CMC Markets Review: A Deep Dive into Spreads, Platforms, and Fees

CMC Markets is a London-based broker, established in 1989, and regulated by top-tier authorities like the FCA (UK) and ASIC (Australia). Known for competitive trading costs, it offers access to over 12,000 instruments. The broker’s FX Active account provides spreads starting at 0.0 pips on six major forex pairs, while the Next Generation platform delivers advanced tools, including 115+ indicators and risk management features like Guaranteed Stop-Loss Orders (GSLOs). However, automated trading is only available on MetaTrader platforms.

Key highlights:

- Spreads: EUR/USD as low as 0.5 pips (Standard) or 0.0 pips + commission (FX Active).

- Platforms: Next Generation (12,000+ instruments), MT4 and MT5.

- Fees: $15 inactivity fee after 12 months, GSLO premiums, and overnight holding costs.

- Trust Score: 99/99 from ForexBrokers.com.

While offering low costs and robust tools, drawbacks include no automated trading on its proprietary platform and fees like the inactivity charge.

CMC Markets Review

1. CMC Markets

CMC Markets Account Types Comparison: Standard vs FX Active

CMC Markets Account Types Comparison: Standard vs FX Active

Spreads

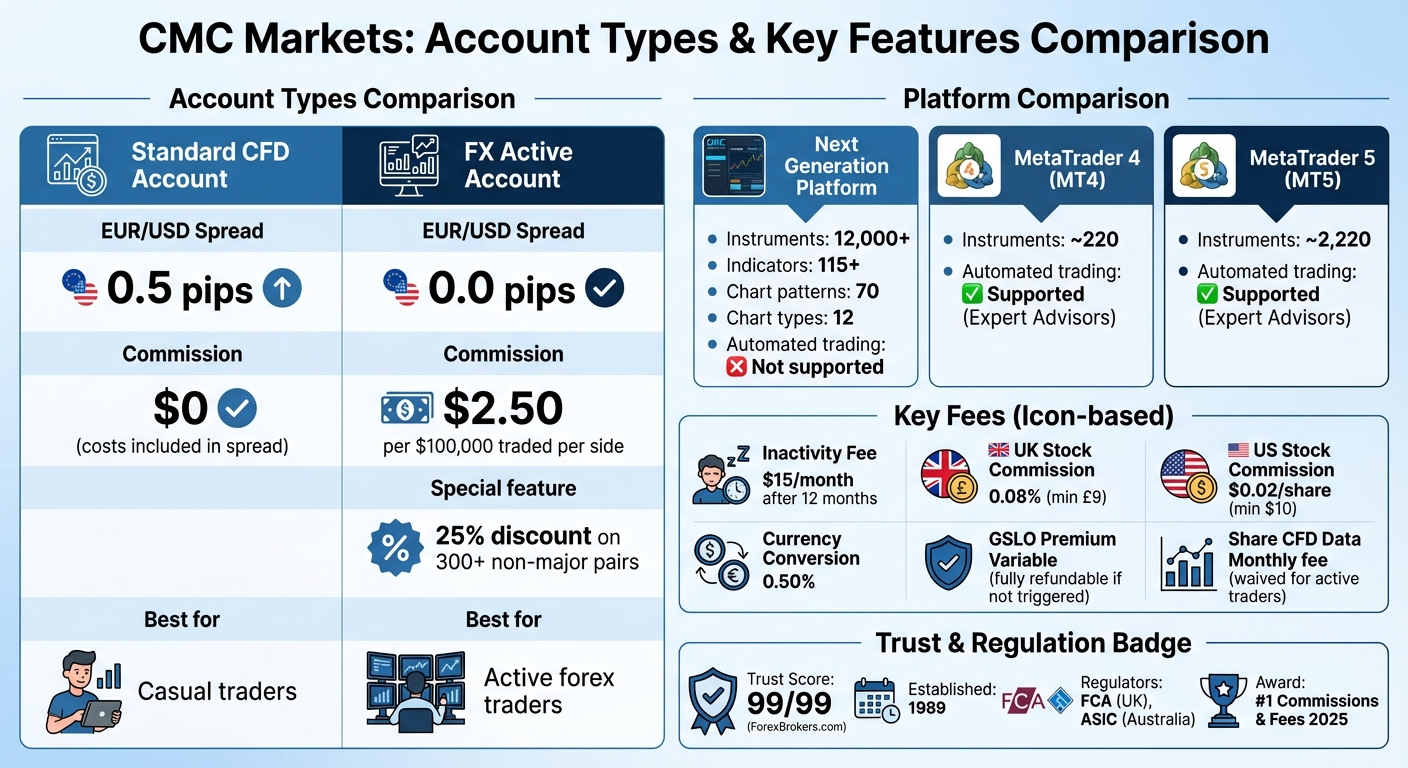

CMC Markets provides two account options: the Standard CFD Account, where trading costs are included in the spread, and the FX Active Account, which offers tighter spreads but charges a fixed commission of $2.50 per $100,000 traded per side.

For forex traders, Standard accounts feature EUR/USD spreads starting at 0.5 pips. Meanwhile, FX Active accounts provide access to spreads as low as 0.0 pips on six major currency pairs, along with a 25% discount on over 300 non-major pairs.

A standout feature is the price depth ladder, which displays up to 10 levels of pricing. This tool highlights how larger orders can impact spreads due to volume effects. For indices and commodities, spreads depend on market hours and liquidity, with pricing derived from underlying futures or cash markets.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Platforms

CMC Markets doesn’t just focus on competitive spreads - it also offers feature-rich trading platforms.

Traders can choose from three platforms: Next Generation, MT4, and MT5. The Next Generation platform provides access to over 12,000 instruments, while MT4 and MT5 offer access to approximately 220 and 2,220 instruments, respectively. The Next Generation platform is packed with tools like 115+ technical indicators, 70 chart patterns, 12 chart types, and a pattern recognition scanner that reviews 120 instruments every 15 minutes.

For those looking for advanced tools, the platform includes institutional-grade features like price depth ladders, module linking, and API access, which are ideal for algorithmic trading strategies. However, automated trading isn’t supported on the Next Generation platform - traders aiming to use Expert Advisors will need MT4 or MT5. Risk management tools include Guaranteed Stop-Loss Orders (GSLOs), which refund the premium in full if not triggered. Additionally, the platform integrates Reuters News and Morningstar research for informed decision-making.

Fees

CMC Markets has a transparent fee structure that goes beyond spreads and commissions.

For share CFDs, UK stocks incur a commission starting at 0.08% (minimum £9), while U.S. stocks are charged $0.02 per share (minimum $10). An inactivity fee of $15 per month applies after 12 months of no trading activity.

Overnight holding costs kick in after 5:00 PM EST. For cash indices (as of August 2025), the daily reference rate is adjusted by ±0.0082%. The GSLO premium varies based on the instrument and trade size. For instance, shorting 50,000 units of GBP/USD in August 2025 would incur a $7.50 premium, calculated at $0.00015 per unit. This amount is refunded if the GSLO isn’t activated.

For share CFD data, a monthly subscription fee may apply, although it’s waived for active traders. Additionally, wire transfers in Canada come with a $15 fee per transaction.

Pros and Cons

Building on the earlier review of spreads, platforms, and fees, here's a closer look at the main benefits and drawbacks of CMC Markets.

The FX Active account stands out with spreads starting as low as 0.0 pips on six major forex pairs, along with access to an impressive selection of over 12,000 tradable instruments through the Next Generation platform. This platform reflects the broker’s substantial £100 million investment, showcasing features designed for institutional-grade trading.

On the downside, automated trading isn’t available on the Next Generation platform. Traders looking for automation must use MetaTrader 4 (MT4), which only supports around 220 instruments. Additionally, users have reported technical issues, such as lost screen formats, and FX spreads can reach up to 6% for overseas shares.

While forex traders enjoy competitive pricing, it’s important to note that 67% of retail investor accounts lose money trading CFDs. Other fees, including a $15 monthly inactivity charge, a 0.50% currency conversion fee, and high minimum costs for stock CFDs, might further impact profitability.

Here’s a quick breakdown of the strengths and weaknesses:

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

| Pros | Cons |

|---|---|

| Spreads as low as 0.0 pips on six major FX pairs (FX Active) | Automated trading unavailable on Next Generation platform |

| Access to over 12,000 tradable instruments | $15 monthly inactivity fee after 12 months |

| Fully refundable GSLO premiums | MT4 limited to approximately 220 instruments |

| No minimum deposit required | 0.50% currency conversion fee |

| High 99/99 Trust Score from ForexBrokers.com | No option for swap-free (Islamic) accounts |

This summary highlights the key points traders should weigh when considering CMC Markets for their trading needs.

Conclusion

CMC Markets stands out with its low-cost structure and broad market access, though it's worth noting that U.S. clients aren't accepted. With access to over 12,000 tradable instruments and a perfect Trust Score of 99/99, the broker earned the title of "#1 Commissions & Fees" for 2025 from ForexBrokers.com.

The FX Active account delivers ultra-tight spreads on major currency pairs, paired with competitive commissions. On top of that, their proprietary Next Generation platform - developed with a $100 million investment - offers professional-grade tools, including over 115 indicators and 70 chart patterns. However, automated trading requires the use of a different platform.

Other notable features include a $15 inactivity fee after a year of no activity, fully refundable Guaranteed Stop-Loss Orders to protect against market swings, and a demo account loaded with $10,000 in virtual funds for practice.

FAQs

What are the key differences between the Standard and FX Active accounts offered by CMC Markets?

The Standard account offers a simple, spread-only pricing structure with no added commissions. For example, spreads on popular pairs like EUR/USD can go as low as 0.6 pips. This option works well for traders who want a clear and straightforward fee setup.

The FX Active account operates on a commission-based model but provides tighter spreads. For instance, spreads on six major currency pairs can start at 0.0 pips, and you’ll also enjoy a 25% reduction on spreads across more than 300 pairs. A fixed commission of $2.50 applies for every $100,000 traded. This account is tailored for high-volume or professional traders aiming to lower their overall trading expenses.

Does CMC Markets charge an inactivity fee, and how might it affect long-term traders?

CMC Markets does not seem to charge an inactivity fee, which can be a plus for long-term traders who don't trade regularly. This means you won't face extra costs during those quieter periods.

That said, it's smart to double-check their terms and conditions or contact their support team directly for the most current fee details, as policies can change.

What platforms does CMC Markets offer, and do they support automated trading?

CMC Markets offers traders a range of platform options to suit various trading preferences. These include the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the broker's proprietary Next Generation platform (accessible via desktop, web, and mobile), and an integrated TradingView charting interface. Whether you prefer desktop access or trading on the go, these platforms provide the flexibility to match your style.

For those interested in automated trading, the MetaTrader platforms (MT4 and MT5) are the top choice. They support Expert Advisors (EAs) and custom scripts, allowing traders to implement fully automated strategies. CMC Markets further enhances this experience by offering free premium indicators and EAs. On the other hand, the Next Generation platform and TradingView focus on manual trading and charting, as they don't natively support automated trade execution. This makes MT4 and MT5 a better fit for traders looking to automate their strategies.