Best VPS for Thinkorswim Schwab (2026): Low-Latency Trading for Stocks & Options

If you're an active trader using Thinkorswim by Charles Schwab, a Virtual Private Server (VPS) can drastically improve your trading experience. Thinkorswim is resource-intensive and requires low-latency internet for real-time data and fast order execution. A VPS provides a reliable, high-performance environment with low latency, ensuring your trades are executed faster and without interruptions caused by local issues like power outages or Wi-Fi instability.

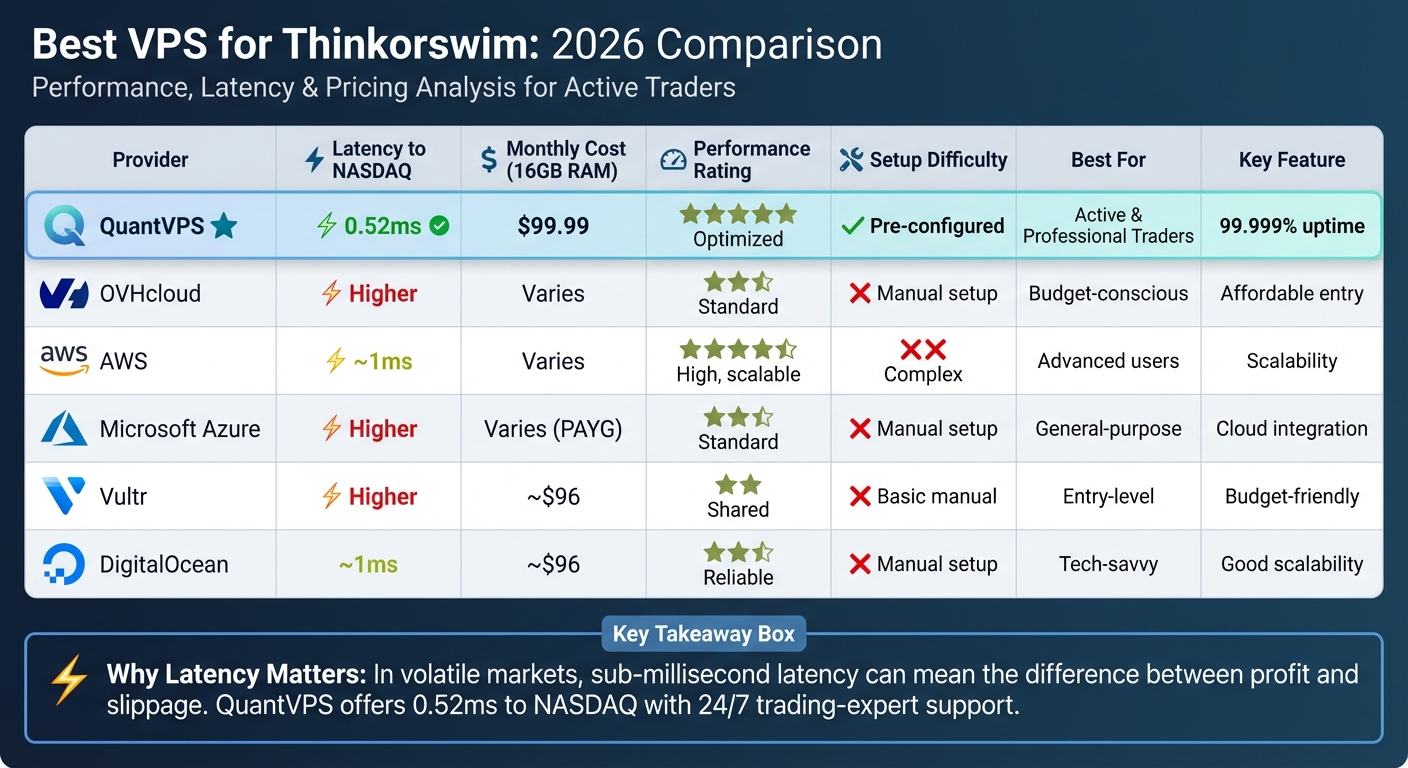

Here’s a quick overview of the best VPS options for Thinkorswim:

- QuantVPS: Offers ultra-low latency (0.52ms to NASDAQ), pre-configured setups for trading, and powerful hardware optimized for Thinkorswim. Plans start at $59.99/month.

- OVHcloud: Affordable but lacks low-latency optimizations for trading. Requires manual setup for Thinkorswim.

- AWS: High performance with options for low-latency setups, but complex to configure and can become expensive.

- Microsoft Azure: Flexible but not optimized for trading. Latency and performance may not meet Thinkorswim’s demands.

- Vultr: Budget-friendly but struggles with latency and performance for advanced trading setups.

- DigitalOcean: Reliable with good scalability but requires significant manual setup for Thinkorswim.

Quick Comparison

| Provider | Latency to NASDAQ | Monthly Cost (16GB RAM) | Performance | Ease of Setup | Best For |

|---|---|---|---|---|---|

| QuantVPS | 0.52ms | $99.99 | Optimized for trading | Pre-configured for Thinkorswim | Active and professional traders |

| OVHcloud | Higher | Varies | Standard hardware | Manual setup required | Budget-conscious traders |

| AWS | ~1ms | Varies (pay-as-you-go) | High, scalable | Complex setup | Advanced users |

| Azure | Higher | Varies | Standard hardware | Manual setup required | General-purpose users |

| Vultr | Higher | ~$96 | Shared infrastructure | Basic manual setup | Entry-level traders |

| DigitalOcean | ~1ms | ~$96 | Reliable but general-purpose | Manual setup required | Tech-savvy users |

For traders seeking speed, reliability, and ease of use, QuantVPS is the top choice. It’s specifically tailored for trading platforms like Thinkorswim, offering ultra-fast order execution and pre-configured setups. Other providers like AWS and DigitalOcean offer scalability but require significant technical expertise to configure for trading. Choose based on your trading needs, budget, and technical comfort level, or use a trading VPS configurator to find the right setup.

Best VPS Providers for Thinkorswim Trading: Performance and Pricing Comparison 2026

Best VPS Providers for Thinkorswim Trading: Performance and Pricing Comparison 2026

1. QuantVPS: High-Performance VPS for Futures Trading

Latency to Schwab Servers

QuantVPS's New York datacenter boasts an impressive 1–2ms proximity to key equities and options matching engines, with a lightning-fast 0.52ms latency to NASDAQ. This strategic setup provides a crucial edge for active traders who depend on split-second execution, especially during high-volatility market scenarios.

"Our infrastructure leverages premium hardware and optimized, high-speed network routes to major financial data centers. This minimizes latency, ensuring your Thinkorswim orders are transmitted and processed with near-instantaneous speed." - QuantVPS

"Our infrastructure leverages premium hardware and optimized, high-speed network routes to major financial data centers. This minimizes latency, ensuring your Thinkorswim orders are transmitted and processed with near-instantaneous speed." - QuantVPS

For Thinkorswim users trading stocks and options, the New York datacenter is the go-to choice for achieving the lowest latency to equities exchanges. This low-latency environment is a cornerstone of the exceptional performance supported by QuantVPS’s advanced hardware and scalable systems.

Performance (CPU, RAM, NVMe Storage)

QuantVPS combines low latency with cutting-edge hardware to deliver seamless and reliable performance. The servers are powered by enterprise-grade AMD EPYC and Ryzen processors, specifically optimized for high-frequency trading. They feature high-speed DDR4 and DDR5 RAM to handle data-intensive tasks during market fluctuations, paired with NVMe M.2 SSDs for ultra-fast application loading. With a 1Gbps connection (capable of 10Gbps bursts) and a stellar 99.999% uptime, QuantVPS ensures uninterrupted data flow.

By December 31, 2025, QuantVPS servers were managing an impressive $16.50 billion in daily futures trading volume. All systems operate on Windows Server 2022, making it easy to run Thinkorswim alongside additional tools like trade copiers or custom indicators.

Scalability and Multi-Monitor Support

Designed with Thinkorswim in mind, QuantVPS offers dedicated infrastructure tailored to handle the demands of professional trading, especially during volatile conditions. The service supports Multi-Monitor RDP (Remote Desktop Protocol), allowing traders to manage multiple screens remotely with ease. This is ideal for users running complex Thinkorswim studies or monitoring multiple charts simultaneously.

QuantVPS also offers a 5-question configurator to help traders determine the optimal CPU and RAM allocation, ensuring smooth performance without bottlenecks. Whether you're running resource-heavy trading bots, custom studies, or automated alerts, QuantVPS keeps everything running - even when your home PC is off.

Pricing and Value for Thinkorswim Workloads

QuantVPS’s tiered plans offer a range of options to meet the needs of different traders, combining robust performance and low latency for enhanced trade execution:

- VPS Lite: $59.99/month ($41.99/month annually) - 4 cores, 8GB RAM, 70GB NVMe storage

- VPS Pro: $99.99/month ($69.99/month annually) - 6 cores, 16GB RAM, 150GB NVMe, up to 2 monitors

- VPS Ultra: $189.99/month ($132.99/month annually) - 24 cores, 64GB RAM, 500GB NVMe, up to 4 monitors

- Dedicated Server: $299.99/month ($209.99/month annually) - 16+ dedicated cores, 128GB RAM, 2TB+ NVMe, up to 6 monitors

Every plan includes unmetered bandwidth, Windows Server 2022, and robust security measures like DDoS protection and advanced firewall rules to safeguard your trading capital and sensitive data. QuantVPS has earned an "Excellent" rating on Trustpilot and offers 24/7 US-based technical support from experts familiar with Thinkorswim and VPS environments.

2. OVHcloud

Latency to Schwab Servers

OVHcloud runs data centers in several U.S. regions, offering both VPS and dedicated server options. However, its infrastructure isn't specifically designed to handle the ultra-low-latency requirements of Thinkorswim trading. For traders, especially during high-stakes moments like market openings or earnings announcements, the routing may not deliver the sub-millisecond connectivity needed for seamless performance.

This can be a challenge for those executing intricate options strategies or running multiple scans, as the added latency during peak trading periods could disrupt critical operations.

Performance (CPU, RAM, NVMe Storage)

OVHcloud provides a range of VPS configurations with varying levels of CPU power, RAM, and storage. However, the hardware setup is fairly standard, and users will need to manually optimize your trading server performance. For traders using Thinkorswim, this means setting up a tailored Windows Server environment to handle resource-intensive activities like advanced charting, real-time data streaming, and processing multi-leg orders.

Pricing and Value for Thinkorswim Workloads

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

While OVHcloud's entry-level VPS plans come at a lower price point, meeting Thinkorswim's performance needs - such as sufficient CPU, memory, and storage - requires a more expensive configuration. On top of that, the manual effort and technical know-how needed to fine-tune and maintain the server can add hidden costs. For active traders managing complex portfolios, this extra workload might outweigh the initial savings.

The following section will explore AWS to compare its performance and value.

3. Amazon Web Services (AWS)

Latency to Schwab Servers

AWS provides Local Zones in New York and Chicago, positioning server resources within just 1 millisecond of major exchange facilities. For Thinkorswim traders, this proximity can significantly reduce the time it takes for order data to reach Schwab's execution infrastructure. However, to achieve such low latency, it's essential to choose the correct Local Zone instead of a standard availability zone.

AWS also leverages Cluster Placement Groups to improve performance. These groups reduce P50 latency by 37% and P90 UDP roundtrip time by 39%, which is especially beneficial for automated alerts and complex multi-leg strategies. With this foundation, AWS demonstrates its ability to meet the performance demands of Thinkorswim.

Performance (CPU, RAM, NVMe Storage)

AWS offers a wide selection of EC2 instance types tailored to different performance needs, featuring varying levels of CPU power, memory, and storage configurations. The Nitro System enhances performance further by enabling nanosecond-precision packet timestamping, which helps pinpoint delays caused by either network issues or Thinkorswim’s resource-heavy tools like charting and scanning.

For traders using multi-monitor setups with real-time market data streaming, selecting instances with enough CPU cores and RAM is essential to handle Thinkorswim's workload. AWS also provides On-Demand Capacity Reservations, ensuring that high-performance instances remain available during critical trading hours. However, choosing the right instance size can be challenging, especially for those without prior cloud infrastructure experience. These features make AWS a strong option for scalable, high-performance trading setups, but they require careful planning.

Scalability and Multi-Monitor Support

AWS’s scalability is another key strength, particularly for traders managing multi-monitor configurations. Features like Auto Scaling dynamically adjust resources based on workload demands. This flexibility is especially useful during high-volatility events, such as earnings reports or major economic announcements, when system performance is critical.

For multi-monitor setups, AWS supports remote display options like NICE DCV or standard RDP. While these tools enable "screen-trading" with single-digit millisecond latency, the actual experience depends on your internet connection and how well you configure the remote display protocol. Unlike trading-specific VPS solutions, AWS requires manual setup and optimization, which can be time-consuming.

Pricing and Value for Thinkorswim Workloads

AWS uses a pay-as-you-go pricing model, charging based on resource usage. However, scaling for Thinkorswim’s demands - such as supporting multiple monitors and real-time data feeds - can result in high monthly costs. Instance pricing varies widely depending on CPU type, memory, storage, and region. Additional costs, like data transfer fees and premium options such as Capacity Reservations, can push expenses beyond what basic VPS solutions offer.

While AWS’s flexibility is appealing, it comes with trade-offs. Monitoring usage is crucial to avoid unexpected charges, and the effort required to configure, optimize, and maintain the system adds hidden costs in terms of time and technical expertise. AWS provides powerful resources, but its complexity might make it less appealing compared to simpler, trading-focused alternatives.

4. Microsoft Azure

Latency to Schwab Servers

Microsoft Azure runs datacenters across the U.S., but it doesn't offer trading-specific features. Unlike trading-focused platforms, Azure doesn't use direct fiber-optic cross-connects, leading to higher and less predictable latency for Thinkorswim orders. For active traders - especially during volatile moments like earnings reports or market opens - these extra milliseconds can affect order execution and increase slippage. This makes Azure less ideal for those who prioritize speed and precision.

Performance (CPU, RAM, NVMe Storage)

Azure provides a variety of virtual machines with different configurations for CPU, memory, and storage, including premium SSDs. However, its processors, built for multi-tenant environments, may fall short of delivering the high-speed performance Thinkorswim users require. Running multiple charts, scans, or watchlists simultaneously can strain resources, resulting in slower responsiveness. While scaling up resources can help, it comes at a higher cost and doesn't address single-thread performance limitations. Another drawback is Azure's inconsistent NVMe-based storage performance, which is crucial for fast data access and quick application loading in trading environments.

Scalability and Multi-Monitor Support

Azure offers flexible scalability with numerous VM size options to match trading needs. However, setting up a multi-monitor Thinkorswim setup on Azure requires manual Remote Desktop Protocol (RDP) configuration. This adds a layer of complexity compared to trading-optimized VPS platforms, which often provide simpler, more user-friendly solutions. For traders without cloud experience, this can mean more time spent on setup and less on actual trading.

Pricing and Value for Thinkorswim Workloads

While Azure's pay-as-you-go pricing offers flexibility, it often leads to higher monthly expenses for Thinkorswim users who need low latency and top-tier performance. Without trading-specific optimizations, Azure struggles to deliver the value that dedicated VPS solutions provide for active traders.

5. Vultr

Latency to Schwab Servers

Vultr's U.S.-based data centers often deliver inconsistent and higher latency, which can be a concern for Thinkorswim users. During high-volatility trading periods, this latency might hinder quick order execution, a critical factor for traders.

Performance (CPU, RAM, NVMe Storage)

While Vultr offers NVMe storage, its shared, multi-tenant infrastructure isn't optimized for the demanding processing requirements of Thinkorswim. Tasks like running multiple charts, real-time scans, or performing advanced options analytics may experience noticeable slowdowns, which could impact trading efficiency.

Scalability and Multi-Monitor Support

Vultr allows users to scale resources like RAM and CPU through its control panel, making upgrades relatively straightforward. However, setting up a multi-monitor Thinkorswim workspace requires manual configuration through Remote Desktop. This lack of trading-specific optimization can mean extra work for traders who rely on professional multi-screen setups, potentially leading to compatibility issues.

Pricing and Value for Thinkorswim Workloads

Vultr's entry-level plans are budget-friendly but fall short in delivering the resources needed for intensive Thinkorswim trading. Meeting the demands of advanced trading setups, such as automated strategies or custom studies, requires upgrading to higher-tier plans, which significantly increases costs. For professional traders, this makes Vultr a less appealing option when compared to other providers. This evaluation highlights the need to explore alternatives better suited for trading workloads in the next section.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

6. DigitalOcean

Latency to Schwab Servers

DigitalOcean operates data centers in New York (NYC1, NYC2, NYC3) and Chicago, giving it a solid geographic advantage for Thinkorswim traders. These locations provide reliable network performance, but they don’t achieve the ultra-low sub-millisecond latency that’s critical during highly volatile market conditions. As a general cloud provider, DigitalOcean doesn’t specialize in ultra-low latency features. While the latency is manageable for most stock and options traders, it’s not ideal for those prioritizing lightning-fast execution speeds during market swings.

Performance (CPU, RAM, NVMe Storage)

DigitalOcean’s Standard Droplets offer a 6-core CPU, 16GB of RAM, and 320GB SSD storage for $96 per month, which includes 6TB of data transfer. The platform has earned a 4.5-star rating on Trustpilot, reflecting positive user experiences. However, the service is unmanaged, meaning you’ll need to handle the installation and configuration of Windows Server yourself, including setting up RDP auto-login, to run the Thinkorswim desktop application. For traders comfortable with server management, this isn’t a major issue, but it does require extra setup time compared to pre-configured trading environments.

Scalability and Multi-Monitor Support

DigitalOcean makes scaling resources straightforward through its control panel, and its 1-click app marketplace simplifies adding features. If you need more RAM or CPU power, resizing your Droplet is relatively simple compared to other providers. However, setting up multi-monitor support for Thinkorswim requires manual configuration. Using Windows Remote Desktop Protocol (RDP) for multi-monitor setups involves tweaking the Windows Server guest OS, which can lead to RDP connection issues and added complexity for traders.

Pricing and Value for Thinkorswim Workloads

At $96 per month ($1,152 annually) for the 16GB plan, DigitalOcean falls in the mid-to-high price range. This plan offers 166MB of RAM per dollar spent, which is on par with some competitors but less efficient than budget-focused alternatives. While the pricing is competitive, the general-purpose nature of the service means additional configuration is required to tailor it for trading. For traders who are comfortable with manual setup and optimization, DigitalOcean offers good value. However, the lack of trading-specific features and the unmanaged nature of the service might make it less appealing for those seeking a ready-to-go trading solution. The extra effort required to optimize the platform could diminish its cost benefits.

Comparison: Pros and Cons

Building on our earlier look at QuantVPS's features, let's dive into how it stands out in terms of latency, performance, and support, especially for Thinkorswim Schwab traders.

QuantVPS is specifically designed to deliver top-tier performance for traders by excelling in three critical areas: latency, hardware optimization, and support. With its New York datacenter achieving an impressive 0.52ms latency to NASDAQ, traders can count on lightning-fast order execution and market data updates, ensuring every second counts during high-stakes trading. The platform leverages high-performance AMD Ryzen 9950X CPUs (clocked at 5.7GHz) alongside NVMe storage, making it an ideal choice for handling Thinkorswim's demanding needs, such as running multiple charts and performing intricate options analyses smoothly.

Reliability is another cornerstone of QuantVPS, with a 99.999% uptime guarantee. This means traders can rely on uninterrupted operations, even during the busiest market hours. To top it off, QuantVPS provides 24/7 US-based technical support staffed by experts familiar with trading platforms like Thinkorswim. This ensures that any trade-related issues are addressed promptly and effectively.

| Feature | QuantVPS |

|---|---|

| Latency to NASDAQ | 0.52ms |

| Monthly Cost (16GB RAM) | $99.99 |

| Uptime SLA | 99.999% |

| Trading Support | 24/7 US-based Expert |

| Windows Pre-Configured | Yes |

These features make QuantVPS a strong option for traders who prioritize speed, reliability, and specialized support when executing trades.

Conclusion

Using Thinkorswim on a well-optimized VPS can make a noticeable difference in your trading performance. Whether you're executing intricate options strategies, managing multi-leg orders, or navigating fast-moving markets, factors like low latency trading principles, consistent uptime, and specialized hardware can directly influence execution speed, reduce slippage, and improve the platform's responsiveness.

For instance, a VPS located near NASDAQ and NYSE matching engines can deliver latencies as low as 0.52ms. This ultra-low delay is especially critical during high-stakes moments like earnings reports, major economic announcements, or sudden market volatility. In these situations, even a fraction of a second can determine whether you secure a profitable trade or miss out. Beyond speed, this proximity ensures more reliable and efficient order transmission.

With a 99.999% uptime guarantee, you can count on your automated alerts, trailing stops, and custom studies to remain active around the clock - even if your home internet goes down or your computer is offline. This always-on setup eliminates common risks of home-based trading, such as internet outages, power failures, or interference from other applications. Equipped with high-performance AMD Ryzen processors, NVMe storage, and 24/7 US-based support from trading experts, QuantVPS is designed to handle the demands of real-time data feeds, complex charting, and fast order execution seamlessly. For active traders, investing in a dedicated VPS isn't just an option - it’s a critical tool for staying ahead in any market condition. This purpose-built infrastructure provides Thinkorswim users with a clear edge when it matters most.

FAQs

How can a VPS enhance Thinkorswim trading performance?

A VPS can greatly improve your Thinkorswim trading experience by delivering ultra-low latency, allowing your orders and data requests to reach Schwab's servers much faster. Hosting your trading platform on a VPS located near major U.S. exchanges, like those in New York, can cut delays down to just 1–2 milliseconds - a crucial advantage for active traders.

Beyond speed, a VPS ensures round-the-clock connectivity and provides dedicated resources like CPU and RAM. This keeps your Thinkorswim platform stable and responsive, even during periods of high market volatility. Plus, it removes dependence on your local hardware or internet connection, minimizing the chances of downtime or missed trades.

What are the key benefits of using QuantVPS for low-latency trading on Thinkorswim?

QuantVPS offers ultra-low latency, with speeds as quick as 0.7 milliseconds to CME and around 1 millisecond to New York exchanges. This means Thinkorswim users can count on faster and more dependable trade execution. With dedicated high-performance CPUs, NVMe storage, and 24/7 uptime, it provides the speed and stability that active traders demand.

The platform is built with DDoS protection and specifically designed for trading, ensuring secure and steady connectivity. Plus, with technical support based in the U.S., QuantVPS equips traders with the reliability and tools they need to excel in fast-paced markets.

Why is low latency critical for traders using Thinkorswim?

For active traders, low latency plays a critical role in ensuring your orders and market data requests reach Schwab's execution servers as quickly as possible. This speed translates to faster order execution, less slippage, and better fill quality - key factors for success in short-term equity and options strategies.

Especially during high-volatility moments like earnings announcements or major economic data releases, reducing delays can be the edge you need to stay competitive. For dedicated Thinkorswim users, having a dependable, low-latency connection can significantly impact overall trading performance, helping you seize market opportunities when they matter most.

A VPS can greatly improve your Thinkorswim trading experience by delivering ultra-low latency, allowing your orders and data requests to reach Schwab's servers much faster. Hosting your trading platform on a VPS located near major U.S. exchanges, like those in New York, can cut delays down to just 1–2 milliseconds - a crucial advantage for active traders.

Beyond speed, a VPS ensures round-the-clock connectivity and provides dedicated resources like CPU and RAM. This keeps your Thinkorswim platform stable and responsive, even during periods of high market volatility. Plus, it removes dependence on your local hardware or internet connection, minimizing the chances of downtime or missed trades.

QuantVPS offers ultra-low latency, with speeds as quick as 0.7 milliseconds to CME and around 1 millisecond to New York exchanges. This means Thinkorswim users can count on faster and more dependable trade execution. With dedicated high-performance CPUs, NVMe storage, and 24/7 uptime, it provides the speed and stability that active traders demand.

The platform is built with DDoS protection and specifically designed for trading, ensuring secure and steady connectivity. Plus, with technical support based in the U.S., QuantVPS equips traders with the reliability and tools they need to excel in fast-paced markets.

For active traders, low latency plays a critical role in ensuring your orders and market data requests reach Schwab's execution servers as quickly as possible. This speed translates to faster order execution, less slippage, and better fill quality - key factors for success in short-term equity and options strategies.

Especially during high-volatility moments like earnings announcements or major economic data releases, reducing delays can be the edge you need to stay competitive. For dedicated Thinkorswim users, having a dependable, low-latency connection can significantly impact overall trading performance, helping you seize market opportunities when they matter most.

"}}]}