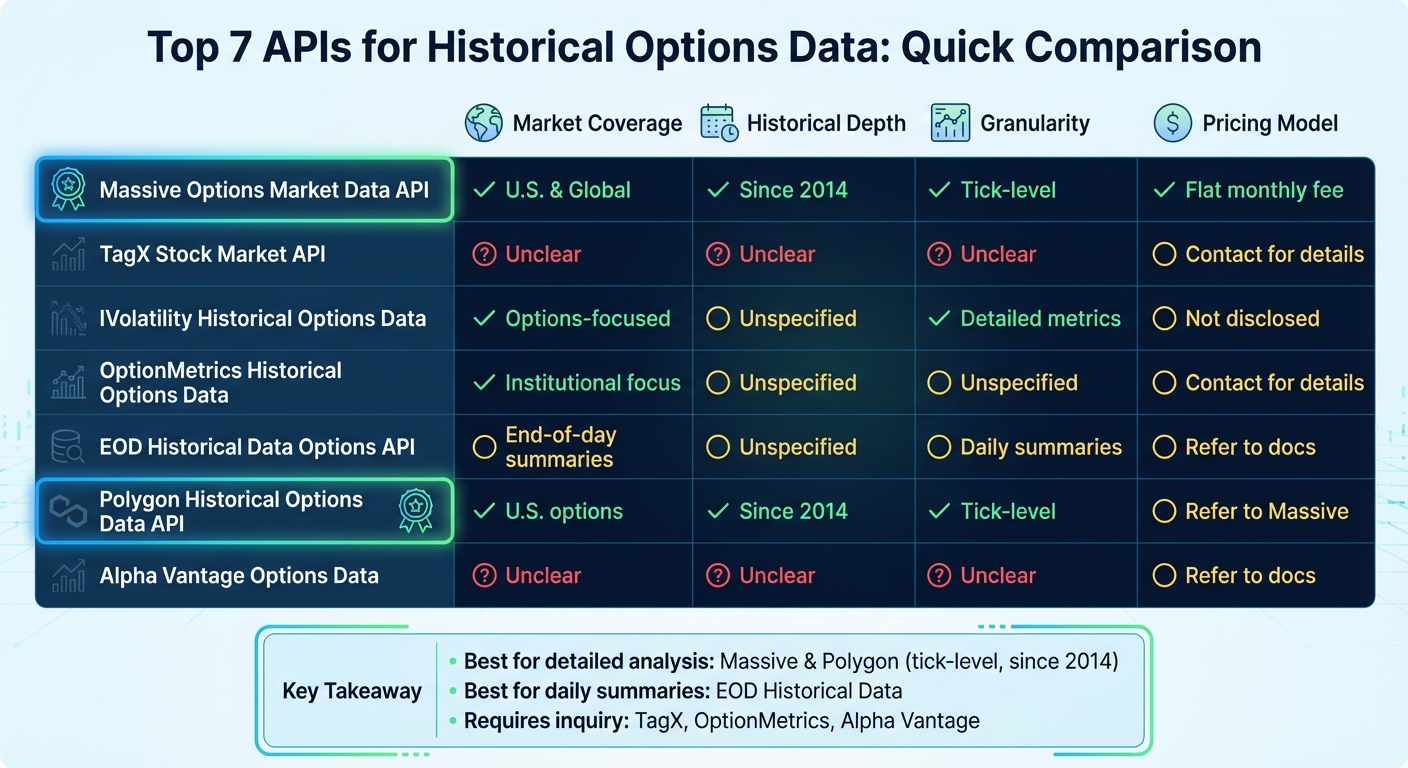

Top 7 APIs for Historical Options Data (Live & Archived)

Historical options data is a critical resource for traders and developers. It includes options chains, Greeks, implied volatility, and trade-level details, enabling precise backtesting and strategy development. Reliable APIs simplify access to this data, offering various delivery methods, granular historical depth, and transparent pricing models. Here's a quick overview of seven APIs worth considering:

- Massive Options Market Data API: Offers U.S. and global options data since 2014, with tick-level precision and unlimited access via a flat monthly fee.

- TagX Stock Market API: Limited documentation and unclear pricing or data details make it less user-friendly.

- IVolatility Historical Options Data: Focuses on options chains, Greeks, and implied volatility, designed for in-depth analysis.

- OptionMetrics Historical Options Data: Tailored for institutional and academic research, though specific details require direct inquiry.

- EOD Historical Data Options API: Provides end-of-day options data summaries, ideal for daily market insights.

- Polygon Historical Options Data API: Specializes in U.S. options with granular data since 2014, optimized for detailed market analysis.

- Alpha Vantage Options Data: Offers historical options data, but specifics on coverage and pricing are unclear.

Quick Comparison

| API Provider | Market Coverage | Historical Depth | Granularity | Pricing Model |

|---|---|---|---|---|

| Massive | U.S. & global | Since 2014 | Tick-level | Flat monthly fee |

| TagX | Unclear | Unclear | Unclear | Contact for details |

| IVolatility | Options-focused | Unspecified | Detailed metrics | Not disclosed |

| OptionMetrics | Institutional focus | Unspecified | Unspecified | Contact for details |

| EOD Historical Data | End-of-day summaries | Unspecified | Daily summaries | Refer to docs |

| Polygon (Massive.com) | U.S. options | Since 2014 | Tick-level | Refer to Massive |

| Alpha Vantage | Unclear | Unclear | Unclear | Refer to docs |

Selecting the right API depends on your needs - granularity, historical range, and pricing transparency are key factors. For detailed analysis, APIs like Massive and Polygon provide extensive coverage and granular data, while simpler tools like EOD are better for daily summaries. Always review documentation and pricing before committing.

Historical Options Data API Comparison: Features, Coverage, and Pricing

Historical Options Data API Comparison: Features, Coverage, and Pricing

1. Massive Options Market Data API

Market Coverage

Massive provides a comprehensive range of options chain data, including Greeks, implied volatility, and trade-level details. This data spans U.S. exchanges, dark pools, OTC markets, and global indices. However, the platform doesn't specify the full geographic scope of its options data just yet.

Historical Depth and Granularity

For those diving into historical market trends, Massive offers options data going back to 2014. The platform delivers trade-level detail with tick-level precision and supports intraday queries using minute-level aggregation. This makes it a valuable tool for conducting detailed market analyses.

Pricing Model

Massive keeps things simple with a clear monthly pricing structure. Users get unlimited access to data across all asset classes, with no hidden fees or per-request costs. Both retail and institutional users benefit from the same high-quality, institutional-grade data.

2. TagX Stock Market API

Market Coverage

TagX's documentation leaves much to be desired when it comes to market coverage. It doesn’t clearly outline the geographic regions or specific markets it supports, creating uncertainty for potential users.

Historical Depth and Granularity

Another significant gap in the documentation is the lack of information about historical data. There’s no indication of whether the API provides end-of-day summaries, intraday updates, or even tick-level details. This omission makes it tough for users to assess how well the API aligns with their needs.

Data Types

When it comes to options data, the documentation falls short again. It doesn’t clarify whether elements like option chains, strike prices, expiration dates, or volume metrics are included. This lack of detail could be a dealbreaker for those who rely on comprehensive options data.

Pricing Model

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

Transparency about pricing is equally crucial, especially for users planning to use the API for backtesting or other intensive applications. Unfortunately, TagX doesn’t publish detailed pricing information or subscription plans. If you're interested, you’ll need to contact them directly to get specifics. Compared to other providers that offer more thorough disclosures, TagX’s limited documentation may feel like a missed opportunity.

Get Historical Option Price Data In Python From Polygon.io API

3. IVolatility Historical Options Data

IVolatility provides a data-driven platform tailored for options traders. It includes key options chain details such as strike prices, expiration dates, pre-calculated Greeks, implied volatility, and open interest. These metrics are designed to support in-depth quantitative analysis, making it a valuable resource for anyone involved in options trading.

The platform's data integrates effortlessly with contemporary trading systems, ensuring smooth compatibility with modern trading workflows.

4. OptionMetrics Historical Options Data

OptionMetrics provides historical options data tailored for institutional and academic research. While details about its market coverage, historical range, data formats, and pricing are not readily available, you can reach out to OptionMetrics directly for the most up-to-date information.

5. EOD Historical Data Options API

The EOD Historical Data Options API provides end-of-day options data, offering insights into market activity at the close of each trading day. For specifics on market coverage, historical range, data formats, integration options, and pricing, you can refer to the provider's documentation. This API is well-suited for traders who rely on daily market summaries to inform their strategies.

Next up, let’s look at an API designed for more in-depth historical analysis.

6. Polygon Historical Options Data API

Polygon.io, now operating as Massive.com, offers a specialized API for accessing detailed options market data. This tool is tailored for those focusing on U.S. options, providing a wealth of information to sharpen market analysis.

Market Coverage

The API covers U.S.-listed options traded on all major U.S. exchanges, as well as activity in dark pools and OTC markets.

Historical Depth and Data Types

With records dating back to 2014, the API delivers granular trade data, including tick-level options chains enriched with Greeks and implied volatility. Unlike end-of-day summaries, this tick-level detail is ideal for high-frequency trading strategies and thorough market analysis. While it shares the extensive data capacity of the Massive API, this service is specifically designed for the U.S. options market.

7. Alpha Vantage Options Data

Alpha Vantage provides historical options data, though specifics about its market coverage, data granularity, access methods, and pricing are not clearly detailed in the available resources. For accurate and up-to-date information, it's best to refer directly to Alpha Vantage's official documentation. Doing so ensures you have the necessary details to integrate their data smoothly into your trading systems.

How to Connect APIs with Your Trading Infrastructure

Integrating historical options data APIs into your trading setup requires a combination of reliable hardware and efficient software solutions. A trading-focused VPS (Virtual Private Server) should feature a high-speed network interface to manage real-time data streams, sufficient CPU and RAM to process large datasets, and enough storage to handle historical data archives. Positioning servers close to major exchange data centers can further minimize latency, often reducing it to under 20ms.

Modern APIs provide flexibility with multiple access options tailored to different workflows. RESTful APIs are ideal for retrieving bulk historical data, while WebSocket connections are better suited for real-time updates. For handling large datasets, options like flat file access through S3-compatible interfaces or direct SQL queries can be more efficient than repeated REST calls, helping to avoid I/O bottlenecks. Client libraries - especially those written in Python - make integration easier by allowing you to fetch and process data programmatically with minimal development effort. These tools play a crucial role in building automated data pipelines.

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Creating automated data pipelines is straightforward with these libraries. For instance, a trader can use a Python script with the Massive client library to fetch minute-level aggregates for a specific ticker over a defined date range. By scheduling this script using cron, regular data ingestion becomes a seamless process. Since the data is delivered in standardized formats, it’s simple to parse, store, and feed directly into backtesting frameworks. For advanced workflows, AI-driven systems can integrate with market data APIs to streamline analysis further.

When it comes to backtesting, using a VPS with APIs that deliver clean, normalized, institutional-grade data - free of survivorship bias - is critical. This ensures that your historical simulations accurately reflect market conditions, laying the groundwork for dependable strategy development. With extensive historical data and low-latency infrastructure, traders can conduct both high-frequency strategy testing and in-depth historical analysis. QuantVPS offers plans tailored to these needs, from VPS Lite ($59.99/month, 4 cores and 8GB RAM) to Dedicated Servers ($299.99/month, 16+ cores and 128GB RAM), providing the processing power and speed necessary for managing massive datasets.

"Massive APIs have set the standard for easy access to financial market data, and have proven to be extremely robust and reliable over the course of our partnership." - Fergus Colleran, Ops Manager, Wealth & Trading

"Massive APIs have set the standard for easy access to financial market data, and have proven to be extremely robust and reliable over the course of our partnership." - Fergus Colleran, Ops Manager, Wealth & Trading

Conclusion

Choosing the right historical options data API comes down to matching your specific needs with the features that matter most. Whether you're backtesting intricate strategies, performing real-time analysis, or building advanced options models, the key factors to consider include the depth of historical data, its accuracy, and how easily the API integrates with your systems.

Access to detailed options chain data, including Greeks and implied volatility, is essential for precise backtesting. For strategies that require high accuracy, institutional-grade data sourced directly from exchanges is a must. Additionally, APIs offering multiple integration methods can save you from unnecessary technical hurdles, ensuring smooth incorporation into your existing tools.

Pricing and ease of integration are just as critical. Transparent, straightforward pricing models can help you manage costs effectively. Look for APIs that offer flat-rate monthly plans with unlimited access across asset classes, avoiding the pitfalls of complicated tiered pricing that might lead to unexpected expenses. The right API should also adapt to your growing needs without frequent plan changes.

Integration speed plays a big role too. APIs with clear documentation, client libraries, and support for standardized formats like JSON or CSV can significantly cut down development time, helping you establish an efficient workflow faster.

Ultimately, the best API for you will strike a balance between high-quality data, reliable infrastructure, and usability. Your choice should align with your specific goals - whether that's low-latency performance for high-frequency trading, extensive historical data for long-term research, or robust libraries and flexible access for automated systems. Combining top-tier data with dependable infrastructure is the foundation for executing advanced trading strategies effectively.

FAQs

What should I look for when selecting an API for historical options data?

When selecting an API for historical options data, it's crucial to prioritize data coverage, accuracy, and reliability. These factors ensure you’re working with datasets that are both complete and dependable. Additionally, pay attention to the latency and data format - these elements can significantly affect how efficiently you can access and utilize the data in your applications.

Cost is another key consideration. Choose an API that aligns with your budget while still delivering the features you require. Finally, look for APIs that offer seamless integration into your workflows. This can save you valuable time and effort during the development process.

How do I integrate historical options data APIs into my trading systems?

To bring historical options data APIs into your trading systems, the first step is to get an API key from your chosen provider. Once you have access, you can use RESTful or WebSocket APIs to retrieve data in formats like JSON or CSV, depending on what suits your system best.

You can pull this data through direct API calls, flat files, or even SQL queries, based on your infrastructure. Make sure your setup is optimized for low-latency data retrieval - aim for under 20ms - and includes robust processes for data normalization to ensure accuracy. With this integration, you’ll be equipped to use the data for backtesting, developing strategies, and analyzing markets in real time.

Why is tick-level precision crucial for backtesting trading strategies?

Tick-level precision plays a crucial role in backtesting by offering an incredibly detailed simulation of market conditions. It captures the precise timing and price of every trade, enabling you to assess how your strategy would hold up in real-world situations, even during periods of high volatility or rapid market shifts.

This granular data helps uncover potential risks, fine-tune execution timing, and enhance the overall performance of your strategy. Without tick-level data, backtesting can miss critical details, making the results less dependable for decision-making.

When selecting an API for historical options data, it's crucial to prioritize data coverage, accuracy, and reliability. These factors ensure you’re working with datasets that are both complete and dependable. Additionally, pay attention to the latency and data format - these elements can significantly affect how efficiently you can access and utilize the data in your applications.

Cost is another key consideration. Choose an API that aligns with your budget while still delivering the features you require. Finally, look for APIs that offer seamless integration into your workflows. This can save you valuable time and effort during the development process.

To bring historical options data APIs into your trading systems, the first step is to get an API key from your chosen provider. Once you have access, you can use RESTful or WebSocket APIs to retrieve data in formats like JSON or CSV, depending on what suits your system best.

You can pull this data through direct API calls, flat files, or even SQL queries, based on your infrastructure. Make sure your setup is optimized for low-latency data retrieval - aim for under 20ms - and includes robust processes for data normalization to ensure accuracy. With this integration, you’ll be equipped to use the data for backtesting, developing strategies, and analyzing markets in real time.

Tick-level precision plays a crucial role in backtesting by offering an incredibly detailed simulation of market conditions. It captures the precise timing and price of every trade, enabling you to assess how your strategy would hold up in real-world situations, even during periods of high volatility or rapid market shifts.

This granular data helps uncover potential risks, fine-tune execution timing, and enhance the overall performance of your strategy. Without tick-level data, backtesting can miss critical details, making the results less dependable for decision-making.

"}}]}