Understanding Triple Witching: How to Trade These Volatile Days

Triple Witching occurs four times a year on the third Friday of March, June, September, and December, when stock options, stock index options, and stock index futures expire simultaneously. These days are known for their high trading volumes and increased market volatility, especially in the final trading hour, often called the "Witching Hour" (3:00 p.m. to 4:00 p.m. ET).

Key takeaways:

- What happens: Expiring contracts create mechanical flows, leading to rapid price changes and trading inefficiencies.

- Why it matters: These events impact market behavior, presenting both risks and opportunities for traders.

- 2025 dates: March 21, June 20, September 19, December 19.

To navigate these days effectively:

- Monitor key strike prices and liquidity zones.

- Use momentum trading, scalping, or gap trading strategies.

- Focus on risk management with smaller positions and tighter stop-losses.

- Consider using low-latency and ultra-low latency infrastructure for faster execution.

Triple Witching is a unique market event that requires preparation, discipline, and the right tools to capitalize on its opportunities while managing risks.

What Is Triple Witching? And How To Trade It Profitably

Market Volatility During Triple Witching

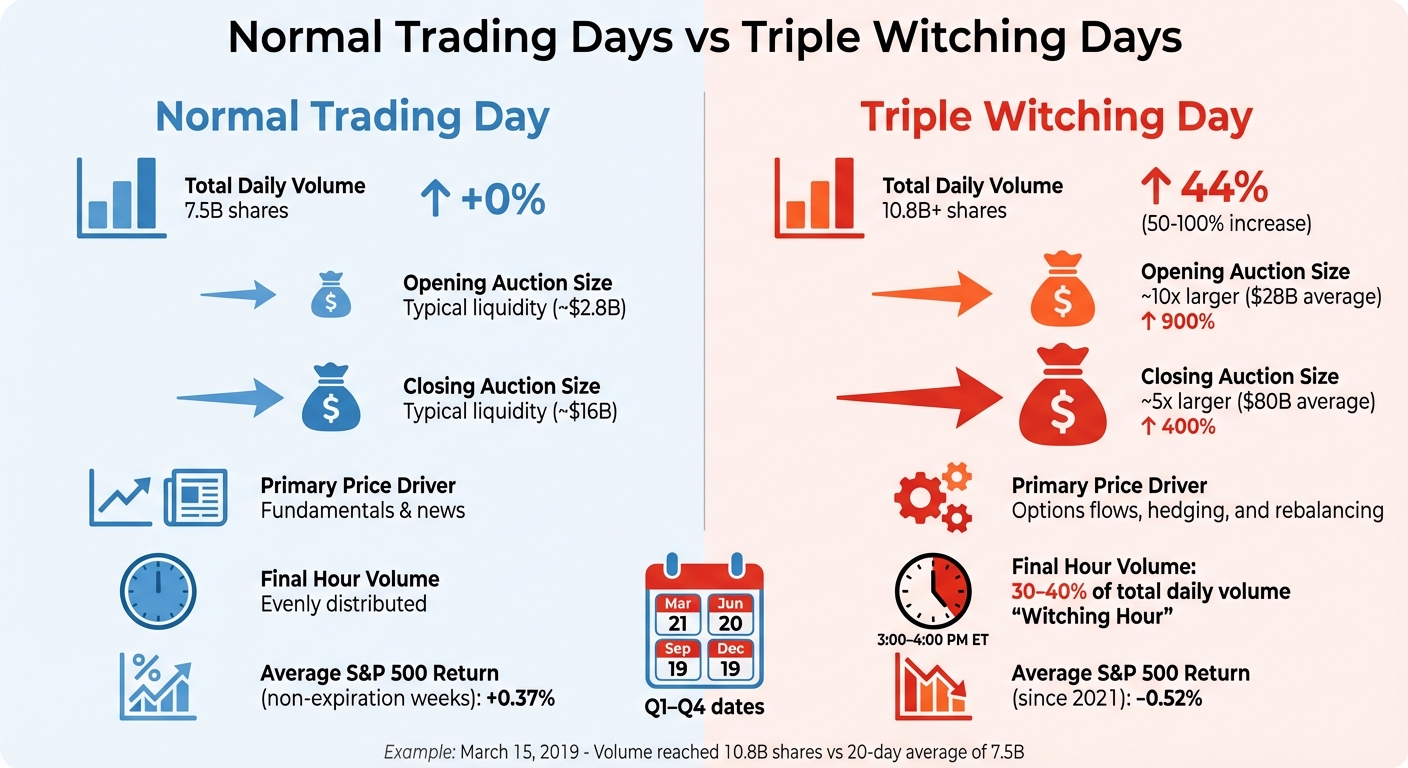

Normal Trading Days vs Triple Witching Days: Volume and Volatility Comparison

Normal Trading Days vs Triple Witching Days: Volume and Volatility Comparison

What Causes Increased Volatility

The turmoil on triple witching days isn’t just happenstance - it’s fueled by specific, predictable factors. One of the primary drivers is position rollovers, where traders close out expiring contracts and open new ones. This process generates a surge in order flow, creating noticeable market activity.

Adding to the frenzy are market makers, who adjust their hedging strategies as prices near key strike levels. This activity often pulls prices toward heavily traded strike levels. According to Nasdaq, market makers must unwind their hedges as contracts expire to avoid sudden price shocks.

Another major factor is index rebalancing. Big names like S&P, Nasdaq, and FTSE schedule their rebalancing efforts to coincide with triple witching days, taking advantage of the increased liquidity. This significantly boosts closing auction volumes. At the same time, arbitrageurs step in to capitalize on temporary price discrepancies between cash and derivatives markets, further intensifying trading activity near the close.

These combined forces create the dramatic spikes in volatility that set triple witching days apart from typical trading days.

Normal Days vs. Triple Witching Days

The numbers paint a vivid picture of the contrast. Take March 15, 2019, for example: U.S. exchange volume skyrocketed to 10.8 billion shares, compared to the 20-day average of 7.5 billion shares. Opening auctions on triple witching days swell to nearly 10 times their usual size, averaging $28 billion, while closing auctions balloon to 5 times normal levels, averaging $80 billion.

| Metric | Normal Trading Day | Triple Witching Day |

|---|---|---|

| Total Daily Volume | 7.5B shares | 50%-100% increase (e.g., 10.8B+ shares) |

| Opening Auction Size | Typical liquidity | ~10x larger ($28B average) |

| Closing Auction Size | Typical liquidity | ~5x larger ($80B average) |

| Primary Price Driver | Fundamentals & news | Options flows, hedging, and rebalancing |

| Final Hour Volume | Evenly distributed | 30%-40% of total daily volume |

One of the most striking differences lies in price behavior. On regular trading days, prices tend to reflect fundamentals like earnings reports or economic indicators. But on triple witching days, price movements are largely dictated by mechanical flows and institutional positioning. Since 2021, the S&P 500 has averaged a -0.52% return on triple witching Fridays, compared to a positive 0.37% average during non-expiration weeks.

Triple Witching Dates for 2025

Key Dates to Watch

Mark your calendars: the Triple Witching dates for 2025 are March 21, June 20, September 19, and December 19.

| Quarter | Triple Witching Date |

|---|---|

| Q1 | March 21, 2025 |

| Q2 | June 20, 2025 |

| Q3 | September 19, 2025 |

| Q4 | December 19, 2025 |

Being aware of these dates gives traders the chance to prepare for the heightened trading activity that typically happens on Triple Witching days. The most intense action usually takes place during the "witching hour", from 3:00 p.m. to 4:00 p.m. ET, as traders rush to finalize, roll over, or offset their positions before the market closes.

Planning ahead is crucial. These dates provide an opportunity to review your portfolio for expiring contracts and decide whether to roll them forward, exercise them, or close them out. For example, during the June 2025 event, a staggering $6.5 trillion in notional U.S.-listed options expired, including $4.2 trillion in index options, creating significant ripples across the market.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Pay special attention to the final trading hour on these days. With nearly 50% of all S&P 500 option volume now stemming from zero-day-to-expiration (0DTE) options, volatility can surge dramatically. To navigate this, using limit orders instead of market orders can help avoid poor trade executions caused by wide bid-ask spreads and slippage.

Trading Strategies for Triple Witching

Momentum Trading

Momentum trading takes a unique spin on Triple Witching days compared to regular sessions. Here, price movements aren't fueled by earnings reports or breaking news. Instead, they're often driven by institutional flows as futures contracts are rolled over and expiring positions are settled. To make the most of these trends, identify major options strike prices with high open interest before the market opens. These levels often act as price magnets because market makers adjust their delta and gamma hedges around them. Pay attention to volume clusters as they can signal the start of directional moves.

The most intense trading typically happens between 3:00 p.m. and 4:00 p.m. ET. For instance, on March 15, 2019, U.S. market volume hit a staggering 10.8 billion shares on Triple Witching Friday, a 45% jump compared to the 20-day average of 7.5 billion shares. This surge creates momentum opportunities, but patience is key - wait for confirmation of strong buying or selling before jumping in. To manage risk, consider reducing position sizes to avoid losses from market noise or false breakouts. These same principles apply if you're using scalping techniques to take advantage of short-lived market imbalances.

Scalping Elevated Volatility

While momentum trading focuses on broader directional trends, scalping hones in on quick, short-term price inefficiencies. The best instruments for this approach are high-liquidity assets like the S&P 500 (ES), Nasdaq (NQ), or widely traded stocks such as Apple (AAPL) and Tesla (TSLA). Timing is crucial - about 30% to 40% of the day’s volume typically occurs in the final hour of trading. Real-time tools like heatmaps can help you spot large buy or sell walls forming or disappearing, signaling opportunities for quick trades.

"These catalysts drive heavy late-session volume as traders exploit fleeting price imbalances." – Investopedia

"These catalysts drive heavy late-session volume as traders exploit fleeting price imbalances." – Investopedia

Keep an eye out for "pinning" behavior, where prices gravitate toward major strike prices due to gamma hedging. This aligns with earlier observations that mechanical flows often create strong support at key strike levels. Before entering a trade, watch for signs of order absorption or aggressive volume, especially during the last 30 minutes when institutional players rebalance their positions.

Gap Trading Opportunities

Gap trading is another effective strategy for Triple Witching, leveraging price differences caused by overnight positioning. These gaps are often amplified as traders prepare for the expiration frenzy. The goal is to identify significant gaps and trade either their continuation or reversal. For example, on June 18, 2021, a record $818 billion in stock options expired. Combined with a Federal Reserve announcement, this Triple Witching event led to a 1.3% drop in the S&P 500 and a 1.6% decline in the Dow Jones Industrial Average in a single session. Traders who spotted the gap at the open and acted accordingly had a chance to secure notable profits.

Focus on gaps near major strike prices with high open interest, as these levels often serve as support or resistance, offering clear entry and exit points. Volume confirmation is critical - a gap with strong volume is more likely to continue, while one on light volume might fill quickly. With trading volume on Triple Witching days often surging by 50% to 100% compared to average sessions, these gaps present plenty of opportunities for traders who wait for volume confirmation before making their move.

Risk Management on Triple Witching Days

Using Strict Risk Controls

Navigating Triple Witching days demands a disciplined approach to risk management. As the clock ticks closer to the 3:00–4:00 p.m. ET "witching hour", market volatility often spikes due to intensified price swings and erratic order flows. To manage this, consider reducing your position sizes and tightening stop-loss orders. Some seasoned traders even steer clear of the final 30 minutes entirely.

Before the opening bell, it’s wise to mark key options strike prices on your charts. These levels often act as magnets for price action due to gamma hedging, offering valuable guidance for placing precise stops. As one expert succinctly puts it:

"The action may seem exciting. But triple witching trading is not the time to go all-in." – Bookmap

"The action may seem exciting. But triple witching trading is not the time to go all-in." – Bookmap

Pay close attention to widening bid-ask spreads during the final hour. These spreads can increase slippage risks, especially as institutional rebalancing drives much of the trading volume, rather than organic market trends. In such moments, efficient execution becomes just as important as strategy.

Using Low-Latency Infrastructure

When milliseconds can make or break a trade, execution speed is everything - especially on Triple Witching days. Standard setups relying on typical Wi-Fi connections can fall short, leading to delays that cost you valuable opportunities. Instead, low-latency infrastructure, like Virtual Private Servers (VPS) located near exchange servers, can execute orders in under 0.52 milliseconds.

For traders who take these high-stakes sessions seriously, solutions like QuantVPS Pro provide the edge needed. Priced at $99.99 per month, it offers near-perfect uptime (99.999%) and direct fiber-optic connections to financial hubs like Chicago. These features can be game-changers, especially when trading volumes surge by 50% to 100% compared to regular sessions.

Trading Infrastructure for Triple Witching

Why Infrastructure Matters

Triple Witching days put an enormous strain on trading systems. For example, on March 15, 2019, U.S. exchanges handled a staggering 10.8 billion shares - far above the usual daily average of 7.5 billion shares. During the final hour of trading, an astounding 30% to 40% of the day's volume can be crammed into just 60 minutes. For traders relying on standard Wi-Fi setups at home, this surge can lead to delays that are nothing short of catastrophic.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

The stakes couldn’t be higher. By 4:00 p.m. ET, traders must close, roll over, or offset positions to avoid the risk of unwanted assignments or the physical delivery of assets. Any infrastructure hiccups during this critical window can result in forced positions or hefty financial penalties. For scalpers and arbitrageurs, even a millisecond of delay can mean missing out on opportunities as the market adjusts. This is why having a reliable, low-latency trading system isn’t just a luxury - it’s an absolute necessity.

QuantVPS Plans for High-Performance Trading

For traders who need speed and reliability, specialized infrastructure like QuantVPS’s VPS Ultra is a game-changer. Priced at $189.99 per month, VPS Ultra supports 5–7 charts simultaneously with lightning-fast 0–1ms latency to exchange servers, all while maintaining 100% uptime. Its location in a Chicago datacenter, directly connected via fiber-optic links to CME Group's matching engines, ensures execution speeds of under 0.52 milliseconds.

This setup is powered by AMD EPYC processors, 64GB of DDR5 RAM, and NVMe M.2 SSDs, capable of handling massive data loads with a 10Gbps burst capacity. This allows for precise order execution even during the most volatile trading periods. To top it off, enterprise-grade DDoS protection shields against disruptions, ensuring uninterrupted performance. You can further optimize your trading server performance by managing resources and network connectivity effectively. Unlike home setups prone to power outages or internet drops, VPS Ultra guarantees that your automated strategies and orders execute exactly when they’re supposed to - especially during those all-important final 60 minutes of trading.

Conclusion

Navigating Triple Witching requires a well-thought-out game plan. These sessions see trading volumes surge far beyond normal levels, largely due to mechanical factors like delta hedging and portfolio rebalancing.

To succeed on Triple Witching Fridays, traders need a disciplined approach, solid risk management, and quick, reliable systems. Before the market opens, identify key strike prices and liquidity zones, adjust your position sizes to account for the extra volatility, and avoid chasing sudden price moves unless supported by strong volume. Equally important is having fast and dependable trading infrastructure. With exchanges handling massive volumes during these events, even small delays can mean missed opportunities. Quick system execution is critical to staying ahead of rapid market changes.

Looking ahead to 2025, the Triple Witching dates are March 21, June 20, September 19, and December 19 - all falling on the third Friday of their respective months. Make sure to mark these dates, update your watchlists, and fine-tune your trading setup. By preparing in advance, you’ll be better equipped to take advantage of the heightened activity and volatility these sessions bring.

FAQs

What are the best strategies to manage risk during Triple Witching days?

Managing risk during Triple Witching days calls for a steady hand and a well-thought-out strategy. Start with a solid trading plan - know exactly when you'll enter, exit, and how much you'll trade before the market even opens. This helps you stay grounded and avoid making impulsive choices, even when the market gets unpredictable.

Zero in on high-probability setups that align with key indicators like price action, volume, and order flow. If the signals seem unclear or unreliable, it’s often smarter to sit out and wait for better opportunities. Tools such as heatmaps or depth-of-market indicators can be incredibly useful for spotting areas of strong liquidity, helping you steer clear of sudden and sharp price swings.

To manage your exposure, think about hedging or offsetting positions with futures or other derivatives. This approach can help balance your risk, especially in volatile conditions. For seasoned traders, short-term arbitrage opportunities between options and futures may also offer a way to earn profits while keeping risk in check. By blending these methods, you can approach the challenges of Triple Witching with a greater sense of control and preparedness.

What is Triple Witching, and how does it impact market volatility and trading volumes?

Triple Witching happens four times a year - on the third Friday of March, June, September, and December. On these days, stock options, index options, and futures contracts all expire at the same time. This convergence often stirs up the markets, leading to increased activity as institutional investors adjust their positions. The result? Higher volatility and unpredictable price swings in both stocks and indices.

Trading volume also tends to spike, particularly in the final hour of the session, as traders scramble to execute last-minute transactions or exercise their options. The mix of sharp price fluctuations and surging volumes creates a unique environment that some traders see as a chance to capitalize on market movements. However, it’s not without risks, making careful planning and risk management essential to navigate these turbulent waters.

Why is a low-latency trading setup important during Triple Witching?

During Triple Witching, a low-latency trading setup becomes a must-have. This event triggers a sharp increase in trading activity and market volatility as stock options, index options, and futures contracts all expire simultaneously. Prices can shift in the blink of an eye, and opportunities often vanish within milliseconds.

With low-latency infrastructure, traders can execute orders almost instantly. This split-second speed allows them to seize short-lived opportunities and minimize risks like slippage. In such a fast-moving market, staying quick is key to remaining competitive and managing the chaos of Triple Witching days effectively.

Managing risk during Triple Witching days calls for a steady hand and a well-thought-out strategy. Start with a solid trading plan - know exactly when you'll enter, exit, and how much you'll trade before the market even opens. This helps you stay grounded and avoid making impulsive choices, even when the market gets unpredictable.

Zero in on high-probability setups that align with key indicators like price action, volume, and order flow. If the signals seem unclear or unreliable, it’s often smarter to sit out and wait for better opportunities. Tools such as heatmaps or depth-of-market indicators can be incredibly useful for spotting areas of strong liquidity, helping you steer clear of sudden and sharp price swings.

To manage your exposure, think about hedging or offsetting positions with futures or other derivatives. This approach can help balance your risk, especially in volatile conditions. For seasoned traders, short-term arbitrage opportunities between options and futures may also offer a way to earn profits while keeping risk in check. By blending these methods, you can approach the challenges of Triple Witching with a greater sense of control and preparedness.

Triple Witching happens four times a year - on the third Friday of March, June, September, and December. On these days, stock options, index options, and futures contracts all expire at the same time. This convergence often stirs up the markets, leading to increased activity as institutional investors adjust their positions. The result? Higher volatility and unpredictable price swings in both stocks and indices.

Trading volume also tends to spike, particularly in the final hour of the session, as traders scramble to execute last-minute transactions or exercise their options. The mix of sharp price fluctuations and surging volumes creates a unique environment that some traders see as a chance to capitalize on market movements. However, it’s not without risks, making careful planning and risk management essential to navigate these turbulent waters.

During Triple Witching, a low-latency trading setup becomes a must-have. This event triggers a sharp increase in trading activity and market volatility as stock options, index options, and futures contracts all expire simultaneously. Prices can shift in the blink of an eye, and opportunities often vanish within milliseconds.

With low-latency infrastructure, traders can execute orders almost instantly. This split-second speed allows them to seize short-lived opportunities and minimize risks like slippage. In such a fast-moving market, staying quick is key to remaining competitive and managing the chaos of Triple Witching days effectively.

"}}]}