Intraday algorithmic trading uses automated systems to execute trades within a single day based on pre-set rules. These systems eliminate human error and hesitation, offering precision and speed critical for fast-moving markets like forex and futures. By 2025, over 90% of forex transactions are projected to be automated, with AI tools achieving accuracy rates as high as 95%. Here’s what you need to know:

- Strategies: Popular approaches include momentum (riding trends), mean reversion (capitalizing on price corrections), and breakout (trading key level breaches).

- Software: Tools like NinjaTrader, Tradovate, and Python libraries (pandas, NumPy) help design, backtest, and execute strategies.

- Infrastructure: Using the best VPS for algorithmic trading ensures low latency and uninterrupted operations, essential for fast and reliable execution.

- Risk Management: Safeguards like stop-loss orders, position size limits, and "kill switches" protect against significant losses.

For success, combine well-defined strategies with robust software and infrastructure. Test thoroughly before live trading to ensure stable performance.

Intraday Trading Strategies That Work

Successful intraday trading algorithms rely on clear, testable rules to take advantage of specific market behaviors. Three systematic trading methods for day traders – momentum, mean reversion, and breakout strategies – focus on different price patterns and thrive under various market conditions. Interestingly, algorithmic trading now drives over 80% of daily trading volume in global stock markets, with the market expected to hit $28.78 billion by 2026.

Momentum-Based Strategies

Momentum strategies aim to ride prevailing trends by buying during uptrends and selling during downtrends. These algorithms constantly scan the markets for signals like price breakouts or spikes in trading volume.

A typical setup uses technical indicators to define clear rules. For instance, a buy signal might be triggered when a short-term moving average crosses above a long-term moving average, supported by a strong Relative Strength Index (RSI). Equally important are the exit rules – such as trailing stop-losses or preset price targets – to lock in profits when the trend weakens.

Speed is crucial for momentum strategies. To minimize slippage during rapid market movements, trading systems should use high-speed network connections of at least 100 Mbps, preferably via hard-wired Ethernet. Backtesting the strategy across different volatility periods ensures its durability, even during market shocks. Notably, around 74% of hedge funds now use AI and machine learning to develop trading models, with deep learning achieving forecasting accuracy close to 92%.

Mean Reversion Strategies

Mean reversion strategies take advantage of the natural tendency of prices to return to their long-term average. As MooreTechLLC explains:

Mean-reversion is a statistical arbitrage approach that capitalizes on predictable price movements around a statistical average.

Mean-reversion is a statistical arbitrage approach that capitalizes on predictable price movements around a statistical average.

These algorithms identify significant deviations from a baseline – often calculated using Simple or Exponential Moving Averages – and predict a return to that average.

In intraday trading, this might involve targeting overnight gap fills, bid-ask imbalances, or temporary price extremes. Tools like Bollinger Bands and z-scores help pinpoint when prices are stretched too far; for example, a z-score above 2 often signals overbought conditions. Secondary filters, such as declining volume or negative divergence, can refine entry points. Because these opportunities are fleeting – sometimes lasting mere milliseconds – low-latency execution is critical. Additionally, regular adjustments to the algorithm’s parameters are necessary to adapt to changing market volatility.

Breakout Strategies

Breakout strategies focus on spotting key support and resistance levels, triggering trades when prices break through these thresholds in anticipation of strong directional moves. Peter, founder of Cracking Markets, explains:

Intraday breakout strategies are simple in design but powerful in practice. The logic is easy to understand, works across many markets, and can be adapted to different volatility regimes.

Intraday breakout strategies are simple in design but powerful in practice. The logic is easy to understand, works across many markets, and can be adapted to different volatility regimes.

A common method involves using the Average True Range (ATR) to set breakout levels, such as Close ± 0.33 x ATR. To filter out false signals, contextual rules can be applied, activating trades only under specific volatility conditions. These filters can triple trade expectancy while cutting trade frequency by six times.

Fine-tuning the timing – like focusing on the market open, the first 30 minutes’ high or low, or premarket activity – can further improve results. Many systems limit breakout attempts to one per market per day and use straightforward exit rules, such as fixed stop-losses or end-of-day closures. This modular approach simplifies testing and makes it easier to tweak code using tools like ChatGPT or Claude.

Next, we’ll dive into the software that drives these strategies.

Software and Tools for Intraday Algorithmic Trading

Once you’ve nailed down your strategies, selecting the right software becomes essential. The tools below help with everything from designing strategies to executing live orders, catering to a variety of trading needs.

Setting Up NinjaTrader

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

NinjaTrader leverages C#-based NinjaScript, allowing you to create custom indicators and automated strategies for trading futures, forex, and stocks. To get started, download and import the NinjaTrader add-on using the platform’s import tool. After importing, restart the platform to ensure all tools are updated. Activate your license by entering your Machine ID. One standout feature is the Market Replay mode, which speeds up backtesting so you can evaluate your algorithm’s performance efficiently. For those running complex strategies, QuantVPS offers plans that support multiple concurrent charts to enhance functionality.

Integrating Tradovate

Tradovate is designed for futures trading and provides both browser-based and desktop platforms with direct market access. Its cloud infrastructure, paired with a dedicated VPS, ensures low latency, making it ideal for executing high-speed algorithms at the tick level.

Using Python for Algorithm Development

Python is a powerhouse for algorithmic trading, thanks to libraries like pandas, NumPy, VectorBT, and Zipline Reloaded. These tools simplify data manipulation, optimization, and event-driven backtesting, which are critical for high-frequency trading. To handle high-frequency data, you can resample trade and quote data into 1-second intervals. Python also allows direct integration with brokerages like Interactive Brokers, enabling real-time tick streaming and programmatic order submissions.

How to Set Up an Intraday Trading System

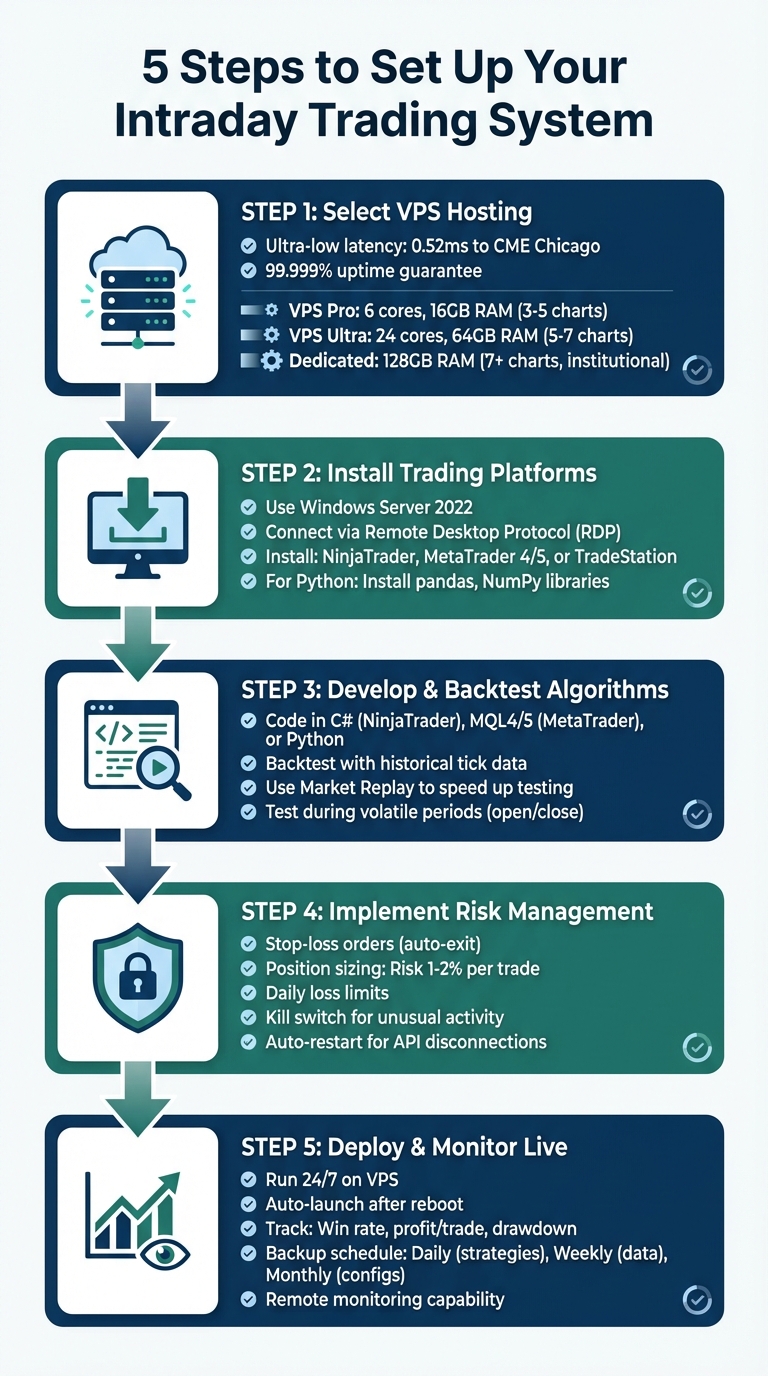

5-Step Intraday Algorithmic Trading System Setup Guide

5-Step Intraday Algorithmic Trading System Setup Guide

Creating an efficient intraday trading system involves selecting high-speed hosting, installing key software, building quick-response algorithms, and integrating safeguards to manage risk. Here’s a step-by-step guide to help you establish your automated trading setup.

Step 1: Select VPS Hosting with QuantVPS

Intraday trading relies on ultra-low latency and uninterrupted uptime, as even a fraction of a second can impact your trades. QuantVPS offers latency as low as 0.52ms to the CME Group exchange in Chicago and guarantees 99.999% uptime.

| Feature | VPS Pro | VPS Ultra | Dedicated Server |

|---|---|---|---|

| CPU Cores | 6 Cores | 24 Cores | High-Performance Dedicated |

| RAM | 16 GB | 64 GB | 128 GB |

| Storage | NVMe | NVMe | 2TB+ NVMe |

| Best For | 3-5 active charts | 5-7 charts + indicators | 7+ charts / Institutional |

| Latency | 0-1ms | 0-1ms | Sub-millisecond |

The VPS Pro plan is ideal for running a few strategies simultaneously. If you’re managing multiple indicators or more complex setups, the VPS Ultra offers additional resources. For institutional-grade operations, the Dedicated Server provides the power needed for high-frequency trading across various instruments.

Step 2: Install Trading Platforms and Necessary Tools

Windows Server 2022 supports popular platforms like NinjaTrader, MetaTrader 4/5, and TradeStation. Use Remote Desktop Protocol (RDP) to connect to your VPS, then download your chosen platform directly from its official website. For NinjaTrader, you can import custom add-ons using its built-in tools and restart to ensure everything works seamlessly.

If you’re coding algorithms in Python, make sure to install the latest version along with libraries like pandas and NumPy. For Tradovate users, its cloud-based infrastructure integrates smoothly with VPS hosting, maintaining secure and direct market access.

Step 3: Develop and Backtest Your Algorithms

Use your platform’s native programming language – C# for NinjaTrader, MQL4/MQL5 for MetaTrader, or Python for custom scripts – to code strategies focusing on specific trading signals like momentum breakouts or mean reversion. Backtest these algorithms using historical tick data, paying close attention to how they perform during volatile periods, such as the market’s opening and closing hours.

NinjaTrader’s Market Replay feature can significantly speed up this process, allowing you to simulate entire trading days in minutes. Fine-tune your parameters based on backtesting results, making sure to account for potential slippage and commission costs.

Step 4: Implement Risk Management Measures

To protect your capital, incorporate safeguards into your system. Use stop-loss orders to automatically exit trades when a position moves against you by a set amount. Adjust position sizes based on your account equity – many traders stick to risking no more than 1-2% of their capital on a single trade. Include maximum daily loss limits to halt trading if losses exceed a certain threshold.

Enable automatic restart settings to recover from temporary API disconnections. Additionally, consider implementing a “kill switch” feature that liquidates all positions if your algorithm detects unusual market activity or technical issues. These measures help maintain control over risk during live trading.

Step 5: Deploy and Monitor Live Trading

Run your algorithm on the VPS using Remote Desktop, ensuring it operates 24/7 without relying on your local machine. Configure the system to automatically launch your trading platform after a reboot, so unexpected restarts don’t disrupt your trading flow.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Set up real-time performance tracking to monitor metrics like win rate, average profit per trade, and maximum drawdown. Regularly back up your files – daily for strategy files, weekly for historical data, and monthly for system configurations. During the initial live trading phase, closely monitor results to identify any discrepancies from backtested performance.

QuantVPS’s secure gateway allows you to oversee your trading system remotely, ensuring you can manage and optimize your strategies from virtually anywhere.

This setup provides a solid foundation for continuous trading and future refinements.

Improving Performance on QuantVPS

Once your intraday trading system is up and running, fine-tuning your VPS setup can significantly improve both execution speed and reliability. QuantVPS is purpose-built for algorithmic trading, and leveraging its advanced features can help you get the most out of your trading strategy.

Hardware optimization plays a key role in enhancing performance. For instance, NVMe storage drastically reduces read/write times compared to standard SSDs. Over the course of a trading day, this faster data handling can make a noticeable difference as your algorithm processes tick data or logs trades. Pair that with QuantVPS’s ultra-low latency, and your orders can reach the exchange faster than the majority of retail setups.

For traders using Interactive Brokers with two-factor authentication, it’s a good idea to schedule regular re-authentication sessions – Sunday afternoons, for example – to avoid interruptions when your token expires. This simple routine complements the risk management protocols you’ve already put in place.

Another important tip: always use a hard-wired connection on your VPS. This ensures stable, uninterrupted data flow, reducing the chance of dropped packets. QuantVPS’s high-bandwidth, reliable network minimizes connectivity issues, which is critical for maintaining smooth order flow. Considering that algorithmic trading now accounts for over 80% of daily trading volume in the stock market, a dependable connection is more important than ever. These network upgrades help your trading system stay resilient, even during periods of high market activity.

Finally, QuantVPS offers a 100% uptime guarantee, ensuring your trading operations run continuously without requiring manual intervention. This level of reliability is essential for staying competitive in today’s fast-paced trading environment.

Conclusion

Intraday algorithmic trading demands a well-thought-out strategy paired with dependable and fast trade execution. This guide has outlined key strategies for intraday trading and the essential steps to design, test, and manage your algorithmic trading system.

While having a strong strategy is important, execution plays a pivotal role. The gap between a system that thrives and one that falls short often boils down to execution speed and system reliability. Running your algorithms on a local computer can expose you to risks like power outages, hardware failures, or unstable internet connections. Using a VPS (Virtual Private Server) ensures 24/7 reliability and ultra-low latency, which are critical for consistent and fast order execution. A well-chosen VPS solution not only guarantees smooth operation but also handles the high-speed processing demands of modern intraday trading.

Thorough testing and safety measures are essential for successful live trading. Always test your strategy on a demo account for several months to confirm its stability under real-world conditions. Additionally, implement a kill switch to liquidate all holdings if your algorithm behaves unpredictably, and avoid placing manual orders on the same account to prevent conflicts or race conditions. These precautions create a strong foundation for reliable intraday trading performance.

FAQs

What are the main advantages of using algorithmic trading for intraday strategies?

Algorithmic trading brings several advantages to intraday strategies, making it a game-changer for traders looking to navigate fast-paced markets. One standout feature is its ability to execute trades with speed and accuracy. In markets where seconds can make all the difference, automated systems can process vast amounts of data and act on predefined rules almost instantly, ensuring trades are executed at the right moment.

Another key advantage is the removal of emotional decision-making. When markets are volatile, human traders can fall victim to stress, fear, or overconfidence, which often leads to costly mistakes. Algorithms, however, stick to the plan, following signals for strategies like mean reversion or momentum trading without wavering.

Finally, algorithmic trading offers scalability and the opportunity to rigorously backtest strategies before putting them into action. This ensures that traders can fine-tune their approach and manage risks more effectively, making it an indispensable tool for those aiming to systematically profit from short-term market movements.

What should I consider when choosing software for intraday algorithmic trading?

When picking software for intraday algorithmic trading, focus on platforms that offer tools for strategy development, backtesting, and live execution. These are essential for building and fine-tuning short-term trading algorithms. Look for features like real-time data feeds, smooth order execution, and support for programming languages such as Python or C#, which are commonly used in algorithmic trading.

Make sure the software fits your specific trading requirements. For example, you might need multi-asset support or tools tailored to strategies like mean reversion or momentum trading. Strong backtesting capabilities are also a must – they allow you to test and refine your strategies thoroughly before moving to live trading. The right platform should streamline the entire process, from research to execution, ensuring efficiency at every step.

What are the key risk management practices for intraday algorithmic trading?

Risk management plays a crucial role in intraday algorithmic trading, where speed and unpredictability dominate. To stay in control, start by setting clear stop-loss and take-profit levels. These tools help limit losses and lock in gains, especially when market conditions become volatile.

Another key element is position sizing. This means risking only a small fraction of your trading capital on each trade. Many seasoned traders stick to risking just 1%–2% of their total capital per trade, which helps shield their portfolio from major losses. Additionally, fine-tune your strategy to align with market volatility. Adjusting factors like order sizes or trade frequency can help reduce slippage and prevent unexpected losses.

By combining disciplined exit points, careful position management, and a proactive approach to risk, you can better handle the fast-paced world of intraday trading while keeping your portfolio safe.