Option payoff diagrams are simple visual tools that help you understand the potential profit or loss of an options trade at expiration. They show how your position might perform based on the stock price. The X-axis represents the stock price, and the Y-axis shows profit or loss. Key points include:

- Strike Price: The price where the payoff line changes slope.

- Premium: The cost of the option, which sets your maximum loss for long positions.

- Breakeven Point: The stock price where profit equals the premium paid or received.

For example, a long call has unlimited profit potential above the breakeven point, while losses are capped at the premium paid. In contrast, a short call has limited profit (the premium received) but unlimited risk if the stock price rises.

To calculate P&L at expiration:

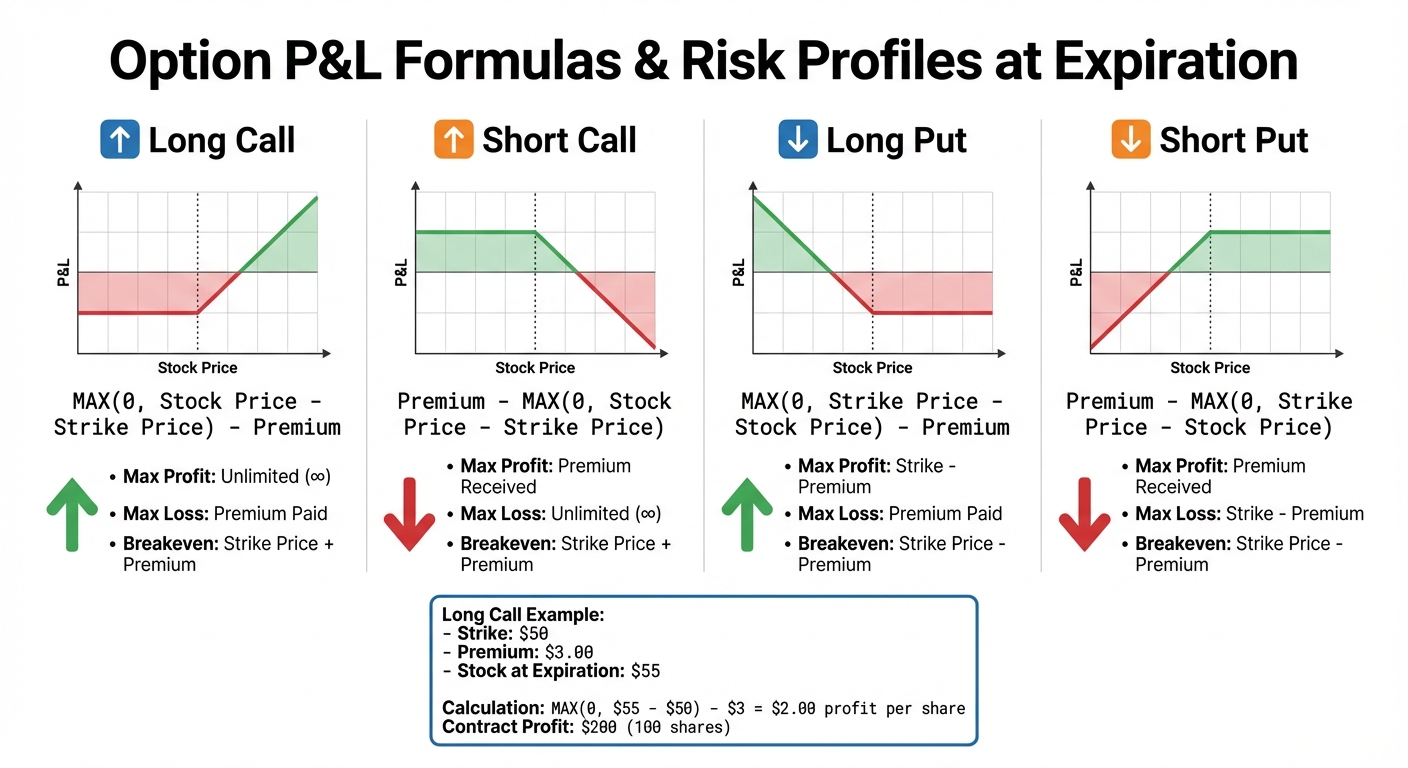

- Long Call:

MAX(0, Stock Price - Strike Price) - Premium - Short Call:

Premium - MAX(0, Stock Price - Strike Price) - Long Put:

MAX(0, Strike Price - Stock Price) - Premium - Short Put:

Premium - MAX(0, Strike Price - Stock Price)

Payoff diagrams are especially helpful for multi-leg strategies like straddles or spreads, where multiple strike prices create more complex risk/reward profiles. Tools like spreadsheets, trading platforms, or online calculators can simplify these calculations.

Understanding these diagrams allows you to evaluate risk, reward, and breakeven points quickly, helping you make informed trading decisions.

How to Calculate P&L at Expiration

Option Payoff Diagrams: P&L Formulas and Risk Profiles Comparison Chart

Option Payoff Diagrams: P&L Formulas and Risk Profiles Comparison Chart

Figuring out profit and loss (P&L) at expiration becomes simple once you grasp the core formulas. The main focus here is on the option’s intrinsic value – its worth if exercised – and factoring in the premium you paid or received. Using the components from the earlier diagram, let’s break down how these calculations work.

P&L Formulas for Basic Options

Here are the key formulas for different option positions:

For a long call, the formula is:

MAX(0, Stock Price - Strike Price) - Premium This ensures the intrinsic value can’t go below zero. For example, if you bought a $50 call for $3.00, and the stock price rises to $55.00 at expiration:

MAX(0, $55 - $50) - $3 = $2.00 That’s $2 per share, or $200 for one contract (since each contract equals 100 shares).

For a short call, the formula flips:

Premium - MAX(0, Stock Price - Strike Price) Here, your profit is capped at the premium received, but losses can grow indefinitely if the stock price skyrockets.

For a long put, the formula is:

MAX(0, Strike Price - Stock Price) - Premium And for a short put:

Premium - MAX(0, Strike Price - Stock Price) Here’s a summary table for quick reference:

| Position | Formula | Max Profit | Max Loss |

|---|---|---|---|

| Long Call | MAX(0, Stock Price – Strike) – Premium | Unlimited | Premium Paid |

| Short Call | Premium – MAX(0, Stock Price – Strike) | Premium Received | Unlimited |

| Long Put | MAX(0, Strike – Stock Price) – Premium | Strike – Premium | Premium Paid |

| Short Put | Premium – MAX(0, Strike – Stock Price) | Premium Received | Strike – Premium |

Once you’ve calculated the P&L, the next step is to determine the breakeven point for your trade.

Calculating Breakeven Points

Breakeven points help you understand the stock price needed to avoid losses. The formulas differ slightly for calls and puts:

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

- For a call, add the premium to the strike price:

Strike Price + Premium - For a put, subtract the premium from the strike price:

Strike Price - Premium

Strike Price + Premium Strike Price - Premium These simple calculations are essential for evaluating whether your trade is positioned for success.

Tools for P&L Calculations

While you can calculate P&L manually, many traders prefer tools to speed up the process. Here are some options:

- Manual Spreadsheets: Using Excel, you can create a simple formula like this for a long call:

=MAX(Stock_Price - Strike, 0) - Premium - Automated Platforms: Platforms like NinjaTrader on QuantVPS offer real-time P&L tracking. Their low-latency environment ensures accurate calculations based on current prices, which is crucial for managing multiple trades.

- Web-Based Calculators: Sites like PayoffCurve.com provide free tools to estimate theoretical values and Greeks using models like Black-Scholes. These are great for quick, browser-based calculations.

=MAX(Stock_Price - Strike, 0) - Premium Common Option Payoff Diagrams

Payoff diagrams are a simple yet powerful way to visualize the potential risks and rewards of option strategies. By mapping out these strategies, you can better understand how they work and make more informed decisions.

Long Call Payoff Diagram

The long call payoff diagram creates the classic "hockey-stick" shape. On the left side of the strike price, the line is flat, representing your maximum loss – the premium you paid for the option. At the strike price, the line takes a sharp upward turn, climbing higher as the stock price rises.

"Profit-loss diagrams are simple tools to help you understand and analyze option strategies before investing." – Fidelity

"Profit-loss diagrams are simple tools to help you understand and analyze option strategies before investing." – Fidelity

For example, if you buy a $100 call for a $1.00 premium, your breakeven point is $101.00. If the stock price stays below $100, you lose the full $1.00 per share. But if the stock climbs to $110, you gain $9.00 per share – the $10 intrinsic value minus the $1.00 premium. The potential profit continues to increase as the stock price rises.

| Stock Price at Expiry | Intrinsic Value | Net Profit/Loss |

|---|---|---|

| $90 | $0 | -$1 |

| $100 (Strike) | $0 | -$1 |

| $101 (Breakeven) | $1 | $0 |

| $110 | $10 | +$9 |

Short Put Payoff Diagram

A short put creates the reverse of the long call diagram. To the right of the strike price, the line is flat, showing your capped profit – the premium you received. As the stock price drops, the line slopes downward, reflecting increasing losses.

"With the short put option, you want the stock to move higher. That caps your risk or your profit potential to the credit that you received in selling that short put option." – Kirk Du Plessis, Founder, Option Alpha

"With the short put option, you want the stock to move higher. That caps your risk or your profit potential to the credit that you received in selling that short put option." – Kirk Du Plessis, Founder, Option Alpha

Your breakeven point is the strike price minus the premium collected. For instance, if you sell a $50 put for $2.00, you keep the full $2.00 if the stock stays at or above $50. But if the stock drops to $48, you break even. Below $48, losses mount dollar-for-dollar until the stock hits zero, where your maximum loss is $48.00 per share ($4,800 per contract).

Straddle Strategy Payoff Diagram

A long straddle combines a call and a put at the same strike price, forming a V-shaped payoff diagram. The lowest point of the "V" is at the strike price, representing your maximum loss – the combined premiums of both options.

This strategy offers profit potential in both directions. Your breakeven points are the strike price plus and minus the total premium paid. For example, if you buy a $100 call for $3.00 and a $100 put for $2.50, your total cost is $5.50. You break even at $105.50 on the upside and $94.50 on the downside. Beyond these points, profits grow indefinitely.

| Strategy | Visual Shape | Max Profit | Max Loss | Breakeven Point(s) |

|---|---|---|---|---|

| Long Call | Hockey-stick | Unlimited | Premium Paid | Strike + Premium |

| Short Put | Inverse Hockey-stick | Premium Received | Substantial (Stock to $0) | Strike – Premium |

| Long Straddle | V-Shape | Unlimited | Total Premiums Paid | Strike ± Total Premium |

Interestingly, only about 10% of options contracts are exercised, as most traders close their positions before expiration. By mastering these diagrams, you can better evaluate whether to hold or exit based on your goals and risk tolerance.

How to Read Payoff Diagrams for Trading

What Payoff Diagrams Tell You

Payoff diagrams are a visual tool that show maximum profit, maximum loss, and breakeven points for a trading strategy. The horizontal X-axis represents the underlying stock price at expiration, while the vertical Y-axis indicates profit (above zero) or loss (below zero).

"The risk graph allows you to grasp a lot of information from a simple visual… it is an indispensable skill for every options trader." – Investopedia

"The risk graph allows you to grasp a lot of information from a simple visual… it is an indispensable skill for every options trader." – Investopedia

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Key features to watch for include horizontal segments on the diagram. These flat lines indicate capped profit or capped risk. A flat line at the top signifies your maximum profit potential, while one at the bottom shows your maximum loss. Sharp bends or "kinks" in the line correspond to the strike prices of your options. To assess if a strategy is worth pursuing, measure the vertical distance between the zero line and these horizontal sections. This gives you a sense of whether the potential reward aligns with the level of risk.

Understanding these basics lays the groundwork for analyzing more complex strategies.

Analyzing Multi-Leg Strategies

Multi-leg strategies, such as spreads and iron condors, add complexity to payoff diagrams. These diagrams often feature multiple kinks, each representing a strike price. A crucial aspect is distinguishing between the "Today" line, which is typically curved, and the "Expiration" line, which is angled and includes kinks. The space between these lines reflects the effects of time decay and changes in volatility on your position.

"Profit and loss diagrams help us understand where and when our option strategy makes money or loses money either today or at expiration." – Kirk Du Plessis, Founder, Option Alpha

"Profit and loss diagrams help us understand where and when our option strategy makes money or loses money either today or at expiration." – Kirk Du Plessis, Founder, Option Alpha

For non-directional strategies, focus on the profit zone between the breakeven points. Time decay doesn’t occur evenly – it accelerates as expiration approaches. For instance, a 60-day option might lose $55 in value during the first 30 days but drop $175 in the final 30 days. Payoff diagrams that include multiple volatility lines (e.g., V+2.5%, V-2.5%) can help you visualize how shifts in implied volatility could affect your position before expiration.

Running Trading Platforms on QuantVPS

Real-time data is essential for managing complex multi-leg strategies. Payoff diagrams that update in real time depend on live pricing to calculate the theoretical "Today" line. This process uses the Black-Scholes model, accounting for current implied volatility and time decay. Such calculations require stable, high-performance hosting to ensure accuracy and prevent lag – especially for intricate multi-leg trades.

"Every position now includes an interactive real-time option payoff diagram that uses live pricing to update key metrics and probabilities, so there’s no guesswork on your position’s current status." – Kirk Du Plessis, Founder, Option Alpha

"Every position now includes an interactive real-time option payoff diagram that uses live pricing to update key metrics and probabilities, so there’s no guesswork on your position’s current status." – Kirk Du Plessis, Founder, Option Alpha

Using platforms like NinjaTrader or TradeStation on QuantVPS ensures smooth, real-time updates. Unlike standard retail setups that may experience delays – sometimes up to 15 minutes during volatile markets – QuantVPS provides 24/7 uptime and 1Gbps+ network speeds. This guarantees your payoff diagrams and automated alerts are always based on the most current market data, enabling precise P&L calculations and informed risk assessments.

Conclusion

Option payoff diagrams are a powerful tool for visualizing maximum profit, loss, and breakeven points. Whether you’re trading something straightforward like a long call or a more complex strategy like an iron condor, these charts provide a clear picture of how your position is expected to perform at expiration – and how it might behave along the way.

"The ability to read and understand risk graphs is a critical skill for anyone who wants to trade options." – Investopedia

"The ability to read and understand risk graphs is a critical skill for anyone who wants to trade options." – Investopedia

One of their key advantages is the ability to separate final profit and loss (P&L) at expiration from your current exposure. This distinction is crucial for managing elements like time decay and shifts in volatility. For instance, an option could lose about $55 during its first 30 days but might see a sharper loss of approximately $175 in the final 30 days before expiration.

To further refine your strategies, calculate breakeven prices: add the premium to the strike price for calls and subtract it for puts. Comparing these calculations across different strategies can help align your trades with your risk tolerance. Remember, only about 10% of options are ever exercised, which highlights the importance of understanding these dynamics.

For those seeking real-time insights, platforms like QuantVPS use models such as Black-Scholes to provide live payoff diagrams. These tools update instantly, offering precise P&L metrics and automated alerts, giving traders the edge they need to make well-informed decisions throughout their options journey.

FAQs

What’s the difference between a long call and a short call in terms of risk and profit potential?

A long call means you’re buying a call option, giving you the right – but not the obligation – to purchase an underlying asset at a set strike price before the option expires. The potential upside? It’s unlimited. If the asset’s price climbs above the strike price (after factoring in the premium you paid), your gains can grow significantly. On the flip side, the most you can lose is the premium you paid if the option expires worthless because the asset’s price stayed below the strike price.

A short call flips the script. Here, you’re selling a call option, which obligates you to sell the underlying asset at the strike price if the buyer exercises the option. Your maximum profit is capped at the premium you received when selling the option. But the risk? It’s much higher. If the asset’s price soars far above the strike price, losses can pile up as you may need to buy the asset at a steep market price to fulfill your obligation.

To sum it up, a long call offers limited risk and unlimited profit potential, making it a go-to for bullish strategies. A short call, while offering limited profit, carries higher risk and is better suited for bearish or neutral strategies – provided it’s managed carefully.

How do multi-leg strategies like straddles impact option payoff diagrams?

Multi-leg strategies, like straddles, make option payoff diagrams more complex because they merge multiple options into one cohesive strategy. Take a long straddle as an example: this involves purchasing both a call and a put option with the same strike price and expiration date. The resulting payoff diagram shows the combined profit and loss of these two positions, creating a more intricate shape with multiple breakeven points and a broader range of possible outcomes.

This added complexity stems from the interaction between the individual option legs under different market conditions, such as changes in volatility or sharp price movements. Traders need to factor in elements like the total premiums paid, the overall risk, and the potential gains or losses. To grasp these diagrams fully, using advanced tools or calculators can be immensely helpful in mapping out how the strategy performs at expiration.

What are the best tools for quickly calculating options profit and loss at expiration?

To calculate profit and loss (P&L) at expiration effectively, traders often turn to tools like options payoff calculators. These tools are designed to create payoff diagrams, pinpoint breakeven points, and evaluate the maximum profit and loss for various strategies, including long calls, short puts, and straddles.

Many online platforms offer intuitive calculators that simplify this process. They make it easy to explore risk-reward profiles and visualize potential outcomes at expiration. By using these tools, traders can save time and gain insights that help refine their options strategies and make well-informed decisions.