What Is the Consistency Rule? Understand Targets & Rules for Funded Accounts

The Consistency Rule is a guideline used by proprietary trading firms to ensure traders achieve steady profits instead of relying on one big win. It limits the percentage of total profits that can come from a single trading day - typically between 20% and 50%, depending on the firm. If you exceed this limit, payouts are paused until you trade more and balance your profit distribution. This rule helps firms identify disciplined traders who can manage risk effectively over time, often by monitoring metrics like trailing drawdown.

Key Points:

- Purpose: Encourages steady trading and reduces reliance on high-risk trades.

- Enforcement: If breached, withdrawals are paused until compliance is restored.

- Thresholds: Vary by firm, ranging from 20% to 50%.

- Example: If your total profit is $10,000 and the rule is 40%, no single day can exceed $4,000 in profit.

To comply, focus on spreading profits across multiple days, monitor your daily gains, and use risk management strategies. Breaching the rule doesn’t terminate your account but delays payouts until you meet requirements again.

How The Consistency Rule REALLY Works (Calculator Included)

What Is the Consistency Rule?

The Consistency Rule is a risk management guideline designed to ensure that profits come from steady trading instead of a single big win. It works by capping the percentage of your total profit that can come from any one trading day - usually between 30% and 50%, depending on the firm. If your profit from a single day exceeds this limit, you’ll need to keep trading until your overall profits dilute that day’s percentage enough to meet the rule.

This isn’t about penalizing success. Instead, it’s about encouraging consistent, lower-risk performance. As MyFundedFutures explains:

"The consistency rule is a requirement that ensures traders generate profits through steady, repeatable performance rather than relying on a single outsized trade."

"The consistency rule is a requirement that ensures traders generate profits through steady, repeatable performance rather than relying on a single outsized trade."

How this rule is enforced depends on whether you’re in the evaluation phase or the funded stage. During evaluations, exceeding the threshold increases your profit target. Once funded, breaking the rule may temporarily pause your withdrawal eligibility, similar to Apex PA account rules regarding profit targets and risk management. To regain compliance, you’ll need to generate smaller, additional profits to reduce the impact of that one big trading day. For instance, if you made $4,500 in one day out of a $10,000 total (45%) and the firm’s limit is 40%, you’d need to add $2,000 in new profits. This would bring your total to $12,000, lowering the big day’s percentage to 37.5% and putting you back in compliance. These mechanics highlight why firms rely on the Consistency Rule.

Why Proprietary Firms Use This Rule

Proprietary firms enforce the Consistency Rule to protect their capital and identify traders who can manage risk consistently across different market conditions. The rule acts as a filter, separating skilled traders from those who might pass evaluations with a few high-risk trades. Fred Harrington, Founder of Vetted Prop Firms, puts it this way:

"The prop firm consistency rule is one of those make-or-break challenges that separates real traders from lucky guessers."

"The prop firm consistency rule is one of those make-or-break challenges that separates real traders from lucky guessers."

Firms value predictable, disciplined traders. Between January 2024 and July 2025, only 20.35% of evaluation accounts at MyFundedFutures advanced, and just 28.56% of those reaching the simulated funded stage earned at least one payout. These numbers illustrate why the rule is so important: it identifies the small percentage of traders who can deliver steady, sustainable results in leveraged markets, where mistakes can quickly spiral. For firms, this rule helps make payouts more predictable and protects their capital from impulsive, high-stakes trading. It’s about creating a sustainable partnership with traders who show consistent skill rather than relying on luck. This approach not only safeguards firm capital but also fosters disciplined trading habits.

How It Promotes Steady Profits

The Consistency Rule pushes traders to focus on smaller, well-thought-out positions instead of chasing one big win. Knowing that no single day can dominate your profit results naturally encourages a more measured approach. This means sticking to fixed risk per trade, keeping position sizes stable, and spreading gains across multiple sessions. This strategy smooths out your equity curve and helps prevent emotionally driven over-leveraging.

Many firms also require a minimum number of trading days - often at least five - during an evaluation period to ensure that your performance reflects skill rather than a lucky streak. As Myfxbook explains:

"Consistency rules exist to stop 'one-hit wonder' passes and encourage repeatable trading."

"Consistency rules exist to stop 'one-hit wonder' passes and encourage repeatable trading."

Take two traders as an example: one earns 0.8% daily over 10 days, while another makes 7.5% in a single day but shows minimal gains afterward. Firms will almost always prefer the first trader because their performance demonstrates a repeatable edge, not a statistical anomaly. By focusing on consistent gains, the Consistency Rule helps traders develop a process that prioritizes steady, sustainable performance over short-term profit spikes - an essential mindset for long-term success in funded trading.

How to Calculate the Consistency Rule

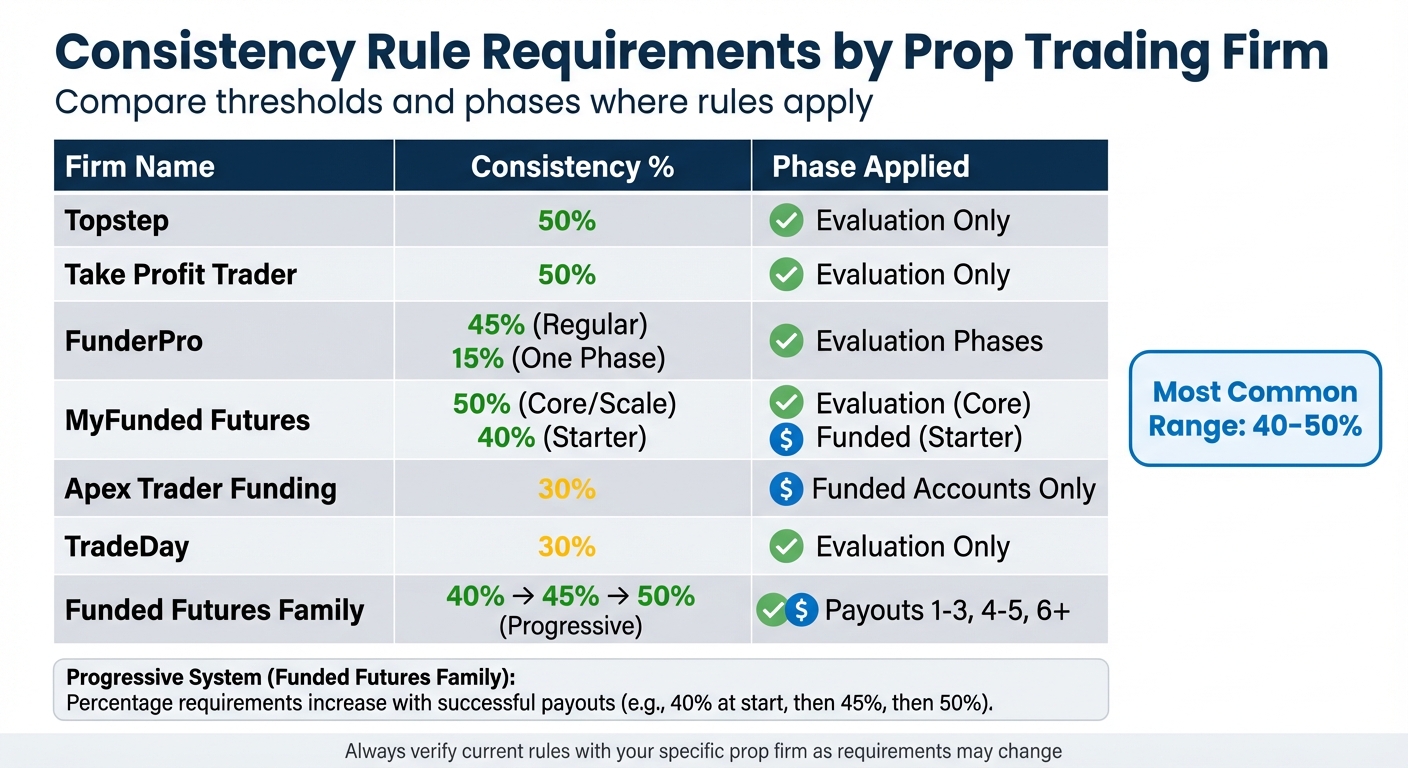

Proprietary Trading Firms Consistency Rule Thresholds and Requirements Comparison

Proprietary Trading Firms Consistency Rule Thresholds and Requirements Comparison

Grasping these calculations is key to staying eligible and developing disciplined trading habits - both of which are crucial for long-term success in funded accounts.

The Consistency Rule Formula

The formula ensures your largest single-day profit doesn’t exceed the allowed percentage of your total gains:

(Largest Daily Profit / Total Realized Profit) × 100 = Current Consistency %

To comply, keep your consistency percentage below your firm's threshold, which typically ranges from 30% to 50%. For instance, if the limit is 40% and your percentage hits 45%, you’ll need to generate additional profits to dilute the excess.

You can also reverse the formula to determine the maximum profit you’re allowed to make in a single day:

Total Realized Profit × Consistency % = Maximum Allowed Daily Profit

Example: If your total profit is $10,000 and the firm enforces a 40% rule, your highest single-day profit can’t exceed $4,000 ($10,000 × 0.40).

If you breach the rule, calculate the extra profit needed to regain compliance with this formula:

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Largest Daily Profit / Consistency % = Total Profit Needed for Payout

For example, say your biggest day brought in $3,500 and the firm’s limit is 30%. To comply, your total profit must reach $11,667 ($3,500 / 0.30). If you’re currently at $9,000, you’ll need an additional $2,667 while ensuring no single day surpasses the allowed limit. By applying these formulas, you can set realistic daily trading goals based on your firm’s requirements.

Common Consistency Percentages

Once you’ve done the math, compare your results to typical firm thresholds to fine-tune your strategy.

Most firms set consistency limits between 40% and 50%, though some adopt stricter or more lenient rules depending on the account type and payout phase. For example, FunderPro allows a 45% limit for regular challenges but imposes a stricter 15% cap for its One Phase Challenges. Apex Trader Funding applies a 30% rule exclusively to funded accounts, while Topstep enforces a 50% threshold during evaluations and removes the rule entirely for funded accounts.

Some firms adjust their percentages as traders progress through payout cycles. Funded Futures Family, for instance, starts with a 40% limit for the first three payouts, raises it to 45% for the fourth and fifth payouts, and increases it to 50% from the sixth payout onward. This tiered approach rewards traders for consistent performance by gradually relaxing the restriction.

| Firm | Consistency % | Phase Applied |

|---|---|---|

| Topstep | 50% | Evaluation Only |

| Take Profit Trader | 50% | Evaluation Only |

| FunderPro | 45% (Regular) / 15% (One Phase) | Evaluation Phases |

| MyFunded Futures | 50% (Core/Scale) / 40% (Starter) | Evaluation (Core) / Funded (Starter) |

| Apex Trader Funding | 30% | Funded Accounts Only |

| TradeDay | 30% | Evaluation Only |

Real Trading Examples: Compliance vs. Breach

These scenarios illustrate how daily trading activities can influence payout eligibility and account status. They highlight the importance of managing daily profits to stay within compliance guidelines.

Example of Following the Rule

Let’s look at a trader participating in a FunderPro Classic evaluation on a $100,000 account. The profit target is $10,000, with a 40% daily profit limit. Here's how the trader distributes their gains over four days:

- Day 1: +$2,500

- Day 2: +$3,500

- Day 3: +$2,000

- Day 4: +$2,000

- Total Profit: $10,000

The highest daily profit, $3,500, amounts to 35% of the total profit - comfortably below the 40% threshold. As a result, the trader successfully passes the evaluation and qualifies for a funded account. This example shows how spreading profits over multiple days ensures compliance while efficiently reaching the target.

Example of Breaking the Rule

Now, consider a trader undergoing an Alpha Futures $50,000 Standard Evaluation. The profit target is 6% ($3,000), with a 50% consistency rule. Here's how their daily profits look:

- Day 1: +$2,100

- Day 2: +$450

- Day 3: +$450

- Total Profit: $3,000

The largest daily profit, $2,100, makes up 70% of the total - well above the 50% limit of $1,500. To meet compliance, the total profit must increase to $4,200 ($2,100 / 0.50), reducing the largest day’s share to the required 50%. Until this adjustment is made, the trader cannot progress in the evaluation or receive payouts.

What Happens When You Break the Consistency Rule

Here’s what happens when you step outside the boundaries of the Consistency Rule.

Breaking the consistency rule doesn’t mean the end of your trading account - it simply limits your ability to move forward or withdraw funds. Most firms classify this as a "soft" violation, meaning your account remains active, but you’ll face certain restrictions until the issue is resolved. You can keep trading, but advancing to the next stage or withdrawing profits will be off the table until you meet the rule’s requirements.

Consequences During Evaluation

If you go over the consistency threshold during the evaluation phase, you won’t be able to progress to the funded stage right away. Instead, you’ll need to keep trading to bring your largest day’s percentage of total profits back within the acceptable range.

"Exceeding 50% does not breach your account. ... you trade additional days until the requirement is met."

- MyFundedFutures

"Exceeding 50% does not breach your account. ... you trade additional days until the requirement is met."

- MyFundedFutures

For example, let’s say you’re in a MyFundedFutures Core evaluation, which has a 50% rule. If one trading day accounts for 61% of your total profits, you’ll need to continue trading to increase your overall gains. This will dilute the impact of that high-profit day until it falls to 50% or less. Essentially, your evaluation period could stretch longer as you work to meet the rule’s criteria.

Funded accounts, on the other hand, come with their own set of consequences when the rule is breached.

Consequences in Funded Accounts

Once you’ve reached the funded stage, breaking the consistency rule halts your ability to withdraw profits. Your account stays active, and you can still trade, but withdrawals will remain on hold until you meet the rule’s requirements again. The firm will notify you of the issue and provide specific instructions on how to fix it.

"This is not a breachable offense. If your payout is denied due to the consistency rule, we'll kindly inform you and explain how your account can be brought into compliance."

"This is not a breachable offense. If your payout is denied due to the consistency rule, we'll kindly inform you and explain how your account can be brought into compliance."

For instance, imagine a trader on the MyFundedFutures Starter Plan who earns $10,000 in total profits, with $4,500 of that coming from a single day - 45% of the total. Since this exceeds the plan’s 40% rule, their withdrawal request would be paused. To fix this, the trader continues trading and earns an additional $2,000, bringing their total profits to $12,000. At that point, the $4,500 day now represents just 37.5% of the total, meeting the rule’s requirements and unlocking the withdrawal. Essentially, you’ll need to grow your profits further to bring the percentages back into compliance.

How to Stay Compliant with the Consistency Rule

Staying on the right side of the Consistency Rule requires a disciplined approach and the right tools. The goal is simple: avoid letting a single trading day dominate your total profits while maintaining steady performance throughout your evaluation or payout period. Here’s how you can achieve that.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Set Daily Profit Limits

One of the easiest ways to avoid breaching the rule is by capping your daily profits. For example, if your profit target is $3,000 under a 30% rule, make sure no single day exceeds $900. To play it safe, consider setting a daily cap between $400 and $600. This spreads your profits over multiple days and reduces the risk of one day becoming disproportionately large.

Once you hit your daily target, stop trading. Continuing beyond that point increases the likelihood of a single day skewing your overall profit distribution, which could jeopardize your compliance with the rule.

Apply Risk Management Techniques

Risk management is another critical element. Use fixed position sizing to ensure no single day produces profits that exceed acceptable thresholds. For instance, risking a consistent percentage of your capital - such as 1% or 2% - on each trade helps stabilize your performance and discourages high-risk, “all-in” trades.

Keep track of your daily profits to make sure your highest-earning day stays within limits. For example, if your total profit is $10,000 and your best day brought in $3,200, that’s 32% - a violation under a 30% rule but acceptable under a 50% rule. Regular monitoring ensures you stay compliant[29, 31].

Use Reliable Trading Infrastructure

Technical issues can throw a wrench in your plans for consistency. Delayed order execution, slippage, or platform crashes during key moments can lead to unintentional trades that disrupt your profit distribution. That’s why having a dependable trading setup is crucial.

QuantVPS offers a stable and low-latency environment (0–1ms) with 100% uptime, making it a solid choice for traders - especially those relying on algorithms for precise entry and exit points. For traders with lighter needs, the VPS Lite plan starts at $59.99/month (or $41.99/month billed annually) and includes 4 cores, 8GB RAM, and 70GB NVMe storage on Windows Server 2022. If your setup is more demanding, the VPS Pro plan at $99.99/month (or $69.99/month billed annually) offers 6 cores, 16GB RAM, and support for up to 2 monitors. These options ensure your platform remains stable, even during volatile market conditions, helping you stay on track with your daily profit targets.

Conclusion

The Consistency Rule is what sets disciplined traders apart from those who rely on luck. Proprietary trading firms use this rule to ensure that success stems from repeatable skills rather than a single, fortunate trade. As MyFundedFutures explains:

"The consistency rule is a training tool that builds the discipline required to survive in leveraged markets".

"The consistency rule is a training tool that builds the discipline required to survive in leveraged markets".

This rule ensures no single day accounts for the majority of your gains, helping firms protect their capital while teaching traders to manage risks across varying market conditions.

To comply, traders must focus on capping daily gains, maintaining consistent position sizes, and using reliable tools. A dependable trading platform plays a key role in executing these strategies smoothly. For instance, QuantVPS offers 0–1ms latency and 100% uptime, ensuring technical issues don’t interfere with your trades. Whether you’re running automated systems or handling manual setups, this infrastructure ensures your orders execute at the intended prices without slippage.

If you breach the rule, firms will pause payouts until you balance out that oversized trading day with more stable performance. The consequence? You miss opportunities to scale your capital. Demonstrating consistency proves to firms that you’re ready to handle larger accounts, making it an essential step in your trading journey.

FAQs

What is the Consistency Rule, and how can traders follow it effectively?

The Consistency Rule is a standard many proprietary trading firms use to assess a trader's performance over time. It emphasizes steady profits rather than relying on one big win. To align with this rule, traders should focus on three main areas:

- Avoid depending on a single trading day: Your best trading day shouldn't account for more than a specific percentage of your total profits, often between 20% and 50%. If you find yourself exceeding this limit, consider adjusting your daily profit targets or taking a break to even out your results.

- Distribute profits across several days: Many trading programs require you to achieve profits over a set number of trading days. For instance, you might need to trade on at least five days or ensure that no single day contributes more than half of your profit target.

- Keep trade sizes and strategies consistent: Stick to similar position sizes, stop-loss levels, and risk management techniques each day. This helps prevent large swings in performance that could breach the rule.

By monitoring your performance, setting achievable daily goals, and sticking to a steady approach, you can meet the Consistency Rule and establish a reliable trading track record in funded accounts.

What happens if I break the Consistency Rule during the evaluation or after funding?

Breaking the Consistency Rule during the evaluation phase usually leads to failing the challenge, which means you won't qualify for a funded account. If the rule is broken after you've already secured funding, payouts could be paused or even denied until the account is back in compliance.

To steer clear of these setbacks, make sure to stick to the program's guidelines. Pay attention to areas like profit distribution, drawdown limits, and keeping your trade sizes consistent. Following these rules not only protects your eligibility but also sets you up for lasting success as a funded trader.

What is the Consistency Rule, and why do proprietary trading firms use it?

The Consistency Rule is a guideline many proprietary trading firms use to make sure traders show steady and reliable performance, rather than depending on a single high-risk or lucky trade. Typically, this rule limits how much of a trader's total profit can come from their best day, often capping it at around 40%–50% of overall earnings.

Here’s an example: Let’s say a trader earns $8,000 during an evaluation period, but $4,500 of that comes from just one day. Under a 50% consistency rule, this would be considered a violation. The idea is to spot traders with sustainable strategies who can handle risk responsibly without relying on risky or unpredictable trading behavior.

By applying this rule, firms safeguard their capital, minimize exposure to major losses, and build long-term relationships with traders who demonstrate disciplined and consistent performance. It’s a way to ensure funded accounts stay profitable and stable over time.

The Consistency Rule is a standard many proprietary trading firms use to assess a trader's performance over time. It emphasizes steady profits rather than relying on one big win. To align with this rule, traders should focus on three main areas:

- Avoid depending on a single trading day: Your best trading day shouldn't account for more than a specific percentage of your total profits, often between 20% and 50%. If you find yourself exceeding this limit, consider adjusting your daily profit targets or taking a break to even out your results.

- Distribute profits across several days: Many trading programs require you to achieve profits over a set number of trading days. For instance, you might need to trade on at least five days or ensure that no single day contributes more than half of your profit target.

- Keep trade sizes and strategies consistent: Stick to similar position sizes, stop-loss levels, and risk management techniques each day. This helps prevent large swings in performance that could breach the rule.

By monitoring your performance, setting achievable daily goals, and sticking to a steady approach, you can meet the Consistency Rule and establish a reliable trading track record in funded accounts.

Breaking the Consistency Rule during the evaluation phase usually leads to failing the challenge, which means you won't qualify for a funded account. If the rule is broken after you've already secured funding, payouts could be paused or even denied until the account is back in compliance.

To steer clear of these setbacks, make sure to stick to the program's guidelines. Pay attention to areas like profit distribution, drawdown limits, and keeping your trade sizes consistent. Following these rules not only protects your eligibility but also sets you up for lasting success as a funded trader.

The Consistency Rule is a guideline many proprietary trading firms use to make sure traders show steady and reliable performance, rather than depending on a single high-risk or lucky trade. Typically, this rule limits how much of a trader's total profit can come from their best day, often capping it at around 40%–50% of overall earnings.

Here’s an example: Let’s say a trader earns $8,000 during an evaluation period, but $4,500 of that comes from just one day. Under a 50% consistency rule, this would be considered a violation. The idea is to spot traders with sustainable strategies who can handle risk responsibly without relying on risky or unpredictable trading behavior.

By applying this rule, firms safeguard their capital, minimize exposure to major losses, and build long-term relationships with traders who demonstrate disciplined and consistent performance. It’s a way to ensure funded accounts stay profitable and stable over time.

"}}]}