PropShopTrader 2026: New Multi-Asset Trading Model

The proprietary trading landscape is undergoing a significant transformation as PropShopTrader unveils its 2026 multi-asset trading model. Designed for professional and semi-professional traders, this cutting-edge framework is more than just an upgrade - it’s a reimagining of the proprietary trading experience. By integrating futures, stocks, and CFDs under one unified model, PropShopTrader is setting the stage for regulatory alignment, streamlined processes, and long-term scalability.

In this article, we’ll explore the core aspects of this new model, its significance for traders in today’s fast-paced markets, and why it represents a pivotal shift for the future of proprietary trading.

A New Era for PropShopTrader: Unified Multi-Asset Trading

PropShopTrader’s evolution into a true multi-asset proprietary trading firm marks a bold step forward. Unlike traditional models that operate in silos for different asset classes, the new framework integrates futures, stocks, and CFDs under a single, cohesive structure.

Why is this important? The benefits of this approach are multifaceted:

- Consistency Across Asset Classes: By unifying the trading framework, traders avoid confusion caused by differing rules and payout structures.

- Regulatory Compliance: The inclusion of stocks mandates adherence to SEC regulations, ensuring the firm and its traders align with strict industry standards.

- Scalability and Durability: A unified structure eliminates potential disruptions and lays the foundation for long-term growth opportunities.

This approach reflects a broader trend in the trading industry: prioritizing professional-grade infrastructure and regulatory foresight over short-term gains.

The Shift in Trader Compensation: From Simulated Payouts to Signing Bonuses

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

One of the most notable changes in the 2026 model is the replacement of simulated payouts with real signing bonuses. This shift isn’t merely a policy update - it’s a strategic response to regulatory requirements and a commitment to preparing traders for real-world conditions.

Why Signing Bonuses Are Better for Traders

- Alignment with Real Capital Readiness: Signing bonuses reward traders for professional behaviors such as consistent execution, disciplined risk management, and capital preservation.

- Larger Financial Incentives: In many cases, these bonuses are up to 1.5 times higher than previous simulated payout caps.

- Seamless Transition to Live Trading: This structure mirrors how institutional proprietary trading firms onboard traders, fostering a realistic and confident progression to live markets.

By focusing on long-term trader development rather than short-term performance spikes, this model cultivates habits that thrive in real market conditions.

The Gladiator Phase: A Testing Ground for Consistency and Discipline

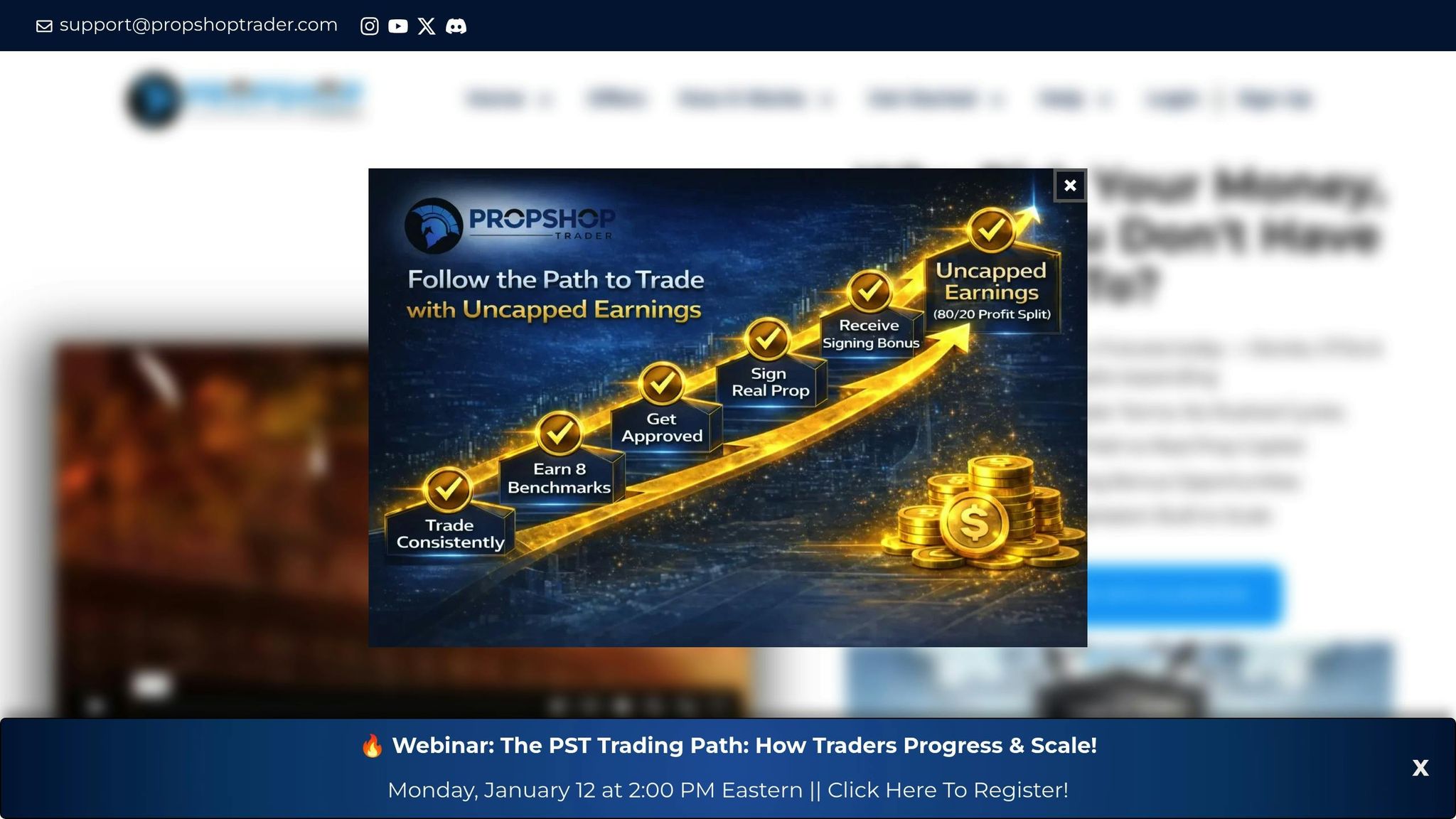

At the heart of the new model lies the Gladiator Phase, which evaluates traders’ readiness for live capital through rigorous performance benchmarks. This phase is not simply a qualifying stage - it’s a proving ground for essential trading traits like risk discipline and emotional control.

Key Features of the Gladiator Phase

- Benchmarks and Consistency: Traders must achieve five qualifying profitable trading days and adhere to a 40% consistency rule to clear each benchmark.

- Structured Targets: Daily profit targets and overall benchmark profit goals ensure traders operate under defined parameters without succumbing to overtrading.

- Risk Management: Strict drawdown limits and Max Adverse Excursion (MAE) thresholds test traders’ ability to manage risk effectively.

The Gladiator Phase is designed to filter for traders who can sustain performance in live markets. It rewards repeatable execution over short-term bursts of success, setting traders up for long-term growth.

Why Regulation Matters: Building a Durable Framework

The inclusion of stocks in PropShopTrader’s ecosystem brings a new layer of regulatory oversight. Under SEC rules, firms cannot compensate traders based on simulated trading performance, necessitating structural changes across the board.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

By aligning with these requirements early, PropShopTrader avoids potential enforcement risks and ensures its model remains scalable and compliant. The firm’s proactive approach demonstrates a commitment to protecting both its traders and its long-term future.

Enhanced Tools and Infrastructure for 2026

Beyond structural changes, PropShopTrader is enhancing its technology and tools to support traders in a competitive market. The roadmap for 2026 includes:

- Multi-Asset Capability: Seamless integration of futures, stocks, and CFDs.

- TradingView-Powered Platforms: Advanced charting and execution tools.

- Native Trade Copiers and Built-In Journaling: Features that streamline operations and improve decision-making.

- Enhanced Dashboards: Data-driven insights for better performance tracking.

These innovations reflect a forward-thinking approach to infrastructure, enabling traders to scale responsibly while leveraging cutting-edge technology.

Key Takeaways

- Unified Framework: PropShopTrader’s integration of futures, stocks, and CFDs under one model reduces complexity and enhances consistency.

- Regulatory Alignment: The new structure adheres to SEC regulations, ensuring compliance and scalability.

- Signing Bonuses Over Simulated Payouts: This shift aligns with institutional trading practices, rewarding traders for consistency and professionalism.

- Gladiator Phase: A rigorous evaluation stage that tests risk management, discipline, and repeatable execution.

- Enhanced Tools: TradingView integration, native trade copiers, and robust dashboards enhance trader efficiency and decision-making.

Conclusion: Building the Future of Proprietary Trading

PropShopTrader’s 2026 model isn’t just an update - it’s a transformation. By prioritizing regulatory compliance, consistency, and long-term scalability, the firm has created a structure that prepares traders for real capital opportunities. This model reflects the firm’s commitment to supporting traders as they develop, grow, and succeed in the ever-evolving world of proprietary trading.

For traders who value professionalism, consistency, and the chance to scale with a durable framework, PropShopTrader’s new model sets a benchmark that others in the industry will undoubtedly strive to follow. Trade well, and embrace the future of proprietary trading with confidence.