Mastering Volume Profile: Indicators & Concepts Explained

Volume Profile is a trading tool that maps out where the most trading activity happens at specific price levels. Unlike traditional volume indicators that show trading over time, Volume Profile focuses on price, helping traders identify key areas like support, resistance, and potential breakout zones. Here’s what you need to know:

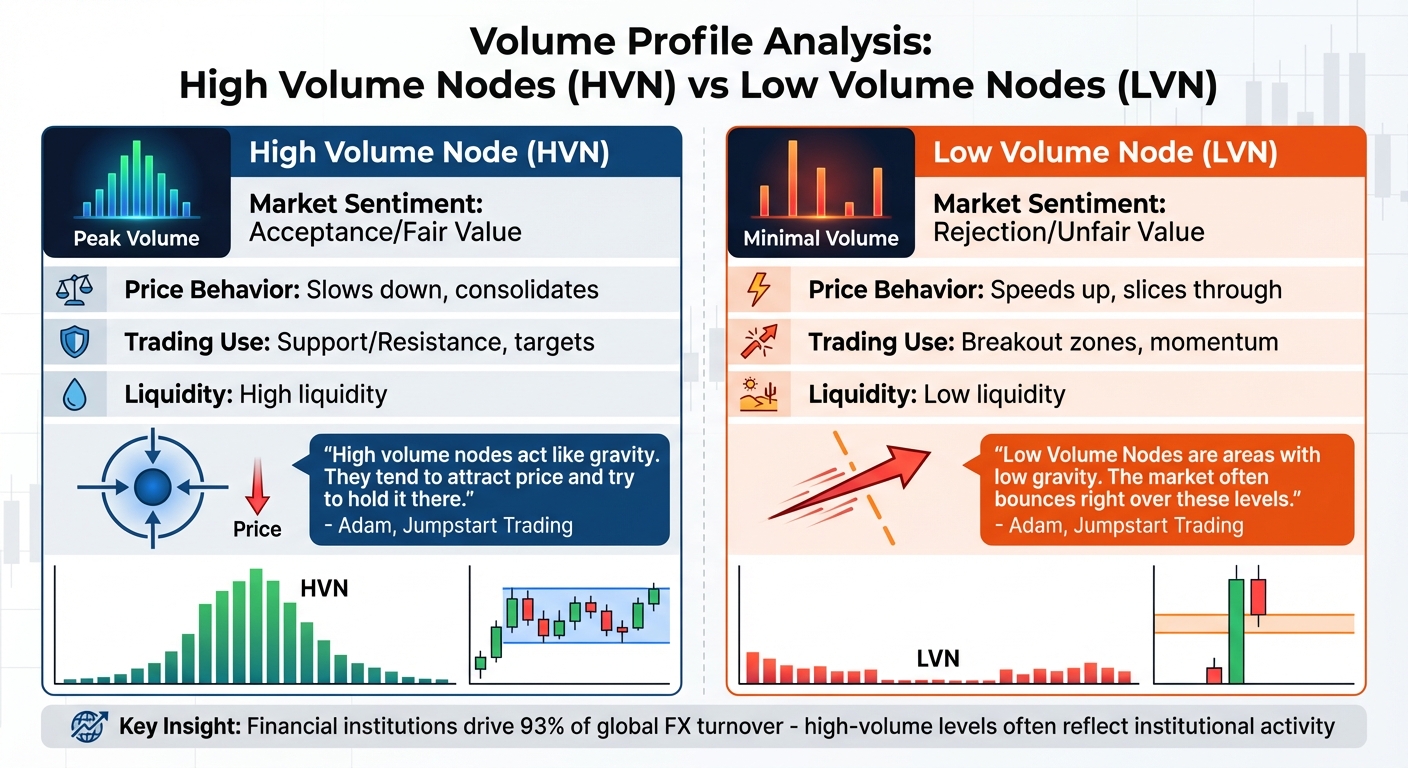

- Key Concepts: High Volume Nodes (HVNs) show price stability, while Low Volume Nodes (LVNs) indicate low liquidity and fast price movement. The Point of Control (POC) marks the price with the highest trading volume and often acts as a price magnet.

- Indicators: Use tools like Volume Profile Visible Range (VPVR) for real-time analysis or Fixed Range Volume Profile for event-specific insights.

- Strategies: Combine HVN retracements, LVN breakouts, and POC-based entries for better trade setups. For instance, prices tend to bounce off HVNs or accelerate through LVNs.

- Automated Trading: Volume Profile is critical for algorithms, especially in defining entry and exit points. Tools like QuantVPS ensure low latency and smooth execution for strategies reliant on real-time data.

Volume Profile offers a clear view of market activity, making it a valuable tool for traders aiming to refine their strategies and align with institutional trading patterns. Dive deeper into its components and how to integrate it into your trading setup.

Volume Profile for Beginners | How to Read it the Right Way

Core Concepts of Volume Profile

High Volume Nodes vs Low Volume Nodes Trading Comparison Chart

High Volume Nodes vs Low Volume Nodes Trading Comparison Chart

To get a handle on Volume Profile, you need to understand three key elements: the Point of Control (POC), the Value Area (VA), and the distinction between High Volume Nodes (HVN) and Low Volume Nodes (LVN). These components together reveal where the market finds balance and where it rejects certain price levels. Let’s break them down to show how they shape market behavior.

Point of Control (POC)

The Point of Control marks the price level where the most trading volume occurred. Think of it as the market's "fair value" anchor, often pulling prices back when they drift away.

"The importance of this tool lies in the fact that volume attracts price. Meaning large areas of volume become favorable price magnets."

"The importance of this tool lies in the fact that volume attracts price. Meaning large areas of volume become favorable price magnets."

Traders often incorporate the POC into mean reversion strategies. A good example of this was in April 2023, when Crude Oil futures surged to a Value Area High of $77.00 after OPEC+ announced production cuts. As the rally lost steam near this resistance level, traders shifted focus to the prior session's POC at $75.30. The price rejected the upper boundary and returned to the POC, offering a 4:1 reward-to-risk opportunity tied to this fair value zone.

Value Area (VA)

The Value Area represents the price range where roughly 70% of the total trading volume took place. This range often aligns with one standard deviation from the mean in a normal distribution. It’s essentially where the market reached consensus on fair value during a session.

The boundaries of the Value Area, known as the Value Area High (VAH) and Value Area Low (VAL), act as natural support and resistance levels. When prices re-enter the Value Area from above or below, they often rotate within the range, pausing at the POC and potentially moving toward the opposite boundary. On the other hand, if prices stay within the previous session’s Value Area, it signals market acceptance and range-bound activity. A quick departure, however, may indicate rejection and a shift in sentiment.

Grasping the dynamics of the Value Area lays the groundwork for understanding the market's high- and low-activity zones.

High Volume Nodes (HVN) vs. Low Volume Nodes (LVN)

High Volume Nodes are the peaks on the volume histogram, showing where heavy trading occurred. These areas reflect price acceptance and often act as stabilizing forces, slowing down price movement and leading to consolidation.

"High volume nodes act like gravity. They tend to attract price and try to hold it there."

- Adam, Founder, Jumpstart Trading

"High volume nodes act like gravity. They tend to attract price and try to hold it there."

- Adam, Founder, Jumpstart Trading

In contrast, Low Volume Nodes are the valleys with minimal trading activity. These zones represent low liquidity, making them areas the market tends to move through quickly. Prices often accelerate through LVNs, which makes them useful for spotting breakout patterns or setting stop-loss levels.

Here’s a quick comparison:

| Feature | High Volume Node (HVN) | Low Volume Node (LVN) |

|---|---|---|

| Market Sentiment | Acceptance/Fair Value | Rejection/Unfair Value |

| Price Behavior | Slows down, consolidates | Speeds up, slices through |

| Trading Use | Support/Resistance, targets | Breakout zones, momentum |

| Liquidity | High liquidity | Low liquidity |

For example, in May 2025, Gold Futures consolidated around a high-volume level near $2,350. After a CPI report, the price attempted a breakout above this level but reversed sharply. Traders who recognized the rejection at the upper edge of the HVN shorted the retest, aiming for a move back to support near $2,330.

It’s worth noting that financial institutions drive over 93% of global FX turnover, meaning high-volume levels on a profile often reflect institutional activity rather than retail trading. Spotting these institutional footprints provides valuable clues about market sentiment and potential price movements.

Best Volume Profile Indicators

These tools bring the principles of volume profile analysis directly to your charts, translating them into actionable insights for spotting support, resistance, and breakout zones. Two of the most commonly used indicators in this space are Volume Profile Visible Range (VPVR) and Fixed Range Volume Profile. Each serves a specific purpose, and understanding their differences can enhance your trading strategy.

Volume Profile Visible Range (VPVR)

VPVR is a dynamic indicator that calculates volume data based on the price levels visible on your screen. It automatically updates as you zoom or scroll, ensuring the profile always reflects the current market view. This makes it particularly useful for traders who need to quickly identify support and resistance levels without manually defining ranges.

For day traders and scalpers, VPVR is a go-to tool for analyzing short-term market behavior. It adjusts in real time, allowing you to scan multiple timeframes and observe how key levels like the Point of Control (POC) and Value Area shift. The underlying calculations rely on lower timeframe data to maintain precision.

While VPVR excels in capturing real-time market dynamics, the Fixed Range Volume Profile offers a more focused approach for analyzing specific market events.

Fixed Range Volume Profile

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York, London & Amsterdam data centers • From $59.99/mo

The Fixed Range Volume Profile allows users to define a specific time period or price range for analysis. This makes it ideal for studying volume activity around particular events or market moves.

For instance, if you’re interested in how the market responded to a Federal Reserve announcement or an earnings report, you can set the Fixed Range to cover that exact timeframe. This provides a detailed view of where key trading activity occurred. It’s also a valuable tool for backtesting, as it lets you isolate specific price swings, such as significant highs and lows.

This indicator is particularly effective for spotting breakout and retracement opportunities. By focusing on a defined rally or sell-off, you can identify High Volume Nodes (HVNs), which often act as resistance during a retest, and Low Volume Nodes (LVNs), where price tends to move quickly.

Here’s a quick comparison of the two indicators:

| Feature | VPVR | Fixed Range |

|---|---|---|

| Scope | Dynamic; adjusts with chart view | Static; user-defined range |

| Best For | Scalping and multi-timeframe analysis | Event-specific and backtesting analysis |

| Updates | Automatic with zoom/scroll | Fixed to the selected range |

| Primary Use | Quick support/resistance detection | Detailed study of price movements |

Each tool has its strengths, and using them together can provide a well-rounded view of the market.

Running Volume Profile Indicators on QuantVPS

Volume profile indicators involve complex calculations, often processing up to 5,000 bars from lower timeframes to generate accurate profiles. Running multiple charts across several monitors can strain your hardware, which is where QuantVPS comes into play.

QuantVPS offers plans tailored for intensive trading setups. With configurations ranging from 6 to 24 cores, 16 GB to 64 GB of RAM, and high-speed NVMe storage, these plans ensure smooth updates for volume profile indicators, even when monitoring five to seven charts at once.

Features like low latency and 100% uptime keep your indicators in sync with every market tick - a critical factor when tracking shifting POC and Value Area levels. QuantVPS also supports up to four monitors on higher-tier plans, while offering system stability through automatic backups and DDoS protection.

For traders using automated systems or strategies reliant on volume profile data, having a reliable VPS is essential. Approximately 73% of professional traders incorporate these tools into their daily analysis, and a robust platform like QuantVPS ensures your insights remain accurate and up-to-date.

Trading Strategies Using Volume Profile

HVN Retracements and LVN Breakouts

High Volume Nodes (HVNs) act like magnets for price movement, marking areas of fair value where significant trading activity has occurred. These zones often provide strong support or resistance levels.

"High volume nodes act like gravity. They tend to attract price and try to hold it there. Conversely, Low Volume Nodes are areas with low gravity. The market often bounces right over these levels." - Adam, Founder, Jumpstart Trading

"High volume nodes act like gravity. They tend to attract price and try to hold it there. Conversely, Low Volume Nodes are areas with low gravity. The market often bounces right over these levels." - Adam, Founder, Jumpstart Trading

When trading around HVNs, wait for the price to approach and look for rejection signals, such as a wick or a confirming candle. Set your stop loss 10–15 ticks below the HVN, and aim for the next major HVN as your profit target.

Low Volume Nodes (LVNs), on the other hand, represent low-liquidity areas where price tends to move quickly. These zones often appear where the market previously experienced rapid movement. For example, in July 2023, FXOpen highlighted how price pierced the Point of Control (POC), which had acted as resistance, and accelerated through an LVN gap to reach a target HVN. Once the price hit the HVN, it formed a tweezer top candlestick pattern and reversed sharply, confirming the HVN as a critical exhaustion point.

For LVN breakouts, enter as the price moves into the low-volume zone and target the next HVN for profit. Place your stop loss just beyond the previous HVN to provide a buffer against high-liquidity zones. To assess your trade's potential, calculate the risk-to-reward ratio by comparing the distance between your entry and the next HVN target with the risk of your stop loss placement.

These strategies become even more effective when combined with an understanding of volume profile shapes for trend analysis.

Identifying Trends with Volume Profile

The shape of the volume profile can reveal market sentiment and directional bias. P-shaped profiles suggest bullish momentum or short squeezes, with heavy volume concentrated near the top of the range. b-shaped profiles indicate bearish liquidations, with volume clustering at the bottom. D-shaped profiles reflect a balanced market with no clear directional bias.

A strong trend aligns the Value Area with price movement. For instance, if prices rise but the Value Area remains flat, it could indicate weak volume support and a potential reversal. This is especially relevant for institutional traders, who account for over 93% of global FX turnover and rely on volume confirmation before making significant trades.

In July 2023, TRADEPRO Academy analyzed the S&P 500 E-mini futures using a 50-day cumulative volume profile. They identified a resistance zone at 4,458–4,460 and predicted a pullback to the 4,442–4,444 level, a prior balance area. The market followed this trajectory, bouncing off support and reaching new highs.

Also, watch for failed auctions, where price breaks out of the Value Area but quickly returns. This often signals a lack of conviction behind the breakout and can be a strong indicator to trade in the opposite direction.

In addition to trend insights, the Point of Control offers precise opportunities for entries and exits.

Using POC for Entry and Exit Points

The Point of Control (POC) can be a powerful tool for pinpointing entry and exit points. Virgin POCs, which are untested levels from previous sessions, often indicate significant institutional interest.

"Virgin POCs (untested ones) are especially powerful... It's like stretching a rubber band – eventually, it snaps back." - Trading In Depth

"Virgin POCs (untested ones) are especially powerful... It's like stretching a rubber band – eventually, it snaps back." - Trading In Depth

A notable example occurred in October 2025, when the S&P 500 E-mini futures reacted precisely at a prior session's POC of 5,832.50. The price bounced off this level, leading to a 20-point move (equivalent to $1,000 per contract) in just 45 minutes. This type of reaction has a historical accuracy rate of 65–70% when POCs are tested.

To trade using the POC, wait for confirmation of a rejection at the level, such as a wick or candle pattern. If the market opens outside the previous day's Value Area but within the profile range, look for a retracement to the prior POC for a high-probability entry in the direction of the open.

Set your stop loss 10–15 ticks beyond the POC. When trading mean reversion, use the POC as your primary profit target, and trail your stop loss behind developing POCs to protect your position. This approach ensures your exit aligns with high-liquidity zones rather than arbitrary price points.

| Strategy Type | Entry Logic | Exit/Target Logic |

|---|---|---|

| Mean Reversion | Enter when price rejects VAH/VAL | Target the POC as the "fair value" magnet |

| Trend Following | Enter on a retest of the prior session's POC | Target the next High Volume Node (HVN) |

| Virgin POC Touch | Limit order at an untested prior POC | Target the opposite edge of the Value Area |

| POC Breakout | Enter when price accepts above/below a POC | Trail stops 10–15 ticks behind the POC |

Setting Up Volume Profile with QuantVPS

Configuring NinjaTrader/MetaTrader on QuantVPS

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

To get the most out of your volume profile analysis, you'll need to fine-tune your platform and hardware. If you're using NinjaTrader, you're in luck - it includes Volume Profile as part of its "Order Flow+" suite, which costs $1,500. To enable it, simply right-click on your chart, choose Indicators, and add the Volume Profile tool. For intraday trading, set the Profile Type to "Volume" and the Period to "Session." Adjust Ticks Per Row to 25 to create consistent histogram bars. Keep in mind that this indicator processes lower timeframe data - up to 5,000 bars of 1-minute data for a daily session - to map volume at specific price levels.

"Volume profile is like having x-ray vision into the market. While regular volume indicators show you when trades happened, Volume Profile shows you where the actual trading occurred." - Footprint Charts vs Volume Profile - TradingInDepth

"Volume profile is like having x-ray vision into the market. While regular volume indicators show you when trades happened, Volume Profile shows you where the actual trading occurred." - Footprint Charts vs Volume Profile - TradingInDepth

MetaTrader users (MT4/MT5) face a different challenge, as these platforms don’t offer built-in, high-quality Volume Profile tools. To add this feature, you’ll need a third-party indicator like "VP-Range-v6" or "MarketProfile." Install by copying the .ex4 or .ex5 files into the Indicators folder. For setup, configure the Value Area to 70% and adjust the row size. Use 100–150 rows for detailed analysis or 50 rows for a cleaner visual that highlights where most trading happens.

Stick to standard candlestick or bar charts for accuracy, as non-standard types like Heikin Ashi or Renko can distort volume data. With these configurations, you'll be ready to tackle advanced setups, including multi-monitor displays.

Multi-Monitor Support for Advanced Analysis

A multi-monitor setup can take your volume profile analysis to the next level, especially for multi-timeframe strategies. QuantVPS offers plans tailored for this purpose. The Pro+ plan ($129.99/month or $90.99/month when billed annually) supports up to 2 monitors, while the Ultra+ plan ($199.99/month or $139.99/month annually) supports up to 4 monitors [website]. This allows you to dedicate one screen to a daily Volume Profile for spotting macro trends and another to a 15-minute profile for pinpointing entry zones.

By comparing Point of Control (POC) levels across different timeframes - like daily, 60-minute, and 5-minute charts - you can identify zones where institutional trading activity is likely concentrated. This multi-timeframe approach requires reliable infrastructure to ensure uninterrupted analysis.

System Stability and Backups for Algo Trading

Beyond just configuration, system stability is essential for running Volume Profile tools effectively. These tools require continuous processing power and steady data feeds. QuantVPS ensures 100% uptime and automatic backups, which are critical for automated trading [website]. Since Volume Profile relies on historical data to identify support and resistance levels, even a brief data interruption can skew calculations for the Point of Control and Value Area.

Automatic backups also protect custom tools, such as "Flexible Volume Profiles" and proprietary footprint charts, from potential system failures. High-performance CPUs and NVMe storage further enhance precision, enabling tick-level accuracy without delays. This is particularly important for platforms like ATAS, which rely on tick data to capture every individual trade. With this infrastructure, you can maintain accurate volume analysis and ensure your algorithms run smoothly, even during high-volatility periods.

Conclusion

Volume Profile offers a window into market behavior, showing where significant trading activity has occurred rather than just when trades took place. By understanding key elements like the Point of Control (POC), Value Area (VA), and the differences between High Volume Nodes (HVN) and Low Volume Nodes (LVN), traders can create automated systems to pinpoint fair value zones, predict breakouts, and manage risk more effectively. It's no wonder professional traders use volume profile daily to define support and resistance levels based on real capital flows.

With these principles in mind, the right tools can turn theory into actionable strategies. Volume Profile Visible Range (VPVR) is excellent for identifying macro trends and spotting institutional trading patterns across any timeframe, while the Fixed Range Volume Profile hones in on specific price events. These tools allow traders to automate strategies, such as HVN retracements, LVN breakouts, and POC-based entries, all while improving reward-to-risk ratios.

Using QuantVPS takes these strategies to the next level. With 100% uptime, ultra-low latency, and automatic backups, QuantVPS ensures uninterrupted data flow for accurate POC and Value Area calculations. For those seeking a broader view, the Ultra+ plan ($139.99/month when billed annually) supports up to four monitors, making it easier to analyze volume profiles across multiple timeframes. Imagine spotting where daily, hourly, and 5-minute POCs align - clear signs of institutional activity.

FAQs

How can I use High Volume Nodes (HVNs) and Low Volume Nodes (LVNs) to improve my trading strategy?

High Volume Nodes (HVNs) are price levels where a lot of trading activity has taken place. These zones often act as strong support or resistance. If the price is below an HVN, it may act as resistance, making it harder for the price to move higher. Conversely, when the price is above an HVN, it often serves as support, helping to keep the price from falling further. Traders often watch for price pullbacks to HVNs and use tools like candlestick patterns or trendline breaks to confirm their entry points. Stop-loss orders are usually placed just beyond the HVN, while profit targets are set near the next HVN or other key price areas.

Low Volume Nodes (LVNs), on the other hand, are price levels where little trading has occurred. These zones often act as breakout or reversal points. Prices tend to move quickly through LVNs because there’s less market interest in those areas. A breakout through an LVN might suggest the trend will continue, while a bounce off an LVN could hint at a reversal. To fine-tune their trades, many traders combine LVN signals with momentum indicators or shifts in volume. Stops are typically placed on the opposite side of the LVN, with profit targets aimed at nearby HVNs or other significant price levels.

By thinking of HVNs as "price magnets" that attract action and LVNs as "low-friction zones" where prices move more freely, traders can sharpen their strategies. This approach helps pinpoint entry and exit points while aligning with key market activity for better risk and reward management.

What’s the difference between Volume Profile Visible Range (VPVR) and Fixed Range Volume Profile, and how do I know which one to use?

Volume Profile Visible Range (VPVR) and Fixed Range Volume Profile both analyze trading volume at different price levels, but they differ in how they gather and display data.

VPVR automatically adjusts to the price bars visible on your chart. As you zoom in or pan around, it updates in real time, giving you a dynamic view of volume activity. This makes it perfect for spotting live market trends and identifying key price levels, such as areas of strong support, resistance, or high-volume nodes as they form.

Fixed Range Volume Profile, however, works differently. You manually select a start and end point on your chart to view the volume distribution for that specific range. This static approach is ideal for studying historical price movements, analyzing specific market events, or testing strategies within a set period, without the profile shifting as you adjust the chart.

In short, use VPVR for live market tracking and Fixed Range Volume Profile when you're diving into a specific time frame or historical event. Each tool shines in its own way depending on your analysis needs.

What is the Point of Control (POC), and how can it help traders determine entry and exit points?

The Point of Control (POC) is the price level where the most trading activity occurred during a specific time frame. This level often acts as a strong support or resistance zone, making it a helpful indicator for spotting potential entry and exit points in trading.

Traders often watch for price movements around the POC. A break above or below this level can indicate a shift in market sentiment, signaling potential trade opportunities. On the flip side, the POC can also act as a natural exit point, as prices tend to pause or reverse near this area due to the heavy trading volume. By understanding the POC, traders can better align their strategies with market behavior, improving their timing and decision-making.

High Volume Nodes (HVNs) are price levels where a lot of trading activity has taken place. These zones often act as strong support or resistance. If the price is below an HVN, it may act as resistance, making it harder for the price to move higher. Conversely, when the price is above an HVN, it often serves as support, helping to keep the price from falling further. Traders often watch for price pullbacks to HVNs and use tools like candlestick patterns or trendline breaks to confirm their entry points. Stop-loss orders are usually placed just beyond the HVN, while profit targets are set near the next HVN or other key price areas.

Low Volume Nodes (LVNs), on the other hand, are price levels where little trading has occurred. These zones often act as breakout or reversal points. Prices tend to move quickly through LVNs because there’s less market interest in those areas. A breakout through an LVN might suggest the trend will continue, while a bounce off an LVN could hint at a reversal. To fine-tune their trades, many traders combine LVN signals with momentum indicators or shifts in volume. Stops are typically placed on the opposite side of the LVN, with profit targets aimed at nearby HVNs or other significant price levels.

By thinking of HVNs as "price magnets" that attract action and LVNs as "low-friction zones" where prices move more freely, traders can sharpen their strategies. This approach helps pinpoint entry and exit points while aligning with key market activity for better risk and reward management.

Volume Profile Visible Range (VPVR) and Fixed Range Volume Profile both analyze trading volume at different price levels, but they differ in how they gather and display data.

VPVR automatically adjusts to the price bars visible on your chart. As you zoom in or pan around, it updates in real time, giving you a dynamic view of volume activity. This makes it perfect for spotting live market trends and identifying key price levels, such as areas of strong support, resistance, or high-volume nodes as they form.

Fixed Range Volume Profile, however, works differently. You manually select a start and end point on your chart to view the volume distribution for that specific range. This static approach is ideal for studying historical price movements, analyzing specific market events, or testing strategies within a set period, without the profile shifting as you adjust the chart.

In short, use VPVR for live market tracking and Fixed Range Volume Profile when you're diving into a specific time frame or historical event. Each tool shines in its own way depending on your analysis needs.

The Point of Control (POC) is the price level where the most trading activity occurred during a specific time frame. This level often acts as a strong support or resistance zone, making it a helpful indicator for spotting potential entry and exit points in trading.

Traders often watch for price movements around the POC. A break above or below this level can indicate a shift in market sentiment, signaling potential trade opportunities. On the flip side, the POC can also act as a natural exit point, as prices tend to pause or reverse near this area due to the heavy trading volume. By understanding the POC, traders can better align their strategies with market behavior, improving their timing and decision-making.

"}}]}