When trading forex, stocks, or futures, understanding pips, points, and ticks is essential. These terms measure price movements but apply differently depending on the market:

- Pips: Used in forex, they represent small price changes. For most currency pairs, 1 pip = 0.0001, while for JPY pairs, 1 pip = 0.01.

- Points: Common in stocks and futures, they indicate whole-number price changes. For example, a stock moving from $100 to $105 gains 5 points.

- Ticks: The smallest price change in stocks, futures, or commodities. Tick size varies by instrument (e.g., 0.25 points for S&P 500 E-mini futures).

Grasping these units helps calculate profits, set stop-loss orders, and manage risk. Misinterpreting them can lead to costly errors, especially in automated or high-frequency trading. Platforms like QuantVPS ensure precise trade execution, critical for strategies targeting small movements.

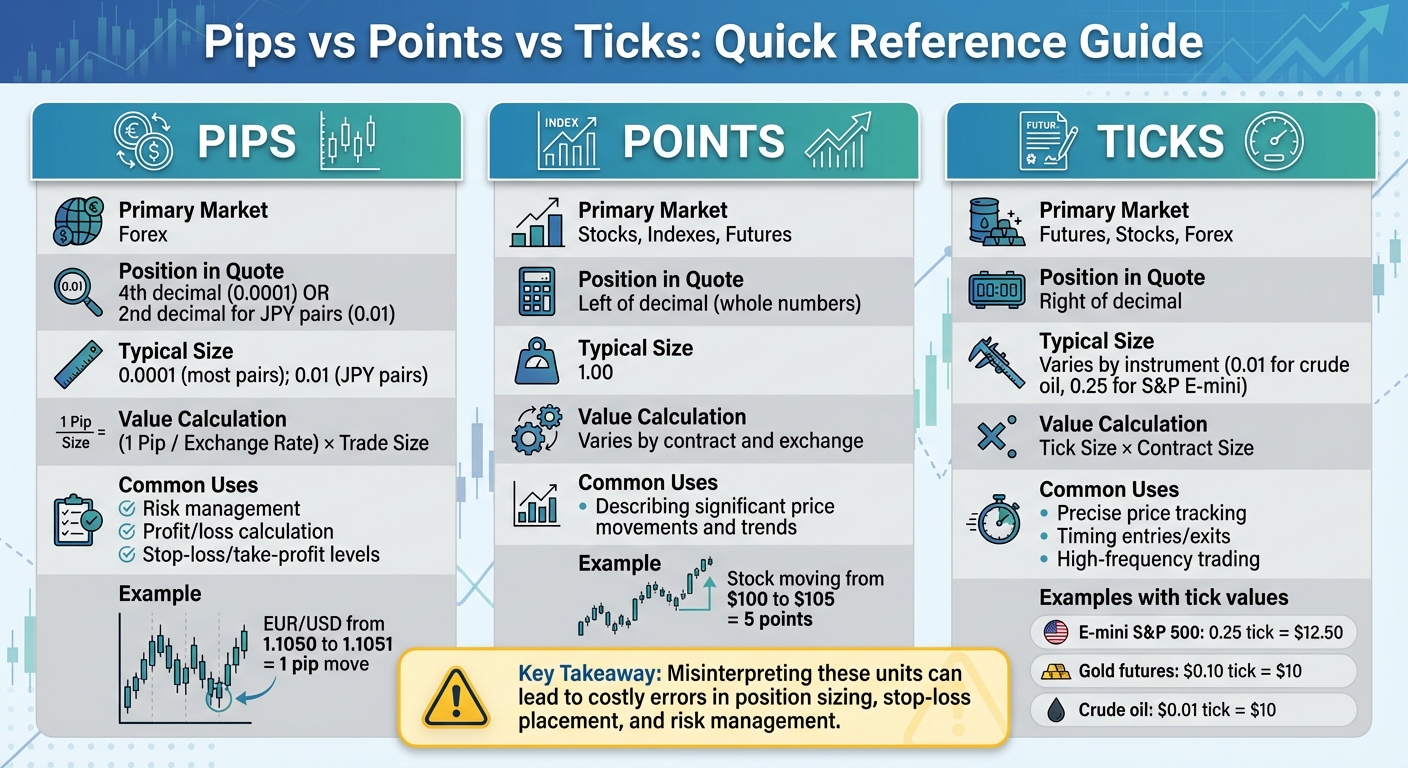

Quick Comparison

| Characteristic | Pips | Points | Ticks |

|---|---|---|---|

| Primary Market | Forex | Stocks, futures | Futures, stocks, forex |

| Position in Price Quote | Fourth decimal (0.0001) or second (JPY pairs) | Left of decimal (whole numbers) | Varies (e.g., 0.01 for crude oil) |

| Typical Size | 0.0001 (most); 0.01 (JPY) | 1.00 | Instrument-specific (e.g., 0.25) |

| Value Calculation | (1 Pip / Exchange Rate) × Trade Size | Varies by contract | Tick Size × Contract Size |

Understanding these differences ensures accurate trades and better strategy execution.

Pips vs Points vs Ticks: Quick Reference Guide for Traders

Pips vs Points vs Ticks: Quick Reference Guide for Traders

Pips, Points and Ticks: What’s the Difference?

What Are Pips in Forex Trading?

A pip – short for "percentage in point" or "price interest point" – is the standard way to measure price changes in the forex market. In simple terms, it’s the smallest amount a currency pair’s value can move. For example, if someone says, "The EUR/USD moved 50 pips today", they’re referring to a 50-unit change in the exchange rate, measured using this basic unit.

How to Calculate Pips

For most currency pairs, like EUR/USD or GBP/USD, a pip corresponds to a change in the fourth decimal place (0.0001). So, if EUR/USD shifts from 1.1050 to 1.1051, that’s a one-pip move. However, it’s a little different for pairs involving the Japanese Yen, such as USD/JPY or EUR/JPY. In these cases, a pip is measured at the second decimal place (0.01). For instance, if USD/JPY moves from 110.25 to 110.26, that’s a one-pip change.

What Are Pipettes?

A pipette is essentially a fraction of a pip – one-tenth, to be exact. It adds an extra layer of precision to price measurements. On trading platforms, pipettes are displayed as the fifth decimal place (0.00001) for most pairs or the third decimal place (0.001) for JPY pairs. For example, if EUR/USD moves from 1.10505 to 1.10515, that’s a 1-pip movement or 10 pipettes. This level of detail is particularly useful in situations where spreads are narrow or when trading large positions, as even tiny price changes can significantly impact outcomes. This precision plays a critical role in risk management and trade execution.

How Traders Use Pips

Pips are at the core of many trading decisions. They’re used to calculate profits and losses and to set stop-loss or take-profit levels. For example, if you’re risking 20 pips on a standard lot (100,000 units), each pip is worth about $10 when trading USD-based pairs. This directly affects how traders size their positions.

For automated trading strategies, such as scalping, pip accuracy is vital. These strategies aim to profit from small price movements, often just a few pips per trade. Platforms like QuantVPS ensure trades are executed with millisecond precision, helping traders capture those tiny movements efficiently.

What Are Points in Trading?

A point represents a larger price movement, typically referring to whole-number changes on the left side of the decimal point. While pips are used to measure smaller shifts in forex trading, points are used to track more substantial movements in stocks, indices, and futures. For instance, if someone says, "The S&P 500 rose by 25 points today", they’re highlighting a significant price change compared to the smaller fluctuations measured by pips.

How Points Work

Points are used to measure full-unit price changes. For example, if a stock moves from $125 to $130, that’s a 5-point increase. Similarly, if an index shifts from 35,000 to 35,100, the change is 100 points. Because points focus on whole numbers, they’re especially useful for tracking larger, more noticeable price shifts rather than minor fluctuations.

Points vs. Pips: Platform Differences

Different trading platforms may define points and pips in their own way. Since points measure whole-number changes and pips capture smaller variations, it’s important to check your platform’s specific definitions. This ensures you calculate position sizes or set stop-loss orders correctly. Understanding these distinctions is key to avoiding confusion and making informed decisions.

Points in Futures Contracts

In futures trading, points are used to describe price changes, with exchanges assigning specific dollar values to these movements. For example, in E-mini S&P 500 futures, one point (equal to four ticks) is valued at $50. A 10-point shift in this market would result in a $500 change in the contract’s value. This framework allows futures traders to calculate profits and losses with precision while managing their orders effectively.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

What Are Ticks in Trading?

A tick represents the smallest possible price change for a financial instrument, defining how much a price can shift at a minimum. Unlike pips, which are specific to forex, and points, which indicate larger price movements, ticks are used across various markets – like stocks, futures, and commodities – and typically reflect changes to the right of the decimal point.

The size and value of a tick aren’t universal; they depend on market standards, contract details, and exchange rules. This means that the definition of a tick can vary widely between markets, so it’s crucial for traders to understand the specific tick structure of the instrument they’re trading.

Tick Size by Market

Tick sizes vary based on the asset being traded. For U.S. stocks, the tick size is standardized at $0.01. This change came with the introduction of decimalization in April 2001, replacing the older system where the smallest price increment was 1/16th of a dollar ($0.0625). Decimalization improved price discovery and narrowed bid-ask spreads, though it also reduced profitability for market makers.

Futures contracts, however, have unique tick sizes determined by their respective exchanges. For example:

- E-mini S&P 500 futures: Tick size of 0.25 index points

- Gold futures: Tick size of $0.10 per ounce

- Crude oil futures: Tick size of $0.01 per barrel

Each futures contract specifies its tick size in its terms, so traders should always verify this information before executing trades.

How Traders Use Ticks

Ticks play a key role in trading strategies that rely on rapid price movements, such as high-frequency trading and scalping. Traders use tick data to analyze micro-level price changes, which can be vital when setting stop-loss and take-profit levels or calculating risk and reward in volatile markets.

For algorithmic trading systems, especially those running on ultra-low-latency platforms like QuantVPS, tick data is even more critical. These systems process thousands of price changes per second, enabling automated strategies to exploit opportunities that might last just milliseconds.

Tick Value in Futures Trading

In addition to understanding tick size, traders need to grasp tick value – the monetary worth of each minimum price movement. The formula is straightforward:

Tick Value = Tick Size × Contract Size.

Here’s how it works for some popular futures contracts:

- E-mini S&P 500 futures: A tick size of 0.25 index points and a contract size of $50 per index point means each tick is worth $12.50.

- Gold futures: A tick size of $0.10 per ounce, combined with a contract size of 100 ounces, results in a tick value of $10.

- Crude oil futures: With a tick size of $0.01 per barrel and a contract size of 1,000 barrels, each tick is also worth $10.

These calculations directly influence a trader’s profit or loss. For instance, if crude oil moves ten points – where one point equals $1.00 (or 100 ticks) – a contract for 1,000 barrels would see a $100 change in value. Always refer to the exchange’s contract specifications to confirm the exact tick value for your chosen instrument.

Understanding tick values sets the stage for comparing them to pips and points in the next section.

Pips vs Points vs Ticks: Side-by-Side Comparison

Main Differences Explained

The key difference between pips, points, and ticks lies in the markets they apply to and what they measure. Pips are specific to forex trading and represent the smallest standard price movement. For most currency pairs, this is the fourth decimal place (0.0001), while for Japanese Yen pairs, it’s the second decimal place (0.01). Points, on the other hand, are used in stock and futures markets to represent larger, whole-number price changes. Lastly, ticks measure the smallest possible price movement across various markets, and their size depends on the instrument and exchange.

Each unit operates under its own rules. For example, forex pips and stock points are consistent and standardized. Ticks, however, can vary significantly. For instance, the S&P 500 E-mini futures have a tick size of 0.25 points, while crude oil futures trade in increments of 0.01, which typically translates to a $10 move per contract.

The value of a pip or tick depends on factors like trade size, exchange rate, and contract specifications. To make these differences easier to grasp, the table below summarizes the main characteristics of pips, points, and ticks.

Comparison Table

Here’s a quick breakdown of the differences between these units:

| Characteristic | Pips | Points | Ticks |

|---|---|---|---|

| Primary Market | Forex | Stocks, indexes, futures | Futures, stocks, forex |

| Position in Price Quote | Fourth decimal (most pairs) or second decimal (JPY pairs) | Left of decimal (whole number changes) | Right of decimal |

| Typical Size | 0.0001 (most pairs); 0.01 (JPY pairs) | Typically 1.00 (stocks/futures) | Varies by instrument (e.g., 0.01 for crude oil, 0.25 for S&P E-mini) |

| Value Calculation | (1 Pip / Exchange Rate) × Trade Size | Varies by contract and exchange | Instrument-specific |

| Common Uses | Risk management, profit/loss calculation, setting stop-loss/take-profit levels | Describing significant price movements and trends | Precise price tracking, timing entries/exits, high-frequency trading |

Grasping these distinctions is essential for accurate calculations and effective risk management. For example, a forex trader might set a 20-pip stop-loss to manage risk, while a futures trader could focus on tick movements, such as the S&P 500 E-mini’s quarter-point shifts, where each tick equals $12.50. Knowing when and how to use these units can make all the difference in executing your trading strategies effectively.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

How These Units Affect Your Trading

Impact on Strategy Design

Understanding the difference between pips, points, and ticks isn’t just a matter of terminology – it directly influences how you craft your trading strategies. Misinterpreting these units can lead to costly mistakes, like setting stop-loss levels too wide or too narrow, miscalculating position sizes, or running flawed backtests. For instance, if you’re trading EUR/USD and mistakenly treat a point as a pip, your stop-loss could end up far wider than planned, exposing you to unnecessary risk.

Getting these units right is especially important for risk management. Take S&P 500 E-mini contracts as an example – confusing ticks with points during backtesting can throw off profit calculations. This kind of error might make a strategy seem more lucrative during testing than it would be in real-world trading.

For scalpers and high-frequency traders, precision is everything. Each tick matters when timing entries and exits. Misjudging the difference between a 0.01 tick in crude oil futures and a 0.25 tick in S&P E-mini futures could result in mismatched profit targets and risk parameters, potentially derailing your trades. In short, mastering these units is essential for executing trades effectively and minimizing costly errors.

Why VPS Infrastructure Matters

Once you’ve nailed the interpretation of trading units, the next step is to ensure your strategies are executed with precision – and that’s where a reliable VPS (Virtual Private Server) comes into play. Accurate unit interpretation is only part of the equation; without dependable infrastructure, even the best strategies can falter.

When your trading strategy hinges on capturing small price movements, execution speed becomes critical. Every millisecond matters, especially for strategies targeting small pip or tick changes. Relying on a standard home internet connection can introduce latency, leading to slippage and eating into your profits.

This is where QuantVPS steps in. With ultra-low latency (0–1ms to major exchanges) and a 100% uptime guarantee, it ensures your trades are executed instantly, even during volatile market conditions. Dedicated CPU cores and NVMe storage provide real-time price feed updates and lightning-fast order execution, giving you an edge when timing is everything.

Another advantage is global accessibility. No matter where you are, you can monitor and adjust your strategies without worrying about local connectivity issues disrupting your performance. When trading instruments measured in pips, points, or ticks, split-second execution is non-negotiable. A dependable VPS eliminates delays, reducing the risk of errors and ensuring your strategies perform as intended.

Conclusion

Understanding the distinctions between pips, points, and ticks is key to making informed decisions in trading. These units serve as the foundation for accurate profit calculations, stop-loss settings, and overall risk management. In currency pairs, pips represent the smallest standard price movement, typically at the fourth decimal place. Points, on the other hand, indicate whole number changes, often used in stock indices. Ticks are the smallest price increments allowed by an exchange, which vary based on contract specifications. Grasping these concepts is crucial for everything from trade sizing to allocating risk effectively.

"The financial markets have different terms for price movements, and it’s important to understand these terms for effective trading and to make informed investment decisions".

"The financial markets have different terms for price movements, and it’s important to understand these terms for effective trading and to make informed investment decisions".

This knowledge becomes even more critical when backtesting strategies or determining position sizes. Misinterpreting a tick as a point, for instance, can throw off your risk-reward calculations entirely, leading to potentially costly errors during live trading.

For traders engaged in automated or scalping strategies, where even a fraction of a pip can make a difference, execution speed is just as vital as understanding these units. Services like QuantVPS ensure lightning-fast execution, helping you maintain an edge in fast-moving markets. Precision in unit measurement paired with swift execution is a winning combination.

FAQs

What’s the difference between pips, points, and ticks in trading, and how do they impact my strategy?

Understanding pips, points, and ticks is key to grasping price movements across different markets. In forex trading, pips represent small price changes, making them invaluable for managing risk and monitoring currency fluctuations with precision. For stocks and indexes, points highlight larger price shifts, offering a clearer picture for broader market analysis. Meanwhile, ticks capture the smallest price increments in futures and other markets, providing pinpoint accuracy for timing entry and exit decisions.

These units aren’t just technical jargon – they directly impact your trading strategy. They help you calculate risk, set stop-loss levels, and establish profit targets effectively. Knowing how they differ allows you to interpret market data correctly and make smarter decisions across various asset classes.

How does a VPS improve trade execution when working with pips, points, and ticks?

A Virtual Private Server (VPS) plays a key role in ensuring quick and dependable trade execution, which is essential when trading involves pips, points, or ticks. By cutting down on latency and reducing the chances of slippage, a VPS enables trades to be executed faster and with greater precision, even during high-volatility market conditions.

This is particularly useful for strategies that depend on accurate price movements. With a VPS, you benefit from a stable, uninterrupted connection to trading servers, which enhances both performance and the ability to make timely decisions.

Why is it important to understand the difference between pips, points, and ticks in trading?

Understanding the terms pips, points, and ticks is crucial because they measure price changes in various markets and play a key role in how trades are analyzed and executed.

In forex trading, a pip is the smallest price movement for most currency pairs, usually found at the fourth decimal place (e.g., $0.0001). On the other hand, points and ticks are typically used in markets like stocks and futures. A point refers to a full unit of price movement, while a tick represents the smallest possible price change within a particular market.

Grasping how these measurements work in your market allows you to track price changes precisely, manage risk more effectively, and make smarter trading choices.