Sunday CME Futures Opening Time: E-mini & Gold Overview

When the CME futures market opens at 5:00 PM CT every Sunday, it sets the stage for the financial week. This session allows traders to react to weekend developments in E-mini S&P 500 (/ES) and Gold (/GC) futures. Key highlights:

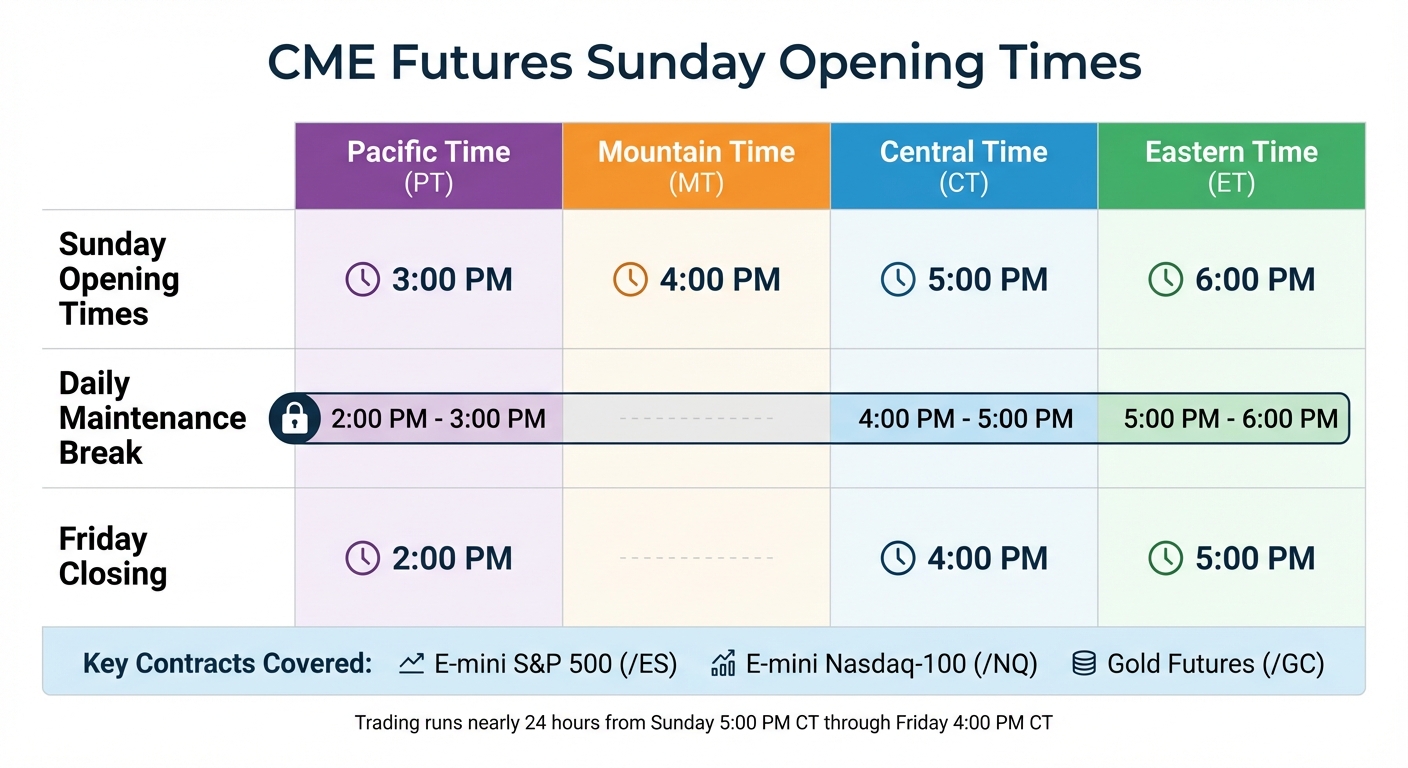

- Opening Time: 5:00 PM CT (6:00 PM ET, 4:00 PM MT, 3:00 PM PT).

- Daily Maintenance Break: 4:00 PM - 5:00 PM CT before Sunday open.

- Gold Futures: High volume (~27 million ounces daily), sensitive to geopolitical events and USD strength.

- E-mini Futures: Actively traded, reflecting market sentiment after the weekend.

Preparation is critical - ensure platform connectivity, set up limit orders during the pre-open phase, and manage risk early due to lower liquidity and wider spreads. Sunday trading offers a chance to position yourself ahead of Monday’s market, making it a key session for informed strategies.

CME Futures Sunday Opening Times

CME Futures Sunday Opening Times Across US Time Zones

CME Futures Sunday Opening Times Across US Time Zones

The CME futures market starts its trading week at 5:00 p.m. Central Time (CT) every Sunday, covering both E-mini and Gold contracts. This schedule applies to major equity index futures and precious metals, giving traders a consistent start to react to weekend news. Trading then continues nearly 24 hours a day through Friday at 4:00 p.m. CT. Below, we’ll break down the opening times and key details for E-mini and Gold futures.

E-mini Futures Opening Time

E-mini S&P 500 (/ES) and Nasdaq-100 (/NQ) futures open at 5:00 p.m. CT on Sunday - 6:00 p.m. ET, 4:00 p.m. MT, and 3:00 p.m. PT. The E-mini S&P 500 is one of the most actively traded futures contracts in the world, with a minimum tick size of 0.25 index points, valued at $12.50 per contract. If you’re outside the Central Time zone, you’ll need to adjust your trading schedule accordingly.

Before the official opening, there’s a "Pre-open" period where traders can place, modify, or cancel orders, though no trades are executed until the market officially opens. This allows you to set up your strategy in advance without prematurely entering trades.

Gold Futures Opening Time

Gold futures (/GC) also open at 5:00 p.m. CT on Sunday - 6:00 p.m. ET, 4:00 p.m. MT, and 3:00 p.m. PT. With a minimum tick size of 0.10 per troy ounce, valued at $10.00 per contract, gold futures see massive trading volumes, averaging about 27 million ounces daily - approximately 30 times the volume of the SPDR Gold ETF.

This opening session is especially reactive to weekend geopolitical and economic events. Gold prices often shift rapidly due to factors like Central Bank policies, fluctuations in the US Dollar Index, or major global developments. As CME Group explains:

Nearly 24-hour access enables you to act, not wait, as major events (Brexit, U.S. elections) unfold.

Nearly 24-hour access enables you to act, not wait, as major events (Brexit, U.S. elections) unfold.

Daily Maintenance Break

Before the Sunday open, the market undergoes a 60-minute maintenance break from 4:00 p.m. to 5:00 p.m. CT (5:00 p.m. to 6:00 p.m. ET). During this time, the market recalibrates by updating profit and loss statements and recalculating overnight margin requirements. No trades are matched during this period, so automated trading systems should account for the downtime.

| Market Session | Central Time (CT) | Eastern Time (ET) | Pacific Time (PT) |

|---|---|---|---|

| Sunday Opening | 5:00 PM | 6:00 PM | 3:00 PM |

| Daily Maintenance Break | 4:00 PM - 5:00 PM | 5:00 PM - 6:00 PM | 2:00 PM - 3:00 PM |

| Friday Closing | 4:00 PM | 5:00 PM | 2:00 PM |

It’s important to ensure your account equity meets the overnight margin requirements before the 4:00 p.m. CT maintenance break, as these requirements may differ from intraday levels. Additionally, "Day" orders are typically canceled at the close before the maintenance break, so if you’re using "Good 'til Canceled" (GTC) orders, double-check their status during the pre-open phase.

Preparing Your Trading Setup for Sunday Open

The time leading up to the 5:00 p.m. CT Sunday open is your chance to ensure everything in your trading setup is running smoothly. Think of this pre-open phase as a trial run - it’s where you confirm your platform, data feeds, and order routing are ready to go. This preparation can be the difference between seizing a trading opportunity and missing out entirely. Start by checking your connectivity and the performance of your data feed.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Platform Connectivity and Latency

Log into your trading platform at least 30 minutes before the Sunday open to confirm your connection and address any potential issues. If you're working from a home setup, you might notice higher latency due to your internet service provider's routing.

QuantVPS servers, located in a Chicago datacenter, offer direct fiber-optic connections to the CME Group exchange matching engines, ensuring ultra-low latency of less than 0.52ms. This setup supports popular futures platforms like NinjaTrader, Sierra Chart, TradeStation, Quantower, and Tradovate, as well as data feeds such as Rithmic and CQG. During this pre-open period, place a test limit order to confirm your platform is properly connected to CME Globex. If you’re using QuantVPS Pro or Ultra plans, you can even monitor your setup remotely from anywhere.

Automated Setup and Pre-Open Configuration

Once your connection is stable, focus on configuring your automated systems for uninterrupted operation. Automated trading systems need to stay active through the Sunday open, as home setups are prone to disruptions like computer shutdowns or internet outages.

QuantVPS offers 24/7 operation with a 99.999% uptime guarantee, ensuring that your trading platforms and bots run continuously without relying on your home setup. Their network includes a 1Gbps connection with 10Gbps burst capability and advanced DDoS protection.

Use the pre-open phase to queue your automated orders for execution when the market opens at 5:00 p.m. CT. Be sure to adjust your risk settings to account for the lower volume and wider spreads typical of Sunday sessions, as slippage can be more noticeable in thinly traded markets. If you encounter any issues, QuantVPS provides 24/7 technical support through live chat or tickets to help keep your setup running smoothly.

Trading Strategies for Sunday Opening Sessions

The Sunday market open at 5:00 p.m. CT provides a distinct opportunity to respond to weekend events that may influence trading. Success here requires a mix of preparation and adaptability, as liquidity tends to build gradually during the evening session.

Analyzing Weekend News and Setting Direction

Before diving into trades, examine key events from the weekend. Gold futures, for example, are highly responsive to geopolitical developments. As CME Group explains, "Financial crises and elections create financial uncertainty and in turn, impact demand for and the price of gold". Keep an eye out for international conflicts, political shifts, or central bank announcements that might have unfolded while the markets were closed.

The US Dollar Index (DXY) is another critical tool for understanding gold's potential direction. Since gold is priced in dollars, it often moves inversely to the dollar's strength. A stronger US Dollar usually puts downward pressure on gold prices. For those trading E-mini futures, review recent macroeconomic data, such as Non-Farm Payrolls (released the first Friday of each month), CPI reports (typically mid-month), or any Federal Reserve announcements from the prior week.

To gain additional insights, check CME Group's "Metals Update" and "Metals Commentary Videos", which provide expert market analysis ahead of the Sunday session. Another valuable resource is the CME Group Volatility Index (CVOL) for gold, which measures 30-day implied volatility and offers clues about whether the market expects calm or turbulence. Once you’ve gauged the market’s direction, adjust your order strategy to align with these expectations.

Placing Limit Orders and Managing Risk

Position your limit orders during the Pre-open phase, which begins 10–15 minutes before the market officially opens at 5:00 p.m. CT. Keep in mind that actual order matching only starts at the open. This approach ensures your orders are ready to go as soon as trading begins.

Risk management is key in these early hours. Set stop-loss orders immediately after entering trades. Sunday sessions often feature lower trading volumes and wider spreads compared to weekdays, increasing the risk of slippage. Pay close attention to early market activity; if spreads remain wide after 5:15 p.m. CT, it may be wise to scale down your position size.

Scaling Into Breakouts After Volume Increases

Once initial risk controls are in place, look for breakout opportunities. After 6:00 p.m. CT, trading volume typically picks up, making this a better time to scale into breakout trades. While the Pre-open phase is useful for placing initial orders, true price discovery happens once continuous trading begins, as market participants digest the weekend’s news.

Use the Volatility Term Structure Tool to compare current implied volatility with last week’s levels. Elevated volatility combined with a clear directional move can signal a strong opportunity to add to your positions.

Gold’s physical settlement process ensures that contract prices stay closely aligned with the cash market, which helps to minimize slippage during high-volume breakouts. Keep monitoring the US Dollar Index to confirm that currency movements align with your breakout strategy. For E-mini futures, watch for consistency across related index futures. For example, if the S&P 500 E-mini is breaking out but Nasdaq-100 futures are lagging, that divergence might suggest a false move worth avoiding.

Conclusion

The Sunday 5:00 p.m. CT CME open provides a valuable opportunity for traders in E-mini and Gold markets, with trading running almost continuously until Friday at 4:00 p.m. CT. This session marks the first chance for global price discovery after the weekend, which is especially relevant given that Gold futures account for the daily trade of approximately 27 million ounces.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Keep in mind the 60-minute maintenance break from 4:00 to 5:00 p.m. CT, which updates margins and P&L.

When planning your trading strategy, consider the distinct dynamics of Sunday sessions. Gold prices often react swiftly to political or economic events from the weekend, while E-mini futures mirror shifts in market sentiment that developed while U.S. equity markets were closed. It’s also wise to track the US Dollar Index alongside your Gold positions and review key economic reports, such as CPI or Non-Farm Payrolls, released in the prior week. Integrating these factors into your broader strategy can help you make the most of early market activity.

The Sunday open gives you a head start on the Monday market, underscoring the need for precise risk management and a strong focus on liquid futures contracts.

FAQs

What steps can traders take to prepare for the Sunday CME futures market open?

The CME futures market kicks off every Sunday at 5:00 p.m. Central Time (CT) and runs continuously until the Friday close at 4:00 p.m. CT. To stay on top of things, double-check the opening time and consult the CME holiday calendar for any potential schedule changes. Setting reminders and enabling platform alerts a few minutes before the market opens can help ensure you're ready.

Before Sunday evening, make sure your trading platform is properly connected to CME Globex and confirm you have enough margin for the contracts you plan to trade, such as E-mini S&P 500 or Gold futures. Take a moment to review contract details - Gold futures, for instance, are available in standard (100 oz), E-mini (50 oz), and Micro (10 oz) sizes - so you can adjust your position sizes accordingly. It’s also wise to conduct a quick pre-market check by reviewing key economic news, technical levels, or any updates that could impact early trading. Placing limit or stop orders ahead of the open can help you capture potential market moves while keeping your risk under control.

By confirming the schedule, prepping your platform, and performing a pre-market review, you’ll be set to tackle the Sunday CME futures session with a clear and organized plan.

What impacts Gold futures during the Sunday evening trading session?

Gold futures on the CME kick off every Sunday evening at 5:00 p.m. Central Time (CT) or 6:00 p.m. Eastern Time (ET). The opening moments can be quite active, often marked by lower liquidity, which sometimes leads to sharper price swings as traders set their positions for the week ahead.

A variety of factors shape Gold futures during this session. Each contract represents 100 troy ounces of gold, priced in U.S. dollars per ounce, and movements tend to align closely with the spot gold market. Key influences include global events tied to inflation expectations, geopolitical developments, the strength of the U.S. dollar, and actions by central banks. These elements can trigger noticeable price shifts shortly after trading begins.

The CME Globex platform, operating 24/5, adds another layer of complexity. It enables traders around the world to react to overnight updates from Asian and European markets, which can further influence Sunday evening prices. A solid grasp of these factors is essential for effectively navigating Gold futures as the trading week unfolds.

Why is it important to check platform connectivity before the Sunday futures market opens?

Ensuring a dependable connection to the trading platform is crucial when trading CME futures like E-mini and Gold contracts, especially during the Sunday market open at 5:00 p.m. CT (6:00 p.m. ET). A stable, low-latency connection lets traders access live price quotes, execute orders swiftly, and react to the early market activity, which often influences the trading week ahead. Without this, traders could miss critical price changes or encounter slippage.

Sunday's market open also kicks off the daily mark-to-market process. This process recalculates margin requirements and updates profit-and-loss figures. A reliable connection ensures traders have accurate account information, helping them manage risks, avoid surprise margin calls, and confidently implement their trading strategies.

The CME futures market kicks off every Sunday at 5:00 p.m. Central Time (CT) and runs continuously until the Friday close at 4:00 p.m. CT. To stay on top of things, double-check the opening time and consult the CME holiday calendar for any potential schedule changes. Setting reminders and enabling platform alerts a few minutes before the market opens can help ensure you're ready.

Before Sunday evening, make sure your trading platform is properly connected to CME Globex and confirm you have enough margin for the contracts you plan to trade, such as E-mini S&P 500 or Gold futures. Take a moment to review contract details - Gold futures, for instance, are available in standard (100 oz), E-mini (50 oz), and Micro (10 oz) sizes - so you can adjust your position sizes accordingly. It’s also wise to conduct a quick pre-market check by reviewing key economic news, technical levels, or any updates that could impact early trading. Placing limit or stop orders ahead of the open can help you capture potential market moves while keeping your risk under control.

By confirming the schedule, prepping your platform, and performing a pre-market review, you’ll be set to tackle the Sunday CME futures session with a clear and organized plan.

Gold futures on the CME kick off every Sunday evening at 5:00 p.m. Central Time (CT) or 6:00 p.m. Eastern Time (ET). The opening moments can be quite active, often marked by lower liquidity, which sometimes leads to sharper price swings as traders set their positions for the week ahead.

A variety of factors shape Gold futures during this session. Each contract represents 100 troy ounces of gold, priced in U.S. dollars per ounce, and movements tend to align closely with the spot gold market. Key influences include global events tied to inflation expectations, geopolitical developments, the strength of the U.S. dollar, and actions by central banks. These elements can trigger noticeable price shifts shortly after trading begins.

The CME Globex platform, operating 24/5, adds another layer of complexity. It enables traders around the world to react to overnight updates from Asian and European markets, which can further influence Sunday evening prices. A solid grasp of these factors is essential for effectively navigating Gold futures as the trading week unfolds.

Ensuring a dependable connection to the trading platform is crucial when trading CME futures like E-mini and Gold contracts, especially during the Sunday market open at 5:00 p.m. CT (6:00 p.m. ET). A stable, low-latency connection lets traders access live price quotes, execute orders swiftly, and react to the early market activity, which often influences the trading week ahead. Without this, traders could miss critical price changes or encounter slippage.

Sunday's market open also kicks off the daily mark-to-market process. This process recalculates margin requirements and updates profit-and-loss figures. A reliable connection ensures traders have accurate account information, helping them manage risks, avoid surprise margin calls, and confidently implement their trading strategies.

"}}]}