Solana Bot Hosting Guide: How VPS Infrastructure Improves Trading Performance

To succeed in Solana trading, speed matters. Trading bots rely on rapid execution, and VPS hosting can significantly improve performance. Here's why:

- Latency Reduction: Hosting bots near Solana RPC nodes cuts delays by up to 10x, achieving ultra-low latency execution speeds as low as 20ms.

- Reliable Uptime: VPS ensures uninterrupted operations, avoiding issues like power outages or internet disruptions common in local setups. You can further enhance your trading server performance by optimizing network connectivity and resource management.

- Enhanced Security: VPS offers advanced measures like firewalls, DDoS protection, and encrypted communication to safeguard trading activities.

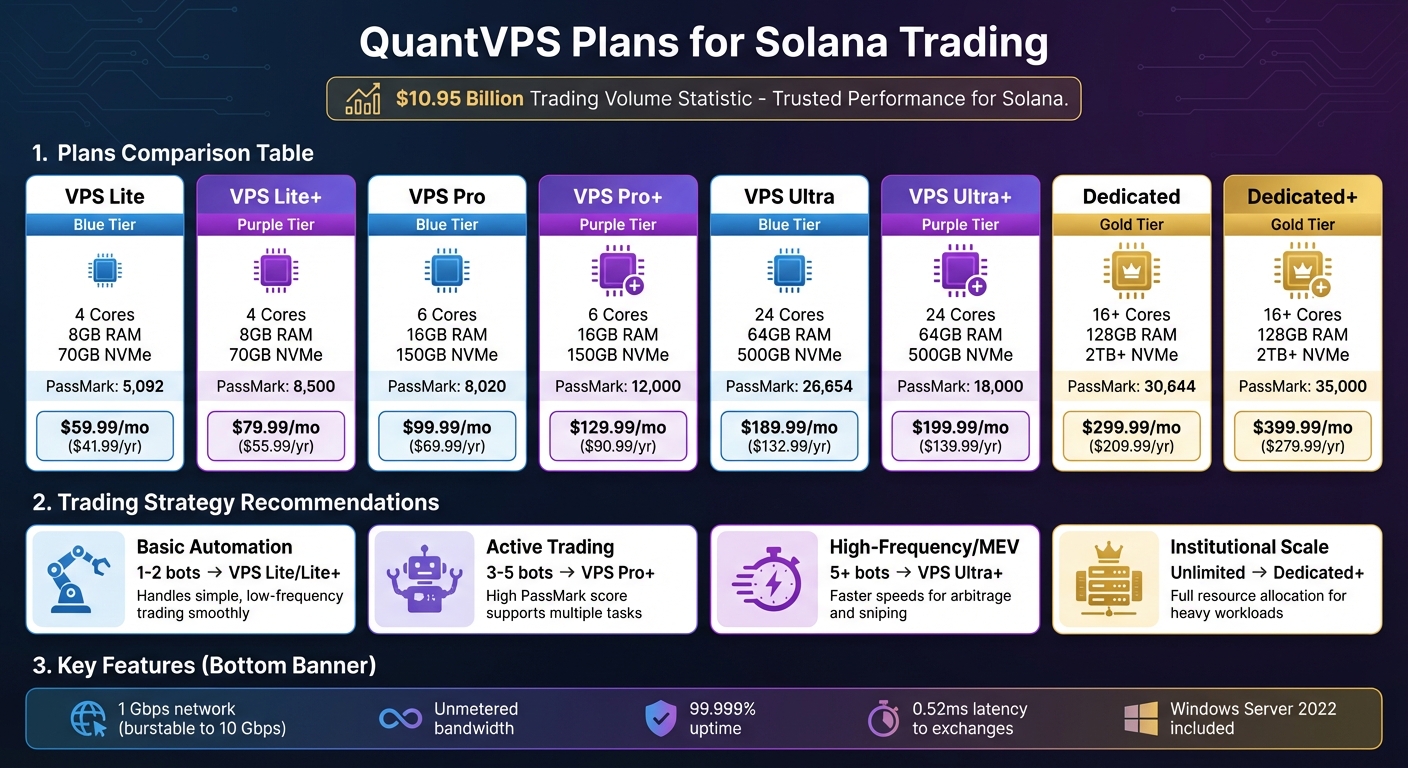

- Customizable Plans: Options range from entry-level VPS Lite ($59.99/month) to Dedicated+ servers ($399.99/month) for high-frequency trading.

VPS hosting is essential for competitive Solana trading, ensuring faster execution, better reliability, and secure operations. QuantVPS provides tailored solutions to meet these needs, offering plans with high-speed processors, NVMe storage, and ultra-low latency.

SOLANA | SOLANA TRADING VOLUME BOT | 2025 | WORKING 100%

How VPS Hosting Improves Solana Trading Performance

VPS hosting can take Solana bot performance to the next level by addressing key challenges like latency, uptime, and security. These improvements make a tangible difference for traders who rely on speed and reliability.

Lower Latency for Faster Trade Execution

VPS hosting significantly reduces latency, a critical factor in Solana trading, by leveraging co-location and cutting-edge hardware.

When your trading bot operates in the same data center as Solana RPC nodes, latency caused by physical distance is nearly eliminated. This setup can reduce delays by up to 10 times, enabling transaction times as low as 20–35 milliseconds from execution to block inclusion.

High-performance VPS configurations featuring NVMe Gen 4 storage, DDR5 RAM, and processors exceeding 5 GHz ensure smooth data processing without I/O bottlenecks. Additionally, premium network routes and direct-to-validator connections minimize congestion and slot drift. This precision allows bots to sync perfectly with Solana's 400 ms slot schedule, executing transactions at the start of a leader's slot.

Here’s how latency varies by region:

| Source Region | Destination | Avg Latency (ms) | Performance Rating |

|---|---|---|---|

| AWS Frankfurt | Solana Frankfurt | 1.5–2.5 ms | Optimal |

| Hetzner Falkenstein | Solana Frankfurt | 1.2 ms | Excellent (Bare-metal) |

| AWS Ashburn | Solana New Jersey | 60–75 ms | Acceptable for US bots |

| AWS Singapore | EU Solana Clusters | 190–220 ms | Unsuitable for HFT |

(Source: RPC Fast Latency Benchmarks)

By reducing latency, VPS hosting directly boosts trade execution speed, giving traders a competitive edge.

24/7 Uptime and System Reliability

In the nonstop world of Solana trading, even a brief outage can lead to missed opportunities or costly mistakes. Solana processes transactions in 400 ms slots, and a bot lagging behind by just 800 ms (two slots) is already outdated - an issue that can derail strategies like sniping or arbitrage.

VPS hosting ensures uninterrupted performance through features like automatic failovers and resource isolation. Unlike home setups prone to power outages or random stutters, VPS environments are designed to maintain sub-second latency.

To keep performance steady, it’s important to operate at 30–40% resource utilization. Exceeding 70–80% can lead to slowdowns or crashes. Tools like Prometheus and Grafana provide real-time monitoring, helping traders spot and resolve issues before they escalate.

Better Security for Trading Operations

Security is just as crucial as speed and reliability in the VPS environment. A secure setup safeguards your trading operations from modern threats.

VPS hosting offers multi-layered security measures, including VLAN separation for network isolation, DDoS protection, advanced firewalls to block malicious traffic, multi-factor authentication (MFA), IP whitelisting, and automated backups for quick recovery.

"Security is the foundation of successful volume bot operations... the threat landscape has evolved to include sophisticated phishing attacks, social engineering attempts, and technical exploits." - Edward Riker, Senior Trading Strategist, Solana Volume Bot

"Security is the foundation of successful volume bot operations... the threat landscape has evolved to include sophisticated phishing attacks, social engineering attempts, and technical exploits." - Edward Riker, Senior Trading Strategist, Solana Volume Bot

Professional VPS providers also prioritize system hardening. Instances are pre-configured with locked-down settings, regular OS security updates, endpoint protection, and encrypted communication protocols.

Selecting the Right QuantVPS Plan for Solana Bots

NEVER MISS A TRADE

Your algos run 24/7

even while you sleep.

99.999% uptime • Chicago, New York & London data centers • From $59.99/mo

QuantVPS Hosting Plans Comparison for Solana Trading Bots

QuantVPS Hosting Plans Comparison for Solana Trading Bots

When choosing a VPS plan for your Solana bots, consider the number of bots you’ll run and how demanding your trading strategies are. Solana’s 400 ms slots require enough processing power to keep up. Pay close attention to key hardware specs like CPU clock speed, RAM, and storage type to ensure smooth operation.

QuantVPS Plans Overview

QuantVPS provides two main tiers: Standard VPS and Performance VPS. The Standard tier uses AMD EPYC processors with DDR4 ECC RAM, while the Performance tier features AMD Ryzen processors paired with DDR5 ECC RAM. The Performance plans are designed for higher single-core speeds and PassMark scores, making them better suited for tasks like running Solana bots.

Here’s a breakdown of the available plans:

| Plan | Cores | RAM | NVMe Storage | PassMark Score | Monthly Price | Annual Price |

|---|---|---|---|---|---|---|

| VPS Lite | 4 | 8GB | 70GB | 5,092 | $59.99 | $41.99 |

| VPS Lite+ | 4 | 8GB | 70GB | 8,500 | $79.99 | $55.99 |

| VPS Pro | 6 | 16GB | 150GB | 8,020 | $99.99 | $69.99 |

| VPS Pro+ | 6 | 16GB | 150GB | 12,000 | $129.99 | $90.99 |

| VPS Ultra | 24 | 64GB | 500GB | 26,654 | $189.99 | $132.99 |

| VPS Ultra+ | 24 | 64GB | 500GB | 18,000 | $199.99 | $139.99 |

| Dedicated | 16+ | 128GB | 2TB+ | 30,644 | $299.99 | $209.99 |

| Dedicated+ | 16+ | 128GB | 2TB+ | 35,000 | $399.99 | $279.99 |

All plans come with 1 Gbps network connections (burstable to 10 Gbps), unmetered bandwidth, and Windows Server 2022 pre-installed. QuantVPS ensures 99.999% uptime and achieves latencies as low as 0.52 ms to major exchange engines .

Matching Plans to Your Trading Needs

Your trading strategy and bot requirements will determine the most suitable plan. For Solana bots, CPU clock speed often matters more than the number of cores, as many trading applications rely on single-threaded performance or effectively use only 1–2 cores.

To maintain optimal performance, aim to keep resource usage between 30% and 40% during normal operations. When usage exceeds 80%, performance can drop significantly. For example, Node.js bots typically need 1–2 cores, while Rust-based applications can take advantage of multiple cores.

Here’s a guide to help you choose the right plan:

| Trading Style | Bot Count | Recommended Plan | Why It Works |

|---|---|---|---|

| Basic Automation | 1–2 bots | VPS Lite or Lite+ | Handles simple, low-frequency trading smoothly. |

| Active Trading | 3–5 bots | VPS Pro+ | High PassMark score supports multiple tasks. |

| High-Frequency/MEV | 5+ bots | VPS Ultra+ | Faster speeds for arbitrage and sniping. |

| Institutional Scale | Unlimited | Dedicated+ | Full resource allocation for heavy workloads. |

For high-frequency strategies like arbitrage or MEV, the Performance tier's Plus models excel at rapid calculations and maintaining consistent network performance. If you’re running institutional-level operations with extensive backtesting or managing numerous bots, the Dedicated servers offer the most reliable performance and lowest latency.

QuantVPS has proven its capacity to handle massive trading volumes. For instance, on January 21, 2026, over $10.95 billion was traded on its low-latency servers in just 24 hours. This highlights its ability to support demanding trading environments effectively.

How to Set Up Solana Bots on QuantVPS

Step 1: Choose and Purchase Your QuantVPS Plan

To ensure faster trade execution, pick a QuantVPS plan that aligns with your Solana trading needs. For the best performance, select the New York location, which offers 0–1 ms latency to major US exchanges. Once you've made your purchase, your server will be provisioned instantly, giving you immediate access to your dashboard. With your plan activated, you can move on to setting up your environment for Solana trading.

Step 2: Set Up the VPS Environment for Solana

Log in to your VPS using Windows RDP, utilizing the credentials provided in your dashboard. QuantVPS comes with Windows Server 2022 pre-installed, so you can dive into configuring your environment right away.

If you're using Node.js bots, install all required dependencies and allocate 1–2 cores per instance for smooth operation. For Rust-based bots, compile them locally and deploy the lightweight executable to leverage multi-threaded performance. Make sure to store RPC URLs and private keys securely in a .env file to prevent accidental exposure.

Step 3: Secure and Optimize Your VPS

After configuring your environment, it's time to secure and fine-tune your VPS for sustained high performance. Enable the Windows Firewall for necessary ports such as RDP, HTTPS, and port 8899. While QuantVPS includes built-in DDoS protection and advanced firewall rules, it's still important to set up application-level security.

Keep an eye on resource usage - try to maintain it at 30–40%. Exceeding 80% could lead to performance issues. Use monitoring tools to track metrics in real-time, and consider upgrading your plan if you're nearing these limits.

For the best execution results, configure your bot to monitor Solana's current slot height in real-time. Pre-build transactions in the preceding slot so they can be executed instantly in the next one. Maksym Bogdan from RPC Fast explains this well:

"A fast bot isn't just about sending transactions quickly - it's about sending them into the right slot, at the right time".

"A fast bot isn't just about sending transactions quickly - it's about sending them into the right slot, at the right time".

STOP LOSING TO LATENCY

Execute faster than

your competition.

Sub-millisecond execution • Direct exchange connectivity • From $59.99/mo

Optimizing Solana Bot Performance on VPS

Once your Solana bot is up and running on QuantVPS, keeping it fine-tuned for peak performance is key.

Use NVMe Storage for Faster Data Access

NVMe storage can significantly speed up data processing for Solana bots. Gen4+ NVMe drives offer exceptional read/write speeds, helping you avoid slowdowns during high-volume trading events. QuantVPS incorporates enterprise-grade NVMe storage into its hardware, achieving ultra-low latency - less than 0.52ms to the CME Group matching engines.

For Solana sniper bots, aim for at least 1TB of NVMe storage to handle continuous data retrieval and logging efficiently. To maintain top performance, keep storage usage under 40%; once you exceed 70–80%, disk performance can take a hit. Regularly monitor your system metrics to ensure you're getting the most out of this setup.

Monitor Resource Usage and Bandwidth

Keeping tabs on your VPS metrics is essential to avoid performance hiccups that could disrupt trading. Ideally, CPU, RAM, and storage usage should stay between 30% and 40% for a good balance of cost, stability, and performance. If resource usage climbs to 80% or higher, expect a noticeable dip in system efficiency.

Tools like Prometheus and Grafana can provide real-time dashboards to track resource usage and identify bottlenecks. Beyond basic metrics, keep an eye on Solana-specific indicators like slot height and slot landing drift. These metrics show how far your node lags behind the network's head. Additionally, log every transaction detail - confirmations, slot numbers, and error codes - to refine your bot's decision-making process.

Upgrade Resources as Your Trading Grows

When your monitoring reveals resource constraints, it's time to scale up. If resource usage consistently hits 80%, consider upgrading your VPS plan. Transitioning from Node.js to Rust-based bots might also require more CPU cores to leverage multi-threaded performance. QuantVPS user Mac Pankiewicz highlights this flexibility:

"The ability to scale on-demand is a huge advantage for my trading operations".

"The ability to scale on-demand is a huge advantage for my trading operations".

Instead of relying on one large server, you might want to distribute workloads across multiple dedicated VPS instances. With Solana's upcoming Alpenglow upgrade reducing block finality times from 12,300ms to just 100–150ms, and Firedancer scaling to over 1,000,000 transactions per second, your infrastructure will need to keep up with these advancements.

Conclusion

Using VPS infrastructure to run Solana bots is a game-changer for competitive trading. The benefits - low latency vs. ultra-low latency, round-the-clock uptime, and powerful hardware - translate directly into faster trade execution, reduced slippage, and better profitability. With Solana's slot timing operating at 400 ms intervals, shaving off even a few milliseconds can make all the difference between seizing a trading opportunity or letting it slip away.

QuantVPS steps up to meet these demands with AMD EPYC processors, NVMe storage, and strategically positioned networks, ensuring precise alignment with Solana’s rapid slot rotations. Their 99.999% uptime guarantee is a lifesaver for critical strategies like liquidations and market making, keeping your bots operational even during power outages or internet disruptions. Whether your trading strategy is simple or highly intricate, these features are designed to adapt and scale with your needs.

From running a straightforward sniper bot on the VPS Lite plan at $59.99/month to managing advanced multi-strategy setups on a Dedicated Server for $299.99/month, QuantVPS provides solutions that grow alongside your trading goals.

FAQs

How does VPS hosting help reduce latency for Solana trading bots?

VPS hosting can dramatically cut down latency by positioning your Solana trading bot closer to the RPC nodes it interacts with. With less physical distance between the server and the RPC endpoint, signals encounter fewer network hops. This reduction can bring response times from several milliseconds down to sub-millisecond levels, which is a game-changer for speed-sensitive trading.

On top of that, VPS setups often rely on high-performance hardware, such as dedicated CPUs and private, high-bandwidth network connections. These upgrades help avoid delays caused by public network congestion or packet loss. If your VPS is strategically located near Solana's infrastructure or your broker’s servers, your bot can execute trades almost instantly. This kind of speed is crucial for strategies like arbitrage, sniping, or liquidations, where every fraction of a second counts.

What security benefits does a VPS provide for running Solana trading bots?

Using a VPS for running Solana trading bots provides a safe and controlled environment, which is crucial for protecting sensitive data and preventing unauthorized access. Since VPS servers operate in isolated environments, you can apply robust security protocols like firewalls, SSH key-based authentication, and IP whitelisting to ensure that only approved devices can interact with your bot's API endpoints.

You can also securely encrypt and store sensitive details, such as API keys, to minimize the risk of them being exposed. For added protection, consider disabling withdrawal permissions on API keys, limiting outbound connections strictly to those required for trading, and keeping the system updated to close any security gaps. These measures help safeguard against threats like credential theft and DDoS attacks, making your automated trading strategies both secure and dependable.

How do I select the best VPS plan for my Solana trading bot?

Choosing the right VPS plan for your Solana trading bot can make a big difference in how well it performs. Start by considering your bot's latency requirements. If you're running high-frequency strategies like arbitrage, you'll need ultra-low latency - ideally under 5 milliseconds. On the other hand, bots with less time-sensitive tasks can handle slightly higher delays without issues.

When it comes to hardware, aim for a VPS with a fast CPU (3.5 GHz or higher), 8–16 GB of RAM, and NVMe SSD storage. These specs are essential for managing Solana's resource-heavy workloads. Network connectivity is just as important. Look for a VPS with a 1 Gbps uplink and a data center located near major Solana RPC nodes, such as those in the U.S. East or West regions. This setup minimizes network delays and keeps your bot running efficiently.

Lastly, find a balance between performance and cost. Choose a plan that fits your budget, but don’t skimp on the resources your bot needs. Before committing to a long-term plan, test the VPS with your bot to ensure it operates smoothly and avoids unnecessary expenses.