When trading stocks or options, speed and reliability are critical. A Virtual Private Server (VPS) located near NYSE and NASDAQ can dramatically reduce latency – down to as low as 0.52ms – compared to a typical 50–100ms home internet connection. This can improve trade execution, reduce slippage, and ensure uninterrupted operations during market hours. You can further optimize your trading server performance by fine-tuning network and resource settings.

Top New York VPS providers for 2026:

- QuantVPS: Offers sub-1ms latency, trading-optimized hardware, and pre-configured setups for platforms like Thinkorswim and Interactive Brokers. Pricing starts at $59.99/month.

- OVHcloud: Budget-friendly with plans starting at $12.75/month but lacks trading-specific optimizations and sub-millisecond latency.

- AWS: Provides single-digit millisecond latency and advanced features but requires complex setup and can be costly.

- Microsoft Azure: Reliable but lacks ultra-low latency and trading-specific features. Plans start around $70/month.

- Vultr: Affordable with low-latency options near NYSE but requires manual setup. Pricing begins at $12/month.

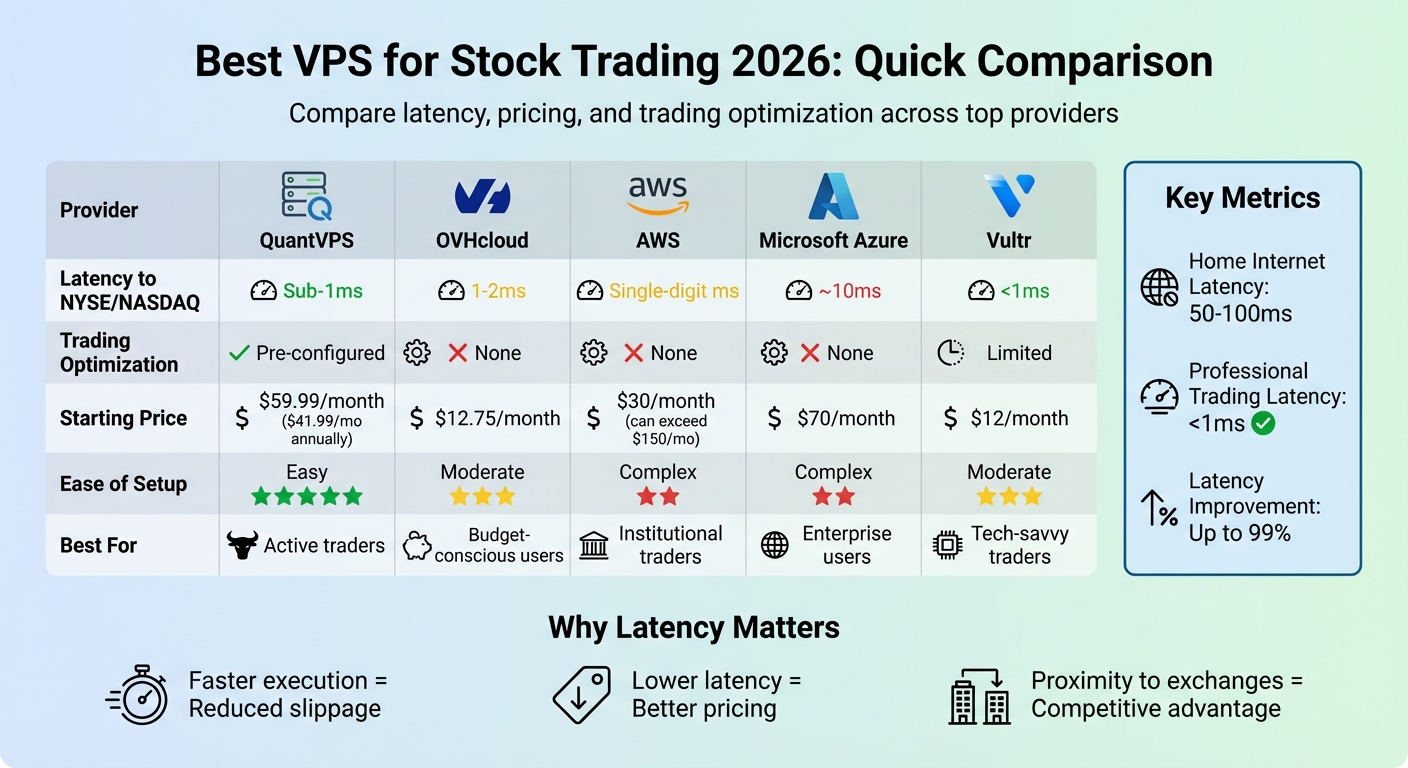

Quick Comparison:

| Provider | Latency to NYSE/NASDAQ | Trading Optimization | Starting Price | Ease of Setup |

|---|---|---|---|---|

| QuantVPS | Sub-1ms | Pre-configured | $59.99/month | Easy |

| OVHcloud | 1–2ms | None | $12.75/month | Moderate |

| AWS | Single-digit ms | None | $30/month | Complex |

| Microsoft Azure | ~10ms | None | $70/month | Complex |

| Vultr | <1ms | Limited | $12/month | Moderate |

For active traders, QuantVPS stands out with its low latency, trading-ready setup, and reliable performance. If budget is a priority, OVHcloud and Vultr are solid alternatives but require more hands-on configuration.

VPS Provider Comparison for Stock Trading: Latency, Pricing & Features 2026

1. QuantVPS

Latency to NYSE/NASDAQ

QuantVPS operates out of a New York data center, offering latency to major order matching engines as low as 0.52ms for NASDAQ and 1–2ms for other key exchanges like NYSE. This ultra-low latency is achieved through direct fiber-optic cross-connects and streamlined routing, reducing network hops between your VPS and the exchange. By positioning your trading platform close to key broker infrastructures, QuantVPS ensures minimal delays, which is crucial for options traders who depend on fast execution for tight spreads and small price movements.

This proximity is just the beginning – QuantVPS also delivers trading-specific hardware and software configurations designed for high performance.

Trading-Specific Optimization

QuantVPS doesn’t just rely on low latency; it builds every aspect of its infrastructure to support high-performance trading. With AMD EPYC and Ryzen processors, high-speed DDR4/5 RAM, and NVMe M.2 SSD storage, the system eliminates processing bottlenecks even during periods of high market volatility. The network boasts a capacity of 1Gbps with bursts up to 10Gbps, ensuring smooth data flow during peak market activity.

The platform comes preloaded with Windows Server 2022, fine-tuned for trading applications like Interactive Brokers TWS, Thinkorswim, and TradeStation. This pre-configured setup saves time, letting traders dive right into their work instead of wrestling with system settings. Plus, multi-monitor RDP support allows users to replicate a professional trading desk remotely, managing complex workspaces across multiple screens from virtually anywhere.

"Your high-performance Windows VPS is provisioned and ready for you instantly… empowering you to connect and start within minutes, with no waiting times." – QuantVPS

This combination of optimized hardware and software translates into a seamless trading experience, supported by transparent pricing tiers.

Pricing and Value

QuantVPS offers a range of plans tailored to different trading needs:

- VPS Lite: $59.99/month ($41.99/month annually) with 4 cores, 8GB RAM, and 70GB NVMe storage, ideal for handling 1–2 charts.

- VPS Pro: $99.99/month ($69.99/month annually) with 6 cores, 16GB RAM, and 150GB NVMe storage, suitable for 3–5 charts.

- VPS Ultra: $189.99/month ($132.99/month annually) featuring 24 cores, 64GB RAM, and 300GB NVMe storage, handling 5–7 charts.

For traders with heavier workloads, the Dedicated Server plan starts at $299.99/month ($209.99/month annually), offering 16+ dedicated cores, 128GB RAM, and 2TB+ NVMe storage. All plans include unmetered bandwidth, Windows Server 2022, and round-the-clock U.S.-based technical support at no extra cost. Instant provisioning and transparent pricing are facilitated through a Stripe-powered checkout system.

Ease of Setup for Trading Platforms

Getting started with QuantVPS is quick and hassle-free. After signing up, secure login credentials are delivered within minutes. A short, five-question configurator helps match your trading strategy to the most suitable plan.

QuantVPS supports all major trading platforms, including NinjaTrader, MetaTrader 4/5, TradeStation, Quantower, TradingView, IBKR TWS, and Thinkorswim. Their technical support team is available 24/7/365 via live chat, support tickets, and an extensive knowledge base, making it easy to resolve any setup issues.

"Whether it’s a technical question about your VPS for Thinkorswim setup at 3 AM or a configuration query during peak market hours, our dedicated support team is available 24/7/365." – QuantVPS

With redundant power and network paths in place, QuantVPS ensures 99.999% uptime. This reliability is a game-changer for traders who rely on automated bots or trade copiers to execute their strategies without interruptions.

2. OVHcloud

Latency to NYSE/NASDAQ

OVHcloud operates a network of 44 data centers worldwide, boasting a total capacity of 100 Tbps. For U.S. equity trading, its Vint Hill, Virginia data center is strategically positioned to serve the East Coast. The company highlights its "Forex VPS" product line, promoting low latency as a key feature for financial markets. However, it does not offer sub-millisecond proximity guarantees.

To improve access times, OVHcloud has implemented "Local Zones" in over 15 cities, with plans to expand to more than 35 locations by the end of 2025. These zones aim to bring data closer to users and exchanges, reducing latency for various workloads. While this approach is advantageous for general cloud applications, trading in stocks and options often requires ultra-close proximity to New York-based exchanges – an area where OVHcloud’s broader strategy may fall short compared to trading-specific solutions.

Trading-Specific Optimization

OVHcloud positions itself as a general-purpose cloud provider, which means it does not offer pre-configured Windows environments tailored for trading platforms like Interactive Brokers, Thinkorswim, or TradeStation. Instead, users are provided with a basic VPS that requires manual setup and optimization for trading.

The service includes features like NVMe SSD storage, anti-DDoS protection, and up to 3 Gbps of unlimited traffic. These capabilities support popular trading platforms such as MetaTrader 4/5, cTrader, and NinjaTrader. However, traders must handle tasks like Windows configuration, platform installation, and fine-tuning performance on their own. OVHcloud does offer a 99.9% SLA for hardware availability, and instances are usually provisioned in about 60 seconds.

While the hardware is solid, the lack of trading-specific optimizations means users need to invest additional effort to tailor the service to their needs.

Pricing and Value

OVHcloud’s pricing is designed to appeal to budget-conscious users who are comfortable managing their own setups. For example, the VPS-3 plan costs $12.75 per month and includes 8 vCores, 24 GB of RAM, and 200 GB of NVMe storage. For those needing more power, the VPS-4 plan is available at $22.08 per month, offering 12 vCores, 48 GB of RAM, and 300 GB of NVMe storage. Windows OS can be added for an extra fee or may come pre-installed in certain configurations.

While OVHcloud provides strong hardware at competitive prices, users must rely on their own expertise to optimize performance. The provider has also gained recognition in industry benchmarks, earning awards for its VPS performance and cost-effectiveness.

3. Amazon Web Services (AWS)

Latency to NYSE/NASDAQ

AWS offers single-digit millisecond latency to New York and Chicago exchange facilities through its Local Zones infrastructure. In November 2023, Nasdaq transitioned its GEMX options exchange to AWS Outposts within the Equinix NY11 data center in Carteret, New Jersey. This move, co-located with core exchange infrastructure, resulted in a 10% improvement in latency while handling a staggering 12 billion daily messages.

"The new cloud-enabled market infrastructure, which uses AWS Outposts, delivers up to a 10% improvement in latency and the ability to more seamlessly adjust capacity in response to changing market conditions." – Nasdaq, Inc.

Additionally, NYSE Cloud Streaming leverages AWS to deliver real-time market data feeds with sub-100ms latency. Traders aiming to enhance performance can utilize Cluster Placement Groups, which reduce roundtrip latencies by about 37% to 39%. Despite these advancements, optimizing AWS for trading requires significant configuration to meet the specific demands of financial markets.

Trading-Specific Optimization

AWS is designed as a general-purpose cloud platform, catering to web applications, data analytics, and enterprise workloads. It is not specifically tailored for trading, which means traders must manage tasks like Windows Server setup, platform installation, network tuning, and ongoing maintenance. In comparison, pre-configured trading environments offer a much simpler setup, making AWS a more complex option for active traders.

The platform does offer advanced timing tools, such as the Amazon Time Sync Service, which delivers sub-50 microsecond time accuracy using Precision Time Protocol (PTP). By June 2025, AWS is set to introduce hardware packet timestamping for nanosecond-precision timestamps at the network interface level. While these features are highly valuable for institutional traders with technical expertise, they can be overwhelming for retail traders unfamiliar with cloud infrastructure.

Pricing and Value

AWS operates on a pay-as-you-go model, which might seem cost-effective at first glance but can quickly become expensive when all trading needs are factored in. Key costs include:

- Base t3.medium instance (2 vCPUs, 4 GB RAM): Around $30/month when reserved.

- Data egress fees: $0.09 per GB, adding $20–$50 per month for real-time data feeds.

- Business-level support: Starts at $100/month, crucial for maintaining trading uptime.

- Additional charges: These include storage snapshots, elastic IPs, and other services.

When combined, monthly costs often range between $70 and $150 or more. This is significantly higher than specialized trading VPS providers, which bundle essential features for $25–$50 per month.

For institutional brokers, AWS’s global infrastructure and scalability provide substantial benefits. For example, in 2022, broker FXGT.com moved to AWS, achieving 3-millisecond latencies and the ability to scale capacity 2–3x in under four minutes during periods of market volatility. However, for individual traders, the high costs and technical demands make AWS less appealing compared to purpose-built trading platforms.

Ease of Setup for Trading Platforms

While AWS offers impressive capabilities and precise timing features, setting it up for live trading is a complex process. It requires advanced technical skills and ongoing management to ensure stability during trading hours.

One challenge is AWS’s maintenance schedule, which is determined by the platform and may conflict with trading sessions. Additionally, AWS uses shared infrastructure, which can result in CPU steal time spikes of 5–15% during periods of high market activity. These spikes can delay order execution, potentially impacting trade outcomes in fast-moving markets.

For traders who are comfortable managing cloud infrastructure and need resources for tasks like backtesting or training machine learning models, AWS is a powerful option. However, for live trading in stocks and options, the platform’s complexity and lack of trading-specific features make it less practical compared to turnkey solutions designed for active traders.

4. Microsoft Azure

Latency to NYSE/NASDAQ

Microsoft Azure operates numerous data centers across the U.S., with its US East region in Virginia being the closest to New York’s financial hubs. However, Azure’s general-purpose cloud design can’t match the ultra-low latencies – like the 0.52ms achieved by specialized trading setups – needed for high-frequency trading. This gap highlights the challenges for traders who rely on microsecond-level precision. While Azure can support trading platforms, it lacks the direct cross-connects and optimized routing paths critical for ultra-fast execution.

For traders, overcoming Azure’s latency limitations often requires significant manual fine-tuning.

Trading-Specific Optimization

To make Azure suitable for trading, users must dive deep into manual configurations. Setting up a Windows Server 2022 environment is essential to reduce system overhead and streamline network routing. High-performance CPUs and sufficient RAM are also key to handling complex trading analytics. Beyond hardware, traders need to implement 24/7 heartbeat monitoring and automated failover systems to ensure uninterrupted operation, especially during volatile market conditions. These customizations demand ongoing maintenance and a high level of technical expertise.

Pricing and Value

Azure’s pricing operates on a pay-as-you-go model. A basic instance with 4 CPU cores and 16GB of RAM – sufficient for platforms like Thinkorswim or Interactive Brokers TWS – typically costs between $70 and $120 per month, covering compute, storage, and data transfer. However, total monthly expenses can exceed $150, depending on additional usage. Traders must weigh these costs against the performance and reliability demands of a low-latency trading environment.

Ease of Setup for Trading Platforms

Using Azure for live trading isn’t straightforward. It requires advanced cloud knowledge and constant oversight. Traders need to configure remote desktop access, enable multi-monitor RDP support, and establish strong security protocols to safeguard trading capital and sensitive API keys. Additionally, Microsoft’s scheduled maintenance windows can sometimes clash with market hours, and the shared infrastructure may experience performance dips during peak times. These complexities can make it challenging for traders who prioritize consistent uptime and execution quality.

5. Vultr

Latency to NYSE/NASDAQ

Vultr’s data center in Secaucus, New Jersey, is strategically located near the Equinix NY4 facility. This setup allows for potential latency of under 1 millisecond, which is critical for traders. However, the lack of direct fiber-optic cross-connects can introduce variability in latency, making performance less predictable. This creates a balance between high-speed access and the flexibility of customizable environments.

Trading-Specific Optimization

Vultr provides specialized plans like High Frequency and Optimized Cloud Compute, designed for trading needs. These plans feature dedicated CPU resources clocked above 3 GHz, making them compatible with platforms such as Interactive Brokers TWS and Thinkorswim. However, traders are responsible for fine-tuning their setups, which involves configuring Windows Server, optimizing network settings, and implementing necessary security measures. These additional steps are crucial but require technical expertise to ensure smooth operation.

Pricing and Value

The High Frequency 2GB plan starts at $12.00 per month, but for a more reliable trading setup, you’ll likely need at least 4 GB of RAM and 2 vCPUs. For higher performance, the Optimized Cloud Compute tier – powered by AMD EPYC processors – starts at $28.00 per month for the basic configuration. Keep in mind, Windows licenses are not included and come with an extra monthly charge. Optional features like DDoS protection (an additional $10.00 per month) and automated backups (adding 20% to the base cost) can significantly increase the overall price.

Ease of Setup for Trading Platforms

Setting up Vultr for live trading requires a hands-on approach. Traders must manually install and configure Windows Server, optimize the network, enable remote desktop access, and secure the environment. While Vultr’s control panel simplifies the deployment of instances, its shared infrastructure can lead to performance fluctuations during peak times. This makes Vultr a better fit for traders with experience in managing cloud infrastructure who can handle ongoing monitoring and troubleshooting.

6. DigitalOcean

DigitalOcean stands out as a platform designed primarily for developers and web applications, rather than for trading-specific needs.

Latency to NYSE/NASDAQ

While DigitalOcean operates data centers in the New York metro area, its infrastructure is built on standard cloud services rather than specialized financial-grade setups. Unlike providers that co-locate hardware in facilities like Equinix NY4, with direct fiber-optic connections designed for ultra-low latency (sub-1 millisecond) to NYSE and NASDAQ, DigitalOcean lacks such routing optimizations. As a result, traders may experience higher round-trip times, especially during high-demand periods like market opens or rapid price movements. This can be a drawback for those relying on split-second execution.

Trading-Specific Optimization

DigitalOcean’s focus on developers means it doesn’t cater to the unique needs of trading workflows. For instance, it doesn’t provide pre-configured Windows Server environments, leaving traders to handle manual installation and fine-tuning for performance. Additionally, its support team lacks expertise in trading software or broker connectivity, so resolving trading-related issues during critical times falls entirely on the user.

Pricing and Value

Although DigitalOcean offers competitive pricing for general use, the demands of live trading often require costly upgrades and additional licensing. This highlights the gap between its affordability for web applications and the higher requirements of trading environments, such as low-latency performance and specialized configurations.

Ease of Setup for Trading Platforms

Setting up a trading platform on DigitalOcean can be challenging. It requires advanced knowledge of server administration and network optimization. Traders must handle everything from installation to securing and maintaining their systems. Moreover, the use of shared infrastructure can result in inconsistent performance during periods of market volatility, adding another layer of complexity for trading professionals.

7. Linode (Akamai)

Linode, now part of Akamai, operates out of its Newark data center and is designed for general cloud workloads rather than trading-specific needs.

Latency to NYSE/NASDAQ

While Newark’s location offers decent proximity to major exchanges like NYSE and NASDAQ, Linode’s standard routing practices can result in higher latency, especially during periods of market volatility. This makes it less ideal for traders who rely on ultra-low latency for high-frequency trading.

Trading-Specific Optimization

Linode’s platform is heavily Linux-focused, which means traders who require Windows environments must handle the installation and configuration themselves. This includes setting up a graphical interface and remote desktop access. (which may require troubleshooting RDP connection issues manually) These extra steps can slow down deployment, especially for traders who prefer pre-configured solutions. Additionally, Linode’s support is limited to its core infrastructure, leaving users to troubleshoot software-level issues on their own.

Pricing and Value

Although Linode offers competitive base pricing, the added costs for Windows licensing and manual configuration can quickly add up. Resource sharing on Linode’s infrastructure may also lead to performance dips during high trading volumes, further impacting its cost-effectiveness for trading applications.

Ease of Setup for Trading Platforms

Setting up a trading environment on Linode requires a fair amount of technical know-how. Traders need to manually handle Windows installation, configure the network, and fine-tune the system – a process that can be time-consuming compared to pre-configured solutions. For those who prioritize quick setup and seamless performance, this added complexity may become a significant drawback.

8. Hetzner

Hetzner runs data centers in Ashburn, Virginia, and Hillsboro, Oregon, offering high-performance hardware at competitive prices. While its services are well-suited for general hosting, they lack the specialized features needed for trading-specific applications.

Latency to NYSE/NASDAQ

The Ashburn data center is geographically closer to New York compared to Hetzner’s European facilities, but it doesn’t achieve the ultra-low latencies that New York metro data centers provide. This makes it less ideal for traders seeking sub-millisecond latency for high-frequency trading.

Trading-Specific Optimization

Hetzner offers robust server configurations but doesn’t include pre-built optimizations for trading. As Kuberns Blog points out, "Hetzner is a traditional infrastructure provider. You get powerful machines, but everything else is still your responsibility". This means traders must handle tasks like installing Windows Server, configuring remote desktop access, setting up security protocols, and optimizing networks themselves. Additionally, Hetzner lacks integrated support for popular trading platforms such as Interactive Brokers, Thinkorswim, or TradeStation. While the lower pricing is appealing, it comes at the cost of requiring significant technical know-how.

Pricing and Value

Hetzner’s pricing is budget-friendly, but it doesn’t include trading-specific features. Entry-level plans start at $4.09 per month for 2 vCPUs and 4 GB of RAM, while mid-tier plans with 4 vCPUs and 8 GB of RAM cost $6.43 per month. Both plans include a 20 TB monthly data allowance and 99.99% uptime guarantees. However, in the U.S., Hetzner only offers AMD-based virtual machines rather than bare-metal servers , unlike dedicated trading servers optimized for high-performance execution, and backup services come with an additional 20% fee. The lack of automated configurations adds to the time and effort required for setup, which could be a drawback for traders who prioritize efficiency.

Ease of Setup for Trading Platforms

Creating a trading environment on Hetzner involves manually setting up Windows Server and optimizing network configurations. This process requires advanced technical skills, making it a challenging choice for active traders who need a quick and reliable setup for seamless market execution.

9. Leaseweb

Leaseweb operates data centers across the U.S., with key facilities in New York and Chicago. These locations are strategically positioned near major financial exchanges, offering general-purpose VPS infrastructure built on reliable hardware. However, the company doesn’t provide trading-specific optimizations, which makes it a versatile but not specialized option for traders. Its broad network footprint allows for a closer look at its performance metrics.

Latency to NYSE/NASDAQ

Leaseweb’s network delivers around 2ms latency to major exchanges like NYSE and NASDAQ. While this is sufficient for basic trading needs, it doesn’t meet the demands of ultra-low latency trading. The company guarantees 99.9% uptime through its SLA and operates a core network with over 10 Tbps bandwidth capacity. This ensures stable connectivity, though the latency highlights its focus on general-purpose hosting rather than high-frequency trading.

Trading-Specific Optimization

Unlike providers tailored for traders, Leaseweb doesn’t offer pre-configured trading environments or optimizations for platforms like Interactive Brokers, Thinkorswim, or TradeStation. Instead, it provides high-performance compute and memory-optimized instances that require manual configuration. This setup is ideal for general hosting but demands additional effort for users looking to fine-tune their trading environments.

Pricing and Value

Leaseweb’s pricing is competitive, offering a solid resource-to-price ratio among affordable VPS hosting solutions for futures trading. Here’s a breakdown of its VPS plans:

- VPS 1: $3.50/month (or $3.15 with a one-year commitment)

Includes 4 CPU cores, 6 GB RAM, 100 GB storage, and 30 TB monthly data transfer. - VPS 2: $9.00/month

Includes 6 CPU cores and 16 GB RAM. - VPS 3: $14.60/month

Offers 8 CPU cores and 24 GB RAM. - VPS 5: $36.70/month

Features 16 CPU cores and 64 GB RAM.

While these plans are affordable, performance benchmarks show mixed results, particularly in network and disk I/O. Additionally, provisioning times average over 5 hours, which can be a drawback for traders needing immediate deployment during market hours.

Ease of Setup for Trading Platforms

Setting up a trading environment on Leaseweb requires manual configuration and a fair amount of technical expertise. Without trading-specific support, users must handle connectivity troubleshooting and execution speed optimization themselves. While Leaseweb’s pricing is appealing, the time and effort needed for setup make it better suited for tech-savvy, budget-conscious traders rather than those seeking quick and seamless deployment for trading.

10. Hostinger

Hostinger is primarily known as a beginner-friendly VPS provider, but its offerings fall short for high-frequency traders. While it does offer "Forex VPS" plans tailored for MetaTrader 4 and 5, these plans are not compatible with platforms like Interactive Brokers, Thinkorswim, or TradeStation. Additionally, its data centers in Phoenix, Boston, and Asheville are far from New York’s financial hubs, which limits its ability to provide the low latency necessary for trading success.

Latency to NYSE/NASDAQ

Hostinger’s geographic disadvantage plays a key role in its latency issues. With no data centers near NYSE or NASDAQ, traders face higher latency levels that can impact trade execution speed. Hostinger’s infrastructure is designed for general web applications, not the sub-1ms latency needed for high-frequency trading. For comparison, professional setups often rely on co-located data centers like Equinix NY4, where exchange engines operate directly.

Trading-Specific Optimization

Hostinger’s technical limitations further complicate its use for trading. The company only offers Linux-based KVM VPS servers, which creates hurdles for traders who rely on native Windows environments. Popular trading platforms like Interactive Brokers TWS and Thinkorswim require Windows and Java to function properly, forcing traders to use tools like Wine to emulate a Windows environment. Unfortunately, Hostinger does not support custom Windows OS images or provide Windows Server licenses, leaving traders to manage these workarounds on their own.

Financial infrastructure analyst Arturo Ferracuti highlights that Hostinger’s Linux servers depend on unstable emulation layers for running Windows-based trading applications, which can lead to inconsistent performance. Moreover, the company’s 99.9% uptime guarantee allows for up to 43.2 minutes of downtime each month, a potential issue during critical trading hours.

Pricing and Value

At first glance, Hostinger’s pricing seems budget-friendly, but renewal rates rise significantly after the initial promotional period:

| Plan | Promotional Price | Renewal Price | vCPU Cores | RAM | NVMe Storage |

|---|---|---|---|---|---|

| KVM 1 | $4.99/mo | $9.99/mo | 1 | 4 GB | 50 GB |

| KVM 2 | $6.99/mo | $12.99/mo | 2 | 8 GB | 100 GB |

| KVM 4 | $9.99/mo | $24.99/mo | 4 | 16 GB | 200 GB |

| KVM 8 | $19.99/mo | $49.99/mo | 8 | 32 GB | 400 GB |

These promotional prices require a 24- or 48-month commitment. However, technical reviews point out that the 1 vCPU plans often struggle with resource-intensive trading applications, leading to CPU bottlenecks and performance issues.

Ease of Setup for Trading Platforms

Setting up trading platforms on Hostinger is a labor-intensive process. Without native Windows support or trading-specific services, users must manually install Linux desktop environments, configure emulation layers, and troubleshoot compatibility problems. This added complexity makes Hostinger a poor fit for traders who need quick and reliable solutions during active market hours.

11. Scala Hosting

Scala Hosting provides a hosting solution with infrastructure based in New York, primarily designed for web hosting rather than trading. Traders looking to use platforms like Interactive Brokers, Thinkorswim, or TradeStation will need to manually configure Scala Hosting‘s managed or unmanaged VPS options to meet their needs.

Latency to NYSE/NASDAQ

Scala Hosting’s New York-based infrastructure places it geographically close to the NYSE and NASDAQ data centers, which can help reduce latency for traders. The servers are equipped with processors running up to 4.1 GHz and supported by 10 Gbps redundant networks to minimize delays in execution. However, the company does not provide specific latency benchmarks for exchange matching engines, unlike high-performance VPS providers that specialize in trading. Additionally, its infrastructure lacks the fine-tuned routing optimizations that professional traders often require for high-speed trading.

Trading-Specific Optimization

When it comes to trading, Scala Hosting has notable limitations. Its proprietary SPanel is tailored for web hosting rather than trading and defaults to a Linux environment. Traders aiming to run trading platforms will need to switch to Windows Server, which incurs additional costs. Moreover, the absence of pre-configured trading setups and dedicated trading support means users must handle all configurations and optimizations on their own.

Pricing and Value

Scala Hosting’s unmanaged Cloud VPS plans start at $14.96 per month as a promotional rate, which later increases to $24.95 per month. For traders requiring higher performance, upgraded plans are priced at $49.95 and $95.95 per month. Additional costs include Windows Server licensing, extra CPU cores at $10 per month per core, and additional RAM at $3 per month per GB. While the service offers a 99.9% uptime guarantee, this translates to potential downtime of up to 43.2 minutes per month.

Ease of Setup for Trading Platforms

Setting up a trading platform on Scala Hosting is a manual process. Users must select the operating system, install the trading software, and optimize the network settings themselves. While server activation is quick – taking less than 30 seconds – and support responses are fast at around 15 seconds, the complete setup process can take hours or even days. This level of complexity can be a significant hurdle for traders who need immediate, ready-to-go performance during critical trading windows. These challenges make the platform less suitable for those seeking a seamless trading experience. For a more reliable alternative, many traders look for best rated VPS for trading that offer pre-configured environments.

12. Kamatera

Kamatera is a cloud provider offering servers in locations like New York City and Chicago, making it a viable option for traders using platforms like Interactive Brokers, Thinkorswim, or TradeStation. However, users need to set up and fine-tune their trading environments manually, as Kamatera doesn’t come with pre-configured trading optimizations.

Latency to NYSE/NASDAQ

With a data center in New York City, Kamatera offers proximity to the NYSE and NASDAQ, which helps reduce latency for U.S. equity and options trading. That said, the provider doesn’t publish specific benchmarks or offer optimized routing for trading platforms. This lack of transparency makes it harder to gauge low latency futures trading potential without manual testing. While the infrastructure guarantees 99.95% uptime, traders will need to tweak their connections to achieve the best performance for futures trading.

Trading-Specific Optimization

Kamatera delivers standard Windows or Linux installations, but it doesn’t include any trading-specific enhancements. This means traders are responsible for installing their platforms, configuring their environments, and optimizing network settings. There’s no built-in support for trading workflows or expertise in platforms like IBKR TWS or Thinkorswim.

Pricing and Value

Kamatera’s pricing starts at $4.00 per month for a basic setup that includes 1 vCPU (2.6GHz), 1GB RAM, and 20GB SSD. For those needing more power, configurations such as 2 vCPUs (5.33GHz), 2GB RAM, and 30GB SSD are available for about $12.00 per month. The platform also offers flexible billing options and a 30-day free trial with $100 in credit.

Ease of Setup for Trading Platforms

While Kamatera boasts rapid server deployment in under 60 seconds, the process doesn’t stop there for traders. Users need to manually install their trading software, adjust settings, and optimize network configurations. Without pre-configured templates, this setup can take significant time, making it less convenient for traders who need a quick, market-ready solution.

Pros and Cons

When selecting a VPS for stocks and options trading, factors like ultra-low latency, trading-focused optimizations, transparent pricing, and ease of setup are crucial. QuantVPS is designed specifically with these needs in mind, providing a ready-to-use environment so traders can focus on their strategies instead of worrying about server configurations.

Here’s a quick overview of what QuantVPS offers:

| Feature | QuantVPS |

|---|---|

| Latency | Sub-1ms (optimized New York colocation) |

| Trading Optimization | Pre-configured for Interactive Brokers, Thinkorswim, and TradeStation |

| Starting Price | $59.99/mo ($41.99/mo when billed annually) |

| Setup Difficulty | Very Low – Trading-ready environment |

Pros

- Ultra-low latency: Ensures minimal delays in order execution, helping to reduce slippage. For those trading futures, specialized VPS for Tradovate options provide similar low-latency connections to Chicago-based exchanges.

- Pre-configured environment: Comes with Windows Server already set up, eliminating the hassle of manual configuration.

- Straightforward pricing: Includes trading optimizations and Windows licensing, making costs predictable and transparent.

- Expert support: A team familiar with major trading platforms helps you get your strategies up and running quickly.

Cons

- Premium pricing: As a specialized trading VPS, it costs more than general-purpose hosting options.

- Limited flexibility: The optimized setup is designed for trading, which might not suit non-trading applications.

For active stock and options traders who need reliable performance and fast deployment, QuantVPS offers a trading-ready platform that eliminates infrastructure headaches. When every millisecond matters, this VPS is built to keep you connected and executing seamlessly.

Conclusion

Choosing the right VPS for stocks and options trading in 2026 boils down to three key considerations: low latency to U.S. exchanges, dependable platform performance, and trading-specific features. For active traders working with the NYSE and NASDAQ, being physically close to the exchanges can make all the difference between seamless trade execution and costly slippage. These elements create a trading environment where every millisecond truly matters.

QuantVPS stands out with sub-1ms latency and pre-configured Windows Server setups tailored for trading, starting at $59.99/month (or $41.99/month with annual billing). This eliminates the hassle of setting up infrastructure from scratch. Impressively, as of late December 2025, the platform supported over $16.49 billion in daily futures volume, proving it can handle the demands of professional traders.

For scalpers, algorithmic traders, and those relying on automated strategies, including copy trading setups, QuantVPS offers 99.99% uptime and robust DDoS protection, ensuring your trades remain secure – even during unexpected local outages. With its trading-focused system, you can deploy strategies in just minutes, giving you the edge when every millisecond counts. QuantVPS delivers the reliability and speed that professional traders need – without the complexity of enterprise cloud solutions.

FAQs

Why is low latency crucial for stock and options trading?

Low latency plays a critical role in stock and options trading by enabling faster order execution. In markets where every millisecond counts, reducing delays can mean the difference between securing the best price or dealing with slippage.

This is especially important for traders using algorithmic strategies or handling options spreads. They depend on low-latency connections to ensure their orders reach major exchanges like NYSE and NASDAQ as quickly as possible. This speed is crucial for maintaining consistent execution, particularly during periods of high volatility or rapid market fluctuations.

How does QuantVPS reduce delays in trade execution for stocks and options trading?

QuantVPS delivers lightning-fast trade execution by hosting state-of-the-art servers in a New York data center. Positioned just 1–2 milliseconds away from major U.S. equity and options exchanges, this setup significantly cuts down on latency – an essential factor for executing orders quickly and accurately.

To further enhance performance, QuantVPS employs optimized high-speed network routing paired with redundant connections. This ensures ultra-low latency and exceptional reliability, even during intense market activity or periods of high volatility.

Which trading platforms are supported and pre-configured with QuantVPS?

QuantVPS is built to integrate effortlessly with many well-known trading platforms. These include Interactive Brokers (IBKR), Thinkorswim, TradeStation, DAS Trader Pro, NinjaTrader, MetaTrader 4/5, Quantower, TradingView, cTrader, MultiCharts, Sierra Chart, and others.

The VPS comes pre-configured for these platforms, so you can dive into trading right away without worrying about lengthy installations or fine-tuning. It’s a great fit for traders juggling multiple tools or executing intricate trading strategies.