Boom and Bust Cycle Examples Since 1929: History & Causes

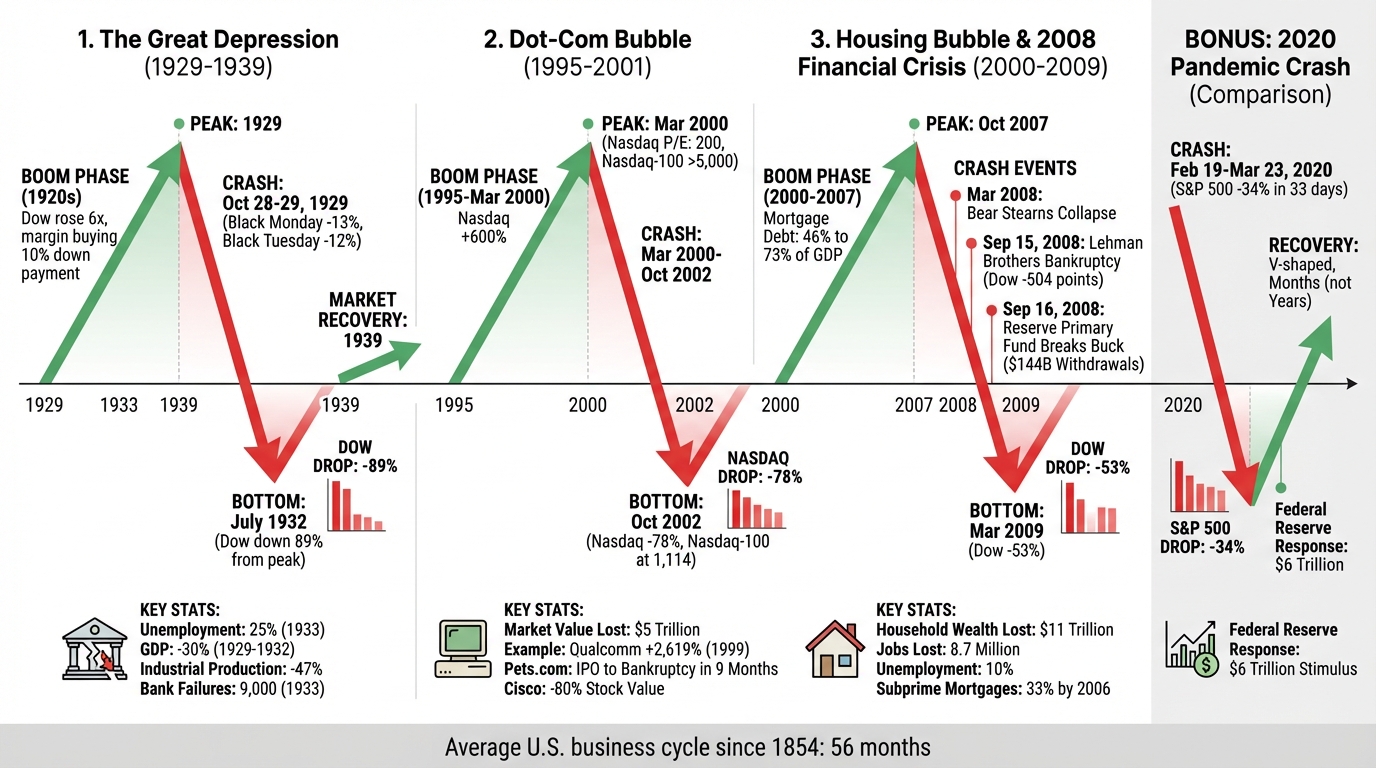

Boom and bust cycles are patterns of economic growth followed by contraction. These cycles typically include four phases: expansion, peak, contraction, and trough. Since 1854, the U.S. has experienced 34 such cycles, lasting an average of 56 months. Historical examples like the Great Depression (1929–1939), the Dot-Com Bubble (1995–2001), and the 2008 Financial Crisis reveal how factors like monetary policy, investor behavior, and structural imbalances drive these cycles.

Key takeaways for traders:

- Understand leverage risks: Excessive borrowing often leads to market collapses.

- Watch for psychological shifts: Optimism during booms can quickly turn to panic in busts.

- Prepare for volatility: Boom and bust periods create unpredictable market conditions, requiring rapid decision-making and reliable trading systems.

The article also highlights how modern markets, shaped by technology and faster feedback loops, have compressed these cycles. Tools like VPS hosting ensure traders can operate efficiently during volatile times, minimizing risks from system disruptions or delays.

What Causes Boom and Bust Cycles

Common Triggers and Drivers

Boom and bust cycles often stem from a mix of monetary policy decisions, investor behavior, and significant structural changes in the economy. Central banks typically spark booms by lowering interest rates, which makes borrowing more affordable. This encourages businesses and individuals to take on more debt. However, this wave of easy credit can lead to what economists refer to as "malinvestment", where capital gets funneled into projects or assets that may not be sustainable in the long run.

Government policies can add fuel to this fire. For instance, tax incentives like mortgage interest deductions can drive investments in specific sectors, occasionally inflating bubbles in those areas. Technological advancements can also play a pivotal role. Take the 1920s, for example - rapid growth in industries like automobiles and telephones fueled speculative investments, contributing to the eventual crash of 1929. During this period, the Federal Reserve raised interest rates in 1928 and 1929 to counteract excessive stock market speculation. This tightening of monetary policy slowed economic activity and, under the constraints of the international gold standard, helped trigger a global recession.

But it's not all about numbers and policies. Psychology plays a massive role in these cycles. As Investopedia explains:

"The boom-bust cycle is driven just as much by investor and consumer psychology as it is by market and economic fundamentals".

"The boom-bust cycle is driven just as much by investor and consumer psychology as it is by market and economic fundamentals".

During the boom phase, optimism dominates, and what Alan Greenspan once called "irrational exuberance" takes over. On the flip side, busts bring fear and uncertainty, causing investors to flock to safer assets like gold, bonds, or the U.S. dollar. These psychological and economic forces interact, creating feedback loops that amplify the swings between boom and bust.

How Market Feedback Loops Work

These cycles are fueled by feedback loops that can turn small trends into major economic events. For example, low interest rates often drive up asset prices, which in turn are used as collateral for more borrowing. A stark example of this occurred in the run-up to the 1929 crash, when investors could purchase stocks on margin by paying just 10% of the stock's price and borrowing the other 90%. As stock prices rose, investors borrowed even more, creating a self-sustaining cycle of rising prices - until it all came crashing down.

When the bubble bursts, the feedback loop reverses with devastating speed. Falling asset prices lead to losses for investors, shaking confidence. Consumers cut back on spending, businesses lay off workers, and credit markets tighten as borrowers begin to default. The 1929 crash illustrates this vividly: the Dow Jones Industrial Average dropped nearly 13% on Black Monday (October 28) and another 12% on Black Tuesday. The Federal Reserve's inability to step in as a lender of last resort during widespread banking panics allowed this downward spiral to worsen, further exacerbating the crisis.

How These Cycles Affect Trading

Booms and busts create vastly different conditions for traders. During booms, markets are typically liquid, and returns can be high, though this often comes with a dangerous sense of complacency about risks. Busts, on the other hand, are marked by extreme volatility and liquidity challenges. Markets can shift dramatically in a short period, as seen during the 1929 crash when the Dow lost nearly half its value by mid-November and eventually plummeted 89% from its peak by July 1932.

In these turbulent times, traders need fast and reliable systems to navigate the chaos. A delay of even a few seconds can mean the difference between executing a stop-loss order to limit losses and suffering catastrophic financial setbacks. Managing risk effectively becomes critical in such volatile environments.

How Do Boom And Bust Cycles Manifest Historically?

Historical Boom and Bust Cycles: Case Studies

Major Boom and Bust Cycles Since 1929: Timeline and Impact

Major Boom and Bust Cycles Since 1929: Timeline and Impact

These examples highlight the factors that have driven major market upheavals and the lessons they offer for today's traders.

The Great Depression (1929–1939)

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

The 1920s saw the Dow rise sixfold, fueled by speculative margin buying that required only a 10% down payment. This frenzy inflated an enormous equity bubble. When the Federal Reserve raised interest rates in 1928 and 1929 to rein in speculation, it inadvertently triggered a global recession. By 1932, the market had plummeted to just a tenth of its peak, laying bare the dangers of unchecked speculation.

The fallout was catastrophic. By 1933, U.S. unemployment soared to 25%, and GDP shrank by 30% between 1929 and 1932. Industrial production dropped nearly 47%, and the banking system was in shambles, with about 9,000 U.S. banks failing by 1933. A pivotal moment came in December 1930 when the Bank of United States collapsed after a massive run, accounting for a third of the $550 million in deposits lost across 608 banks that shut down in late 1930.

The crisis exposed critical flaws in monetary policy and structural weaknesses. The Federal Reserve’s reluctance to act as a lender of last resort during the 1930–1933 banking panics caused a sharp contraction in the money supply. Globally, the gold standard forced countries into deflationary policies to protect reserves, worsening the depression's reach. Nations like Great Britain, which abandoned the gold standard early in 1931, recovered faster than those like France, which held on until 1936.

For modern traders, the Great Depression offers a stark reminder of the risks tied to leverage and liquidity. It also led to lasting reforms, such as the creation of the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC), which remain cornerstones of today's financial systems.

Dot-Com Bubble and Bust (1995–2001)

Between 1995 and March 2000, the Nasdaq skyrocketed 600%, driven by the rapid adoption of the internet, ample venture capital, and low interest rates. Investors embraced "new economy" metrics, ignoring traditional valuation benchmarks. At its height, the Nasdaq's price–earnings ratio hit 200, far exceeding the peak of 80 seen during Japan's asset bubble in 1991.

The frenzy reached absurd levels - Qualcomm's stock, for instance, jumped 2,619% in 1999 alone. Companies prioritized growth over profitability, pouring money into advertising and branding. But when the bubble burst, the Nasdaq plunged 78% between March 2000 and October 2002, wiping out $5 trillion in market value. The Nasdaq-100 fell from over 5,000 to just 1,114.

High-profile casualties piled up. Pets.com, after a flashy IPO and Super Bowl ads, folded just nine months later in November 2000. Even established players like Cisco Systems weren't immune, as its stock lost 80% of its value amid a telecom spending collapse. Investor Sir John Templeton profited by shorting 84 dot-com stocks before their IPO lock-up periods expired, correctly anticipating a sell-off by executives that would tank prices.

The key takeaway? Hype isn’t enough - businesses need sustainable models. Survivors like Amazon and eBay thrived by focusing on well-defined niches and solid revenue streams. Traders should remain cautious when valuations stray too far from historical norms and prioritize diversification. This era serves as a warning against chasing trends without evaluating long-term viability.

Housing Bubble and 2008 Financial Crisis

Low interest rates between 2000 and 2003 fueled a boom in homeownership and speculative real estate investment. Mortgage debt relative to GDP surged from 46% in the 1990s to 73% by 2008. Banks eagerly issued subprime and "no-documentation" loans, which by 2006 made up one-third of all mortgages. These risky loans were bundled into securities and sold globally, creating a fragile web of financial interconnections.

When housing prices declined and defaults rose, the system unraveled. In March 2008, Bear Stearns collapsed under $46 billion in mortgage assets and was sold to JPMorgan Chase for $2 per share (later raised to $10) in a Federal Reserve–brokered rescue. By September 15, 2008, Lehman Brothers filed for the largest bankruptcy in U.S. history after the Fed refused to guarantee its loans, leading to a 504-point drop in the Dow and a global market crash. The next day, the Reserve Primary Fund "broke the buck" due to Lehman exposure, prompting $144 billion in withdrawals from U.S. money market funds in a single day. To prevent further collapse, the government provided an $85 billion bailout to AIG, the nation’s largest insurer.

The crisis wiped out $11 trillion in household wealth, eliminated 8.7 million jobs, and pushed unemployment to 10%. The Dow fell 53% between October 2007 and March 2009. Federal Reserve Chair Ben Bernanke captured the gravity of the situation when he told Congress:

"If we don't do this, we may not have an economy on Monday".

"If we don't do this, we may not have an economy on Monday".

For traders, the 2008 crisis underscores the need to prepare for systemic failures. Stress-testing strategies and understanding how correlations between assets can spike during crises are essential. These lessons continue to shape modern risk management practices and reinforce the importance of a resilient trading framework.

Modern Markets and Faster Boom-Bust Cycles

How Markets Changed Since the 1990s

The late 1990s marked a turning point for financial markets, as online trading platforms brought retail investors into the fold and fueled the Dot-Com bubble. What used to take years to unfold now happens in mere days. Traditional floor trading gave way to electronic systems, while high-frequency trading algorithms began executing thousands of trades in the blink of an eye. And markets that once adhered to a strict 4:00 PM Eastern closing time now operate around the clock across global exchanges.

These advancements have reshaped the way boom-and-bust cycles play out. Modern tools like Exchange Traded Funds (ETFs), passive index funds, and dark pools have made it easier for financial shocks to ripple across markets worldwide. In moments of panic, automated systems can amplify sell-offs, leading to steeper and faster declines. This tech-driven environment has set the stage for the rapid market swings that have defined recent financial crises.

Recent Example: 2020 Pandemic Market Crash

The market crash of March 2020 is a prime example of how quickly modern cycles can unfold. Between February 19 and March 23, 2020, the S&P 500 plunged roughly 34% - a historic drop that occurred in just 33 days. Unlike the drawn-out recoveries following the Great Depression or the 2008 financial crisis, the 2020 crash saw a swift "V-shaped" rebound. This recovery was fueled by aggressive action from the Federal Reserve, which pumped $6 trillion into the economy, stabilizing markets in a matter of months rather than years.

This fast-paced collapse and recovery highlighted the need for immediate decision-making. Traders faced immense challenges, particularly those who lost access to markets during critical moments or whose systems failed under the pressure. Liquidity dried up, making it even harder to execute trades when it mattered most.

How VPS Hosting Helps Manage Trading Risks

In today’s volatile markets, having a strong and reliable infrastructure is no longer optional - it’s a necessity. As market swings grow faster and more unpredictable, traders need tools that can keep up.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

This is where VPS hosting comes in. It provides the kind of reliable, low-latency performance that modern trading strategies demand, especially during periods of extreme volatility. Home internet connections are prone to disruptions and delays, which can turn a winning trade into a costly loss. QuantVPS offers 0–1ms latency and guarantees 100% uptime, ensuring traders always have access to the market, even during the most chaotic moments.

For algorithmic traders, uninterrupted execution is critical. A dependable VPS eliminates the risk of missing key trades due to local technical issues. Features like dedicated resources, DDoS protection, and automatic backups allow traders to focus entirely on their strategies without worrying about system reliability. In a world where market cycles can compress from years into weeks, having enterprise-grade infrastructure is no longer just helpful - it’s essential.

Conclusion: Lessons for Traders and Infrastructure

Key Lessons from Historical Cycles

Since 1854, U.S. business cycles have averaged about 56 months. What determines whether a downturn is simply a correction or a full-blown collapse often lies in the system's structure rather than the specific trigger. Leverage remains the biggest risk. When debt grows faster than the economy itself, it creates a dangerous feedback loop, turning normal market volatility into systemic breakdowns. Today, much of this leverage is embedded in derivatives, options markets, and securities-based lending.

Another critical issue is market concentration. By late 2025, the top seven stocks in the S&P 500 made up roughly 30% to 35% of the index's total value. This concentration, combined with leverage, can amplify forced selling during downturns. When passive investment flows reverse, they essentially become a "forced-selling machine". And liquidity, which seems abundant in good times, can dry up in an instant during a panic, leaving wide spreads and few buyers. Traders who recognize these patterns can take proactive steps: stress-testing portfolios for steep declines, monitoring credit spreads for early warning signs, and maintaining liquid reserves to avoid selling under pressure. These strategies highlight the need for solid trading systems that can withstand turbulent markets.

Why Infrastructure Matters for Trading Success

Historical market cycles also show that strong infrastructure can reduce the impact of sudden market shifts. When liquidity disappears and price swings intensify, quick execution becomes vital. Systems must be reliable enough to seize opportunities and avoid forced exits. The banking stress of March 2023 is a vivid example - three mid-sized U.S. banks collapsed in just one week, showing how quickly liquidity issues can escalate into solvency crises. In such moments, traders need dependable systems. Relying on unstable home internet or unreliable platforms can turn manageable losses into catastrophic ones.

QuantVPS offers a solution with its high-performance VPS hosting designed to keep traders fully operational during market chaos. With ultra-low latency (0–1ms) and a 100% uptime guarantee, it ensures trades are executed without delay, even in the most volatile conditions. Features like DDoS protection, automatic backups, and dedicated resources provide an added layer of security, allowing algorithmic strategies to run smoothly. This is particularly effective when building automated strategies on professional platforms. In a world where market cycles are compressing from years into weeks, having enterprise-grade infrastructure can mean the difference between staying competitive and being forced out at the worst possible time.

FAQs

How does investor psychology influence boom and bust cycles?

Investor psychology is a powerful force behind the dramatic ups and downs of markets. During boom periods, emotions like optimism, overconfidence, and herd behavior take center stage. Investors, caught up in the excitement, often overlook the true value of assets. This leads to a self-reinforcing cycle: rising prices attract more buyers, which pushes prices even higher and fuels the belief that the upward trend will never end.

But when prices soar too far beyond their actual worth, the mood shifts. Fear and panic set in, and a rush to sell begins. This selling frenzy causes prices to tumble, kicking off the bust phase. These emotional swings - from greed-fueled buying to fear-driven selling - are what drive the dramatic highs and lows that define market cycles.

How do modern technologies affect the speed of economic boom-and-bust cycles?

Modern technologies like high-speed digital communication, algorithmic trading, and artificial intelligence have dramatically sped up the cycle of economic booms and busts. These advancements allow information to travel almost instantly, leading to rapid capital surges during optimistic periods. At the same time, automated trading systems can make split-second decisions, intensifying both the highs and lows of asset prices.

Take the recent buzz around generative AI as an example. Within just a few months, investments in AI-focused companies skyrocketed, driving valuations to new heights. But this rapid ascent, fueled by social media hype and AI-powered investment strategies, could just as quickly unravel if market sentiment shifts due to events like regulatory changes or underwhelming earnings reports. These technologies not only drive growth but also shrink the timeline of economic cycles, making them faster and far more unpredictable than ever before.

Why is having reliable trading infrastructure essential during market volatility?

When markets become volatile, having a reliable trading infrastructure isn't just helpful - it's essential. It ensures you can access trading platforms quickly and without interruptions, reducing the risk of delays or outages that could lead to missed opportunities or costly mistakes.

A strong system allows for real-time data processing, swift order execution, and secure transactions - all of which are crucial when markets are moving fast. By using dependable technology, traders can navigate unpredictable conditions with more confidence and better risk management.

Investor psychology is a powerful force behind the dramatic ups and downs of markets. During boom periods, emotions like optimism, overconfidence, and herd behavior take center stage. Investors, caught up in the excitement, often overlook the true value of assets. This leads to a self-reinforcing cycle: rising prices attract more buyers, which pushes prices even higher and fuels the belief that the upward trend will never end.

But when prices soar too far beyond their actual worth, the mood shifts. Fear and panic set in, and a rush to sell begins. This selling frenzy causes prices to tumble, kicking off the bust phase. These emotional swings - from greed-fueled buying to fear-driven selling - are what drive the dramatic highs and lows that define market cycles.

Modern technologies like high-speed digital communication, algorithmic trading, and artificial intelligence have dramatically sped up the cycle of economic booms and busts. These advancements allow information to travel almost instantly, leading to rapid capital surges during optimistic periods. At the same time, automated trading systems can make split-second decisions, intensifying both the highs and lows of asset prices.

Take the recent buzz around generative AI as an example. Within just a few months, investments in AI-focused companies skyrocketed, driving valuations to new heights. But this rapid ascent, fueled by social media hype and AI-powered investment strategies, could just as quickly unravel if market sentiment shifts due to events like regulatory changes or underwhelming earnings reports. These technologies not only drive growth but also shrink the timeline of economic cycles, making them faster and far more unpredictable than ever before.

When markets become volatile, having a reliable trading infrastructure isn't just helpful - it's essential. It ensures you can access trading platforms quickly and without interruptions, reducing the risk of delays or outages that could lead to missed opportunities or costly mistakes.

A strong system allows for real-time data processing, swift order execution, and secure transactions - all of which are crucial when markets are moving fast. By using dependable technology, traders can navigate unpredictable conditions with more confidence and better risk management.

"}}]}