FXGlory Review: Are Traders Using This High Leverage Brokerage?

FXGlory offers extreme leverage of up to 1:3000 and a low entry cost of $1, making it attractive to traders seeking high-risk, high-reward opportunities. However, its lack of regulation, high withdrawal fees, and restrictive trading policies like the "7-minute rule" raise serious concerns about safety and reliability.

Key points to consider:

- Leverage: Up to 1:3000, allowing control of large positions with minimal capital.

- Regulation: Operates offshore without oversight from major financial regulators.

- Fees: High withdrawal fees (up to 9%) and fixed spreads starting at 2.0 pips.

- Trading Policies: Profits on trades held for less than seven minutes are invalidated.

- Customer Reviews: Low ratings on ForexPeaceArmy (2/5) and Trustpilot (3.4/5).

- VPS Hosting: Free for accounts with $1,000+ deposits, but comes with conditions.

While FXGlory may appeal to experienced traders willing to take on significant risks, most traders are better off with brokers that offer stronger regulatory protections and more transparent policies.

1. FXGlory

Regulation and Safety

FXGlory operates without oversight from any major financial regulator. The broker is registered offshore in Saint Vincent and the Grenadines and Saint Lucia under Glory Group Limited, but neither location enforces strict regulatory standards. This lack of oversight means there’s no investor compensation scheme or protections for client funds. Additionally, the Italian financial authority CONSOB has issued a warning, stating that FXGlory is not authorized to offer investment services in Italy. WikiBit rates the broker poorly, with an overall score of 2.33 out of 10, including a concerning 0.00 for both regulation and risk control. This leaves traders with limited options for recourse in case of disputes, and these regulatory gaps directly influence the trading conditions FXGlory provides.

Trading Conditions

The broker's regulatory weaknesses also affect its account offerings. FXGlory has four account types, each with different requirements and conditions.

- Standard Account: Requires a $1 minimum deposit and offers fixed spreads of 2.0 pips.

- Premium Account: Requires a $1,000 deposit with spreads of 1.5 pips.

- VIP Account: Requires a $5,000 deposit and provides spreads of 0.7 pips.

- CIP Account: Designed for high-volume traders, this account requires a $50,000 deposit and offers spreads as low as 0.1 pips.

All accounts operate on a commission-free model, with FXGlory earning revenue solely through its fixed spreads. However, the broker enforces a strict 7-minute trading rule, invalidating profits on trades held for less than seven minutes. This rule significantly affects scalpers and algorithmic traders, limiting their ability to use short-term strategies or tools for forex algo traders effectively.

Fees and Costs

FXGlory’s fee structure raises additional concerns. While the broker advertises commission-free trading, its spreads and withdrawal fees are notably higher than industry averages. For example:

- Wire Transfers: A 9% fee applies to withdrawals over $1,000.

- PayPal Withdrawals: Charged at 9%.

- Credit Card Withdrawals: A 5% fee applies for amounts under $300.

- Cryptocurrency Withdrawals: Fees range from 0% to 5%, plus a flat $20 charge.

The Standard account’s fixed spread of 2.0 pips is less competitive compared to the industry average of around 1.5 pips. Additionally, FXGlory imposes inactivity fees on dormant accounts. Combined with restrictive trading policies, these fees further erode trader protections and profitability.

Customer Support

FXGlory offers customer support through various channels, but user reviews highlight ongoing issues. The broker has a rating of 2 out of 5 on ForexPeaceArmy (based on 62 reviews) and 3.4 out of 5 on Trustpilot (from 17 reviews). Common complaints include delays in withdrawals and profit reversals tied to the 7-minute rule. These problems further limit traders’ ability to resolve disputes effectively, adding to the challenges of trading with FXGlory.

2. QuantVPS

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Performance and Reliability

FXGlory offers free VPS hosting specifically for traders using automated Expert Advisors (EAs). With a 99.9% uptime guarantee, this service is designed to ensure uninterrupted trading, even when managing high-leverage positions of up to 1:3000. This level of reliability is essential for keeping trades active during volatile market conditions.

"As an advantage for professional traders, we provide free VPS (99.9% up time) for those traders who like to use EAs." – FXGlory

"As an advantage for professional traders, we provide free VPS (99.9% up time) for those traders who like to use EAs." – FXGlory

The VPS also delivers high-speed execution, giving traders a competitive edge in fast-paced markets. To address any technical issues or questions, FXGlory provides 24/7 customer support, ensuring that help is always available when needed. However, eligibility for this free service depends on specific account conditions.

Pricing Plans

To access these benefits, traders must meet certain account requirements. The VPS service is free for Premium, VIP, and CIP account holders, but each account type has a minimum deposit threshold:

- Premium accounts: $1,000 minimum deposit

- VIP accounts: $5,000 minimum deposit

- CIP accounts: $50,000 minimum deposit

Standard accounts, which only require a $1 deposit, do not qualify for the free VPS service. Additionally, traders must maintain a deposit of at least $1,000 every three months to keep the service active. If an account remains inactive for over a month, VPS access is revoked.

Platform Compatibility

The VPS is fully compatible with MetaTrader 4 and MetaTrader 5, making it ideal for automated trading strategies. FXGlory's trading servers are based in the United States, which may affect latency for traders located in other parts of the world. While the VPS is primarily focused on MetaTrader platforms, FXGlory also offers its proprietary GloryTrader platform, accessible through web browsers and mobile devices. However, VPS support is not extended to GloryTrader, emphasizing its role for MetaTrader users.

FX Glory Honest Review

Pros and Cons

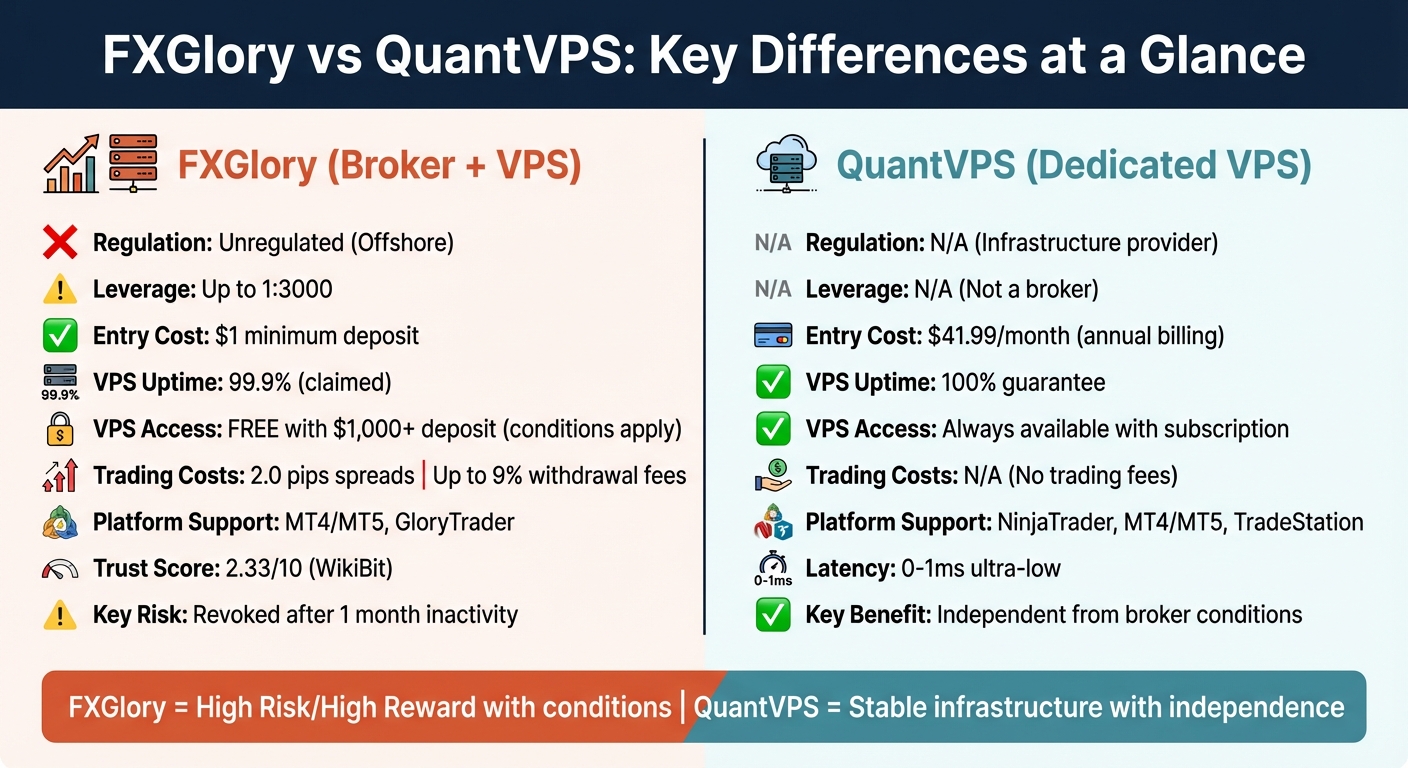

FXGlory vs QuantVPS: Trading Conditions and VPS Features Comparison

FXGlory vs QuantVPS: Trading Conditions and VPS Features Comparison

Here's a breakdown comparing FXGlory's trading conditions with QuantVPS's technical offerings, highlighting their key features and differences.

| Aspect | FXGlory | QuantVPS |

|---|---|---|

| Primary Service | Forex/CFD broker with integrated VPS | Dedicated VPS hosting for trading platforms |

| Regulation | Unregulated (offshore, e.g., St. Vincent and the Grenadines) | N/A (Infrastructure provider) |

| Leverage | Up to 1:3000 for Standard accounts | N/A (Not a broker) |

| Entry Cost | $1 minimum deposit | $41.99/month (annual billing) |

| VPS Uptime | Claimed 99.9% uptime | 100% uptime guarantee |

| VPS Access | Free with a $1,000+ deposit; revoked after 1 month of inactivity | Always available with subscription |

| Trading Costs | Spreads from 2.0 pips; withdrawal fees up to 9% | N/A (No trading fees) |

| Platform Support | MetaTrader 4/5, GloryTrader | NinjaTrader, MetaTrader, TradeStation |

| Customer Support | 24/7 multilingual support, average response time under 3 minutes | System monitoring and dedicated technical support |

| Trust Score | 71/100 (FXLeaders); 2.33/10 (WikiBit) | Established infrastructure provider |

FXGlory stands out for its extreme leverage of up to 1:3000 and a low entry cost of just $1. However, its unregulated status and steep withdrawal fees make it a riskier choice for traders. The broker offers free VPS access for accounts with a minimum deposit of $1,000 or more, but this perk comes with conditions - such as maintaining activity and dealing with higher spreads.

On the other hand, QuantVPS provides a more reliable and independent VPS solution. With pricing starting at $41.99 per month (via annual billing), it guarantees 100% uptime, ultra-low latency (0–1 ms), and full root access. Unlike FXGlory, QuantVPS's services remain unaffected by trading activity or account balances, offering consistent support across multiple platforms like NinjaTrader, MetaTrader, and TradeStation.

The choice boils down to control versus convenience. FXGlory bundles VPS access with its brokerage services, appealing to those seeking high leverage and integrated hosting. However, this comes with regulatory risks, higher fees, and limited control. QuantVPS, by contrast, offers a standalone infrastructure solution, giving traders more flexibility and independence without broker-related conditions.

For those prioritizing stability and consistent VPS access, QuantVPS's independent model is a better fit. Meanwhile, traders comfortable with offshore brokers and looking for high leverage might find FXGlory's combined services appealing - provided they meet the deposit requirements and are prepared for the risks involved.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Conclusion

FXGlory's high-leverage offerings, like its 1:3000 leverage and $1 minimum deposit, might seem appealing at first glance. However, the broker's weak regulatory oversight and warnings from authorities raise serious concerns about safety and reliability for traders. These factors make it critical for traders to weigh the risks carefully before diving in.

Adding to the challenges, FXGlory's operational policies - such as high withdrawal fees and the restrictive "7-minute rule", which voids profits on trades held for less than seven minutes - can create significant hurdles for users. These practices complicate the trading experience and may deter many from using the platform.

For those willing to take on these risks, having a stable technical setup is non-negotiable. A dedicated VPS solution, like QuantVPS, offers uninterrupted trade execution with 100% uptime and ultra-low latency (0–1 ms). Starting at $41.99 per month (billed annually), it provides independent hosting that sidesteps broker-imposed limitations. This level of reliability is crucial when managing trades in a high-leverage environment.

While FXGlory may attract experienced traders who understand and accept these risks, most traders are better off prioritizing brokers with strong Tier-1 regulation, even if it means sacrificing higher leverage. For those who do choose to trade with FXGlory, coupling it with a dependable VPS can help mitigate some of the risks associated with the platform’s operational and regulatory shortcomings.

FAQs

What are the risks of trading with an unregulated broker like FXGlory?

Trading with an unregulated broker, such as FXGlory, carries serious risks. Without oversight from a recognized financial authority, there’s no assurance of fair practices, financial security, or safeguarding of your funds. This lack of regulation means your money could be vulnerable to mismanagement, fraud, or even complete loss if the broker faces insolvency.

On top of that, FXGlory offers extremely high leverage - up to 1:3000. While leverage can amplify profits, it also magnifies losses at the same rate. And since FXGlory doesn’t provide negative balance protection, traders could find themselves owing more than their initial deposit. To make matters worse, there have been reports of high fees, non-competitive spreads, and limited transparency, making FXGlory a particularly risky option for U.S. traders.

What is the '7-minute rule,' and does it impact trading on FXGlory?

Based on the available information, there’s no reference to a '7-minute rule' in FXGlory’s official trading policies, platform documentation, or customer reviews. None of the reviewed sources suggest that such a rule exists or explain its potential impact on trading strategies.

If you have a specific source or details about this rule, feel free to share them, and we’ll gladly provide more insights.

Is FXGlory's high-leverage trading safe, and are there better options?

FXGlory stands out for offering incredibly high leverage - up to 1:3,000. However, this comes with a major downside: the broker operates without substantial regulatory oversight. Its offshore licensing structure offers minimal protection for investors, and the lack of safeguards like compensation schemes, segregated accounts, or negative balance protection makes trading with FXGlory a risky endeavor.

If you're looking for a safer trading environment, it's wise to choose brokers regulated by well-known financial authorities. These brokers often impose lower leverage limits, such as 1:50 or 1:100, and include essential protections like client fund security and negative balance protection. Opting for regulated brokers and moderate leverage can significantly reduce the risks associated with leveraged trading.

Trading with an unregulated broker, such as FXGlory, carries serious risks. Without oversight from a recognized financial authority, there’s no assurance of fair practices, financial security, or safeguarding of your funds. This lack of regulation means your money could be vulnerable to mismanagement, fraud, or even complete loss if the broker faces insolvency.

On top of that, FXGlory offers extremely high leverage - up to 1:3000. While leverage can amplify profits, it also magnifies losses at the same rate. And since FXGlory doesn’t provide negative balance protection, traders could find themselves owing more than their initial deposit. To make matters worse, there have been reports of high fees, non-competitive spreads, and limited transparency, making FXGlory a particularly risky option for U.S. traders.

Based on the available information, there’s no reference to a '7-minute rule' in FXGlory’s official trading policies, platform documentation, or customer reviews. None of the reviewed sources suggest that such a rule exists or explain its potential impact on trading strategies.

If you have a specific source or details about this rule, feel free to share them, and we’ll gladly provide more insights.

FXGlory stands out for offering incredibly high leverage - up to 1:3,000. However, this comes with a major downside: the broker operates without substantial regulatory oversight. Its offshore licensing structure offers minimal protection for investors, and the lack of safeguards like compensation schemes, segregated accounts, or negative balance protection makes trading with FXGlory a risky endeavor.

If you're looking for a safer trading environment, it's wise to choose brokers regulated by well-known financial authorities. These brokers often impose lower leverage limits, such as 1:50 or 1:100, and include essential protections like client fund security and negative balance protection. Opting for regulated brokers and moderate leverage can significantly reduce the risks associated with leveraged trading.

"}}]}