RoboForex Review: Is This High-Leverage Broker Safe?

RoboForex is a broker offering leverage up to 1:2000, access to 12,000+ trading instruments, and a low $10 minimum deposit. While these features appeal to traders seeking high exposure with minimal capital, its regulatory framework under Belize's FSC raises concerns compared to stricter regulators like the FCA or ASIC.

Key points to consider:

-

Pros:

- High leverage (up to 1:2000).

- Low minimum deposit ($10).

- Negative balance protection.

- Civil Liability insurance (€2,500,000 coverage).

- Membership in The Financial Commission (€20,000 compensation fund).

-

Cons:

- Offshore regulation (Belize FSC).

- Mixed user reviews (Trustpilot: 2.6/5).

- Not available in the U.S., Canada, Japan, or Australia.

- High leverage (up to 1:2000).

- Low minimum deposit ($10).

- Negative balance protection.

- Civil Liability insurance (€2,500,000 coverage).

- Membership in The Financial Commission (€20,000 compensation fund).

- Offshore regulation (Belize FSC).

- Mixed user reviews (Trustpilot: 2.6/5).

- Not available in the U.S., Canada, Japan, or Australia.

RoboForex may suit experienced traders comfortable with offshore risks but is less ideal for those prioritizing strong regulatory oversight.

RoboForex Review: Everything You Need to Know!

1. RoboForex

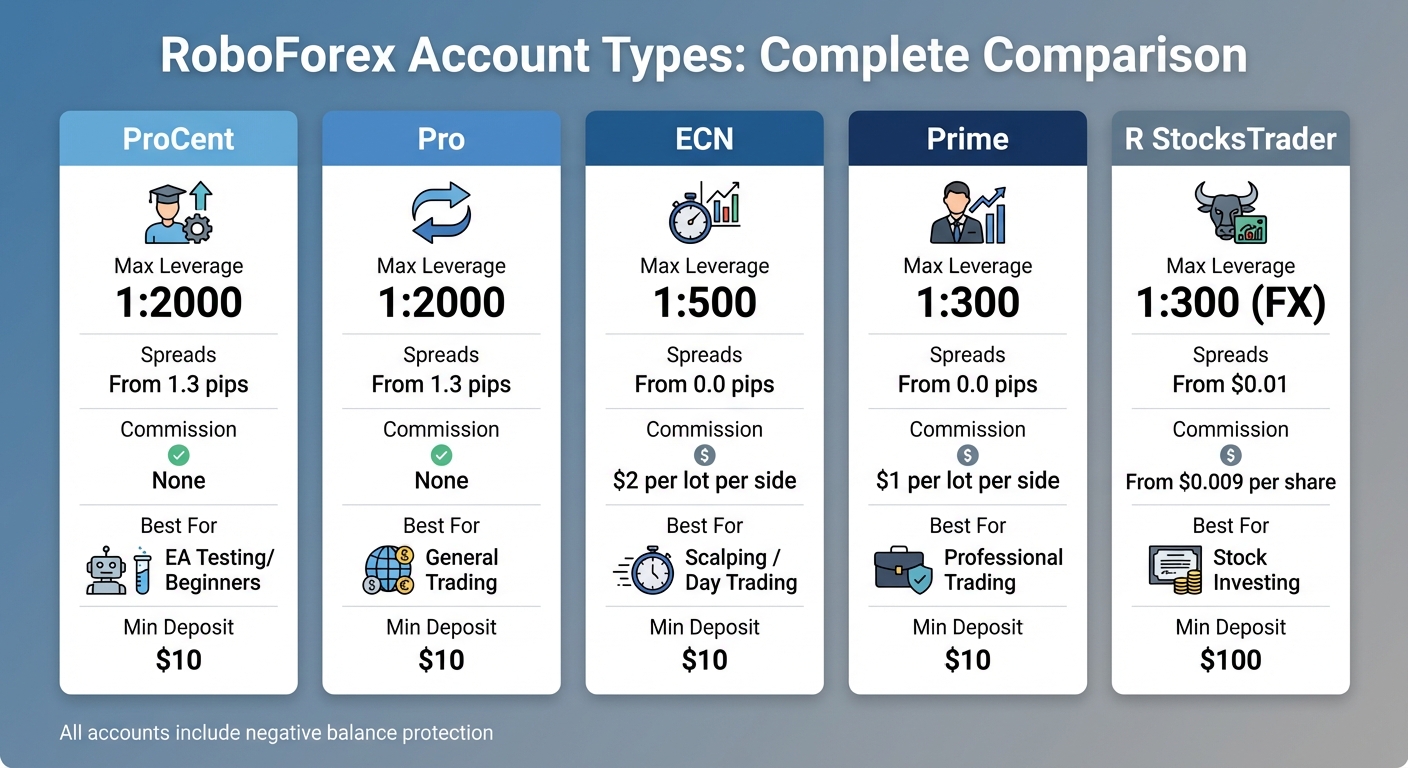

RoboForex Account Types Comparison: Leverage, Spreads, and Commissions

RoboForex Account Types Comparison: Leverage, Spreads, and Commissions

Regulatory Compliance

RoboForex operates under the oversight of Belize's Financial Services Commission (FSC, License No. 000138/32). While FSC Belize is considered an offshore (Tier-4) regulator and lacks the stringent oversight of top-tier regulators like the FCA or ASIC, RoboForex has implemented additional safety measures to bolster client confidence. For example, the broker is a Category "A" member of The Financial Commission, an independent dispute resolution organization offering up to €20,000 in compensation per claim. Furthermore, RoboForex has a Civil Liability insurance program providing coverage of up to €2,500,000, protecting clients from fraud, errors, and negligence.

"RoboForex is the only broker offering all three pillars of a well-regulated trading environment [FSC regulation, Financial Commission membership, and Civil Liability insurance] where most offer only one or two." – DailyForex Team

"RoboForex is the only broker offering all three pillars of a well-regulated trading environment [FSC regulation, Financial Commission membership, and Civil Liability insurance] where most offer only one or two." – DailyForex Team

To enhance transparency, RoboForex submits 5,000 anonymized trades each month for independent analysis, earning the "Verify My Trade" execution quality certificate. While these efforts improve client protection, they cannot fully replace the rigorous oversight of Tier-1 regulators. These regulatory details provide context for RoboForex's leverage offerings.

Leverage and Account Options

RoboForex stands out with leverage as high as 1:2000 on its Pro and ProCent accounts, significantly exceeding the limits set by EU regulators. However, this leverage is reduced to 1:1000 when account equity surpasses $10,000 or during specific periods.

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

The broker offers five account types, each tailored to different trading needs. The ProCent account is ideal for algorithmic testing and transitioning from demo to live trading with micro lots. The Pro account serves as a versatile option for both new and seasoned traders. For scalpers and day traders, the ECN account provides raw spreads starting at 0.0 pips with a $2 commission per lot per side, while the Prime account offers similar conditions with a reduced commission of $1 per lot per side. The R StocksTrader account is geared toward stock and ETF investors, granting access to over 12,000 instruments with spreads starting at $0.01 and commissions from $0.009 per share.

| Account Type | Max Leverage | Spreads | Commission | Best For |

|---|---|---|---|---|

| ProCent | 1:2000 | From 1.3 pips | None | EA Testing / Beginners |

| Pro | 1:2000 | From 1.3 pips | None | General Trading |

| ECN | 1:500 | From 0.0 pips | $2 per lot per side | Scalping / Day Trading |

| Prime | 1:300 | From 0.0 pips | $1 per lot per side | Professional Trading |

| R StocksTrader | 1:300 (FX) | From $0.01 | From $0.009 per share | Stock Investing |

The minimum deposit for most accounts is $10, though the R StocksTrader account requires $100. Additionally, RoboForex offers free withdrawals on the second, third, and fourth Tuesdays of each month.

Trading Platforms and Infrastructure

RoboForex supports popular platforms like MetaTrader 4 and MetaTrader 5, along with its proprietary R StocksTrader platform. For algorithmic traders, the broker provides free VPS hosting, provided they meet a minimum trading volume of 3 lots per month. This infrastructure also powers the CopyFX social trading system, allowing users to replicate strategies from experienced traders with customizable settings and manual control.

Client funds are held in segregated accounts at top-tier banks like Barclays, ensuring they remain separate from the broker’s operational funds and are protected in case of insolvency. Since its founding in 2009, RoboForex has served over 5 million traders worldwide.

Risk Management Tools

RoboForex prioritizes risk management by offering negative balance protection across all account types. This feature ensures that traders cannot lose more than their initial deposit, even during volatile market conditions. The broker also enforces varying stop-out levels depending on the account type: 100% for Prime accounts, 40% for ECN accounts, and between 10% and 30% for Pro and ProCent accounts. These stop-out levels automatically close positions to prevent account depletion.

Additional tools, like Margin, Stop Loss, and Deal Size calculators, help traders make informed decisions about lot sizes and risk exposure. To enhance security, RoboForex provides two-step authentication (2FA) via SMS and backup codes.

Fee Structure

RoboForex maintains a straightforward fee structure. Pro and ProCent accounts feature commission-free trading with floating spreads starting at 1.3 pips. ECN accounts charge $2 per lot per side with raw spreads beginning at 0.0 pips, while Prime accounts offer similar conditions with a lower commission of $1 per lot per side. For US stocks, the R StocksTrader account charges commissions starting at $0.009 per share.

It’s important to note that 58.42% of retail investor accounts lose money when trading CFDs with RoboForex, highlighting the risks associated with high-leverage trading.

Pros and Cons

RoboForex comes with its share of upsides and downsides, appealing to some traders while raising concerns for others. On the plus side, it offers high leverage up to 1:2000 and a low minimum deposit of $10, making it attractive for traders who favor aggressive strategies. However, such high leverage also means that losses can escalate quickly, posing significant risks.

The broker provides access to over 12,000 instruments across various asset classes, giving traders plenty of options. But this diversity also influences its pricing structure, which varies by account type. For example, Pro and ProCent accounts have no commissions but come with spreads starting at 1.3 pips, while ECN accounts feature raw spreads beginning at 0.0 pips.

RoboForex incorporates some safety measures, such as negative balance protection and client compensation up to €20,000 through The Financial Commission. It also offers Civil Liability insurance coverage of €2,500,000. However, its regulation under FSC Belize - a Tier-4 offshore authority - doesn’t provide the same oversight as top-tier regulators like the FCA or ASIC.

Strengths and Weaknesses

Here’s a quick breakdown of RoboForex’s main advantages and drawbacks:

| Strengths | Weaknesses |

|---|---|

| High leverage up to 1:2000 for aggressive strategies | Regulation under FSC Belize lacks Tier-1 oversight |

| $10 minimum deposit for most accounts | Higher spreads (1.3 pips) on Pro/ProCent accounts |

| Access to over 12,000 instruments | Limited selection of forex pairs (about 30–40) |

| Safety measures like negative balance protection | Not available to residents of the USA, Canada, Japan, and Australia |

| Free VPS for algorithmic traders meeting volume requirements | Outdated educational resources and market research |

| Two commission-free withdrawals per month | Proprietary platform may lead to vendor lock-in |

One notable downside is the geographic restrictions, which prevent residents of the USA, Canada, Japan, and Australia from accessing RoboForex’s services.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

User Feedback

User reviews paint a mixed picture. On one hand, RoboForex has an average user rating of 2.6 out of 5 from 631 reviews, with complaints about withdrawal delays and platform reliability. On the other hand, DayTrading.com rates it 4.5 out of 5 based on 14 reviews, and ForexBrokers.com gives it a Trust Score of 73 out of 99, categorizing the broker as "Average Risk".

Overall, while RoboForex offers attractive features like high leverage and a diverse range of instruments, potential users should weigh these benefits against its regulatory limitations and mixed user feedback.

Conclusion

RoboForex presents a mixed bag for traders looking to leverage high-risk opportunities. With leverage up to 1:2000, a low $10 minimum deposit, and access to a wide range of markets, it delivers on its promise of affordability and accessibility. Its three-layer protection system - membership in the Financial Commission, €2,500,000 Civil Liability insurance, and Verify My Trade certification - offers more security than many other offshore brokers.

That said, its FSC Belize regulation comes with clear drawbacks. While RoboForex has maintained a clean track record since 2009, its Tier-4 regulatory oversight doesn’t hold up against stronger frameworks like those from the FCA or ASIC. This is reflected in its Trust Score of 73/99 and mixed user ratings, including a 2.6/5 average on Trustpilot. This split makes RoboForex appealing to some trader profiles while less suitable for others.

As Justin Grossbard from CompareForexBrokers aptly puts it:

"RoboForex is not the safest, but it is tailored for experienced traders who understand offshore risks and prioritize cost-efficiency."

"RoboForex is not the safest, but it is tailored for experienced traders who understand offshore risks and prioritize cost-efficiency."

For seasoned traders who are comfortable navigating offshore environments and value cost savings, RoboForex stands out with its competitive pricing and high leverage options. Features like negative balance protection and a compensation fund capped at €20,000 add an extra layer of safety. However, newer traders or those who prioritize strong regulatory oversight should weigh these factors carefully, as the broker's offshore licensing may not meet their expectations.

It’s also worth noting that RoboForex imposes geographic restrictions. U.S. residents are not eligible, and the broker excludes clients from Canada, Japan, and Australia as well. Eligible traders should ensure timely account verification and take advantage of the free withdrawal days - offered on the second, third, and fourth Tuesdays of each month - to minimize costs.

FAQs

What are the potential risks of using a broker regulated by Belize's Financial Services Commission (FSC)?

Brokers overseen by Belize's Financial Services Commission (FSC) are subject to regulatory standards that are generally less rigorous than those set by major financial authorities. This can translate to weaker protections for client funds and limited regulatory oversight.

For traders, this creates an environment with increased risks, including potential fraud, financial losses, or operational challenges. Additionally, avenues for legal recourse may be more restricted. Because of this, it’s crucial to thoroughly research a broker’s reputation, examine user reviews, and assess the available risk management tools before making any commitments.

How does RoboForex's high leverage impact trading strategies and risk management?

RoboForex provides leverage of up to 1:2000, which can greatly magnify both profits and losses. This level of leverage demands that traders exercise strict risk management to safeguard their accounts from sudden and significant losses.

Trading with such high leverage calls for smart strategies. Tools like stop-loss orders are crucial, as they help limit potential losses. Additionally, maintaining disciplined position sizing and steering clear of overexposure are key practices. While this leverage opens doors to larger opportunities, it also requires thoughtful planning to manage risks effectively and support consistent trading over time.

How does RoboForex ensure the safety of traders' funds?

RoboForex implements multiple safeguards to ensure the security of traders' funds. One key measure is its civil liability insurance, which offers compensation in the rare event of financial loss due to the broker's shortcomings. Additionally, RoboForex is a member of The Financial Commission, an independent body that resolves disputes and provides extra layers of protection for clients.

The broker operates under the regulation of the Financial Services Commission of Belize (FSC, License No. 000138/333). This regulatory body enforces strict standards, including the segregation of client funds from the company’s assets and the requirement for regular financial reporting. Together, these measures - insurance, third-party oversight, and regulatory compliance - help build trust and provide reassurance to traders who choose RoboForex.