When to Trade Silver (XAGUSD): Top Strategies for 2026

Silver enters 2026 with strong momentum after a 120% price surge in 2025, closing the year at $74.56. This rally is fueled by tight supply, growing industrial demand from green energy and electric vehicles, and supportive Federal Reserve policies. With silver in a multi-year bull market, traders can leverage specific strategies to maximize opportunities in this volatile market.

Key Takeaways:

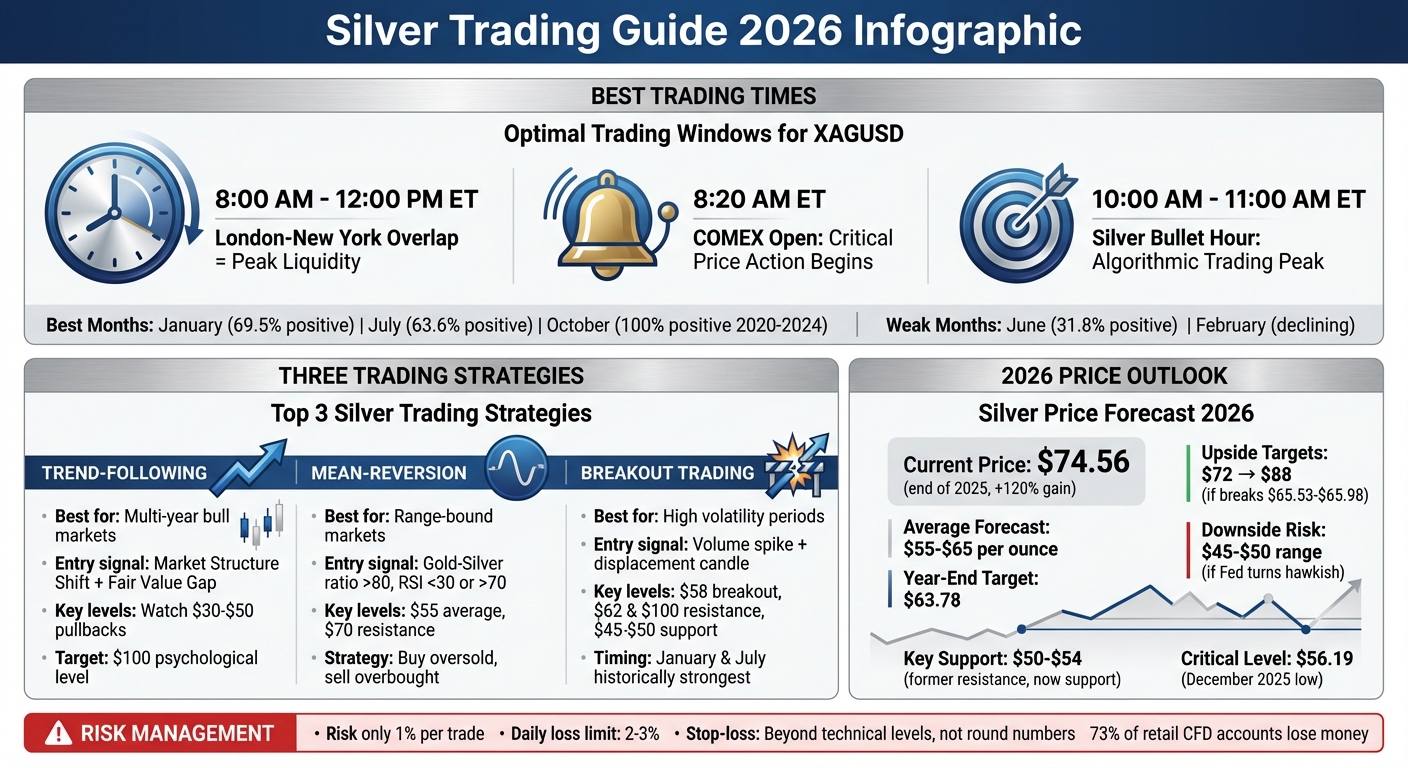

- Best Trading Window: 8:00 AM–12:00 PM ET (London-New York overlap) for peak liquidity.

- Seasonal Trends: January and July historically deliver strong returns.

-

Top Strategies:

- Trend-Following: Ride long-term momentum during pullbacks.

- Mean-Reversion: Trade range-bound markets using gold-silver ratio and RSI.

- Breakout Trading: Target sharp moves above key levels like $58 and $65.

- Trend-Following: Ride long-term momentum during pullbacks.

- Mean-Reversion: Trade range-bound markets using gold-silver ratio and RSI.

- Breakout Trading: Target sharp moves above key levels like $58 and $65.

Silver's price outlook remains bullish, with analysts forecasting an average of $55–$65 per ounce in 2026. However, risks like Federal Reserve rate changes and geopolitical tensions could impact prices. Stay disciplined with futures trading risk management and use tools like VPS for fast trade execution during volatile periods.

Silver Trading Times and Strategies for 2026

Silver Trading Times and Strategies for 2026

Best Times to Trade Silver (XAGUSD)

Trading Session Overlaps for Maximum Liquidity

If you're looking for the best time to trade silver, focus on the 8:00 AM to 12:00 PM Eastern Time window. This period sees the overlap between London's bullion banks and New York's COMEX futures market, creating a sweet spot for liquidity and volatility. Jasper Osita, Market Analyst at ACY Securities, explains:

"The London and New York overlap (8:00 AM–12:00 PM NY time) is where silver truly comes alive... European bullion banks and funds meet US futures flow on COMEX, creating peak liquidity."

"The London and New York overlap (8:00 AM–12:00 PM NY time) is where silver truly comes alive... European bullion banks and funds meet US futures flow on COMEX, creating peak liquidity."

Pay special attention to 8:20 AM ET, when the COMEX metals pit officially opens. This is when overnight orders flood in, and spot prices align with futures contracts. Traders often see dramatic price moves, including "displacement candles" and "liquidity sweeps", which can set the tone for the rest of the trading day. Together, London and New York account for over half of daily foreign exchange and commodity trades, resulting in tighter spreads and better order execution.

For day traders and those targeting breakouts, the 10:00 AM to 11:00 AM ET window - often called the "Silver Bullet" hour - is particularly interesting. This period is marked by structural breaks fueled by algorithmic trading activity. Silver's smaller market size and its significant industrial demand make it more volatile than gold, which adds to the appeal of these high-volume trading windows.

Beyond these daily liquidity peaks, seasonal trends also play a key role in timing silver trades.

Seasonal Patterns in Silver Prices

Silver prices follow distinct seasonal patterns. For example, January has delivered positive returns 69.5% of the time since 2001, driven by industrial orders placed early in the financial year. July is another strong month, with a historical profitability rate of 63.6%.

A seasonal trading strategy that focuses on December through February and July through August has historically outperformed a simple buy-and-hold approach by more than 4% annually since 2001. However, recent trends from 2020 to 2024 show some shifts. October has closed higher 100% of the time during this period, while April has shown an 80% positive occurrence rate.

On the flip side, June has been a weak performer, ending positive only 31.8% of the time, and February has also shown signs of softening in recent years. These trends suggest a cautious approach - or even opportunities for short trades - during historically weaker months, while maintaining a bullish outlook during the stronger periods.

Top Trader Forecasts Gold & Silver for 2026 – and the Black Swan That Could Derail Markets

Economic Factors That Move Silver Prices

Once you've pinpointed the best trading opportunities, it's essential to understand the economic forces that shape silver prices.

Federal Reserve Policy Effects on Silver

The Federal Reserve's interest rate decisions are the most influential factor affecting silver prices. Since silver doesn’t generate yield, its value often climbs when interest rates drop, as the cost of holding it decreases. For instance, in December 2025, the FOMC voted 9–3 to cut rates by 25 basis points, setting the fed funds range at 3.5%–3.75%. This decision propelled silver to an all-time high of $64.67 per troy ounce.

Looking ahead to 2026, traders should keep a close eye on the Fed's quarterly "dot plot", which may hint at two or three additional rate cuts this year. As James Hyerczyk, Technical Analyst at FXEmpire, puts it:

"The market wants higher - it just needs the Fed to stay out of the way."

"The market wants higher - it just needs the Fed to stay out of the way."

But rate cuts aren’t the only factor. Late in 2025, the Fed began Reserve Management Purchases of Treasury bills, injecting about $40 billion monthly into the market. This move was seen as favorable for precious metals. However, if inflation remains above 2% or rate hikes resume, silver prices could face pressure as investors pivot toward higher-yielding assets. Monitoring U.S. CPI data is critical - if inflation steadies around 3%, silver’s appeal as an inflation hedge strengthens, but it could also delay further Fed easing.

Geopolitical Events and Supply Chain Issues

Silver prices are also shaped by global political developments and supply chain challenges. Its recent inclusion on the U.S. Geological Survey's critical minerals list has added a geopolitical premium to its value. This designation has led to aggressive stockpiling in U.S. vaults, depleting inventories in major markets like London and Shanghai.

For example, President Donald Trump’s threat of 100% secondary tariffs on Russia over the Ukraine conflict and the unresolved tariff truce with China have fueled volatility. These tensions have contributed to what analysts describe as a "historic squeeze", with international inventories flowing into U.S. markets.

The supply situation remains tight. In 2026, the silver market is expected to experience its sixth consecutive year of deficits, with a projected shortfall of 117 million ounces. Adding to this challenge, 70%–80% of global silver production comes as a byproduct of mining other metals like lead, zinc, copper, or gold. This means that even rising prices won’t immediately boost supply. New mining projects are unlikely to come online before 2027–2028 due to permitting hurdles and funding constraints.

Ewa Manthey, Commodities Strategist at ING, sums it up well:

"Silver's volatility will continue next year. It can massively outperform gold in a bull market, but it can also fall harder in a downturn."

"Silver's volatility will continue next year. It can massively outperform gold in a bull market, but it can also fall harder in a downturn."

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Industrial Demand Drivers

Beyond economic policies and geopolitics, silver’s industrial applications play a huge role in its price movements. About 58% of global silver demand comes from industrial use, and this demand tends to stay steady even at high price levels. Silver’s importance in technology and manufacturing, combined with its relatively small share of total production costs, ensures that industries keep buying it.

The solar energy sector alone consumes over 200 million ounces of silver annually, accounting for roughly 20% of the global supply. Electric vehicles further add to demand, as they require significantly more silver than traditional internal combustion engines. On top of that, the rise of AI infrastructure is creating a new source of demand. Tech companies are projected to invest $700 billion in capital expenditures to build AI systems, a process that heavily relies on silver for its superior conductivity in chips and power systems. Michele Schneider, Chief Market Strategist at MarketGauge, highlights this point:

"Tech companies are projected to spend $700 billion in capex as they build out the growing AI infrastructure, but that can't happen if there isn't enough silver."

"Tech companies are projected to spend $700 billion in capex as they build out the growing AI infrastructure, but that can't happen if there isn't enough silver."

Ole Hansen, Head of Commodity Strategy at Saxo, emphasizes silver’s critical role for manufacturers:

"For manufacturers, silver is essential but represents a relatively small share of total production costs. Running out of supply is not an option."

"For manufacturers, silver is essential but represents a relatively small share of total production costs. Running out of supply is not an option."

With ongoing supply deficits, geopolitical uncertainties, and rising industrial demand, the outlook for silver in 2026 leans bullish. The physical market deficit for 2025 reached an estimated 120 million ounces, and COMEX registered inventories have plummeted by about 70% since 2020. Traders should prepare for continued price swings and potential gains.

3 Trading Strategies for Silver (XAGUSD) in 2026

Drawing from the economic drivers and market trends discussed earlier, here are three approaches to trading silver in 2026.

Trend-Following Strategy

This strategy focuses on capturing silver's long-term upward momentum. In 2025, silver shattered the $50 resistance level - a barrier untouched since 1980 - and soared from around $30 per ounce in January to nearly $70 by December. Trend-following traders aim to capitalize on this kind of sustained movement by identifying the overall market direction on higher timeframes (like H4 or H1 charts) and timing entries on shorter intervals (such as M15 or M5) during pullbacks.

Muhammad Umair, Financial Analyst at FXEmpire, highlighted:

"The breakout from the cup-and-handle pattern in 2025 is projected to yield a gain of over 700%... the first major hurdle is the psychological $100 level, which could be tested in 2026."

"The breakout from the cup-and-handle pattern in 2025 is projected to yield a gain of over 700%... the first major hurdle is the psychological $100 level, which could be tested in 2026."

Look for a "Market Structure Shift + Fair Value Gap" pattern as a signal for high-probability entries. Retracements into the $30–$50 range may also offer opportunities to establish long-term positions. Trading during the London–New York overlap (8:00 AM–12:00 PM EST) can provide access to higher liquidity, while risk management - such as limiting exposure to 1% per trade and placing stop-loss orders beyond key structural levels - helps protect your capital. This strategy aligns well with the backdrop of ongoing supply shortages and a supportive Federal Reserve policy.

If the market transitions to a sideways pattern, a mean-reversion strategy might be more effective.

Mean-Reversion Strategy

Mean-reversion works best in range-bound markets where silver prices oscillate between established support and resistance levels. A key tool for this approach is the gold-silver ratio, which measures how many ounces of silver equal one ounce of gold. Historically, a ratio above 80 has signaled undervalued silver.

Traders can also use the Relative Strength Index (RSI) to time entries - RSI readings above 70 suggest overbought conditions, while readings below 30 indicate oversold levels. Oddmund Groette, Analyst at Quantified Strategies, observes:

"The gold-silver ratio has been one of the most reliable technical indicators for a 'buy' signal in silver, whenever the ratio climbs above 80."

"The gold-silver ratio has been one of the most reliable technical indicators for a 'buy' signal in silver, whenever the ratio climbs above 80."

Consider placing buy and sell limit orders near key support and resistance zones. Pay attention to liquidity sweeps around the COMEX open (8:20 AM EST), as these can create trading opportunities. With 2026 forecasts pointing to an average silver price of $55 per ounce, any spikes toward the late-2025 high of $70 could present short-selling opportunities, especially if the Federal Reserve hints at rate hikes. This strategy leverages the market's natural retracements amid economic shifts.

For those looking to seize sharp price movements, breakout trading offers another option.

Breakout Trading Strategy

Breakout trading aims to capture significant price moves when silver breaks out of a defined range. In 2026, keep an eye on ascending channel breakouts. For instance, a breakout above $58 could indicate a new upward trend, with resistance levels around $62 and $100, and support zones between $45 and $50.

To confirm a breakout, watch for increased trading volume and momentum shifts (using indicators like MACD or RSI). Wait for a displacement candle that breaks prior structure, then enter on a pullback into the resulting Fair Value Gap. Jasper Osita, Market Analyst at ACY, advises:

"Silver rewards timing, patience, and structure. Focus on the windows where liquidity is thickest - London–US overlap and COMEX open - then trade the sweep, displacement, and FVG return."

"Silver rewards timing, patience, and structure. Focus on the windows where liquidity is thickest - London–US overlap and COMEX open - then trade the sweep, displacement, and FVG return."

Timing your trades during periods of high liquidity ensures better order flow. Avoid chasing price movements; instead, wait for clear confirmation of a breakout. Historical data shows January and July have been particularly favorable months for breakout strategies, with positive returns occurring roughly 69.5% and 63.6% of the time, respectively. Geopolitical tensions and supply chain issues could further fuel sharp price swings in 2026.

Risk Management and Trading Infrastructure

Risk Management Rules for XAGUSD Trading

Silver's performance can be a double-edged sword. For instance, it delivered a staggering 168% return in 2025, but history shows its volatility, with drawdowns as steep as 90% in 1980 and 70% in 2011. This kind of unpredictability demands strict discipline, especially when about 73% of retail investor accounts lose money trading CFDs.

A key principle to follow is the 1% rule: never risk more than 1% of your total account equity on a single trade. For example, with a $10,000 account, cap your potential loss at $100 per trade. Combine this with a daily loss limit of 2% to 3% to avoid emotional decisions like "revenge trading" when the market turns against you. If you hit that limit, it’s time to step away from the charts for the day.

Equally important is stop-loss placement. Place your stops beyond technical levels like Fair Value Gaps or recent swing highs and lows, rather than at round numbers like $50.00 or $55.00, which often attract liquidity sweeps. Timing also matters - steer clear of trading at least an hour before major U.S. economic data releases, such as CPI or Nonfarm Payrolls at 8:30 AM EST, to avoid slippage during volatile periods. For trend analysis, the 200-period Simple Moving Average on 4-hour charts can be a reliable tool to identify potential support or resistance levels.

To effectively implement these strategies, having a robust trading setup is non-negotiable.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

How QuantVPS Improves Trade Execution Speed

Fast trade execution is crucial for managing risk, especially given silver's sharp intraday moves. Timing is everything, particularly during the COMEX metals pit open at 8:20 AM EST, when market activity surges and orders flood in. A delay of even a few hundred milliseconds could mean missing a favorable entry. QuantVPS solves this problem with order processing speeds of under 30ms, helping your trades reach liquidity providers before prices shift during high-volatility moments.

For traders needing reliable infrastructure, QuantVPS offers tailored plans. The VPS Pro plan ($99.99/month or $69.99/month with an annual subscription) provides 6 cores, 16GB of RAM, and 150GB of NVMe storage - ideal for running 3–5 charts and automation during the London–New York trading overlap. If you’re managing larger portfolios or multiple strategies, the VPS Ultra plan ($189.99/month or $132.99/month annually) offers 24 cores, 64GB of RAM, and 300GB of NVMe storage, supporting up to 4 monitors and 5–7 charts. Both plans include 100% uptime guarantees, DDoS protection, and unmetered bandwidth on networks exceeding 1Gbps. These features are critical when silver’s dual role as a precious and industrial metal leads to sudden price shifts triggered by supply chain updates or Federal Reserve announcements.

Silver Price Outlook for 2026

Price Levels to Watch in 2026

As 2026 begins, silver finds itself in a critical phase of price discovery, having recently broken through a 13-year resistance zone between $50.00 and $54.00. This former resistance now acts as a key support level and a potential buying opportunity during price dips. One critical level to monitor is $56.19, the December 2025 monthly low. A drop below this mark could lead to a deeper pullback toward $52.52, aligning with the 10-week moving average.

On the upside, analysts from financial institutions anticipate silver prices averaging between $55.00 and $65.00, with a year-end target of $63.78. Should silver break above the $65.53–$65.98 resistance zone, technical forecasts point to further targets at $72.00 and $88.00. Marcus Garvey, Head of Commodities Strategy at Macquarie, comments on silver's potential:

"Moving into 2026, as global economic growth re-accelerates, silver should outperform gold".

"Moving into 2026, as global economic growth re-accelerates, silver should outperform gold".

This optimism is bolstered by silver's sixth consecutive year of structural deficits. Demand from solar energy alone is projected to exceed 200 million ounces annually, while electric vehicles require 1–2 ounces of silver per unit. At the same time, inventories on the Shanghai Futures Exchange have hit decade-long lows, highlighting tight physical supply. However, potential risks, such as unexpected Federal Reserve hawkishness or a stronger U.S. Dollar, could push prices down to the $45.00–$50.00 range. These factors create a complex but strategic environment for silver trading in 2026.

Key Considerations for Trading Silver in 2026

To navigate silver's expected volatility in 2026, traders need to implement flexible strategies. Effective trading will require disciplined risk management, scaling into positions during pullbacks, and paying close attention to Federal Reserve policy signals. Historically, silver markets have seen drawdowns of 30–50%, even during bullish phases. This makes it essential to avoid chasing sharp price spikes. Analysts suggest that two to three interest rate cuts in 2026 could act as a catalyst for the next rally.

For those focused on trade execution, earlier discussions on how QuantVPS enhances trading speed may prove useful. Farah Mourad, UAE Market Analyst at IG, emphasizes silver's growing significance:

"Silver is no longer the side story, it's one of the most asymmetric opportunities in commodities right now".

"Silver is no longer the side story, it's one of the most asymmetric opportunities in commodities right now".

FAQs

What economic factors will impact silver prices in 2026?

Silver prices in 2026 are expected to be shaped by several important economic factors. U.S. monetary policy is likely to play a central role, as potential interest rate cuts by the Federal Reserve could weaken the dollar and reduce real yields. This scenario typically boosts demand for silver, especially among investors looking for alternatives to traditional currencies. Additionally, tight physical supply - fueled by record inflows into silver-backed ETFs and historically low inventories - could put further upward pressure on prices.

On the industrial side, demand is projected to remain robust, driven by the expansion of key sectors like solar energy, electric vehicles, and electronics manufacturing. Analysts believe these industries will continue to support strong silver consumption throughout the year. Adding to this outlook, a declining gold-to-silver ratio indicates that silver might outperform gold, attracting investors eager for higher returns in the precious metals market.

Other elements, such as ongoing inflation, geopolitical tensions, and a weaker U.S. dollar, are expected to enhance silver’s appeal as a safe-haven asset. Together, these factors are set to define the silver market landscape in 2026.

What are the best ways to manage risk when trading silver (XAGUSD) in a volatile market?

Managing risk when trading silver in a volatile market calls for a steady and calculated approach. A smart first step is to limit your risk on any single trade to 1–2% of your account balance. This helps protect your capital from significant losses. To further safeguard your trades, use stop-loss orders wisely - position them just beyond crucial support or resistance levels to shield against unexpected price swings.

Silver prices are influenced by several factors, including fluctuations in the U.S. dollar, changes in interest rates, and shifts in industrial demand. Staying informed about these macroeconomic trends is essential for making informed decisions. Additionally, seasonal patterns can offer valuable insights. Historical data reveals that silver often performs better during specific months, so timing your trades to align with these trends could improve your results.

During periods of heightened volatility, consider using limit orders to enter trades near well-tested support levels. At the same time, set profit targets around resistance zones to secure gains. This approach can help you maintain control even when the market becomes unpredictable.

Lastly, pay close attention to broader economic indicators, such as Federal Reserve policy changes or increasing demand from industries like solar panel manufacturing and electric vehicle production. These factors can cause sudden price shifts, but having a clear plan in place will help you navigate the uncertainty while protecting your investment.

Why is the overlap between the London and New York trading sessions the best time to trade silver?

The overlap between the London and New York trading sessions is often regarded as the optimal time to trade silver due to its high market liquidity. This window offers traders several advantages, including tighter spreads, greater trading volume, and more pronounced price movements, all of which can contribute to smoother trade execution.

This period brings together the active European and U.S. markets, making it an excellent opportunity for both day traders and long-term investors to take advantage of market dynamics. It’s a key time for executing trades effectively and potentially boosting returns.

Silver prices in 2026 are expected to be shaped by several important economic factors. U.S. monetary policy is likely to play a central role, as potential interest rate cuts by the Federal Reserve could weaken the dollar and reduce real yields. This scenario typically boosts demand for silver, especially among investors looking for alternatives to traditional currencies. Additionally, tight physical supply - fueled by record inflows into silver-backed ETFs and historically low inventories - could put further upward pressure on prices.

On the industrial side, demand is projected to remain robust, driven by the expansion of key sectors like solar energy, electric vehicles, and electronics manufacturing. Analysts believe these industries will continue to support strong silver consumption throughout the year. Adding to this outlook, a declining gold-to-silver ratio indicates that silver might outperform gold, attracting investors eager for higher returns in the precious metals market.

Other elements, such as ongoing inflation, geopolitical tensions, and a weaker U.S. dollar, are expected to enhance silver’s appeal as a safe-haven asset. Together, these factors are set to define the silver market landscape in 2026.

Managing risk when trading silver in a volatile market calls for a steady and calculated approach. A smart first step is to limit your risk on any single trade to 1–2% of your account balance. This helps protect your capital from significant losses. To further safeguard your trades, use stop-loss orders wisely - position them just beyond crucial support or resistance levels to shield against unexpected price swings.

Silver prices are influenced by several factors, including fluctuations in the U.S. dollar, changes in interest rates, and shifts in industrial demand. Staying informed about these macroeconomic trends is essential for making informed decisions. Additionally, seasonal patterns can offer valuable insights. Historical data reveals that silver often performs better during specific months, so timing your trades to align with these trends could improve your results.

During periods of heightened volatility, consider using limit orders to enter trades near well-tested support levels. At the same time, set profit targets around resistance zones to secure gains. This approach can help you maintain control even when the market becomes unpredictable.

Lastly, pay close attention to broader economic indicators, such as Federal Reserve policy changes or increasing demand from industries like solar panel manufacturing and electric vehicle production. These factors can cause sudden price shifts, but having a clear plan in place will help you navigate the uncertainty while protecting your investment.

The overlap between the London and New York trading sessions is often regarded as the optimal time to trade silver due to its high market liquidity. This window offers traders several advantages, including tighter spreads, greater trading volume, and more pronounced price movements, all of which can contribute to smoother trade execution.

This period brings together the active European and U.S. markets, making it an excellent opportunity for both day traders and long-term investors to take advantage of market dynamics. It’s a key time for executing trades effectively and potentially boosting returns.

"}}]}