Optimus Futures Fees Explained

When trading with Optimus Futures, understanding the fee structure is key to managing costs effectively. Here's a quick breakdown:

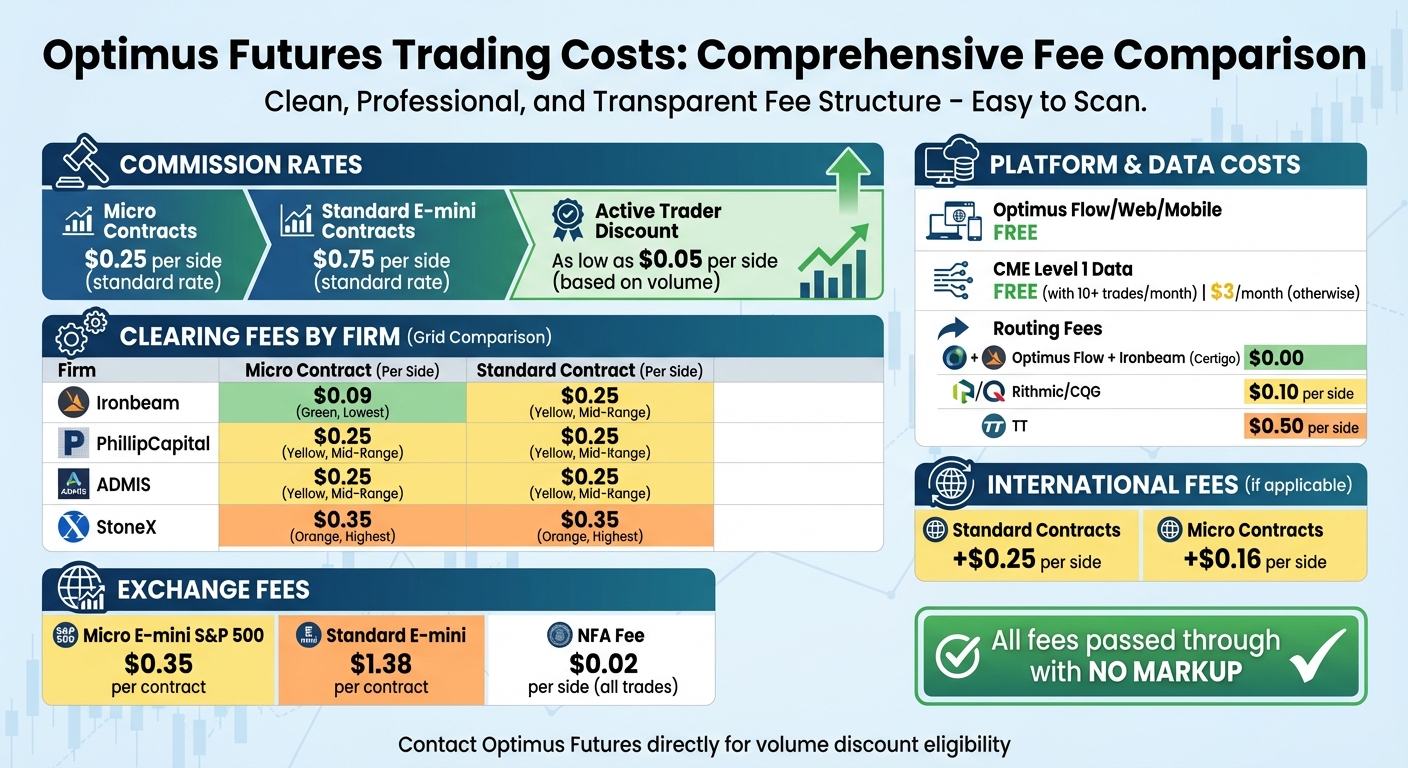

- Commissions: Starting at $0.25 per side for micro contracts and $0.75 for standard contracts. Active traders can access rates as low as $0.05 per side based on volume.

- Clearing Fees: Vary by clearing firm - Ironbeam charges $0.09 (micro) and $0.25 (standard) per side, while others like StoneX charge up to $0.35.

- Exchange Fees: Range from $0.35 for Micro E-mini S&P 500 contracts to $1.38 for standard E-mini contracts, plus a $0.02 NFA fee per side.

- Platform and Data: Optimus Flow is free, and CME Level 1 data is free with 10 trades/month; otherwise, it's $3/month. Routing fees depend on the data feed - free with Ironbeam, but Rithmic adds $0.10 per side, and TT adds $0.50.

- QuantVPS Hosting: Plans start at $59.99/month for basic setups, with discounts for annual billing.

Key Tip: Contact Optimus Futures directly to ensure you're eligible for volume discounts or reduced rates. For reliable trading performance, consider QuantVPS for low-latency hosting tailored to futures trading.

Optimus Futures Complete Fee Structure Breakdown by Contract Type

Optimus Futures Complete Fee Structure Breakdown by Contract Type

1. Optimus Futures Fee Structure

Fee Breakdown

Optimus Futures' commission structure starts at $0.25 per side for micro contracts and $0.75 per side for standard E-mini contracts. For active traders who meet specific volume requirements, rates can go as low as $0.05 per side, plus exchange fees. These reduced rates are available by contacting Optimus Futures directly. Clearing fees depend on the clearing firm: Ironbeam charges $0.09 per side for micro contracts and $0.25 per side for standard contracts. Other firms, like PhillipCapital and ADMIS, charge $0.25 per side, while StoneX charges $0.35 per side. Exchange fees range from $0.35 for Micro E-mini S&P 500 contracts to $1.38 for standard E-mini contracts, and there's an additional $0.02 NFA fee per side on every trade. Understanding these fees is crucial for managing trading costs effectively. In the next section, we'll explore platform and data costs that contribute to your overall expenses.

Platform and Data Costs

Optimus Futures provides access to its platforms - Optimus Flow, Web, and Mobile - at no charge. Additionally, CME Level 1 market data is free after completing 10 trades per month; otherwise, it costs $3 per month. Order routing fees vary based on the data feed you use: Optimus Flow with Ironbeam (Certigo) has no additional fee, while Rithmic and CQG add $0.10 per side, and TT adds $0.50 per side.

Cost Efficiency

All exchange, clearing, routing, and NFA fees are passed through without any markup, ensuring that traders can calculate their expenses with complete transparency. For international clients, there is an extra clearing fee of $0.25 per side on standard contracts and $0.16 per side on micro contracts. Traders should also be aware that holding positions beyond the session close or using lower day trading margins may result in higher commissions. To minimize costs, consider using platforms and data feeds that qualify for discounted rates. However, keep in mind that not all clients may meet the requirements for these discounts.

2. QuantVPS Hosting Plans for Optimus Traders

Connectivity and VPS Costs

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

For traders using Optimus Futures, having a reliable and fast hosting solution is just as critical as understanding fee structures. Smooth trade execution depends on robust, low-latency hosting, and that's precisely what QuantVPS delivers. Their VPS hosting services are tailored for futures trading and are fully compatible with popular platforms like NinjaTrader, MetaTrader, and TradeStation. This ensures your trading setup remains efficient and dependable.

QuantVPS offers several hosting plans to cater to different trading needs. If you have a simpler setup, their entry-level plans are a great fit. For those running complex, algorithm-driven strategies, their advanced plans provide enhanced computing power, memory, and storage to handle the workload effortlessly.

Every plan from QuantVPS comes with unmetered bandwidth, secure servers, and advanced connectivity. These features are designed to maintain high uptime and low latency - critical factors in fast-paced futures markets where even a small delay can make a big difference.

The fixed pricing structure of QuantVPS plans adds another layer of convenience by offering cost predictability. This allows traders to focus entirely on executing their strategies without the distraction of unexpected hosting costs or performance issues. Combined with the transparent fee structure previously discussed, this stability ensures a seamless trading experience.

Optimus Futures Honest Review 2025 – Best Platform for Futures Scalping & Custom Charts?

Pros and Cons

After examining the fee breakdowns and hosting details, let's weigh the benefits and challenges of using Optimus Futures' fee structure alongside QuantVPS hosting. Together, they offer a mix of transparent pricing, volume-based discounts, and predictable hosting costs.

Optimus Futures' pricing transparency stands out as a key benefit. The broker provides clear breakdowns without marking up pass-through fees from exchanges, clearing firms, or technology providers. This means you’ll know exactly where your money is going. Plus, active traders can take advantage of discounts ranging from $0.75 to $0.05 per side.

However, there are some caveats to consider. For instance, CME Level 1 data is free only under specific conditions. Free routing is exclusive to Optimus Flow with Ironbeam, while other data feeds come with extra costs between $0.10 and $0.50 per side. Additionally, commission rates may change, and discounted tiers aren’t automatically applied. To ensure you’re getting the best rates, it’s important to contact Optimus Futures directly to confirm eligibility and request any rate adjustments.

QuantVPS hosting complements this setup by offering fixed monthly pricing, eliminating surprises. Plans start at $59.99 per month for the VPS Lite (ideal for 1–2 charts) and go up to $299.99 per month for dedicated servers that can handle 7+ charts. Opting for annual billing reduces costs by 30%, bringing the VPS Lite plan down to $41.99 per month.

| Factor | Optimus Futures Fees | QuantVPS Hosting |

|---|---|---|

| Pricing Transparency | Clear breakdowns with no mark-ups on pass-through fees (ideal for budget-conscious traders) | Fixed monthly rates with no hidden charges (great for budget-conscious traders) |

| Scalability | Volume discounts from $0.75 to $0.05 per side, rewarding high-frequency trading | Plans scale from 4 to 16+ cores, accommodating both simple and complex strategies |

| Conditions | Free data requires at least 10 trades/month; free routing limited to specific data feeds | No trading volume requirements; service remains consistent regardless of trading activity |

| Cost Predictability | Costs vary based on volume, platform, and data feed choices | Fixed monthly costs with 30% savings available through annual billing |

These elements provide a comprehensive view of trading costs, helping you make more informed decisions tailored to your trading style and needs.

Conclusion

At Optimus Futures, only 20% of total trading costs are attributed to commissions, with the remaining expenses covering exchange, clearing, and NFA fees.

Your trading habits significantly influence how you can minimize costs. For beginners, there’s free access to Optimus Flow when paired with Ironbeam routing, along with reduced micro contract clearing fees - just $0.09 per side compared to the standard $0.25. Additionally, completing at least 10 trades per month ensures free CME Level 1 market data; otherwise, a $3 monthly fee applies. For more seasoned traders, reaching out to Optimus can unlock volume-based discounts, potentially lowering commissions from $0.75 to as little as $0.05 per side.

While managing fees is key, maintaining seamless connectivity is just as important. Reliable VPS hosting can simplify trading costs and enhance performance. QuantVPS offers plans starting at $59.99 per month (or $41.99/month with annual billing) for the Lite option, up to $299.99 per month for dedicated servers capable of handling seven or more charts. These fixed costs ensure no unexpected surprises, while the dependable uptime and ultra-low latency support accurate order execution and uninterrupted strategies.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

FAQs

How can I qualify for discounts on volume-based commissions with Optimus Futures?

To access volume-based commission discounts, you must hit certain monthly trading volume benchmarks. These discounts can lower your cost per side to as little as $0.05, based on how much you trade.

Think you might qualify? Contact customer support to review your trading volume and check your eligibility. They’ll guide you through the process and help you make the most of these savings.

What are the extra costs for accessing real-time market data on Optimus Futures?

The price for real-time market data through Optimus Futures varies depending on the exchange and data provider. Monthly fees generally fall between $3.00 and $149.00, covering access to exchanges such as CME, ICE, CBOE, and international markets.

The exact cost depends on factors like whether you require professional or non-professional access and the specific exchanges you plan to trade on. Having a clear understanding of these charges can help you better manage your trading budget.

What are the advantages of using QuantVPS for futures trading?

When it comes to futures trading, QuantVPS offers some standout benefits that can make a real difference in your trading experience. With lightning-fast execution speeds and low-latency connections, you can act on market shifts in real time, giving you an edge in capturing opportunities as they unfold.

QuantVPS also prioritizes reliability and stability, minimizing the chances of downtime that could disrupt your trades. Together, these features create a seamless and efficient trading setup designed specifically to handle the fast-paced demands of futures trading.

To access volume-based commission discounts, you must hit certain monthly trading volume benchmarks. These discounts can lower your cost per side to as little as $0.05, based on how much you trade.

Think you might qualify? Contact customer support to review your trading volume and check your eligibility. They’ll guide you through the process and help you make the most of these savings.

The price for real-time market data through Optimus Futures varies depending on the exchange and data provider. Monthly fees generally fall between $3.00 and $149.00, covering access to exchanges such as CME, ICE, CBOE, and international markets.

The exact cost depends on factors like whether you require professional or non-professional access and the specific exchanges you plan to trade on. Having a clear understanding of these charges can help you better manage your trading budget.

When it comes to futures trading, QuantVPS offers some standout benefits that can make a real difference in your trading experience. With lightning-fast execution speeds and low-latency connections, you can act on market shifts in real time, giving you an edge in capturing opportunities as they unfold.

QuantVPS also prioritizes reliability and stability, minimizing the chances of downtime that could disrupt your trades. Together, these features create a seamless and efficient trading setup designed specifically to handle the fast-paced demands of futures trading.

"}}]}