Butterfly spreads in futures are a defined-risk trading strategy that focuses on price relationships between three different contracts – front, middle, and back months. They are structured in a 1:2:1 ratio, offering a neutral stance on outright price changes while profiting from term-structure shifts, time decay, and reduced implied volatility. Here’s what you need to know:

- Key Features:

- Risk-defined: Maximum loss is limited to the upfront cost (net debit).

- Profit Potential: Peaks when the underlying price settles at the middle strike.

- Market View: Best for neutral or mean-reverting markets with low volatility.

- Execution: Done as a multi-leg order to minimize "leg risk."

- Types:

- Vertical Butterfly: Uses three different strikes with the same expiration.

- Calendar Butterfly: Same strike price, but across three expiration dates.

- Profit Mechanics:

- Gains rely on time decay (positive theta) and volatility contraction (negative vega).

- Example: A $350 trade can yield up to $3,650 if the market aligns with the middle strike.

- Risk Management:

- Enter trades 20-45 days before expiration to optimize time decay.

- Close positions early (75-80% of max profit) to avoid late-stage risks.

- Execution Tools:

- Use low-latency systems to ensure precise multi-leg order execution.

- Platforms like QuantVPS provide high-speed, reliable trading environments.

- Risk-defined: Maximum loss is limited to the upfront cost (net debit).

- Profit Potential: Peaks when the underlying price settles at the middle strike.

- Market View: Best for neutral or mean-reverting markets with low volatility.

- Execution: Done as a multi-leg order to minimize "leg risk."

- Vertical Butterfly: Uses three different strikes with the same expiration.

- Calendar Butterfly: Same strike price, but across three expiration dates.

- Gains rely on time decay (positive theta) and volatility contraction (negative vega).

- Example: A $350 trade can yield up to $3,650 if the market aligns with the middle strike.

- Enter trades 20-45 days before expiration to optimize time decay.

- Close positions early (75-80% of max profit) to avoid late-stage risks.

- Use low-latency systems to ensure precise multi-leg order execution.

- Platforms like QuantVPS provide high-speed, reliable trading environments.

Butterfly spreads are ideal for traders seeking to profit from stable markets while maintaining clear risk limits. By focusing on structure, timing, and volatility, this strategy offers a calculated approach to futures trading.

How Butterfly Spreads Are Structured

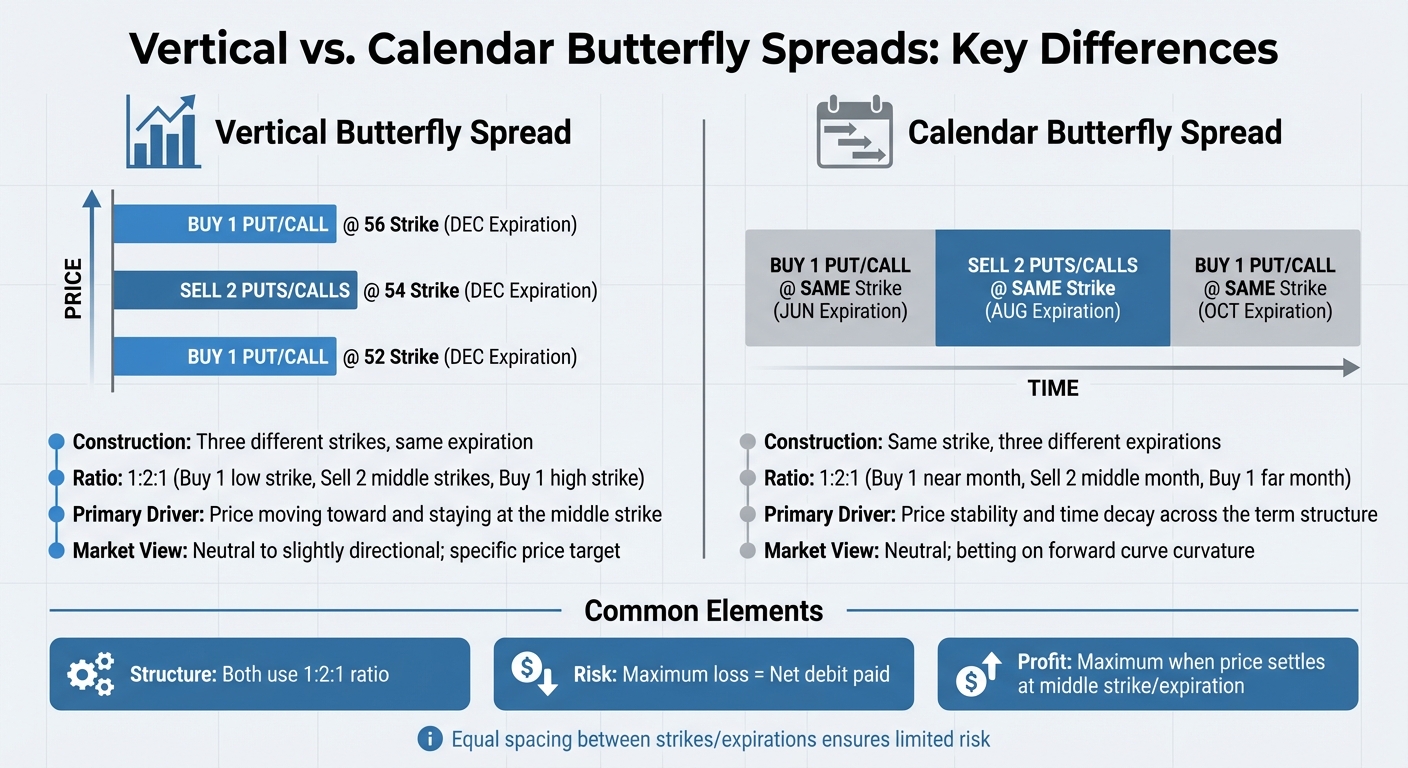

Butterfly Spread Structure: Vertical vs Calendar Comparison Chart

Butterfly Spread Structure: Vertical vs Calendar Comparison Chart

A butterfly spread operates on a 1-2-1 contract ratio across three legs. Here’s how it works: you buy one contract at the lower strike (or earlier expiration) – this forms the lower wing. Then, you sell two contracts at the middle strike or expiration – this is the body. Finally, you buy one contract at the upper strike (or later expiration) – the upper wing. The wings provide protection, while the sold contracts in the body generate profit through time decay or price convergence. In a long butterfly spread, your goal is for the market to settle at the middle strike upon expiration. Keeping an equal spacing between strikes (e.g., 95/100/105) or expirations (e.g., June, August, and October) ensures that your maximum loss is limited to the net cost of the trade.

A long butterfly spread requires an upfront net debit, and it reaches peak profitability if the price aligns with the middle strike at expiration. On the other hand, a short butterfly spread results in a net credit, and it profits when prices move significantly beyond either wing. For example, in August 2024, a CME Group E‑mini Nasdaq‑100 long call butterfly spread with strikes at 19,400/19,600/19,800 required a net debit of 17.5 points ($350). If the index settled exactly at 19,600, the maximum profit would be 182.5 points ($3,650).

"The wings of the butterfly protect the trader from the unlimited risk of the straddle. Buying a butterfly limits the risk of being wrong to the cost of the butterfly." – CME Group

"The wings of the butterfly protect the trader from the unlimited risk of the straddle. Buying a butterfly limits the risk of being wrong to the cost of the butterfly." – CME Group

Vertical vs. Calendar Butterfly Spreads

The basic butterfly structure can be adapted to suit different market outlooks through variations like vertical and calendar spreads.

Vertical butterfly spreads involve three different strike prices but share the same expiration date. This approach assumes the underlying price will land at a specific target by the expiration date. For instance, buying one 52 call, selling two 54 calls, and buying one 56 call – all expiring in December – forms a vertical butterfly spread.

Calendar butterfly spreads, also known as horizontal butterflies, use the same strike price but span three different expiration dates. Instead of betting on a specific price, this strategy focuses on the term structure or forward curve. For example, you might buy one nearby contract, sell two middle-month contracts, and buy one distant-month contract to benefit from shifts in contango or backwardation.

| Feature | Vertical Butterfly Spread | Calendar Butterfly Spread |

|---|---|---|

| Construction | Three different strikes, same expiration | Same strike, three different expirations |

| Primary Driver | Price moving toward and staying at the middle strike | Price stability and time decay across the term structure |

| Market View | Neutral to slightly directional; specific price target | Neutral; betting on forward curve curvature |

These variations provide a framework for tailoring butterfly spreads to align with different market scenarios. The next section will delve deeper into how these spreads generate profit.

How Butterfly Spreads Generate Profit

A long butterfly spread becomes profitable when the price of the underlying asset settles at the middle strike price at expiration. In this situation, the two short options expire worthless, while the lower-strike option reaches its full intrinsic value (equal to the wing width), and the higher-strike long option also expires worthless.

Time decay plays a crucial role here, as it erodes the value of the short options faster than the long wings, especially as expiration approaches. This effect becomes more pronounced in the final month, which is why many traders open these positions 20 to 45 days before expiration to take advantage of optimal theta decay.

"Time decay generally works to the trader’s advantage because it erodes the value of the short options at the middle strike price faster than the long options." – Investopedia

"Time decay generally works to the trader’s advantage because it erodes the value of the short options at the middle strike price faster than the long options." – Investopedia

This strategy comes with a clearly defined risk-reward profile. The maximum potential loss is limited to the initial net debit paid for the trade. These mechanics set the stage for calculating maximum profit, loss, and breakeven points, as detailed below.

Calculating Maximum Profit, Loss, and Breakeven Points

The math behind butterfly spreads is fairly straightforward. Here’s how it works:

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

- Maximum Profit: Subtract the net debit from the wing width (the difference between the middle and lower strikes).

- Maximum Loss: Equal to the net debit paid.

- Lower Breakeven: Add the net debit to the lower strike.

- Upper Breakeven: Subtract the net debit from the upper strike.

For instance, consider a SPY call butterfly with a $5.00 wing width and a $0.70 net debit. The trade offers a maximum profit of $4.30 and breakeven points at $515.70 and $524.30. When SPY was trading at $519.50 in a low-volatility environment, the position’s value increased, allowing the trader to exit with a $3.10 profit per share – a 443% return in just 24 days.

Another example comes from August 2024, when CME Group demonstrated a futures butterfly spread using E-mini Nasdaq-100 options with 25 days to expiration. With futures trading at 19,553, the trade involved buying one 19,400 call, selling two 19,600 calls, and buying one 19,800 call. This setup required a net debit of 17.5 points (or $350). If the index had expired exactly at 19,600, the trade would have delivered a maximum profit of 182.5 points (or $3,650).

| Metric | Calculation Formula | Example ($95/$100/$105 at $1.50 cost) |

|---|---|---|

| Maximum Profit | Wing Width – Net Debit | $5.00 – $1.50 = $3.50 |

| Maximum Loss | Net Debit Paid | $1.50 |

| Lower Breakeven | Lower Strike + Net Debit | $95 + $1.50 = $96.50 |

| Upper Breakeven | Upper Strike – Net Debit | $105 – $1.50 = $103.50 |

Experienced traders often follow some key guidelines with butterfly spreads. One common rule is to enter the trade only if the net debit is 25% to 30% or less of the wing width. Additionally, many aim for a reward-to-risk ratio of at least 3:1. It’s also a popular practice to close the position once 75% to 80% of the maximum profit has been captured, as the remaining potential gains may not justify the risk of late-stage gamma exposure.

Setting Up a Butterfly Spread Trade

To set up a butterfly spread, use a 1:2:1 ratio for the lower, middle, and higher strikes. For example, you could structure it with strikes like $95/$100/$105 to maintain the strategy’s neutral stance.

The key to success lies in centering the middle strike where you anticipate the underlying asset will land at expiration. This decision should be guided by technical analysis – consider strong support and resistance levels or implied volatility-based expected moves. If you lean slightly bearish, position the middle strike just below the current price; if bullish, place it slightly above.

The width of the wings plays a critical role in shaping both the trade’s cost and its profit potential. Wider wings can increase your maximum profit and expand the breakeven range but come with a higher upfront cost. A common rule among seasoned traders is to keep the spread cost between 25–30% of the wing width to maintain a balanced reward-to-risk ratio. For longer-dated options, aim for a spread cost that’s 10% or less of the wing width.

To minimize risks, execute the butterfly spread as a single multi-leg order. This avoids "leg risk", where one part of the trade executes while the others do not. Additionally, exchanges like CME Group and ICE Futures offer spread-margining, which reduces the capital required compared to holding three separate positions.

How to Choose the Right Strikes

Once you’ve structured the spread, the next step is selecting strikes that align with your market outlook and risk tolerance.

Start by identifying the price level where the underlying asset is most likely to settle at expiration. This becomes your middle strike. Use tools like technical indicators, pivot points, or recent trading ranges to pinpoint this target price.

Pay attention to implied volatility (IV) before entering the trade. Butterfly spreads tend to work best when IV is above the 50th percentile, as the higher IV makes the sold middle strikes more valuable. Timing is also critical – look to enter the trade 20 to 45 days before expiration to take advantage of accelerated theta decay in the final month.

For the wings, you’ll need to find a balance between cost and profit potential. Narrower wings reduce your upfront cost but also limit your profit range. On the other hand, wider wings give you more room for error but come at a higher cost. A "broken wing" butterfly, such as $95/$100/$110, can lower the entry cost or expand the profit zone on one side, though it increases risk on that same side.

Lastly, liquidity is crucial. Thinly traded strikes can make it difficult to adjust or exit your position without facing unfavorable bid-ask spreads, which could eat into your profits. Before committing capital, check the open interest and daily trading volume for each strike. This step ensures smoother execution and reduces the risk of slippage during order management.

Risk Management and When to Use Butterfly Spreads

Butterfly spreads are a popular strategy for traders who want to manage risk effectively. Unlike straddles, which carry unlimited risk, butterfly spreads come with defined, capped losses limited to the net debit paid for the position. Additionally, exchanges like CME Group and ICE Futures offer spread margining, which reduces initial margin requirements by offsetting risks. This lower margin requirement frees up capital, allowing traders to allocate funds across multiple trades or explore other opportunities.

These spreads work best in range-bound, low-volatility markets where the underlying asset stays near a specific target price. The strategy primarily earns profits from time decay (theta) and volatility contraction (vega). When the price lingers near the middle strike, the two short options lose value faster than the long wings, creating an opportunity to profit as expiration nears. Since butterfly spreads are short vega positions, they also benefit when implied volatility drops – often after major events that reduce market uncertainty.

"Butterfly spreads provide traders with multiple attractive benefits when they want to use a structured method for making profits in markets that stay stable or within a range."

– Kyle Maring, HighStrike

"Butterfly spreads provide traders with multiple attractive benefits when they want to use a structured method for making profits in markets that stay stable or within a range."

– Kyle Maring, HighStrike

Professional traders often aim for at least a 3:1 reward-to-risk ratio when using butterfly spreads. To maintain this balance, it’s generally recommended not to pay more than 25–30% of the wing width for the spread. Additionally, many traders choose to close their positions once they’ve captured 75–80% of the maximum profit potential. Exiting 3–5 days before expiration is also crucial to avoid "pin risk", which can arise when the underlying price settles near the middle strike. Understanding how volatility influences this strategy can further refine risk management.

How Implied Volatility Affects Butterfly Spreads

Implied volatility (IV) plays a key role in the profitability of butterfly spreads. When IV is elevated, the middle strikes become more valuable, offering better entry pricing. As IV contracts, the short vega position benefits, boosting the spread’s profitability. This dynamic makes butterfly spreads particularly effective after significant market events – like earnings releases, Federal Reserve announcements, or other catalysts – when uncertainty fades and IV typically decreases. The combination of falling volatility and accelerating time decay can create a favorable environment for this strategy, as long as the underlying price remains near the middle strike.

Advanced Butterfly Spread Strategies

Butterfly spreads, typically seen as neutral strategies, can be adjusted to reflect specific market views or take advantage of term structure dynamics. By tweaking elements like strike prices, ratios, or contract choices, traders can align the strategy with their expectations while keeping risk under control.

One popular application is curve trading. Here, traders use calendar butterflies to focus on shifts in the forward curve – specifically, changes between contango and backwardation. For instance, a trader might buy one front-month contract, sell two middle-month contracts, and buy one back-month contract. This setup profits if the middle contract’s price moves to a predicted level. Exchanges often recognize the offsetting risks in this structure, making it a margin-efficient choice.

Another variation involves altering the standard ratio (1:2:1) to something like 1:3:2, introducing a directional bias with a single breakeven point and a potentially higher reward-to-risk ratio. For example, traders might use puts to express a bullish view or calls for a bearish one. These positions are typically entered four to six weeks before expiration, striking a balance between time decay and anticipated price movement. By making these adjustments, traders can transform a neutral butterfly into a directional strategy.

Using Butterfly Spreads for Directional Trades

Traders aiming for a directional edge can modify a butterfly spread by placing the middle strike at an out-of-the-money target. Imagine you’re moderately bullish on crude oil futures. In this case, you could position the short middle strikes above the current price, aiming for maximum profit if the underlying asset lands precisely at that target upon expiration.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

For scenarios involving high volatility and sharp price swings, a long iron butterfly offers an alternative. This four-leg strategy is designed to profit when prices move significantly beyond the outer wings, making it ideal when implied volatility is low but expected to rise. Unlike standard butterflies, which benefit from falling volatility (negative vega), iron butterflies gain from rising volatility (positive vega). To enhance the risk-reward profile, consider entering the trade when the spread costs 10% or less of the distance between the lower and middle strikes. This approach can provide a more favorable balance of risk and potential returns.

Technology Requirements for Executing Butterfly Spreads

Executing butterfly spreads involves managing three or four legs simultaneously. Any delay in execution can expose traders to "leg risk", where one part of the trade executes while another does not. To avoid this, having a reliable and high-performance trading setup is absolutely essential. Speed and precision are key, with latency playing a critical role in ensuring all legs of the trade are filled at the desired prices.

In fast-moving futures markets, ultra-low latency is non-negotiable. Professional-grade systems should aim for latencies between 0 and 2 milliseconds to ensure accurate and timely execution. Studies show that trading platforms optimized with VPS (Virtual Private Server) solutions can achieve 42% faster order fills and cut missed trading opportunities by as much as 58%. This is particularly significant given that algorithmic trading now accounts for nearly 80% of daily market activity.

System stability is another critical factor. High-performance CPUs and NVMe storage are essential for keeping platforms responsive, even during periods of market volatility. Dedicated resources prevent delays caused by system overloads, while a 100% uptime guarantee ensures your trading platform remains operational at all times. This kind of reliability protects against disruptions from local power outages or internet failures. Many professional traders use specialized VPS solutions to maintain constant monitoring and effective risk management.

How QuantVPS Enhances Butterfly Spread Execution

QuantVPS is specifically designed to meet these technical demands. By positioning servers close to major exchange hubs like Chicago’s CME, QuantVPS achieves latencies as low as 0–1 milliseconds. This proximity minimizes data travel time, ensuring smooth and accurate execution of multi-leg butterfly spread orders.

QuantVPS supports popular trading platforms like NinjaTrader, MetaTrader, and TradeStation, offering dedicated CPU cores (ranging from 4 to 24+ cores, depending on the plan) and fast NVMe storage. The service also provides a 100% uptime guarantee, automatic backups, and robust DDoS protection, ensuring your trading environment remains stable and operational 24/7, even during volatile market conditions.

Pricing for QuantVPS starts at $59.99 per month for the VPS Lite plan, which includes 4 CPU cores and 8GB of RAM. For traders managing more complex strategies, dedicated servers with 16+ cores and 128GB of RAM are available for $299.99 per month. All plans come with unmetered bandwidth on high-speed networks – 1Gbps+ for standard plans and 10Gbps+ for dedicated servers – ensuring seamless, real-time data flow during critical trading moments.

Conclusion

Butterfly spreads are a calculated strategy for traders aiming to benefit from range-bound markets while keeping risks under control. Built with a three-leg structure (commonly in a 1:2:1 ratio), this approach focuses on price curvature rather than directional movement. The goal? To profit when the underlying asset lands near the middle strike price at expiration. Plus, you know your maximum potential gain and loss right from the start – a clear advantage over strategies with unlimited risk, like short straddles.

Success with butterfly spreads depends on choosing the right strikes, timing volatility shifts accurately, and leveraging theta decay. Maximum profit is achieved when the futures contract expires exactly at the center strike, while losses are limited to your initial net debit. For traders looking to tweak the strategy, variations like modified butterflies (1:3:2 ratio) and iron butterflies offer added flexibility, allowing adjustments to risk-reward profiles and directional biases.

Timing and risk management are critical. Since butterfly spreads have negative Vega, they perform best when implied volatility is high but expected to drop. Rising volatility can work against the strategy, so careful entry timing is essential.

Executing these strategies effectively also requires dependable trading infrastructure. Multi-leg trades demand precision, and low-latency futures trading systems are crucial for capturing the exact price relationships that make butterfly spreads work.

"The Futures butterfly spread refines exposure from outright price bets to curvature and relative value, making it a precision tool for term-structure strategies".

"The Futures butterfly spread refines exposure from outright price bets to curvature and relative value, making it a precision tool for term-structure strategies".

When paired with disciplined risk management, well-timed execution, and reliable technology, butterfly spreads can be a powerful addition to an advanced trader’s toolkit. They offer defined-risk opportunities in markets where directional bets might be too unpredictable.

FAQs

What’s the difference between vertical and calendar butterfly spreads in futures trading?

Vertical and calendar butterfly spreads are distinct in their setups and the market situations they aim to address.

A vertical butterfly spread combines options or futures contracts that share the same expiration date but have varying strike prices. This strategy is ideal when you expect the price to stay within a tight range around a specific level by the time the contracts expire. It’s a way to target limited price movement while keeping risk contained.

In contrast, a calendar butterfly spread involves contracts with the same strike price but different expiration dates. This strategy capitalizes on the differences in time decay and volatility between short-term and long-term options. It’s a go-to choice when you foresee stable prices but expect volatility to shift as time progresses.

To put it simply, vertical spreads are tailored for short-term price stability, while calendar spreads shine when time decay and volatility changes are the main considerations.

How does implied volatility affect the profitability of butterfly spreads in futures trading?

Implied volatility has a big impact on how profitable butterfly spreads can be. When implied volatility rises, option premiums become more expensive, which can shrink the potential profits from this strategy. On the other hand, when implied volatility is lower, butterfly spreads tend to perform better because they work best in calm, low-volatility markets.

It’s important for traders to evaluate both current and anticipated volatility levels before using butterfly spreads. Shifts in implied volatility can significantly affect the balance between risk and reward, as well as how effective the strategy will be overall.

How do I choose the best strike prices for a butterfly spread in futures trading?

When choosing strike prices for a butterfly spread, the goal is to create a balanced risk-reward setup that matches your market expectations. Typically, the middle strike is positioned close to the current price of the underlying asset. This approach maximizes profit potential if the market remains within a tight range by the time the options expire. The outer strikes are usually placed at equal distances from the middle strike, forming a symmetrical structure that makes managing risk more straightforward.

In a low-volatility market, it’s often better to place the strikes closer together to capitalize on minimal price movement. On the other hand, if volatility is higher, wider strike distances may be more appropriate to accommodate larger price fluctuations. It’s also important to keep the initial cost of the spread reasonable – ideally less than 10% of the distance between the strikes. This helps maintain a solid risk-reward ratio. Always align your strike price choices with your market outlook, volatility expectations, and personal risk tolerance to achieve the best possible outcome.