coursera.

Each course caters to different skill levels and trading goals, so choosing the right one depends on your experience, budget, and preferred learning style.

Quick Comparison

| Course | Skill Level | Mentorship/Community | Technology Focus | Pricing | Best For |

|---|---|---|---|---|---|

| Bear Bull Traders | Beginner to Advanced | Live chatrooms, coaching | DAS Trader Pro, advanced tools | $99/month+ | Trading psychology, structured paths |

| Warrior Trading | Beginner to Intermediate | Live streams, trading rooms | DayTradeDash, simulators | $797–$3,997 | Hands-on learning, live trading |

| Bullish Bears | Beginner to Intermediate | Trade rooms, Discord | Swing trading tools, stock screeners | $47/month+ | Budget-friendly education |

| Humbled Trader | Beginner to Advanced | Weekly webinars, group chats | Watchlists, trading resources | $990/year or $1,999 | Mentorship, realistic strategies |

| Investors Underground | Intermediate to Advanced | Active chatrooms, live trading | Pre-market tools, video lessons | $297/month+ | Community-based learning |

| Google Cloud Course | Advanced | Online forums | TensorFlow, Keras, AI tools | Coursera subscription | Algorithmic trading, AI integration |

| Indian School of Business | Intermediate | Academic support | Algorithmic trading concepts | Coursera subscription | Academic approach to trading |

Choosing the right course and setting up a reliable trading system, like using VPS hosting for low-latency execution, can help you succeed in this competitive field.

How to Choose a Day Trading Course

Picking the right day trading course can make a big difference in your trading journey. With so many options out there, it’s essential to know what to focus on so you can make the most of your investment.

Start by checking the instructor’s credentials. Look for instructors with real-world trading experience and a solid, verifiable track record. This ensures you’re learning from someone who knows the market inside and out and can teach strategies that actually work.

Next, consider the depth of the course content. A good course should go beyond the basics and cover key topics like technical and fundamental analysis, risk management, and trading psychology. It should also guide you step-by-step, from beginner concepts to advanced strategies.

Access to mentorship and a supportive community can make a huge difference in how quickly you learn. Courses that offer direct interaction with the instructor and active student communities can provide real-time advice and encouragement.

Look for programs that include practical tools and resources. Hands-on tools like trading simulators, real-time scanners, and templates can help you apply what you’ve learned and build confidence before trading with real money.

As trading relies more and more on technology, check that the course covers technology infrastructure. Topics like hardware requirements, internet standards, and VPS solutions can help you minimize delays and downtime – something we’ll explore further in the section on trading technology.

The pricing structure should reflect the course’s value. While cheap courses might seem tempting, they often lack depth. Look for programs that offer flexible payment plans or money-back guarantees to ensure you’re getting your money’s worth.

Don’t overlook student success stories, but take them with a grain of salt. Look for detailed accounts that show how students overcame challenges, rather than vague claims of success.

Finally, think about course format flexibility. Whether you prefer live sessions with replays or self-paced learning, choose a course that fits your schedule and learning style.

It’s also important to ensure the course offers ongoing updates and support. Markets change constantly, so the best courses regularly update their content to keep you informed and prepared for new challenges.

Day Trading Technology Requirements

Getting your technology setup right is a must for executing day trading strategies effectively. Modern trading relies on specialized platforms and tools that ensure smooth execution and accurate analysis.

First and foremost, a stable and reliable internet connection is critical. Without it, even the best strategies can falter. Your trading system also needs to be compatible with popular platforms like NinjaTrader, MetaTrader, and TradeStation. These platforms form the core of your setup and allow you to integrate more advanced tools as you progress.

For serious day traders, VPS (Virtual Private Server) hosting becomes a game-changer. Offloading resource-heavy tasks to a high-performance VPS ensures your trading system remains fast and dependable. For example, QuantVPS offers a premium solution tailored for traders, boasting 0–1 millisecond latency and a 100% uptime guarantee. This ensures your platform stays operational, even if your local setup encounters issues.

QuantVPS provides plans designed to fit different trading needs:

- VPS Pro Plan ($99.99/month): Ideal for intermediate traders, this plan supports 3–5 charts, 6 cores, 16GB RAM, and up to 2 monitors – perfect for managing mid-level strategies.

- VPS Ultra Plan ($189.99/month): Built for advanced traders, this plan handles 5–7 charts with 24 cores and 64GB RAM, making it a solid choice for algorithmic and technical trading.

Platform-specific optimizations further enhance performance. For instance, NinjaTrader users benefit from an optimized Windows Server 2022 setup, while MetaTrader users gain access to automatic backups for expert advisors and custom indicators. Plus, you can securely access your trading system from anywhere.

Security is another critical aspect. QuantVPS includes DDoS protection and system monitoring to guard against potential attacks. For traders with demanding workloads, the dedicated server option offers impressive specs, such as 128GB RAM and over 2TB of NVMe storage. This setup is perfect for handling heavy applications and running multiple strategies simultaneously. Multi-monitor support also allows you to keep charts, news feeds, order entry systems, and course materials open without constant window-switching.

Whether you’re just starting or diving into advanced algorithmic trading, your technology setup should align with your goals and strategy complexity. Beginners can start with a simpler setup, while advanced traders will benefit from robust VPS solutions to execute their plans reliably.

1. Bear Bull Traders

Bear Bull Traders has carved a niche as a day trading education platform that blends technical training with a strong focus on trading psychology. Recognized by major financial publications, it’s a go-to resource for those serious about mastering day trading.

Instructor Expertise and Reputation

The platform is led by Andrew Aziz, a seasoned trader with years of hands-on experience. His expertise, combined with the program’s structure, has earned Bear Bull Traders accolades from outlets like Investopedia and Business Insider. Both have named it the "Best Overall" day trading course, with Investopedia specifically praising it as "Best for Learning While Trading." This recognition stems from its comprehensive educational content and robust support network.

A key feature of the program is its emphasis on trading psychology. The platform provides access to psychologists who help traders navigate the mental challenges of the market, making it a standout for those seeking to improve both their technical and emotional approach to trading.

Depth and Clarity of Curriculum

The curriculum is thoughtfully structured, offering a clear pathway from basic market concepts to advanced trading strategies. It includes on-demand lessons and live sessions, ensuring flexibility and depth. For those seeking even more, higher-tier memberships feature weekly webinars that focus on advanced techniques and market psychology, providing insights that go beyond the basics.

Access to Mentorship and Trading Communities

One of Bear Bull Traders’ strongest assets is its vibrant community and mentorship opportunities. All membership tiers grant access to a stock chatroom, where traders can engage in real-time discussions about market trends. Elite Monthly members gain additional benefits like weekly mentorship sessions, while Elite Annual members can take it a step further with one-on-one coaching sessions. These sessions, led by psychologists, explore key aspects like trading discipline, motivations, and personal strengths and weaknesses.

"Bear Bull Traders is best for day traders because it offers personalized coaching, weekly mentorships, high-quality on-demand content, as well as access to essential tools pertinent to training for the complex nature of day trading." – Investopedia

"Bear Bull Traders is best for day traders because it offers personalized coaching, weekly mentorships, high-quality on-demand content, as well as access to essential tools pertinent to training for the complex nature of day trading." – Investopedia

"Bear Bull Traders’ standout feature is that it provides you with experts in the psychology of day trading. With an Elite annual membership, you can access one-on-one coaching sessions with psychologists to discuss your motivations for day trading, discipline, strengths, and weaknesses." – Business Insider

"Bear Bull Traders’ standout feature is that it provides you with experts in the psychology of day trading. With an Elite annual membership, you can access one-on-one coaching sessions with psychologists to discuss your motivations for day trading, discipline, strengths, and weaknesses." – Business Insider

Pricing Options

The platform offers flexible pricing to suit different needs. There’s a 7-day trial available for just $1, followed by Basic memberships at $99 per month. Elite memberships are priced at $199 per month, while an Elite Annual membership costs $2,388 per year. For those looking for lifetime access, a one-time payment of $4,000 secures it.

2. Warrior Trading

Warrior Trading is an educational platform for day traders that blends structured coursework with live trading experiences. Founded by Ross Cameron in 2012 and based in Great Barrington, Massachusetts, the platform focuses on hands-on learning, going beyond theoretical ideas to offer practical trading insights.

Instructor Expertise and Reputation

Ross Cameron, the founder and lead instructor, brings a wealth of experience to the table. As the author of the e-book How to Day Trade, he provides students with clear and actionable lessons. His teaching style is rooted in real-world trading, with live-streaming sessions where students can watch professional traders make decisions and execute trades in real time.

The platform emphasizes a learn-by-doing approach. By observing live trading, students gain insights into decision-making, risk management, and the application of trading strategies as they unfold in the market.

Curriculum Structure and Content

Warrior Trading’s curriculum is designed to cater to traders at varying levels of expertise, from beginners to advanced traders. It offers tiered courses that cover everything from basic market principles to advanced trading techniques, with the depth of content increasing across membership levels.

- Warrior Starter Course: For $797, this course provides 18 hours of foundational material, with three years of access to essential day trading concepts.

- Warrior Plus: Includes over 100 hours of content, offering a more in-depth learning experience.

- Warrior Pro: At $2,997, this package delivers over 200 hours of educational material, covering advanced strategies and tools.

- Warrior Pro Special: Priced at $3,997, this is the most extensive option. It includes everything in the Pro package, plus one year of live stream and chat access, and 90-day access to tools like Day Trade Dash and the Real-Time Data Simulator.

The platform’s curriculum uses various formats, such as pre-recorded video lessons, live presentations, interactive course materials, and written guides. While the content is comprehensive, the depth of some strategies might feel overwhelming for beginners. However, the variety of learning formats helps students absorb the material at their own pace.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Mentorship and Community Support

Beyond its courses, Warrior Trading fosters a supportive learning environment through mentorship and active trading communities. Members can join specialized trading rooms, such as the Small Cap Trading Room, Warrior Lounge, and Mentor Room, with access depending on their membership tier.

The mentorship program allows traders to receive personalized feedback on their trades and strategies. This guidance bridges the gap between learning concepts and applying them effectively. Additionally, the community aspect enables traders to share experiences, learn from each other, and grow in a collaborative space.

"Warrior Trading also offers live-streaming videos where students can watch professional traders in action." – Investopedia

"Warrior Trading also offers live-streaming videos where students can watch professional traders in action." – Investopedia

For those seeking additional tools, the platform offers optional add-ons. The Day Trade Dash tool, featuring scanners, charts, and market news, is available for $197 per month. The Real-Time Data Simulator, priced at $97 per month, provides a safe environment for practicing strategies without risking real money.

The combination of mentorship, community engagement, and access to advanced tools creates a well-rounded support system for aspiring traders.

3. Bullish Bears

Bullish Bears stands out as a platform dedicated to offering practical and affordable day trading education. Founded in 2016 by trader Lucien Bechard, it has gained recognition from top industry publications for its value to both day and swing traders. The platform’s affordability is rooted in Bechard’s hands-on trading experience, making it a trusted resource for aspiring traders.

Instructor Expertise and Reputation

Lucien Bechard’s real-world trading expertise is the foundation of Bullish Bears’ credibility. His mission to make trading education accessible at a reasonable price has earned the platform a strong reputation. Business Insider named Bullish Bears the "Best Budget Course" for day trading, while Investopedia praised it as the "Best Value" and "Best for Swing Traders." These accolades highlight the platform’s commitment to quality education without breaking the bank.

Curriculum: Depth and Accessibility

The curriculum at Bullish Bears focuses on both day and swing trading strategies, offering a balance of depth and affordability. This makes it an appealing choice for beginners who want to learn effective trading techniques without a hefty financial commitment. The courses emphasize swing trading, catering to those who prefer holding positions for several days or weeks, rather than engaging in fast-paced intraday trading.

Community and Mentorship Opportunities

Bullish Bears doesn’t just provide courses – it creates a supportive trading community. Members gain access to trade rooms featuring mentorship, live streams, and active chats. These resources are ideal for both swing and options traders. The platform also includes a dedicated Discord channel, fostering interaction and collaboration among members.

"Bullish Bears, founded by trader Lucien Bechard, is a very reasonably priced day trading class. Along with the day trading courses, you can access trade alerts, trade rooms with mentorship, live streams, and a chat room if you choose a monthly membership."

– Business Insider

"Bullish Bears, founded by trader Lucien Bechard, is a very reasonably priced day trading class. Along with the day trading courses, you can access trade alerts, trade rooms with mentorship, live streams, and a chat room if you choose a monthly membership."

– Business Insider

Membership options are flexible: $47 per month, $497 annually (with access to live stream replays), or a one-time payment of $697 for lifetime access.

"We chose Bullish Bears because it offers the best value among day trading courses. In addition to monthly and annual memberships, it offers a one-time payment for lifetime access to its courses and trading tools, making it one of the most cost-effective educational offerings for aspiring day traders."

– Investopedia

"We chose Bullish Bears because it offers the best value among day trading courses. In addition to monthly and annual memberships, it offers a one-time payment for lifetime access to its courses and trading tools, making it one of the most cost-effective educational offerings for aspiring day traders."

– Investopedia

4. Humbled Trader

Humbled Trader Academy has made a name for itself as a go-to platform for day trading education, especially for those looking for mentorship and realistic advice. In 2025, Business Insider named it the "Best for Mentorship" among day trading courses, while TradersDNA included it in their list of the top 15 day trading courses of the year.

Instructor Expertise and Reputation

The academy is led by Shay, widely known as "Humbled Trader", who has built a loyal following through her YouTube channel, boasting 1.3 million subscribers. Her teaching style stands out for its no-nonsense, hype-free approach.

Shay emphasizes transparency by sharing both her wins and losses during live trading recaps, giving students a well-rounded perspective on the realities of trading. Her honest acknowledgment of the risks and challenges involved in day trading adds credibility to her lessons, making them relatable and grounded.

Her unique teaching style combines humor with practical advice, breaking down complex trading concepts while stressing the importance of discipline and risk management. This approach has earned her the trust of learners who appreciate her straightforward and approachable demeanor.

Depth and Clarity of Curriculum

Humbled Trader Academy offers over 12 hours of video lessons spread across 17 comprehensive units. The curriculum covers essential topics like realistic trading strategies, market psychology, and effective risk management. Designed to cater to both beginners and intermediate traders, the course pairs these lessons with ongoing mentorship and access to a supportive community.

"Led by a relatable, no-hype instructor, this academy focuses on realistic strategies, market psychology, and risk control. It’s ideal for those who want honest guidance without overpromises."

- TradersDNA

"Led by a relatable, no-hype instructor, this academy focuses on realistic strategies, market psychology, and risk control. It’s ideal for those who want honest guidance without overpromises."

- TradersDNA

Pricing for the program includes two main options: a one-time fee of $1,999 for lifetime access or an annual membership priced at $990 per year, which breaks down to roughly $99 per month.

Access to Mentorship or Trading Communities

One of the academy’s standout features is its mentorship program. The Pro membership level provides access to tools like trading watch lists, separate chatrooms for day trading and swing trading, and weekly live mentorship webinars. While one-on-one mentor meetings are offered, they are currently at capacity due to demand, making the annual membership the best starting point for new students.

The platform also fosters a strong sense of community, enabling traders to interact with peers and learn from experienced mentors. This combination of hands-on mentorship and a well-structured curriculum bridges the gap between theory and real-world trading, helping students apply what they learn in live market conditions. It’s an approach that continues to highlight the value of expert-led, practical education in the world of day trading.

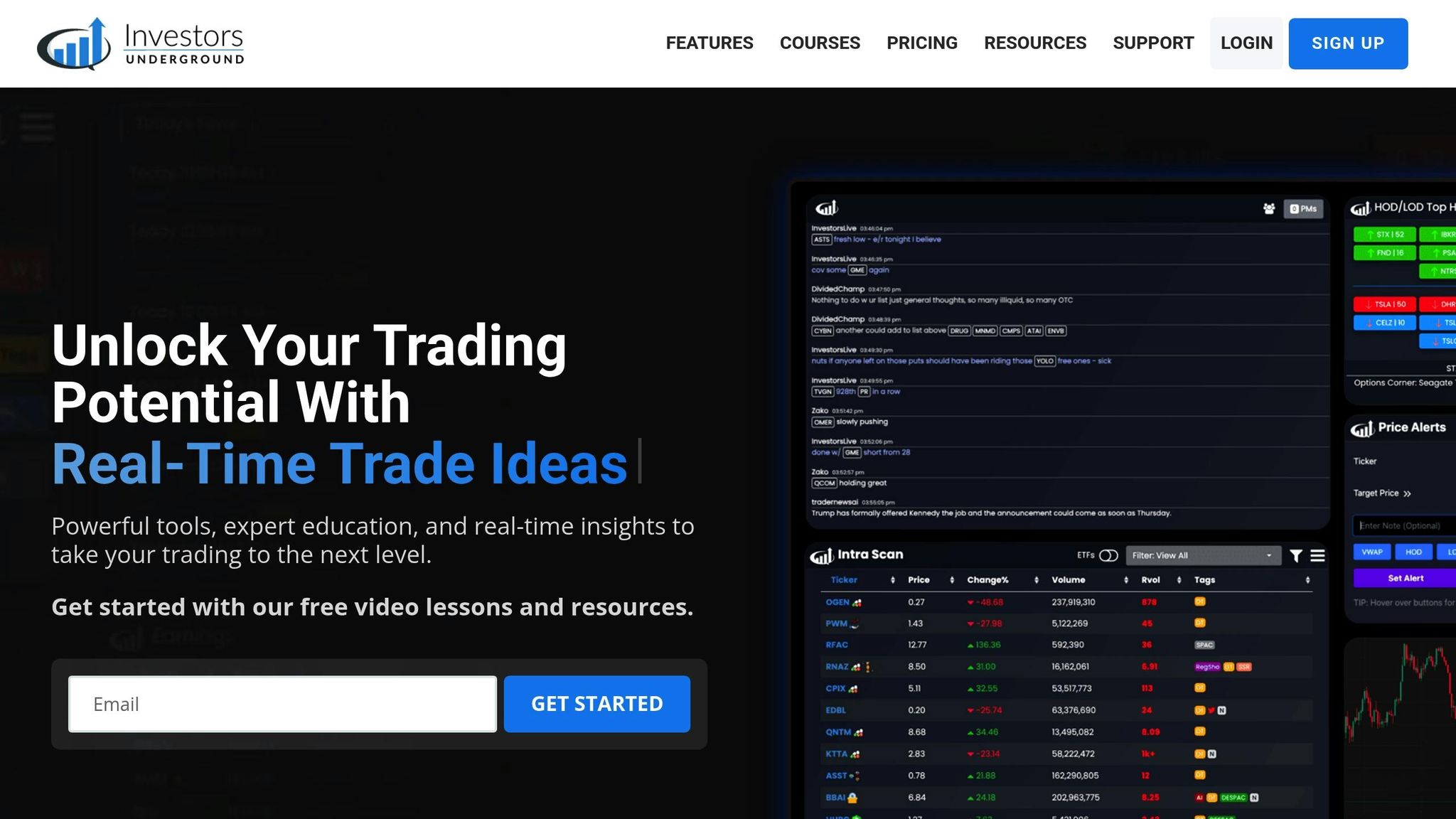

5. Investors Underground

Investors Underground, spotlighted by Business Insider and TradersDNA in 2025, stands out for its combination of a solid curriculum and vibrant trader interactions. The platform thrives on blending detailed lessons with real-time market discussions, creating a dynamic learning environment rooted in practical experience.

Instructor Expertise and Reputation

Founded by trader Nathan Michaud in 2008, Investors Underground boasts a team of expert instructors who actively engage with members. These professionals bring hands-on trading experience to the table, offering insights that extend well beyond textbook theories.

What makes these instructors particularly effective is their accessibility. They’re not just teaching – they’re in the trenches with members, moderating chatrooms and answering questions directly. This approach ensures that learners receive immediate feedback and guidance from seasoned traders who understand the fast-paced nature of the markets.

Depth and Clarity of Curriculum

The educational offerings at Investors Underground are extensive, featuring over 1,000 video lessons and more than 26 hours of in-depth material. The curriculum is thoughtfully designed with specialized courses tailored to different trading styles, including Textbook Trading, Swing Trading, and Tandem Trading.

These lessons aren’t just theoretical – they incorporate real-world trading examples, making complex ideas easier to grasp and apply.

Access to Mentorship or Trading Communities

One of the platform’s standout features is its active and well-structured community. Members can access a main trading chatroom, along with dedicated spaces for swing trading and penny stocks. This setup allows traders to dive into areas of personal interest while staying connected to broader market conversations.

The community is actively moderated by experienced day traders. Members benefit from resources like pre-market broadcasts, live trading floor access, trade caps, nightly watchlists, and morning calls. This interactive environment not only facilitates real-time learning but also fosters collaboration and networking among traders.

For those interested in joining, Investors Underground offers flexible pricing options. Monthly memberships start at $297 (without courses) and go up to $1,297 (with courses). Quarterly plans are available for $697 (without courses) or $1,697 (with courses). The annual membership provides the most savings, priced at $1,897 per year (without courses) or $2,697 per year (with courses).

6. Machine Learning for Trading by Google Cloud

Google Cloud’s Machine Learning for Trading course offers a fresh perspective on day trading. Instead of relying on manual chart analysis or subjective decision-making, this intermediate-level program teaches participants how to design algorithmic systems powered by artificial intelligence. It’s a modern solution tailored to meet the rising demand for automation in trading.

Instructor Expertise and Reputation

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

This course is crafted by Google Cloud’s team of engineers and data scientists, combining their knowledge in machine learning and cloud computing. With over 1,200 reviews and an average rating of 3.8 out of 5 stars, it has gained recognition among traders looking to incorporate advanced technology into their strategies.

Depth and Clarity of Curriculum

The curriculum dives into a variety of technical skills, merging machine learning techniques with real-world trading applications. Students work with tools like TensorFlow and Keras to build neural networks while exploring concepts such as reinforcement learning, supervised learning, and time series analysis. The program also focuses on constructing data pipelines and applying statistical methods to develop algorithmic trading strategies, including portfolio management and predictive modeling. Designed to be completed in 1–3 months, the course includes hands-on projects that use real financial data.

Technology and Platform Guidance

Beyond technical training, the course emphasizes building a robust infrastructure for automated trading on Google Cloud. Participants learn how to deploy and scale machine learning models, creating systems capable of handling the speed and volume of today’s markets. Unlike traditional trading courses that focus on brokerage platforms, this program equips learners with the tools to develop their own automated trading systems from the ground up. For those curious to explore this approach, a free trial option is available, providing an opportunity to experiment with algorithmic trading before making a full commitment.

7. Trading Algorithms by Indian School of Business

The Trading Algorithms course from the Indian School of Business provides a structured academic framework for understanding algorithmic trading. This intermediate-level program blends financial theory with hands-on trading applications, making it ideal for individuals who already have a basic understanding of trading but want to build more advanced algorithmic skills.

Instructor Expertise and Course Reputation

The Indian School of Business lends its academic excellence and institutional reputation to this course. With a 4.5 out of 5-star rating from over 1,100 reviews on Coursera, it has earned positive feedback from students for its quality and depth.

Balanced Curriculum: Theory Meets Practice

This course strikes a balance between theoretical knowledge and real-world application. Key topics include Financial and Statement Analysis, Market Trends and Dynamics, and practical aspects like Financial Trading, Equities, and Decision Making. Designed for flexibility, the program can be completed in 1 to 4 weeks, offering a focused yet thorough exploration of algorithmic trading principles.

Focus on Technology and Computational Techniques

In addition to its academic rigor, the course emphasizes modern computational methods essential for algorithmic trading. Students learn how to develop systematic trading strategies that combine financial insights with efficient market execution. For those curious about this structured academic approach, the course offers a free trial.

Course Comparison Table

Here’s a side-by-side look at key aspects of various day trading courses to help you evaluate which one aligns best with your goals.

| Course Name | Instructor/Provider | Skill Level | Mentorship/Community | Technology Focus | Pricing (USD) | Platform Support |

|---|---|---|---|---|---|---|

| Bear Bull Traders | Andrew Aziz & Team | Beginner to Advanced | Live chat rooms, community simulator | DAS Trader Pro, advanced simulator, trading tools | $39 (7-day trial), Basic Monthly available | DAS Trader Pro platform |

| Warrior Trading | Ross Cameron & Team | Beginner to Intermediate | Live stream, chat rooms, community support | DayTradeDash proprietary software, Real-Time Data Simulator | Subscription-based with add-ons | Proprietary DayTradeDash platform |

| Bullish Bears | Trading Team | Beginner to Intermediate | Trading rooms, live daily streams, Discord channel | Stock screeners, trading apps, swing trading tools | Varies by membership level | Multiple broker platforms |

| Humbled Trader | Shay (Humbled Trader) | Beginner to Advanced | Weekly live mentorship webinars, one-on-one meetings, dedicated chatrooms | Trading watchlists, Academy resources | Premium membership required | Various trading platforms |

| Investors Underground | Nate Michaud & Team | Intermediate to Advanced | Dedicated chatrooms, live trading floor, community of 1,000+ | Pre-market broadcast, trade caps, nightly watchlist | Premium subscription model | Multiple platform compatibility |

| Machine Learning for Trading | Google Cloud | Advanced | Online course community | TensorFlow, Keras, Google Cloud Platform, neural networks | Coursera subscription pricing | Google Cloud Platform |

| Trading Algorithms | Indian School of Business | Intermediate | Academic course support | Algorithmic trading concepts, financial analysis tools | Coursera course fee | Platform-agnostic concepts |

The table outlines major differences between these courses. Below, we dive into some of the most notable distinctions.

Key Differences in Skill Requirements

Bear Bull Traders stands out for its inclusivity, offering both beginner-friendly options and advanced tools for seasoned traders. For example, its Essentials Course is tailored to those just starting out, while advanced users can benefit from its sophisticated trading tools. On the other hand, Google Cloud’s Machine Learning for Trading course is aimed at advanced learners, requiring knowledge of TensorFlow, Keras, and data pipelines. Similarly, the Indian School of Business course focuses on algorithmic trading concepts and financial analysis, making it more suitable for those with prior experience.

Community and Mentorship Variations

The level of community interaction and mentorship varies significantly across these courses. Warrior Trading and Bear Bull Traders emphasize real-time engagement through live streams and chat rooms, creating a highly interactive learning environment. Humbled Trader takes this a step further by offering weekly live mentorship webinars and one-on-one meetings, providing a more personalized experience. Investors Underground fosters peer learning through dedicated chatrooms tailored to different trading styles, supported by an extensive library of over 1,000 video lessons.

Technology Integration Considerations

The integration of technology into these courses is another important factor. Bear Bull Traders and Warrior Trading focus on hands-on experience with specific platforms like DAS Trader Pro and DayTradeDash, helping students get comfortable with professional-grade tools. Bullish Bears, in contrast, offers broader flexibility by covering tools compatible with multiple brokers and swing trading strategies. For those interested in automated trading, Google Cloud and Indian School of Business courses provide a solid foundation in algorithmic and machine learning technologies, catering to more technical trading needs.

Each course’s approach to technology and mentorship plays a vital role in determining how well it aligns with your trading objectives.

Setting Up Your Trading Technology Infrastructure

Having a solid technical setup is key to executing trades efficiently. A dependable system that minimizes downtime and reduces latency can make all the difference in your trading performance.

Why Day Traders Should Consider VPS Hosting

Day trading requires fast execution, where even a slight delay can impact your results. Relying solely on a home computer may leave you vulnerable to interruptions like power outages or internet issues. A Virtual Private Server (VPS) designed for trading solves these problems by hosting your trading platforms on high-performance servers. For example, QuantVPS offers near-zero latency (0–1 ms) and guarantees 100% uptime, ensuring your trades execute when it matters most. This makes a VPS an excellent solution to overcome the limitations of home-based systems.

Choosing the Right VPS Plan for Your Needs

The VPS plan you select should align with your trading style and the resources you need. Here’s a breakdown of options:

- VPS Lite: Ideal for light traders managing 1–2 charts. Priced at $59.99/month (or $41.99/month with annual billing), this plan includes 4 cores, 8GB RAM, and 70GB NVMe storage.

- VPS Pro: Perfect for active day traders handling 3–5 charts at once. At $99.99/month (or $69.99/month annually), it offers 6 cores, 16GB RAM, and supports up to 2 monitors.

- VPS Ultra: Designed for professional traders working with 5–7 charts and advanced analysis. This plan costs $189.99/month (or $132.99/month annually) and delivers 24 cores, 64GB RAM, and support for up to 4 monitors.

Each plan is tailored to meet specific trading demands, allowing you to scale up as your strategies become more complex.

Prioritizing Security and Reliability

Security is critical in trading, and QuantVPS addresses this with features like DDoS protection and automatic backups to safeguard your data. Additionally, all plans offer full root access, enabling you to customize your setup with specialized indicators or software recommended by trading courses. This flexibility ensures your system is both secure and adaptable.

Ensuring Platform Compatibility

Your VPS should seamlessly support the trading platforms you rely on. QuantVPS is compatible with popular platforms such as NinjaTrader, MetaTrader, and TradeStation, ensuring smooth operation for your preferred tools. With this level of compatibility, you can focus on refining your strategies rather than worrying about technical issues.

Budgeting for Your Trading Setup

While VPS hosting adds a recurring cost, it’s a necessary investment for serious traders. Opting for annual billing reduces expenses – for instance, the VPS Lite plan drops to $41.99/month when paid annually. This allows you to allocate more of your budget to actual trading while maintaining a reliable infrastructure.

For new traders, standard plans offer a great starting point. As your trading volume increases or you adopt more advanced strategies, upgrading to higher-tier plans ensures your infrastructure keeps pace. For those managing 7+ charts or running multiple automated systems, QuantVPS also offers a dedicated server option at $299.99/month, ideal for advanced algorithmic strategies like those taught in courses such as Trading Algorithms by the Indian School of Business.

Conclusion

Before diving into a day trading course, take a moment to evaluate your goals, risk tolerance, and resources. Day trading requires a daily time commitment and a significant amount of capital, while swing trading offers a more flexible schedule and less stress. The course you choose should align with your financial goals – whether you’re building a retirement fund or aiming to replace your current income.

Look for courses that address the emotional challenges of trading and emphasize the importance of disciplined habits. Developing a trading system tailored to your unique style can help you navigate common psychological hurdles and stay consistent over time.

Choosing the right course is a crucial step in combining solid education with practical strategies. When paired with the right trading tools, this approach can give you a competitive edge. Take stock of your schedule, financial resources, and risk appetite before committing to a program. With quality education and disciplined practice, you’ll be well-positioned for trading success in 2026.

FAQs

How can I choose the best day trading course for my skill level and budget?

To choose the best day trading course for your needs, start by assessing where you stand in terms of experience – are you just starting out, or do you already have some trading knowledge? Once you’ve pinpointed your skill level, look at the course content to see if it matches your learning objectives. Features like hands-on strategies, access to trading tools, mentorship, or live trading sessions can be especially helpful.

Budget is another key factor. Day trading courses come in a wide range of prices, so take the time to compare what’s included for the cost. Instead of focusing solely on price, aim for courses that offer real-world insights and practical skills that can genuinely improve your trading success.

What are the essential tech requirements for building a reliable day trading setup?

To set up a successful day trading system, you’ll need the right mix of hardware, software, and a fast internet connection. Start with a powerful computer featuring a fast processor and at least 16GB of RAM to handle the demands of trading platforms. Dual monitors are a smart addition, allowing you to track multiple charts and platforms at the same time. And don’t underestimate the importance of a stable, high-speed internet connection – it’s essential for real-time data and smooth trade execution.

Pair this setup with professional trading software that provides advanced charting tools, real-time market updates, and customizable features to match your trading strategy. To safeguard against unexpected power outages, consider investing in a backup power source like an uninterruptible power supply (UPS). With these tools in place, along with a well-defined trading plan, you’ll be better equipped to navigate the fast-moving world of day trading efficiently.

Why are mentorship and community support important in day trading courses, and what should I look for?

Mentorship and community support are crucial for traders aiming to excel. A mentor can provide tailored advice, share practical strategies, and guide you away from common mistakes. At the same time, being part of an active community creates opportunities to exchange ideas, tackle challenges together, and maintain motivation.

When evaluating a course, prioritize those that offer direct access to seasoned traders through one-on-one mentoring or live Q&A sessions. Also, ensure the program includes a strong community component, such as forums or chat groups, where you can interact with fellow traders to learn, share experiences, and grow collectively.