LiteFinance (formerly LiteForex), rebranded in November 2021, has shifted from a forex-focused broker to a broader financial services provider. Founded in 2005 by Aleksey Smirnov, it now serves over 1.5 million clients worldwide. This transformation introduced new trading platforms, enhanced security features, and expanded asset options, including 60+ cryptocurrency pairs, stocks, and indices.

Key Takeaways:

- Rebranding Impact: Expanded global presence with new offices in 2022 and a broader asset selection.

- Trading Platforms: Offers MetaTrader 4, MetaTrader 5, cTrader, and a proprietary mobile app.

- Account Types: ECN, Classic, and Cent accounts with a $50 minimum deposit for most.

- Security: Two-factor authentication (2FA) and segregated client funds.

- Global Operations: Multi-entity structure with CySEC regulation in Europe and SVGFSA oversight globally.

While LiteFinance offers diverse trading tools and features, higher-than-average fees for some accounts and services may deter cost-sensitive traders. Its Forex VPS hosting and copy-trading platform stand out for automated and social trading enthusiasts.

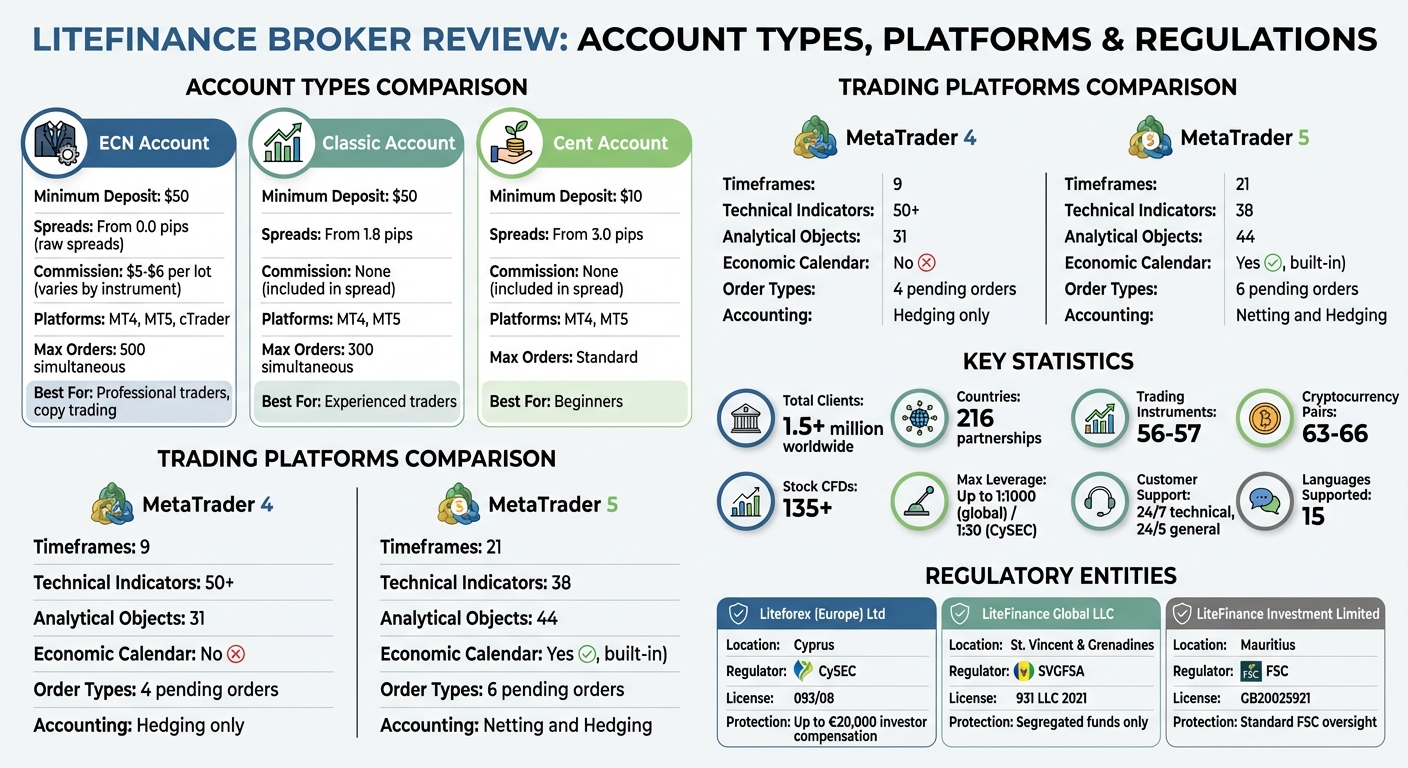

LiteFinance Account Types and Trading Platform Comparison

Company Background and Regulation

Company History and Ownership Structure

LiteFinance was established in 2005 by Aleksey Smirnov, who remains the company’s owner and CEO. The broker quickly gained attention by being the first to offer cent accounts with a minimum deposit of just $1, making Forex trading accessible to a broader audience.

In 2021, the company underwent a rebranding, transferring all trading accounts and obligations from LiteForex Investments Limited to LiteFinance Global LLC. Alongside this change, the headquarters moved from the Marshall Islands to St. Vincent and the Grenadines. By 2022, LiteFinance had expanded its operations significantly, establishing a presence in over 15 countries and forming partnerships in 216 countries. As of 2024, the broker serves over 1.5 million clients worldwide.

These organizational shifts have influenced the company’s regulatory framework, which is detailed below.

Regulatory Status and Global Operations

After rebranding, LiteFinance adopted a multi-entity structure to meet the regulatory requirements of different regions. The level of oversight depends on the entity managing your account.

| Entity Name | Jurisdiction | Regulator | License Number | Market Focus |

|---|---|---|---|---|

| Liteforex (Europe) Ltd | Cyprus | CySEC | 093/08 | EEA residents, UAE, Marshall Islands |

| LiteFinance Global LLC | St. Vincent & the Grenadines | SVGFSA | 931 LLC 2021 | Global (excluding EEA, USA, Israel, Japan, Russia) |

| LiteFinance Investment Limited | Mauritius | FSC | GB20025921 | Global |

Liteforex (Europe) Ltd operates under CySEC regulation (license 093/08) and adheres to the Markets in Financial Instruments Directive (MiFID). This provides European clients with benefits like the Investor Compensation Fund, which offers coverage of up to €20,000 per individual, negative balance protection, and segregated client funds.

On the other hand, LiteFinance Global LLC, registered in St. Vincent and the Grenadines, is overseen by the SVGFSA. However, the SVGFSA primarily acts as a business registry and does not impose prudential standards. Accounts under this entity lack access to an investor compensation fund but still benefit from segregated client funds. The level of protection clients receive depends on the entity managing their accounts.

Trading Platforms and Tools

MetaTrader 4 and MetaTrader 5 Features

LiteFinance provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) across desktop, web, and mobile platforms. MT4 is a favorite among beginners due to its user-friendly interface. It includes over 50 built-in indicators, supports 9 timeframes, and uses 128-bit encryption to ensure secure trading. Additionally, MT4 is optimized for Expert Advisors, making it a solid choice for automated trading.

Meanwhile, MT5 caters to traders seeking more advanced features. It offers 38 technical indicators, 44 analytical tools, and 21 timeframes, enabling detailed multi-timeframe analysis. MT5 also includes a built-in economic calendar, supports both hedging and netting systems, and features a Depth of Market view for insights into order book liquidity – perfect for professional traders.

Both platforms allow one-click trading for quick execution and enable trading directly from charts. LiteFinance imposes no restrictions on trading styles, accommodating scalping, news trading, and full EA automation. Additionally, traders have complimentary access to Claws & Horns, a tool that provides independent technical and fundamental analysis directly within the trading platform.

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Timeframes | 9 | 21 |

| Technical Indicators | 30+ built-in (up to 50) | 38 |

| Analytical Objects | 31 | 44 |

| Economic Calendar | No | Yes (Built-in) |

| Order Types | 4 Pending Orders | 6 Pending Orders |

| Accounting | Hedging | Netting and Hedging |

For traders looking to test strategies or Expert Advisors, LiteFinance offers unlimited demo accounts that simulate real market conditions. Beyond the MetaTrader platforms, LiteFinance also supports seamless copy-trading and a proprietary social trading ecosystem.

Copy-Trading and Proprietary Trading Tools

LiteFinance has developed a unique social trading platform that combines copy-trading with social networking features like newsfeeds, personal channels, and direct chat with professional traders. This web-based platform offers four automated copying modes:

- Full Size 1-1: Mirrors the trader’s volume exactly.

- Fixed Size: Opens trades with a pre-set lot size.

- Percentage of Each Trade: Copies between 1% and 10,000% of the trader’s volume.

- Proportional to Assets: Adjusts trade volume based on the ratio of the investor’s equity to the trader’s equity.

Professional traders typically set their commission at around 20% of the profits. Unlike PAMM accounts, investors retain full control of their funds, allowing for flexible withdrawals. The platform provides complete transparency, offering insights into a trader’s history, open positions, and risk levels. Risk is automatically rated on a scale of 1 to 10, taking into account factors like deposit utilization, equity drawdown, leverage, and account age.

To further manage risk, investors can set Max Loss and Max Profit limits, which act as stop-loss and take-profit tools for the entire copy-trading relationship. LiteFinance’s proprietary mobile app also supports automatic withdrawals of up to $3,000 and includes access to over 100 graphical tools and 75 indicators. For enhanced performance, the platform integrates a VPS service for low-latency trading.

VPS Integration for Low-Latency Trading

LiteFinance offers a VPS service tailored for traders using Expert Advisors on MT4 and MT5. This VPS ensures 24/7 trading with fast execution and minimal slippage.

Priced at $15 per month, the VPS includes a 1,100 MHz CPU, 1,024 MB of RAM, 25 GB of HDD storage, and runs on Windows Server 2012. With execution speeds averaging around 5 milliseconds, it’s ideal for high-frequency scalping and automated trading strategies.

"LiteFinance is a solid option for day trading FX… because it has fast ECN execution, tight spreads on USD pairs and a solid VPS service for running algo strategies."

– Damien, Verified User

The VPS is optimized for both MetaTrader platforms, offering a secure trading environment with isolated servers protected by firewalls. Even when devices are offline, traders can manage their positions, making the VPS an essential tool for maintaining automated strategies during high-volatility events like Federal Reserve announcements.

Account Types, Fees, and Trading Assets

Account Types and Minimum Deposits

LiteFinance caters to different trading styles and levels of experience with three main account options: ECN, Classic, and Cent.

The ECN account is tailored for professional traders and those interested in copy trading. It provides direct access to liquidity and market execution, supporting trading on MT4, MT5, and cTrader platforms. The minimum deposit for this account is $50, and it allows up to 500 simultaneous orders.

The Classic account is ideal for experienced traders who prefer commission-free trading with wider spreads, starting at 1.8 pips. Available on MT4 and MT5, this account supports up to 300 simultaneous orders and is designed for those who prioritize simplicity in trading costs.

For beginners, the Cent account offers a low-risk way to get started. With a micro-lot contract size of $1,000 and a minimum deposit of just $10, it’s a practical choice for learning the ropes. Spreads for this account start at 3.0 pips.

All account types come with Islamic (swap-free) options and support social trading, making them accessible to a wide range of traders. Leverage options depend on jurisdiction: global clients can access leverage up to 1:1000, while accounts regulated by CySEC are capped at 1:30. Margin calls occur at 100%, with stop-out levels set at 20%.

Spreads, Commissions, and Leverage

LiteFinance offers a fee structure that varies based on the account type, with specific costs tied to spreads, commissions, and leverage.

For the ECN account, traders benefit from raw spreads starting at 0.0 pips, with fixed commissions applied per lot:

| Instrument | Commission (per lot) |

|---|---|

| Forex majors | $5 |

| Forex crosses | $5 |

| Forex minors | $6 |

| Metals | $5 |

| Oil | $0.5 |

| Stock indices | $3.5 per contract |

| Cryptocurrencies | 0.12% of market price |

On MT4 and MT5 platforms, the full commission is charged when a trade is opened, while on cTrader, it’s split equally between trade opening and closing.

The Classic account avoids direct commissions by incorporating fees into its spreads, which start at 1.8 pips. While this simplifies cost structures, some analysts, like Plamen Stoyanov from FX Empire, have noted:

"LiteFinance’s fees are generally uncompetitive, with spreads that exceed the industry average across most asset classes, except for share CFDs."

Additional costs include overnight swap fees, withdrawal fees that vary by provider, and a $3 monthly inactivity fee after 180 days. However, LiteFinance offsets deposit costs by reimbursing third-party deposit fees, effectively making deposits free of charge.

Available Trading Instruments

LiteFinance provides access to over 250 trading instruments across multiple asset classes, offering a diverse range of opportunities. These include approximately 56–57 Forex pairs, 63–66 cryptocurrency pairs, and more than 135 stock CFDs from major exchanges like the NYSE and NASDAQ.

The platform also covers a variety of commodities, including precious metals (gold, silver, platinum, palladium), energy products (Brent, WTI, natural gas), and agricultural goods (coffee, cocoa, corn, soybeans, wheat). Traders can also access major global stock indices, such as the Dow Jones (US30), Germany 40, and indices from the UK, Australia, and Asia.

Leverage settings vary by asset type. Most instruments support leverage up to 1:500, while cryptocurrencies are capped at 1:50. Stock CFDs operate at a leverage of 1:1 or between 1:20 and 1:50, depending on regulatory requirements. Both the ECN and Classic accounts use Market Execution, which is especially useful during volatile market conditions or major news events, as it eliminates the risk of requotes.

To further enhance trading efficiency, LiteFinance offers one of the best VPS for Forex trading with low latency – approximately 5 milliseconds – thanks to servers located near key international exchanges. This is particularly advantageous for high-frequency traders and those using automated Expert Advisors, ensuring uninterrupted trading 24/7 without depending on local internet connections.

Customer Support and Platform Performance

Customer Support Channels and Response Times

LiteFinance offers a variety of customer support options, including live chat, email, phone, Skype, and Telegram. These services are available 24/5 for general inquiries, with technical support provided 24/7. Impressively, assistance is offered in up to 15 languages, such as English, Spanish, Portuguese, and Russian, ensuring accessibility for a wide range of users.

Live chat and Telegram are the fastest options, with responses arriving in seconds – perfect for urgent matters. Plamen Stoyanov from FX Empire highlighted this efficiency:

Agents respond within seconds and deliver high-quality answers.

Email support is also reliable, with most queries addressed within 24 hours. On average, email response times clock in at 22.44 hours, with a reply rate of 45.86%. For immediate concerns during business hours, phone support is another solid option.

Customer support has earned high ratings across various platforms, including 4.7/5 on TrustedBrokers, 4.8/5 on IAmForexTrader, 4.4/5 on FX Empire, and 3.3/5 on DayTrading.com. Stefan from TrustedBrokers shared his experience:

Customer service is available 24 hours a day, 5 days a week both online and over the phone. Our queries have always been addressed promptly, to a high standard.

That said, some traders have noted occasional delays when connecting to live support or resolving withdrawal-related issues.

Platform Uptime and Reliability

LiteFinance operates with ECN technology, providing direct access to Tier-1 liquidity. This setup ensures market execution without requotes, making it a reliable choice for professional traders. The platform supports MT4, MT5, and cTrader – tools well-regarded for their stability and performance. Even during high-volatility events, such as Federal Reserve announcements, LiteFinance’s ECN accounts maintain raw spreads starting at 0.0 pips and deliver swift execution.

While standard setups depend on local hardware and internet connections, which can be vulnerable to outages, LiteFinance offers a solution: dedicated VPS services. These remote servers are strategically located near major exchanges, ensuring uninterrupted trading even if local conditions fail. This feature is particularly valuable during critical trading periods.

Lucia, a trader, shared her experience:

LiteFinance offers consistently low spreads and no annoying requotes, even during volatile market hours. I mostly trade gold and crypto, and the execution is always fast.

For those seeking even more robust performance, LiteFinance recommends QuantVPS hosting. With ultra-low latency (0–1ms), guaranteed 100% uptime, dedicated resources, DDoS protection, automatic backups, and full root access, QuantVPS ensures a seamless trading experience. Plans start at $59.99 per month, offering a premium solution for serious traders.

Conclusion: Evaluating LiteFinance for Your Trading Needs

Strengths and Weaknesses of LiteFinance

LiteFinance offers a range of trading options that cater to different trader profiles, but it comes with higher-than-average trading costs. Some of its standout features include a low minimum deposit of just $50, compatibility with MetaTrader 4, MetaTrader 5, and cTrader, and an extensive selection of trading instruments. Its proprietary copy-trading system is particularly appealing, allowing less experienced traders to follow seasoned professionals managing assets worth over $500,000. For ECN account holders, there’s an added perk: 2.5% annual interest on uninvested funds alongside market execution without requotes.

On the flip side, LiteFinance’s trading costs are above the industry norm. Spreads for Classic accounts start at 1.8 pips, and ECN commissions can go as high as $30 per lot on minor currency pairs – well above standard rates. Withdrawal fees also add up, with credit cards incurring a 3.5% charge and Neteller transactions costing 2%. Additionally, between 81% and 83% of retail traders lose money trading CFDs, making it essential to carefully manage costs.

For beginners, the platform provides accessible entry points, educational webinars, and the copy-trading feature. Advanced traders benefit from unrestricted use of Expert Advisors (EAs), scalping and hedging capabilities, and reliable VPS hosting. Cryptocurrency enthusiasts can trade a wide variety of digital assets 24/7. User reviews are generally positive, with LiteFinance earning ratings of 3.9/5 from TrustedBrokers and 3.97/5 from FxScouts. Traders also appreciate its mobile app and the Claws & Horns market analysis tools.

Adding to these features, the availability of VPS hosting ensures consistent, low-latency performance, which is critical for automated trading strategies.

VPS Hosting with LiteFinance: A Boost for Automated Trading

Using VPS hosting alongside LiteFinance can significantly improve trading efficiency, especially for automated strategies. The broker provides an integrated VPS service for $15 per month, offering uninterrupted connectivity for Expert Advisors – even when your personal computer is offline. With servers strategically located near major financial exchanges, traders benefit from minimal latency and protection against local internet disruptions or power outages.

For those seeking even better performance, QuantVPS provides an advanced alternative. Starting at $59.99 per month, QuantVPS offers ultra-low latency (0–1 ms), a 100% uptime guarantee, dedicated resources, DDoS protection, and automatic backups. Fully compatible with MetaTrader platforms and Windows Server 2022, this solution is especially useful during high-volatility events like Federal Reserve announcements, where execution speed can directly impact profitability. Whether you choose LiteFinance’s built-in VPS or upgrade to QuantVPS, remote hosting ensures that your trading algorithms run smoothly and without interruptions.

LiteFinance continues to evolve, focusing on technology-driven solutions to meet the demands of today’s traders. Its combination of features and tools makes it a viable option for those looking to enhance their trading experience.

Lite Finance Review For Beginners

FAQs

What are the main differences between LiteFinance’s ECN, Classic, and Cent accounts?

LiteFinance provides three types of accounts – ECN, Classic, and Cent – tailored to suit different trading styles and levels of expertise.

The ECN account is designed for seasoned traders who value advanced tools, access to deep liquidity, and competitive floating spreads. With a minimum deposit of $50, leverage up to 1:1000, and support for strategies like scalping and news trading, this account ensures fast and reliable execution.

The Classic account caters to traders who prefer a more straightforward approach. It offers standard trading conditions with a typically lower minimum deposit, making it a user-friendly option for those who don’t need the advanced features of an ECN account.

For beginners or cautious traders, the Cent account is an excellent starting point. It supports smaller lot sizes and requires a lower initial deposit, providing a low-risk environment for gaining experience and testing the platform in a simplified setting.

How does LiteFinance protect client funds and personal information?

LiteFinance places a strong emphasis on safeguarding both client funds and personal data by adhering to strict regulations and leveraging advanced technology. Regulated by CySEC, the platform meets rigorous financial standards, including routine audits and transparent reporting practices. To ensure the safety of client assets, funds are stored in segregated accounts, completely separate from the company’s operational finances, minimizing any risk of misuse.

On top of this, LiteFinance employs cutting-edge encryption protocols to protect personal information during transactions and storage. The platform also supports secure payment options like bank cards and e-wallets, which include added safety measures such as fraud detection and encryption. Together, these measures provide users with a secure and trustworthy trading experience.

What tools and platforms does LiteFinance provide for automated trading?

LiteFinance offers a range of tools and platforms designed for automated trading, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) leading the pack. These platforms enable traders to deploy Expert Advisors (EAs) – automated trading systems that execute trades based on predefined strategies. If you’re not familiar with programming, LiteFinance has you covered with tools like the Forex Strategy Builder, which simplifies the process of creating custom EAs.

For those diving into algorithmic trading, LiteFinance provides advanced features such as AI-driven models, lightning-fast execution speeds (as quick as 0.01 seconds), raw spreads starting at 0.0 pips, and leverage options up to 1:1000. These features cater to traders aiming for automation and high-frequency strategies, making LiteFinance a compelling choice for tech-savvy investors.