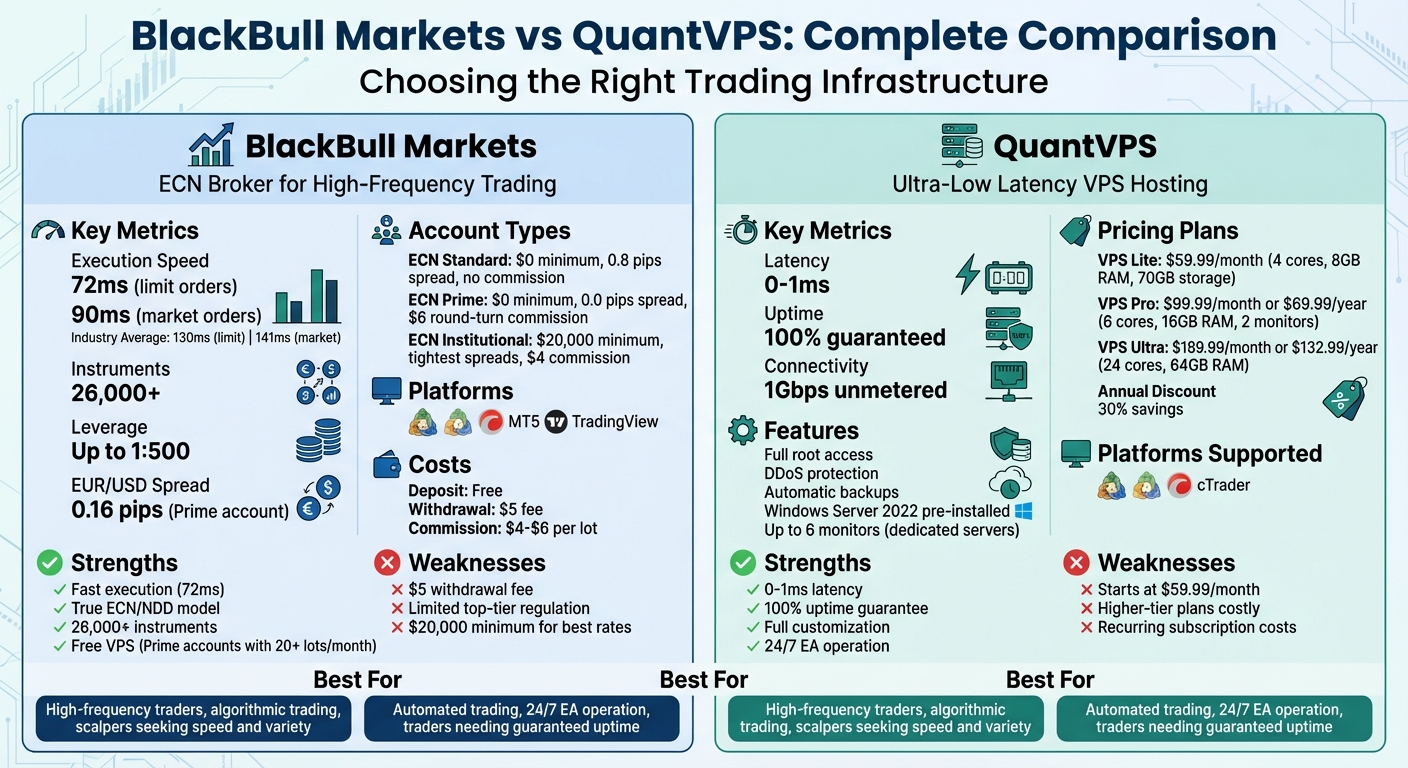

BlackBull Markets Review: Is This ECN Broker Worth It?

BlackBull Markets, a New Zealand-based broker founded in 2014, offers a true ECN trading environment with fast execution speeds and access to over 26,000 instruments. Their infrastructure, powered by Equinix servers in New York, London, and Tokyo, ensures low-latency trading, making it ideal for high-frequency and algorithmic traders. Limit orders execute in 72 ms, faster than the industry average of 130 ms, and market orders in 90 ms versus 141 ms.

Key highlights:

- Account Types: Three ECN accounts with spreads starting at 0.0 pips and leverage up to 1:500.

- Trading Platforms: Supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

- Costs: $6 round-turn commission on ECN Prime; $5 withdrawal fee.

- Perks: Free VPS hosting for Prime accounts meeting volume thresholds.

For traders needing uninterrupted performance, pairing BlackBull with QuantVPS offers ultra-low latency (0–1 ms) and 100% uptime. QuantVPS plans start at $59.99/month and cater to automated trading strategies. While BlackBull excels in execution speed and instrument variety, its $5 withdrawal fee and limited top-tier regulation may deter some traders. QuantVPS, while reliable, may feel costly for those on tight budgets.

Quick Comparison:

| Aspect | BlackBull Markets | QuantVPS |

|---|---|---|

| Strengths | Fast execution (72 ms); ECN model; 26,000+ instruments | 0–1 ms latency; 100% uptime; DDoS protection |

| Weaknesses | $5 withdrawal fee; lacks top-tier regulation | Starts at $59.99/month; higher-tier plans costly |

| Best For | High-frequency, algorithmic traders | Automated trading, 24/7 EA operation |

| Costs | $0–$20,000 deposit; $4–$6 commission/lot | $59.99–$299.99/month; 30% discount annually |

BlackBull Markets is ideal for active traders seeking speed and variety, while QuantVPS suits those prioritizing uninterrupted automated trading.

BlackBull Markets vs QuantVPS: Complete Trading Infrastructure Comparison

BlackBull Markets vs QuantVPS: Complete Trading Infrastructure Comparison

1. BlackBull Markets

Account Types

BlackBull Markets offers three main ECN account types tailored to different trading needs and volumes. The ECN Standard account has no minimum deposit requirement, charges no commission, and offers spreads starting from 0.8 pips. The ECN Prime account also requires no minimum deposit but provides raw spreads starting at 0.0 pips, with a $6.00 round-turn commission per standard lot. For institutional traders, the ECN Institutional account requires a $20,000 deposit, delivering the tightest spreads and negotiable commissions starting at $4.00 round-turn.

All accounts support automated trading on platforms like MT4, MT5, and cTrader, accommodating strategies such as scalping, hedging, and high-frequency trading. Traders can access leverage of up to 1:500 across all account types. Additionally, Prime account holders who maintain a balance of $2,000 and trade at least 20 lots per month qualify for top VPS providers for Forex trading - a service that typically costs $30 per month.

These flexible account options integrate seamlessly with BlackBull's advanced trading platforms, making them a solid choice for traders of all levels.

Trading Platforms and Tools

BlackBull Markets supports a range of industry-leading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. MT4 offers 30 technical indicators and full support for automated trading, while MT5 enhances this with 21 timeframes, over 80 indicators, and depth-of-market pricing - ideal for multi-asset trading, including stocks. TradingView, a platform trusted by over 30 million traders, provides advanced charting tools with 100+ pre-built indicators and a built-in social network.

For institutional clients, BlackBull offers a FIX API, allowing direct market access with lower latency, bypassing standard retail platforms. The broker also integrates Autochartist, a tool that identifies trading patterns and sends automated alerts directly within MetaTrader. Moreover, clients trading at least one lot per month gain free access to TradingView Pro features.

With these tools, BlackBull Markets ensures traders have access to cutting-edge technology and resources.

Fees and Costs

The ECN Prime account is an excellent option for active traders, combining raw spreads starting at 0.0 pips with a $3.00 commission per side ($6.00 round-turn per lot). This results in an all-in cost of approximately 0.76 pips for EUR/USD trades, which is significantly lower than the Standard account’s 0.8 pips spread. On average, the EUR/USD spread for Prime accounts is an impressive 0.16 pips, making it highly competitive.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

Additional costs include a $5 withdrawal fee and a $5 monthly inactivity fee after 90 days without trading. Deposits are free, and swap rates are tied to tier-1 bank interest rates, with triple swaps applied on Wednesdays to cover the weekend.

"There are no fees for opening or funding a BlackBull account, which is a big plus for new traders, but the $5 withdrawal charge is a letdown - accessing my funds shouldn't come at a cost."

– Christian Harris, Active Trader and Researcher

"There are no fees for opening or funding a BlackBull account, which is a big plus for new traders, but the $5 withdrawal charge is a letdown - accessing my funds shouldn't come at a cost."

– Christian Harris, Active Trader and Researcher

Trading Conditions

BlackBull Markets offers access to over 26,000 tradable instruments, including 64–72 forex pairs, indices, metals, and cryptocurrencies. Its true ECN/STP model ensures no dealing desk interference, eliminating conflicts of interest. Margin calls are triggered when account equity drops below 70%, and positions are automatically closed at 50%.

Execution speeds are impressive, with most orders completed in under 75 ms. Trades executed on the NY4 Equinix server can be processed in as little as 2–5 ms. BlackBull collaborates with over 66 liquidity providers, ensuring deep market depth and minimal slippage - an essential feature for high-frequency trading strategies.

This focus on speed and efficiency makes BlackBull Markets a strong choice for traders who prioritize fast execution and reliable trading conditions.

BlackBull Markets Review 2025 – Is This ECN Broker Worth It?

2. QuantVPS

Designed to complement the trading environment provided by BlackBull Markets, QuantVPS delivers a low-latency hosting solution tailored for automated trading strategies.

Trading Platforms and Tools

QuantVPS offers a hosting environment optimized for automated and algorithmic trading. It supports MetaTrader 4, MetaTrader 5, and cTrader, ensuring smooth integration for traders using Expert Advisors (EAs) and trading bots. With ultra-low latency ranging from 0-1ms and a 100% uptime guarantee, it ensures uninterrupted trading operations.

The hosting infrastructure is built on NVMe storage, high-performance CPUs, and 1Gbps unmetered connectivity. Traders benefit from full root access, enabling complete customization, along with DDoS protection and automatic backups to secure trading data. For those needing extensive market coverage, the service supports up to six monitors on dedicated servers, making it ideal for monitoring multiple trading instruments simultaneously. This robust setup aligns perfectly with BlackBull’s emphasis on speed and efficiency in trading.

Fees and Costs

QuantVPS plans start at $59.99 per month for the VPS Lite plan, which includes 4 cores, 8GB of RAM, and 70GB of NVMe storage. The VPS Pro plan, priced at $99.99 per month (or $69.99 annually), offers 6 cores, 16GB of RAM, and support for two monitors. For higher performance, the VPS Ultra plan costs $189.99 monthly (or $132.99 annually) and includes 24 cores and 64GB of RAM.

Opting for annual billing saves approximately 30% compared to monthly subscriptions. Enhanced Performance Plans (+) are also available, starting at $79.99 per month, offering upgraded specifications for traders seeking even more power. These pricing options complement BlackBull’s low-latency execution, creating a streamlined trading experience.

Trading Conditions

QuantVPS operates data centers strategically designed to provide low-latency connections to major financial markets. This setup is particularly beneficial for high-frequency traders, where every millisecond counts. The service runs 24/5, ensuring continuous availability throughout the trading week.

With dedicated resources, traders avoid the performance issues often associated with shared hosting environments. Real-time system monitoring tools provide visibility into server performance, helping users address potential issues before they disrupt trading. Additionally, servers come pre-installed with Windows Server 2022, offering an optimized environment for running Windows-based trading applications without requiring extra configuration.

Pros and Cons

BlackBull Markets and QuantVPS each bring their own set of strengths and drawbacks to the table. Let’s start with BlackBull Markets. This broker boasts an impressive 72ms limit order speed, which is far faster than the industry average. Its true ECN/NDD execution model ensures no re-quotes and access to a massive range of over 26,000 tradeable instruments. These features make it an attractive option for traders who value speed and variety.

That said, there are a few downsides to consider. BlackBull Markets imposes a $5 withdrawal fee on every transaction, which can add up for traders who frequently transfer funds. Additionally, the broker lacks regulatory licenses from top-tier authorities like the FCA, ASIC, or CFTC, instead operating under the oversight of the FMA (New Zealand) and the FSA (Seychelles). Another potential hurdle is the $20,000 minimum deposit required for the Institutional account, which offers the lowest commission rate of $4 per roundtrip. This high entry point might be a dealbreaker for some traders.

On the other hand, QuantVPS prioritizes ultra-low latency and reliability. It offers latency as low as 0–1ms and guarantees 100% uptime, ensuring uninterrupted performance for Expert Advisors (EAs). Traders also benefit from full root access for customization, DDoS protection, and automatic backups to secure their data. The service’s strategic use of Equinix data centers further reduces physical distance to major exchanges, enhancing execution speed - particularly for traders using platforms like BlackBull Markets.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

However, QuantVPS isn’t without its challenges. Pricing starts at $59.99 per month, and while higher-tier plans include multi-monitor support and a 30% annual discount, these recurring costs can strain traders working with tighter budgets.

Here’s a quick comparison of the two:

| Aspect | BlackBull Markets | QuantVPS |

|---|---|---|

| Key Strengths | Fast execution speeds (72ms); True ECN/NDD model; 26,000+ instruments; Leverage up to 1:500 | 0–1ms latency; 100% uptime; Full root access; DDoS protection; Multi-monitor support (Pro plan and higher) |

| Main Weaknesses | $5 withdrawal fee; Limited regulation from Tier-1 authorities; $20,000 minimum deposit for best rates | Starting cost of $59.99/month; Lite plan lacks multi-monitor support; Annual billing needed for 30% savings |

| Best For | High-frequency and algorithmic traders; active traders seeking institutional-grade execution | Automated trading; 24/7 EA operation; traders needing low latency and guaranteed uptime |

| Costs | $0–$20,000 minimum deposit based on account type; $4–$6 commission per lot (Prime/Institutional); $5 withdrawal fee | $59.99–$299.99 monthly depending on plan; 30% discount with annual billing; no hidden fees |

Both options cater to different trading needs, so it’s essential to align your choice with your trading goals and priorities. For traders focused on execution speed and a broad range of instruments, BlackBull Markets may be the better fit. Meanwhile, those relying on uninterrupted automated trading and ultra-low latency might find QuantVPS more appealing.

Conclusion

BlackBull Markets provides the kind of institutional-grade execution and deep liquidity that appeals to scalpers, algorithmic traders, and high-frequency traders using advanced algorithmic trading tools. With a strong 4.8/5.0 rating on Trustpilot from 2,681 reviews, it’s clear that traders value its performance in key areas.

This platform is tailored for active traders rather than casual investors. As the DailyForex Editorial Team aptly notes, "BlackBull is a premium broker designed for speed, scale, and strategy, but not for passive investing or casual trading".

Even with these considerations, the trading infrastructure stands out. Partnering BlackBull Markets with QuantVPS ensures seamless, low-latency execution. By hosting your Expert Advisors (EAs) on a VPS with ultra-low latency (0–1ms) and 100% uptime, you eliminate the risks associated with local hardware failures. Plus, staying close to BlackBull’s Equinix servers in New York, London, and Tokyo enhances execution speed - a critical advantage for traders running 24/7 strategies where uninterrupted performance and minimal slippage are non-negotiable.

Active traders also enjoy perks like free VPS hosting when hitting specific trading volume thresholds. For those managing multiple EAs or requiring advanced monitoring, QuantVPS offers scalable plans starting at $59.99 per month. These plans deliver the reliability and flexibility needed to support demanding automated strategies.

FAQs

Why is BlackBull Markets a good choice for high-frequency traders?

BlackBull Markets is tailored for high-frequency traders (HFTs), offering an ultra-low-latency infrastructure designed to keep up with the demands of rapid trading. As a true ECN broker, it provides direct access to deep liquidity pools, ensuring execution speeds of less than 20 milliseconds. This speed is critical for reducing slippage, especially in algorithmic trading strategies. Traders can further enhance performance with a FIX API and dedicated VPS hosting, enabling them to colocate their trading systems near BlackBull Markets’ servers for even quicker execution.

Beyond speed, BlackBull Markets delivers tight spreads starting at 0.0 pips and a commission-based pricing structure, helping keep transaction costs manageable for traders handling high volumes. With leverage of up to 1:500 and access to over 26,000 instruments - including forex, stocks, indices, commodities, futures, and cryptocurrencies - HFT traders gain the flexibility and depth to execute a wide range of strategies effectively. These features position BlackBull Markets as a strong option for high-frequency trading.

Does BlackBull Markets charge any fees for withdrawing funds?

When withdrawing funds from BlackBull Markets, keep in mind that fees vary based on the method you choose. Credit card, Neteller, or Skrill withdrawals usually come with a $5 fee, while bank transfers are charged a $20 fee. It's a good idea to factor in these costs when planning your withdrawals to manage your finances effectively.

Does the lack of top-tier regulation impact BlackBull Markets' trustworthiness?

BlackBull Markets operates under the regulation of New Zealand’s Financial Markets Authority (FMA) and the Seychelles Financial Services Authority (FSA). While these regulatory bodies oversee the broker, they are often seen as less rigorous compared to top-tier regulators like the U.S. Commodity Futures Trading Commission (CFTC), the U.K.’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC). This means BlackBull Markets isn’t held to the stricter standards seen with these top-tier regulators, such as maintaining higher capital reserves, segregating client funds, or offering investor compensation schemes - factors many traders associate with enhanced security.

Because of this, some traders might perceive BlackBull Markets as less reliable, especially those who prioritize strong regulatory frameworks. Furthermore, the broker is not available to U.S. residents, as it does not meet the regulatory requirements necessary to operate in the United States. This limitation could make it less appealing to traders in regions with stricter regulatory standards.

BlackBull Markets is tailored for high-frequency traders (HFTs), offering an ultra-low-latency infrastructure designed to keep up with the demands of rapid trading. As a true ECN broker, it provides direct access to deep liquidity pools, ensuring execution speeds of less than 20 milliseconds. This speed is critical for reducing slippage, especially in algorithmic trading strategies. Traders can further enhance performance with a FIX API and dedicated VPS hosting, enabling them to colocate their trading systems near BlackBull Markets’ servers for even quicker execution.

Beyond speed, BlackBull Markets delivers tight spreads starting at 0.0 pips and a commission-based pricing structure, helping keep transaction costs manageable for traders handling high volumes. With leverage of up to 1:500 and access to over 26,000 instruments - including forex, stocks, indices, commodities, futures, and cryptocurrencies - HFT traders gain the flexibility and depth to execute a wide range of strategies effectively. These features position BlackBull Markets as a strong option for high-frequency trading.

When withdrawing funds from BlackBull Markets, keep in mind that fees vary based on the method you choose. Credit card, Neteller, or Skrill withdrawals usually come with a $5 fee, while bank transfers are charged a $20 fee. It's a good idea to factor in these costs when planning your withdrawals to manage your finances effectively.

BlackBull Markets operates under the regulation of New Zealand’s Financial Markets Authority (FMA) and the Seychelles Financial Services Authority (FSA). While these regulatory bodies oversee the broker, they are often seen as less rigorous compared to top-tier regulators like the U.S. Commodity Futures Trading Commission (CFTC), the U.K.’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC). This means BlackBull Markets isn’t held to the stricter standards seen with these top-tier regulators, such as maintaining higher capital reserves, segregating client funds, or offering investor compensation schemes - factors many traders associate with enhanced security.

Because of this, some traders might perceive BlackBull Markets as less reliable, especially those who prioritize strong regulatory frameworks. Furthermore, the broker is not available to U.S. residents, as it does not meet the regulatory requirements necessary to operate in the United States. This limitation could make it less appealing to traders in regions with stricter regulatory standards.

"}}]}